Concentrated Solar Power Market was valued at US$ 4.83 Bn. in 2020. Global Concentrated Solar Power Market size is estimated to grow at a CAGR of 15.93%.Concentrated Solar Power Market Overview:

Concentrated Solar Power (CSP) plants use mirrors to concentrate the sun's thermal energy at temperatures ranging from 400 0C to 1,000 0C which is used in a conventional steam turbine to make electricity. This energy is subsequently used in a variety of applications, such as heating a fluid (water or oil), to produce steam or hot air. A CSP plant's concentrated thermal energy can be stored and used to generate electricity whenever it is needed. In 2020, more than 200 MW of CSP capacity was added, across the globe, which was a 66 % decline as compared to 2019 and much below the ten-year average. All capacity expansions were completed in China, while overall CSP generation remained unchanged from the previous year. Countries like China, Morocco, and South Africa, along with the United Arab Emirates, have been responsible for the majority of capacity additions during the last decade, and they are expected to continue dominating deployment during the forecast period.To know about the Research Methodology:- Request Free Sample Report 2020 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2027. 2020 is a year of exception and analyzed especially with the impact of lockdown by region.

Concentrated Solar Power Market Dynamics:

The growing government support and initiatives for the adoption of renewable technology, along with an increase in energy consumption and the capacity to deliver power without emitting CO2 are driving the concentrated solar power market growth across the globe. In addition, the growing environmental concerns related to carbon emissions lead to a greater focus on reducing air pollution and raising awareness of global warming leading to rising adoption of CSP installations across the commercial, industrial, and utility-scale applications are boosting the CSP market growth across the globe. The global installed capacity of concentrated solar power was 5.50 GW with 2.5 GW under construction and 1.5 GW in development in 2019. The average cost of installing CSP systems in 2020 was US$ 4725 per kilowatt installed. According to IEA, from 2020 to 2030, average annual generation growth of 31% is required to achieve Net Zero power generation of 204 TWh from CSP. CSP installations are currently not aligned with the Net Zero Scenario, as this translates to 6.7 GW of new capacity every year. The factors such as the lowering cost of CSP components across the globe are expected to drive the concentrated solar power market during the forecast period.CSP also has an advantage over PV cells in that it can create power even when the sun is not shining. This is accomplished using thermal storage devices, which can store heat and use it to generate energy during cloudy or nighttime conditions. As many governments fund renewable energy alternatives to fulfill rising electricity demand while reducing their environmental footprint, the CSP market is expected to experience significant investments. The high capital cost of concentrated solar power energy generation is expected to hamper the CSP market growth during the forecast period. For instance, the average cost of electricity generated by CSP is US$ 0.20 per Kwh, and for solar PV, it is between US$ 0.05 to 0.10 per kWh. Nonetheless, an increase in investment in renewable energy from various industries, along with an increased acceptance of heat storage systems, are expected to create lucrative opportunities in the CSP market during the forecast period.

Concentrated Solar Power Market Segment Analysis:

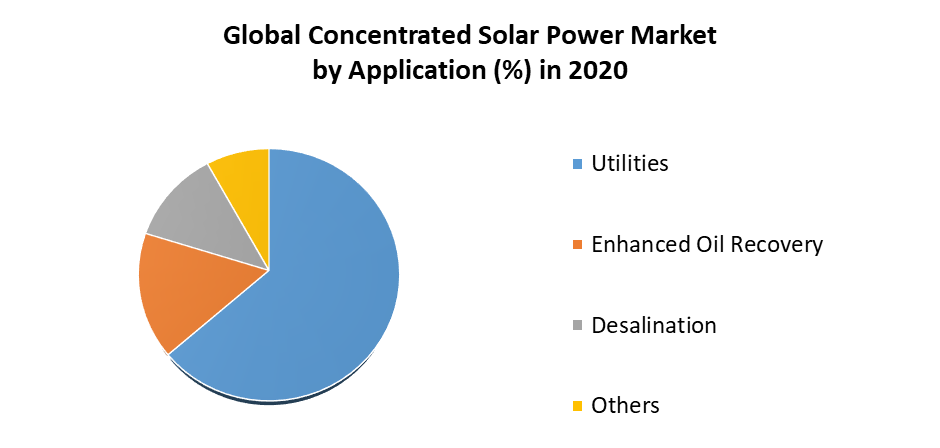

Based on the Technology, the Concentrated Solar Power Market is segmented into Parabolic Trough, Linear Fresnel, Power Tower, and Dish/Engine System. The Parabolic Trough segment held the largest market share, accounting for 81.19% in 2020. The segment growth is attributed to the high penetration of design, and easy installation along with convention. The segment required low capital cost as compared to its counterparts. Parabolic trough collectors are the most extensively used CSP technology. More than 4,000 MW of active parabolic trough CSP was present in 2020, out of 6,128 MW of built CSP capacity. In addition, parabolic trough technology offers high efficiency and better capability to store energy, which in turn drives the CSP market growth for this segment. Based on the Application, the Concentrated Solar Power Market is segmented into Utilities, Enhanced Oil Recovery, Desalination, and Others. The Utility segment held the largest market share, accounting for 62.13% in 2020. The segment growth is attributed to growing significant concentrated solar power project developments in the Middle East and Africa, along with the Asia Pacific, particularly in Saudi Arabia, Morocco, the United Arab Emirates, and China. The CSP installation for utility aids in managing the power demand, peak load shaving, and allow integrated thermal storage with varying time for varying technologies. The necessity to create renewable energy with storage technologies to meet rising electricity demands in residential regions is driving demand for CSP across the globe. The favorable government efforts and regulations encourage the usage of renewable energy sources. Various financial and economic benefits offered by the government, such as Feed-in Tariffs (FiT) and tax credits, are expected to uplift the CSP market growth for this segment.

Concentrated Solar Power Market Regional Insights:

Europe region held the largest market share accounted for 38.21 % in 2020. As per the study, it is expected that the European Union's total CSP capacity would increase to 5 GW by the end of the forecast period. CSP activity is continuing on a trial scale in Europe, with a hybrid biomass-CSP station of 17 MW of CSP being built in Denmark and a 9 MW Fresnel facility being built in France. Spain has led the European CSP markets, owing to government assistance schemes and feed-in tariffs. Since 2010, the country has been the undisputed world's largest market for concentrated solar power installation, with 2.304 installed capacity.Asia Pacific region is expected to witness significant growth at a CAGR of 14.27% during the forecast period. An increase in investment in concentrated solar power for grid placement relief in China is driving the CSP market growth in China. For instance, in Sept 2019, the Power China Gonghe 50 MW Molten Salt Tower project was successfully connected to the grid. The growing investment in developing renewable energy sources, in India, China, and a few South Asian countries, is boosting the region's concentrating solar power market growth. The objective of the report is to present a comprehensive analysis of the global Concentrated Solar Power Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Concentrated Solar Power Market dynamic, structure by analyzing the market segments and projecting the Concentrated Solar Power Market size. Clear representation of competitive analysis of key players by Component, price, financial position, product portfolio, growth strategies, and regional presence in the Concentrated Solar Power Market make the report investor’s guide.

Concentrated Solar Power Market Scope: Inquire before buying

Concentrated Solar Power Market Report Coverage Details Base Year: 2020 Forecast Period: 2021-2027 Historical Data: 2016 to 2020 Market Size in 2020: US $ 4.83 Bn. Forecast Period 2021 to 2027 CAGR: 15.93% Market Size in 2027: US $ 13.59 Bn. Segments Covered: by Technology • Parabolic Trough • Linear Fresnel • Power Tower • Dish/Engine System by Component • Power Block • Solar Field • Thermal Energy Storage System by Application • Utilities • Enhanced Oil Recovery • Desalination • Others Concentrated Solar Power Market, by Region

• North America • Europe • Asia Pacific • Latin America • The Middle East and AfricaConcentrated Solar Power Market Key Players

• Esolar, Inc. • Frenell Gmbh • Nexans • Siemens Ag • Solar Reserve • Ibereolica Group • Solastor • Soltigua • Engie • Aalborg Csp A/S • Abengoa Solar, S.A. • Acwa Power • Alsolen • Archimedes Solar Energy • Baysolar Csp • Brightsource Energy, Inc. • Cobra Energia • SCHOTT Solar AG • Solar Millennium AG • Acciona • BrightSource Energy Inc.Frequently Asked Questions:

1] What segments are covered in the Concentrated Solar Power Market report? Ans. The segments covered in the Concentrated Solar Power Market report are based Technology, Component, and Application. 2] Which region is expected to hold the highest share in the Concentrated Solar Power Market? Ans. The Europe region is expected to hold the highest share in the Concentrated Solar Power Market. 3] What is the market size of the Concentrated Solar Power Market by 2027? Ans. The market size of the Concentrated Solar Power Market by 2027 is US$ 13.59 Bn. 4] What is the forecast period for the Concentrated Solar Power Market? Ans. The forecast period for the Concentrated Solar Power Market is 2020-2027. 5] What was the market size of the Concentrated Solar Power Market in 2020? Ans. The market size of the Concentrated Solar Power Market in 2020 was US$ 4.83 Bn.

1. Global Concentrated Solar Power Market Size: Research Methodology 2. Global Concentrated Solar Power Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Concentrated Solar Power Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Concentrated Solar Power Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Concentrated Solar Power Market Size Segmentation 4.1. Global Concentrated Solar Power Market Size, by Technology (2020-2027) • Parabolic Trough • Linear Fresnel • Power Tower • Dish/Engine System 4.2. Global Concentrated Solar Power Market Size, by Component (2020-2027) • Power Block • Solar Field • Thermal Energy Storage System 4.3. Global Concentrated Solar Power Market Size, by Application (2020-2027) • Utilities • Enhanced Oil Recovery • Desalination • Others 5. North America Concentrated Solar Power Market (2020-2027) 5.1. Global Concentrated Solar Power Market Size, by Technology (2020-2027) • Parabolic Trough • Linear Fresnel • Power Tower • Dish/Engine System 5.2. Global Concentrated Solar Power Market Size, by Component (2020-2027) • Power Block • Solar Field • Thermal Energy Storage System 5.3. Global Concentrated Solar Power Market Size, by Application (2020-2027) • Utilities • Enhanced Oil Recovery • Desalination • Others 5.4. North America Concentrated Solar Power Market, by Country (2020-2027) • United States • Canada • Mexico 6. European Concentrated Solar Power Market (2020-2027) 6.1. European Concentrated Solar Power Market, by Technology (2020-2027) 6.2. European Concentrated Solar Power Market, by Component (2020-2027) 6.3. European Concentrated Solar Power Market, by Application (2020-2027) 6.4. European Concentrated Solar Power Market, by Country (2020-2027) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Concentrated Solar Power Market (2020-2027) 7.1. Asia Pacific Concentrated Solar Power Market, by Technology (2020-2027) 7.2. Asia Pacific Concentrated Solar Power Market, by Component (2020-2027) 7.3. Asia Pacific Concentrated Solar Power Market, by Application (2020-2027) 7.4. Asia Pacific Concentrated Solar Power Market, by Country (2020-2027) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Concentrated Solar Power Market (2020-2027) 8.1. The Middle East and Africa Concentrated Solar Power Market, by Technology (2020-2027) 8.2. The Middle East and Africa Concentrated Solar Power Market, by Component (2020-2027) 8.3. The Middle East and Africa Concentrated Solar Power Market, by Application (2020-2027) 8.4. The Middle East and Africa Concentrated Solar Power Market, by Country (2020-2027) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Concentrated Solar Power Market (2020-2027) 9.1. Latin America Concentrated Solar Power Market, by Technology (2020-2027) 9.2. Latin America Concentrated Solar Power Market, by Component (2020-2027) 9.3. Latin America Concentrated Solar Power Market, by Application (2020-2027) 9.4. Latin America Concentrated Solar Power Market, by Country (2020-2027) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Esolar, Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Frenell Gmbh 10.3. Nexans 10.4. Siemens Ag 10.5. Solar Reserve 10.6. Ibereolica Group 10.7. Solastor 10.8. Soltigua 10.9. Engie 10.10. Aalborg Csp A/S 10.11. Abengoa Solar, S.A. 10.12. Acwa Power 10.13. Alsolen 10.14. Archimedes Solar Energy 10.15. Baysolar Csp 10.16. Brightsource Energy, Inc. 10.17. Cobra Energia 10.18. SCHOTT Solar AG 10.19. Solar Millennium AG 10.20. Acciona 10.21. BrightSource Energy Inc.