The Cesium Market size was valued at USD 363.58 Million in 2024 and the total revenue is expected to grow at a CAGR of 6.5 % from 2025 to 2032, reaching nearly USD 601.72 Million.Cesium Market Overview:

Cesium is a light, gold-colored alkali metal mineral that interacts rapidly with water and is easily affected by air. Cesium may be found in rare minerals such as pollucite and lepidolite. Pollucite is abundant at Bernic Lake, Canada, and in the United States, and the element may be industrially manufactured there. The majority of commercial cesium production, however, is leftover from lithium manufacturing. Cesium derivatives are most commonly used as drilling fluids for oil and gas, and they are also employed in the production of specialty optical glass, as a catalytic promoter in chemical reactions, in vacuum tubes, and in radioactivity monitoring and surveillance equipment. Cesium’s applications in high-tech industries, nuclear technology, and advanced electronics make it a critical element in modern industrial processes, driving Cesium Market growth.To know about the Research Methodology:- Request Free Sample Report

Cesium Market Dynamics:

Rising Adoption of Cesium in Advanced Cancer Therapies to Boost Cesium Market Growth Cesium is a naturally occurring material that is useful in the treatment of cancer. It can infiltrate malignant cells and transform their acidic pH to basic pH. Once the pH is alkaline, cesium damages the cancer cell's metabolism and hence its capacity to reproduce. Cesium chloride is utilized in the healthcare sector industries for neuroimaging, cancer treatment, and positron emission tomography. A growing number of cancer patients are requesting reliable medical treatments that include the use of cesium isotopes, which is anticipated to drive Cesium Market growth in the previously mentioned forecast period. Cesium-operated oncology therapy is not only cost-effective but also safe and without adverse effects. The primary application of cesium is in petrochemical processing. High-Performance Cesium Formate Drilling Fluids to boost Demand in the Petroleum Industry The dilute or brine liquid of cesium formate is widely utilized as a drilling fluid and drill point lube in the petroleum sector. Cesium formate is created by combining cesium hydroxide with formic acid. It may be utilized efficiently even when the subsurface temperature and pressure are extremely high. As a result of its adaptability, the Cesium market demand is rapidly in the petroleum industry. The US Department of the Interior included cesium on its list of essential minerals in May 2021. 15 metals are extremely vital to high technology sectors, combat uses, and mobile communications. China regulates the availability of every single one of them due to its 95 percent manufacturing control. This comprises cesium, for which China has a grip on stocks, mines are no longer providing sufficient output, and the US has none, leaving Canada as North America's last chance.Cesium Market Segment Analysis:

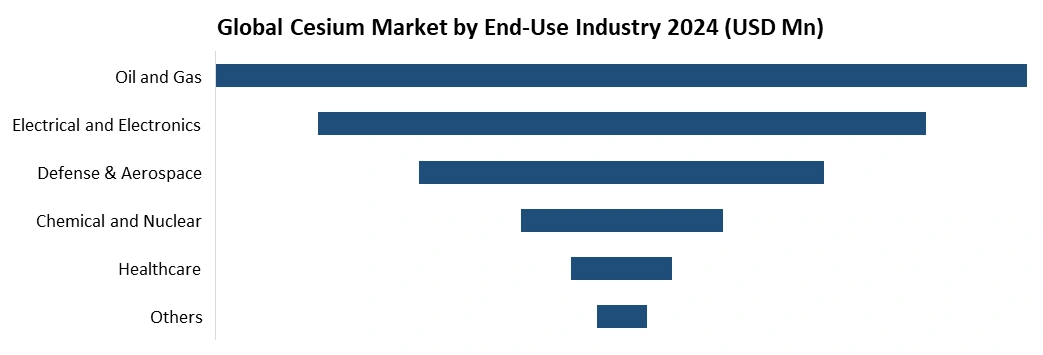

Based on the application, in 2024, the Cesium Market sees significant demand across a variety of applications. The largest segment is likely to be Drilling Fluids in the oil and gas industry, where cesium compounds like cesium formate are essential for high-density drilling fluids. Medicinal Drugs will also play a crucial role, particularly for cesium’s use in cancer treatment, while applications in Optoelectronics, such as in atomic clocks, photoelectric cells, and other advanced technologies, will see steady Cesium Market growth. Catalysis & Chemical Synthesis continue to be important, leveraging cesium’s unique chemical properties. The Glass & Ceramics sector use cesium for specialized glass products, and Nuclear Power & Radiation Detection will remain a key area for cesium’s use in radiation detection. Other emerging applications in diverse fields will further contribute to market growth.By End-Use Industry, Based on end-use industry, oil and gas held the highest cesium market share. This is attributable to cesium formate brines are crucial for high-pressure, high-temperature drilling operations. These brines ability to provide exceptional density, thermal stability, and lubricity, making them safer and more efficient in comparison with conventional drilling fluids. The product can also assist in preventing blowouts, reducing formation damage, and improving wellbore stability, especially in deepwater and complex reservoirs. Hence, these factors play a significant contribution to the dominance of the oil and gas end-use industry.

Cesium Market Regional Insights:

North America is expected to dominated the Cesium market share in 2024. Few cesium ores are produced in the United States; all ore is sourced from Canada. A few of the necessary metals and chemicals are also transported from Germany and other countries. Canada's availability of lepidolite and pollucite ore deposits looks to be secure. The economy’s growth after the pandemic, the lack of interest in cesium for Magnetohydrodynamic power production, contemporary domestic use is anticipated to be less than 30,000 kg/yr. The total global consumption is expected to be less than 7,000 kg/year. The total accessible North American stocks are large in comparison to the United States and the global demand for cesium. A cesium laser has been purchased for use in ballistic missiles and other technical applications. Considering China's ability to deprive industrialists of a rare mineral e.g. Cesium, which would severely upset the American industry and impede the development of crucial military hardware. As a result, the United States and Canada eventually agreed in December 2021 on a policy to lower the demand for precious minerals produced or regulated by China. The objective of the report is to present a comprehensive analysis of the Cesium market to the stakeholders in the industry. The past and current status of the industry, with the forecasted market size and trends, are presented in the report with the analysis of complicated data in simple language.The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Cesium market dynamics, structure by analyzing the market segments and projecting the Cesium market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Cesium market make the report investor’s guide.

Cesium Market Competitive Landscape

Major Cesium players are putting more focus on integrating mining, refining, and derivative production to uphold cost efficiency and quality control. Investment in cesium-based technologies, including atomic clocks, optical glass, and specialty chemicals, propels competitive advantage among players operating in the market. Availability of cesium is often tied to lithium and tantalum extraction by-products, making suppliers sensitive to upstream disruptions. In addition, companies target high-value sectors such as aerospace, defense, and healthcare, decreasing dependence on commodity markets. Players increasingly focus on environmental extraction methods and recycling of cesium-containing materials for meeting ESG standards.Recent Development

• On 18 February 2025, Grid Metals Corp announced that it had signed a cesium supply agreement with the Tantalum Mining Corporation of Canada Limited. This agreement will provide funding for Grid to drill for cesium at its Donner Property. If drilling identifies enough resources, the agreement allows for 10,000 tonnes of Grid’s cesium material to be processed at the Tanco Cesium Plant, the only cesium processing plant in the western world. • On 6 September 2024, Bentley Systems announced the acquisition of 3D geospatial company Cesium. This acquisition is expected to greatly influence Bentley Systems' business growth by expanding its geographical reach and business portfolio.Cesium Market Scope: Inquire before buying

Cesium Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 363.58 Mn. Forecast Period 2025 to 2032 CAGR: 6.5% Market Size in 2032: USD 601.72 Mn. Segments Covered: by Product Cesium Formate Cesium Chloride and Other Halides Cesium Carbonate Cesium Nitrate Cesium Hydroxide Others by Grade Technical Pharmaceutical Optical by Application Drilling Fluids (Oil & Gas Industry) Optoelectronics, Atomic Clocks, Photoelectric Cells Catalysis & Chemical Synthesis Glass & Ceramics Medicinal Drugs Nuclear Power & Radiation Detection Others by End-Use Industry Oil and Gas Electrical and Electronics Defense & Aerospace Chemical and Nuclear Healthcare Others Cesium Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cesium Market, Key Players

1. Thermo Fisher Scientific 2. American Elements 3. Cabot Corporation 4. Albemarle Corporation 5. GFS Chemicals, Inc. 6. Sigma-Aldrich Corporation 7. Materion Corporation 8. Schlumberger Limited 9. Pioneer Resources 10. Avalon Advanced Materials 11. Power Metals Corp 12. Frontier Lithium 13. Prochem, Inc. 14. NOAH Technologies Corporation 15. Sinomine Resource Group Co., Ltd 16. AMSYN 17. Reade Advanced Materials 18. Isoray Inc. 19. KANTO CHEMICAL CO., INC 20. ALPHA CHEMIKA 21. Island Pyrochemical Industries 22. Microsemi 23. SkySpring Nanomaterials 24. Iwatani Corporation 25. HiMedia Laboratories 26. EMEC 27. Rare Earth Products, Inc 28. BLDpharm 29. GODO SHIGEN Co., Ltd. 30. Bat New Materials Co. Ltd.Frequently Asked Questions:

1] What segments are covered in the Cesium Market report? Ans. The segments covered in the Cesium Market report are based on Product, Grade, Application, End-use Industry, and region 2] Which region is expected to hold the highest share of the Cesium Market? Ans. The North America region is expected to hold the highest share of the Cesium Market. 3] What is the market size of the Cesium Market by 2032? Ans. The market size of the Cesium Market by 2032 is USD 601.72 Mn. 4] What is the growth rate of the Cesium Market? Ans. The Global Cesium Market is growing at a CAGR of 6.5 % during the forecasting period 2025-2032. 5] What was the market size of the Cesium Market in 2024? Ans. The market size of the Cesium Market in 2024 was USD 363.58 Mn.

1. Cesium Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Cesium Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Cesium Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Cesium Market: Dynamics 3.1. Cesium Market Trends by Region 3.1.1. North America Cesium Market Trends 3.1.2. Europe Cesium Market Trends 3.1.3. Asia Pacific Cesium Market Trends 3.1.4. Middle East and Africa Cesium Market Trends 3.1.5. South America Cesium Market Trends 3.2. Cesium Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cesium Market Drivers 3.2.1.2. North America Cesium Market Restraints 3.2.1.3. North America Cesium Market Opportunities 3.2.1.4. North America Cesium Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cesium Market Drivers 3.2.2.2. Europe Cesium Market Restraints 3.2.2.3. Europe Cesium Market Opportunities 3.2.2.4. Europe Cesium Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cesium Market Drivers 3.2.3.2. Asia Pacific Cesium Market Restraints 3.2.3.3. Asia Pacific Cesium Market Opportunities 3.2.3.4. Asia Pacific Cesium Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cesium Market Drivers 3.2.4.2. Middle East and Africa Cesium Market Restraints 3.2.4.3. Middle East and Africa Cesium Market Opportunities 3.2.4.4. Middle East and Africa Cesium Market Challenges 3.2.5. South America 3.2.5.1. South America Cesium Market Drivers 3.2.5.2. South America Cesium Market Restraints 3.2.5.3. South America Cesium Market Opportunities 3.2.5.4. South America Cesium Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Cesium Industry 3.8. Analysis of Government Schemes and Initiatives For Cesium Industry 3.9. Cesium Market Trade Analysis 3.10. The Global Pandemic Impact on Cesium Market 4. Cesium Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Cesium Market Size and Forecast, by Product (2024-2032) 4.1.1. Cesium Formate 4.1.2. Cesium Chloride and Other Halides 4.1.3. Cesium Carbonate 4.1.4. Cesium Nitrate 4.1.5. Cesium Hydroxide 4.1.6. Others 4.2. Cesium Market Size and Forecast, by Grade (2024-2032) 4.2.1. Technical 4.2.2. Pharmaceutical 4.2.3. Optical 4.3. Cesium Market Size and Forecast, by Application (2024-2032) 4.3.1. Drilling Fluids (Oil & Gas Industry) 4.3.2. Optoelectronics, Atomic Clocks, Photoelectric Cells 4.3.3. Catalysis & Chemical Synthesis 4.3.4. Glass & Ceramics 4.3.5. Medicinal Drugs 4.3.6. Nuclear Power & Radiation Detection 4.3.7. Others 4.4. Cesium Market Size and Forecast, by End Use Industry (2024-2032) 4.4.1. Oil and Gas 4.4.2. Electrical and Electronics 4.4.3. Defense & Aerospace 4.4.4. Chemical and Nuclear 4.4.5. Healthcare 4.4.6. Others 4.5. Cesium Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Cesium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Cesium Market Size and Forecast, by Product (2024-2032) 5.1.1. Cesium Formate 5.1.2. Cesium Chloride and Other Halides 5.1.3. Cesium Carbonate 5.1.4. Cesium Nitrate 5.1.5. Cesium Hydroxide 5.1.6. Others 5.2. North America Cesium Market Size and Forecast, by Grade (2024-2032) 5.2.1. Technical 5.2.2. Pharmaceutical 5.2.3. Optical 5.3. North America Cesium Market Size and Forecast, by Application (2024-2032) 5.3.1. Drilling Fluids (Oil & Gas Industry) 5.3.2. Optoelectronics, Atomic Clocks, Photoelectric Cells 5.3.3. Catalysis & Chemical Synthesis 5.3.4. Glass & Ceramics 5.3.5. Medicinal Drugs 5.3.6. Nuclear Power & Radiation Detection 5.3.7. Others 5.4. North America Cesium Market Size and Forecast, by End Use Industry (2024-2032) 5.4.1. Oil and Gas 5.4.2. Electrical and Electronics 5.4.3. Defense & Aerospace 5.4.4. Chemical and Nuclear 5.4.5. Healthcare 5.4.6. Others 5.5. North America Cesium Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Cesium Market Size and Forecast, by Product (2024-2032) 5.5.1.1.1. Cesium Formate 5.5.1.1.2. Cesium Chloride and Other Halides 5.5.1.1.3. Cesium Carbonate 5.5.1.1.4. Cesium Nitrate 5.5.1.1.5. Cesium Hydroxide 5.5.1.1.6. Others 5.5.1.2. United States Cesium Market Size and Forecast, by Grade (2024-2032) 5.5.1.2.1. Technical 5.5.1.2.2. Pharmaceutical 5.5.1.2.3. Optical 5.5.1.3. United States Cesium Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Drilling Fluids (Oil & Gas Industry) 5.5.1.3.2. Optoelectronics, Atomic Clocks, Photoelectric Cells 5.5.1.3.3. Catalysis & Chemical Synthesis 5.5.1.3.4. Glass & Ceramics 5.5.1.3.5. Medicinal Drugs 5.5.1.3.6. Nuclear Power & Radiation Detection 5.5.1.3.7. Others 5.5.1.4. United States Cesium Market Size and Forecast, by End Use Industry (2024-2032) 5.5.1.4.1. Oil and Gas 5.5.1.4.2. Electrical and Electronics 5.5.1.4.3. Defense & Aerospace 5.5.1.4.4. Chemical and Nuclear 5.5.1.4.5. Healthcare 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Cesium Market Size and Forecast, by Product (2024-2032) 5.5.2.1.1. Cesium Formate 5.5.2.1.2. Cesium Chloride and Other Halides 5.5.2.1.3. Cesium Carbonate 5.5.2.1.4. Cesium Nitrate 5.5.2.1.5. Cesium Hydroxide 5.5.2.1.6. Others 5.5.2.2. Canada Cesium Market Size and Forecast, by Grade (2024-2032) 5.5.2.2.1. Technical 5.5.2.2.2. Pharmaceutical 5.5.2.2.3. Optical 5.5.2.3. Canada Cesium Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Drilling Fluids (Oil & Gas Industry) 5.5.2.3.2. Optoelectronics, Atomic Clocks, Photoelectric Cells 5.5.2.3.3. Catalysis & Chemical Synthesis 5.5.2.3.4. Glass & Ceramics 5.5.2.3.5. Medicinal Drugs 5.5.2.3.6. Nuclear Power & Radiation Detection 5.5.2.3.7. Others 5.5.2.4. Canada Cesium Market Size and Forecast, by End Use Industry (2024-2032) 5.5.2.4.1. Oil and Gas 5.5.2.4.2. Electrical and Electronics 5.5.2.4.3. Defense & Aerospace 5.5.2.4.4. Chemical and Nuclear 5.5.2.4.5. Healthcare 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Cesium Market Size and Forecast, by Product (2024-2032) 5.5.3.1.1. Cesium Formate 5.5.3.1.2. Cesium Chloride and Other Halides 5.5.3.1.3. Cesium Carbonate 5.5.3.1.4. Cesium Nitrate 5.5.3.1.5. Cesium Hydroxide 5.5.3.1.6. Others 5.5.3.2. Mexico Cesium Market Size and Forecast, by Grade (2024-2032) 5.5.3.2.1. Technical 5.5.3.2.2. Pharmaceutical 5.5.3.2.3. Optical 5.5.3.3. Mexico Cesium Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Drilling Fluids (Oil & Gas Industry) 5.5.3.3.2. Optoelectronics, Atomic Clocks, Photoelectric Cells 5.5.3.3.3. Catalysis & Chemical Synthesis 5.5.3.3.4. Glass & Ceramics 5.5.3.3.5. Medicinal Drugs 5.5.3.3.6. Nuclear Power & Radiation Detection 5.5.3.3.7. Others 5.5.3.4. Mexico Cesium Market Size and Forecast, by End Use Industry (2024-2032) 5.5.3.4.1. Oil and Gas 5.5.3.4.2. Electrical and Electronics 5.5.3.4.3. Defense & Aerospace 5.5.3.4.4. Chemical and Nuclear 5.5.3.4.5. Healthcare 5.5.3.4.6. Others 6. Europe Cesium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Cesium Market Size and Forecast, by Product (2024-2032) 6.2. Europe Cesium Market Size and Forecast, by Grade (2024-2032) 6.3. Europe Cesium Market Size and Forecast, by Application (2024-2032) 6.4. Europe Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5. Europe Cesium Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Cesium Market Size and Forecast, by Product (2024-2032) 6.5.1.2. United Kingdom Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.1.3. United Kingdom Cesium Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5.2. France 6.5.2.1. France Cesium Market Size and Forecast, by Product (2024-2032) 6.5.2.2. France Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.2.3. France Cesium Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Cesium Market Size and Forecast, by Product (2024-2032) 6.5.3.2. Germany Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.3.3. Germany Cesium Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Cesium Market Size and Forecast, by Product (2024-2032) 6.5.4.2. Italy Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.4.3. Italy Cesium Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Cesium Market Size and Forecast, by Product (2024-2032) 6.5.5.2. Spain Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.5.3. Spain Cesium Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Cesium Market Size and Forecast, by Product (2024-2032) 6.5.6.2. Sweden Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.6.3. Sweden Cesium Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Cesium Market Size and Forecast, by Product (2024-2032) 6.5.7.2. Austria Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.7.3. Austria Cesium Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Cesium Market Size and Forecast, by End Use Industry (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Cesium Market Size and Forecast, by Product (2024-2032) 6.5.8.2. Rest of Europe Cesium Market Size and Forecast, by Grade (2024-2032) 6.5.8.3. Rest of Europe Cesium Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7. Asia Pacific Cesium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Cesium Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Cesium Market Size and Forecast, by Grade (2024-2032) 7.3. Asia Pacific Cesium Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5. Asia Pacific Cesium Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Cesium Market Size and Forecast, by Product (2024-2032) 7.5.1.2. China Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.1.3. China Cesium Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Cesium Market Size and Forecast, by Product (2024-2032) 7.5.2.2. S Korea Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.2.3. S Korea Cesium Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Cesium Market Size and Forecast, by Product (2024-2032) 7.5.3.2. Japan Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.3.3. Japan Cesium Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.4. India 7.5.4.1. India Cesium Market Size and Forecast, by Product (2024-2032) 7.5.4.2. India Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.4.3. India Cesium Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Cesium Market Size and Forecast, by Product (2024-2032) 7.5.5.2. Australia Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.5.3. Australia Cesium Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Cesium Market Size and Forecast, by Product (2024-2032) 7.5.6.2. Indonesia Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.6.3. Indonesia Cesium Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Cesium Market Size and Forecast, by Product (2024-2032) 7.5.7.2. Malaysia Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.7.3. Malaysia Cesium Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Cesium Market Size and Forecast, by Product (2024-2032) 7.5.8.2. Vietnam Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.8.3. Vietnam Cesium Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Cesium Market Size and Forecast, by Product (2024-2032) 7.5.9.2. Taiwan Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.9.3. Taiwan Cesium Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Cesium Market Size and Forecast, by End Use Industry (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Cesium Market Size and Forecast, by Product (2024-2032) 7.5.10.2. Rest of Asia Pacific Cesium Market Size and Forecast, by Grade (2024-2032) 7.5.10.3. Rest of Asia Pacific Cesium Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Cesium Market Size and Forecast, by End Use Industry (2024-2032) 8. Middle East and Africa Cesium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Cesium Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Cesium Market Size and Forecast, by Grade (2024-2032) 8.3. Middle East and Africa Cesium Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Cesium Market Size and Forecast, by End Use Industry (2024-2032) 8.5. Middle East and Africa Cesium Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Cesium Market Size and Forecast, by Product (2024-2032) 8.5.1.2. South Africa Cesium Market Size and Forecast, by Grade (2024-2032) 8.5.1.3. South Africa Cesium Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Cesium Market Size and Forecast, by End Use Industry (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Cesium Market Size and Forecast, by Product (2024-2032) 8.5.2.2. GCC Cesium Market Size and Forecast, by Grade (2024-2032) 8.5.2.3. GCC Cesium Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Cesium Market Size and Forecast, by End Use Industry (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Cesium Market Size and Forecast, by Product (2024-2032) 8.5.3.2. Nigeria Cesium Market Size and Forecast, by Grade (2024-2032) 8.5.3.3. Nigeria Cesium Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Cesium Market Size and Forecast, by End Use Industry (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Cesium Market Size and Forecast, by Product (2024-2032) 8.5.4.2. Rest of ME&A Cesium Market Size and Forecast, by Grade (2024-2032) 8.5.4.3. Rest of ME&A Cesium Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Cesium Market Size and Forecast, by End Use Industry (2024-2032) 9. South America Cesium Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Cesium Market Size and Forecast, by Product (2024-2032) 9.2. South America Cesium Market Size and Forecast, by Grade (2024-2032) 9.3. South America Cesium Market Size and Forecast, by Application(2024-2032) 9.4. South America Cesium Market Size and Forecast, by End Use Industry (2024-2032) 9.5. South America Cesium Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Cesium Market Size and Forecast, by Product (2024-2032) 9.5.1.2. Brazil Cesium Market Size and Forecast, by Grade (2024-2032) 9.5.1.3. Brazil Cesium Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Cesium Market Size and Forecast, by End Use Industry (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Cesium Market Size and Forecast, by Product (2024-2032) 9.5.2.2. Argentina Cesium Market Size and Forecast, by Grade (2024-2032) 9.5.2.3. Argentina Cesium Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Cesium Market Size and Forecast, by End Use Industry (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Cesium Market Size and Forecast, by Product (2024-2032) 9.5.3.2. Rest Of South America Cesium Market Size and Forecast, by Grade (2024-2032) 9.5.3.3. Rest Of South America Cesium Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Cesium Market Size and Forecast, by End Use Industry (2024-2032) 10. Company Profile: Key Players 10.1. Thermo Fisher Scientific 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. American Elements 10.3. Cabot Corporation 10.4. Albemarle Corporation 10.5. GFS Chemicals, Inc. 10.6. Sigma-Aldrich Corporation 10.7. Materion Corporation 10.8. Schlumberger Limited 10.9. Pioneer Resources 10.10. Avalon Advanced Materials 10.11. Power Metals Corp 10.12. Frontier Lithium 10.13. Prochem, Inc. 10.14. NOAH Technologies Corporation 10.15. Sinomine Resource Group Co., Ltd 10.16. AMSYN 10.17. Reade Advanced Materials 10.18. Isoray Inc. 10.19. KANTO CHEMICAL CO., INC 10.20. ALPHA CHEMIKA 10.21. Island Pyrochemical Industries 10.22. Microsemi 10.23. SkySpring Nanomaterials 10.24. Iwatani Corporation 10.25. HiMedia Laboratories 10.26. EMEC 10.27. Rare Earth Products, Inc 10.28. BLDpharm 10.29. GODO SHIGEN Co., Ltd. 10.30. Bat New Materials Co. Ltd. 11. Key Findings 12. Industry Recommendations 13. Cesium Market: Research Methodology 14. Terms and Glossary