Crude Oil Carriers Market Size was valued at USD 257.37 Bn in 2024, and total global Crude Oil Carriers Market revenue is expected to grow at a CAGR of 4.2% from 2025 to 2032, reaching nearly USD 357.68 Bn.Crude Oil Carriers Market Overview

Crude oil carriers market consists of specialized marine vessels, including VLCCs and ULCCs, designed to transport unrefined petroleum across international trade routes. Market is surrounded with operators, shipbuilder and logistics providers facilitating global energy supply chains. Market growth has been driven by increasing crude production and refining demand, particularly in emerging economies. Increased oil consumption in Asia Pacific and surging extraction in the Middle East create a steady supply demand dynamic, accelerating long haul crude transportation. Asia Pacific led market in 2024 due to China and India's import reliance, while Middle East dominates supply owing to high output and export volumes. Key players liked China COSCO Shipping Energy, Euronav NV and Teekay Corporation lead through scale, sustainability strategy and global fleet networks. End user dominance is observed in refineries and downstream petroleum sectors. Recent trade initiatives, like India’s Make in India tanker program 8and ADNOC’s acquisition of Navig8, are reshaping fleet capacity and reducing foreign dependency, influencing regional competitiveness and trade flows. Report covers the Crude Oil Carriers Market dynamic, structure by analysing the market segments and projecting Crude Oil Carriers Market size. Clear representation of competitive analysis of key players by Product, price, financial position, Product portfolio, growth strategies and regional presence in the Crude Oil Carriers Market.To know about the Research Methodology :- Request Free Sample Report

Crude Oil Carriers Market Dynamics

Rising Production and Shifting Export to drive Crude Oil Carriers Market

Crude oil carriers are mostly referred to as oil tankers that is transport crude oil from one location to another. Oil tankers have become an essential part of the transportation process of crude oil around the world. Crude oil carriers are intended for the majority transport of crude oil. The different vessel sizes have enlarged the volume of crude oil that can be transported to several locations across the global. In terms of exports, crude oil heads across the Atlantic to Europe are reducing North America dependency on crude oil from other regions like the Middle East. Intensification of crude oil extraction activities are augmented the demand for the crude oil carrier market globally. The upsurge in the production of crude oil in the Middle East Africa region is anticipated to boost the crude oil carrier market growth during the forecast period. at 69.5 mg/g. Also, the olive tree, the most used plant as a Crude Oil Carriers source, includes Crude Oil Carriers as 7 mg/g in its leaves.Crude Oil Carriers Market Segment Analysis

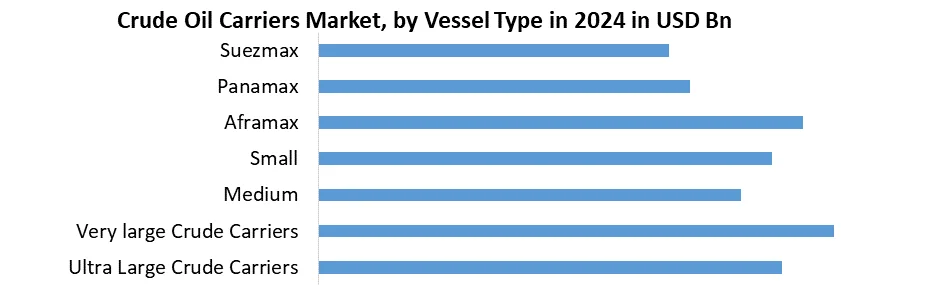

Based on Hull Type, Crude oil carriers are categorized by hull type into Single Bottom, Double Bottom, and Double Hull configurations. Among these, Double Hull carriers dominated the global market in 2024 due to strict international safety and environmental regulations, particularly after incidents like the Exxon Valdez oil spill. Double hulls provide an extra layer between the cargo and the sea, significantly reducing the risk of spills during accidents. Single bottom vessels, which offer minimal protection, are now largely outdated and phased out. Double bottom designs add structural reinforcement beneath cargo tanks, offering moderate protection but not as comprehensive as double hulls. As a result, modern crude carriers are increasingly built with double hulls, making them the industry standard for oil transportation worldwide. Based On Vessel Type, the Very Large Crude Carriers (VLCC) segment has led the crude oil carriers market in 2024. VLCC have a size range between 180,000 to 320,000 DWT and are capable of passing through the Suez Canal in Egypt, therefore, these carriers are widely used across the North Sea, the Mediterranean and West Africa. Demand for VLCC has increased by around 5% and is projected to grow with decreasing spot rate of VLCC due to reduced domestic production, especially in the Asia-Pacific region.VLCC and ULCC together dominated the market share in 2024 owing to large number of VLCCs are presently in operation than other vessels type. Tanker vessel with a capacity of approximately 2 Mn barrels of crude oil, which is used to transport crude oil over long distances in inter-regional trade.

Crude Oil Carriers Market Regional Insights

Asia Pacific Region dominated the Crude Oil Carriers Market in 2024 and is expected to dominate during the forecast period (2025-2032)

Especially China has store huge amounts of low-cost crude oil in spite of its emerging economy. Asia-Pacific, particularly India's domestic crude production is declining from the past decade, which is anticipated to increase its dependency on the overseas nations and is likely to increase crude trade and thereby crude oil carrier market. Therefore, India's dependence on other countries for crude oil is estimated to create an opportunity for the crude oil carrier market in the coming years. Japan, China, South Korea, and Malaysia, has operate and own majority of the crude oil carriers and these countries are the major contributors in the overall crude oil carriers market. The Middle East is one of the largest producers of crude oil and is export its maximum volume of crude oil to Asia-Pacific. Moreover, the rising investments in research and development activities for the introduction of advanced crude oil carriers are predicted to accelerate the growth of this region in the near future.Crude Oil Carriers Market Competitive Landscape

In crude oil carrier market, three dominant players China COSCO Shipping Energy (China), Euronav NV (Belgium) and Teekay Corporation (Canada) stand out due to their operational scale, strategic expansion and financial resilience. China COSCO Shipping Energy (China), Asia largest tanker operator, with strong backing from Chinese government and vertically integrated logistics infrastructure to dominate's long haul crude route, particularly between the Middle East and East Asia. Vast fleet and continuous investment in dual fuel and LNG powered vessel position it as enabler of China’s energy security and decarbonization goals. Euronav NV (Belgium), is one of the world’s largest independent crude tanker operator with strong foothold in VLCC and Suezmax segments. Euronav’s strategic merger and acquisition, along with robust ESG focus, allow it to cater both Atlantic and Pacific trade route with agility and operational excellence. Partnership with shipyard and green shipping venture underscore its leadership in sustainable marine transport. Teekay's Corporation (Canada), brings diversified exposure with its operations spanning crude tankers, LNG and offshore logistics. Teekay’s asset light model, strategic joint venture and digital optimization of fleet performance allow it to remain competitive despite market volatility. Collectively, these firms define the strategic landscape through innovation, scale and adaptability.Crude Oil Carriers Market Trends

Trends Details Impact Shift Toward Eco-Friendly Tankers Growing adoption of LNG-fueled and dual-fuel crude carriers to meet IMO decarbonization targets. Enhances fleet sustainability and reduces emissions and regulatory risks. Increased Demand from Asia-Pacific Surge in crude imports from China and India driving demand for VLCCs and long-haul crude transport. Boosts tanker utilization rates and supports fleet expansion in the region. Consolidation and Strategic Alliances Mergers, acquisitions, and partnerships among top players to optimize routes and reduce costs. Improves operational efficiency and global fleet coverage. Crude Oil Carriers Market Key Developments

• 21st May 2025, The Indian government unveiled a $10 billion plan to build over 100 domestically constructed crude oil tankers under the Make in India initiative, aiming to reduce dependency on leased foreign vessels and modernize its shipping fleet • 21st January 2025, Abu Dhabi’s ADNOC Logistics & Services (ADNOCLS) completed an 80% acquisition of Singapore’s Navig8 for over $1 billion. The deal included transferring ADNOC’s tankers to Navig8, expected to boost earnings per share by at least 20% in 2025 and achieve $20 million annual savings. • May 2025, Repsol E&P Group and NEO UK formed a joint venture named “NEO Next Energy” to combine their North Sea oil & gas portfolios. Repsol holds 45% and NEO UK 55%, targeting ~130,000 boe/d production in 2025, with scope for operational synergies. • 6th December 2023, Russia’s Zvezda Shipbuilding (Near Vladivostok) delivered the Aframax tanker “Vostochny Prospect” for Sovcomflot. As of June 2025, Zvezda has delivered six Aframax crude tankers and currently has 26 more under construction. • 18th June 2025, VLCC (Very Large Crude Carrier) spot rates from West Africa to China surged over 40%, this sharp rise reflects buyers scrambling for alternative loading regions amid Middle East instability.Crude Oil Carriers Market Scope: Inquire before buying

Crude Oil Carriers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 257.37 Bn. Forecast Period 2025 to 2032 CAGR: 4.2% Market Size in 2032: USD 357.68 Bn. Segments Covered: by Hull Type Single Bottom Double Hull Double Bottom by Vessel Type Suezmax Panamax Aframax Small Medium Very Large Crude Carriers Ultra Large Crude Carriers Crude Oil Carriers Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Crude Oil Carriers Market Key Players

North America 1. Teekay Corporation (Canada) 2. International Seaways, Inc. (U.S.) 3. Overseas Shipholding Group (U.S.) 4. Nordic American Tankers Limited (U.S.) 5. DHT Holdings, Inc. (U.S.) Europe 6. Frontline Ltd. (Bermuda) 7. Euronav NV (Belgium) 8. Tsakos Energy Navigation Ltd. (Greece) 9. Scorpio Tankers Inc. (Monaco) 10. International Seaways, Inc. (Bermuda) 11. SFL Corporation Ltd. (Bermuda) Asia-Pacific 12. China COSCO Shipping Energy (China) 13. Mitsui O.S.K. Lines, Ltd. (MOL) (Japan) 14. Hyundai Merchant Marine Co., Ltd. (South Korea) 15. AET Tanker Holdings Sdn Bhd (Malaysia) 16. Vela International Marine (Bahri) (UAE) 17. Essar Shipping Ports & Logistics Ltd. (India) 18. China Merchants Group (China) Middle East & Africa 19. Bahri (Saudi Arabia) 20. Oman Shipping Company S.A.O.C. (Oman) South America 21. Minerva Marine Inc. (Brazil) 22. Petrobras (Brazil) 23. Braskem S.A. (Brazil) 24. Yemen LNG (Yemen)FAQs

1. Which region has the largest share in Global Crude Oil Carriers Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global Crude Oil Carriers Market? Ans: The Global Crude Oil Carriers Market is growing at a CAGR of 4.2% during forecasting period 2025-2032. 3. What is scope of the Global Crude Oil Carriers Market report? Ans: Global Crude Oil Carriers Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Crude Oil Carriers Market? Ans: The important key players in the Global Crude Oil Carriers Market are Maersk Tankers, China Shipping Tanker Co., Keystone Alaska LLC, Alaska Tanker Co., Shipping Corporation of India, Teekay Corporation, F China Cosco Shipping Corporation Limited, China Merchants Group Ltd., National Iranian Oil Company (NIOC), The National Shipping Co. Saudi Arabia, Euronav NV, and Angelicoussis Shipping Group Ltd. 5. What is the study period of this Market? Ans: The Global Crude Oil Carriers Market is studied from 2024 to 2032.

1. Crude Oil Carriers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Crude Oil Carriers Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Crude Oil Carriers Market: Dynamics 3.1. Region wise Trends of Crude Oil Carriers Market 3.1.1. North America Crude Oil Carriers Market Trends 3.1.2. Europe Crude Oil Carriers Market Trends 3.1.3. Asia Pacific Crude Oil Carriers Market Trends 3.1.4. Middle East and Africa Crude Oil Carriers Market Trends 3.1.5. South America Crude Oil Carriers Market 3.2. Crude Oil Carriers Market Dynamics 3.2.1. Global Crude Oil Carriers Market Drivers 3.2.1.1. Crude oil production 3.2.1.2. Rising refinery output 3.2.1.3. Industrialization growth 3.2.2. Global Crude Oil Carriers Market Restraints 3.2.3. Global Crude Oil Carriers Market Opportunities 3.2.3.1. Fleet modernization 3.2.3.2. Domestic vessel building 3.2.3.3. Green shipping demand 3.2.4. Global Crude Oil Carriers Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Global oil demand 3.4.2. Energy consumption patterns 3.4.3. Emission reduction mandates 3.5. Crude Oil Carriers U.S.ge Rate (%), by region 3.6. Technological Advancements in Crude Oil Carriers 3.7. Price Trend Analysis by Region 3.8. Technological Roadmap 3.9. Regulatory Landscape by Region 3.9.1. North America 3.9.2. Europe 3.9.3. Asia Pacific 3.9.4. Middle East and Africa 3.9.5. South America 3.10. Analysis of Government Schemes and Initiatives for Crude Oil Carriers Industry 3.11. Key Opinion Leader Analysis 4. Crude Oil Carriers Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 4.1.1. Single Bottom 4.1.2. Double Hull 4.1.3. Double Bottom 4.2. Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 4.2.1. Suezmax 4.2.2. Panamax 4.2.3. Aframax 4.2.4. Small 4.2.5. Medium 4.2.6. Very Large Crude Carriers 4.2.7. Ultra Large Crude Carriers 4.3. Crude Oil Carriers Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Crude Oil Carriers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 5.1.1. Single Bottom 5.1.2. Double Hull 5.1.3. Double Bottom 5.2. Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 5.2.1. Suezmax 5.2.2. Panamax 5.2.3. Aframax 5.2.4. Small 5.2.5. Medium 5.2.6. Very Large Crude Carriers 5.2.7. Ultra Large Crude Carriers 5.3. North America Crude Oil Carriers Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 5.3.1.1.1. Single Bottom 5.3.1.1.2. Double Hull 5.3.1.1.3. Double Bottom 5.3.1.2. United States Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 5.3.1.2.1. Suezmax 5.3.1.2.2. Panamax 5.3.1.2.3. Aframax 5.3.1.2.4. Small 5.3.1.2.5. Medium 5.3.1.2.6. Very Large Crude Carriers 5.3.1.2.7. Ultra Large Crude Carriers 5.3.2. Canada 5.3.2.1. Canada Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 5.3.2.1.1. Single Bottom 5.3.2.1.2. Double Hull 5.3.2.1.3. Double Bottom 5.3.2.2. Canada Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 5.3.2.2.1. Suezmax 5.3.2.2.2. Panamax 5.3.2.2.3. Aframax 5.3.2.2.4. Small 5.3.2.2.5. Medium 5.3.2.2.6. Very Large Crude Carriers 5.3.2.2.7. Ultra Large Crude Carriers 5.3.3. Mexico 5.3.3.1. Mexico Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 5.3.3.1.1. Single Bottom 5.3.3.1.2. Double Hull 5.3.3.1.3. Double Bottom 5.3.3.2. Mexico Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 5.3.3.2.1. Suezmax 5.3.3.2.2. Panamax 5.3.3.2.3. Aframax 5.3.3.2.4. Small 5.3.3.2.5. Medium 5.3.3.2.6. Very Large Crude Carriers 5.3.3.2.7. Ultra Large Crude Carriers 6. Europe Crude Oil Carriers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.2. Europe Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3. Europe Crude Oil Carriers Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.1.2. United Kingdom Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3.2. France 6.3.2.1. France Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.2.2. France Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.3.2. Germany Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.4.2. Italy Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.5.2. Spain Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.6.2. Sweden Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3.7. Russia 6.3.7.1. Russia Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.7.2. Russia Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 6.3.8.2. Rest of Europe Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7. Asia Pacific Crude Oil Carriers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.2. Asia Pacific Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3. Asia Pacific Crude Oil Carriers Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.1.2. China Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.2.2. S Korea Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.3.2. Japan Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.4. India 7.3.4.1. India Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.4.2. India Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.5.2. Australia Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.6.2. Indonesia Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.7.2. Malaysia Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.8. Philippians 7.3.8.1. Philippians Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.8.2. Philippians Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.9. Thailand 7.3.9.1. Thailand Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.9.2. Thailand Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.10. Vietnam 7.3.10.1. Vietnam Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.10.2. Vietnam Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 8. Middle East and Africa Crude Oil Carriers Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 8.2. Middle East and Africa Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 8.3. Middle East and Africa Crude Oil Carriers Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 8.3.1.2. South Africa Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 8.3.2.2. GCC Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 8.3.3. Egypt 8.3.3.1. Egypt Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 8.3.3.2. Egypt Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 8.3.4. Nigeria 8.3.4.1. Nigeria Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 8.3.4.2. Nigeria Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 8.3.5. Rest of ME&A 8.3.5.1. Rest of ME&A Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 8.3.5.2. Rest of ME&A Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 9. South America Crude Oil Carriers Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 9.2. South America Crude Oil Carriers Market Size and Forecast, By Country (2024-2032) 9.2.1. Brazil 9.2.1.1. Brazil Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 9.2.1.2. Brazil Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 9.2.2. Argentina 9.2.2.1. Argentina Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 9.2.2.2. Argentina Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 9.2.3. Colombia 9.2.3.1. Colombia Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 9.2.3.2. Colombia Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 9.2.4. Chile 9.2.4.1. Chile Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 9.2.4.2. Chile Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 9.2.5. Rest of South America 9.2.5.1. Rest of South America Crude Oil Carriers Market Size and Forecast, By Hull Type (2024-2032) 9.2.5.2. Rest of South America Crude Oil Carriers Market Size and Forecast, By Vessel Type (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Teekay Corporation (Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. International Seaways, Inc. (U.S.) 10.3. Overseas Shipholding Group (U.S.) 10.4. Nordic American Tankers Limited (U.S.) 10.5. DHT Holdings, Inc. (U.S.) 10.6. Frontline Ltd. (Bermuda) 10.7. Euronav NV (Belgium) 10.8. Tsakos Energy Navigation Ltd. (Greece) 10.9. Scorpio Tankers Inc. (Monaco) 10.10. International Seaways, Inc. (Bermuda) 10.11. SFL Corporation Ltd. (Bermuda) 10.12. China COSCO Shipping Energy (China) 10.13. Mitsui O.S.K. Lines, Ltd. (MOL) (Japan) 10.14. Hyundai Merchant Marine Co., Ltd. (South Korea) 10.15. AET Tanker Holdings Sdn Bhd (Malaysia) 10.16. Vela International Marine (Bahri) (UAE) 10.17. Essar Shipping Ports & Logistics Ltd. (India) 10.18. China Merchants Group (China) 10.19. Bahri (Saudi Arabia) 10.20. Oman Shipping Company S.A.O.C. (Oman) 10.21. Minerva Marine Inc. (Brazil) 10.22. Petrobras (Brazil) 10.23. Braskem S.A. (Brazil) 10.24. Yemen LNG (Yemen) 11. Key Findings 12. Analyst Recommendations 13. Crude Oil Carriers Market: Research Methodology