Global Colorants Market size was valued at USD 66.80 Bn in 2024, and the total Colorants Market revenue is expected to grow at a CAGR of 4.81% from 2025 to 2032, reaching nearly USD 97.27 BnColorants Market Overview

Colorants are vibrant substances that impart visual appeal to materials, available as dyes (soluble for textiles/food) or pigments (insoluble for paints/plastics). From nature-derived hues to synthetic brilliance, they transform everyday productsclothing, packaging, cosmetics—into visually captivating experiences. As sustainability surges, innovations like bio-based dyes and smart pigments are redefining color science for a greener, more dynamic future. Demand for colorants is surging, driven by booming industries like textiles, packaging, and automotive coatings, alongside rising consumer preference for eco-friendly and smart pigments. Meanwhile, supply is expanding through innovations in bio-based dyes and scaled synthetic production, though raw material volatility and regional disruptions (e.g., Asia’s dominance) create dynamic market balances. Asia-Pacific dominated the global colorants market with over 45% share in 2024, led by China's textile dyes and India's pigment manufacturing, while BASF SE (Germany) emerges as the top global player with USD 4.8 billion in colorant revenue, pioneering sustainable innovations like bio-based pigments and circular economy solutions, followed closely by DIC Corporation (Japan) in printing inks and Clariant (Switzerland) in high-performance pigments.To know about the Research Methodology :- Request Free Sample Report Colorant Market Recent Trend 1. Shift to Sustainable & Bio-Based Colorants • Rising demand for plant-based, microbial, and algae-derived dyes/pigments (e.g., beetroot red, spirulina blue). • Brands like Unilever, L’Oreal adopting natural colorants for cosmetics and food. 2. Stringent Regulations Driving Innovation • EU bans on synthetic dyes (e.g., titanium dioxide in food) pushing R&D in safer alternatives. • FDA & REACH compliance forcing reformulations in pigments and dyes. 3. Digital Printing Boom • High growth in digital textile printing inks (eco-solvent, UV-curable). • Packaging industry adopting digital colorants for short-run, customized labels. 4. Smart & Functional Colorants • Thermochromic & photochromic pigments for packaging, automotive, and security inks. • Self-healing coatings with color-changing properties (automotive sector).

Colorant Market Dynamics

Bio-Based Colorants Boom the Colorants Market The increasing demand for sustainable and eco-friendly alternatives to synthetic dyes and pigments. Derived from renewable biological sources such as plants, algae, fungi, and microorganisms, bio-based colorants offer a low-carbon footprint, reduced toxicity, and biodegradability, aligning with stringent environmental regulations and consumer preference for green products. Industries such as textiles, food & beverages, cosmetics, and packaging are adopting these natural solutions to meet regulatory compliance and brand sustainability goals. In textiles, bio-based dyes are gaining traction as a replacement for petrochemical-based colorants, while in food and cosmetics, plant-derived pigments such as anthocyanins, carotenoids, and chlorophyll are valued for their clean-label appeal. Technological advancements in fermentation and extraction processes are improving yield, stability, and color intensity, making bio-based options more competitive. Furthermore, collaborations between biotech firms and major FMCG brands are accelerating commercialization. Although challenges remain such as scalability, cost competitiveness, and limited color range rising investments, supportive policies, and consumer awareness are expected to boost market growth. This “green shift” is positioning bio-based colorants not just as an alternative, but as a key driver of innovation in the broader colorants market. Regulations Over the Colorant Products Restrain the Colorants Market Growth Stringent environmental regulations are increasingly hindering the growth of the synthetic colorants market, as governments tighten controls on harmful chemicals. In major economies such as the EU and the US, bans on substances like titanium dioxide and certain azo dyes have been implemented due to health and environmental concerns. These measures have driven compliance costs up by more than 30%, pushing manufacturers to reformulate their product lines or, in some cases, withdraw entirely from affected markets. Smaller and mid-sized producers are particularly vulnerable, as limited resources make it challenging to meet costly compliance and certification requirements. Many face the risk of liquidation, further consolidating the market among larger, well-capitalized players. At the same time, low-cost, less-regulated alternatives from Asia are gaining traction, intensifying competitive pressures on Western manufacturers. This combination of regulatory stringency and competitive disadvantage threatens over $12 billion in legacy dye and pigment revenues globally. While these developments are pushing the industry toward greener, bio-based alternatives, the transition involves significant investment and higher production costs. Nevertheless, with sustainability becoming a critical market driver, adapting to these regulations is increasingly viewed as essential for long-term competitiveness and survival in the evolving colorants industry. Expanding Applications in Emerging Industries Create Growth Opportunities to the Colorants Market Growth The global colorants market is growth through expanding applications in emerging industries such as 3D printing, advanced coatings, and high-performance plastics. In 3D printing, colorants are used to create vibrant, durable finishes for prototypes, customized consumer products, and industrial components, new revenue streams for pigment and dye manufacturers. In advanced coatings, the demand for functional colorants offering UV resistance, anti-microbial properties, or heat reflection is on the rise, driven by sectors like automotive, aerospace, and construction seeking both aesthetics and performance enhancement. In packaging, innovations in smart and active packaging are fueling the use of colorants that respond to environmental stimuli, such as temperature or light, providing interactive consumer experiences and improved product safety. Additionally, the shift toward premiumization in consumer goods is creating opportunities for specialized, high-value colorants that deliver unique shades, effects, and branding differentiation Drives the colorants market.Global Colorants Market Segment Analysis

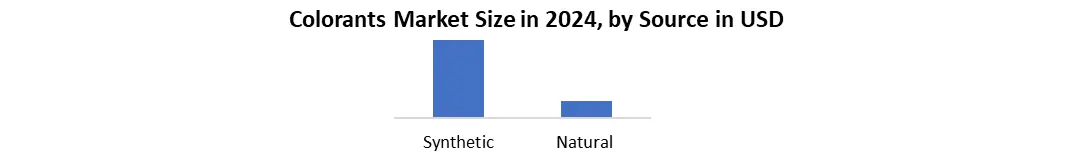

Based on Source Type, Colorant Market is segmented into Natural and Synthetic. Synthetic segment dominated the Colorant Market in 2024 and is expected to maintained the largest market share over the forecast period. Manufactured primarily from petrochemical sources, synthetic colorants provide a broad spectrum of vibrant and consistent shades, along with excellent stability against light, heat, and chemicals. These attributes make them the preferred choice across high-demand industries such as textiles, plastics, paints & coatings, printing inks, and packaging. Their ability to deliver uniform results at scale has solidified their position as the industry standard for mass production. The growing environmental concerns and strict regulatory frameworks in regions like the EU and the US have created challenges, synthetic colorants continue to maintain strong market traction. This resilience is largely supported by advancements in safer, compliant formulations and ongoing investments in technologies that reduce harmful emissions during production. Furthermore, the presence of well-established supply chains, competitive pricing, and the ability to meet large-volume orders make synthetic colorants difficult to replace in several sectors, especially in cost-sensitive markets. However, natural colorants are the fastest-growing segment (CAGR ~8%), fueled by stringent regulations (EU bans on synthetics in food/cosmetics) and consumer demand for clean-label products. Plant-based (turmeric, beetroot), microbial (algae blue), and mineral-derived pigments are gaining traction in food, beauty, and premium textiles. While synthetic production scales keep prices low, brands like Beyond Meat and Lush are accelerating the shift to natural alternativeshinting at a future USD 15B+ bio-based colorants market by 2030.

Global Colorants Market Regional Analysis

The Asia-Pacific (APAC) region dominated the global colorants market, accounting for over XX % of revenue in 2024, driven with massive textile, packaging, and paint demand in China, India, and Southeast Asia. This leadership is fueled by the region’s robust industrial base, rapidly expanding consumer markets, and strong demand from key sectors such as textiles, packaging, and paints & coatings. China, India, and Southeast Asian nations are at the forefront, driven by large-scale manufacturing, competitive labor costs, and rising domestic consumption. In textiles, APAC countries benefit from their position as global manufacturing hubs, supplying both domestic and export markets with dyed fabrics and finished apparel. The packaging industry, buoyed by booming e-commerce and processed food sectors, is also a major driver, with high demand for printing inks, pigments, and masterbatches. In paints and coatings, rapid urbanization and infrastructure development are boosting decorative and industrial applications in Colorants Market. Global Colorants Market Competitive Landscape The global colorants market is dominated by chemical giants, with BASF SE (USD 4.8B colorant revenue in 2024) leading through sustainable innovation, including bio-based automotive pigments and a USD 2.3B R&D budget. Clariant AG (USD 3.1B) specializes in high-performance pigments for plastics and eco-friendly coatings, with its Earth-Friendly series driving 18% of sales. DIC Corporation (USD 3.9B) rules printing inks and textile dyes, boosted by its Sun Chemical acquisition and Asia's manufacturing boom. Together they command 38% market share, but face disruption from bio-tech startups like Pili Bio's microbial dyes (growing at 200% YoY). BASF leads in circular solutions, Clariant in regulatory-compliant pigments, while DIC expands through strategic acquisitions - making this a USD 25B battleground of technology versus sustainability. Colorants Market Recent Development In March 2022, with Colorants International AG, a joint venture between Heubach Group and SK Capital Partners, acquiring a 3.36525% stake in the company. This acquisition was part of a broader strategy that led to Colorants International AG increasing its holding to 54.37%.Colorants Market Scope: Inquire before buying

Global Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 66.80 Bn. Forecast Period 2025 to 2032 CAGR: 4.81% Market Size in 2032: USD 97.27 Bn. Segments Covered: by Product Type Pigment Dyes Others by Source Synthetic Natural by End Use Paint and coatings Packaging Food & Beverages Textiles Paper & Printing Others Colorant Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Colorant Market Key Players

North America Colorant Market Key Players 1. BASF SE (Ludwigshafen, Germany) – 2. Huntsman Corporation (Texas, USA) 3. Sensient Technologies (Wisconsin, USA) 4. Sun Chemical (New Jersey, USA) 5. PPG Industries (Pennsylvania, USA) 6. Sherwin-Williams (Ohio, USA) 7. Dow Chemical Company (Michigan, USA) Europe Colorant Market Key Players 1. Lanxess AG (Cologne, Germany) 2. Archroma (Reinach, Switzerland) 3. AkzoNobel N.V. (Amsterdam, Netherlands) 4. DSM-Firmenich (Kaiseraugst, Switzerland) 5. Heubach GmbH (Langelsheim, Germany) Asia Pacific Colorant Market Key Players 1. DIC Corporation (Tokyo, Japan) 2. Sudarshan Chemical Industries (Pune, India) 3. Kiri Industries (Gujarat, India) 4. Atul Ltd (Gujarat, India) Middle East and Africa Colorant Market Key Players 1. National Paints Factories (Jordan) 2. Hempel Middle East (UAE) 3. Jotun (UAE operations) 4. Saudi Basic Industries Corp (SABIC) South America Colorant Market Key Players 1. Oxiteno (Brazil) 2. Unigel (Brazil) 3. Elekeiroz (Brazil)Frequently Asked Questions:

1. Which region has the largest share in Global Colorant Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global Colorant Market? Ans: The Global Colorant Market is growing at a CAGR of 4.81% during forecasting period 2025-2032. 3. What is scope of the Global Colorant market report? Ans: Global Colorant Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Colorant market? Ans: The important key players in the Global Colorant Market are BASF SE, Sun Chemical Corporation, Huntsman Corporation and DIC Corporation. 5. What is the study period of this market? Ans: The Global Colorant Market is studied from 2024 to 2032.

1. Colorants Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Colorants Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Colorants Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Colorants Market: Dynamics 3.1. Colorants Market Trends by Region 3.1.1. North America Colorants Market Trends 3.1.2. Europe Colorants Market Trends 3.1.3. Asia Pacific Colorants Market Trends 3.1.4. Middle East and Africa Colorants Market Trends 3.1.5. South America Colorants Market Trends 3.2. Colorants Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Colorants Market Drivers 3.2.1.2. North America Colorants Market Restraints 3.2.1.3. North America Colorants Market Opportunities 3.2.1.4. North America Colorants Market Challenges 3.2.2. Europe 3.2.2.1. Europe Colorants Market Drivers 3.2.2.2. Europe Colorants Market Restraints 3.2.2.3. Europe Colorants Market Opportunities 3.2.2.4. Europe Colorants Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Colorants Market Drivers 3.2.3.2. Asia Pacific Colorants Market Restraints 3.2.3.3. Asia Pacific Colorants Market Opportunities 3.2.3.4. Asia Pacific Colorants Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Colorants Market Drivers 3.2.4.2. Middle East and Africa Colorants Market Restraints 3.2.4.3. Middle East and Africa Colorants Market Opportunities 3.2.4.4. Middle East and Africa Colorants Market Challenges 3.2.5. South America 3.2.5.1. South America Colorants Market Drivers 3.2.5.2. South America Colorants Market Restraints 3.2.5.3. South America Colorants Market Opportunities 3.2.5.4. South America Colorants Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Colorants Industry 3.8. Analysis of Government Schemes and Initiatives For Colorants Industry 3.9. Colorants Market Trade Analysis 3.10. The Global Pandemic Impact on Colorants Market 4. Colorants Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Colorants Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Pigment 4.1.2. Dyes 4.1.3. Others 4.2. Colorants Market Size and Forecast, by Source (2024-2032) 4.2.1. Synthetic 4.2.2. Natural 4.3. Colorants Market Size and Forecast, by End Use (2024-2032) 4.3.1. Paint and coatings 4.3.2. Packaging 4.3.3. Food & Beverages 4.3.4. Textiles 4.3.5. Paper & Printing 4.3.6. Others 4.4. Colorants Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Colorants Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Colorants Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Pigment 5.1.2. Dyes 5.1.3. Others 5.2. North America Colorants Market Size and Forecast, by Source (2024-2032) 5.2.1. Synthetic 5.2.2. Natural 5.3. North America Colorants Market Size and Forecast, by End Use (2024-2032) 5.3.1. Paint and coatings 5.3.2. Packaging 5.3.3. Food & Beverages 5.3.4. Textiles 5.3.5. Paper & Printing 5.3.6. Others 5.4. North America Colorants Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Colorants Market Size and Forecast, by Product Type (2024-2032) 5.4.1.1.1. Pigment 5.4.1.1.2. Dyes 5.4.1.1.3. Others 5.4.1.2. United States Colorants Market Size and Forecast, by Source (2024-2032) 5.4.1.2.1. Synthetic 5.4.1.2.2. Natural 5.4.1.3. United States Colorants Market Size and Forecast, by End Use (2024-2032) 5.4.1.3.1. Paint and coatings 5.4.1.3.2. Packaging 5.4.1.3.3. Food & Beverages 5.4.1.3.4. Textiles 5.4.1.3.5. Paper & Printing 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Colorants Market Size and Forecast, by Product Type (2024-2032) 5.4.2.1.1. Pigment 5.4.2.1.2. Dyes 5.4.2.1.3. Others 5.4.2.2. Canada Colorants Market Size and Forecast, by Source (2024-2032) 5.4.2.2.1. Synthetic 5.4.2.2.2. Natural 5.4.2.3. Canada Colorants Market Size and Forecast, by End Use (2024-2032) 5.4.2.3.1. Paint and coatings 5.4.2.3.2. Packaging 5.4.2.3.3. Food & Beverages 5.4.2.3.4. Textiles 5.4.2.3.5. Paper & Printing 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Colorants Market Size and Forecast, by Product Type (2024-2032) 5.4.3.1.1. Pigment 5.4.3.1.2. Dyes 5.4.3.1.3. Others 5.4.3.2. Mexico Colorants Market Size and Forecast, by Source (2024-2032) 5.4.3.2.1. Synthetic 5.4.3.2.2. Natural 5.4.3.3. Mexico Colorants Market Size and Forecast, by End Use (2024-2032) 5.4.3.3.1. Paint and coatings 5.4.3.3.2. Packaging 5.4.3.3.3. Food & Beverages 5.4.3.3.4. Textiles 5.4.3.3.5. Paper & Printing 5.4.3.3.6. Others 6. Europe Colorants Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Colorants Market Size and Forecast, by Product Type (2024-2032) 6.2. Europe Colorants Market Size and Forecast, by Source (2024-2032) 6.3. Europe Colorants Market Size and Forecast, by End Use (2024-2032) 6.4. Europe Colorants Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.1.2. United Kingdom Colorants Market Size and Forecast, by Source (2024-2032) 6.4.1.3. United Kingdom Colorants Market Size and Forecast, by End Use (2024-2032) 6.4.2. France 6.4.2.1. France Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.2.2. France Colorants Market Size and Forecast, by Source (2024-2032) 6.4.2.3. France Colorants Market Size and Forecast, by End Use (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.3.2. Germany Colorants Market Size and Forecast, by Source (2024-2032) 6.4.3.3. Germany Colorants Market Size and Forecast, by End Use (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.4.2. Italy Colorants Market Size and Forecast, by Source (2024-2032) 6.4.4.3. Italy Colorants Market Size and Forecast, by End Use (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.5.2. Spain Colorants Market Size and Forecast, by Source (2024-2032) 6.4.5.3. Spain Colorants Market Size and Forecast, by End Use (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.6.2. Sweden Colorants Market Size and Forecast, by Source (2024-2032) 6.4.6.3. Sweden Colorants Market Size and Forecast, by End Use (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.7.2. Austria Colorants Market Size and Forecast, by Source (2024-2032) 6.4.7.3. Austria Colorants Market Size and Forecast, by End Use (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Colorants Market Size and Forecast, by Product Type (2024-2032) 6.4.8.2. Rest of Europe Colorants Market Size and Forecast, by Source (2024-2032) 6.4.8.3. Rest of Europe Colorants Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Colorants Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Colorants Market Size and Forecast, by Product Type (2024-2032) 7.2. Asia Pacific Colorants Market Size and Forecast, by Source (2024-2032) 7.3. Asia Pacific Colorants Market Size and Forecast, by End Use (2024-2032) 7.4. Asia Pacific Colorants Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.1.2. China Colorants Market Size and Forecast, by Source (2024-2032) 7.4.1.3. China Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.2.2. S Korea Colorants Market Size and Forecast, by Source (2024-2032) 7.4.2.3. S Korea Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.3.2. Japan Colorants Market Size and Forecast, by Source (2024-2032) 7.4.3.3. Japan Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.4. India 7.4.4.1. India Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.4.2. India Colorants Market Size and Forecast, by Source (2024-2032) 7.4.4.3. India Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.5.2. Australia Colorants Market Size and Forecast, by Source (2024-2032) 7.4.5.3. Australia Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.6.2. Indonesia Colorants Market Size and Forecast, by Source (2024-2032) 7.4.6.3. Indonesia Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.7.2. Malaysia Colorants Market Size and Forecast, by Source (2024-2032) 7.4.7.3. Malaysia Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.8.2. Vietnam Colorants Market Size and Forecast, by Source (2024-2032) 7.4.8.3. Vietnam Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.9.2. Taiwan Colorants Market Size and Forecast, by Source (2024-2032) 7.4.9.3. Taiwan Colorants Market Size and Forecast, by End Use (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Colorants Market Size and Forecast, by Product Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Colorants Market Size and Forecast, by Source (2024-2032) 7.4.10.3. Rest of Asia Pacific Colorants Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Colorants Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Colorants Market Size and Forecast, by Product Type (2024-2032) 8.2. Middle East and Africa Colorants Market Size and Forecast, by Source (2024-2032) 8.3. Middle East and Africa Colorants Market Size and Forecast, by End Use (2024-2032) 8.4. Middle East and Africa Colorants Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Colorants Market Size and Forecast, by Product Type (2024-2032) 8.4.1.2. South Africa Colorants Market Size and Forecast, by Source (2024-2032) 8.4.1.3. South Africa Colorants Market Size and Forecast, by End Use (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Colorants Market Size and Forecast, by Product Type (2024-2032) 8.4.2.2. GCC Colorants Market Size and Forecast, by Source (2024-2032) 8.4.2.3. GCC Colorants Market Size and Forecast, by End Use (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Colorants Market Size and Forecast, by Product Type (2024-2032) 8.4.3.2. Nigeria Colorants Market Size and Forecast, by Source (2024-2032) 8.4.3.3. Nigeria Colorants Market Size and Forecast, by End Use (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Colorants Market Size and Forecast, by Product Type (2024-2032) 8.4.4.2. Rest of ME&A Colorants Market Size and Forecast, by Source (2024-2032) 8.4.4.3. Rest of ME&A Colorants Market Size and Forecast, by End Use (2024-2032) 9. South America Colorants Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Colorants Market Size and Forecast, by Product Type (2024-2032) 9.2. South America Colorants Market Size and Forecast, by Source (2024-2032) 9.3. South America Colorants Market Size and Forecast, by End Use(2024-2032) 9.4. South America Colorants Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Colorants Market Size and Forecast, by Product Type (2024-2032) 9.4.1.2. Brazil Colorants Market Size and Forecast, by Source (2024-2032) 9.4.1.3. Brazil Colorants Market Size and Forecast, by End Use (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Colorants Market Size and Forecast, by Product Type (2024-2032) 9.4.2.2. Argentina Colorants Market Size and Forecast, by Source (2024-2032) 9.4.2.3. Argentina Colorants Market Size and Forecast, by End Use (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Colorants Market Size and Forecast, by Product Type (2024-2032) 9.4.3.2. Rest Of South America Colorants Market Size and Forecast, by Source (2024-2032) 9.4.3.3. Rest Of South America Colorants Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. BASF SE (Ludwigshafen, Germany) – 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Huntsman Corporation (Texas, USA) 10.3. Sensient Technologies (Wisconsin, USA) 10.4. Sun Chemical (New Jersey, USA) 10.5. PPG Industries (Pennsylvania, USA) 10.6. Sherwin-Williams (Ohio, USA) 10.7. Dow Chemical Company (Michigan, USA) 10.8. Lanxess AG (Cologne, Germany) 10.9. Archroma (Reinach, Switzerland) 10.10. AkzoNobel N.V. (Amsterdam, Netherlands) 10.11. DSM-Firmenich (Kaiseraugst, Switzerland) 10.12. Heubach GmbH (Langelsheim, Germany) 10.13. DIC Corporation (Tokyo, Japan) 10.14. Sudarshan Chemical Industries (Pune, India) 10.15. Kiri Industries (Gujarat, India) 10.16. Atul Ltd (Gujarat, India) 10.17. National Paints Factories (Jordan) 10.18. Hempel Middle East (UAE) 10.19. Jotun (UAE operations) 10.20. Saudi Basic Industries Corp (SABIC) 10.21. Oxiteno (Brazil) 10.22. Unigel (Brazil) 10.23. Elekeiroz (Brazil) 11. Key Findings 12. Industry Recommendations 13. Colorants Market: Research Methodology 14. Terms and Glossary