Global Cold Plasma Market size was valued at USD 2.17Bn. in 2024 and the total Cold Plasma Market is expected to grow by 10.8 % from 2025 to 2032, reaching nearly USD 4.93 Bn. in 2032.Cold Plasma Market Overview:

Cold plasma technology is a non-thermal processing innovation with broad applications in healthcare, packaging, textiles, electronics, and food industries. Unlike conventional plasma, it enables sterilization, surface activation, decontamination, and medical therapies while preserving the integrity of sensitive materials. Over the past decade, the Cold Plasma Market has evolved from limited industrial surface treatment systems to advanced medical devices for wound healing, oncology, dental procedures, and plasma sterilization. Eco-friendly plasma coating solutions for packaging and electronics manufacturing have also emerged, aligning with global sustainability trends.Increasing awareness of environmentally friendly processing, the rising prevalence of chronic wounds, heightened infection control measures, and adoption in emerging markets boost the growth of Cold plasma Industry . In healthcare, devices such as Apyx Medical's Renuvion are widely used in cosmetic surgery for minimally invasive applications, while atmospheric plasma systems from Plasmatreat, Nordson, and Tantec enhance adhesion and reduce chemical reliance in industries such as automotive, packaging, and flexible electronics. Medical advancements have demonstrated the potential of cold atmospheric plasma in treating diabetic wounds, which affect 1–2% of people in developed countries and are often slow and costly to heal. This technology offers a painless, safe, and effective method to reduce bacterial infections, including multidrug-resistant strains, while accelerating tissue regeneration. Its role in burn wound management and trauma care is also gaining attention, especially with increasing road traffic accidents.With Germany projected to have over 21 million seniors by 2040, demand for advanced wound care solutions will continue to grow. Combining safety, efficiency, and eco-friendliness, cold plasma is positioned as a transformative technology in both medical and industrial sectors, offering solutions that address global healthcare challenges and sustainability goals.To know about the Research Methodology:- Request Free Sample Report

Cold Plasma Market Dynamics

Unique Decontamination Benefits and Medical Applications to Drive Cold Plasma Market Growth Cold plasma technology is gaining traction across diverse sectors due to its advantages over conventional processing methods, including minimal fiber damage, low chemical use, improved wettability, low cost, and reduced water and energy consumption. Unlike traditional techniques, it eliminates the need for large on-site storage of processing water or chemicals. These benefits are driving adoption in industries such as textiles, food processing, and healthcare. In food applications, cold plasma is increasingly used for decontaminating packaging particularly for meat and poultry while also enabling the development of self-decontaminating filters. In healthcare, the rising incidence of Hospital-Acquired Infections (HAIs) and growing demand for non-invasive therapies are boosting uptake. Cold plasma aids wound healing by promoting blood clotting, sterilizing wounds, and stimulating cell proliferation, and is showing promise in cancer treatment. For example, a December 2022 according to MMR Study report cold argon plasma treatment of tumor tissue in head and neck cancers induced higher extracellular cytochrome c levels and apoptosis in cancer cells, with greater selectivity than in healthy tissue. Such targeted efficacy, combined with its non-toxic profile, is expected to accelerate demand for cold plasma therapies,and driving Cold Plasma Market growth . Limited Commercialization and Market Awareness limits the growth of Cold Plasma Market Many industries, especially in developing economies, lack familiarity with the technology’s benefits, leading to reluctance in adoption. Although cold plasma has demonstrated applications in healthcare, textiles, and agriculture, the absence of targeted education and practical demonstrations slows its uptake. High initial investment requirements for equipment, installation, and maintenance further limit accessibility, particularly for small and medium-sized enterprises. The technology’s operational complexity, requiring precise control over multiple parameters and skilled personnel, adds to adoption challenges. Additionally, the market is served by a small number of manufacturers, constraining supply, product diversity, and large-scale availability. In sectors such as textiles and healthcare, adoption remains slow in low-resource regions due to cost barriers and inadequate infrastructure. These factors collectively hinder commercialization, despite emerging innovations such as AI and robotics integration. Expanding awareness initiatives, developing affordable and scalable solutions, and fostering training programs are essential to overcoming these challenges and accelerating global Cold Plasma Market penetration. Emerging Healthcare Applications and Infection Control creates lucrative growth Opportunities to the Cold Plasma Market The cold plasma market is witnessing significant growth opportunities driven by its expanding role in healthcare, particularly in wound healing, infection control, and cancer therapy. Cold plasma has proven highly effective in accelerating the healing of chronic wounds, such as diabetic ulcers, by enhancing tissue oxygenation and reducing microbial load. With the global prevalence of chronic diseases such as diabetes and cancer rising, the demand for advanced, non-invasive treatment solutions is increasing.Infection control presents another strong growth driver. Cold plasma offers a chemical-free, non-thermal method for sterilizing medical instruments, surfaces, and even air, effectively inactivating pathogens within seconds without leaving harmful residues. The heightened focus on infection prevention post-COVID-19 has further fueled interest in such technologies, especially for hospital environments.Cold plasma is showing potential in oncology by selectively targeting cancer cells while sparing healthy tissue, with early clinical trials demonstrating encouraging results. The integration of real-time sensors in devices enables personalized treatments, enhancing clinical outcomes and supporting regulatory approvals.Global Cold Plasma Market Segment Analysis

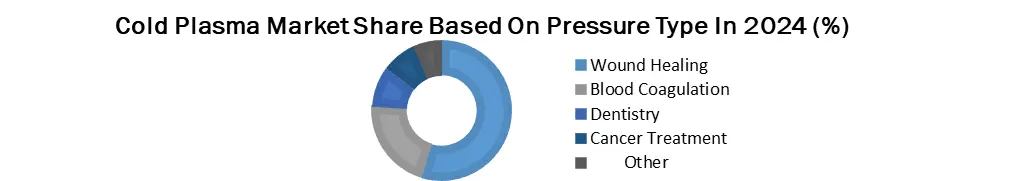

Based on Pressure Type, Cold Plasma Market is segmented into Low-Pressure Cold Plasma, Atmospheric Pressure Cold Plasma .The Atmospheric Pressure segment is held the largest market share in 2024.Due to its versatility, cost-effectiveness, and ease of integration into industrial and medical applications. Unlike low-pressure systems, atmospheric pressure cold plasma operates without the need for expensive vacuum chambers, reducing installation and maintenance costs. This makes it suitable for large-scale continuous processing in industries such as textiles, packaging, food safety, and electronics manufacturing. In healthcare, it enables on-site sterilization, wound healing, and surface decontamination without complex infrastructure, driving higher adoption. The technology also offers operational flexibility, as it can treat materials of varying shapes and sizes without interrupting production lines. Post-COVID-19, demand has surged for atmospheric plasma systems in disinfection and infection control. Its ability to deliver effective, chemical-free treatment in open environments further enhances its commercial appeal, boosting its position as the dominant segment in the global cold plasma market.Based on Application, Cold Plasma Market is segmented into Wound Healing ,Blood Coagulation ,Dentistry ,Cancer Treatment and Other . In 2024, the wound healing segment holds the largest share of the cold plasma market, driven by its proven efficacy in accelerating recovery from chronic and acute wounds. Cold atmospheric plasma to wounds three times weekly for three consecutive weeks significantly reduces wound size without harming healthy tissue. The technology effectively lowers bacterial load, promotes tissue regeneration, and, in the case of helium-based plasma, aids healing by acidifying the wound environment. The demand is driven by rising trauma cases. According to the World Health Organization,road accidents claim over 1.35 million lives annually and cause millions of non-fatal injuries, increasing the need for advanced wound care. Additionally, the growing geriatric population 727.5 million people aged 65+ in 2020, projected to reach 1.5 billion by 2050 is more susceptible to chronic wounds from conditions like diabetes and peripheral artery disease. These factors collectively position wound healing as the dominant application area, with hospitals and healthcare facilities increasingly adopting cold plasma for its non-invasive, rapid, and safe therapeutic benefits.

Cold Plasma Market Regional Insights

North America Dominated The Cold Plasma Market in 2024. The strong presence of leading industry players and the availability of numerous FDA-approved products. The region’s advanced healthcare infrastructure and rapid adoption of technologically enhanced solutions have significantly contributed to market growth . A major growth driver is the increasing prevalence of cancer, which remains a critical health concern. In the U.S. alone, cancer accounted for approximately 609,660 fatalities, highlighting the urgent need for innovative treatment options. Cold plasma technology offers promising therapeutic potential in oncology by aiding cancer treatment and reducing mortality rates, thereby fueling its adoption. The strong research and development capabilities, coupled with supportive regulatory frameworks, have accelerated product commercialization in the region. Strategic collaborations between healthcare institutions and technology developers have also enhanced market penetration. Additionally, the rising demand for non-invasive and cost-effective medical solutions, alongside growing awareness of cold plasma applications in infection control and wound healing, has bolstered the market’s position. With an established ecosystem for advanced medical technology deployment and a receptive healthcare sector, North America is expected to maintain its leading share throughout the forecast period. Cold Plasma Market Competitive Landscape The global cold plasma market is highly competitive , because of growing demand for non-thermal plasma solutions across both medical and industrial sectors. Key players are leveraging differentiated technologies, regulatory clearances, and application-specific expertise to strengthen their market presence. Apyx Medical Corporation (United States) specializes in cold plasma surgical products, with its flagship Renuvion system witnessing strong demand in minimally invasive aesthetic procedures. The company supported by recent FDA clearances expanding its use for broader indications. Its strategic focus lies in developing FDA-cleared, minimally invasive devices tailored to surgical specialists, ensuring high safety and clinical efficacy.Nordson Corporation (United States) targets large-scale industrial applications, offering atmospheric cold plasma systems for packaged goods, electronics, and automotive manufacturing. Its Advanced Technology Systems segment, which includes plasma surface treatment. The company emphasizes energy-efficient, high-throughput plasma solutions, adhering to NFPA safety standards and stringent regulatory approvals.Despite their differing market focuses, both companies maintain leadership through innovation, compliance with safety and quality standards, and commitment to delivering specialized cold plasma solutions to diverse end-user segments. Cold Plasma Market Recent Development • In July 29, 2025, Apyx Medical Corporation launched its Renuvion system in China through a distribution agreement with GlamMoon Medical Technology, a division of BeauCare Clinics Investment Co., Ltd., following initial market clearance. Early clinical interest and completed procedures highlight strong demand, supporting the company’s international expansion and positioning Renuvion for wider adoption in China’s medical aesthetics market. • In January 2025, Plasmatreat GmbH (Germany) introduced the PFW10LT Openair-Plasma nozzle, engineered to deliver low-temperature, high-intensity treatment for activating thermally sensitive materials and delicate surfaces. This innovation enhances processing precision, enabling effective surface activation without thermal damage, making it suitable for advanced industrial and specialty material applications. • In January 2025, Plasmatreat GmbH (Germany) launched the PFW100 Openair-Plasma nozzle, designed for high-speed processing of flat components or surfaces across a large width. This advanced nozzle enhances production efficiency, ensuring uniform surface treatment for diverse industrial applications, including packaging, electronics, and automotive manufacturing, while maintaining high quality and precision. • In December 2024, Relyon plasma GmbH (Germany) partnered with Viromed Medical GmbH to advance cold atmospheric pressure plasma technology for medical applications. Under the collaboration, Relyon focuses on technology development, while Viromed oversees regulatory approvals and distribution, aiming to introduce innovative plasma-based solutions to improve patient care and clinical outcomes. Cold Plasma Market Recent Trends

Category Key Trend Example Product Market Impact Medical Applications Rising use of cold plasma in wound healing and oncology therapies Apyx Medical’s Renuvion device and CINOGY’s cold plasma systems Expands market by addressing chronic wounds, surgical applications, and cancer treatment support Surface Treatment Surge in demand for eco-friendly plasma surface activation in packaging & electronics Plasmatreat Openair Plasma and Tantec PlasmaTEC-X systems Reduces chemical use, improves adhesion & printability, and supports sustainable manufacturing Miniaturization & Custom Systems Development of compact, user-friendly cold plasma devices for clinics and R&D Henniker Plasma's benchtop plasma cleaners Makes plasma technology accessible to smaller labs and niche clinical practices Cold Plasma Market Scope: Inquire before buying

Cold Plasma Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.17 Bn. Forecast Period 2025 to 2032 CAGR: 10.8% Market Size in 2032: USD 4.93 Bn. Segments Covered: by Pressure Type Low-Pressure Cold Plasma Atmospheric Pressure Cold Plasma by Technology Remote Treatment Direct Treatment Electrode Contact by Application Wound Healing Blood Coagulation Dentistry Cancer Treatment Other by End User Medical Industry Textile Industry Electrical & Electronic Industry Food & Agriculture Industry Other Industries Cold Plasma Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Sweden, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, GCC, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South AmericaNorth America Cold Plasma Market Key Players

1. Apyx Medical Corporation (US) 2. Nordson Corporation (US) 3. Enercon Industries (US) 4. Plasmatreat USA, Inc. (US) 5. Thierry Corporation (US) 6. Surfx Technologies (US) 7. Advanced Plasma Solutions (US) 8. US Medical Innovations (US) 9. UNIQAIR Technologies (Canada) Europe Cold Plasma Market Key Players 1. SOFTAL Corona & Plasma (Germany) 2. Relyon Plasma GmbH (Germany) 3. Neoplas GmbH (Germany) 4. Terraplasma GmbH (Germany) 5. Molecular Plasma Group (Germany) 6. CINOGY Technologies GmbH (Germany) 7. Henniker Plasma (UK) 8. AcXys Plasma Technologies (France) 9. Coating Plasma Innovation (France) 10. Ferrarini & Benelli Srl (Italy) 11. COMET Plasma Control Technologies (Switzerland) 12. Europlasma (Belgium) 13. Tantec A/S (Denmark) Asia Pacific Cold Plasma Market Key Players 1. Adtec Plasma Technology Co. Ltd (Japan) 2. PlasmaLeap Technologies (Australia)Frequently Asked Questions:

1. Which is the potential market for the Cold Plasma Market in terms of the region? Ans. In North America region, the growing business and educational sectors are expected to help drive the use of collaborative screens. 2. What are the opportunities for new market entrants? Ans. The key opportunity in the market is new initiatives from governments that provide funding for Cold Plasma Markets in educational institutes 3. What is the projected market size & growth rate of the Cold Plasma Market? Ans. Global Cold Plasma Market size was valued at USD 2.17Bn. in 2024 and the total Cold Plasma Market is expected to grow by 10.8 % from 2025 to 2032, reaching nearly USD 4.93 Bn. in 2032. 4. What segments are covered in the Cold Plasma Market report? Ans. The segments covered are Pressure Type, Application, Technology, End user and Region.

1. Cold Plasma Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Cold Plasma Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Cold Plasma Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Cold Plasma Market: Dynamics 3.1. Cold Plasma Market Trends by Region 3.1.1. North America Cold Plasma Market Trends 3.1.2. Europe Cold Plasma Market Trends 3.1.3. Asia Pacific Cold Plasma Market Trends 3.1.4. Middle East and Africa Cold Plasma Market Trends 3.1.5. South America Cold Plasma Market Trends 3.2. Cold Plasma Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cold Plasma Market Drivers 3.2.1.2. North America Cold Plasma Market Restraints 3.2.1.3. North America Cold Plasma Market Opportunities 3.2.1.4. North America Cold Plasma Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cold Plasma Market Drivers 3.2.2.2. Europe Cold Plasma Market Restraints 3.2.2.3. Europe Cold Plasma Market Opportunities 3.2.2.4. Europe Cold Plasma Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cold Plasma Market Drivers 3.2.3.2. Asia Pacific Cold Plasma Market Restraints 3.2.3.3. Asia Pacific Cold Plasma Market Opportunities 3.2.3.4. Asia Pacific Cold Plasma Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cold Plasma Market Drivers 3.2.4.2. Middle East and Africa Cold Plasma Market Restraints 3.2.4.3. Middle East and Africa Cold Plasma Market Opportunities 3.2.4.4. Middle East and Africa Cold Plasma Market Challenges 3.2.5. South America 3.2.5.1. South America Cold Plasma Market Drivers 3.2.5.2. South America Cold Plasma Market Restraints 3.2.5.3. South America Cold Plasma Market Opportunities 3.2.5.4. South America Cold Plasma Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Cold Plasma Industry 3.8. Analysis of Government Schemes and Initiatives For Cold Plasma Industry 3.9. Cold Plasma Market Trade Analysis 3.10. The Global Pandemic Impact on Cold Plasma Market 4. Cold Plasma Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 4.1.1. Low-Pressure Cold Plasma 4.1.2. Atmospheric Pressure Cold Plasma 4.2. Cold Plasma Market Size and Forecast, by Technology (2024-2032) 4.2.1. Remote Treatment 4.2.2. Direct Treatment 4.2.3. Electrode Contact 4.3. Cold Plasma Market Size and Forecast, by Application (2024-2032) 4.3.1. Wound Healing 4.3.2. Blood Coagulation 4.3.3. Dentistry 4.3.4. Cancer Treatment 4.3.5. Other 4.4. Cold Plasma Market Size and Forecast, by End User (2024-2032) 4.4.1. Medical Industry 4.4.2. Textile Industry 4.4.3. Electrical & Electronic Industry 4.4.4. Food & Agriculture Industry 4.4.5. Other Industries 4.5. Cold Plasma Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Cold Plasma Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 5.1.1. Low-Pressure Cold Plasma 5.1.2. Atmospheric Pressure Cold Plasma 5.2. North America Cold Plasma Market Size and Forecast, by Technology (2024-2032) 5.2.1. Remote Treatment 5.2.2. Direct Treatment 5.2.3. Electrode Contact 5.3. North America Cold Plasma Market Size and Forecast, by Application (2024-2032) 5.3.1. Wound Healing 5.3.2. Blood Coagulation 5.3.3. Dentistry 5.3.4. Cancer Treatment 5.3.5. Other 5.4. North America Cold Plasma Market Size and Forecast, by End User (2024-2032) 5.4.1. Medical Industry 5.4.2. Textile Industry 5.4.3. Electrical & Electronic Industry 5.4.4. Food & Agriculture Industry 5.4.5. Other Industries 5.5. North America Cold Plasma Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 5.5.1.1.1. Low-Pressure Cold Plasma 5.5.1.1.2. Atmospheric Pressure Cold Plasma 5.5.1.2. United States Cold Plasma Market Size and Forecast, by Technology (2024-2032) 5.5.1.2.1. Remote Treatment 5.5.1.2.2. Direct Treatment 5.5.1.2.3. Electrode Contact 5.5.1.3. United States Cold Plasma Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Wound Healing 5.5.1.3.2. Blood Coagulation 5.5.1.3.3. Dentistry 5.5.1.3.4. Cancer Treatment 5.5.1.3.5. Other 5.5.1.4. United States Cold Plasma Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Medical Industry 5.5.1.4.2. Textile Industry 5.5.1.4.3. Electrical & Electronic Industry 5.5.1.4.4. Food & Agriculture Industry 5.5.1.4.5. Other Industries 5.5.2. Canada 5.5.2.1. Canada Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 5.5.2.1.1. Low-Pressure Cold Plasma 5.5.2.1.2. Atmospheric Pressure Cold Plasma 5.5.2.2. Canada Cold Plasma Market Size and Forecast, by Technology (2024-2032) 5.5.2.2.1. Remote Treatment 5.5.2.2.2. Direct Treatment 5.5.2.2.3. Electrode Contact 5.5.2.3. Canada Cold Plasma Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Wound Healing 5.5.2.3.2. Blood Coagulation 5.5.2.3.3. Dentistry 5.5.2.3.4. Cancer Treatment 5.5.2.3.5. Other 5.5.2.4. Canada Cold Plasma Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Medical Industry 5.5.2.4.2. Textile Industry 5.5.2.4.3. Electrical & Electronic Industry 5.5.2.4.4. Food & Agriculture Industry 5.5.2.4.5. Other Industries 5.5.3. Mexico 5.5.3.1. Mexico Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 5.5.3.1.1. Low-Pressure Cold Plasma 5.5.3.1.2. Atmospheric Pressure Cold Plasma 5.5.3.2. Mexico Cold Plasma Market Size and Forecast, by Technology (2024-2032) 5.5.3.2.1. Remote Treatment 5.5.3.2.2. Direct Treatment 5.5.3.2.3. Electrode Contact 5.5.3.3. Mexico Cold Plasma Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Wound Healing 5.5.3.3.2. Blood Coagulation 5.5.3.3.3. Dentistry 5.5.3.3.4. Cancer Treatment 5.5.3.3.5. Other 5.5.3.4. Mexico Cold Plasma Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Medical Industry 5.5.3.4.2. Textile Industry 5.5.3.4.3. Electrical & Electronic Industry 5.5.3.4.4. Food & Agriculture Industry 5.5.3.4.5. Other Industries 6. Europe Cold Plasma Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.2. Europe Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.3. Europe Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.4. Europe Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5. Europe Cold Plasma Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.1.2. United Kingdom Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.1.3. United Kingdom Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.2.2. France Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.2.3. France Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.3.2. Germany Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.3.3. Germany Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.4.2. Italy Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.4.3. Italy Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.5.2. Spain Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.5.3. Spain Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.6.2. Sweden Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.6.3. Sweden Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.7.2. Austria Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.7.3. Austria Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Cold Plasma Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 6.5.8.2. Rest of Europe Cold Plasma Market Size and Forecast, by Technology (2024-2032) 6.5.8.3. Rest of Europe Cold Plasma Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Cold Plasma Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Cold Plasma Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.2. Asia Pacific Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.3. Asia Pacific Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Cold Plasma Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.1.2. China Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.1.3. China Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.2.2. S Korea Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.2.3. S Korea Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.3.2. Japan Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.3.3. Japan Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.4.2. India Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.4.3. India Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.5.2. Australia Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.5.3. Australia Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.6.2. Indonesia Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.6.3. Indonesia Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.7.2. Malaysia Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.7.3. Malaysia Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.8.2. Vietnam Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.8.3. Vietnam Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.9.2. Taiwan Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.9.3. Taiwan Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Cold Plasma Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Cold Plasma Market Size and Forecast, by Technology (2024-2032) 7.5.10.3. Rest of Asia Pacific Cold Plasma Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Cold Plasma Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Cold Plasma Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 8.2. Middle East and Africa Cold Plasma Market Size and Forecast, by Technology (2024-2032) 8.3. Middle East and Africa Cold Plasma Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Cold Plasma Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Cold Plasma Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 8.5.1.2. South Africa Cold Plasma Market Size and Forecast, by Technology (2024-2032) 8.5.1.3. South Africa Cold Plasma Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Cold Plasma Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 8.5.2.2. GCC Cold Plasma Market Size and Forecast, by Technology (2024-2032) 8.5.2.3. GCC Cold Plasma Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Cold Plasma Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 8.5.3.2. Nigeria Cold Plasma Market Size and Forecast, by Technology (2024-2032) 8.5.3.3. Nigeria Cold Plasma Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Cold Plasma Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 8.5.4.2. Rest of ME&A Cold Plasma Market Size and Forecast, by Technology (2024-2032) 8.5.4.3. Rest of ME&A Cold Plasma Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Cold Plasma Market Size and Forecast, by End User (2024-2032) 9. South America Cold Plasma Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 9.2. South America Cold Plasma Market Size and Forecast, by Technology (2024-2032) 9.3. South America Cold Plasma Market Size and Forecast, by Application(2024-2032) 9.4. South America Cold Plasma Market Size and Forecast, by End User (2024-2032) 9.5. South America Cold Plasma Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 9.5.1.2. Brazil Cold Plasma Market Size and Forecast, by Technology (2024-2032) 9.5.1.3. Brazil Cold Plasma Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Cold Plasma Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 9.5.2.2. Argentina Cold Plasma Market Size and Forecast, by Technology (2024-2032) 9.5.2.3. Argentina Cold Plasma Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Cold Plasma Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Cold Plasma Market Size and Forecast, by Pressure Type (2024-2032) 9.5.3.2. Rest Of South America Cold Plasma Market Size and Forecast, by Technology (2024-2032) 9.5.3.3. Rest Of South America Cold Plasma Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Cold Plasma Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Apyx Medical Corporation (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Nordson Corporation (US) 10.3. Enercon Industries (US) 10.4. Plasmatreat USA, Inc. (US) 10.5. Thierry Corporation (US) 10.6. Surfx Technologies (US) 10.7. Advanced Plasma Solutions (US) 10.8. US Medical Innovations (US) 10.9. UNIQAIR Technologies (Canada) 10.10. SOFTAL Corona & Plasma (Germany) 10.11. Relyon Plasma GmbH (Germany) 10.12. Neoplas GmbH (Germany) 10.13. Terraplasma GmbH (Germany) 10.14. Molecular Plasma Group (Germany) 10.15. CINOGY Technologies GmbH (Germany) 10.16. Henniker Plasma (UK) 10.17. AcXys Plasma Technologies (France) 10.18. Coating Plasma Innovation (France) 10.19. Ferrarini & Benelli Srl (Italy) 10.20. COMET Plasma Control Technologies (Switzerland) 10.21. Europlasma (Belgium) 10.22. Tantec A/S (Denmark) 10.23. Adtec Plasma Technology Co. Ltd (Japan) 10.24. PlasmaLeap Technologies (Australia) 11. Key Findings 12. Industry Recommendations 13. Cold Plasma Market: Research Methodology 14. Terms and Glossary