Global Capecitabine Market size was valued at USD 469.33 Mn. in 2024, and the total Capecitabine Market is expected to grow by 6.29 %. from 2025 to 2032, reaching nearly USD 674.99 Mn.Global Capecitabine Market Overview

Capecitabine, commercially available under brand names such as Xeloda, is an oral chemotherapy agent used in the treatment of colorectal, stomach, and breast cancers. Classified as a fluoropyrimidine carbamate, it is converted into 5-fluorouracil (5-FU) directly within tumor tissues, allowing higher efficacy with reduced systemic toxicity compared to conventional intravenous chemotherapies. Its oral formulation further enhances patient convenience, aligning with the growing trend toward at-home cancer care and reduced hospital visits. The adoption of combination therapies and precision oncology CREATES lucrative growth opportunities to Capecitabine Market. For Instance, the CAPOX regimen, which combines capecitabine with oxaliplatin and is widely used for colorectal cancer treatment, offering improved progression-free survival and better quality of life for patients. Moreover, the rise of personalized medicine, where patients are selected for treatment based on tumor genetics and biomarkers, is broadening the scope of capecitabine applications.To know about the Research Methodology:-Request Free Sample Report Rising cancer prevalence remains the strongest growth driver. According to the World Health Organization, cancer cases are expected to rise to 30 million annually by 2040, with colorectal cancer contributing significantly. In the U.S. alone, the American Cancer Society projected more than 150,000 new colorectal cancer cases in 2024, underscoring the expanding need for capecitabine.

Global Capecitabine Market Dynamics

Global Cancer Trends to Drive the Capecitabine Market Growth The rising global incidence of cancer is one of the major factors boosting the growth of the Capecitabine Market. Cancer continues to remain one of the leading causes of mortality worldwide, creating a critical demand for effective therapies. According to estimates by the World Health Organization (WHO), cancer ranks among the most significant public health challenges globally. Supporting this, the U.S. National Cancer Institute reported in May 2024 that cancer accounted for 9.6 million deaths and nearly 19 million new cases in 2022 alone. These figures underline the severity of the disease burden, positioning cancer as the leading cause of death across many regions. Furthermore, projections indicate that the number of new cancer cases is expected to increase by nearly 69% over the next two decades, further highlighting the urgent need for advanced therapeutic solutions. Capecitabine, an oral chemotherapy drug widely prescribed for colorectal, breast, and gastric cancers, is increasingly recognized as a vital part of treatment regimens. Its effectiveness, convenience of oral administration, and broad clinical acceptance are expected to significantly drive market demand. As cancer prevalence escalates, the adoption of capecitabine as an essential treatment option is set to expand, reinforcing its importance in global oncology care. Rising Combination Therapy and Generic Access creates lucrative growth opportunities to the Capecitabine Market Combination therapy plays a significant role in enhancing the efficacy of cancer treatment, and Capecitabine is increasingly used alongside other chemotherapeutic or targeted agents to improve clinical outcomes. By working synergistically, these regimens not only increase survival rates but also expand the therapeutic application of Capecitabine across multiple cancer types such as colorectal, breast, and gastric cancers. For instance, the CAPOX regimen, which combines Capecitabine with oxaliplatin, is widely recognized as a standard of care in colorectal cancer and has significantly improved patient prognosis. Such proven benefits are driving oncologists worldwide to adopt Capecitabine-based combination therapies, thereby accelerating global demand. The growing accessibility of generic versions is a key driver for Capecitabine Market growth. With multiple manufacturers securing regulatory approvals, the cost of Capecitabine has declined, making it more affordable and accessible to patients, especially in emerging markets. This increased affordability ensures broader patient reach, boosting volume growth across regions. The rising cancer prevalence and the widespread adoption of combination therapies. The U.S. alone recorded 1.9 million new cancer cases in 2021, where Capecitabine remains a frontline treatment for breast and colorectal cancers. Similarly, Mexico reported over 195,000 new cancer cases in 2021, further underscoring the expanding demand for Capecitabine in the region.Global Capecitabine Market Segment Analysis:

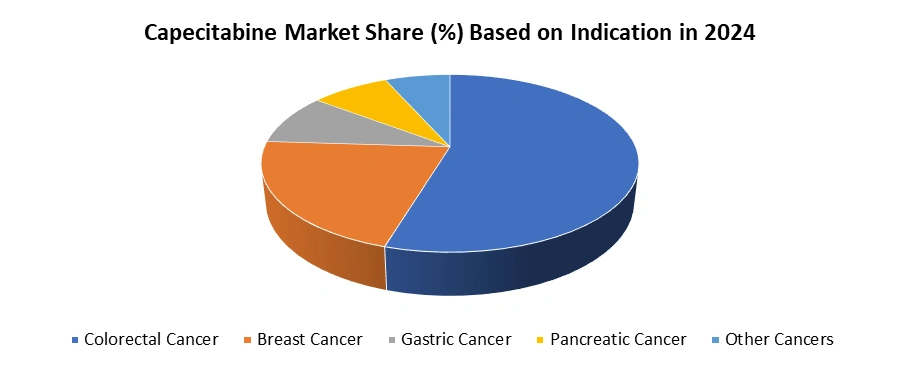

Based on Indication, Global Capecitabine Market is segmented into Colorectal Cancer, Breast Cancer, Gastric Cancer, Pancreatic Cancer, and Other Cancers In 2024, colorectal cancer dominated the Indication segment of Capecitabine Market Segment. This dominance is largely attributed to the high global prevalence of colorectal cancer, which ranks among the top three most commonly diagnosed cancers worldwide. According to the World Health Organization, millions of new colorectal cancer cases are reported annually, driving consistent demand for effective treatment options such as Capecitabine. Capecitabine’s clinical efficacy as both monotherapy and in combination regimens notably the CAPOX regimen (Capecitabine with Oxaliplatin) makes it a preferred choice for adjuvant and metastatic colorectal cancer treatment. Its oral formulation offers patients greater convenience compared to intravenous chemotherapy, enhancing adherence and treatment outcomes. Furthermore, the widespread adoption of metronomic dosing strategies for elderly and advanced-stage patients supports its broader use. Regulatory approvals across multiple geographies, along with inclusion in global clinical guidelines, further solidify Capecitabine’s role as a frontline therapy. With ongoing research into improved formulations and combination approaches, the colorectal cancer segment is expected to maintain its leadership in the Capecitabine market, reflecting both clinical relevance and strong patient demand.

Global Capecitabine Market Regional Analysis:

North America dominated the Capecitabine Market in 2024, The United States held the largest market share in North America. A high burden of cancer, continuous product development, and robust healthcare infrastructure. According to the American Cancer Society, the U.S. recorded approximately 1.9 million new cancer cases in 2021, including over 104,270 colorectal and 284,200 breast cancer cases annually two major therapeutic areas where Capecitabine remains integral. The adoption of metronomic dosing regimens low-dose, continuous chemotherapy has further strengthened Capecitabine’s role, particularly among elderly pancreatic cancer patients. This approach enhances tolerability, prolongs disease control, and expands treatment applicability to a challenging patient population. Mexico also contributes to regional growth, with 195,499 new cancer cases in 2021, spanning colorectal, lymphoma, lung, and breast cancers, thereby supporting Capecitabine demand across diverse oncology segments. Key growth enablers include advanced healthcare infrastructure, significant government research funding, and a supportive regulatory landscape, with the USFDA facilitating timely drug approvals. In addition, the presence of major pharmaceutical players such as Teva, Roche, and Mylan ensures wide product availability and ongoing innovation. Global Capecitabine Market Competitive Analysis: The Capecitabine market is competitive, with strong competition between established generics and branded players. Leading generic manufacturers such as Teva, Cipla, and Dr. Reddy’s utilize vertically integrated supply chains, enabling them to offer competitive pricing and secure raw material access. On the branded side, CHEPLAPHARM focuses on safeguarding its franchise through patient-support initiatives and exploration of novel combination therapies to sustain differentiation. Supply-chain resilience has emerged as a key competitive factor. Many companies are adopting dual-sourcing strategies and investing in continuous-flow production technologies to enhance efficiency, reduce cycle times, and improve quality reliability. Firms with a geographically diversified manufacturing base are better positioned to manage regulatory challenges and logistical disruptions. Strategic collaborations between pharmaceutical firms and diagnostics providers are increasingly driving the market, particularly in advancing DPYD testing to ensure faster treatment initiation and safer therapeutic outcomes. Also, partnerships with specialty pharmacies strengthen patient-adherence programs, a feature highly regarded by payers seeking to improve value, minimize wastage, and optimize clinical results. Global Capecitabine Market Key Trends: 1. Growing Adoption of Combination Therapies Combination regimens involving Capecitabine with other chemotherapeutic or targeted agents are gaining traction, especially in colorectal, breast, and gastric cancers. Regimens such as CAPOX (Capecitabine + Oxaliplatin) have become standard for colorectal cancer, significantly improving survival outcomes. This trend enhances Capecitabine’s clinical utility, expands its therapeutic scope, and drives sustained market demand. 2. Rising Use of Pharmacogenomic Testing (DPYD Testing) The market is witnessing increased integration of DPYD gene testing to evaluate patients’ tolerance to Capecitabine. Pharmacogenomic screening helps identify individuals at risk of severe toxicity, ensuring safer and more effective treatment. Collaborations between pharmaceutical firms and diagnostic providers are accelerating adoption, aligning with precision oncology practices and boosting Capecitabine’s long-term market relevance. Global Capecitabine Market Key Development: January 23,2023, CHEPLAPHARM has expanded its oncology portfolio by acquiring the commercial rights to Xeloda (Capecitabine) in China from Roche, following its 2022 global rights acquisition (excluding Japan and China). Approved in China since 1997, Xeloda is widely used in treating metastatic breast, colorectal, and advanced gastric cancers. With registration in 80 countries, it remains a key cancer therapy. This deal strengthens CHEPLAPHARM’s footprint in the world’s second-largest pharmaceutical market, though it excludes manufacturing facilities and employees. January 19, 2024, Processa Pharmaceuticals announced the expansion of its Next Generation Capecitabine (NGC-Cap) program into advanced or metastatic breast cancer, following FDA agreement that existing data can support a Phase 2 trial. Breast cancer, the most diagnosed cancer with over 3.8 million patients in the U.S., presents a larger market than colorectal cancer. Processa expects to initiate its Phase 2 trial in Q3 2024, aiming to demonstrate NGC-Cap’s improved safety and efficacy over existing capecitabine therapies. August 28, 2024 Camber Pharmaceuticals announced the launch of generic Xeloda (Capecitabine Tablets, USP), expanding its oncology portfolio. Indicated for colorectal, breast, gastric, esophageal, gastroesophageal junction, and pancreatic cancers, Capecitabine offers both monotherapy and combination therapy options. The tablets are available in 150 mg and 500 mg strengths in 60-count bottles, and 500 mg in 120-count bottles. December 17 ,2022 Shilpa Medicare has launched Capecitabine (Capebel) dispersible tablets (DT), designed to disperse in water within 90 seconds for treating colorectal and metastatic breast cancer. Patients can now replace swallowing 7–8 tablets daily with drinking 100 ml dissolved solution twice daily, improving compliance and outcomes. Backed by bioequivalence studies and CDSCO approval, Shilpa plans to introduce Capebel 1 gm DT in global markets through its partners.Capecitabine Market Scope: Inquire before buying

Global Capecitabine Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 469.33 Mn. Forecast Period 2025 to 2032 CAGR: 6.29% Market Size in 2032: USD 764.57 Mn. Segments Covered: by Indication Colorectal Cancer Breast Cancer Gastric Cancer Pancreatic Cancer Other Cancers by Form Tablet Powder by Formulation Branded Generic by Distribution Channel Hospitals Oncology Clinics / Clinical Laboratories Retail & Online Pharmacies Others Capecitabine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Capecitabine Market, Key Players:

North America 1. Roche Holding AG (USA) 2. Teva Pharmaceutical Industries Ltd. (USA) 3. Fresenius SE & Co. KGaA (USA) 4. Pfizer Inc. (USA) 5. Merck & Co., Inc. (USA) 6. Dr. Reddy's Laboratories Ltd. (USA) 7. Sun Pharmaceutical Industries Ltd. (USA) 8. LGM Pharma (USA) 9. Apotex Inc. (Canada) Europe 10. Hikma Pharmaceuticals PLC (U.K) 11. Accord Healthcare Ltd. (U.K) 12. Novartis AG (Switzerland) 13. GSK plc (UK) 14. Sandoz Group (Switzerland) Asia Pacific 15. Aurobindo Pharma (India) 16. Intas Pharmaceuticals Ltd. (India) 17. Cerata Pharmaceuticals (India) 18. Alkem Labs Ltd. (India) 19. Zeon Pharma (India) 20. Avanscure Lifesciences (India) 21. Torrent Pharmaceuticals (India) 22. Reliance Group (India) 23. Global Calcium (India) 24. Zydus Lifesciences (India) 25. Ranbaxy Laboratories Ltd. (India)Global Capecitabine Market Frequently Asked Questions

1. Global Capecitabine Market Size? Ans: The Global Capecitabine Market, valued at USD 469.33 Mn in 2024, is projected to grow at a strong CAGR of 6.29 %, reaching USD 764.57 Mn by 2032. 2. The End Users of the Global Capecitabine Market? Ans: Hospital, Retail Pharmacies, Online Pharmacies are the End Users of the Global Capecitabine Market. 3. Which region in the Global Capecitabine Market dominates the most? Ans: North America is the region that dominates the Global Capecitabine Market. 4. What is the study period of this market? Ans: The Global Capecitabine Market is studied from 2024 to 2032.

1. Capecitabine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Capecitabine Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Capecitabine Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Capecitabine Market: Dynamics 3.1. Capecitabine Market Trends by Region 3.1.1. North America Capecitabine Market Trends 3.1.2. Europe Capecitabine Market Trends 3.1.3. Asia Pacific Capecitabine Market Trends 3.1.4. Middle East and Africa Capecitabine Market Trends 3.1.5. South America Capecitabine Market Trends 3.2. Capecitabine Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Capecitabine Market Drivers 3.2.1.2. North America Capecitabine Market Restraints 3.2.1.3. North America Capecitabine Market Opportunities 3.2.1.4. North America Capecitabine Market Challenges 3.2.2. Europe 3.2.2.1. Europe Capecitabine Market Drivers 3.2.2.2. Europe Capecitabine Market Restraints 3.2.2.3. Europe Capecitabine Market Opportunities 3.2.2.4. Europe Capecitabine Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Capecitabine Market Drivers 3.2.3.2. Asia Pacific Capecitabine Market Restraints 3.2.3.3. Asia Pacific Capecitabine Market Opportunities 3.2.3.4. Asia Pacific Capecitabine Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Capecitabine Market Drivers 3.2.4.2. Middle East and Africa Capecitabine Market Restraints 3.2.4.3. Middle East and Africa Capecitabine Market Opportunities 3.2.4.4. Middle East and Africa Capecitabine Market Challenges 3.2.5. South America 3.2.5.1. South America Capecitabine Market Drivers 3.2.5.2. South America Capecitabine Market Restraints 3.2.5.3. South America Capecitabine Market Opportunities 3.2.5.4. South America Capecitabine Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Capecitabine Industry 3.8. Analysis of Government Schemes and Initiatives For Capecitabine Industry 3.9. Capecitabine Market Trade Analysis 3.10. The Global Pandemic Impact on Capecitabine Market 4. Capecitabine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Capecitabine Market Size and Forecast, by Indication (2024-2032) 4.1.1. Colorectal Cancer 4.1.2. Breast Cancer 4.1.3. Gastric Cancer 4.1.4. Pancreatic Cancer 4.1.5. Other Cancers 4.2. Capecitabine Market Size and Forecast, by Form (2024-2032) 4.2.1. Tablet 4.2.2. Powder 4.3. Capecitabine Market Size and Forecast, by Formulation (2024-2032) 4.3.1. Branded 4.3.2. Generic 4.4. Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.1. Hospitals 4.4.2. Oncology Clinics / Clinical Laboratories 4.4.3. Retail & Online Pharmacies 4.4.4. Others 4.5. Capecitabine Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Capecitabine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Capecitabine Market Size and Forecast, by Indication (2024-2032) 5.1.1. Colorectal Cancer 5.1.2. Breast Cancer 5.1.3. Gastric Cancer 5.1.4. Pancreatic Cancer 5.1.5. Other Cancers 5.2. North America Capecitabine Market Size and Forecast, by Form (2024-2032) 5.2.1. Tablet 5.2.2. Powder 5.3. North America Capecitabine Market Size and Forecast, by Formulation (2024-2032) 5.3.1. Branded 5.3.2. Generic 5.4. North America Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1. Hospitals 5.4.2. Oncology Clinics / Clinical Laboratories 5.4.3. Retail & Online Pharmacies 5.4.4. Others 5.5. North America Capecitabine Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Capecitabine Market Size and Forecast, by Indication (2024-2032) 5.5.1.1.1. Colorectal Cancer 5.5.1.1.2. Breast Cancer 5.5.1.1.3. Gastric Cancer 5.5.1.1.4. Pancreatic Cancer 5.5.1.1.5. Other Cancers 5.5.1.2. United States Capecitabine Market Size and Forecast, by Form (2024-2032) 5.5.1.2.1. Tablet 5.5.1.2.2. Powder 5.5.1.3. United States Capecitabine Market Size and Forecast, by Formulation (2024-2032) 5.5.1.3.1. Branded 5.5.1.3.2. Generic 5.5.1.4. United States Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.1.4.1. Hospitals 5.5.1.4.2. Oncology Clinics / Clinical Laboratories 5.5.1.4.3. Retail & Online Pharmacies 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Capecitabine Market Size and Forecast, by Indication (2024-2032) 5.5.2.1.1. Colorectal Cancer 5.5.2.1.2. Breast Cancer 5.5.2.1.3. Gastric Cancer 5.5.2.1.4. Pancreatic Cancer 5.5.2.1.5. Other Cancers 5.5.2.2. Canada Capecitabine Market Size and Forecast, by Form (2024-2032) 5.5.2.2.1. Tablet 5.5.2.2.2. Powder 5.5.2.3. Canada Capecitabine Market Size and Forecast, by Formulation (2024-2032) 5.5.2.3.1. Branded 5.5.2.3.2. Generic 5.5.2.4. Canada Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.2.4.1. Hospitals 5.5.2.4.2. Oncology Clinics / Clinical Laboratories 5.5.2.4.3. Retail & Online Pharmacies 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Capecitabine Market Size and Forecast, by Indication (2024-2032) 5.5.3.1.1. Colorectal Cancer 5.5.3.1.2. Breast Cancer 5.5.3.1.3. Gastric Cancer 5.5.3.1.4. Pancreatic Cancer 5.5.3.1.5. Other Cancers 5.5.3.2. Mexico Capecitabine Market Size and Forecast, by Form (2024-2032) 5.5.3.2.1. Tablet 5.5.3.2.2. Powder 5.5.3.3. Mexico Capecitabine Market Size and Forecast, by Formulation (2024-2032) 5.5.3.3.1. Branded 5.5.3.3.2. Generic 5.5.3.4. Mexico Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.3.4.1. Hospitals 5.5.3.4.2. Oncology Clinics / Clinical Laboratories 5.5.3.4.3. Retail & Online Pharmacies 5.5.3.4.4. Others 6. Europe Capecitabine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.2. Europe Capecitabine Market Size and Forecast, by Form (2024-2032) 6.3. Europe Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.4. Europe Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5. Europe Capecitabine Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.1.2. United Kingdom Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.1.3. United Kingdom Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.1.4. United Kingdom Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.2. France 6.5.2.1. France Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.2.2. France Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.2.3. France Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.2.4. France Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.3.2. Germany Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.3.3. Germany Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.3.4. Germany Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.4.2. Italy Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.4.3. Italy Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.4.4. Italy Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.5.2. Spain Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.5.3. Spain Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.5.4. Spain Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.6.2. Sweden Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.6.3. Sweden Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.6.4. Sweden Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.7.2. Austria Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.7.3. Austria Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.7.4. Austria Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Capecitabine Market Size and Forecast, by Indication (2024-2032) 6.5.8.2. Rest of Europe Capecitabine Market Size and Forecast, by Form (2024-2032) 6.5.8.3. Rest of Europe Capecitabine Market Size and Forecast, by Formulation (2024-2032) 6.5.8.4. Rest of Europe Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Capecitabine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.2. Asia Pacific Capecitabine Market Size and Forecast, by Form (2024-2032) 7.3. Asia Pacific Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.4. Asia Pacific Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5. Asia Pacific Capecitabine Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.1.2. China Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.1.3. China Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.1.4. China Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.2.2. S Korea Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.2.3. S Korea Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.2.4. S Korea Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.3.2. Japan Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.3.3. Japan Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.3.4. Japan Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.4. India 7.5.4.1. India Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.4.2. India Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.4.3. India Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.4.4. India Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.5.2. Australia Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.5.3. Australia Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.5.4. Australia Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.6.2. Indonesia Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.6.3. Indonesia Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.6.4. Indonesia Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.7.2. Malaysia Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.7.3. Malaysia Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.7.4. Malaysia Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.8.2. Vietnam Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.8.3. Vietnam Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.8.4. Vietnam Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.9.2. Taiwan Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.9.3. Taiwan Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.9.4. Taiwan Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Capecitabine Market Size and Forecast, by Indication (2024-2032) 7.5.10.2. Rest of Asia Pacific Capecitabine Market Size and Forecast, by Form (2024-2032) 7.5.10.3. Rest of Asia Pacific Capecitabine Market Size and Forecast, by Formulation (2024-2032) 7.5.10.4. Rest of Asia Pacific Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Capecitabine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Capecitabine Market Size and Forecast, by Indication (2024-2032) 8.2. Middle East and Africa Capecitabine Market Size and Forecast, by Form (2024-2032) 8.3. Middle East and Africa Capecitabine Market Size and Forecast, by Formulation (2024-2032) 8.4. Middle East and Africa Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 8.5. Middle East and Africa Capecitabine Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Capecitabine Market Size and Forecast, by Indication (2024-2032) 8.5.1.2. South Africa Capecitabine Market Size and Forecast, by Form (2024-2032) 8.5.1.3. South Africa Capecitabine Market Size and Forecast, by Formulation (2024-2032) 8.5.1.4. South Africa Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Capecitabine Market Size and Forecast, by Indication (2024-2032) 8.5.2.2. GCC Capecitabine Market Size and Forecast, by Form (2024-2032) 8.5.2.3. GCC Capecitabine Market Size and Forecast, by Formulation (2024-2032) 8.5.2.4. GCC Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Capecitabine Market Size and Forecast, by Indication (2024-2032) 8.5.3.2. Nigeria Capecitabine Market Size and Forecast, by Form (2024-2032) 8.5.3.3. Nigeria Capecitabine Market Size and Forecast, by Formulation (2024-2032) 8.5.3.4. Nigeria Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Capecitabine Market Size and Forecast, by Indication (2024-2032) 8.5.4.2. Rest of ME&A Capecitabine Market Size and Forecast, by Form (2024-2032) 8.5.4.3. Rest of ME&A Capecitabine Market Size and Forecast, by Formulation (2024-2032) 8.5.4.4. Rest of ME&A Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Capecitabine Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Capecitabine Market Size and Forecast, by Indication (2024-2032) 9.2. South America Capecitabine Market Size and Forecast, by Form (2024-2032) 9.3. South America Capecitabine Market Size and Forecast, by Formulation(2024-2032) 9.4. South America Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 9.5. South America Capecitabine Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Capecitabine Market Size and Forecast, by Indication (2024-2032) 9.5.1.2. Brazil Capecitabine Market Size and Forecast, by Form (2024-2032) 9.5.1.3. Brazil Capecitabine Market Size and Forecast, by Formulation (2024-2032) 9.5.1.4. Brazil Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Capecitabine Market Size and Forecast, by Indication (2024-2032) 9.5.2.2. Argentina Capecitabine Market Size and Forecast, by Form (2024-2032) 9.5.2.3. Argentina Capecitabine Market Size and Forecast, by Formulation (2024-2032) 9.5.2.4. Argentina Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Capecitabine Market Size and Forecast, by Indication (2024-2032) 9.5.3.2. Rest Of South America Capecitabine Market Size and Forecast, by Form (2024-2032) 9.5.3.3. Rest Of South America Capecitabine Market Size and Forecast, by Formulation (2024-2032) 9.5.3.4. Rest Of South America Capecitabine Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. Roche Holding AG (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Teva Pharmaceutical Industries Ltd. (USA) 10.3. Fresenius SE & Co. KGaA (USA) 10.4. Pfizer Inc. (USA) 10.5. Merck & Co., Inc. (USA) 10.6. Dr. Reddy's Laboratories Ltd. (USA) 10.7. Sun Pharmaceutical Industries Ltd. (USA) 10.8. LGM Pharma (USA) 10.9. Apotex Inc. (Canada) 10.10. Hikma Pharmaceuticals PLC (U.K) 10.11. Accord Healthcare Ltd. (U.K) 10.12. Novartis AG (Switzerland) 10.13. GSK plc (UK) 10.14. Sandoz Group (Switzerland) 10.15. Aurobindo Pharma (India) 10.16. Intas Pharmaceuticals Ltd. (India) 10.17. Cerata Pharmaceuticals (India) 10.18. Alkem Labs Ltd. (India) 10.19. Zeon Pharma (India) 10.20. Avanscure Lifesciences (India) 10.21. Torrent Pharmaceuticals (India) 10.22. Reliance Group (India) 10.23. Global Calcium (India) 10.24. Zydus Lifesciences (India) 10.25. Ranbaxy Laboratories Ltd. (India) 11. Key Findings 12. Industry Recommendations 13. Capecitabine Market: Research Methodology 14. Terms and Glossary