Global Chronic Kidney Disease Drugs Market size was valued at USD 13.94 Bn. in 2024, and the total Chronic Kidney Disease Drugs Market revenue is expected to grow by 6.2% from 2025 to 2032, reaching nearly USD 22.56 Bn.Chronic Kidney Disease Drugs Market Overview:

The CKD drugs market covers therapies addressing complications such as anemia, hyperphosphatemia, secondary hyperparathyroidism, hypertension, and metabolic acidosis. Key drug classes include erythropoiesis-stimulating agents (ESAs), iron supplements, phosphate binders, calcimimetics, diuretics, and RAAS inhibitors, all of which help slow CKD progression and improve patient outcomes.To know about the Research Methodology :- Request Free Sample Report CKD Drugs Market growth has been driven by rising CKD prevalence linked to diabetes, hypertension, and aging populations, alongside expanding pipelines of branded and generic drugs. North America led the CKD drugs market due to advanced healthcare systems, reimbursement policies, and strong pharma presence, followed by Europe with high adoption of innovative therapies. Asia-Pacific is the fastest-growing region, fuelled by large patient pools, government healthcare initiatives, and growing awareness. Major players include AstraZeneca, Amgen, Bayer, GSK, Pfizer, Johnson & Johnson, Novartis, and Akebia Therapeutics. Hospitals and specialty clinics dominate end-use, while retail and online pharmacies are expanding with rising outpatient demand. Overall, the market presents strong opportunities for innovation, access, and patient-centered care.

Chronic Kidney Disease Drugs Market Dynamics:

Rising population of Kidney Failures across the globe to Drive Chronic Kidney Disease Drugs Market Kidney failure is a global public health issue with rising incidence and prevalence, high expenditures, and poor results. There is also a much greater frequency of chronic kidney disease (CKD) in its early stages, with negative effects such as renal function loss, cardiovascular disease (CVD), and premature mortality. Strategies for improving outcomes necessitate a global effort focused on the early stages of CKD. One of the main factors in the increased prevalence of kidney failure is CKD. If the kidneys are harmed by an inability to control risk factors, recurring kidney infections, or medications or chemicals that are toxic to the kidneys, CKD is more likely to progress to renal failure, especially in older persons. Lower-income and related issues such as food insecurity and a lack of access to excellent health care are also linked to worsening CKD. However, not all people with CKD progress to renal failure. Treatment may decrease the loss of kidney function and delay renal failure if CKD is discovered early. Even with medication, kidney failure might occur in some situations. According to the National Kidney Foundation (NKD), CKD affects around 15% of the global population, with millions of people dying each year. According to the NKD, emerging nations such as China and India have a large aging population. The number of patients receiving treatment with a kidney transplant or dialysis continues to rise at a pace of 7-9% every year. Women are expected to have a higher prevalence of chronic kidney disease than males (15% versus 12%). Other factors driving market growth include a rising number of patients suffering from hypertension and diabetes. CKD affects over one-third of the diabetic population and is the leading cause of end-stage kidney failure. Hypertension is mostly caused by high blood pressure, which raises the risk of ESRD considerably. According to the WHO statistics in 2019, around 1.13 million people all across the globe have hypertension. Diabetes and hypertension were responsible for about 75% of kidney failure. Diabetes is the leading cause of severe kidney disease, followed by hypertension, which affects an estimated 1 million people across the globe. As a result, the growing number of individuals suffering from hypertension and diabetes is driving the market growth. Medication dosing errors to restrain Chronic Kidney Disease Drugs Market Growth Medication dosing errors are one of the most common drug-related issues in patients with chronic kidney disease (CKD). Many medications, drugs, and their metabolites are eliminated through the kidney. To avoid toxicity, adequate renal function is essential. Pharmacokinetic and pharmacodynamics characteristics are often altered in patients with renal impairment. Renal failure reduces the clearance of medicines removed predominantly by renal filtration. As a result, when these medications are provided to individuals with compromised renal function, particular care should be undertaken. Despite the necessity of dose modifications in CKD patients, they are often overlooked. Physicians and pharmacists can collaborate to ensure safe medication prescriptions. This process can be difficult and requires a step-by-step strategy to assure efficacy, reduce future damage, and avoid medication nephrotoxicity.Chronic Kidney Disease Drugs Market Segment Analysis:

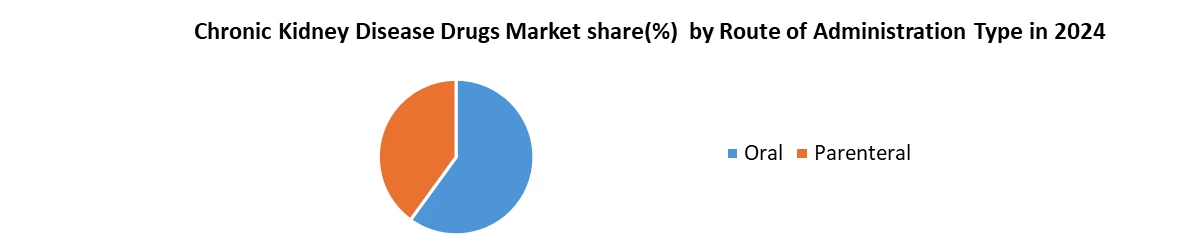

Based on Drug Class, the Calcium channel blockers segment dominated the market in terms of value and volume in 2024 and is expected to maintain its dominance at the end of the forecast period. Calcium channel blockers (CCBs) are a class of antihypertensive drugs with a wide range of pharmacokinetics and therapeutic effects. Calcium channel blockers relieve the symptoms in a wide range of disorders, including coronary artery disease and high blood pressure, etc., and hence, this is driving the segment growth. The Calcium channel blockers have been widely used in clinical practice because of their antihypertensive capacity. The prevention of renal damage is a critical goal of antihypertensive treatment. This is especially true given the general population's high prevalence of chronic kidney disease (CKD). Recent research has linked CKD to the absence of proper blood pressure regulation, as well as the clustering of additional cardiovascular risk factors found in metabolic syndrome. Based on route of administration, oral segment is estimated to contribute the highest market share of xx% in 2024, owing to convenience and ease of use advantages over parenteral drugs. High efficacy demonstrated by oral medications over long term has established them as first line treatment choice for chronic kidney diseases. Being non-invasive in nature, oral drugs are generally preferred by patients and clinicians alike for chronic therapy adherence. Self-administration of pills also saves resources by reducing hospital visits for injections. This has led to extensive research and development of novel drug delivery systems like timed and controlled release formulations, thus, enhancing oral bioavailability and stability of drugs. Moreover, ability to take medications conveniently without medical supervision has powered compliant oral administration across care settings for chronic kidney disease patients.

Regional Insights:

North America held the largest market share and dominated the market in 2024. It is expected to maintain its dominance at the end of the forecast period. The improved healthcare infrastructure and increased government efforts, which offer attractive reimbursement policies in the country, are the primary drivers driving the market's growth in the United States. According to the American Cancer Society, around 73,750 new occurrences of kidney cancer in the United States in 2020, with roughly 14,830 fatalities from this illness. According to the source, kidney cancer is one of the top 10 cancers in both men and women. In men, the lifetime chance of having kidney cancer is around 1 in 46 (2.02%). For women, the lifetime risk is roughly 1 in 82 (1.02%). This suggests that the market for kidney disease diagnostics and therapies has significant potential. The market in the United States is expected to grow during the forecast period due to the significant growth in the incidence and prevalence of renal illnesses.Competition Landscape for the Chronic Kidney Disease (CKD) Drugs Market:

CKD Drugs Market competition landscape offers a strategy-first view of key players’ positioning, innovation, and value chain coverage. Leading companies—AstraZeneca (SGLT2), Bayer (finerenone), Boehringer Ingelheim/Eli Lilly (SGLT2), Amgen (CKD complications), and CSL Vifor (renal franchise)—maintain extensive global, guideline-aligned portfolios. Followers like Otsuka, GSK, Akebia, Takeda, Sanofi, and Pfizer expand via limited indications and lifecycle management, while upstarts Ardelyx, Calliditas, Travere, Vera, Chinook/Novartis, and Ionis focus on niche or first-in-class therapies. Companies are benchmarked on financials, technology delivery (HIF-PHIs, biologics, precision nephrology, IgAN/ADPKD), regulatory momentum, and market coverage. M&A, partnerships, and R&D (2019–2024) are reshaping pipelines, especially in CKD disease modification, inflammatory modulation, and dialysis-adjacent care, providing actionable insights for payers, investors, and manufacturers.Recent Development in Chronic Kidney Disease (CKD) Drugs Market

1. March 2024, United States Merck & Co., Inc.: Merck’s investigational anemia therapy daprodustat (Duvroq) received FDA approval as the first oral treatment for anemia due to chronic kidney disease in adults on dialysis in the U.S., marking a pivotal milestone in CKD pharmacotherapy. 2. May 2025, United States, Pfizer Inc.: Pfizer’s investigational monoclonal antibody Pacibekitug (targeting IL-6) achieved positive Phase II trial results for patients with chronic kidney disease, showing significant reductions in high-sensitivity C-reactive protein (hsCRP) among CKD patients with elevated inflammation. This underscores Pfizer’s entry into the anti-inflammatory treatment space for chronic kidney disease. 3. March 2025, Johnson & Johnson – New Brunswick, United State: Johnson & Johnson is developing JNJ-0237, an experimental oral therapy currently in Phase I clinical trials for autosomal dominant polycystic kidney disease (ADPKD), which is being explored for broader use in chronic kidney disease (CKD). Although early in development, JNJ-0237 represents a notable expansion of J&J’s pipeline into CKD-specific treatments. 4. July 2025, United States, Amgen Inc.: Amgen announced positive results from a Phase 3 clinical trial of AMG 416, its novel intravenous calcimimetic agent (also known as etelcalcetide), for the treatment of secondary hyperparathyroidism (SHPT) in patients with CKD receiving hemodialysis. The study, involving 515 patients over a 26-week treatment period alongside hemodialysis, demonstrated that AMG 416 effectively reduced parathyroid hormone (PTH) levels and met all primary and secondary endpoints, marking a significant milestone in the CKD therapeutics space.key trends are shaping the Chronic Kidney Disease (CKD) Drugs Market:

1. Shift Toward Novel and Targeted Therapies – Companies are expanding beyond traditional CKD treatments by focusing on innovative drug classes, such as oral anemia therapies (e.g., Merck’s daprodustat/Duvroq) and monoclonal antibodies (e.g., Pfizer’s Pacibekitug targeting IL-6). This highlights a clear trend toward precision medicine and inflammation-modulating therapies in CKD drug development. 2. Expansion of Pipeline into Rare and Genetic Kidney Disorders – Several leading pharmaceutical players, including AbbVie and Johnson & Johnson, are investing in investigational therapies for autosomal dominant polycystic kidney disease (ADPKD), a genetic form of CKD. This reflects a growing industry trend to diversify CKD treatment portfolios by targeting niche yet unmet patient needs. 3. Focus on Improving Quality of Life for Dialysis Patients – Amgen’s advancement of AMG 416 (etelcalcetide), an intravenous calcimimetic for secondary hyperparathyroidism in hemodialysis patients, underscores the trend of developing supportive therapies aimed at reducing complications and improving outcomes for dialysis-dependent CKD patients.Chronic Kidney Disease Drugs Market Scope: Inquire before buying

Global Chronic Kidney Disease Drugs Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 13.94 Bn. Forecast Period 2025 to 2032 CAGR: 6.2% Market Size in 2032: USD 22.56 Bn. Segments Covered: by Drug Class ACE Inhibitors Angiotensin-II Receptor Blockers Calcium Channel Blockers Beta Blockers Erythropoiesis-Stimulating Agents (Esas) Diuretics Others by Route of Administration Oral Parenteral by Indication Diabetic Nephropathy Glomerulonephritis Hypertensive Nephropathy Polycystic Kidney Disease Other Indications by End-User Hospitals Specialty Clinics Chronic Kidney Disease Drugs Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Key Players are:

North America 1. AbbVie Inc. – North Chicago, United States 2. Amgen Inc. – Thousand Oaks, United States 3. Johnson & Johnson – New Brunswick, United States 4. Pfizer Inc. – New York City, United States 5. Merck & Co., Inc. – Kenilworth, New Jersey, United States 6. Reata Pharmaceuticals, Inc. – Texas, United States 7. Akebia Therapeutics, Inc. – Massachusetts, United States 8. Regeneron Pharmaceuticals, Inc. – New York, United States 9. Ardelyx, Inc. – California, United States Europe 1. AstraZeneca plc – Cambridge, United Kingdom 2. GlaxoSmithKline plc (GSK) – London, United Kingdom 3. Sanofi S.A. – Paris, France 4. F. Hoffmann-La Roche Ltd – Basel, Switzerland 5. Bayer AG – Leverkusen, Germany 6. Boehringer Ingelheim GmbH – Ingelheim, Germany Asia-Pacific 1. Kissei Pharmaceutical Co., Ltd. – Japan 2. Takeda Pharmaceutical Company Limited – Tokyo, Japan 3. Otsuka Pharmaceutical Co., Ltd.: Tokyo, Japan 4. Novo Nordisk A/S – Bagsværd, Denmark 5. FibroGen, Inc. – San Francisco, ChinaFAQs:

1. Which is the potential market for Chronic Kidney Disease (CKD) Drugs in terms of the region? Ans. North America is the potential market for Chronic Kidney Disease (CKD) Drugs in terms of the region. 2. What are the restraints for new market entrants? Ans. The key restraint in the market is Medication dosing errors. 3. What is expected to drive the growth of the Chronic Kidney Disease Drugs Market in the forecast period? Ans. A major driver in the Chronic Kidney Disease Drugs Market is the rising population of Kidney Failures across the globe. 4. What is the projected market size & growth rate of the Chronic Kidney Disease Drugs Market? Ans. Chronic Kidney Disease Drugs Market size was valued at USD 13.94 Bn. in 2024 and the total Chronic Kidney Disease (CKD) Drugs revenue is expected to grow by 6.2% from 2025 to 2032, reaching nearly USD 22.56 Bn. 5. What segments are covered in the Chronic Kidney Disease Drugs Market report? Ans. The segments covered are Drug Class, End User, and Region.

1. Chronic Kidney Disease Drugs Market: Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Chronic Kidney Disease Drugs Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Chronic Kidney Disease Drugs Market: Dynamics 3.1. Region wise Trends of Chronic Kidney Disease Drugs Market 3.1.1. North America Chronic Kidney Disease Drugs Market Trends 3.1.2. Europe Chronic Kidney Disease Drugs Market Trends 3.1.3. Asia Pacific Chronic Kidney Disease Drugs Market Trends 3.1.4. Middle East and Africa Chronic Kidney Disease Drugs Market Trends 3.1.5. South America Chronic Kidney Disease Drugs Market Trends 3.2. Chronic Kidney Disease Drugs Market Dynamics 3.2.1. Global Chronic Kidney Disease Drugs Market Drivers 3.2.2. Global Chronic Kidney Disease Drugs Market Restraints 3.2.3. Global Chronic Kidney Disease Drugs Market Opportunities 3.2.4. Global Chronic Kidney Disease Drugs Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Political 3.4.2. Economic 3.4.3. Social 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Chronic Kidney Disease Drugs Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 4.1.1. Calcium channel Blockers 4.1.2. Angiotensin-II Receptor Blockers 4.1.3. ACE Inhibitors 4.1.4. Beta Blockers 4.1.5. Erythropoiesis-Stimulating Agents 4.1.6. Diuretics 4.1.7. Others 4.2. Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 4.2.1. Oral 4.2.2. Parenteral 4.3. Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 4.3.1. Diabetic Nephropathy 4.3.2. Glomerulonephritis 4.3.3. Hypertensive Nephropathy 4.3.4. Polycystic Kidney Disease 4.3.5. Other Indications 4.4. Chronic Kidney Disease Drugs Market Size and Forecast, by End Use (2024-2032) 4.4.1 Hospitals 4.4.2 Specialty Clinics 4.5. Chronic Kidney Disease Drugs Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Chronic Kidney Disease Drugs Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 5.1.1. Calcium channel Blockers 5.1.2. Angiotensin-II Receptor Blockers 5.1.3. ACE Inhibitors 5.1.4. Beta Blockers 5.1.5. Erythropoiesis-Stimulating Agents 5.1.6. Diuretics 5.1.7. Others 5.2. North America Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 5.2.1. Oral 5.2.2. Parenteral 5.3. North America Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 5.3.1. Diabetic Nephropathy 5.3.2. Glomerulonephritis 5.3.3. Hypertensive Nephropathy 5.3.4. Polycystic Kidney Disease 5.3.5. Other Indications 5.4. North America Chronic Kidney Disease Drugs Market Size and Forecast, by End Use (2024-2032) 5.4.1 Hospitals 5.4.2 Specialty Clinics 5.5. North America Chronic Kidney Disease Drugs Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 5.5.1.1.1. Calcium channel Blockers 5.5.1.1.2. Angiotensin-II Receptor Blockers 5.5.1.1.3. ACE Inhibitors 5.5.1.1.4. Beta Blockers 5.5.1.1.5. Erythropoiesis-Stimulating Agents 5.5.1.1.6. Diuretics 5.5.1.1.7. Others 5.5.1.2. United States Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 5.5.1.2.1. Oral 5.5.1.2.2. Parenteral 5.5.1.3. United States Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 5.5.1.3.1. Diabetic Nephropathy 5.5.1.3.2. Glomerulonephritis 5.5.1.3.3. Hypertensive Nephropathy 5.5.1.3.4. Polycystic Kidney Disease 5.5.1.3.5. Other Indications 5.5.1.4. United States Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 5.5.1.4.1. Hospitals 5.5.1.4.2. Specialty Clinics 5.5.2. Canada 5.5.2.1. Canada Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 5.5.2.1.1. Calcium channel Blockers 5.5.2.1.2. Angiotensin-II Receptor Blockers 5.5.2.1.3. ACE Inhibitors 5.5.2.1.4. Beta Blockers 5.5.2.1.5. Erythropoiesis-Stimulating Agents 5.5.2.1.6. Diuretics 5.5.2.1.7. Others 5.5.2.2. Canada Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 5.5.2.2.1. Oral 5.5.2.2.2. Parenteral 5.5.2.3. Canada Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 5.5.2.3.1. Diabetic Nephropathy 5.5.2.3.2. Glomerulonephritis 5.5.2.3.3. Hypertensive Nephropathy 5.5.2.3.4. Polycystic Kidney Disease 5.5.2.3.5. Other Indications 5.5.2.4. Canada Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 5.5.2.4.1. Hospitals 5.5.2.4.2. Specialty Clinics 5.5.3. Mexico 5.5.3.1. Mexico Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 5.5.3.1.1. Calcium channel Blockers 5.5.3.1.2. Angiotensin-II Receptor Blockers 5.5.3.1.3. ACE Inhibitors 5.5.3.1.4. Beta Blockers 5.5.3.1.5. Erythropoiesis-Stimulating Agents 5.5.3.1.6. Diuretics 5.5.3.1.7. Others 5.5.3.2. Mexico Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 5.5.3.2.1. Oral 5.5.3.2.2. Parenteral 5.5.3.3. Mexico Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 5.5.3.3.1. Diabetic Nephropathy 5.5.3.3.2. Glomerulonephritis 5.5.3.3.3. Hypertensive Nephropathy 5.5.3.3.4. Polycystic Kidney Disease 5.5.3.3.5. Other Indications 5.5.3.4. Mexico Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 5.5.3.4.1. Hospitals 5.5.3.4.2. Specialty Clinics 6. Europe Chronic Kidney Disease Drugs Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.2. Europe Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.3. Europe Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.4. Europe Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5. Europe Chronic Kidney Disease Drugs Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.1.2. United Kingdom Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.1.3. United Kingdom Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.1.4. United Kingdom Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5.2. France 6.5.2.1. France Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.2.2. France Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.2.3. France Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.2.4. France Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.3.2. Germany Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.3.3. Germany Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.3.4. Germany Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.4.2. Italy Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.4.3. Italy Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.4.4. Italy Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.5.2. Spain Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.5.3. Spain Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.5.4. Spain Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.6.2. Sweden Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.6.3. Sweden Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.6.4. Sweden Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.7.2. Austria Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.7.3. Austria Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.7.4. Austria Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 6.5.8.2. Rest of Europe Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 6.5.8.3. Rest of Europe Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 6.5.8.4. Rest of Europe Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7. Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.2. Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.3. Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.4. Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5. Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.1.2. China Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.1.3. China Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.1.4. China Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.2.2. S Korea Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.2.3. S Korea Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.2.4. S Korea Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.3.2. Japan Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.3.3. Japan Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.3.4. Japan Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.4. India 7.5.4.1. India Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.4.2. India Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.4.3. India Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.4.4. India Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.5.2. Australia Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.5.3. Australia Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.5.4. Australia Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.6.2. Indonesia Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.6.3. Indonesia Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.6.4. Indonesia Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.7.2. Philippines Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.7.3. Philippines Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.7.4. Philippines Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.8.2. Malaysia Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.8.3. Malaysia Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.8.4. Malaysia Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.9.2. Vietnam Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.9.3. Vietnam Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.9.4. Vietnam Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.10.2. Thailand Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.10.3. Thailand Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.10.4. Thailand Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 7.5.11.2. Rest of Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 7.5.11.3. Rest of Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 7.5.11.4. Rest of Asia Pacific Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 8. Middle East and Africa Chronic Kidney Disease Drugs Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 8.2. Middle East and Africa Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 8.3. Middle East and Africa Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 8.4. Middle East and Africa Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 8.5. Middle East and Africa Chronic Kidney Disease Drugs Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 8.5.1.2. South Africa Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 8.5.1.3. South Africa Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 8.5.1.4. South Africa Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 8.5.2.2. GCC Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 8.5.2.3. GCC Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 8.5.2.4. GCC Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 8.5.3.2. Nigeria Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 8.5.3.3. Nigeria Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 8.5.3.4. Nigeria Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 8.5.4.2. Rest of ME&A Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 8.5.4.3. Rest of ME&A Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 8.5.4.4. Rest of ME&A Chronic Kidney Disease Drugs Market Size and Forecast, By End Use(2024-2032) 9. South America Chronic Kidney Disease Drugs Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 9.2. South America Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 9.3. South America Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 9.4. South America Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 9.5. South America Chronic Kidney Disease Drugs Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 9.5.1.2. Brazil Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 9.5.1.3. Brazil Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 9.5.1.4. Brazil Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 9.5.2.2. Argentina Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 9.5.2.3. Argentina Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 9.5.2.4. Argentina Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Chronic Kidney Disease Drugs Market Size and Forecast, By Drug Class (2024-2032) 9.5.3.2. Rest of South America Chronic Kidney Disease Drugs Market Size and Forecast, By Route of Administration (2024-2032) 9.5.3.3. Rest of South America Chronic Kidney Disease Drugs Market Size and Forecast, By Indication (2024-2032) 9.5.3.4. Rest of South America Chronic Kidney Disease Drugs Market Size and Forecast, By End Use (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major End Use Players) 10.1. AbbVie Inc. – North Chicago, United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Amgen Inc. – Thousand Oaks, United States 10.3. Johnson & Johnson – New Brunswick, United States 10.4. Pfizer Inc. – New York City, United States 10.5. Merck & Co., Inc. – Kenilworth, New Jersey, United States 10.6. AstraZeneca plc – Cambridge, United Kingdom 10.7. GlaxoSmithKline plc (GSK) – London, United Kingdom 10.8. Sanofi S.A. – Paris, France 10.9. F. Hoffmann-La Roche Ltd – Basel, Switzerland 10.10. Bayer AG – Leverkusen, Germany 10.11. Kissei Pharmaceutical Co., Ltd. – Japan 10.12. Takeda Pharmaceutical Company Limited – Tokyo, Japan 10.13. Otsuka Pharmaceutical Co., Ltd. : Tokyo, Japan 10.14. Novo Nordisk A/S – Bagsværd, Denmark 10.15. FibroGen, Inc. – San Francisco, China 10.16. Boehringer Ingelheim GmbH – Ingelheim, Germany 10.17. Reata Pharmaceuticals, Inc. – Texas, United States 10.18. Akebia Therapeutics, Inc. – Massachusetts, United States 10.19. Regeneron Pharmaceuticals, Inc. – New York, United States 10.20. Ardelyx, Inc. – California, United States 11. Key Findings 12. Analyst Recommendations 13. Chronic Kidney Disease Drugs Market: Research Methodology