Global Clinical Oncology Next Generation Sequencing Market size was valued at USD 478.425 Mn. in 2024, and the total Clinical Oncology Next Generation Sequencing Market is expected to grow by 16.28%. from 2025 to 2032, reaching nearly USD 1,599.02 Mn. Clinical Oncology Next-Generation Sequencing (NGS) refers to the use of high-throughput genomic sequencing to analyze tumor DNA and RNA, enabling the simultaneous detection of multiple genetic mutations and alterations. This approach supports precision oncology by guiding diagnosis, prognosis, and treatment decisions. It plays a critical role in tumor profiling, companion diagnostics, liquid biopsies, and minimal residual disease monitoring.Due to the rising global cancer burden. With cancer prevalence steadily increasing, healthcare systems are seeking advanced tools to understand the molecular mechanisms of tumors and personalize treatments. In 2021, the United States recorded nearly 1.9 million new cancer cases and 0.6 million related deaths, according to the American Cancer Society. By 2032, cancer survivors in the U.S. are projected to reach 22.5 million. On a global scale, new cancer cases are expected to rise to 29.9 million by 2040, intensifying the demand for advanced genomic diagnostics. Illustrating this trend, Illumina’s TruSight Comprehensive pan-cancer genomic profiling test, FDA-approved and widely adopted in the U.S. by 2024, enables oncologists to match therapies to genetic mutations across diverse cancers, improving treatment outcomes while reducing trial-and-error approaches.To know about the Research Methodology :- Request Free Sample Report Technological progress is a major driver of Clinical Oncology Next Generation Sequencing Market growth. Platforms such as Illumina’s NovaSeq deliver faster sequencing speeds, higher accuracy, and greater affordability, making genomic analysis more accessible to hospitals and research centers. Additionally, automation solutions from companies like Agilent Technologies streamline workflows, enhancing throughput, reducing variability, and accelerating turnaround times, thereby supporting the integration of NGS into routine clinical oncology practice.

Clinical Oncology Next Generation Sequencing Market Dynamics

Rising Prevalence of Cancer to drives the growth of Clinical Oncology Next Generation Sequencing Market The surging global burden of cancer drives the demand of Clinical Oncology Next Generation Sequencing, with one in five individuals in North America suffering from cancer. This rising incidence heightens the need for precise genomic profiling to guide treatment decisions. NGS technologies enable comprehensive tumor analysis, early cancer detection, and personalized therapy selection, making them critical tools in modern oncology. The growing adoption of companion diagnostics, where NGS identifies actionable genetic alterations that align treatments with tumor biology, ensuring better outcomes. The increasing preference for liquid biopsies and minimal residual disease monitoring further accelerates demand, as these non-invasive methods provide real-time insights into disease progression and treatment efficacy. Significant government and healthcare investments in genomic research and personalized medicine infrastructure also boost Clinical Oncology Next Generation Sequencing Market growth. The technological innovations such as Illumina’s TriSight FDA-approved pan-cancer companion diagnostic illustrate how advances in sequencing platforms are broadening accessibility and clinical application. Combined with the aging population and lifestyle-related cancer risks, these factors strongly boost the Clinical Oncology Next Generation Sequencing Market. Regulatory and reimbursement challenges pose significant obstacles to the growth of the Clinical Oncology Next-Generation Sequencing (NGS) Market. Regulatory and reimbursement hurdles represent major challenges to the growth of the clinical oncology next-generation sequencing (NGS) market, directly influencing technology adoption and patient access. Regulatory approval processes vary significantly across regions, creating uneven adoption patterns. For instance, while the U.S. FDA has introduced expedited pathways such as the Breakthrough Device designation, enabling faster approvals for advanced tests like Illumina’s TruSight Oncology assay, other regions follow slower and more complex procedures that delay commercialization. Stringent requirements for clinical validation, reproducibility, and demonstration of clinical utility further add to development costs and timelines. These rigorous standards, while ensuring patient safety, often become obstacles for companies developing comprehensive genomic profiling tests. Even after regulatory approval, inconsistent reimbursement policies remain a barrier. In markets such as the U.S., Medicare has expanded coverage for FDA-approved NGS assays; however, private insurers differ in their decisions, creating uncertainty and limiting patient access. High test costs, coupled with limited insurance coverage, restrict adoption, especially in low- and middle-income countries. Furthermore, evolving frameworks, such as the European Union’s In Vitro Diagnostic Regulation (IVDR), introduce stricter requirements that initially slow market entry. These factors collectively create significant challenges, restraining widespread clinical adoption of NGS despite its strong technological potential. Advancements in NGS Technology creates lucrative growth opportunities to Clinical Oncology Next Generation Sequencing Market The Advancements in next-generation sequencing (NGS) are creating significant growth opportunities for the Clinical Oncology Next Generation Sequencing Market by improving the speed, precision, and scalability of genomic analysis. Modern sequencing platforms such as Roche’s Sequencing by Expansion (SBX) enable ultra-rapid, high-throughput sequencing, cutting turnaround times from days to hours and supporting timely clinical decision-making in cancer care. Enhanced accuracy through hybrid sequencing, which combines long- and short-read technologies, allows better detection of complex structural variants and gene fusions, particularly in cancers such as leukaemia’s integration of artificial intelligence further strengthens the market, with AI-powered bioinformatics platforms optimizing variant detection, error correction, and patient-specific treatment predictions. Portable sequencing devices, such as Oxford Nanopore’s MinION, expand accessibility by enabling real-time genomic testing even in remote or resource-limited clinical environments. These advances accelerate oncology diagnostics and expand their reach. The scalability and flexibility of next-generation platforms support diverse applications, from whole-genome to RNA sequencing, while robotics and multiplexing enhance throughput and efficiency. Ongoing cost reductions due to automation make sequencing more affordable, promoting adoption across hospitals, precision medicine centers, and emerging markets. Collectively, these technological improvements expand clinical applications, including tumor heterogeneity analysis, minimal residual disease monitoring, and immuno-oncology, thereby unlocking new market opportunities.Clinical Oncology Next Generation Sequencing Market Segment Analysis

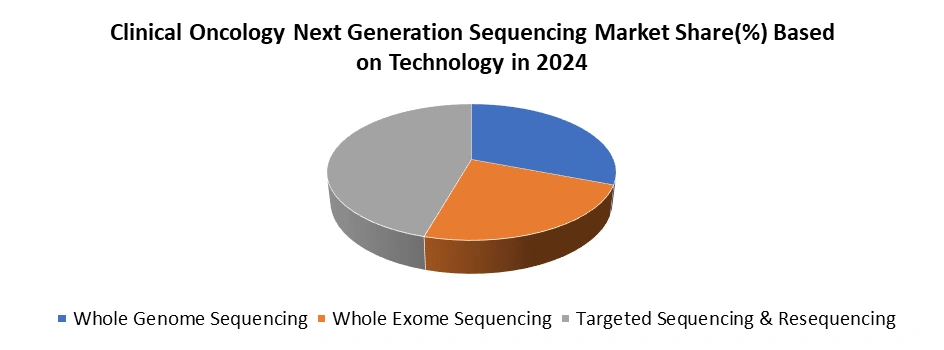

Based on Technology, Clinical Oncology Next Generation Sequencing Market is segment into Whole Genome Sequencing, Whole Exome Sequencing and Targeted Sequencing & Resequencing. The targeted sequencing & resequencing dominated the Clinical Oncology Next Generation Sequencing Market Technology segment in 2024. Due to its cost-effectiveness, clinical relevance, and efficiency. Unlike whole-genome or whole-exome sequencing, targeted approaches focus on specific genes or panels most commonly associated with cancer, enabling precise detection of clinically actionable mutations. This makes it a preferred choice for oncologists who require rapid, accurate insights for therapy selection and patient management. Targeted sequencing delivers faster turnaround times and lower costs, making it more accessible for hospitals, cancer centers, and diagnostic laboratories. Its high depth of coverage ensures greater sensitivity in detecting rare variants, minimal residual disease, and tumor heterogeneity, which are critical for treatment decisions. Moreover, the increasing availability of FDA-approved targeted NGS panels and broader insurance coverage in regions like the U.S. have accelerated adoption. Combined with advancements in companion diagnostics and precision oncology, targeted sequencing and resequencing have solidified their position as the most widely used technology in clinical oncology applications.

Clinical Oncology Next-generation Sequencing Market Regional Breakdown

North America dominated the Clinical Oncology Next Generation Sequencing Market in 2024. This dominance is primarily attributed to the region’s high cancer prevalence, advanced healthcare infrastructure, supportive regulatory policies, and significant investment in precision medicine. The United States, the largest contributor, benefits from well-established oncology centers, state-of-the-art diagnostic laboratories, and government-backed initiatives such as the National Cancer Moonshot and Precision Medicine Initiative, which continue to accelerate genomic research and clinical adoption of NGS technologies. Regulatory support enhances growth, with the U.S. FDA granting accelerated approvals through programs such as the Breakthrough Device designation. A notable example is Illumina’s TruSight Comprehensive test, FDA-approved in 2024, which quickly gained traction as a pan cancer companion diagnostic. In addition, favorable reimbursement policies by Medicare and many private insurers reduce financial barriers, encouraging broader patient access to NGS-based oncology testing. Canada is also emerging as a strong market, supported by growing public investment in genomic medicine and the integration of NGS into national cancer care programs. Together, the U.S. and Canada create a robust ecosystem for innovation and adoption, positioning North America as the global leader in clinical oncology NGS applications. Clinical Oncology Next-generation Sequencing Market Competitive Analysis The Clinical Oncology Next-Generation Sequencing (NGS) market is dominated by few key players. They shaping the competitive environment through scale, innovation, and strategic collaborations. Market leadership is largely defined by established sequencing platforms, extensive global distribution, and deep integration with healthcare systems. Illumina, Inc. remains the clear category leader, offering advanced sequencing instruments and consumables designed specifically for oncology applications. Its broad product portfolio, consistent innovation, and trusted brand position reinforce its dominance. Thermo Fisher Scientific follows closely with a wide-ranging product line, including Ion Torrent systems and Oncomine assays, catering to a diverse customer base across hospitals, laboratories, and research centers. Both companies benefit from strong partnerships with health systems that strengthen market leadership and restrict direct competition. Emerging players are also reshaping the landscape. Guardant Health has expanded its liquid biopsy portfolio by consolidating screening, comprehensive genomic profiling (CGP), and minimal residual disease (MRD) testing under a single brand, reducing reliance on tissue-based assays. In February 2025, Foundation Medicine, in collaboration with Fulgent, introduced hereditary cancer panels, adding new revenue from germline testing and tumor normal paired analysis. Illumina has also partnered with AI firms such as Tempus to advance multimodal analytics, further enhancing clinical utility. Clinical Oncology Next-generation Sequencing Market Key Trends: Rising Cancer Incidence and Personalized Medicine: The worldwide rise in cancer cases, particularly lung, prostate, bowel, and breast cancer, is helping to drive NGS in oncology, in combination with an increasing focus on precision medicine, where specific genetic mutations are identified with precision, NGS plays an integral part in targeting therapies and the potential improvement of patient outcomes. Comprehensive Genomic Profiling (CGP): CGP is becoming more relevant with the ability to analyze many genes and many genomic regions in parallel to provide a greater view of the genetic landscape of the tumor. This broader perspective captures a greater array of actionable mutations and potential therapeutic targets that can guide personalized treatment strategies. AI and Machine Learning in Clinical Oncology Next-generation Sequencing Artificial intelligence and machine learning algorithms are being incorporated into the NGS workflows to help speed data analysis, enhance accuracy, and aid the recognition of complex genomic patterns. These integrations allow for actionable intelligence to be produced for clinical use, allowing clinicians to make better treatment decisions. Clinical Oncology Next-generation Sequencing Market Key Development: On February 4, 2025, Foundation Medicine, in partnership with Fulgent Genetics, introduced FoundationOneGermline and FoundationOneGermline More hereditary cancer tests. These panels analyze 50 and 154 genes, respectively, to detect genetic variants linked to hereditary cancers. The launch strengthens comprehensive genomic profiling capabilities, providing healthcare providers with deeper insights for precision oncology and patient care. On January 8, 2025, Tempus AI, Inc. announced a multi-year collaboration with Genialis to develop RNA-based biomarker algorithms using Tempus’ multimodal dataset. Genialis will validate its Large Molecular Model, including the Genialis Supermodel, to enhance drug development and clinical practice. The partnership also supports commercialization opportunities, building on the success of Genialis krasID, a KRAS-response prediction algorithm. On December 16, 2024, Personalis, Inc. and Tempus AI expanded their collaboration to provide biopharma companies access to Personalis’ ultra-sensitive MRD test, NeXT Personal Dx. Already adopted in breast, lung, and solid tumor monitoring, the test will now be bundled with Tempus’ offerings for pharmaceutical and biotech studies, accelerating market penetration and enhancing precision oncology solutions for clinical and research applications. On May 28, 2025, Illumina Inc. expanded its clinical oncology portfolio with tumor profiling and IVD solutions, including TruSight (TSO) Comprehensive, the first FDA-approved distributable genomic profiling kit with pan-cancer CDx claims. Recently adopted by UofL Health, the test is covered by Medicare and most commercial insurers. Illumina also gained regulatory approval for TSO Comprehensive in Japan.Clinical Oncology Next-Generation Sequencing Market Scope: Inquire before buying

Global Clinical Oncology Next-Generation Sequencing Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 478.425 Mn. Forecast Period 2025 to 2032 CAGR: 16.28% Market Size in 2032: USD 1599.02 Mn. Segments Covered: by Technology Whole Genome Sequencing Whole Exome Sequencing Targeted Sequencing & Resequencing by Workflow NGS Pre-Sequencing NGS Sequencing NGS Data Analysis by Sample Type Tissue-based Liquid Biopsy Other Biofluids by Application Screening Sporadic Cancer Inherited Cancer Companion Diagnostics Other Diagnostics by End User Hospitals Clinics Laboratories Clinical Oncology Next-Generation Sequencing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Clinical Oncology Next-Generation Sequencing Market Key Players:

North America 1. Illumina, Inc (USA) 2. Thermo Fisher Scientific (USA) 3. Guardant Health (USA) 4. Foundation Medicine (USA) 5. Fulgent Genetics (USA) 6. Tempus (USA) 7. PerkinElmer, Inc (USA) 8. Myriad Genetics, Inc. (USA) 9. Creative Biolabs (USA) 10. Invitae Corporation (USA) 11. Natera Inc. (USA) 12. NeoGenomics Laboratories, Inc (USA) 13. DNASTAR Inc. (USA) 14. Exosome Diagnostics Inc. (USA) Europe 15. Roche Diagnostics (Switzerland) 16. Agilent Technologies, Inc. (Germany) 17. Qiagen N.V. (Netherlands) 18. CLC Bio (Qiagen CLC) (Denmark) 19. Veracyte Inc (France) Asia Pacific 20. BGI (Beijing Genomics Institute) (China) 21. Macrogen Inc. (South Korea) 22. Takara Bio Inc (Japan)Clinical Oncology Next-generation Sequencing Market Frequently Asked Questions

1. Clinical Oncology Next-generation Sequencing Market Size? Ans: Global Clinical Oncology Next Generation Sequencing Market size was valued at USD 478.425 Mn. in 2024, and the total Clinical Oncology Next Generation Sequencing Market is expected to grow by 16.28%. from 2025 to 2032, reaching nearly USD 1,599.02 Mn. 2. Which region dominated the Clinical Oncology Next-generation Sequencing Market in 2024? Ans: North America is the region that dominates the Clinical Oncology Next-generation Sequencing Market. 3. The End Users of the Clinical Oncology Next-generation Sequencing Market? Ans: Hospitals, Clinics, Laboratories are the End Users of the Clinical Oncology Next-generation Sequencing Market. 4. What is the study period of this market? Ans: The Global Market is studied from 2024 to 2032.

1. Clinical Oncology Next-generation Sequencing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Clinical Oncology Next-generation Sequencing Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Clinical Oncology Next-generation Sequencing Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Clinical Oncology Next-generation Sequencing Market: Dynamics 3.1. Clinical Oncology Next-generation Sequencing Market Trends by Region 3.1.1. North America Clinical Oncology Next-generation Sequencing Market Trends 3.1.2. Europe Clinical Oncology Next-generation Sequencing Market Trends 3.1.3. Asia Pacific Clinical Oncology Next-generation Sequencing Market Trends 3.1.4. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Trends 3.1.5. South America Clinical Oncology Next-generation Sequencing Market Trends 3.2. Clinical Oncology Next-generation Sequencing Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Clinical Oncology Next-generation Sequencing Market Drivers 3.2.1.2. North America Clinical Oncology Next-generation Sequencing Market Restraints 3.2.1.3. North America Clinical Oncology Next-generation Sequencing Market Opportunities 3.2.1.4. North America Clinical Oncology Next-generation Sequencing Market Challenges 3.2.2. Europe 3.2.2.1. Europe Clinical Oncology Next-generation Sequencing Market Drivers 3.2.2.2. Europe Clinical Oncology Next-generation Sequencing Market Restraints 3.2.2.3. Europe Clinical Oncology Next-generation Sequencing Market Opportunities 3.2.2.4. Europe Clinical Oncology Next-generation Sequencing Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Clinical Oncology Next-generation Sequencing Market Drivers 3.2.3.2. Asia Pacific Clinical Oncology Next-generation Sequencing Market Restraints 3.2.3.3. Asia Pacific Clinical Oncology Next-generation Sequencing Market Opportunities 3.2.3.4. Asia Pacific Clinical Oncology Next-generation Sequencing Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Drivers 3.2.4.2. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Restraints 3.2.4.3. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Opportunities 3.2.4.4. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Challenges 3.2.5. South America 3.2.5.1. South America Clinical Oncology Next-generation Sequencing Market Drivers 3.2.5.2. South America Clinical Oncology Next-generation Sequencing Market Restraints 3.2.5.3. South America Clinical Oncology Next-generation Sequencing Market Opportunities 3.2.5.4. South America Clinical Oncology Next-generation Sequencing Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Clinical Oncology Next-generation Sequencing Industry 3.8. Analysis of Government Schemes and Initiatives For Clinical Oncology Next-generation Sequencing Industry 3.9. Clinical Oncology Next-generation Sequencing Market Trade Analysis 3.10. The Global Pandemic Impact on Clinical Oncology Next-generation Sequencing Market 4. Clinical Oncology Next-generation Sequencing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 4.1.1. Whole Genome Sequencing 4.1.2. Whole Exome Sequencing 4.1.3. Targeted Sequencing & Resequencing 4.2. Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 4.2.1. NGS Pre-Sequencing 4.2.2. NGS Sequencing 4.2.3. NGS Data Analysis 4.3. Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 4.3.1. Tissue-based 4.3.2. Liquid Biopsy 4.3.3. Other Biofluids 4.4. Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 4.4.1. Screening 4.4.2. Companion Diagnostics 4.4.3. Other Diagnostics 4.5. Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 4.5.1. Hospitals 4.5.2. Clinics 4.5.3. Laboratories 4.6. Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Clinical Oncology Next-generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 5.1.1. Whole Genome Sequencing 5.1.2. Whole Exome Sequencing 5.1.3. Targeted Sequencing & Resequencing 5.2. North America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 5.2.1. NGS Pre-Sequencing 5.2.2. NGS Sequencing 5.2.3. NGS Data Analysis 5.3. North America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 5.3.1. Tissue-based 5.3.2. Liquid Biopsy 5.3.3. Other Biofluids 5.4. North America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 5.4.1. Screening 5.4.2. Companion Diagnostics 5.4.3. Other Diagnostics 5.5. North America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 5.5.1. Hospitals 5.5.2. Clinics 5.5.3. Laboratories 5.6. North America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 5.6.1.1.1. Whole Genome Sequencing 5.6.1.1.2. Whole Exome Sequencing 5.6.1.1.3. Targeted Sequencing & Resequencing 5.6.1.2. United States Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 5.6.1.2.1. NGS Pre-Sequencing 5.6.1.2.2. NGS Sequencing 5.6.1.2.3. NGS Data Analysis 5.6.1.3. United States Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 5.6.1.3.1. Tissue-based 5.6.1.3.2. Liquid Biopsy 5.6.1.3.3. Other Biofluids 5.6.1.4. United States Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Screening 5.6.1.4.2. Companion Diagnostics 5.6.1.4.3. Other Diagnostics 5.6.1.5. United States Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 5.6.1.5.1. Hospitals 5.6.1.5.2. Clinics 5.6.1.5.3. Laboratories 5.6.2. Canada 5.6.2.1. Canada Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 5.6.2.1.1. Whole Genome Sequencing 5.6.2.1.2. Whole Exome Sequencing 5.6.2.1.3. Targeted Sequencing & Resequencing 5.6.2.2. Canada Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 5.6.2.2.1. NGS Pre-Sequencing 5.6.2.2.2. NGS Sequencing 5.6.2.2.3. NGS Data Analysis 5.6.2.3. Canada Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 5.6.2.3.1. Tissue-based 5.6.2.3.2. Liquid Biopsy 5.6.2.3.3. Other Biofluids 5.6.2.4. Canada Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Screening 5.6.2.4.2. Companion Diagnostics 5.6.2.4.3. Other Diagnostics 5.6.2.5. Canada Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 5.6.2.5.1. Hospitals 5.6.2.5.2. Clinics 5.6.2.5.3. Laboratories 5.6.3. Mexico 5.6.3.1. Mexico Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 5.6.3.1.1. Whole Genome Sequencing 5.6.3.1.2. Whole Exome Sequencing 5.6.3.1.3. Targeted Sequencing & Resequencing 5.6.3.2. Mexico Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 5.6.3.2.1. NGS Pre-Sequencing 5.6.3.2.2. NGS Sequencing 5.6.3.2.3. NGS Data Analysis 5.6.3.3. Mexico Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 5.6.3.3.1. Tissue-based 5.6.3.3.2. Liquid Biopsy 5.6.3.3.3. Other Biofluids 5.6.3.4. Mexico Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Screening 5.6.3.4.2. Companion Diagnostics 5.6.3.4.3. Other Diagnostics 5.6.3.5. Mexico Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 5.6.3.5.1. Hospitals 5.6.3.5.2. Clinics 5.6.3.5.3. Laboratories 6. Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.2. Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.3. Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.4. Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.5. Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6. Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.1.2. United Kingdom Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.1.3. United Kingdom Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.1.4. United Kingdom Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6.2. France 6.6.2.1. France Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.2.2. France Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.2.3. France Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.2.4. France Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.3.2. Germany Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.3.3. Germany Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.3.4. Germany Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.4.2. Italy Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.4.3. Italy Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.4.4. Italy Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.5.2. Spain Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.5.3. Spain Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.5.4. Spain Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.6.2. Sweden Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.6.3. Sweden Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.6.4. Sweden Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.7.2. Austria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.7.3. Austria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.7.4. Austria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 6.6.8.2. Rest of Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 6.6.8.3. Rest of Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 6.6.8.4. Rest of Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.2. Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.3. Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.4. Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6. Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.1.2. China Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.1.3. China Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.1.4. China Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.2.2. S Korea Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.2.3. S Korea Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.2.4. S Korea Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.3.2. Japan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.3.3. Japan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.3.4. Japan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.4. India 7.6.4.1. India Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.4.2. India Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.4.3. India Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.4.4. India Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.5.2. Australia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.5.3. Australia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.5.4. Australia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.6.2. Indonesia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.6.3. Indonesia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.6.4. Indonesia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.7.2. Malaysia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.7.3. Malaysia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.7.4. Malaysia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.8.2. Vietnam Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.8.3. Vietnam Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.8.4. Vietnam Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.9.2. Taiwan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.9.3. Taiwan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.9.4. Taiwan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 7.6.10.2. Rest of Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 7.6.10.3. Rest of Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 7.6.10.4. Rest of Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 8.2. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 8.3. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 8.4. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 8.6. Middle East and Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 8.6.1.2. South Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 8.6.1.3. South Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 8.6.1.4. South Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 8.6.2.2. GCC Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 8.6.2.3. GCC Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 8.6.2.4. GCC Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 8.6.3.2. Nigeria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 8.6.3.3. Nigeria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 8.6.3.4. Nigeria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 8.6.4.2. Rest of ME&A Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 8.6.4.3. Rest of ME&A Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 8.6.4.4. Rest of ME&A Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 9. South America Clinical Oncology Next-generation Sequencing Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 9.2. South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 9.3. South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type(2024-2032) 9.4. South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 9.5. South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 9.6. South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 9.6.1.2. Brazil Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 9.6.1.3. Brazil Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 9.6.1.4. Brazil Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 9.6.2.2. Argentina Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 9.6.2.3. Argentina Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 9.6.2.4. Argentina Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Technology (2024-2032) 9.6.3.2. Rest Of South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Workflow (2024-2032) 9.6.3.3. Rest Of South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Sample Type (2024-2032) 9.6.3.4. Rest Of South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Clinical Oncology Next-generation Sequencing Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Illumina, Inc (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Thermo Fisher Scientific (USA) 10.3. Guardant Health (USA) 10.4. Foundation Medicine (USA) 10.5. Fulgent Genetics (USA) 10.6. Tempus (USA) 10.7. PerkinElmer, Inc (USA) 10.8. Myriad Genetics, Inc. (USA) 10.9. Creative Biolabs (USA) 10.10. Invitae Corporation (USA) 10.11. Natera Inc. (USA) 10.12. NeoGenomics Laboratories, Inc (USA) 10.13. DNASTAR Inc. (USA) 10.14. Exosome Diagnostics Inc. (USA) 10.15. Roche Diagnostics (Switzerland) 10.16. Agilent Technologies, Inc. (Germany) 10.17. Qiagen N.V. (Netherlands) 10.18. CLC Bio (Qiagen CLC) (Denmark) 10.19. Veracyte Inc (France) 10.20. BGI (Beijing Genomics Institute) (China) 10.21. Macrogen Inc. (South Korea) 10.22. Takara Bio Inc (Japan) 11. Key Findings 12. Industry Recommendations 13. Clinical Oncology Next-generation Sequencing Market: Research Methodology 14. Terms and Glossary