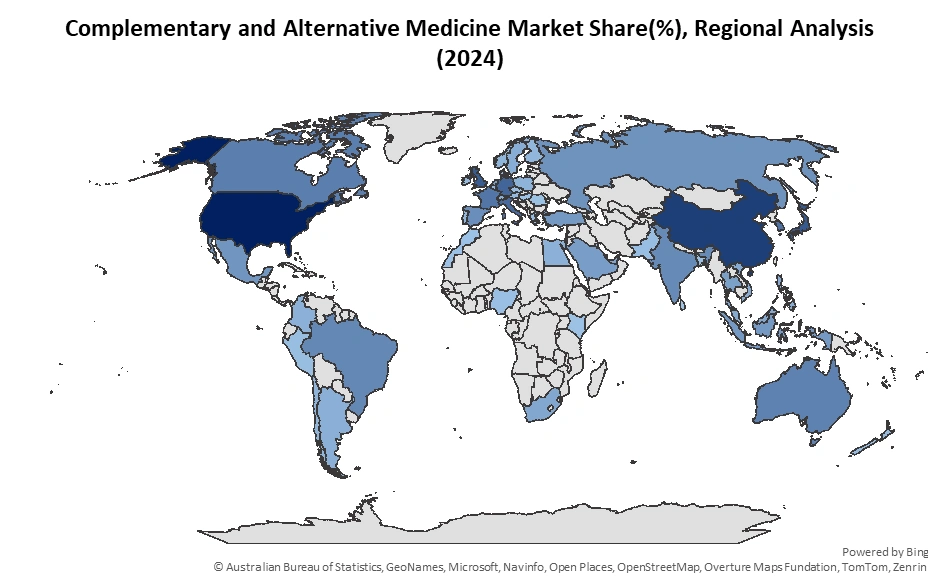

The global Complementary and Alternative Medicine (CAM) Market was valued at USD 135.13 billion in 2024, and with the momentum of holistic wellness rising worldwide, the market is projected to grow at a robust CAGR of 17.9% from 2025 to 2032, reaching an extraordinary USD 504.52 billion by the end of the forecast period — reflecting the world’s accelerating shift toward natural healing, integrative therapies, and preventive health solutions. The Complementary and Alternative Medicine (CAM) Market represents a diverse ecosystem of holistic healthcare systems, including Ayurvedic medicine, Traditional Chinese Medicine, naturopathy, homeopathy, herbal supplements, cupping therapy, and various mind–body interventions. These practices follow distinct diagnostic approaches and offer natural, non-invasive treatment options that complement or substitute conventional medical care. CAM therapies such as shark cartilage, bee pollen, ozone therapy, and herbal formulations continue to gain popularity due to increasing consumer preference for personalized and preventive wellness solutions. The global Complementary & Alternative Medicine Market is expanding rapidly as developed and emerging economies adopt integrative health approaches driven by affordability, cultural acceptance, and rising awareness of natural healing. Many CAM therapies are accessible, cost-effective, and show promising results in managing chronic illnesses and late-stage diseases, further supporting market penetration. Strong government initiatives promoting herbal medicine, wellness tourism, traditional healing, and integrative healthcare systems continue to fuel growth across regions. According to global estimates, nearly two-thirds of the world’s population prefers alternative healthcare services, underscoring the rising trust in holistic healing. CAM adoption is significantly high in countries such as the United States (42%), Australia (48%), Canada (70%), and France (49%). Usage is even stronger across Asia, the Middle East, and Africa—where 86% of Egypt’s population and 88% of Saudi Arabia’s population rely on CAM for primary care. Traditional healers also dominate treatment landscapes in Bangladesh (90%), Myanmar (85%), India (80%), Nepal (75%), Sri Lanka (65%), and Indonesia (60%). These trends collectively highlight the strong global momentum driving the Complementary and Alternative Medicine Market.To know about the Research Methodology :- Request Free Sample Report

Global Complementary and Alternative Medicine Market Dynamics:

The increasing chronic diseases driving the Complementary and Alternative Medicine Market The increasing incidence of chronic conditions like cancer is expected to accelerate the growth of the complementary and alternative medicine sector. Global Complementary and Alternative Medicine plays an essential role in cancer treatment and effectively alleviates prevalent side effects like pain, nausea, and fatigue. The medical community is increasingly acknowledging Global Complementary and Alternative Medicine's effectiveness in treating and diagnosing various conditions. A surge in global disease rates, combined with an expanding elderly population, drives its Global Complementary and Alternative Medicine market growth significantly. The global geriatric population is expected to exceed 2 billion by 2032. Growing public interest is driving research efforts in the C.A.M. industry The high cost of contemporary pharmaceuticals, time constraints from both patients and healthcare providers, microbial resistance, and adverse effects of modern medicine, the public interest has regained in the Complementary and Alternative Medicine Market. Self-medication, traditional healing techniques, and indigenous systems of medicine, including Ayurveda, herbal preparations, Yunani, homeopathy, acupuncture, naturopathy, chiropractic manipulation, and other therapies are the factors growing the Complementary and Alternative Medicine Market. In October, Herb Pharm invested in Regenerative Organic Certification as a demonstration of the company's commitment to navigating challenges for enduring advantages in the business landscape. The shifting lifestyles of individuals, coupled with a growing elderly demographic, are also pivotal in driving the growth of the complementary and alternative medicine market. Increase in the number of research and development activities The increasing number of research and development department is concrete the way for enhanced growth in the complementary and alternative medicine market. Trend offers promising avenues for growth. Also, drug approvals and introductions present opportunities to accelerate market growth. Increasing number of collaborations The market has witnessed significant growth, driven by the introduction of new products in response to heightened demand and continuous innovation. For Instance, in , DaVita Medical Group signalled a move towards original therapies designed for children and supporting a broad range of healthcare professionals, like physicians, physical therapists, and chiropractors. In , approximately two-thirds of the population in both industrialized and developing nations had reported using some form of complementary or alternative treatment. Increased advanced technologies and the rise of new markets present promising avenues for the growth of the complementary and alternative medicine market during the forecast period.Complementary and Alternative Medicine Market Segment Analysis:

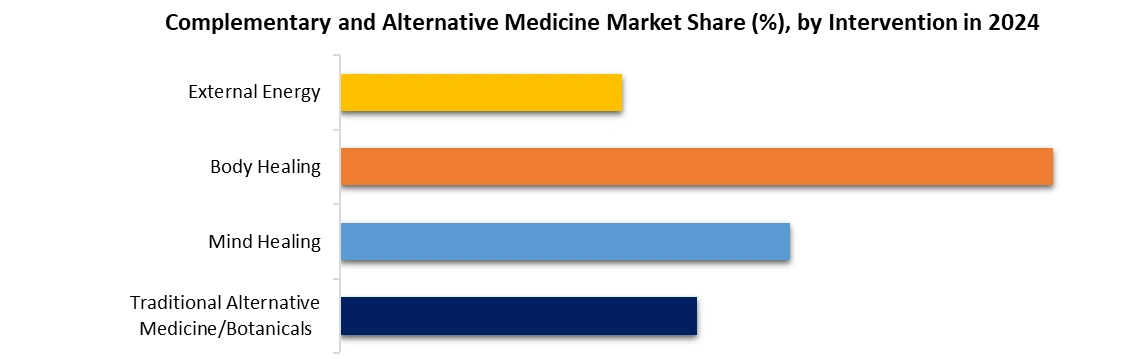

By Disease, the cancer segment is expected to grow at a CAGR of 8.1% during the forecast period. For decades, there has been a steady growth in the use of complementary and alternative medicine among cancer patients. 16% of Cancer patients in the UK use complementary and alternative medicine. The percentage is comparable to complementary and alternative medicine usage is stated to be 13% in the United States. However, a survey of 127 cancer patients in the United Kingdom found that 29% used some type of complementary and alternative medicine. A systematic review of surveys on the use of complementary and alternative medicine among cancer patients in 13 countries found a range of 7% to 64% of use among the adult cancer population, with an average of 31.4% market. Herbs, nutritional treatment, meditation, relaxation, homeopathy, hypnosis, and other vitamins were some of the most regularly utilized complementary and alternative medicine (CAM). Despite the apparent widespread usage of CAM, there has been relatively little scientific investigation into the Complementary and Alternative Medicine Market.By Intervention, Body healing- Massage uses your body's nerve endings and pressure points to promote relaxation. Many types of massage exist, such as shiatsu, Heller work, and reflexology. Massage therapy to reduce stress and anxiety, improves mood, enhance relaxation, and manages pain and the working sector people demand the most. After surgery, massage help healing at incision sites and might prevent or minimize scarring also, foot massage positively impacts pain, nausea, and relaxation, The Complementary and Alternative Medicine Market expected growth at a CAGR of 9%. The leading key players in the global massage therapy services market include Massage Envy, Hand and Stone Massage and Facial Spa, Elements Massage, Massage Heights, and others are expected to grow in the Complementary and Alternative Medicine Market. Acupuncture applies manual pressure to areas of the foot, hand, or ear believed to correspond to affected organs or body systems. It relieves symptoms like pain, constipation, and nausea. The Acupuncture market led by Europe with a 33% share, followed by Asia-Pacific with a 28% share, and the Americas with a 22% share. By intervening Complementary and Alternative Medicine Market, Mind Healing therapy takes a similar share Meditation quiets the mind and relaxes the body, relieving muscle tension and fostering inner peace. Deep breathing and relaxation techniques release muscle tension, ease breathlessness, reduce anxiety, and promote a sense of control, especially during stressful treatments. The global meditation market is expected to be approx. USD 8 billion by 2032. According to Health Survey in the United States 18 % of women used to mediate and 12% of men.

Regional Insights:

In North America, the complementary and alternative medicine market leads due to an increasing population with significant disorders and escalating healthcare expenditure. These factors continue to drive the Global market growth in North America. Also, the rising number of professionals in the area contributes to its growth rate. In 2024, North America led in revenue compared to other regions. Due to higher healthcare spending in the region, the presence of key players, and their strategic product development approaches. In Europe, the Global Complementary and Alternative Medicine Market is expected to hold a significant revenue share in the forecast period. Within Europe, the demand for complementary and alternative therapies, including treatments like acupuncture that rely less on contemporary drugs, has seen a notable surge in popularity. In 2024, Europe has a leading position as the most significant global market for complementary and alternative medicine, having a 28.72% market revenue share. From, the complementary and alternative medicine industry in the Middle East and Africa is expected to experience the fastest growth. The area has seen a significant increase in the number of alternative medicine practitioners. During the forecast period, Asia Pacific is expected to experience significant growth. The rising demand for herbal supplements is fueling the development of the complementary & and alternative medicine market in the region. Given its abundance in medicinal plants, the complementary and alternative medicine market in Asia Pacific is poised for growth throughout the forecast period. North America dominates the global Complementary and Alternative Medicine Market, led by the United States and Canada, with the highest number of Complementary and Alternative Medicines

Complementary and Alternative Medicine Market Competitive Landscape

The Complementary and Alternative Medicine (CAM) Market is expanding rapidly as leading companies adopt innovative wellness technologies, holistic healthcare solutions, and natural therapy advancements to strengthen their global footprint. Major brands such as Pure Encapsulation and Geriatric Medical continue to dominate the global CAM market through strategic innovation and strong regional presence. In 2023, Pure Encapsulation introduced fully recyclable packaging and reaffirmed its commitment to achieving 100% net-zero greenhouse gas emissions by 2050, supporting the rising demand for sustainable natural remedies and eco-friendly CAM products. Geriatric Medical also advanced its sustainability goals, with Mass American Energy congratulating the team on completing a major solar energy project projected to offset nearly 25 million pounds of greenhouse gases by 2040—a move aligned with the global shift toward green healthcare practices. In 2023, Bioyona’s Skin Activating Serum became a finalist at the Pure Beauty Global Awards, showcasing innovation backed by patents across the U.S., Japan, and Taiwan, and highlighting strong growth in the holistic skincare and herbal therapy segment. Additionally, Herb Pharm, a notable U.S. player, continues to elevate the market with its herbal health drinks and immune-boosting formulations, attracting consumers who increasingly prefer plant-based healing, naturopathic remedies, and organic CAM products. These continuous innovations are significantly driving the overall Complementary & Alternative Medicine Market growth worldwide.Complementary and Alternative Medicine Market Scope: Inquire before buying

Global Complementary and Alternative Medicine Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 135.13 Bn. Forecast Period 2025 to 2032 CAGR: 17.9% Market Size in 2032: USD 504.52 Bn. Segments Covered: By Intervention Traditional Alternative Medicine/Botanicals Mind Healing Body Healing External Energy By Product Vitamins Minerals Herbal products others By Diseases Cancer Diabetes Chronic pain Coronary artery disease Others By Distribution Channel Direct Sales E-sales Distance Correspondence Other Complementary and Alternative Medicine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Complementary and Alternative Medicine Market, Key Players

1. Pure Encapsulations, Inc.(US) 2. Nordic Naturals(US) 3. Unity Woods Yoga Center(US) 4. Quantum Touch(US) 5. Geriatric & Medical Companies, Inc.,(US) 6. Herb Pharm(US) 7. Helio USA Inc.(US) 8. Merck Sharp & Dohme Corporation(US) 9. UAS Laboratories.(US) 10. The Healing Company (New Zealand) 11. Nature’s Bounty(UK) 12. First Natural Brands Ltd.(UK) 13. Herbal Hills(India) 14. Sheng Chang Pharmaceutical Company (Taiwan) 15. Ramamani Iyengar Memorial Yoga Institute (Maharashtra, India) 16. Ayush Ayurvedic Pte. Ltd.(Singapore) 17. Columbia Nutritional LLC (Washington, United States) 18. Yoga Tree Studios, Inc. (Toronto, Ontario, Canada) 19. ALCES LLP, (London, United Kingdom) 20. Amrita Ayurveda and Yoga, (Kerala, India) 21. NatureKue, (Singapore) 22. Body and Soul Yoga Club, (Brussels, Belgium) 23. Bikram Yoga, (California, United States) 24. LKK Health Products Group Limited (Hong Kong, China)FAQ's:

1. Which is the potential market for Complementary and Alternative Medicine in terms of the region? Ans. North America is the potential market for Complementary and Alternative Medicine in terms of the region. 2. What are the opportunities for new market entrants? Ans. Alternative treatment options for a growing number of diabetic Cardiac issue related patients around the globe. 3. What is expected to drive the growth of the Complementary and Alternative Medicine market in the forecast period? Ans. Growing public interest is expected to drive the growth CAM market in the forecast period. 4. What was the Global Complementary and Alternative Medicine Market size in 2024? Ans: The Global Complementary and Alternative Medicine Market size was USD 135.13 Billion in 2024. 5. What segments are covered in the Complementary and Alternative Medicine Market report? Ans. The segments covered are Therapy Type, Disease, Distribution Channel, and Region.

1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Complementary and Alternative Medicine Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Service Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2024 2.2.6. Market Share (%) 2.2.7. Profit Margin(%) 2.2.8. Growth rate [Y-o-Y(%)] 2.2.9. Technologies Advancements 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Complementary and Alternative Medicine Market: Dynamics 3.1. Complementary and Alternative Medicine Market Trends 3.2. Complementary and Alternative Medicine Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis For the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Pricing Analysis & Cost Structure Evaluation 4.1. Comparative pricing assessment of herbal, naturopathic, and homeopathic products 4.2. Cost analysis of manufacturing natural remedies and therapeutic formulations 4.3. Evaluation of raw material procurement and organic botanical sourcing challenges 4.4. Impact of supply chain disruptions on global alternative medicine pricing 4.5. Influence of certification, purity testing, and quality verification on pricing 4.6. Cost variations across direct-to-consumer channels and wellness marketplaces 5. Technology & Innovation Assessment 5.1. Role of biotechnology in improving herbal extraction and purity enhancement 5.2. Advancements in digital diagnostics supporting personalized CAM treatments 5.3. Integration of wearable devices for monitoring alternative therapy outcomes 5.4. Innovations in natural supplement formulations using plant-based actives 5.5. AI-driven recommendations for optimizing individualized complementary therapies 5.6. Technology adoption supporting large-scale production of herbal nutraceuticals 5.7. Development of sustainable packaging for eco-friendly CAM products 6. Complementary Therapy Segment Analysis 6.1. Botanical and herbal medicines market assessment with growth determinants 6.2. Acupuncture and acupressure treatment adoption across major healthcare markets 6.3. Naturopathy and holistic healing trends driving integrative medical practices 6.4. Homeopathy demand analysis with regional adoption and clinical usage patterns 6.5. Meditation, yoga, and mindfulness practices supporting mental wellness growth 6.6. Energy healing modalities gaining traction among chronic pain sufferers 6.7. Traditional Chinese Medicine (TCM) and Ayurveda adoption in global markets 7. Disease-Type Market Breakdown (2019–2032) 7.1. Cancer management therapy adoption using supportive CAM interventions 7.2. Diabetes patient preference for herbal supplements and natural remedies 7.3. Chronic pain treatment through acupuncture, massage, and alternative therapies 7.4. Coronary artery disease management using integrative cardiovascular healing 7.5. Rising adoption of CAM therapies for general wellness and immune health 8. Customer Analysis & Behavioral Insights 8.1. Consumer preference shift toward non-invasive and natural healing therapies 8.2. Demographic profiling of CAM users across different global regions 8.3. Analysis of digital influence on consumer choices for CAM practitioners 8.4. Factors driving adoption of herbal supplements among urban populations 8.5. Influence of clinical awareness campaigns on CAM therapy acceptance 8.6. Patient perception of safety, effectiveness, and holistic treatment outcomes 9. Complementary and Alternative Medicine Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 9.1.1. Traditional Alternative Medicine/Botanicals 9.1.2. Mind Healing 9.1.3. Body Healing 9.1.4. External Energy 9.2. Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 9.2.1. Vitamins 9.2.2. Minerals 9.2.3. Herbal products 9.2.4. Others 9.3. Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 9.3.1. Cancer 9.3.2. Diabetes 9.3.3. Chronic pain 9.3.4. Coronary artery disease 9.3.5. Others 9.4. Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.1. Direct Sales 9.4.2. E-sales 9.4.3. Distance Correspondence 9.4.4. Others 9.5. Complementary and Alternative Medicine Market Size and Forecast, By Region (2024-2032) 9.5.1. North America 9.5.2. Europe 9.5.3. Asia Pacific 9.5.4. Middle East and Africa 9.5.5. South America 10. North America Complementary and Alternative Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. North America Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 10.1.1. Traditional Alternative Medicine/Botanicals 10.1.2. Mind Healing 10.1.3. Body Healing 10.1.4. External Energy 10.2. North America Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 10.2.1. Vitamins 10.2.2. Minerals 10.2.3. Herbal products 10.2.4. Others 10.3. North America Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 10.3.1. Cancer 10.3.2. Diabetes 10.3.3. Chronic pain 10.3.4. Coronary artery disease 10.3.5. Others 10.4. North America Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 10.4.1. Direct Sales 10.4.2. E-sales 10.4.3. Distance Correspondence 10.4.4. Others 10.5. North America Complementary and Alternative Medicine Market Size and Forecast, by Country (2024-2032) 10.5.1. United States 10.5.1.1. United States Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 10.5.1.1.1. Traditional Alternative Medicine/Botanicals 10.5.1.1.2. Mind Healing 10.5.1.1.3. Body Healing 10.5.1.1.4. External Energy 10.5.1.2. United States Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 10.5.1.2.1. Vitamins 10.5.1.2.2. Minerals 10.5.1.2.3. Herbal products 10.5.1.2.4. Others 10.5.1.3. United States Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 10.5.1.3.1. Cancer 10.5.1.3.2. Diabetes 10.5.1.3.3. Chronic pain 10.5.1.3.4. Coronary artery disease 10.5.1.3.5. Others 10.5.1.4. United States Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 10.5.1.4.1. Direct Sales 10.5.1.4.2. E-sales 10.5.1.4.3. Distance Correspondence 10.5.1.4.4. Others 10.5.2. Canada 10.5.2.1. Canada Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 10.5.2.1.1. Traditional Alternative Medicine/Botanicals 10.5.2.1.2. Mind Healing 10.5.2.1.3. Body Healing 10.5.2.1.4. External Energy 10.5.2.2. Canada Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 10.5.2.2.1. Vitamins 10.5.2.2.2. Minerals 10.5.2.2.3. Herbal products 10.5.2.2.4. Others 10.5.2.3. Canada Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 10.5.2.3.1. Cancer 10.5.2.3.2. Diabetes 10.5.2.3.3. Chronic pain 10.5.2.3.4. Coronary artery disease 10.5.2.3.5. Others 10.5.2.4. Canada Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 10.5.2.4.1. Direct Sales 10.5.2.4.2. E-sales 10.5.2.4.3. Distance Correspondence 10.5.2.4.4. Others 10.5.3. Mexico 10.5.3.1. Mexico Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 10.5.3.1.1. Traditional Alternative Medicine/Botanicals 10.5.3.1.2. Mind Healing 10.5.3.1.3. Body Healing 10.5.3.1.4. External Energy 10.5.3.2. Mexico Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 10.5.3.2.1. Vitamins 10.5.3.2.2. Minerals 10.5.3.2.3. Herbal products 10.5.3.2.4. Others 10.5.3.3. Mexico Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 10.5.3.3.1. Cancer 10.5.3.3.2. Diabetes 10.5.3.3.3. Chronic pain 10.5.3.3.4. Coronary artery disease 10.5.3.3.5. Others 10.5.3.4. Mexico Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 10.5.3.4.1. Direct Sales 10.5.3.4.2. E-sales 10.5.3.4.3. Distance Correspondence 10.5.3.4.4. Others 11. Europe Complementary and Alternative Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 11.1. Europe Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.2. Europe Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.3. Europe Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.4. Europe Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5. Europe Complementary and Alternative Medicine Market Size and Forecast, by Country (2024-2032) 11.5.1. United Kingdom 11.5.1.1. United Kingdom Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.1.2. United Kingdom Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.1.3. United Kingdom Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.1.4. United Kingdom Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5.2. France 11.5.2.1. France Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.2.2. France Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.2.3. France Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.2.4. France Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5.3. Germany 11.5.3.1. Germany Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.3.2. Germany Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.3.3. Germany Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.3.4. Germany Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5.4. Italy 11.5.4.1. Italy Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.4.2. Italy Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.4.3. Italy Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.4.4. Italy Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5.5. Spain 11.5.5.1. Spain Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.5.2. Spain Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.5.3. Spain Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.5.4. Spain Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5.6. Sweden 11.5.6.1. Sweden Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.6.2. Sweden Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.6.3. Sweden Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.6.4. Sweden Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5.7. Russia 11.5.7.1. Russia Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.7.2. Russia Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.7.3. Russia Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.7.4. Russia Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 11.5.8. Rest of Europe 11.5.8.1. Rest of Europe Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 11.5.8.2. Rest of Europe Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 11.5.8.3. Rest of Europe Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 11.5.8.4. Rest of Europe Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12. Asia Pacific Complementary and Alternative Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 12.1. Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.2. Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.3. Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.4. Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5. Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, by Country (2024-2032) 12.5.1. China 12.5.1.1. China Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.1.2. China Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.1.3. China Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.1.4. China Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.2. S Korea 12.5.2.1. S Korea Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.2.2. S Korea Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.2.3. S Korea Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.2.4. S Korea Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.3. Japan 12.5.3.1. Japan Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.3.2. Japan Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.3.3. Japan Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.3.4. Japan Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.4. India 12.5.4.1. India Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.4.2. India Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.4.3. India Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.4.4. India Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.5. Australia 12.5.5.1. Australia Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.5.2. Australia Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.5.3. Australia Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.5.4. Australia Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.6. Indonesia 12.5.6.1. Indonesia Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.6.2. Indonesia Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.6.3. Indonesia Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.6.4. Indonesia Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.7. Malaysia 12.5.7.1. Malaysia Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.7.2. Malaysia Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.7.3. Malaysia Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.7.4. Malaysia Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.8. Philippines 12.5.8.1. Philippines Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.8.2. Philippines Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.8.3. Philippines Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.8.4. Philippines Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.9. Thailand 12.5.9.1. Thailand Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.9.2. Thailand Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.9.3. Thailand Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.9.4. Thailand Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.10. Vietnam 12.5.10.1. Vietnam Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.10.2. Vietnam Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.10.3. Vietnam Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.10.4. Vietnam Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 12.5.11. Rest of Asia Pacific 12.5.11.1. Rest of Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 12.5.11.2. Rest of Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 12.5.11.3. Rest of Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 12.5.11.4. Rest of Asia Pacific Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 13. Middle East and Africa Complementary and Alternative Medicine Market Size and Forecast (by Value in USD Million) (2024-2032 13.1. Middle East and Africa Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 13.2. Middle East and Africa Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 13.3. Middle East and Africa Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 13.4. Middle East and Africa Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 13.5. Middle East and Africa Complementary and Alternative Medicine Market Size and Forecast, by Country (2024-2032) 13.5.1. South Africa 13.5.1.1. South Africa Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 13.5.1.2. South Africa Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 13.5.1.3. South Africa Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 13.5.1.4. South Africa Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 13.5.2. GCC 13.5.2.1. GCC Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 13.5.2.2. GCC Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 13.5.2.3. GCC Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 13.5.2.4. GCC Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 13.5.3. Egypt 13.5.3.1. Egypt Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 13.5.3.2. Egypt Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 13.5.3.3. Egypt Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 13.5.3.4. Egypt Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 13.5.4. Nigeria 13.5.4.1. Nigeria Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 13.5.4.2. Nigeria Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 13.5.4.3. Nigeria Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 13.5.4.4. Nigeria Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 13.5.5. Rest of ME&A 13.5.5.1. Rest of ME&A Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 13.5.5.2. Rest of ME&A Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 13.5.5.3. Rest of ME&A Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 13.5.5.4. Rest of ME&A Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 14. South America Complementary and Alternative Medicine Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 14.1. South America Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 14.2. South America Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 14.3. South America Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 14.4. South America Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 14.5. South America Complementary and Alternative Medicine Market Size and Forecast, by Country (2024-2032) 14.5.1. Brazil 14.5.1.1. Brazil Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 14.5.1.2. Brazil Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 14.5.1.3. Brazil Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 14.5.1.4. Brazil Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 14.5.2. Argentina 14.5.2.1. Argentina Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 14.5.2.2. Argentina Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 14.5.2.3. Argentina Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 14.5.2.4. Argentina Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 14.5.3. Colombia 14.5.3.1. Colombia Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 14.5.3.2. Colombia Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 14.5.3.3. Colombia Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 14.5.3.4. Colombia Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 14.5.4. Chile 14.5.4.1. Chile Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 14.5.4.2. Chile Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 14.5.4.3. Chile Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 14.5.4.4. Chile Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 14.5.5. Rest Of South America 14.5.5.1. Rest Of South America Complementary and Alternative Medicine Market Size and Forecast, By Intervention (2024-2032) 14.5.5.2. Rest Of South America Complementary and Alternative Medicine Market Size and Forecast, By Product (2024-2032) 14.5.5.3. Rest Of South America Complementary and Alternative Medicine Market Size and Forecast, By Diseases (2024-2032) 14.5.5.4. Rest Of South America Complementary and Alternative Medicine Market Size and Forecast, By Distribution Channel (2024-2032) 15. Company Profile: Key Players 15.1. Pure Encapsulations, Inc.(US) 15.1.1. Company Overview 15.1.2. Business Portfolio 15.1.3. Financial Overview 15.1.4. SWOT Analysis 15.1.5. Strategic Analysis 15.1.6. Recent Developments 15.2. Nordic Naturals(US) 15.3. Unity Woods Yoga Center(US) 15.4. Quantum Touch(US) 15.5. Geriatric & Medical Companies, Inc.,(US) 15.6. Herb Pharm(US) 15.7. Helio USA Inc.(US) 15.8. Merck Sharp & Dohme Corporation(US) 15.9. UAS Laboratories.(US) 15.10. The Healing Company (New Zealand) 15.11. Nature’s Bounty(UK) 15.12. First Natural Brands Ltd.(UK) 15.13. Herbal Hills(India) 15.14. Sheng Chang Pharmaceutical Company (Taiwan) 15.15. Ramamani Iyengar Memorial Yoga Institute (Maharashtra, India) 15.16. Ayush Ayurvedic Pte. Ltd.(Singapore) 15.17. Columbia Nutritional LLC (Washington, United States) 15.18. Yoga Tree Studios, Inc. (Toronto, Ontario, Canada) 15.19. ALCES LLP, (London, United Kingdom) 15.20. Amrita Ayurveda and Yoga, (Kerala, India) 15.21. NatureKue, (Singapore) 15.22. Body and Soul Yoga Club, (Brussels, Belgium) 15.23. Bikram Yoga, (California, United States) 15.24. LKK Health Products Group Limited (Hong Kong, China) 16. Key Findings 17. Industry Recommendations 18. Complementary and Alternative Medicine Market: Research Methodology