Commercial Security Market size was valued at US$ 239.57 Bn. in 2022 and the total Commercial Security revenue is expected to grow by 8.7% from 2023 to 2029, reaching nearly US$ 429.58 Bn.Commercial Security Market Overview:

A commercial security system is an integrated group of components that work together to secure what is most important. One may remotely monitor activities using a video surveillance component in a business security solution via live streaming or recorded replay. The ability to watch several camera perspectives on a single screen not only increases situational awareness but also allows for faster response time. Modern improvements enable users to operate hundreds of cameras from any place using their cell phone, allowing them to respond quickly to threats without wasting important time traveling across town. Video surveillance is unique in its ability to provide evidence-based insight into various elements of corporate operations, such as retail loss prevention, workplace safety compliance initiatives, and more, while also delivering ease of mind that vital company assets are secured.Report Scope:

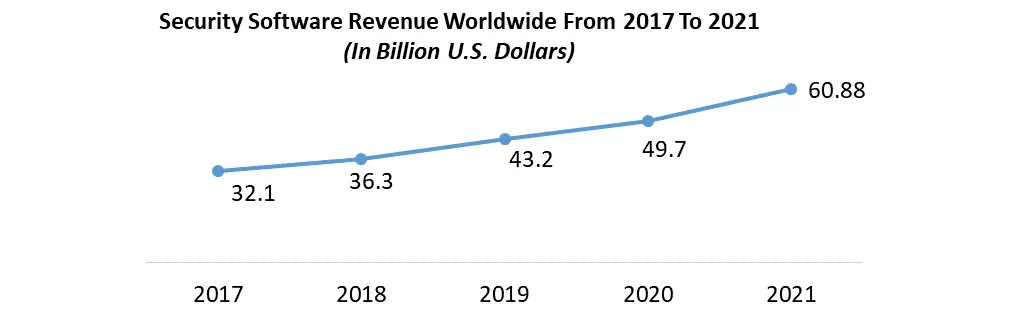

The Commercial Security market is segmented based on System, Service, Software, Vertical, and Region. The growth of various segments helps our clients in acquiring knowledge of the many growth factors expected to be prevalent throughout the market and develop different strategies to help identify core application areas and the gap in the target market. The report provides an in-depth analysis of the market and contains meaningful insights, facts, historical data, and statistically supported and industry-validated market statistics. It also includes estimates based on an appropriate set of assumptions and methodologies. The bottom-up approach has been used to estimate the market size. Major Key Players in the Commercial Security market are identified through secondary research and their market revenues are determined through primary and secondary research. Secondary research included a review of annual and financial reports of leading manufacturers, while primary research included interviews with important opinion leaders and industry experts such as skilled front-line personnel, entrepreneurs, and marketing professionals. Some of the leading key players in the global Commercial Security market include Johnson Controls, Hikvision, Carrier, and Dahua Technology. They are continuously strategizing on mergers and acquisitions, strategic alliances, joint ventures, and partnerships for the growth of their market shares.To know about the Research Methodology :- Request Free Sample Report

Commercial Security Market Dynamics:

Growing demand for private security is a major driver of market growth Private security is critical for protecting people and property, as well as intellectual property and sensitive company information. Many of the nation's institutions and important infrastructure systems, such as industry and manufacturing, utilities, transportation, and health and educational facilities, are protected by private security professionals. Companies also make significant investments in private security, using security organizations to undertake duties such as store security, private investigations, pre-employment screening, and information technology (IT) security. These services are utilized in a wide range of areas, including commercial and residential. Some businesses hire their security people, while others engage security agencies or utilize a combination of services—both proprietary and contract workers. Under today's broad meaning, the phrase "private security" can refer to a wide variety of enterprises, including corporate security, security guard firms, armored car businesses, investigative services, and many more. Personnel recruited by these firms might be armed or unarmed, employed as in-house or contract personnel, and have varying levels of authority depending on where they work and what functions they do. Some cities in the United States have deputized their security staff under state law to form a force with complete authority to arrest, search, and seize. Increasing security breaches in SMEs is a major opportunity for the market Small firms, according to experts, are increasingly becoming victims of data breaches. These circumstances usually occur because they are not up to speed with the most recent security changes in the sector. According to Avast, approximately 60% of all security breaches target small firms, and nearly half of all small enterprises have been targeted. From lost consumers to ruined company image, increased expenditures to decreased profits, these assaults can have irreversible implications, which is why no one likes to deal with them. Fortunately, with adequate information, one can take action and put some of the greatest preventive measures in place. Employees are a key source of data leaks. It can be ascribed to a lack of data security knowledge among employees. Most workers make innocent mistakes because they do not comprehend how hackers operate. Educating the staff on this will provide additional protection for SMBs. Theft, vandalism, and corporate espionage are major challenges to market growth Any good firm makes a profit, which is dependent on a variety of valuable assets such as machinery, products, and infrastructure. The preservation of those assets is a top objective for any successful business security system. Theft protection can take numerous forms, with a variety of discrete yet interrelated mechanisms contributing to the process. A prominent downtown company location is beneficial for sales, exposure, brand awareness, and networking, but it can have downsides. A company site is vulnerable to vandalism in such a public setting, especially after hours. It's not as tough as it sounds to deter vandals. Exterior lights strategically placed makes a property a far less appealing target. The same is true for security cameras pointed directly at the door. Institutions must also be safeguarded from more subtle attacks. Allowing the wrong person inside the organization might result in important information falling into the hands of the wrong people. Access control systems, which manage door locking and unlocking automatically, are an important component of any business security architecture. They allow businesses to screen anybody who walks through the doors, whether they're card-carrying workers, contractors with temporary PINs, or investors who have their fingerprints on file.Commercial Security Market Segment Analysis:

By System, the alarm monitoring system segment is expected to grow at a CAGR of 7.1% during the forecast period. Numerous insurance companies provide insurance discounts for installing and maintaining an alarm system that includes some type of central monitoring. Insurance companies provide the greatest discounts when the alarm system is linked to a central monitoring station. In the event of an alarm, these monitoring stations notify the emergency services.

The commercial advantages of an alarm monitoring system include:

1. Access Control - One may have more control over who has access to what in the office. If a company does not want all (or any) employees to have access to particular areas of the building or office, a business alarm monitoring system can help them gain greater control. It can also assist to safeguard an organization against former employees and make key management easier. 2. Round the Clock Protection - A company/office is secure 24 hours a day, seven days a week. The premises are watched by a certified monitoring station, and if there is an incursion, individuals will be alerted and the police will be dispatched to the location. 3. Minimum Insurance Costs - Insurance is an important and necessary cost for the operation of a business. Many insurance providers mandate that businesses install security systems. If a company needs to submit a claim, the lack of such a system might raise overall rates or make it harder to get appropriate coverage, which could harm the business. 4. Continued Operations - A successful burglary or theft can disrupt a business's operations for days, weeks, or even months. This has repercussions not just for the company, but also for company staff, who may be unable to work while the company recovers. By avoiding large losses, companies will reduce downtime, which will allow companies to retain their competitive edge over their adversaries. False alarms are a key impediment to the widespread deployment of alarm monitoring systems. The exterior physical environment, such as temperature and humidity variations, has an impact on alarm systems. For example, in the summer, the overpowering heat causes glassware to shatter, resulting in the activation of alarm systems—a false alert. Prank calls, wrong keypad codes, and a lack of training for authorized users are all common sources of false alerts. False alarms heighten the risk to public safety.Commercial Security Market Regional Insights:

Commercial security influences a variety of development-related aspects, including a state's ability to govern, general sense of public safety, economic growth, and social welfare. Security markets can stimulate economic growth while relieving pressure on the public security sector. Nonetheless, difficulties have arisen as a result of lax regulation of commercial security methods. Low-level confrontations between public and private security providers over police authority in certain environments are examples of this. Also, a trend toward corporatization of private protection has resulted in severely exploitative labour relations in the commercial security industry.Private military and security firms have attracted increased attention in recent years due to their major presence in numerous war and crisis zones. According to reports, the commercial security sector in Iraq comprises of more than 30,000 armed guards who defend military sites, foreign embassies, oil pipelines, and the facilities of humanitarian relief groups, as well as supply convoys. According to a study, the number of security contractors recruited by the US Department of Defense in Afghanistan surged by 236%, from 3,184 to 10,712. These developments may be seen as part of a wider global trend marked by the increasing commercialization of security-related services. Importantly, this broader tendency is not restricted to areas of violent conflict, but can also be found in many developed countries. The size and total yearly income of the German private security business, for example, have almost doubled in the previous decade. So far, little political and economic attention has been paid to the more ordinary, day-to-day provision of commercial security services in developing nations. This is even more unexpected given that, especially in developing cities, commercial security is a fundamental mechanism by which individuals strive to protect themselves from a variety of hazards. Although Europe and North America have the greatest commercial security markets in absolute terms, emerging nations have the highest growth rates as well as the highest density of security businesses.

Commercial Security Market Scope: Inquire before buying

Commercial Security Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 239.57 Bn. Forecast Period 2023 to 2029 CAGR: 8.7% Market Size in 2029: US $ 429.58 Bn. Segments Covered: by System Alarm Monitoring System Video Surveillance Access Control System Entrance Control System Other by Service Security System Integration Service Remote Monitoring Alarm Monitoring Service Video Surveillance Service Access Control Service Other by Software Fire Analysis Video Surveillance Software Access Control Software Other by Vertical Commercial Government Transportation Retail Banking and Finance Education Industrial Energy and Utility Sports and Leisure Healthcare Commercial Security Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Commercial Security Market, Key Players are

1. ADT Security Services 2. Bosch Security Systems 3. Allegion 4. Godrej & Boyce Manufacturing Company Limited 5. United Technologies Corporation 6. ASSA ABLOY AB 7. Nortek Security and Control 8. Honeywell International, Inc. 9. UTC Fire & Security 10. Control4 11. Tyco International Ltd 12. Johnson Controls 13. Hikvision 14. Carrier 15. Dahua Technology 16. Axis Communications 17. Secom 18. Siemens 19. Halma 20. Hochiki Corporation FAQs: 1. Which is the potential market for Commercial Security in terms of the region? Ans. North America is the potential market for Commercial Security in terms of the region. 2. What are the opportunities for new market entrants? Ans. Increasing security breaches in SMEs is a major opportunity for the market. 3. What is expected to drive the growth of the Commercial Security market in the forecast period? Ans. Growing demand for private security is a major driver of market growth. 4. What is the projected market size & growth rate of the Commercial Security Market? Ans. Commercial Security Market size was valued at US$ 239.57 Bn. in 2022 and the total Commercial Security revenue is expected to grow by 8.7% from 2023 to 2029, reaching nearly US$ 429.58 Bn. 5. What segments are covered in the Commercial Security Market report? Ans. The segments covered are System, Service, Software, Vertical and Region.

1. Global Commercial Security Market: Research Methodology 2. Global Commercial Security Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Commercial Security Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Commercial Security Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Commercial Security Market Segmentation 4.1 Global Commercial Security Market, by System (2022-2029) • Alarm Monitoring System • Video Surveillance • Access Control System • Entrance Control System • Other 4.2 Global Commercial Security Market, by Service (2022-2029) • Security System Integration Service • Remote Monitoring • Alarm Monitoring Service • Video Surveillance Service • Access Control Service • Other 4.3 Global Commercial Security Market, by Software (2022-2029) • Fire Analysis • Video Surveillance Software • Access Control Software • Other 4.4 Global Commercial Security Market, by Vertical (2022-2029) • Commercial • Government • Transportation • Retail • Banking and Finance • Education • Industrial • Energy and Utility • Sports and Leisure • Healthcare 5. North America Commercial Security Market(2022-2029) 5.1 North America Commercial Security Market, by System (2022-2029) • Alarm Monitoring System • Video Surveillance • Access Control System • Entrance Control System • Other 5.2 North America Commercial Security Market, by Service (2022-2029) • Security System Integration Service • Remote Monitoring • Alarm Monitoring Service • Video Surveillance Service • Access Control Service • Other 5.3 North America Commercial Security Market, by Software (2022-2029) • Fire Analysis • Video Surveillance Software • Access Control Software • Other 5.4 North America Commercial Security Market, by Vertical (2022-2029) • Commercial • Government • Transportation • Retail • Banking and Finance • Education • Industrial • Energy and Utility • Sports and Leisure • Healthcare 5.5 North America Commercial Security Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Commercial Security Market (2022-2029) 6.1. European Commercial Security Market, by System (2022-2029) 6.2. European Commercial Security Market, by Service (2022-2029) 6.3. European Commercial Security Market, by Software (2022-2029) 6.4. European Commercial Security Market, by Vertical (2022-2029) 6.5. European Commercial Security Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Commercial Security Market (2022-2029) 7.1. Asia Pacific Commercial Security Market, by System (2022-2029) 7.2. Asia Pacific Commercial Security Market, by Service (2022-2029) 7.3. Asia Pacific Commercial Security Market, by Software (2022-2029) 7.4. Asia Pacific Commercial Security Market, by Vertical (2022-2029) 7.5. Asia Pacific Commercial Security Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Commercial Security Market (2022-2029) 8.1 Middle East and Africa Commercial Security Market, by System (2022-2029) 8.2. Middle East and Africa Commercial Security Market, by Service (2022-2029) 8.3. Middle East and Africa Commercial Security Market, by Software (2022-2029) 8.4. Middle East and Africa Commercial Security Market, by Vertical (2022-2029) 8.5. Middle East and Africa Commercial Security Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Commercial Security Market (2022-2029) 9.1. South America Commercial Security Market, by System (2022-2029) 9.2. South America Commercial Security Market, by Service (2022-2029) 9.3. South America Commercial Security Market, by Software (2022-2029) 9.4. South America Commercial Security Market, by Vertical (2022-2029) 9.5. South America Commercial Security Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 ADT Security Services 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Bosch Security Systems 10.3 Allegion 10.4 Godrej & Boyce Manufacturing Company Limited 10.5 United Technologies Corporation 10.6 ASSA ABLOY AB 10.7 Nortek Security and Control 10.8 Honeywell International, Inc. 10.9 UTC Fire & Security 10.10 Control4 10.11 Tyco International Ltd 10.12 Johnson Controls 10.13 Hikvision 10.14 Carrier 10.15 Dahua Technology 10.16 Axis Communications 10.17 Secom 10.18 Siemens 10.19 Halma 10.20 Hochiki Corporation