The Global Chocolate Market is expected to grow at a CAGR of 4.65%, rising from USD 128.1 billion in 2025 to USD 176.09 billion by 2032. Market growth is driven by increasing consumer demand for premium, dark, and artisanal chocolates, as well as sugar-free and organic options, alongside urbanization and changing global lifestyles.Global Chocolate Market Overview:

Chocolate, one of the most widely consumed confectioneries globally, is increasingly shifting toward premium, dark, and artisanal varieties as health-conscious and indulgent consumer preferences rise. In 2024–2025, global cocoa consumption reached approximately 4.8 million tonnes, with premium segments capturing notable value despite a smaller share of total volume. Europe continues to lead consumption, with over 950,000 metric tons of premium chocolate sold, and overall chocolate intake exceeding 2 million metric tons across major markets. Countries such as India, China, and Japan are expecting the fastest growth in chocolate consumption, driven by urbanization, rising disposable incomes, and evolving taste preferences. Opportunities exist in sugar-free, organic, and clean-label chocolate segments, though cocoa price volatility and supply challenges continue to pressure margins and influence product volumes and pricing strategies.To know about the Research Methodology :- Request Free Sample Report

Key Highlights:

• Strong Cocoa Trade Supports Chocolate Supply: cocoa bean and semi-finished product exports rose nearly 6% year-on-year in early 2025, ensuring steady raw material flows for global chocolate manufacturers despite earlier supply disruptions. • Input Tightness Continues to Shape Production: Lower cocoa output in the 2023/24 season continues to impact chocolate production planning in 2025, encouraging manufacturers to optimize formulations, pricing strategies, and inventory management. • Cost Pressures Ease but Remain Elevated: Cocoa prices corrected by over 30% in 2025 from late-2024 record highs, providing partial cost relief for chocolate producers, though prices remain well above historical averages. • Volatile Raw Material Environment: Ongoing price sensitivity to weather conditions, stock levels, and supply forecasts keeps procurement risks high for chocolate makers in 2025. • Moderate Supply Improvement Outlook: A small projected cocoa surplus for 2024/25 signals gradual supply stabilization, but limited availability continues to support firm cocoa prices, influencing chocolate pricing and margins. • Market Adaptation Accelerates: Chocolate manufacturers in 2025 increasingly focus on premiumization, portion control, and reformulation to manage input volatility while sustaining demand.

Trends – Premiumization and Increasing Demand for Dark and Artisanal Chocolates.

The global chocolate industry is undergoing a structural shift toward premiumization, as consumers increasingly prefer dark, single-origin, and artisanal chocolates with higher cocoa content and perceived health benefits. These products appeal due to higher cocoa content, superior quality, and perceived health benefits, especially among affluent and health-conscious consumers. Sustained industrial activity, coupled with robust cocoa supply and growing per-capita availability, supports innovation in premium and artisanal chocolates, creating opportunities for differentiated product offerings and niche market growth . • High-quality fine flavor cocoa is increasingly central to artisanal chocolate market growth, supporting innovation in premium and dark chocolate segments. • Sustained cocoa per-capita availability was more than 0.710 kg/person in 2025 underpin stable global chocolate market size and forecast, enabling broader consumption of premium, dark, and artisanal chocolates.Drivers – Growing Consumer Preference for Premium and Dark Chocolate Variants

The Global Chocolate Industry is experiencing steady growth, driven by a structural shift toward premium and dark chocolate variants as consumer lifestyles evolve and health awareness rises. Rising discretionary spending, supported by global GDP per capita of nearly more than USD 12,647 in 2025, enables higher demand for quality chocolate products. Urbanization, reaching 57.7% globally, improves market access through organized and specialty retail channels. While the 15–29 age cohort, representing around 17% of the global population, shows strong preference for indulgent, artisanal, and dark chocolates.Opportunities – Expansion of Sugar-Free, Vegan, Organic, and Clean-Label Chocolate Segments

The Global Chocolate Market offers substantial growth potential in specialty segments, driven by evolving consumer preferences, health awareness, and sustainability trends. Premium, artisanal, sugar-free, vegan, organic, and clean-label chocolates represent key areas for strategic market differentiation. • Certified Organic Agriculture: By 2023, 98.9 million hectares globally were managed under certified organic systems, providing a robust supply foundation for premium, health-oriented, and sustainable chocolate production. • Organic Producer Base: With 4.3 million certified organic producers worldwide as of 2022, chocolate manufacturers can scale sourcing for artisanal, vegan, and functional product innovation. • Sugar Reduction Policies: Increasing emphasis on limiting free sugar to below 10% of daily energy intake drives innovation in sugar-free and low-sugar chocolate variants.Restraints – Volatility in Cocoa Prices Impacting Costs and Margins

The Global Chocolate Market faces constraints from high volatility in cocoa prices, which significantly affects production costs, profit margins, and financial planning. Cocoa prices surged to USD 4,452.60 per tonne in 2024, with short-term spikes exceeding USD 6,000 per tonne in October 2024. The cocoa price index increased by Nearly 60% from 2020 to 2024, while futures averaged USD 4,980 per tonne in January 2025, reflecting ongoing market sensitivity. Rising freight and import costs intensify financial pressure, challenging manufacturers to maintain cost efficiency and risk mitigation. • Cocoa import costs rose nearly 28% in 2023, while bulk cocoa transport and freight rates increased by 19% in 2024, significantly raising production and logistics expenses. • Manufacturers are mitigating margin pressure through forward contracts, futures trading, diversified sourcing, and improved energy efficiency, packaging optimization, and supply chain resilience.Global Chocolate Market Segmentation.

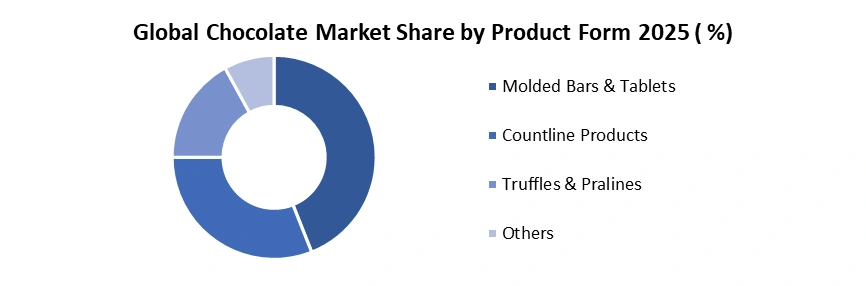

The Global Chocolate Market is highly diversified across multiple dimensions, enabling companies to target consumer preferences, optimize product offerings, and capture growth in premium, dark, organic, and gifting segments. Urbanization and e-commerce channels further support emerging market penetration. By Type: Milk chocolate dominated the Global Chocolate Market in 2025, while dark chocolate driven by health-conscious consumers. White chocolate is gaining traction in premium markets, and other variants, including flavored, filled, and functional chocolates, cater to niche indulgence preferences.By Product Form: Molded chocolates led the global Chocolate Market in 2025, driven by their wide availability, standardized formats, and strong demand across mass retail channels. Countline products, including individually wrapped and snack-size bars, followed, supported by impulse purchases and on-the-go consumption. Specialty formats such as truffles, pralines, and novelty shapes cater to premium, artisanal, and experience-driven consumer segments, reinforcing value growth despite lower volumes.

Regional Insights of Global Chocolate Market.

Europe dominated the Global Chocolate Market in 2025, driven by retail networks and strong seasonal demand, with holiday demand rising 10–15% annually, boosting premium and dark chocolate adoption. While it has high-consumption, mature market, with more than 6.2 kg per-capita intake in 2025 and growing preference for premium, organic, and ethically sourced chocolates. Asia-Pacific leads as the fastest-growing region, with India USD 2.9B (2024) and China more than 0.7 kg per capita in 2025, accelerating premium, dark, and sugar-free chocolate adoption globally. • Europe experiences 10–15% seasonal sales growth during holidays, while Brazil imported 150,000 MT of chocolate/cocoa products in 2025, reflecting expanding market activity. • UAE imported more than 45,000 MT in 2025, highlighting premium chocolate demand, and e-commerce with urban retail channels drive chocolate accessibility across Asia-Pacific.

Global Chocolate Market – Competitive Landscape

• Multinational conglomerates such as Mars, Ferrero, Mondelēz, Nestlé, and Hershey dominate the Global Chocolate Market, leveraging advanced R&D, diversified product portfolios, and large-scale manufacturing, with global cocoa utilization exceeding 4 million metric tonnes in 2025. Premium and artisanal brands, including Lindt, Valrhona, Godiva, and Ghirardelli, drive per-capita expenditure of more than USD 24.5 per person in 2024. • B2B and ingredient specialists supply industrial chocolate and cocoa derivatives, while emerging niche players capitalize on e-commerce growth and specialty retail, supported by online food and beverage sales rose 11.2% in 2025, reinforcing market growth, innovation, and adoption of premium and artisanal chocolate products. Global Chocolate Market- Recent Developments:

Company Year Recent Development Impact / Business Implication Mars, Inc. 2024 Sustainability milestones: 675,000 ha of farms assessed for deforestation risk, 112,000 farmers trained, 1.8 million trees distributed Reinforces sustainable, traceable cocoa supply chain, reduces regulatory risk, and ensures long-term raw material security Ferrero Group 2025 Achieved >90 % traceability for key ingredients; progress toward 2030 emissions reduction goals Enhances supply chain resilience, ESG credentials, and transparency, meeting regulatory and consumer expectations Mondelēz International 2025 Regulatory engagement to align compliance timelines with supply chain capabilities Proactive risk management and influence on global cocoa sourcing policies Nestlé S.A. 2024–2025 Launched sustainably sourced chocolate programs impact Nearly 30,000 farming families, scaling to 160,000 by 2030 Strengthens ethical sourcing, sustainability credentials, and supply chain security The Hershey Company 2024–2025 Achieved 43 % GHG emission reduction toward 50 % goal by 2030; expanded renewable energy and farmer programs Supports environmental governance, operational resilience, long-term supply stability, while maintaining market performance Chocolate Market Scope: Inquire before buying

Global Chocolate Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 128.1 Bn. Forecast Period 2026 to 2032 CAGR: 4.65% Market Size in 2032: USD 176.09 Bn. Segments Covered: by Type Milk Chocolate White Chocolate Dark Chocolate Others by Product Form Molded Countline Others by Nature Organic Conventional by Price Range Economy Mid-Range Premium by Packaging Type Pouches and Bags Boxed Chocolate Others by Distribution Channel Convenience Store Online Retail Store Supermarket/Hypermarket Others by End User Retail and Consumer Food service and HoReCa Others Chocolate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Chocolate Market, Key Players:

1. Mars, Inc. 2. Ferrero Group 3. Mondelēz International 4. Nestlé S.A. 5. The Hershey Company 6. Chocoladefabriken Lindt & Sprüngli AG 7. Barry Callebaut AG 8. Pladis Global (Ülker, Godiva) 9. Meiji Holdings Co., Ltd. 10. Ezaki Glico Co., Ltd. 11. Cargill Cocoa & Chocolate 12. Blommer Chocolate Company 13. Guan Chong Berhad 14. Puratos Group (Belcolade) 15. Natra 16. Valrhona 17. Orion Corporation 18. Godiva Chocolatier 19. Ghirardelli Chocolate Company 20. Russell Stover 21. Amedei 22. Fu Wan Chocolate 23. Vosges Haut Chocolat 24. Moonstruck Chocolatier Co. 25. TCHO Chocolate 26. Dandelion Chocolate 27. Puratos Artisan Lines 28. Cémoi Group 29. Irca 30. Bonajuto 31.Others FAQs Of Global Chocolate Market: Q1: What is the global chocolate market size and forecast for 2025–2032? A: The global chocolate market size was valued at USD 128.1 billion in 2025 and is forecast to reach USD 176.09 billion by 2032, growing at a CAGR of 4.65%. Q2: Which region dominates the global chocolate market share? A: Europe dominates the global chocolate market share due to the highest per-capita consumption and strong demand for premium and dark chocolates. Q3: What are the key trends driving global chocolate market growth? A: Premiumization, rising demand for dark and artisanal chocolates, and growing adoption of sugar-free, organic, and clean-label products are the key growth trends. Q4: Why is dark chocolate gaining popularity worldwide? A: Dark chocolate is gaining popularity globally due to its higher cocoa content, perceived health benefits, and increasing consumer health awareness. Q5: How does cocoa price volatility affect the global chocolate industry? A: Cocoa price volatility increases production costs and margin pressure, pushing manufacturers to adopt hedging strategies, sustainable sourcing, and cost optimization.

1. Chocolate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Chocolate Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Business Portfolio 2.2.4. Total Company Revenue (2025) 2.2.5. End User 2.2.6. Profit Margin (%) 2.2.7. Revenue Growth Rate (Y-O-Y) 2.2.8. Production Capacity (Metric Tons) 2.2.9. R&D investment (%) 2.2.10. Certifications & Compliance 2.2.11. Sustainability Initiatives 2.2.12. Distribution Channels 2.2.13. Supply Chain Resilience 2.2.14. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Chocolate Market: Dynamics 3.1. Chocolate Market Trends 3.2. Chocolate Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Regional Cocoa Cultivation and Processing Analysis 4.1. Major Cocoa Farming Regions Globally (West Africa, Latin America, Southeast Asia) 4.2. Global Cocoa Bean Production Statistics (2020–2025) 4.3. Regional Dependence on Cocoa Imports and Supply Concentration Risks 4.4. Role of International Cocoa Organizations and Government Support Programs 4.5. Global Supply Chain Integration Between Farmers, Traders, and Processors 5. Pricing and Cost Analysis 5.1. Global Historical and Current Chocolate Price Trends (2019–2024) 5.2. Retail Pricing by Region, Brand Tier, and Product Category 5.3. Impact of Cocoa, Sugar, and Dairy Price Volatility 5.4. Global Cost Structure: Raw Materials, Processing, Packaging, and Distribution 5.5. Global Price Forecast and Consumer Affordability Trends 6. Consumer Behavior and Demographics 6.1. Chocolate Consumption Patterns by Age Group and Gender Globally 6.2. Regional Taste Preferences and Flavor Trends 6.3. Seasonal, Festive, and Gifting-Led Consumption Patterns 6.4. Urban vs. Rural Chocolate Consumption Split 6.5. Health Consciousness, Indulgence, and Product Substitution Trends 6.6. Correlation Between Income Growth and Chocolate Consumption 6.7. Market Penetration by Income Segment and Region 7. Import and Trade Analysis 7.1. Global Cocoa and Chocolate Import–Export Statistics 7.2. Cocoa-Producing vs. Cocoa-Consuming Region Dynamics 7.3. Trade Policies, Tariffs, and Regulatory Barriers 7.4. Export Potential of Value-Added and Premium Chocolates 7.5. Global Trade Balance and Competitive Positioning 8. Regional Chocolate Market Overview 8.1. High-Consumption Regions by Value and Volume (Europe, North America, Asia-Pacific) 8.2. Retail Density and Market Accessibility by Region 8.3. Urbanization, Lifestyle Changes, and Purchasing Power Correlation 8.4. Chocolate Consumption Growth in Emerging Economies 8.5. High-Growth Markets and Future Expansion Hotspots 9. Health, Nutrition, and Product Innovation 9.1. Growth of Dark, Sugar-Free, Organic, and Vegan Chocolate Segments 9.2. Innovation in Functional, Fortified, and Protein-Enhanced Chocolates 9.3. Nutritional Awareness, Clean Labeling, and Ingredient Transparency 9.4. Global Regulatory Guidelines for Food Labeling and Claims 9.5. R&D Focus on Health Optimization Without Compromising Taste 10. Marketing and Branding Strategies 10.1. Global Consumer Engagement and Omnichannel Marketing Approaches 10.2. Packaging Innovation, Premiumization, and Sustainability Branding 10.3. Influence of Global Influencers, Celebrities, and Social Media Platforms 10.4. Seasonal Campaigns, Limited Editions, and Cross-Promotions 10.5. Retail Experience Optimization Across Physical and Digital Channels 11. E-Commerce and Digital Transformation 11.1. Growth of Online Chocolate Sales Across Global Markets 11.2. Subscription, Gifting, and Corporate Chocolate Platforms 11.3. Expansion of D2C and Digital-First Chocolate Brands 11.4. Online Consumer Behavior, Reviews, and Repeat Purchase Patterns 11.5. Impact of Pricing, Discounts, and Last-Mile Delivery Experience 12. Sustainability and ESG Practices 12.1. Ethical Cocoa Sourcing, Fair Trade, and Farmer Livelihood Programs 12.2. Sustainable and Biodegradable Packaging Innovations 12.3. Carbon-Neutral Manufacturing and Emission Reduction Initiatives 12.4. Corporate Social Responsibility Programs in Cocoa-Origin Countries 12.5. ESG Reporting and Compliance Trends Among Global Players 13. Global Chocolate Statistical and Comparative Analysis 13.1. Per Capita Chocolate Consumption by Region 13.2. Growth Rate Comparison: Mass, Premium, and Artisanal Segments 13.3. Price Elasticity, Premiumization Index, and Affordability Metrics 13.4. Cocoa Yield Productivity and Global Supply Chain Efficiency 13.5. Correlation Between Global GDP Growth and Chocolate Demand 14. Logistics, Cold Chain, and Distribution Efficiency Analysis 14.1. Temperature Sensitivity and Shelf-Life Challenges Across Regions 14.2. Global Infrastructure Requirements for Storage and Transportation 14.3. Regional Disparities in Distribution and Cold Chain Efficiency 14.4. Adoption of Smart Logistics, IoT, and Cold Chain Technologies 14.5. Cost Optimization and Risk Mitigation Strategies 15. Production and Supply Chain Analysis 15.1. Global Cocoa Sourcing Strategies and Import Dependence 15.2. Role of Contract Manufacturing and Co-Packers 15.3. Packaging, Warehousing, and Cold Chain Management 15.4. Impact of Climate Change on Cocoa Supply and Manufacturing 16. Investment and Funding Landscape 16.1. Global Investment Trends in the Chocolate and Confectionery Sector 16.2. M&A Activity and Strategic Alliances Among Key Players 16.3. Venture Capital Funding in Premium and Artisanal Chocolate Brands 16.4. Manufacturing Capacity Expansion and Automation Investments 16.5. Outlook for Future Capital Inflows and ROI Trends 17. Regulatory and Food Safety Landscape 17.1. Global Food Safety Standards and Chocolate Labeling Regulations 17.2. Sugar, Fat, and Additive Compliance Across Regions 17.3. Advertising, Sustainability, and Child-Targeted Marketing Regulations 17.4. Packaging, Shelf-Life, and Traceability Requirements 17.5. Impact of Regulatory Changes on Product Innovation and Market Entry 18. Chocolate Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 18.1. Chocolate Market Size and Forecast, By Type (2025-2032) 18.1.1. Milk Chocolate 18.1.2. White Chocolate 18.1.3. Dark Chocolate 18.1.4. Others 18.2. Chocolate Market Size and Forecast, By Product Form (2025-2032) 18.2.1. Molded 18.2.2. Countline 18.2.3. Others 18.3. Chocolate Market Size and Forecast, By Nature (2025-2032) 18.3.1. Organic 18.3.2. Conventional 18.4. Chocolate Market Size and Forecast, By Price Range (2025-2032) 18.4.1. Economy 18.4.2. Mid-Range 18.4.3. Premium 18.5. Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 18.5.1. Pouches and Bags 18.5.2. Boxed Chocolate 18.5.3. Others 18.6. Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 18.6.1. Convenience Store 18.6.2. Online Retail Store 18.6.3. Supermarket/Hypermarket 18.6.4. Others 18.7. Chocolate Market Size and Forecast, By End User (2025-2032) 18.7.1. Retail and Consumer 18.7.2. Food service and HoReCa 18.7.3. Others 18.8. Chocolate Market Size and Forecast, By Region (2025-2032) 18.8.1. North America 18.8.2. Europe 18.8.3. Asia Pacific 18.8.4. Middle East and Africa 18.8.5. South America 19. North America Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 19.1. North America Chocolate Market Size and Forecast, By Type (2025-2032) 19.1.1. Milk Chocolate 19.1.2. White Chocolate 19.1.3. Dark Chocolate 19.1.4. Others 19.2. North America Chocolate Market Size and Forecast, By Product Form (2025-2032) 19.2.1. Molded 19.2.2. Countline 19.2.3. Others 19.3. North America Chocolate Market Size and Forecast, By Nature (2025-2032) 19.3.1. Organic 19.3.2. Conventional 19.4. North America Chocolate Market Size and Forecast, By Price Range (2025-2032) 19.4.1. Economy 19.4.2. Mid-Range 19.4.3. Premium 19.5. North America Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 19.5.1. Pouches and Bags 19.5.2. Boxed Chocolate 19.5.3. Others 19.6. North America Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 19.6.1. Convenience Store 19.6.2. Online Retail Store 19.6.3. Supermarket/Hypermarket 19.6.4. Others 19.7. North America Chocolate Market Size and Forecast, By End User (2025-2032) 19.7.1. Retail and Consumer 19.7.2. Food service and HoReCa 19.7.3. Others 19.8. North America Chocolate Market Size and Forecast, by Country (2025-2032) 19.8.1. United States 19.8.1.1. United States Chocolate Market Size and Forecast, By Type (2025-2032) 19.8.1.2. United States Chocolate Market Size and Forecast, By Product Form (2025-2032) 19.8.1.3. United States Chocolate Market Size and Forecast, By Nature (2025-2032) 19.8.1.4. United States Chocolate Market Size and Forecast, By Price Range (2025-2032) 19.8.1.5. United States Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 19.8.1.6. United States Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 19.8.1.7. United States Chocolate Market Size and Forecast, By End User (2025-2032) 19.8.1.8. United States Chocolate Market Size and Forecast, by Country (2025-2032) 19.8.2. Canada 19.8.2.1. Canada Chocolate Market Size and Forecast, By Type (2025-2032) 19.8.2.2. Canada Chocolate Market Size and Forecast, By Product Form (2025-2032) 19.8.2.3. Canada Chocolate Market Size and Forecast, By Nature (2025-2032) 19.8.2.4. Canada Chocolate Market Size and Forecast, By Price Range (2025-2032) 19.8.2.5. Canada Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 19.8.2.6. Canada Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 19.8.2.7. Canada Chocolate Market Size and Forecast, By End User (2025-2032) 19.8.2.8. Canada Chocolate Market Size and Forecast, by Country (2025-2032) 19.8.3. Mexico 19.8.3.1. Mexico Chocolate Market Size and Forecast, By Type (2025-2032) 19.8.3.2. Mexico Chocolate Market Size and Forecast, By Product Form (2025-2032) 19.8.3.3. Mexico Chocolate Market Size and Forecast, By Nature (2025-2032) 19.8.3.4. Mexico Chocolate Market Size and Forecast, By Price Range (2025-2032) 19.8.3.5. Mexico Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 19.8.3.6. Mexico Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 19.8.3.7. Mexico Chocolate Market Size and Forecast, By End User (2025-2032) 19.8.3.8. Mexico Chocolate Market Size and Forecast, by Country (2025-2032) 20. Europe Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 20.1. Europe Chocolate Market Size and Forecast, By Type (2025-2032) 20.2. Europe Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.3. Europe Chocolate Market Size and Forecast, By Nature (2025-2032) 20.4. Europe Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.5. Europe Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.6. Europe Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.7. Europe Chocolate Market Size and Forecast, By End User (2025-2032) 20.8. Europe Chocolate Market Size and Forecast, by Country (2025-2032) 20.8.1. United Kingdom 20.8.1.1. United Kingdom Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.1.2. United Kingdom Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.1.3. United Kingdom Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.1.4. United Kingdom Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.1.5. United Kingdom Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.1.6. United Kingdom Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.1.7. United Kingdom Chocolate Market Size and Forecast, By End User (2025-2032) 20.8.2. France 20.8.2.1. France Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.2.2. France Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.2.3. France Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.2.4. France Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.2.5. France Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.2.6. France Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.2.7. France Chocolate Market Size and Forecast, By End User (2025-2032) 20.8.3. Germany 20.8.3.1. Germany Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.3.2. Germany Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.3.3. Germany Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.3.4. Germany Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.3.5. Germany Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.3.6. Germany Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.3.7. Germany Chocolate Market Size and Forecast, By End User (2025-2032) 20.8.4. Italy 20.8.4.1. Italy Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.4.2. Italy Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.4.3. Italy Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.4.4. Italy Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.4.5. Italy Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.4.6. Italy Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.4.7. Italy Chocolate Market Size and Forecast, By End User (2025-2032) 20.8.5. Spain 20.8.5.1. Spain Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.5.2. Spain Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.5.3. Spain Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.5.4. Spain Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.5.5. Spain Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.5.6. Spain Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.5.7. Spain Chocolate Market Size and Forecast, By End User (2025-2032) 20.8.6. Sweden 20.8.6.1. Sweden Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.6.2. Sweden Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.6.3. Sweden Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.6.4. Sweden Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.6.5. Sweden Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.6.6. Sweden Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.6.7. Sweden Chocolate Market Size and Forecast, By End User (2025-2032) 20.8.7. Russia 20.8.7.1. Russia Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.7.2. Russia Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.7.3. Russia Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.7.4. Russia Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.7.5. Russia Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.7.6. Russia Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.7.7. Russia Chocolate Market Size and Forecast, By End User (2025-2032) 20.8.8. Rest of Europe 20.8.8.1. Rest of Europe Chocolate Market Size and Forecast, By Type (2025-2032) 20.8.8.2. Rest of Europe Chocolate Market Size and Forecast, By Product Form (2025-2032) 20.8.8.3. Rest of Europe Chocolate Market Size and Forecast, By Nature (2025-2032) 20.8.8.4. Rest of Europe Chocolate Market Size and Forecast, By Price Range (2025-2032) 20.8.8.5. Rest of Europe Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 20.8.8.6. Rest of Europe Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 20.8.8.7. Rest of Europe Chocolate Market Size and Forecast, By End User (2025-2032) 21. Asia Pacific Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 21.1. Asia Pacific Chocolate Market Size and Forecast, By Type (2025-2032) 21.2. Asia Pacific Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.3. Asia Pacific Chocolate Market Size and Forecast, By Nature (2025-2032) 21.4. Asia Pacific Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.5. Asia Pacific Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.6. Asia Pacific Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.7. Asia Pacific Chocolate Market Size and Forecast, By End User (2025-2032) 21.8. Asia Pacific Chocolate Market Size and Forecast, by Country (2025-2032) 21.8.1. China 21.8.1.1. China Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.1.2. China Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.1.3. China Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.1.4. China Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.1.5. China Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.1.6. China Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.1.7. China Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.2. S Korea 21.8.2.1. S Korea Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.2.2. S Korea Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.2.3. S Korea Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.2.4. S Korea Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.2.5. S Korea Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.2.6. S Korea Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.2.7. S Korea Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.3. Japan 21.8.3.1. Japan Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.3.2. Japan Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.3.3. Japan Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.3.4. Japan Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.3.5. Japan Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.3.6. Japan Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.3.7. Japan Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.4. India 21.8.4.1. India Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.4.2. India Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.4.3. India Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.4.4. India Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.4.5. India Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.4.6. India Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.4.7. India Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.5. Australia 21.8.5.1. Australia Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.5.2. Australia Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.5.3. Australia Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.5.4. Australia Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.5.5. Australia Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.5.6. Indonesia Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.5.7. Indonesia Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.6. Indonesia 21.8.6.1. Indonesia Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.6.2. Indonesia Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.6.3. Indonesia Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.6.4. Indonesia Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.6.5. Indonesia Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.6.6. Indonesia Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.6.7. Indonesia Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.7. Malaysia 21.8.7.1. Malaysia Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.7.2. Malaysia Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.7.3. Malaysia Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.7.4. Malaysia Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.7.5. Malaysia Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.7.6. Malaysia Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.7.7. Malaysia Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.8. Philippines 21.8.8.1. Philippines Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.8.2. Philippines Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.8.3. Philippines Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.8.4. Philippines Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.8.5. Philippines Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.8.6. Philippines Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.8.7. Philippines Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.9. Thailand 21.8.9.1. Thailand Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.9.2. Thailand Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.9.3. Thailand Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.9.4. Thailand Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.9.5. Thailand Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.9.6. Thailand Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.9.7. Thailand Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.10. Vietnam 21.8.10.1. Vietnam Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.10.2. Vietnam Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.10.3. Vietnam Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.10.4. Vietnam Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.10.5. Vietnam Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.10.6. Vietnam Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.10.7. Vietnam Chocolate Market Size and Forecast, By End User (2025-2032) 21.8.11. Rest of Asia Pacific 21.8.11.1. Rest of Asia Pacific Chocolate Market Size and Forecast, By Type (2025-2032) 21.8.11.2. Rest of Asia Pacific Chocolate Market Size and Forecast, By Product Form (2025-2032) 21.8.11.3. Rest of Asia Pacific Chocolate Market Size and Forecast, By Nature (2025-2032) 21.8.11.4. Rest of Asia Pacific Chocolate Market Size and Forecast, By Price Range (2025-2032) 21.8.11.5. Rest of Asia Pacific Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 21.8.11.6. Rest of Asia Pacific Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 21.8.11.7. Rest of Asia Pacific Chocolate Market Size and Forecast, By End User (2025-2032) 22. Middle East and Africa Chocolate Market Size and Forecast (by Value in USD Billion) (2025-2032) 22.1. Middle East and Africa Chocolate Market Size and Forecast, By Type (2025-2032) 22.2. Middle East and Africa Chocolate Market Size and Forecast, By Product Form (2025-2032) 22.3. Middle East and Africa Chocolate Market Size and Forecast, By Nature (2025-2032) 22.4. Middle East and Africa Chocolate Market Size and Forecast, By Price Range (2025-2032) 22.5. Middle East and Africa Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 22.6. Middle East and Africa Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 22.7. Middle East and Africa Chocolate Market Size and Forecast, By End User (2025-2032) 22.8. Middle East and Africa Chocolate Market Size and Forecast, by Country (2025-2032) 22.8.1. South Africa 22.8.1.1. South Africa Chocolate Market Size and Forecast, By Type (2025-2032) 22.8.1.2. South Africa Chocolate Market Size and Forecast, By Product Form (2025-2032) 22.8.1.3. South Africa Chocolate Market Size and Forecast, By Nature (2025-2032) 22.8.1.4. South Africa Chocolate Market Size and Forecast, By Price Range (2025-2032) 22.8.1.5. South Africa Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 22.8.1.6. South Africa Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 22.8.1.7. South Africa Chocolate Market Size and Forecast, By End User (2025-2032) 22.8.2. GCC 22.8.2.1. GCC Chocolate Market Size and Forecast, By Type (2025-2032) 22.8.2.2. GCC Chocolate Market Size and Forecast, By Product Form (2025-2032) 22.8.2.3. GCC Chocolate Market Size and Forecast, By Nature (2025-2032) 22.8.2.4. GCC Chocolate Market Size and Forecast, By Price Range (2025-2032) 22.8.2.5. GCC Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 22.8.2.6. GCC Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 22.8.2.7. GCC Chocolate Market Size and Forecast, By End User (2025-2032) 22.8.3. Egypt 22.8.3.1. Egypt Chocolate Market Size and Forecast, By Type (2025-2032) 22.8.3.2. Egypt Chocolate Market Size and Forecast, By Product Form (2025-2032) 22.8.3.3. Egypt Chocolate Market Size and Forecast, By Nature (2025-2032) 22.8.3.4. Egypt Chocolate Market Size and Forecast, By Price Range (2025-2032) 22.8.3.5. Egypt Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 22.8.3.6. Egypt Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 22.8.3.7. Egypt Chocolate Market Size and Forecast, By End User (2025-2032) 22.8.4. Nigeria 22.8.4.1. Nigeria Chocolate Market Size and Forecast, By Type (2025-2032) 22.8.4.2. Nigeria Chocolate Market Size and Forecast, By Product Form (2025-2032) 22.8.4.3. Nigeria Chocolate Market Size and Forecast, By Nature (2025-2032) 22.8.4.4. Nigeria Chocolate Market Size and Forecast, By Price Range (2025-2032) 22.8.4.5. Nigeria Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 22.8.4.6. Nigeria Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 22.8.4.7. Nigeria Chocolate Market Size and Forecast, By End User (2025-2032) 22.8.5. Rest of ME&A 22.8.5.1. Rest of ME&A Chocolate Market Size and Forecast, By Type (2025-2032) 22.8.5.2. Rest of ME&A Chocolate Market Size and Forecast, By Product Form (2025-2032) 22.8.5.3. Rest of ME&A Chocolate Market Size and Forecast, By Nature (2025-2032) 22.8.5.4. Rest of ME&A Chocolate Market Size and Forecast, By Price Range (2025-2032) 22.8.5.5. Rest of ME&A Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 22.8.5.6. Rest of ME&A Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 22.8.5.7. Rest of ME&A Chocolate Market Size and Forecast, By End User (2025-2032) 23. South America Chocolate Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 23.1. South America Chocolate Market Size and Forecast, By Type (2025-2032) 23.2. South America Chocolate Market Size and Forecast, By Product Form (2025-2032) 23.3. South America Chocolate Market Size and Forecast, By Nature (2025-2032) 23.4. South America Chocolate Market Size and Forecast, By Price Range (2025-2032) 23.5. South America Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 23.6. South America Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 23.7. South America Chocolate Market Size and Forecast, By End User (2025-2032) 23.8. South America Chocolate Market Size and Forecast, by Country (2025-2032) 23.8.1. Brazil 23.8.1.1. Brazil Chocolate Market Size and Forecast, By Type (2025-2032) 23.8.1.2. Brazil Chocolate Market Size and Forecast, By Product Form (2025-2032) 23.8.1.3. Brazil Chocolate Market Size and Forecast, By Nature (2025-2032) 23.8.1.4. Brazil Chocolate Market Size and Forecast, By Price Range (2025-2032) 23.8.1.5. Brazil Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 23.8.1.6. Brazil Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 23.8.1.7. Brazil Chocolate Market Size and Forecast, By End User (2025-2032) 23.8.2. Argentina 23.8.2.1. Argentina Chocolate Market Size and Forecast, By Type (2025-2032) 23.8.2.2. Argentina Chocolate Market Size and Forecast, By Product Form (2025-2032) 23.8.2.3. Argentina Chocolate Market Size and Forecast, By Nature (2025-2032) 23.8.2.4. Argentina Chocolate Market Size and Forecast, By Price Range (2025-2032) 23.8.2.5. Argentina Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 23.8.2.6. Argentina Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 23.8.2.7. Argentina Chocolate Market Size and Forecast, By End User (2025-2032) 23.8.3. Colombia 23.8.3.1. Colombia Chocolate Market Size and Forecast, By Type (2025-2032) 23.8.3.2. Colombia Chocolate Market Size and Forecast, By Product Form (2025-2032) 23.8.3.3. Colombia Chocolate Market Size and Forecast, By Nature (2025-2032) 23.8.3.4. Colombia Chocolate Market Size and Forecast, By Price Range (2025-2032) 23.8.3.5. Colombia Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 23.8.3.6. Colombia Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 23.8.3.7. Colombia Chocolate Market Size and Forecast, By End User (2025-2032) 23.8.4. Chile 23.8.4.1. Chile Chocolate Market Size and Forecast, By Type (2025-2032) 23.8.4.2. Chile Chocolate Market Size and Forecast, By Product Form (2025-2032) 23.8.4.3. Chile Chocolate Market Size and Forecast, By Nature (2025-2032) 23.8.4.4. Chile Chocolate Market Size and Forecast, By Price Range (2025-2032) 23.8.4.5. Chile Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 23.8.4.6. Chile Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 23.8.4.7. Chile Chocolate Market Size and Forecast, By End User (2025-2032) 23.8.5. Rest Of South America 23.8.5.1. Rest Of South America Chocolate Market Size and Forecast, By Type (2025-2032) 23.8.5.2. Rest Of South America Chocolate Market Size and Forecast, By Product Form (2025-2032) 23.8.5.3. Rest Of South America Chocolate Market Size and Forecast, By Nature (2025-2032) 23.8.5.4. Rest Of South America Chocolate Market Size and Forecast, By Price Range (2025-2032) 23.8.5.5. Rest Of South America Chocolate Market Size and Forecast, By Packaging Type (2025-2032) 23.8.5.6. Rest Of South America Chocolate Market Size and Forecast, By Distribution Channel (2025-2032) 23.8.5.7. Rest Of South America Chocolate Market Size and Forecast, By End User (2025-2032) 24. Company Profile: Key Players 24.1. Mars, Inc. 24.1.1. Company Overview 24.1.2. Business Portfolio 24.1.3. Financial Overview 24.1.4. SWOT Analysis 24.1.5. Strategic Analysis 24.1.6. Recent Developments 24.2. Ferrero Group 24.3. Mondelēz International 24.4. Nestlé S.A. 24.5. The Hershey Company 24.6. Chocoladefabriken Lindt & Sprüngli AG 24.7. Barry Callebaut AG 24.8. Pladis Global (Ülker, Godiva) 24.9. Meiji Holdings Co., Ltd. 24.10. Ezaki Glico Co., Ltd. 24.11. Cargill Cocoa & Chocolate 24.12. Blommer Chocolate Company 24.13. Guan Chong Berhad 24.14. Puratos Group (Belcolade) 24.15. Natra 24.16. Valrhona 24.17. Orion Corporation 24.18. Godiva Chocolatier 24.19. Ghirardelli Chocolate Company 24.20. Russell Stover 24.21. Amedei 24.22. Fu Wan Chocolate 24.23. Vosges Haut‑Chocolat 24.24. Moonstruck Chocolate Co. 24.25. TCHO Chocolate 24.26. Dandelion Chocolate 24.27. Puratos Artisan Lines 24.28. Cémoi Group 24.29. Irca 24.30. Bonajuto 25. Key Findings 26. Industry Recommendations 27. Chocolate Market: Research Methodology