The Global Candle Market is expected to grow from USD 9.79 billion in 2024 to USD 18.39 billion by 2032 at an 8.2% CAGR. The rising use of aromatherapy, demand for natural wax, wellness trends, home décor preferences, eco-friendly fragrances, and strong seasonal and gifting consumption drive the Candle industry Growth.Candle Market Overview

A candle is a wax-based product with a wick that produces light, fragrance, and ambiance when burned for décor or relaxation. The candle market refers to the global industry that produces decorative, aromatic, and functional candles used for ambiance, wellness, gifting, and interior décor across residential and commercial spaces. The sector is evolving rapidly as consumers increasingly prioritize home aesthetics, relaxation rituals, aromatherapy benefits, and premium fragrance experiences. The industry has been strongly influenced by lifestyle trends such as hygge, rising interest in wellness routines, and the use of scented candles as mood enhancers. Around 42% of U.S. consumers burn candles in living rooms, and nine out of ten use them to create a cozy atmosphere, reflecting deep integration into daily life. Seasonal demand is strong, with 35% of annual sales occurring during the holiday period, while the remaining 65% comes from everyday use, décor, and gifting. Innovation remains central, with brands introducing natural waxes like soy, coconut, and beeswax, along with cleaner fragrances and sustainable packaging to meet rising expectations in the eco-friendly and premium candles categories. The Candle Market benefits from strong online growth, as digital channels allow consumers to explore niche fragrances and artisanal products more easily. The paraffin wax remains widely used due to its strong scent throw and affordability, dominating mass-market production.To know about the Research Methodology :- Request Free Sample Report

Trend: shift toward natural, sustainable, and wellness-oriented candles.

Modern buyers are increasingly choosing candles made from soy wax, beeswax, coconut wax, or blended botanical waxes, steering away from traditional paraffin due to concerns about soot, synthetic fragrances, and petroleum-based inputs. This shift is reinforced by the growing influence of the eco-friendly candle movement, where consumers actively seek candles labeled as non-toxic, vegan, cruelty-free, phthalate-free, and sustainably sourced. The rise of wellness culture, along with the global popularity of aromatherapy, has positioned candles as functional wellness tools rather than mere décor items, boosting candle market share. The scented candles infused with essential oils such as lavender, eucalyptus, peppermint, chamomile, and sandalwood have surged in Candle Market demand, as users associate them with stress relief, mood balancing, sleep enhancement, and emotional well-being. Social media trends, especially on Instagram and TikTok, amplify this movement through home décor influencers showcasing minimalist interiors enhanced with natural candle aesthetics. Brands now launch seasonal wellness collections and limited-edition aromatherapy lines to maintain relevance. Additionally, packaging has evolved into recyclable jars, biodegradable labels, and reusable vessels, aligning with sustainability expectations. Premium brands are especially benefiting, as consumers show greater willingness to pay for safe, artisanal, and ethically crafted products. Increasing adoption of aromatherapy and holistic wellness practices to drive the Candle Market Modern consumers are placing greater emphasis on emotional balance, relaxation routines, and mental well-being, particularly after the rise of stress-related concerns in recent years, which continues to strengthen demand in the candle market. Essential-oil-infused candles featuring lavender for relaxation, rose for emotional comfort, bergamot for anxiety relief, and eucalyptus for respiratory benefits have seen remarkable growth as wellness tools integrated into daily life. Homes, spas, yoga studios, meditation centers, and even workplaces now use aromatherapy candles to enhance ambiance, increase mindfulness, and support mood elevation. Seasonal and atmospheric preferences also play a critical role, as consumers rely on fragrance-driven candles to create cozy environments during holidays, celebrations, and weekend routines. The surge in interior décor trends, such as hygge and minimalism, further supports this driver by encouraging candle use to create warmth, comfort, and personalized home aesthetics. Additionally, gifting culture across birthdays, housewarmings, weddings, and festive seasons continues to strengthen candle demand because of their universal appeal and emotional resonance. Volatility in Raw Material Prices and Supply Chain Instability to Restrain Candle Market The cost of natural waxes such as soy, beeswax, and coconut wax fluctuates heavily due to unpredictable agricultural factors, global weather disruptions, bee population decline, and crop yield variations. For instance, soy wax pricing rises whenever soybean crops face droughts or supply shortages, while beeswax availability is affected by environmental pressures on global bee colonies. Essential oils used in premium and aromatherapy candles are also highly vulnerable to global climate patterns, international trade restrictions, and geopolitical tensions. These fluctuations directly impact production costs, squeezing profit margins for both large manufacturers and small artisanal brands, which hamper Candle Market. The regulatory compliance adds another layer of financial burden. Agencies like the U.S. Consumer Product Safety Commission (CPSC) and the European Chemicals Agency (ECHA) enforce strict regulations related to emissions, labeling, wick materials, and fragrance components. Meeting these requirements demands rigorous testing, documentation, and certification processes that increase operational complexity and cost. The Candle industry also faces growing competition from alternative home fragrance products such as diffusers, wax melts, essential oil warmers, and electric air fresheners, which appeal to consumers seeking flameless or longer-lasting options.Global Candle Market Segment Analysis

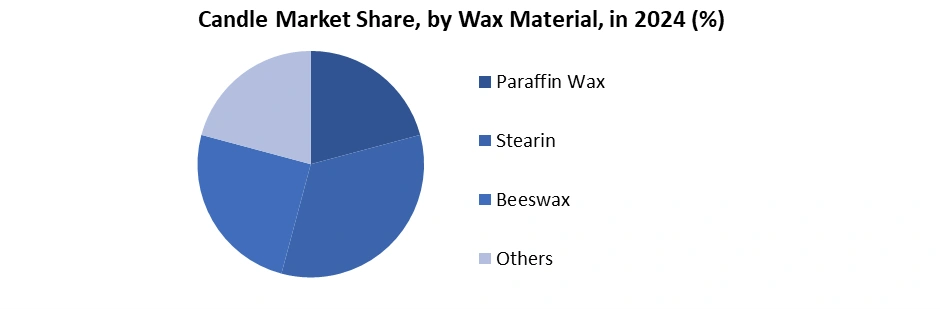

Based on Product Type, the market is segmented into the Votive Candles, Tea Lights, Pillar Candles, Tapers and Others. The votive candles and pillar candles dominated the Candle market in 2024, due to their high versatility, strong fragrance performance, and widespread use across the residential and commercial candle industry. Votive candles lead thanks to their affordability, compact size, and popularity in the home fragrance market, while pillar candles dominate premium categories because of their longer burn time, decorative appeal, and relevance in the religious market, spa market, and hospitality environments. Growing demand for scented candles, aromatherapy candles, and decorative candles, along with increased seasonal purchases and gifting trends, continues to strengthen the leadership of votive and pillar candles within overall candle market demand.By Wax Material, the market is categorized into Paraffin Wax, Stearin, Beeswax and Others. The paraffin wax dominates the candle industry due to its low cost, excellent scent throw, strong color retention, and compatibility with mass production across jar candles, tealights, votives, and pillar candles. Paraffin’s superior fragrance diffusion allows it to lead the scented candle market, making it the preferred choice for large manufacturers in both online and offline channels. Although sustainable alternatives such as soy wax, beeswax, and coconut wax are expanding within the eco-friendly candles market and sustainable candles market, paraffin wax continues to dominate due to its performance advantages and high demand across the regions.

Global Candle Market Regional Insights

North America dominated the Candle Market in 2024 and is expected to continue its dominance over the forecast period. Growing awareness of aromatherapy and holistic wellness, strengthening overall growth in the global market, especially within the scented candle industry, and the soy wax and aromatherapy market. Essential oil-infused candles featuring lavender, eucalyptus, and citrus remain highly preferred for stress relief and mood enhancement, supporting rising demand across the home fragrance market. Seasonal trends remain influential, with 35% of candle sales occurring during the Christmas and holiday season and 65% from non-seasonal use. The U.S. demonstrates massive production capacity, using over 1 billion pounds of wax annually, while National Candle Association members produce 80% of all U.S. candles. Retail candle sales total USD 3.14 billion per year, primarily through specialty shops, department/home décor stores, and mass merchandisers. With 10,000+ candle scents and extensive product diversity, container candles, jar candles, votives, tapers, pillars, tealights, floating candles, novelty candles, liturgical candles, and utility candles, the market continues expanding across both the residential and commercial candle markets. Candle prices range from USD 1.99 for a votive to USD 35 for jar/pillar candles, while luxury options exceed USD 200, boosting growth in the premium and the luxury market. Consumer insights show container and jar candles are the most preferred, with 75% of buyers ranking fragrance as the top purchase factor, followed by color, cost, and shape. Nine in ten consumers use candles to create a cozy atmosphere; 42% burn candles in the living room, 18% in the kitchen, 13% in bedrooms, and 20% of women use candles outdoors. Strong gifting demand, 76% holiday, 74% housewarming, 66% dinner parties, 61% thank-you, 58% adult birthdays continue to boost overall candle market growth and strengthen global candle industry analysis.Global Candle Market Competitive Landscape

The candle market remains highly competitive as global and regional players expand across premium, luxury, and eco-friendly segments, driven by innovations in fragrance, sustainable wax materials, and design differentiation. Leading brands in the scented, soy wax, paraffin, and beeswax categories are focusing on cleaner-burning formulas and aromatherapy-inspired offerings to cater to rising demand in the home fragrance and wellness sectors. Major companies such as Massimo Luna, Yankee Candle, Bath & Body Works, and Colonial Candle, along with emerging artisanal producers, are strengthening their positions through premiumization, seasonal collections, and sustainability initiatives.Competition is especially strong across container, votive, pillar, and tealight segments, supported by e-commerce expansion and exclusive online launches. Retailers continue to benefit from increasing usage in residential, commercial, spa, and hospitality environments, while brands invest in digital engagement, fragrance technology, and eco-friendly packaging to influence future candle market forecasts and global industry dynamics. • On July 23, 2025, Yankee Candle unveiled a major rebrand aimed at reversing declining sales and appealing to younger consumers. The update features a new logo, a cleaner wax formulation, upgraded packaging with larger scent imagery, and plans for seasonal exclusives and a luxury line. The company will also enhance its retail presence by shifting stores to outdoor centers and launching a national media and influencer campaign under the tagline “Every Scent Tells a Story.” • On January 7, 2025, Bath & Body Works reported strong results from its Candle Day sale (Dec 7–8, 2024), offering 3-wick candles at $9.95. Goldman Sachs reaffirmed a Buy rating with a $52 target, citing solid demand and loyalty growth. The sale operated online and in stores with a 24-candle limit. BBW’s loyalty program reached 38 million members, and app downloads surged in December, reflecting improved engagement and retention strength. • In February 2024, Jo Malone London launched its limited-edition Paddington Collection, inspired by the iconic Paddington Bear. The collection centers on a unique Orange Marmalade Cologne, complemented by four themed gift sets that capture the character’s love for marmalade. Blending nostalgia with luxury perfumery, the collection appeals to fragrance enthusiasts, collectors, and fans of British cultural icons, reinforcing Jo Malone’s reputation for creativity and storytelling through scent.

Candle Market Scope: Inquire before buying

Global Candle Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.79 Bn. Forecast Period 2025 to 2032 CAGR: 8.2% Market Size in 2032: USD 18.39 Bn. Segments Covered: by Product Type Votive Candles Tea Lights Pillars Candles Tapers Others by Scent Type Scented Unscented by Wax Material Paraffin Wax Stearin Beeswax Others by End-User Household Aromatherapy & Spa Centers Recreation Centers Hotels and Resorts Others by Distribution Channel Specialty Stores Supermarkets & Hypermarkets Online Retail Others Global Candle Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Candle Key Players

1. The Yankee Candle Company, Inc. (USA) 2. Bath & Body Works, Inc. (USA) 3. Bolsius International BV (Netherlands) 4. Diptyque S.A.S. (France) 5. Paddywax Candles (USA) 6. WoodWick® (Candle-lite Co.) (USA) 7. Bridgewater Candle Company (USA) 8. Colonial Candle Co. (USA) 9. Liljeholmens Stearinfabriks AB (Sweden) 10. Hansa Candle AS (Norway) 11. Baltic Candles Ltd (UK/Estonia region) 12. Delsbo Candle AB (Sweden) 13. Affari AB (Sweden) 14. BISPOL Sp. z o.o. (Poland) 15. Engels Kerzen GmbH (Germany) 16. Gebr. Müller Kerzenfabrik AG (Switzerland) 17. Monterosa Zelandi Srl (Italy) 18. The Copenhagen Candle Company Ltd. (Denmark) 19. Circle E Candles (USA) 20. Jo Malone London (UK) 21. Malin+Goetz (USA) 22. NEST Fragrances, LLC (USA) 23. Trudon (France) 24. Wicks n’ More (USA) 25. Mayfield Consumer Products (USA) 26. Gies Kerzen GmbH (Germany) 27. Armadilla Wax Works, Inc. (USA) 28. MVP Group International, Inc. (USA) 29. Empire Candle Company, LLC (USA) 30. Seal Aromas GmbH (Germany)Frequently Asked Questions:

1] What is the growth rate of the Global Candle Market? Ans. The Global Candle Market is growing at a significant rate of 8.2 % during the forecast period. 2] Which region is expected to dominate the Global Candle Market? Ans. North America is expected to dominate the Candle Market during the forecast period. 3] What was the Global Candle Market size in 2024? Ans. The Candle Market size is expected to reach USD 9.79 billion in 2024. 4] What is the expected Global Candle Market size by 2032? Ans. The Candle Market size is expected to reach USD 18.39 billion by 2032. 5] Which are the top players in the Global Candle Market? Ans. The major players in the Global Candle Market are Mondi Group Plc, International Paper Company, WestRock Company, Smurfit Kappa Group PLC, Stora Enso Oyj and Others. 6] What are the factors driving the Global Candle Market growth? Ans. Rising aromatherapy adoption, home décor focus, gifting culture, eco-friendly wax innovation, premium fragrance demand, online retail expansion and wellness lifestyles drive the Global Candle Market growth across residential and commercial users.

1. Candle Market: Research Methodology 2. Candle Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Candle Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Candle Market: Dynamics 4.1. Candle Market Trends 4.2. Candle Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Candle Market 5. Candle Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 5.1. Candle Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Votive Candles 5.1.2. Tea Lights 5.1.3. Pillars Candles 5.1.4. Tapers 5.1.5. Others 5.2. Candle Market Size and Forecast, by Scent Type (2024-2032) 5.2.1. Scented 5.2.2. Unscented 5.3. Candle Market Size and Forecast, by Wax Material (2024-2032) 5.3.1. Paraffin Wax 5.3.2. Stearin 5.3.3. Beeswax 5.3.4. Others 5.4. Candle Market Size and Forecast, by End-user (2024-2032) 5.4.1. Household 5.4.2. Aromatherapy & Spa Centers 5.4.3. Recreation Centers 5.4.4. Hotels and Resorts 5.4.5. Others 5.5. Candle Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.1. Specialty Stores 5.5.2. Supermarkets & Hypermarkets 5.5.3. Online Retail 5.5.4. Others 5.6. Candle Market Size and Forecast, by Region (2024-2032) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Candle Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 6.1. North America Candle Market Size and Forecast, by Product Type (2024-2032) 6.1.1. Votive Candles 6.1.2. Tea Lights 6.1.3. Pillars Candles 6.1.4. Tapers 6.1.5. Others 6.2. North America Candle Market Size and Forecast, by Scent Type (2024-2032) 6.2.1. Scented 6.2.2. Unscented 6.3. North America Candle Market Size and Forecast, by Wax Material (2024-2032) 6.3.1. Paraffin Wax 6.3.2. Stearin 6.3.3. Beeswax 6.3.4. Others 6.4. North America Candle Market Size and Forecast, by End-user (2024-2032) 6.4.1. Household 6.4.2. Aromatherapy & Spa Centers 6.4.3. Recreation Centers 6.4.4. Hotels and Resorts 6.4.5. Others 6.5. North America Candle Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.1. Specialty Stores 6.5.2. Supermarkets & Hypermarkets 6.5.3. Online Retail 6.5.4. Others 6.6. North America Candle Market Size and Forecast, by Country (2024-2032) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Candle Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 7.1. Europe Candle Market Size and Forecast, by Product Type (2024-2032) 7.2. Europe Candle Market Size and Forecast, by Scent Type (2024-2032) 7.3. Europe Candle Market Size and Forecast, by Wax Material (2024-2032) 7.4. Europe Candle Market Size and Forecast, by End-user (2024-2032) 7.5. Europe Candle Market Size and Forecast, by Distribution Channel (2024-2032) 7.6. Europe Candle Market Size and Forecast, by Country (2024-2032) 7.6.1. United Kingdom 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Russia 7.6.7. Rest of Europe 8. Asia Pacific Candle Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 8.1. Asia Pacific Candle Market Size and Forecast, by Product Type (2024-2032) 8.2. Asia Pacific Candle Market Size and Forecast, by Scent Type (2024-2032) 8.3. Asia Pacific Candle Market Size and Forecast, by Wax Material (2024-2032) 8.4. Asia Pacific Candle Market Size and Forecast, by End-user (2024-2032) 8.5. Asia Pacific Candle Market Size and Forecast, by Distribution Channel (2024-2032) 8.6. Asia Pacific Candle Market Size and Forecast, by Country (2024-2032) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Rest of Asia Pacific 9. Middle East and Africa Candle Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 9.1. Middle East and Africa Candle Market Size and Forecast, by Product Type (2024-2032) 9.2. Middle East and Africa Candle Market Size and Forecast, by Scent Type (2024-2032) 9.3. Middle East and Africa Candle Market Size and Forecast, by Wax Material (2024-2032) 9.4. Middle East and Africa Candle Market Size and Forecast, by End-user (2024-2032) 9.5. Middle East and Africa Candle Market Size and Forecast, by Distribution Channel (2024-2032) 9.6. Middle East and Africa Candle Market Size and Forecast, by Country (2024-2032) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Nigeria 9.6.4. Rest of ME&A 10. South America Candle Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 10.1. South America Candle Market Size and Forecast, by Product Type (2024-2032) 10.2. South America Candle Market Size and Forecast, by Scent Type (2024-2032) 10.3. South America Candle Market Size and Forecast, by Wax Material (2024-2032) 10.4. South America Candle Market Size and Forecast, by End-user (2024-2032) 10.5. South America Candle Market Size and Forecast, by Distribution Channel (2024-2032) 10.6. South America Candle Market Size and Forecast, by Country (2024-2032) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Colombia 10.6.4. Chile 10.6.5. Rest Of South America 11. Company Profile: Key Players 11.1. The Yankee Candle Company, Inc. (USA) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Bath & Body Works, Inc. (USA) 11.3. Bolsius International BV (Netherlands) 11.4. Diptyque S.A.S. (France) 11.5. Paddywax Candles (USA) 11.6. WoodWick® (Candle-lite Co.) (USA) 11.7. Bridgewater Candle Company (USA) 11.8. Colonial Candle Co. (USA) 11.9. Liljeholmens Stearinfabriks AB (Sweden) 11.10. Hansa Candle AS (Norway) 11.11. Baltic Candles Ltd (UK/Estonia region) 11.12. Delsbo Candle AB (Sweden) 11.13. Affari AB (Sweden) 11.14. BISPOL Sp. z o.o. (Poland) 11.15. Engels Kerzen GmbH (Germany) 11.16. Gebr. Müller Kerzenfabrik AG (Switzerland) 11.17. Monterosa Zelandi Srl (Italy) 11.18. The Copenhagen Candle Company Ltd. (Denmark) 11.19. Circle E Candles (USA) 11.20. Jo Malone London (UK) 11.21. Malin+Goetz (USA) 11.22. NEST Fragrances, LLC (USA) 11.23. Trudon (France) 11.24. Wicks n’ More (USA) 11.25. Mayfield Consumer Products (USA) 11.26. Gies Kerzen GmbH (Germany) 11.27. Armadilla Wax Works, Inc. (USA) 11.28. MVP Group International, Inc. (USA) 11.29. Empire Candle Company, LLC (USA) 11.30. Seal Aromas GmbH (Germany) 12. Key Findings 13. Analyst Recommendations