Conveyor System Market size was valued at USD 10.29 Bn in 2024, and the total Conveyor System Market revenue is expected to grow at a CAGR of 4.20% from 2025 to 2032, reaching nearly USD 14.3 Bn. by 2032.Conveyor System Market Overview

A conveyor system is a mechanical handling device used to transport materials efficiently across short or long distances within facilities. It enhances productivity in manufacturing, logistics, and warehousing operations. The conveyor system market is experiencing steady growth due to its rising demand across industries like automotive, food & beverage, and e-commerce. Increased automation, warehouse expansion, and just-in-time manufacturing have led to high demand, and also stable supply of modular and energy-efficient systems supports market growth. Asia Pacific dominated the Conveyor System Market in 2024, due to their rapid industrialization and infrastructure development in countries like China and India, also North America and Europe continue to contribute with advanced technologies and automation adoption. Report Covered Major leading companies like Siemens AG (Germany), Honeywell International Inc. (USA), Daifuku Co., Ltd. (Japan), and Interroll Holding AG (Switzerland) are focusing on integrating smart technologies and improving efficiency. End-user industries, including automotive, logistics, retail, and food & beverage, play a significant role in market expansion by increasingly relying on conveyor systems to streamline operations and reduce labor dependency. The report also helps in understanding the Global Conveyor System Market dynamics, structure by analyzing the market segments and projecting the Global market. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Conveyor System Market makes the report an investor’s guide.To know about the Research Methodology :- Request Free Sample Report

Conveyor System Market Dynamics

Advancements in Medical Types with Increasing Research in Nanotechnology to Drive the Conveyor System Market Growth

The growing adoption of automation in the manufacturing and logistics sectors boosts the necessity for conveyor systems, which is driving the growth of the Conveyor System Market. For example, Amazon, a pioneer in e-commerce, heavily relies on conveyor systems for its fulfillment centers, where automated sorting and transportation of packages streamline operations and enhance productivity. The exponential growth of the e-commerce industry necessitates conveyor systems to handle the burgeoning volume of orders. Giants such as Alibaba and JD.com leverage conveyor systems in their warehouses to expedite the movement of goods, ensuring prompt order fulfillment and customer satisfaction amidst the surge in online shopping trends. Rising concerns about workplace safety have led to the integration of safety features in conveyor systems, as seen in solutions offered by companies like Honeywell Intelligrated. These safety mechanisms, such as sensors and emergency stop buttons, not only enhance worker protection but also mitigate the risk of accidents in industrial settings. Additionally, the focus on sustainability drives the adoption of eco-friendly conveyor systems equipped with energy-efficient features. Swisslog's EcoDrive technology, for instance, optimizes motor speed based on load requirements, reducing energy consumption and supporting sustainability goals while minimizing operational costs for users. These factors collectively contribute to the robust growth of the conveyor system market, catering to diverse industry needs and driving innovation in material handling solutions.

Regulatory Concerns and Safety Issues to Restrain Conveyor System Market

High initial investment requirements act as a significant deterrent, particularly for smaller companies, as implementing automated conveyor systems entails substantial costs encompassing equipment procurement, installation, and integration, hindering the growth of the Conveyor System Market. Many potential buyers are dissuaded from adopting conveyor systems, thereby limiting market growth. Ongoing maintenance costs add to the total cost of ownership, influencing businesses' decision-making processes. Components such as belts, motors, and bearings require regular servicing or replacement, and failure to address maintenance needs can result in costly downtime, further exacerbating financial burdens on businesses. The rapid advancements in conveyor system technology present a challenge for Conveyor System Market players, necessitating expertise and investment for the integration of new features like automation, IoT connectivity, or AI-driven optimization. For example, implementing RFID technology for real-time tracking of goods enhances operational efficiency but requires careful consideration of potential disruptions and staff training needs. Space constraints in industrial facilities also hinder the adoption of conveyor systems, particularly in environments with limited floor space. This limitation becomes more pronounced in urban areas with high real estate prices, prompting companies to explore alternative material handling solutions that utilize vertical space or have a smaller footprint.IoT Solutions for Resolving Common Industrial Conveyor Belt Problems

Common Industrial Conveyor Belt Problems Solutions with IoT Technology Conveyor Belt Mistracing Implement IoT sensors to detect abnormalities in speed, tension, and temperature patterns, providing real-time alerts to maintenance teams. Automated adjustments ensure smooth operations and preventive measures, reducing downtime and loss of man-hours. Belt Slippage Utilize IoT-based smart cameras to detect material spillage and notify teams in real-time, reducing safety hazards, product loss, and maintenance costs. Material Spillage Employ IoT vibration sensors, infrared cameras, and ultrasonic sensors to identify irregularities in roller operation and notify maintenance teams in advance, reducing downtime and ensuring personnel safety Seized Rollers in Conveyor Belt Implement IoT sensors to monitor material flow and belt tension in real-time, providing alerts to teams and reducing downtime and maintenance costs associated with blockages. Blockages Utilize IoT-based predictive maintenance to identify unusual patterns and potential causes of belt mistracking, triggering proactive measures to prevent further damage and ensure smooth operation. Conveyor System Market Segment Analysis

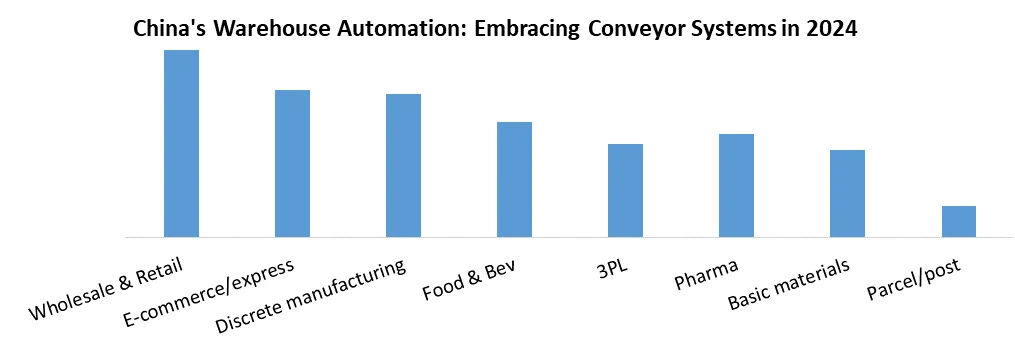

Based on Type, Belt Conveyors dominated the Conveyor System Market in 2024, being versatile and widely applicable, they find extensive adoption across various industries for transporting goods horizontally or with inclines. Gravity Conveyors, with their simplicity and cost-effectiveness, are commonly utilized for manual material handling tasks like loading and unloading. Motorized Driven Roller (MDR) Conveyors are gaining traction due to their energy efficiency and flexibility, suitable for applications requiring precise control over product movement. Sortation Conveyors are essential for automated sorting processes in distribution centers and warehouses, enhancing efficiency and order accuracy. Accumulation Conveyors enable buffering and spacing of products in assembly lines or distribution facilities, optimizing throughput. Overhead Trolley Conveyor Systems are favored for overhead transportation in manufacturing and assembly environments, while Pick and Pass Conveyors streamline order picking operations in e-commerce fulfillment centers. Empty Corrugate Conveyor (ECC) Systems specializes in handling empty cardboard boxes, improving recycling processes, and warehouse space utilization. Each type offers distinct advantages tailored to specific applications, contributing to the overall growth and innovation within the Conveyor System Market.Based on industry, the food and beverage industry dominated the conveyor system market in 2024, due to its high demand for automation, hygiene, and efficiency in processing and packaging. Strict safety regulations drive the need for specialized conveyors with stainless steel and washdown-ready designs, ensuring contamination-free production. A rise in processed and packaged food consumption is boosting conveyor adoption for sorting, filling, and sealing operations. While industries like automotive, mining, and airports rely on conveyors for assembly lines, bulk transport, and baggage handling, food & beverage remains the top sector by its continuous production needs and regulatory compliance requirements, making it the largest market for conveyor systems. Tyson Foods partnered with Honeywell Intelligrated to implement AI-powered conveyor systems in poultry plants, enhancing efficiency with 99% accuracy in sorting and packaging while meeting strict hygiene standards, showcasing the food industry's leadership in conveyor tech innovation. Conveyor System Market Regional Analysis Asia Pacific dominated the Conveyor System Market in 2024 as the largest Conveyor system-producing region, driven by countries like China, Japan, and India. China, being a manufacturing powerhouse, contributes significantly to the global conveyor system market with its robust production capabilities and extensive industrial infrastructure. Japan's advanced technology and focus on automation further bolster the region's production output. North America emerges as a prominent large utilizing region, particularly the United States and Canada. With a mature industrial sector and high adoption of automation in various industries such as automotive, e-commerce, and food processing, North America constitutes a significant market for conveyor systems. Regional import-export data also reflects interesting trends, with countries like Germany serving as major exporters of conveyor systems due to their advanced manufacturing technology and engineering expertise. Conversely, emerging economies in Asia, such as Vietnam and Indonesia, witness a surge in conveyor system imports to support their growing manufacturing sectors. These regional dynamics underscore the global interconnectedness of the conveyor system market, with production hotspots, utilization hubs, and trade flows shaping industry growth and innovation in real time.

Conveyor System Market Competitive Landscape

The conveyor system market features intense competition with leading players driving innovation and global expansion. Daifuku Co., Ltd. (Japan) leads with advanced automation solutions and a strong presence in the automotive and electronics sectors, supported by consistent R&D investment. Siemens AG (Germany) leads by integrating digital technologies like IoT and AI into conveyor control systems, enhancing efficiency and customization across industries. Honeywell International Inc. (USA) focuses on smart material handling and warehouse automation, offering end-to-end integrated solutions for logistics. BEUMER Group (Germany) is renowned for long-distance and airport conveyor systems, focusing on energy-efficient and modular designs. Interroll Holding AG (Switzerland) specializes in plug-and-play modular conveyors, catering to e-commerce and parcel logistics with flexible, scalable systems. These players are market leaders by their global footprint, sector-specific solutions, advanced technologies, and ability to address the evolving needs of the manufacturing, warehousing, and logistics sectors.Conveyor System Market Key Trends

Key Trends Description E-commerce Expansion Growth in e-commerce is driving the adoption of fast, scalable, and modular conveyor systems in warehouses and fulfillment centers. Energy-efficient Systems Emphasis on energy-saving conveyor motors and designs to lower operational costs and support sustainability goals. Smart Conveyor Technologies Use of IoT sensors and AI for real-time monitoring, predictive maintenance, and process optimization in conveyor operations. Customization & Modularity Demand for tailored conveyor systems with modular components to suit diverse industry applications and quick layout changes. Conveyor System Market Recent Developments

1. On October 8, 2024, Terex Corporation acquired Environmental Solutions Group (ESG) from Dover Corporation for $2 billion, expanding its footprint in the solid waste and recycling sectors. 2. On April 6, 2023, Terex Materials Processing (MP) acquired MARCO Conveyors, a Missouri-based company, to strengthen its mobile conveying capabilities and boost manufacturing capacity in North America. 3. On November 1, 2023, Continental AG’s ContiTech division acquired Vertech AB, based in Kiruna, Sweden, to reinforce its presence in mining conveyor servicing. 4. On July 7, 2022, Continental AG also acquired WCCO Belting, a North Dakota-based manufacturer, to enhance its portfolio in agricultural conveyor solutions.Conveyor System Market Scope: Inquire before Buying

Global Conveyor System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 10.29 Bn. Forecast Period 2025 to 2032 CAGR: 4.20% Market Size in 2032: USD 14.3 Bn. Segments Covered: by Type Belt Roller Pallet Overhead Others by Industry Automotive Food & Beverage Manufacturing Airport Mining & Quarrying Others Conveyor System Market, By Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Conveyor System Market key players

North America 1. Honeywell International Inc. (USA) 2. Terex Corporation (USA) 3. Dorner Mfg Corp. (USA) 4. Hytrol Conveyor Co. Inc. (USA) Europe 5. Continental AG (Germany) 6. Siemens AG (Germany) 7. Kion Group AG (Germany) 8. KUKA AG (Germany) 9. Interroll Holding AG (Switzerland) 10. Beumer Group GmbH & Co. KG (Germany) 11. Viastore Systems GmbH (Germany) 12. SSI Schaefer AG (Germany) 13. Knapp AG (Austria) 14. Mecalux SA (Spain) 15. Witron Logistik + Informatik GmbH (Germany) 16. Kardex Group (Switzerland) 17. FlexLink AB (Sweden) 18. mk Technology Group Inc. (Germany) 19. TGW Logistics Group (Austria) 20. Conveyor Systems Ltd. (UK) 21. Conveyor Units Ltd. (UK) 22. ConveyorTek Ltd. (UK) 23. LAC Conveyors & Automation Ltd. (UK) 24. Advance Automated Systems Ltd. (UK) Asia Pacific 25. Daifuku Co., Ltd. (Japan) 26. Taikisha Ltd. (Japan) 27. Toyota Industries Corporation (Japan) 28. Murata Machinery Ltd. (Japan) 29. Omtech Food Engineering (India) South America 30. TOTVS Logistics (Brazil)Frequently Asked Questions

1] What is the growth rate of the Global Conveyor System Market? Ans. The Global Conveyor System Market is growing at a significant rate of 4.20% during the forecast period. 2] What is the expected Global Conveyor System Market size by 2030? Ans. The Conveyor System Market size is expected to reach USD 14.3 billion by 2032. 3. Which country is expected to lead the global Conveyor System Market during the forecast period? Ans. Asia Pacific is expected to lead the Conveyor System Market during the forecast period. 4] What is the expected Global Conveyor System Market size by 2024? Ans. The Conveyor System Market size is expected to reach USD 10.29 billion by 2024. 5. What segments are covered in the Conveyor System Market report? Ans. The segments covered in the Conveyor System Market report are by Type, Industry, and Region.

1. Conveyor System Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Conveyor System Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Conveyor System Market: Dynamics 3.1. Region-wise Trends of Conveyor System Market 3.1.1. North America Conveyor System Market Trends 3.1.2. Europe Conveyor System Market Trends 3.1.3. Asia Pacific Conveyor System Market Trends 3.1.4. Middle East and Africa Conveyor System Market Trends 3.1.5. South America Conveyor System Market Trends 3.2. Conveyor System Market Dynamics 3.2.1. Global Conveyor System Market Drivers 3.2.1.1. E-commerce growth 3.2.1.2. Automation demand 3.2.2. Global Conveyor System Market Restraints 3.2.3. Global Conveyor System Market Opportunities 3.2.3.1. Green conveyors 3.2.3.2. Modular solutions 3.2.4. Global Conveyor System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Trade policies 3.4.2. Industrial regulations 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Conveyor System Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Conveyor System Market Size and Forecast, By Type (2024-2032) 4.1.1. Belt 4.1.2. Roller 4.1.3. Pallet 4.1.4. Overhead 4.1.5. Others 4.2. Conveyor System Market Size and Forecast, By Industry (2024-2032) 4.2.1. Automotive 4.2.2. Food & Beverage Manufacturing 4.2.3. Airport 4.2.4. Mining & Quarrying 4.2.5. Others 4.3. Conveyor System Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Conveyor System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Conveyor System Market Size and Forecast, By Type (2024-2032) 5.1.1. Belt 5.1.2. Roller 5.1.3. Pallet 5.1.4. Overhead 5.1.5. Others 5.2. North America Conveyor System Market Size and Forecast, By Industry (2024-2032) 5.2.1. Automotive 5.2.2. Food & Beverage Manufacturing 5.2.3. Airport 5.2.4. Mining & Quarrying 5.2.5. Others 5.3. North America Conveyor System Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Conveyor System Market Size and Forecast, By Type (2024-2032) 5.3.1.1.1. Belt 5.3.1.1.2. Roller 5.3.1.1.3. Pallet 5.3.1.1.4. Overhead 5.3.1.1.5. Others 5.3.1.2. United States Conveyor System Market Size and Forecast, By Industry (2024-2032) 5.3.1.2.1. Automotive 5.3.1.2.2. Food & Beverage Manufacturing 5.3.1.2.3. Airport 5.3.1.2.4. Mining & Quarrying 5.3.1.2.5. Others 5.3.2. Canada 5.3.2.1. Canada Conveyor System Market Size and Forecast, By Type (2024-2032) 5.3.2.1.1. Belt 5.3.2.1.2. Roller 5.3.2.1.3. Pallet 5.3.2.1.4. Overhead 5.3.2.1.5. Others 5.3.2.2. Canada Conveyor System Market Size and Forecast, By Industry (2024-2032) 5.3.2.2.1. Automotive 5.3.2.2.2. Food & Beverage Manufacturing 5.3.2.2.3. Airport 5.3.2.2.4. Mining & Quarrying 5.3.2.2.5. Others 5.3.3. Mexico 5.3.3.1. Mexico Conveyor System Market Size and Forecast, By Type (2024-2032) 5.3.3.1.1. Belt 5.3.3.1.2. Roller 5.3.3.1.3. Pallet 5.3.3.1.4. Overhead 5.3.3.1.5. Others 5.3.3.2. Mexico Conveyor System Market Size and Forecast, By Industry (2024-2032) 5.3.3.2.1. Automotive 5.3.3.2.2. Food & Beverage Manufacturing 5.3.3.2.3. Airport 5.3.3.2.4. Mining & Quarrying 5.3.3.2.5. Others 6. Europe Conveyor System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Conveyor System Market Size and Forecast, By Type (2024-2032) 6.2. Europe Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3. Europe Conveyor System Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.1.2. United Kingdom Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3.2. France 6.3.2.1. France Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.2.2. France Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.3.2. Germany Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.4.2. Italy Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.5.2. Spain Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.6.2. Sweden Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3.7. Russia 6.3.7.1. Russia Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.7.2. Russia Conveyor System Market Size and Forecast, By Industry (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Conveyor System Market Size and Forecast, By Type (2024-2032) 6.3.8.2. Rest of Europe Conveyor System Market Size and Forecast, By Industry (2024-2032) 7. Asia Pacific Conveyor System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Conveyor System Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3. Asia Pacific Conveyor System Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.1.2. China Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.2.2. S Korea Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.3.2. Japan Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.4. India 7.3.4.1. India Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.4.2. India Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.5.2. Australia Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.6.2. Indonesia Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.7.2. Malaysia Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.8. Philippines 7.3.8.1. Philippines Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.8.2. Philippines Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.9. Thailand 7.3.9.1. Thailand Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.9.2. Thailand Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.10. Vietnam 7.3.10.1. Vietnam Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.10.2. Vietnam Conveyor System Market Size and Forecast, By Industry (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Conveyor System Market Size and Forecast, By Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Conveyor System Market Size and Forecast, By Industry (2024-2032) 8. Middle East and Africa Conveyor System Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Conveyor System Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Conveyor System Market Size and Forecast, By Industry (2024-2032) 8.3. Middle East and Africa Conveyor System Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Conveyor System Market Size and Forecast, By Type (2024-2032) 8.3.1.2. South Africa Conveyor System Market Size and Forecast, By Industry (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Conveyor System Market Size and Forecast, By Type (2024-2032) 8.3.2.2. GCC Conveyor System Market Size and Forecast, By Industry (2024-2032) 8.3.3. Egypt 8.3.3.1. Egypt Conveyor System Market Size and Forecast, By Type (2024-2032) 8.3.3.2. Egypt Conveyor System Market Size and Forecast, By Industry (2024-2032) 8.3.4. Nigeria 8.3.4.1. Nigeria Conveyor System Market Size and Forecast, By Type (2024-2032) 8.3.4.2. Nigeria Conveyor System Market Size and Forecast, By Industry (2024-2032) 8.3.5. Rest of ME&A 8.3.5.1. Rest of ME&A Conveyor System Market Size and Forecast, By Type (2024-2032) 8.3.5.2. Rest of ME&A Conveyor System Market Size and Forecast, By Industry (2024-2032) 9. South America Conveyor System Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Conveyor System Market Size and Forecast, By Type (2024-2032) 9.2. South America Conveyor System Market Size and Forecast, By Industry (2024-2032) 9.3. South America Conveyor System Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Conveyor System Market Size and Forecast, By Type (2024-2032) 9.3.1.2. Brazil Conveyor System Market Size and Forecast, By Industry (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Conveyor System Market Size and Forecast, By Type (2024-2032) 9.3.2.2. Argentina Conveyor System Market Size and Forecast, By Industry (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia Conveyor System Market Size and Forecast, By Type (2024-2032) 9.3.3.2. Colombia Conveyor System Market Size and Forecast, By Industry (2024-2032) 9.3.4. Chile 9.3.4.1. Chile Conveyor System Market Size and Forecast, By Type (2024-2032) 9.3.4.2. Chile Conveyor System Market Size and Forecast, By Industry (2024-2032) 9.3.5. Rest of South America 9.3.5.1. Rest of South America Conveyor System Market Size and Forecast, By Type (2024-2032) 9.3.5.2. Rest of South America Conveyor System Market Size and Forecast, By Industry (2024-2032) 10. Company Profile: Key Players 10.1. Honeywell International Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Terex Corporation (USA) 10.3. Dorner Mfg Corp. (USA) 10.4. Hytrol Conveyor Co. Inc. (USA) 10.5. Continental AG (Germany) 10.6. Siemens AG (Germany) 10.7. Kion Group AG (Germany) 10.8. KUKA AG (Germany) 10.9. Interroll Holding AG (Switzerland) 10.10. Beumer Group GmbH & Co. KG (Germany) 10.11. Viastore Systems GmbH (Germany) 10.12. SSI Schaefer AG (Germany) 10.13. Knapp AG (Austria) 10.14. Mecalux SA (Spain) 10.15. Witron Logistik + Informatik GmbH (Germany) 10.16. Kardex Group (Switzerland) 10.17. FlexLink AB (Sweden) 10.18. mk TechnOlogy Group Inc. (Germany) 10.19. TGW LogistICS Group (Austria) 10.20. Conveyor Systems Ltd. (UK) 10.21. Conveyor Units Ltd. (UK) 10.22. ConveyorTek Ltd. (UK) 10.23. LAC Conveyors & Automation Ltd. (UK) 10.24. Advance Automated Systems Ltd. (UK) 10.25. Daifuku Co., Ltd. (Japan) 10.26. Taikisha Ltd. (Japan) 10.27. Toyota Industries Corporation (Japan) 10.28. Murata Machinery Ltd. (Japan) 10.29. Omtech Food Engineering (India) 10.30. TOTVS Logistics (Brazil) 11. Key Findings 12. Industry Recommendations 13. Conveyor System Market: Research Methodology