Global Diffractive Optical Elements Market size was valued at USD 671.74 Mn. in 2024, and the total Diffractive Optical Elements Market revenue is expected to grow by 5.2% from 2025 to 2032, reaching nearly USD 1007.69 Mn.Diffractive Optical Elements Market Overview:

The report on the Diffraction Optical Elements (DOE) market presents a thorough review of this rapidly growing sector of the photonics market. Diffraction Optical Elements are specialized micro-structured optical elements based upon the principle of diffraction that manipulate and control light with various diffraction elements to achieve functionality such as a beam splitter, beam shaper, and beam focus. The report includes an example of DOEs in which the market includes beam shapers, diffusers, and splitters and is produced using state-of-the-art technologies such as nanoimprint lithography and wafer-level processing. In addition, the report discusses how DOEs are sold for both catalog research & prototyping offerings and custom high-volume offerings for industrial and consumer products. The study highlights the end-use industry as it relates to demand and supply, and it mentions that the diffusion optics market has been driven by increasing adoption in areas such as industrial laser processing, medical imaging, aerospace displays, LiDAR, and AR/VR devices, which drives application needs especially for high-performance functionalities and scalable production needs.To know about the Research Methodology :- Request Free Sample Report The report evaluates regional strength in the DOE market, Asia-Pacific, and in particular Japan and China, are leading global share and the embrace of large-scale manufacturing; both likewise in LiDAR for consumer electronics and a 3D sensing appliances. Europe distinguishes itself as strong in high-end micro- and holographic optics market segments, particularly likely due to aerospace, automotive, and healthcare applications; and North America distinguishes itself as leading in high-power industrial lasers used in defense and prototyping. The report also presents profiles of major key players including Coherent Corp. (US), ZEISS Group (Germany), Jenoptik AG (Germany), AGC Inc. (Japan), Apollo Optical Systems (US) and NIL Technology (Denmark) benchmarking their technological innovations, global reach, and strategic positioning. It also evaluated by end-user contribution demonstrating industrial manufacturing and automotive LiDAR represent the largest revenue generation, followed by AR/VR, medical devices, and aerospace applications. Overall, the report delivered a thorough evaluation of the market dynamics, demonstrated how technology advancement, regional capabilities, and end-user capacity shape the trajectory of industry growth in the DOE space.

Global Diffractive Optical Elements Market Dynamics:

High-Precision Optical Needs to Drive Growth of Diffractive Optical Elements Market The primary driver for the Diffractive Optical Elements market is the increasing need for high-precision optical solutions, primarily in the healthcare, industrial, and consumer fields. Unlike conventional optics, DOEs are required in the advanced diagnostic and surgical devices found in healthcare, such as optical coherence tomography (OCT), confocal microscopy, LASIK guidance systems, and cataract surgery instruments, where precision, minimization of volume, and manipulation of light are important. Also, there is a developing industries like semiconductor fabrication, additive manufacturing and materials processing that utilize laser-applied manufacturing processes, which is also driving demand for DOEs since they need to be able to shape, split, and homogenize light and DOEs can do it better and more efficiently. In addition, there is a worldwide trend towards miniaturization in electronics and photonics which facilitates the continued importance of DOEs as they can provide a more optimal solution and superior performance when compared to conventional optics. Continued investments in photonics R&D and even more use of minimally invasive procedures with precision imaging should continue to promote and strengthen their status as a core enabler of technological innovation going forward. Opportunities The DOE market has begun to open to the possibilities of emerging technologies such as augmented reality (AR), virtual reality (VR), LiDAR, and enhanced methods of communication: all of which we see displaying strong growth potential. In the automotive area, DOEs are being utilized, to an increasing extent, for LiDAR sensors applied to self-driving and advanced driver-assistance systems (ADAS), which has abundant potential for growth as self-driving technology is utilized further. In consumer electronics specifically, DOEs are being increased into compact projectors, AR/VR headsets, and wearable devices. The inclusion of DOEs into various devices with limitations on physical size, offers the consumer an enhanced visual experience, while providing a practical size for consumers. Furthermore, telecommunications and 5G/6G networks enable DOEs to form opportunities, via improved optical signal processing, beam steering, and multiplexing data in transmitting data. In general, the rapid growth in quantum optics and photonic computing, and optics for space has potential for introducing unique applications for DOEs. In addition, the launch of photonics initiatives with government funding (particularly in Europe, U.S., and Asia-Pacific) introduces strong support for research, development and commercialization of DOEs which will stimulate sustained growth opportunities long term for the market. Emerging Tech and Photonics Initiatives to Boost Diffractive Optical Elements Market Growth Although the index of growth is exciting, the DOE industry faces major threats in complexity of the design, precision in manufacturing, and cost to manufacture. The complexity of creating DOEs is that it relies on large capital investments in advanced nano- and micro fabrication technologies. The most common of these needed technologies are electron-beam lithography and other capital-intensive processes/protocols requiring specialized expertise. It is exceedingly difficult to attain uniformity and defect-free manufacturing at scale, specifically for high-performance applications in aerospace and defense, or high-end medical imaging, since even minor deviations in manufacturing can affect system performance. The DOE industry must also develop solutions on best practices and protocols for integrating a DOE in an optical system, which means custom designing and often redesigning each piece of hardware to accommodate one DOE, which will extend the product development cycle. Further complicating matters, there are competing optical technologies (e.g., refractive optics and metasurfaces) that will put pressure on the adoption of DOEs in certain applications if other aspects of those technologies hold similar or better performance relati إمy updated the cost of manufacturing and use for their systems, and protocol. Limited Awareness and Market Fragmentation to Hinder Diffractive Optical Elements Adoption High cost of manufacturing and integration, limited awareness of their advantages in developing Markets and the inability to scale up are currently restricting the growth of the DOE market. Despite the superior capabilities of DOEs, initial investments in equipment and skilled employees to design and manufacture DOEs result in increased system costs, which makes adoption more difficult for cost-centric markets, like small to medium size medical facilities or mid to large size manufacturing companies. In developing markets, limited awareness of advantages associated with DOEs and employed skilled individuals will further restrict commercialization and limit the speed of adoption. Slow regulatory approval processes for medical devices with DOEs will also limit market entry for healthcare applications. In addition to limited accessible knowledge and expertise, there is also market fragmentation into sub-markets that rely on specialist suppliers, which create risks in global supply chains, especially for critical applications like defense and aerospace systems where the consequences of supply interruption can be huge.Global Diffractive Optical Elements Market, Segment Analysis:

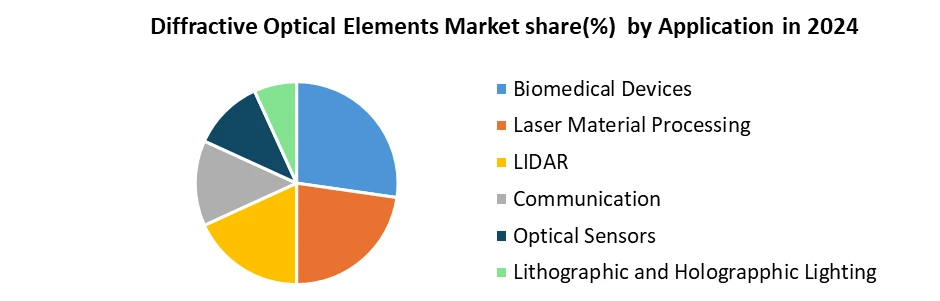

Based on Industry, Diffractive Optical Elements Market is segmented into Healthcare, Electronics and Semiconductor, Telecommunication and Others. Healthcare segment is expected to contribute xx% share in the global diffractive optical elements market during the forecast period. The diffractive optical elements are used as application of optoelectronic component in the healthcare sector. The regional governments are taking initiative to increase healthcare and medicine investments. An increase in adoption of micro-optics in numerous applications mainly in ophthalmology and biomedical devices, high capitalist investments in diffractive optical elements is expected to offer key opportunities for diffractive optical elements manufacturers. Based on Application, Diffractive Optical Elements Market is segmented into Biomedical Devices, Laser Material Processing, LIDAR, Communication, Optical Sensors, Lithographic and Holographic Lighting, the medical devices segment dominated the Diffractive Optical Elements (DOE) market due to their extensive use in advanced imaging and laser-based applications such as optical coherence tomography, endoscopy, LASIK, and cataract surgeries, where high precision and miniaturization are critical. Rising demand for minimally invasive procedures and vision correction treatments has accelerated DOE adoption, as they enable superior beam shaping, splitting, and focusing compared to traditional optics. Additionally, increasing healthcare investments, continuous R&D in biomedical optics, and the need for safer, more efficient treatment options further strengthen the dominance of medical devices in the DOE market.

Global Diffractive Optical Elements Market, Regional Analysis:

The Asia-Pacific (APAC) region is dominating the global Diffractive Optical Elements (DOE) market due to its strong manufacturing capabilities, large-scale consumer electronics and semiconductor industries, and rapid adoption of emerging technologies. Countries such as China, Japan, South Korea, and Taiwan host advanced precision optics and semiconductor fabrication facilities, enabling high-volume production at competitive costs. The region’s growing demand for automotive LiDAR, industrial lasers, smartphone cameras, and AR/VR devices further drives DOE consumption. Additionally, supportive government initiatives, investments in photonics manufacturing, and vertically integrated supply chains enhance APAC’s ability to lead the market, making it the largest and fastest-growing regional hub for DOE applications globally.Competitive landscape of the Diffractive Optical Elements (DOE) Market

The competitive environment of the Differactive Optical Elements (DOE) market consists of established market leaders, strong followers, and new entrants. Each has different abilities to take advantage of opportunities across a mix of industrial, automotive, aerospace and consumer applications. The importance of meta optics is a growing issue in the overall landscape. The market leaders such as Coherent (US), ZEISS Group (Germany), Jenoptik (Germany), AGC Inc. (Japan), SUSS Micro Optics (Switzerland) enjoy dominant positions in terms of capabilities (process IP, reliability improvements, application support) and pathways to market (namely the complete range) because they have both advanced coatings technologies and global operating footprints. All have applications in high-power laser beam shaping, semiconductor tools, augmented/virtual reality displays and aerospace heads-up-displays (HUD’s). Strong followers like Edmund Optics (US), Holographix (US), Luminit (US), HOLOEYE Photonics (Germany), PowerPhotonic (UK), Thorlabs/Wasatch Photonics (US) gain market leverage through customization of products to niche applications or ability to transition quickly from prototyping to production to customer applications (i.e. build value with flexibility) and leveraging R&D opportunities. Finally, there are new and emerging players like NIL Technology (Denmark), META Materials (Canada), Dispelix (Finland), WaveOptics/Snap (UK/US) and Sunny Optical (China) are opportunistically employing meta-optics, flat optics, and diffractive waveguides as they disrupt existing players, particularly in high-growth missions (i.e. AR/VR, LiDAR, next generation consumer electronics) that leverage significant portions of optical engines in existing/established use cases. When benchmarking these players, we see that the leaders excel in financial performance, technology development, and global scope with demonstrated proficiency in coatings for high-damage-threshold applications, wafer-level DOE replication, and Holographic Optical Element integration. The followers are becoming increasingly important for their flexibility to respond to specialized DOE applications, while the newer entrants are developing miniaturization levels of integration into immersive displays sensing environments, including automotive-derived optics. The activity from 2019 to 2024 includes mergers, partnerships, and R&D investments, focusing on additional elements of nanoimprint lithography, wafer-level manufacturing, and co-development of specific applications with Tier-1 OEMs. Some of the remarkable developments we see include Coherent's DOE line for kW-class industrial lasers, ZEISS's HOE-based HUDs for aerospace and defense applications, AGC's glass DOEs designed for mass manufacture, and intended for LiDAR and AR/VR applications, and NIL Technologies's latest demonstration of meta-optics for sensing applications XR. Regionally, the Asia-Pacific Region is the most active region for large-scale DOE manufacturing, with Japan and China established as supply chain nodes for LiDAR, AR/VR, and 3D-3D sensing. Europe is leading in micro- and holographic optics (especially for aerospace, automotive, and medical applications), while North America is best-known for industrial laser systems and prototyping, as well as defense/aerospace programs. The market structure is dynamic, with leaders in long-term contracts through high reliability and process IP, followers, who excel in agility and customization and disruptors who will cause demand for thinner, lighter, and multi-functional DOE designs. Overall, the DOE market is evolving around three growth drivers: adoption in high-power industrial lasers, integration into mobility and XR ecosystem (expecting that AR displays will drive demand), and demand for glass-based optics, that also durable and mass-producible. This competitive landscape presents clear growth opportunities for stakeholders who want to align with innovators built on a technological foundation, yet rugged enough to manufacture at scale.Recent Development in Diffractive Optical Elements Market:

1. Jan 2023 Coherent Corp. (U.S.): Coherent introduced a new product line of diffractive optical elements (DOEs) for high-power industrial lasers, leveraging proprietary nanoimprint technology to deliver high optical efficiency, uniform beam shaping, and precision optical coatings for kW-class applications like welding, cutting, and additive manufacturing. 2. February 2024, Apollo Optical Systems Inc (US) California, USA: Partnership with SilvaCo Optics Apollo Optical Systems entered into a strategic partnership with SilvaCo Optics (based in Northern California), appointing them as their sales representative for all new business in the state of California. This move aims to extend Apollo’s reach in key markets, particularly those related to diffractive and precision polymer optics. 3. June-2025, Zeiss Group, Germany: ZEISS launched a new AEROSPACE field of business within ZEISS Microoptics. This strategic move focuses on holographic display solutions particularly compact “third-generation” head-up displays (HUDs) for cockpits and transparent cabin displays leveraging holographic optical elements, an application of diffractive optics, to create lightweight, multifunctional, and space-efficient solutions. 4. Jan 2025 AGC Inc (Japan): AGC markets DOE and diffuser technologies glass-based, micro-structured optical components for applications in 3D sensing, LiDAR, AR/VR/MR, optical communications, projectors, lighting, and laser beam shaping. High durability, large FOV, high-density dot projection, one-stop design-to-mass-production service emphasized. 5. Jan 2024, Nil Technology (Singapore): NIL Technology ApS (NILT) is headquartered in Copenhagen, Denmark, with offices in Switzerland, Sweden, and the U.S. but no mention of Singapore in their corporate footprint or press materials.Key Trends in the Diffractive Optical Elements Market

1. Departure into High-Power Laser and Industrial Applications Companies like Coherent Corp. are now offering DOE solutions directly intended for kW-class lasers used in welding, cutting, and additive manufacturing. Overall, this shows that DOEs are venturing into new territory by pushing out of just low-power optics and entering the core of industrial processes that require high optical efficiency, the ability to shape their beam, and durable enough pieces to withstand longer runtime operations. 2. Arrival into Emerging Display and Sensing Technologies One area that is set to accelerate the demand for DOE (via holographic optical elements) is next-generation aerospace HUDs and transparent display of the cabin environment by ZEISS, while AGC has added LiDAR, AR/VR/MR, and 3D sensing in their portfolio. This is part of a broader trend of DOEs that will enable wide field-of-view miniaturization and multi-functional optics. These technologies are important to autonomous vehicles, immersive AR/VR/MR experience, and advanced cockpit systems that are being established. 3. Partnerships for Further Partnerships Inspectional in Context With Apollo Optical Systems and SilvaCo Optics partnership on the west coast of California, it provides evidence of how DOE companies are establishing regional sales networks and partnerships that provide added value to expandable markets in polymer optics and custom optical components. These activities are indicative that we are entering an era where we are not only addressing innovation in technology along the development curve, but we are also advancing innovation in scaling business models around the globe to capture demand across industry segments.Diffractive Optical Elements Market Scope : Inquire before buying

Diffractive Optical Elements Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 671.74 Bn. Forecast Period 2025 to 2032 CAGR: 5.2% Market Size in 2032: USD 1007.69 Bn. Segments Covered: by Type Beam Splitter Beam Shaper Homogenizer (Beam Diffusers) by Industry Healthcare Electronics and Semiconductor Telecommunication Others by Application Biomedical Devices Laser Material Processing LIDAR Communication Optical Sensors Lithographic and Holographic Lighting Others Global Diffractive Optical Elements Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key players operating in Global Diffractive Optical Elements Market

North America 1. Coherent Corp (US) 2. Broadcom (US) 3. Apollo Optical Systems Inc (US) 4. Viavi Solutions Inc. (US) 5. Holo/Or Ltd (Israel) Europe 1. Zeiss Group (Germany) 2. Jenoptik AG (Germany) 3. Holoeye Photonics AG (Germany) 4. SUSS MicroOptics SA (Switzerland) 5. HORIBA, Ltd. (France/Japan) Asia-Pacific 1. AGC Inc (Japan) 2. Nil Technology (Singapore) 3. Nissei Technology Corp (Japan) 4. Sintec Optronics Ltd (Singapore) 5. Hyperion Optics (China)Frequently Asked Questions:

1. Which region has the largest share in Global market? Ans: Asia Pacific region held the highest share in the Diffractive Optical Element Market in 2024. 2. What is the growth rate of Global Diffractive Optical Element Market? Ans: The Global market is growing at a CAGR of 5.2% during forecasting period 2025-2032. 3. What is scope of the Global Diffractive Optical Element Market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What was the Global Diffractive Optical Element Market size in 2024? Ans: The Global market was valued at US$ 671.74 Bn. In 2024. 5. What is the study period of this Diffractive Optical Element Market? Ans: The Global market is studied from 2024 to 2032.

1. Diffractive Optical Elements Market: Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Diffractive Optical Elements Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Diffractive Optical Elements Market: Dynamics 3.1. Region wise Trends of Diffractive Optical Elements Market 3.1.1. North America Diffractive Optical Elements Market Trends 3.1.2. Europe Diffractive Optical Elements Market Trends 3.1.3. Asia Pacific Diffractive Optical Elements Market Trends 3.1.4. Middle East and Africa Diffractive Optical Elements Market Trends 3.1.5. South America Diffractive Optical Elements Market Trends 3.2. Diffractive Optical Elements Market Dynamics 3.2.1. Global Diffractive Optical Elements Market Drivers 3.2.2. Global Diffractive Optical Elements Market Restraints 3.2.3. Global Diffractive Optical Elements Market Opportunities 3.2.4. Global Diffractive Optical Elements Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Technological 3.4.2. Social 3.4.3. Legal 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Diffractive Optical Elements Market: Global Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 4.1.1. Beam Splitter 4.1.2. Beam Shaper 4.1.3. Homogenizer (Beam Diffusers) 4.2. Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 4.2.1. Healthcare 4.2.2. Electronics and Semiconductor 4.2.3. Telecommunication 4.2.4. Others 4.3. Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 4.3.1. Biomedical Devices 4.3.2. Laser Material Processing 4.3.3. LIDAR 4.3.4. Communication 4.3.5. Optical Sensors 4.3.6. Lithographic and Holographic 4.3.7. Lighting 4.3.8. Others 4.4. Diffractive Optical Elements Market Deployment and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Diffractive Optical Elements Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 5.1.1. Beam Splitter 5.1.2. Beam Shaper 5.1.3. Semi-Autonomous 5.2. North America Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 5.2.1. Healthcare 5.2.2. Electronics and Semiconductor 5.2.3. Telecommunication 5.2.4. Others 5.3. North America Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 5.3.1. Biomedical Devices 5.3.2. Laser Material Processing 5.3.3. LIDAR 5.3.4. Communication 5.3.5. Optical Sensors 5.3.6. Lithographic and Holographic 5.3.7. Lighting 5.3.8. Others 5.4. North America Diffractive Optical Elements Market Deployment and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 5.4.1.1.1. Beam Splitter 5.4.1.1.2. Beam Shaper 5.4.1.1.3. Homogenizer (Beam Diffusers) 5.4.1.2. United States Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 5.4.1.2.1. Healthcare 5.4.1.2.2. Electronics and Semiconductor 5.4.1.2.3. Telecommunication 5.4.1.2.4. Others 5.4.1.3. United States Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 5.4.1.3.1. Biomedical Devices 5.4.1.3.2. Laser Material Processing 5.4.1.3.3. LIDAR 5.4.1.3.4. Communication 5.4.1.3.5. Optical Sensors 5.4.1.3.6. Lithographic and Holographic 5.4.1.3.7. Lighting 5.4.1.3.8. Others 5.4.2. Canada 5.4.2.1. Canada Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 5.4.2.1.1. Beam Splitter 5.4.2.1.2. Beam Shaper 5.4.2.1.3. Homogenizer (Beam Diffusers) 5.4.2.1. Canada Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 5.4.2.1.2. Healthcare 5.4.2.1.3. Electronics and Semiconductor 5.4.2.1.4. Telecommunication 5.4.2.1.5. Others 5.4.2.2. Canada Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 5.4.2.2.2. Biomedical Devices 5.4.2.2.3. Laser Material Processing 5.4.2.2.4. LIDAR 5.4.2.2.5. Communication 5.4.2.2.6. Optical Sensors 5.4.2.2.7. Lithographic and Holographic 5.4.2.2.8. Lighting 5.4.2.2.9. Others 5.4.3. Mexico 5.4.3.1. Mexico Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 5.4.3.1.2. Beam Splitter 5.4.3.1.3. Beam Shaper 5.4.3.1.4. Homogenizer (Beam Diffusers) 5.4.3.2. Mexico Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 5.4.3.2.2. Healthcare 5.4.3.2.3. Electronics and Semiconductor 5.4.3.2.4. Telecommunication 5.4.3.2.5. Others 5.4.3.3. Mexico Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 5.4.3.3.2. Biomedical Devices 5.4.3.3.3. Laser Material Processing 5.4.3.3.4. LIDAR 5.4.3.3.5. Communication 5.4.3.3.6. Optical Sensors 5.4.3.3.7. Lithographic and Holographic 5.4.3.3.8. Lighting 5.4.3.3.9. Others 6. Europe Diffractive Optical Elements Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.2. Europe Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.3. Europe Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4. Europe Diffractive Optical Elements Market Deployment and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.1.3. United Kingdom Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4.2. France 6.4.2.1. France Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.2.2. France Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.2.3. France Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.3.2. Germany Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.3.3. Germany Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.4.2. Italy Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.4.3. Italy Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.5.2. Spain Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.5.3. Spain Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.6.3. Sweden Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.7.2. Austria Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.7.3. Austria Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 6.4.8.3. Rest of Europe Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7. Asia Pacific Diffractive Optical Elements Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.2. Asia Pacific Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.3. Asia Pacific Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4. Asia Pacific Diffractive Optical Elements Market Deployment and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.1.2. China Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.1.3. China Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.2.3. S Korea Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.3.2. Japan Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.3.3. Japan Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.4. India 7.4.4.1. India Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.4.2. India Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.4.3. India Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.5.2. Australia Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.5.3. Australia Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.6.3. Indonesia Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.7.3. Philippines Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.8.3. Malaysia Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.9.3. Vietnam Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.10.3. Thailand Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 7.4.11.3. Rest of Asia Pacific Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 8. Middle East and Africa Diffractive Optical Elements Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 8.3. Middle East and Africa Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 8.4. Middle East and Africa Diffractive Optical Elements Market Deployment and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 8.4.1.3. South Africa Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 8.4.2.2. GCC Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 8.4.2.3. GCC Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 8.4.3.3. Nigeria Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 8.4.4.3. Rest of ME&A Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 9. South America Diffractive Optical Elements Market Deployment and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 9.2. South America Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 9.3. South America Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 9.4. South America Diffractive Optical Elements Market Deployment and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 9.4.1.3. Brazil Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 9.4.2.3. Argentina Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Diffractive Optical Elements Market Deployment and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Diffractive Optical Elements Market Deployment and Forecast, By Industry (2024-2032) 9.4.3.3. Rest of South America Diffractive Optical Elements Market Deployment and Forecast, By Deployment (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Power Output Players) 10.1. Coherent Corp (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Broadcom (US) 10.3. Apollo Optical Systems Inc (US) 10.4. Viavi Solutions Inc. (US) 10.5. Holo/Or Ltd (Israel) 10.6. Zeiss Group (Germany) 10.7. Jenoptik AG (Germany) 10.8. Holoeye Photonics AG (Germany) 10.9. SUSS MicroOptics SA (Switzerland) 10.10. HORIBA, Ltd. (France/Japan) 10.11. AGC Inc (Japan) 10.12. Nil Technology (Singapore) 10.13. Nissei Technology Corp (Japan) 10.14. Sintec Optronics Ltd (Singapore) 10.15. Hyperion Optics (China) 11. Key Findings 12. Analyst Recommendations 13. Diffractive Optical Elements Market: Research Methodology