Global Data Centre Uninterruptible Power Supply Market (UPS) size was valued at USD 4.15 Bn. in 2024, and is expected to grow by 8.5 % from 2025 to 2032, reaching nearly USD 7.97 Bn. in 2032Data Centre Uninterruptible Power Supply Market (UPS) Overview

The Data Centre Uninterruptible Power Supply (UPS) has been defined as comprising systems designed to provide backup power and ensure redundant uptime for critical IT assets in the event of power disruptions. These systems have been essential for protecting sensitive data, maintaining service delivery, supporting IT workloads, and ensuring business continuity while minimising operational risks for organisations with real-time digital operations. As digitisation has expanded, UPS systems have become standard capabilities for data centres serving cloud service providers, e-commerce, financial services, and telecommunications. Ongoing advancements in infrastructure aim to establish reliable and resilient power systems this factor significant drives the market Data centre footprints and capacities have been expanding steadily. The adoption of edge computing has been growing. Hyperscale facility development has been increasing. Frequent power outages have highlighted the need for advanced UPS systems. The rising costs of downtime have reinforced their value. New UPS designs have been incorporating energy-efficient architectures. Lithium-ion battery technology has been replacing traditional options. Modular capacity expansion has been addressing dynamic enterprise needs. Also, the industry has faced challenges such as high initial capital investment, regular maintenance demands, battery disposal issues, regulatory compliance, and tightening energy efficiency standards. Manufacturers have focusing on reducing lifecycle costs, mitigating environmental impacts, and aligning products with compliance requirements through dedicated R&D. Geographically, North America has held the largest market share of Data Centre Uninterruptible Power Supply Market (UPS) due to its mature data centre ecosystem and high-power reliability. Asia-Pacific has been witnessing rapid growth, boosted by digital transformation, increasing cloud adoption, and large-scale data centre construction in markets such as China and India. Leading players, including Eaton Corporation, Vertiv Holdings, and Schneider Electric, have shaping the industry with innovative technologies, strategic partnerships, and service-oriented UPS models tailored to enterprise and colocation data centres.To Know About The Research Methodology :- Request Free Sample Report The increasing reliance on digital infrastructure across sectors to Drive the Data Centre Uninterruptible Power Supply Market Increasing dependence on digital infrastructure in areas such as banking, healthcare, telecom and e-commerce is increasing the demand for reliable and uninterrupted power systems. As more businesses go to cloud-based operations and data-intensive applications, the requirement for continuous data centre operations increases This Factor Significantly Drive The Data Centre Uninterruptible Power Supply Market (UPS). UPS systems are playing an important role in ensuring operational continuity, protecting data from sensitive hardware and electrical ups and downs, outages and grid instability. Edge Computing, Artificial Intelligence and IOT rise have led to the spread of small, distributed data centres, requiring scalable and energy-efficient UPS systems. Additionally, growing concerns about electricity disruption due to natural disasters and grid overloads are prompting enterprises to invest in advanced backup power solutions. Demand is supported in particular by financial and government institutions with strict uptime requirements and service level agreements (SLA). High Initial Cost of Investment to Restrain the Data Centre Uninterruptible Power Supply Market UPS systems designed for large-scale data centers demand capital-intensive equipment, including high-capacity batteries, advanced power electronics, and sophisticated control systems. Depending on scale and redundancy requirements, costs range from tens of thousands to several million dollars. Beyond equipment purchase, installation adds significant expense due to integration with existing electrical infrastructure, allocation of physical space, cooling arrangements, and compliance with safety standards. These requirements substantially raise the upfront financial burden limits the growth of Data Centre Uninterruptible Power Supply Market growth. Ongoing costs, such as periodic battery replacements and regular maintenance, heighten the total cost of ownership (TCO), making investors more cautious. Small and medium-sized data centers, in particular, face budget constraints, slowing the adoption of advanced UPS solutions despite their proven reliability and efficiency benefits. For example, implementing a three-phase UPS system with a 10–50 kVA rating cost $10,000–$50,000 for a mid-sized facility, while hyperscale installations reach millions. Although modular UPS systems provide scalability and long-term operational advantages, the substantial initial expenditure remains a challenge especially in cost-sensitive markets hindering rapid, widespread deployment. The Ongoing Transition toward Modular UPS Systems to Create New Opportunities in the Data Centre Uninterruptible Power Supply Market Modular UPS solutions offer scalability, allowing data centers and enterprises to grow power capacity as demand increases, while providing greater flexibility, space efficiency, and simplified maintenance. The integration of lithium-ion battery technology enhances these systems, delivering longer lifespan, reduced maintenance needs, and improved energy efficiency compared to traditional battery options. The rising focus on green data centers is creating strong demand for UPS systems that align with sustainability goals. Organizations are increasingly willing to invest in solutions with high energy efficiency ratings and the capability to integrate renewable energy sources, helping to reduce overall carbon footprints. Additionally, the deployment of always-on 5G networks and the rapid development of smart cities are driving the need for highly reliable power backup solutions this creates multiple opportunities for Data Centre Uninterruptible Power Supply Market. Modular UPS systems are well-positioned to provide continuous, stable power for critical telecom infrastructure and public services, ensuring uninterrupted operation in mission-critical environments. These trends pathways for innovation, premium product offerings, and market penetration across developed and emerging economies. The Data Centre Ups Market to Face Challenges in the Data Centre Uninterruptible Power Supply Market (UPS) The data centre UPS industry is challenged by standardisation and regulatory compliance issues as governments issue stricter mandates around energy efficiency and data security. Ongoing improvement and assurance are necessary to maintain compliance with certifications such as Energy Star, RoHS (Restriction of Hazardous Substances Directive), and ISO (International Organisation for Standardisation) standards. Furthermore, supply chain disruptions and ongoing raw material shortages of critical inputs, such as semiconductors and batteries, hamper product availability and lead times. The industry is fragmented, consisting of global and regional competitors implementing pricing, innovation, and service delivery strategies. Fast-changing technology represents the newly created need for UPS systems to constantly redefine itself with regard to next-generation data centres, and with this requirement comes the pressure of R&D and operating capabilities.

Data Centre Uninterruptible Power Supply Market (UPS) Segment Analysis:

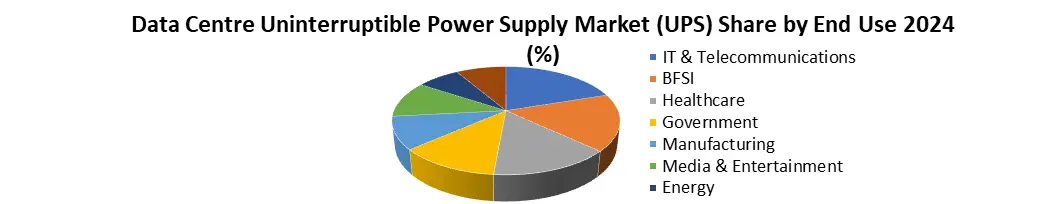

Based on Data center Size, the data centre seamless power supply market is segmented into small data centres, medium data centres and large data centres. The big data centres dominated the market in 2024. Due to their substantial power demands and critical reliance on uninterrupted electricity. These facilities, often hosting hyperscale cloud infrastructure, AI processing clusters, and massive enterprise workloads, require multi-megawatt UPS systems to ensure operational continuity. The growing adoption of data-intensive technologies, including generative AI, IoT, and big data analytics, has significantly increased the need for high-capacity, efficient, and redundant power solutions. Large data centres typically adhere to stringent uptime standards, such as Tier IV, where even brief power interruptions can lead to considerable financial and operational losses. This drives heavy investment in advanced UPS systems featuring modular scalability, high efficiency, and integrated backup capabilities. Furthermore, the global expansion of major cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud has accelerated large facility deployments, reinforcing this segment’s market dominance. Integration of renewable energy and battery storage further strengthens their resilience and sustainability.By End Use, the Data Centre Uninterruptible Power Supply Market (UPS) market has been segmented into IT & Telecommunications, BFSI, Healthcare, Government, Manufacturing, Media & Entertainment, Energy and Others. The IT & Telecommunications segment dominated the Application segment in 2024. The rapid expansion of cloud computing, hyperscale data centres, and 5G infrastructure. This sector generates massive volumes of data requiring continuous processing, storage, and transmission, making uninterrupted power supply critical to avoid downtime and service disruptions. The surge in AI, IoT, and big data analytics further amplified the demand for robust UPS systems capable of supporting high-density computing environments. Major telecom operators and IT service providers operate facilities with stringent uptime requirements, often adhering to Tier III or Tier IV standards, where even brief power interruptions can result in significant operational and financial losses. This has led to substantial investments in advanced UPS solutions offering high efficiency, scalability, and redundancy. Additionally, the increasing rollout of edge data centres to support low-latency applications in telecommunications has fueled the need for reliable power backup, consolidating the IT & Telecommunications segment’s leadership in the market.

Data Centre Uninterruptible Power Supply Market (UPS)Regional Insights

North America dominated the Data Centre Uninterruptible Power Supply Market in 2024. The strong infrastructure, high digital adoption, and substantial investments in hyperscale and colocation facilities. The U.S. and Canada host a significant share of the world’s largest data centres, driven by the rapid expansion of cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. These companies continually invest in advanced UPS systems to ensure uninterrupted operations for AI, IoT, and big data workloads. Government initiatives strengthen Data Centre Uninterruptible Power Supply Market (UPS) growth. For example, the U.S. Department of Energy’s Better Buildings Initiative promotes energy-efficient data centre operations, indirectly encouraging the adoption of high-efficiency UPS systems. Federal and state-level investments in broadband expansion and 5G infrastructure, such as the Infrastructure Investment and Jobs Act (IIJA), boost demand for reliable power backup in telecom and edge data centres. Additionally, Canada’s Innovation Superclusters Initiative supports digital infrastructure development, prompting operators to integrate scalable, sustainable UPS technologies, consolidating North America’s leadership in the global Data Centre Uninterruptible Power Supply Market (UPS). Data Centre Uninterruptible Power Supply Market (UPS) Competitive Landscape: The Data Centre Uninterruptible Power Supply Market is intensive competition among key players in the market, with Eaton Corporation and Schneider Electric emerging as two major forces. Eaton goes to North America and Europe, operating by its extensive UPS portfolio, strong service network and intensive integration with power management and automation systems. Its strong presence in enterprises and industrial data centres allows it to complete both the infrastructure of the heritage and the deployment of the emerging edge. Meanwhile, the Schneider is dominated by the Electric Asia-Pacific and the global hyperscale Data Centre Uninterruptible Power Supply Market (UPS), which take advantage of its ecostruxer architecture, energy-skilled solutions and comprehensive channel participation to serve cloud service providers and colocation facilities. The two companies invest heavily in R&D, smart grid integration and modular UPS techniques, while expanding their global access through acquisition and stability-driven innovation. Their continuous market leadership rests on fulfilling the increasing demand for energy-efficient, scalable solutions and navigating regulatory pressures on data centre energy use and uptime performance. Data Centre Uninterruptible Power Supply Market (UPS) Key Developments: In October 2023, ABB introduced nickel-zinc (NiZn) batteries into its MegaFlex high-power UPS solutions for data centers and critical power systems. Supplied by ZincFive, these batteries offer a safer, more resilient, and sustainable alternative to traditional battery technologies, enhancing reliability and environmental performance in mission-critical energy storage applications. In December 2024, Vertiv unveiled the Vertiv PowerUPS 9000, a compact and energy-efficient uninterruptible power supply (UPS) system engineered for a wide range of IT applications, from traditional computing setups to high-density environments. Featuring high power density, it ensures optimal performance while saving valuable space. The system is available globally in both CE and UL-certified models, offering power capacities from 250 to 1250 kW per unit. Designed to enhance reliability, scalability, and energy efficiency, it addresses the evolving demands of modern data centers and mission-critical IT infrastructure. In June 2025, Eaton partnered with Siemens Energy to distribute modular, grid-independent power plants for data center construction. The solution combines a 500 MW gas turbine, battery energy storage, and on-site generation, enabling faster, more flexible deployment. This integrated approach reduces typical project timelines by up to two years while significantly lowering costs and emissions, supporting sustainable and efficient power infrastructure for large-scale data center operations. Data Centre Uninterruptible Power Supply Market (UPS) Key Trends: Rising Digitalization and Cloud Adoption in Data Centre Uninterruptible Power Supply Market The surge in digital data traffic, driven with widespread internet usage, cloud computing expansion, and data-intensive applications, is significantly boosting demand for reliable UPS systems in data centers. With businesses and consumers increasingly dependent on uninterrupted digital services, even minor outages cause operational and financial losses. UPS systems ensure consistent power delivery, protecting critical IT infrastructure from disruptions. The growth of edge computing, video streaming, IoT networks, and hybrid cloud environments further amplifies the need for robust, scalable UPS solutions, enabling data centers to maintain uptime, support rapid data exchange, and meet evolving digital service demands efficiently. Technological Innovation in Modular UPS Systems The adoption of modular UPS systems is accelerating due to their scalability, compact design, and simplified maintenance. Unlike traditional monolithic systems, modular UPS units allow incremental capacity expansion without complete system overhauls, reducing capital expenditure. Their plug-and-play configuration minimizes downtime during maintenance or upgrades, improving operational continuity. Space efficiency is especially valuable in high-density data centers where floor space is at a premium. Modular designs also enhance fault isolation, ensuring failures in one module do not affect the entire system. As data center workloads fluctuate, modular UPS systems offer flexible power management while optimizing energy usage and improving efficiency.Data Centre Uninterruptible Power Supply Market (UPS) Scope: Inquire before buying

Data Centre Uninterruptible Power Supply Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.15 Bn. Forecast Period 2025 to 2032 CAGR: 8.5 % Market Size in 2032: USD 7.97 Bn. Segments Covered: by Setup Centralized Distributed by Architecture Monolithic Modular by Data Center Size Small Data Centers (20 kVA to 200 kVA) Medium Data Centers (200.1 kVA to 500 kVA) Large Data Centers (More than 500 kVA) by Product Line Interactive Standby Double Conversion by End Use IT & Telecommunications BFSI Healthcare Government Manufacturing Media & Entertainment Energy Others Data Centre Uninterruptible Power Supply Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Data Centre Uninterruptible Power Supply Market Key Players

North America 1. Vertiv (USA) 2. Eaton Corp. (USA/Ireland) 3. Active Power (USA) 4. ZincFive (USA) 5. Natron Energy (USA) 6. APC (Schneider Electric SA) (USA) 7. Cyber Power Systems Inc. (USA) 8. Active Power, Inc. (USA) Europe 1. Schneider Electric SA (France) 2. ABB (Switzerland) 3. Riello UPS (Italy) 4. Socomec Group (France) 5. Borri S.p.A. (Italy) 6. AEG Power Solutions BV (Germany) Asia-Pacific 1. Toshiba Corp. (Japan) 2. Delta Electronics (Delta Power Solutions) (Taiwan) 3. Huawei Technologies (China) 4. Mitsubishi Electric Corporation (Japan)FAQ’S

1. Which region has the largest share in the Global Data Centre Uninterruptible Power Supply Market (UPS)? Ans: North America region held the Largest Market share in 2024. 2. What is the growth rate of the Global Data Centre Uninterruptible Power Supply Market (UPS)? Ans: The Global Data Centre Uninterruptible Power Supply Market (UPS) is growing at a CAGR of 8.5 % during the forecasting period 2025-2032. 3. What is the scope of the Global Data Centre Uninterruptible Power Supply Market (UPS) report? Ans: Global Data Centre Uninterruptible Power Supply Market (UPS) report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Data Centre Uninterruptible Power Supply Market (UPS)? Ans: The important key players in the Global Data Centre Uninterruptible Power Supply Market (UPS) are – Vertiv (USA), Eaton Corp. (USA/Ireland), Active Power (USA), ZincFive (USA), Natron Energy (USA), Schneider Electric SA (France), ABB (Switzerland), Riello UPS (Italy), Toshiba Corp. (Japan), Delta Electronics (Taiwan), and Huawei Technologies (China). 5. What is the study period of this Market? Ans: The Global Data Centre Uninterruptible Power Supply Market (UPS) is studied from 2024 to 2032.

1. Data Centre Uninterruptible Power Supply Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Data Centre Uninterruptible Power Supply Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Data Centre Uninterruptible Power Supply Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Data Centre Uninterruptible Power Supply Market: Dynamics 3.1. Data Centre Uninterruptible Power Supply Market Trends by Region 3.1.1. North America Data Centre Uninterruptible Power Supply Market Trends 3.1.2. Europe Data Centre Uninterruptible Power Supply Market Trends 3.1.3. Asia Pacific Data Centre Uninterruptible Power Supply Market Trends 3.1.4. Middle East and Africa Data Centre Uninterruptible Power Supply Market Trends 3.1.5. South America Data Centre Uninterruptible Power Supply Market Trends 3.2. Data Centre Uninterruptible Power Supply Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Data Centre Uninterruptible Power Supply Market Drivers 3.2.1.2. North America Data Centre Uninterruptible Power Supply Market Restraints 3.2.1.3. North America Data Centre Uninterruptible Power Supply Market Opportunities 3.2.1.4. North America Data Centre Uninterruptible Power Supply Market Challenges 3.2.2. Europe 3.2.2.1. Europe Data Centre Uninterruptible Power Supply Market Drivers 3.2.2.2. Europe Data Centre Uninterruptible Power Supply Market Restraints 3.2.2.3. Europe Data Centre Uninterruptible Power Supply Market Opportunities 3.2.2.4. Europe Data Centre Uninterruptible Power Supply Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Data Centre Uninterruptible Power Supply Market Drivers 3.2.3.2. Asia Pacific Data Centre Uninterruptible Power Supply Market Restraints 3.2.3.3. Asia Pacific Data Centre Uninterruptible Power Supply Market Opportunities 3.2.3.4. Asia Pacific Data Centre Uninterruptible Power Supply Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Data Centre Uninterruptible Power Supply Market Drivers 3.2.4.2. Middle East and Africa Data Centre Uninterruptible Power Supply Market Restraints 3.2.4.3. Middle East and Africa Data Centre Uninterruptible Power Supply Market Opportunities 3.2.4.4. Middle East and Africa Data Centre Uninterruptible Power Supply Market Challenges 3.2.5. South America 3.2.5.1. South America Data Centre Uninterruptible Power Supply Market Drivers 3.2.5.2. South America Data Centre Uninterruptible Power Supply Market Restraints 3.2.5.3. South America Data Centre Uninterruptible Power Supply Market Opportunities 3.2.5.4. South America Data Centre Uninterruptible Power Supply Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Data Centre Uninterruptible Power Supply Industry 3.8. Analysis of Government Schemes and Initiatives For Data Centre Uninterruptible Power Supply Industry 3.9. Data Centre Uninterruptible Power Supply Market Trade Analysis 3.10. The Global Pandemic Impact on Data Centre Uninterruptible Power Supply Market 4. Data Centre Uninterruptible Power Supply Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 4.1.1. Centralized 4.1.2. Distributed 4.2. Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 4.2.1. Monolithic 4.2.2. Modular 4.3. Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 4.3.1. Small Data Centers (20 kVA to 200 kVA) 4.3.2. Medium Data Centers (200.1 kVA to 500 kVA) 4.3.3. Large Data Centers (More than 500 kVA) 4.4. Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 4.4.1. Line Interactive 4.4.2. Standby 4.4.3. Double Conversion 4.5. Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 4.5.1. IT & Telecommunications 4.5.2. BFSI 4.5.3. Healthcare 4.5.4. Government 4.5.5. Manufacturing 4.5.6. Media & Entertainment 4.5.7. Energy 4.5.8. Others 4.6. Data Centre Uninterruptible Power Supply Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Data Centre Uninterruptible Power Supply Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 5.1.1. Centralized 5.1.2. Distributed 5.2. North America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 5.2.1. Monolithic 5.2.2. Modular 5.3. North America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 5.3.1. Small Data Centers (20 kVA to 200 kVA) 5.3.2. Medium Data Centers (200.1 kVA to 500 kVA) 5.3.3. Large Data Centers (More than 500 kVA) 5.4. North America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 5.4.1. Line Interactive 5.4.2. Standby 5.4.3. Double Conversion 5.5. North America Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 5.5.1. IT & Telecommunications 5.5.2. BFSI 5.5.3. Healthcare 5.5.4. Government 5.5.5. Manufacturing 5.5.6. Media & Entertainment 5.5.7. Energy 5.5.8. Others 5.6. North America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 5.6.1.1.1. Centralized 5.6.1.1.2. Distributed 5.6.1.2. United States Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 5.6.1.2.1. Monolithic 5.6.1.2.2. Modular 5.6.1.3. United States Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 5.6.1.3.1. Small Data Centers (20 kVA to 200 kVA) 5.6.1.3.2. Medium Data Centers (200.1 kVA to 500 kVA) 5.6.1.3.3. Large Data Centers (More than 500 kVA) 5.6.1.4. United States Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 5.6.1.4.1. Line Interactive 5.6.1.4.2. Standby 5.6.1.4.3. Double Conversion 5.6.1.5. United States Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 5.6.1.5.1. IT & Telecommunications 5.6.1.5.2. BFSI 5.6.1.5.3. Healthcare 5.6.1.5.4. Government 5.6.1.5.5. Manufacturing 5.6.1.5.6. Media & Entertainment 5.6.1.5.7. Energy 5.6.1.5.8. Others 5.6.2. Canada 5.6.2.1. Canada Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 5.6.2.1.1. Centralized 5.6.2.1.2. Distributed 5.6.2.2. Canada Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 5.6.2.2.1. Monolithic 5.6.2.2.2. Modular 5.6.2.3. Canada Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 5.6.2.3.1. Small Data Centers (20 kVA to 200 kVA) 5.6.2.3.2. Medium Data Centers (200.1 kVA to 500 kVA) 5.6.2.3.3. Large Data Centers (More than 500 kVA) 5.6.2.4. Canada Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 5.6.2.4.1. Line Interactive 5.6.2.4.2. Standby 5.6.2.4.3. Double Conversion 5.6.2.5. Canada Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 5.6.2.5.1. IT & Telecommunications 5.6.2.5.2. BFSI 5.6.2.5.3. Healthcare 5.6.2.5.4. Government 5.6.2.5.5. Manufacturing 5.6.2.5.6. Media & Entertainment 5.6.2.5.7. Energy 5.6.2.5.8. Others 5.6.3. Mexico 5.6.3.1. Mexico Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 5.6.3.1.1. Centralized 5.6.3.1.2. Distributed 5.6.3.2. Mexico Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 5.6.3.2.1. Monolithic 5.6.3.2.2. Modular 5.6.3.3. Mexico Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 5.6.3.3.1. Small Data Centers (20 kVA to 200 kVA) 5.6.3.3.2. Medium Data Centers (200.1 kVA to 500 kVA) 5.6.3.3.3. Large Data Centers (More than 500 kVA) 5.6.3.4. Mexico Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 5.6.3.4.1. Line Interactive 5.6.3.4.2. Standby 5.6.3.4.3. Double Conversion 5.6.3.5. Mexico Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 5.6.3.5.1. IT & Telecommunications 5.6.3.5.2. BFSI 5.6.3.5.3. Healthcare 5.6.3.5.4. Government 5.6.3.5.5. Manufacturing 5.6.3.5.6. Media & Entertainment 5.6.3.5.7. Energy 5.6.3.5.8. Others 6. Europe Data Centre Uninterruptible Power Supply Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.2. Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.3. Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.4. Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.5. Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6. Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.1.2. United Kingdom Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.1.3. United Kingdom Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.1.4. United Kingdom Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.1.5. United Kingdom Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6.2. France 6.6.2.1. France Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.2.2. France Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.2.3. France Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.2.4. France Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.2.5. France Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.3.2. Germany Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.3.3. Germany Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.3.4. Germany Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.3.5. Germany Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.4.2. Italy Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.4.3. Italy Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.4.4. Italy Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.4.5. Italy Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.5.2. Spain Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.5.3. Spain Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.5.4. Spain Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.5.5. Spain Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.6.2. Sweden Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.6.3. Sweden Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.6.4. Sweden Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.6.5. Sweden Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.7.2. Austria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.7.3. Austria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.7.4. Austria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.7.5. Austria Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 6.6.8.2. Rest of Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 6.6.8.3. Rest of Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 6.6.8.4. Rest of Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 6.6.8.5. Rest of Europe Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.2. Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.3. Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.4. Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.5. Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6. Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.1.2. China Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.1.3. China Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.1.4. China Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.1.5. China Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.2.2. S Korea Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.2.3. S Korea Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.2.4. S Korea Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.2.5. S Korea Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.3.2. Japan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.3.3. Japan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.3.4. Japan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.3.5. Japan Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.4. India 7.6.4.1. India Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.4.2. India Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.4.3. India Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.4.4. India Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.4.5. India Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.5.2. Australia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.5.3. Australia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.5.4. Australia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.5.5. Australia Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.6.2. Indonesia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.6.3. Indonesia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.6.4. Indonesia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.6.5. Indonesia Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.7.2. Malaysia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.7.3. Malaysia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.7.4. Malaysia Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.7.5. Malaysia Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.8.2. Vietnam Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.8.3. Vietnam Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.8.4. Vietnam Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.8.5. Vietnam Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.9.2. Taiwan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.9.3. Taiwan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.9.4. Taiwan Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.9.5. Taiwan Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 7.6.10.2. Rest of Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 7.6.10.3. Rest of Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 7.6.10.4. Rest of Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 7.6.10.5. Rest of Asia Pacific Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Data Centre Uninterruptible Power Supply Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 8.2. Middle East and Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 8.3. Middle East and Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 8.4. Middle East and Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 8.5. Middle East and Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 8.6. Middle East and Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 8.6.1.2. South Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 8.6.1.3. South Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 8.6.1.4. South Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 8.6.1.5. South Africa Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 8.6.2.2. GCC Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 8.6.2.3. GCC Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 8.6.2.4. GCC Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 8.6.2.5. GCC Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 8.6.3.2. Nigeria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 8.6.3.3. Nigeria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 8.6.3.4. Nigeria Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 8.6.3.5. Nigeria Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 8.6.4.2. Rest of ME&A Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 8.6.4.3. Rest of ME&A Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 8.6.4.4. Rest of ME&A Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 8.6.4.5. Rest of ME&A Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 9. South America Data Centre Uninterruptible Power Supply Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 9.2. South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 9.3. South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size(2024-2032) 9.4. South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 9.5. South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 9.6. South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 9.6.1.2. Brazil Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 9.6.1.3. Brazil Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 9.6.1.4. Brazil Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 9.6.1.5. Brazil Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 9.6.2.2. Argentina Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 9.6.2.3. Argentina Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 9.6.2.4. Argentina Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 9.6.2.5. Argentina Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Setup (2024-2032) 9.6.3.2. Rest Of South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Architecture (2024-2032) 9.6.3.3. Rest Of South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Data Center Size (2024-2032) 9.6.3.4. Rest Of South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by Product (2024-2032) 9.6.3.5. Rest Of South America Data Centre Uninterruptible Power Supply Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. Vertiv (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Eaton Corp. (USA/Ireland) 10.3. Active Power (USA) 10.4. ZincFive (USA) 10.5. Natron Energy (USA) 10.6. APC (Schneider Electric SA) (USA) 10.7. Cyber Power Systems Inc. (USA) 10.8. Active Power, Inc. (USA) 10.9. Schneider Electric SA (France) 10.10. ABB (Switzerland) 10.11. Riello UPS (Italy) 10.12. Socomec Group (France) 10.13. Borri S.p.A. (Italy) 10.14. AEG Power Solutions BV (Germany) 10.15. Toshiba Corp. (Japan) 10.16. Delta Electronics (Delta Power Solutions) (Taiwan) 10.17. Huawei Technologies (China) 10.18. Mitsubishi Electric Corporation (Japan) 11. Key Findings 12. Industry Recommendations 13. Data Centre Uninterruptible Power Supply Market: Research Methodology 14. Terms and Glossary