Breath Analyzers Market size is estimated to grow at a CAGR of 18.05%, Global Breath Analyzers Market is expected to reach a value of US $ 4.41 Bn. in 2029.Breath Analyzers Market Overview and Dynamics:

The breath analyzer is a device for estimating BAC (blood alcohol content) in samples of breath. Use of breath analyzer in the detection of infectious and chronic diseases. Such as, in September 2021, Hound Labs Company launched the Hound COVID-19 Breath alyzers, one of the world’s first portable breath alyzer to detention SARS-CoV-2 virus in breath of human test subjects. Hound Labs first successfully utilized the HOUND COVID-19 Breathalyzers with hospitalized patients. Infrared spectroscopy, semiconductor, fuel cell and photovoltaic assay are some of the sensors used in breath analyzers.To know about the Research Methodology:- Request Free Sample Report 2021 is considered as a base year to forecast the market from 2022 to 2029. 2021’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2029. 2021 is a year of exception and analyzed especially with the impact of lockdown by region.

Growing Drug and Alcohol Abuse:

According to the WHO (World Health Organization), nearly 2.5 million people die yearly across the world because of extreme alcohol consumption. Also, 20% of the fatally injured drivers in the developed economies are found to have high blood alcohol content. This rise in the number of road accidents due to extreme alcohol consumption has created a demand for alcohol detection devices, therefore, increasing the overall growth of this industry. Thanks to the potential advantages of breath analyzers many manufacturers and academic institutions are aiming to develop breath analysis devices for the detection of various diseases like tuberculosis, asthma, and others.Stringent Government Regulations:

The increasing use of alcohol and prevalence of alcohol-associated abuses and crimes around the globe has led to more stringent legislation for the needed testing of alcohol levels by different governments around the world. It is the main factor for the extensive use of breath analyzers, and it is expected to be responsible for the further growth of the global market as many economies still lack suitable regulatory laws against alcohol and its abuse. For example, as per the report of the National Survey on Drug Use and Health’s 2019 t, in the US, nearly 85.6% of people of age 18 years.Hindering factors on Breath Analyzers Market:

The accuracy issue of the breath analyzers devices is the major hindering factor that affects the growth of the global market due to which. Similarly, in some economies of the world, alcohol test from the breath analyzers is not admissible in the court of law because of its inaccuracy even if the driver was driving under the influence of alcohol, which can also impact the growth of the breath analyzers market globally. For instance, in January 2021, as per the news by Car and Driver, approximately 52 drunk driving cases of Michigan State Police of the U.S. were coming under scrutiny because of the flaw in the maintenance of breath analyzers which was common across the USA.Breath Analyzers Market Segment Analysis:

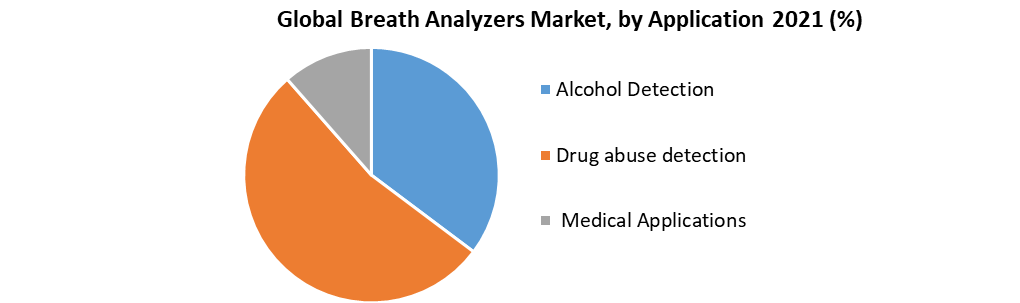

Alcohol Detection Segment is expected to Account for the Largest 40% Market Share By 2029. Based on application, the alcohol detection segment is projected to witness the highest CAGR of nearly 19.11% during 2022-2029 thanks to modern technologies that are readily available. Moreover, stringent government rules for driving under the influence are mainly driving the alcohol detection segment’s growth. In 2021, the Fuel Cell segment Held the Largest xx% Market Share: By Technology, the fuel cell segment is expected to grow at the largest CAGR of xx% during the forecast period. This growth is attributed to the most widely utilized technology having a high level of sensitivity, accuracy, and dependability. They are intended to detect alcohol precisely and do not need many sensors. For both professional and personal use, these analyzers are stared as the gold standard of hand-held alcohol testers.

Recent Development:

The MMR reports cover recent developments in the breath analyzer market as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as product approvals, product launches, and others. Such as, • In 2021, Lifeloc Technologies launched LT7 and LX9 breath analyzer. These are U. S. DOT/NHTS Approved breath alcohol testers for law enforcement and workplace markets intended to be user friendly. • In June 2021, OLYTHE publicized the launch of a predictive alcohol E-breathalyzer in 30 European economies and is based on reduced infrared technology. • In Feb 2021, Indonesia installs a Breath Analyzers to tests for COVID-19 patients at the train station. The Breathalyzer, called GeNose, was advanced by the University of Gadjah Mada in Yogyakarta and can detect COVID-19 from body tissues with professionally up to 95% accuracy.Breath Analyzers Market Regional Insights:

Geographically, North America Breath Analyzers market is expected to grow at the highest CAGR of 20.54% during the forecast period. This growth is driven by increasing number of drunk and drive cases. In this region, the U.S. is the largest market for Breath Analyzers and is projected to show the same trend over 2022-2029. The key reason behind this is the stringent alcohol testing laws because of the high consumption rate of alcohol in the country and growing cases of binge drinking along with the crimes associated with the alcohol such as drug abuse and drunk and drive cases. Moreover, the technological advancements by the key companies in the region will also boom the growth of the market. In May 2021, BACtrack launched BACtrack C8 including ZeroLine, the first stand-alone Breath Analyzers ever to display a projected time to sobriety with every blood alcohol content (BAC) result. Thus, because of growing launches of new products, the market studied is expected to have a significant share in the Breath Analyzers market. Asia-Pacific is the fastest growing region due to technological developments, upsurge in the demand for breath analyzers in emerging countries such as China, India, and increase in the number of road accidents. The objective of the report is to present a comprehensive analysis of the Breath Analyzers Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help understand the Breath Analyzers Market dynamic and structure by analyzing the market segments and projecting the Breath Analyzers Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Breath Analyzers Market make the report investor’s guide.Breath Analyzers Market Scope: Inquire before buying

Breath Analyzers Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US$ 1.17 Bn. Forecast Period 2022 to 2029 CAGR: 18.05% Market Size in 2029: US$ 4.41Bn. Segments Covered: by Technology • Fuel Cell • Semiconductor Oxide Sensor • Others by Application • Alcohol Detection • Drug abuse detection • Medical Applications by End User • Law Enforcement Agencies • Enterprises • Individuals Breath Analyzers Market by Region

• North America • Europe • Asia Pacific • Latin America • The Middle East and AfricaBreath Analyzers Market Key Players

• AK GlobalTech Corporation • Alcohol Countermeasure Systems Corporation • Alcolizer Technology • Alcopro, Inc • Lifeloc Technologies • BACtrack, Inc • Quest Products, Inc. • Akers Biosciences, Inc. • Intoximeter, Inc. • EnviteC-Wismar GmbH • Lion Laboratories Ltd. • Pas Systems International • Guth Laboratories, Inc • Andatech Private Ltd • Alere • C4 development (UK). • Drägerwerk AG & Co. KGaA • MPD, IncFrequently Asked

• Bedfont Scientific Limited Questions: 1] What segments are covered in the Breath Analyzers Market report? Ans. The segments covered in the Breath Analyzers Market report are based on Power output, End User, Application, and Technology. 2] Which region is expected to hold the highest share in the Breath Analyzers Market? Ans. The North American region is expected to hold the highest share in the Breath Analyzers Market. 3] What is the market size of the Breath Analyzers Market by 2029? Ans. The market size of the Breath Analyzers Market by 2029 is US $ 4.41 Bn. 4] What is the forecast period for the Breath Analyzers Market? Ans. The Forecast period for the Breath Analyzers Market is 2022-2029. 5] What is the market CAGR of the Breath Analyzers Market during forecast period? Ans. The market CAGR of the Breath Analyzers Market during forecast period is 18.05%.

1. Global Breath Analyzers Market: Research Methodology 2. Global Breath Analyzers Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Breath Analyzers Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Breath Analyzers Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Breath Analyzers Market Segmentation 4.1. Global Breath Analyzers Market, By Technology (2021-2029) • Fuel Cell • Semiconductor Oxide Sensor • Others 4.2. Global Breath Analyzers Market, by Application (2021-2029) • Alcohol Detection • Drug abuse detection • Medical Applications 4.3. Global Breath Analyzers Market, By End User (2021-2029) • Law Enforcement Agencies • Enterprises • Individuals 5. North America Breath Analyzers Market (2021-2029) 5.1. North America Breath Analyzers Market, By Technology (2021-2029) • Fuel Cell • Semiconductor Oxide Sensor • Others 5.2. North America Breath Analyzers Market, by Application (2021-2029) • Alcohol Detection • Drug abuse detection • Medical Applications 5.3. North America Breath Analyzers Market, By End User (2021-2029) • Law Enforcement Agencies • Enterprises • Individuals 5.4. North America Breath Analyzers Market, by Country (2021-2029) • United States • Canada • Mexico 6. European Breath Analyzers Market (2021-2029) 6.1. European Breath Analyzers Market, By Technology (2021-2029) 6.2. European Breath Analyzers Market, by Application (2021-2029) 6.3. European Breath Analyzers Market, By End User (2021-2029) 6.4. European Breath Analyzers Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Breath Analyzers Market (2021-2029) 7.1. Asia Pacific Breath Analyzers Market, By Technology (2021-2029) 7.2. Asia Pacific Breath Analyzers Market, by Application (2021-2029) 7.3. Asia Pacific Breath Analyzers Market, By End User (2021-2029) 7.4. Asia Pacific Breath Analyzers Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Breath Analyzers Market (2021-2029) 8.1. Middle East and Africa Breath Analyzers Market, By Technology (2021-2029) 8.2. Middle East and Africa Breath Analyzers Market, by Application (2021-2029) 8.3. Middle East and Africa Breath Analyzers Market, By End User (2021-2029) 8.4. Middle East and Africa Breath Analyzers Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Breath Analyzers Market (2021-2029) 9.1. South America Breath Analyzers Market, By Technology (2021-2029) 9.2. South America Breath Analyzers Market, by Application (2021-2029) 9.3. South America Breath Analyzers Market, By End User (2021-2029) 9.4. South America Breath Analyzers Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. AK GlobalTech Corporation. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Alcohol Countermeasure Systems Corporation 10.3. Alcolizer Technology 10.4. Alcopro, Inc 10.5. Drägerwerk AG & Co. KGaA 10.6. MPD, Inc 10.7. Lifeloc Technologies 10.8. BACtrack, Inc 10.9. Quest Products, Inc. 10.10. Akers Biosciences, Inc. 10.11. Intoximeter, Inc. 10.12. EnviteC-Wismar GmbH 10.13. Lion Laboratories Ltd. 10.14. Pas Systems International 10.15. Guth Laboratories, Inc 10.16. Andatech Private Ltd 10.17. Alere 10.18. C4 development 10.19. Bedfont Scientific Limited (UK)