Biopharmaceutical CMO & CRO Market size was valued at US$ 29.42 Bn. in 2021 and the total revenue is expected to grow at a CAGR of 6.7% through 2021 to 2029, reaching nearly US$ 49.43 Bn. by 2029.Biopharmaceutical CMO & CRO Market Overview:

Biopharmaceuticals are medical drugs manufactured using biotechnology, which is the genetic alteration of living cells or organisms to create therapeutic products. Contract research organizations are used by the pharmaceutical, biotech, and medical technology industries (CROs). They work with clients to develop, test, and commercialize cutting-edge pharmaceuticals and medical devices. CMOS is a sort of outsourcing in which a company enters into a formal arrangement with another company to supply parts, commodities, or components.To know about the Research Methodology:- Request Free Sample Report

Biopharmaceutical CMO & CRO Market Dynamics:

Due to the COVID-19 pandemic, there was tremendous growth in 2021. The increasing investments in the biopharmaceutical industry by major players to improve productivity and efficiency have driven bio producers to place a greater emphasis on outsourcing activities. Currently, biopharmaceutical businesses are outsourcing resource- and capital-intensive steps, as well as the full biomanufacturing chain in some circumstances, driving demand for contract-based services. The COVID-19 pandemic has caused major disruptions in the pharmaceutical industry's supply chain. However, because biopharmaceutical CMOs and CROs benefit from supply chain interruptions, they have responded favorably to the outbreak. During a pandemic, CMOs and CROs based in the Western Hemisphere would benefit the most. For example, the Australian government has teamed with Sandoz and expects to invest roughly 50 million Euros in Europe to boost integrated antibiotic production. Mergers and acquisitions enable CMOs to provide integrated bioprocessing services to their clients, making CMOS/CROs an appealing and viable choice for speedy product launches. The biopharmaceutical business has seen a substantial number of mergers and acquisitions in recent years. These mergers were primarily intended to help companies grow their businesses and remain competitive in the biopharmaceutical contract manufacturing and services sector. The introduction of new bioprocessing tools, novel therapies, and priority adjustments in the bio/pharmaceutical business relevant to products has raised the pressure on contract bio manufacturers, even though the biopharmaceutical CMO & CRO industry is comparatively developed. As a result, CDMOs are experimenting with various business models to best meet the needs of their clients and stakeholders. Besides, the integration of single-use systems in manufacturing facilities allows CMOs to grow their manufacturing capacity at a lower cost. Single-use goods provide for quick turnaround while limiting ancillary operations like cleaning and changeover certification. However, due to the legal landscape and the complexity of the service, contract discussions between CMOs and customers have been reported to be challenging. Clients and CMOs are dealing with concerns such as intellectual property rights, warranties, liabilities, pricing, and timetables, all of which add to the negotiation's complexity.

Biopharmaceutical CMO & CRO Market Segment Analysis:

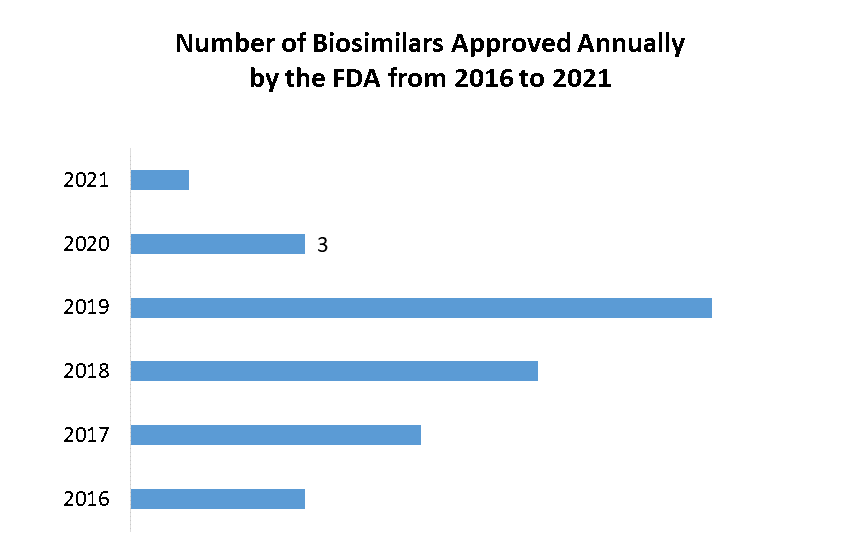

The Biopharmaceutical CMO & CRO Market is segmented by Source, Service Type, and Product. Based on the Source, the market is segmented into Mammalian and Non-mammalian. The mammalian segment is expected to hold the largest market share of xx% by 2029. This is due to the industry's lack of internal expertise. This is due to their ability to make sophisticated protein therapies with human-like post-translational modifications. Besides, the emergence of novel and improved expression systems, improved process monitoring solutions, cell line engineering tools, automated screening procedures, and disposable equipment has considerably benefitted the industry. These advancements have resulted in more productive and efficient biologics manufacturing employing mammalian cells. Non-mammalian cell lines, such as microbial cell lines, have been identified as capable factories. To identify and investigate the potential of diverse microorganisms, new tactics are being adopted. As a result, the non-mammalian biopharmaceutical production segment is expected to grow. Based on the Service Type, the market is segmented into Contract Manufacturing, and Contract Research. The contract manufacturing segment is expected to grow rapidly at a CAGR of 7.5% during the forecast period 2021-2029. As pharmaceutical and biotechnology businesses boost their spending on outsourced services, the biopharmaceutical contract manufacturing industry continues to grow. The expansive use of biopharmaceuticals, new biopharmaceutical approvals, and new biopharmaceutical development programs has all contributed to this growth. Domestic (bio) pharmaceutical research organizations, which were previously compelled to fund and operate their production lines, are now permitted to engage contract manufacturers, who can typically perform crucial manufacturing duties more efficiently. This is particularly critical for many early-stage medication developers. Contract Manufacture Organizations (CMOs) have been a key factor in the biopharmaceutical industry's development by meeting the needs of pharmaceutical companies by delivering competitive services ranging from medication manufacturing to aseptic filling. The CMOs' upbeat view stems from a variety of factors. A surge in small, well-funded virtual biotechnology companies, increased need for production services supporting cell and gene therapies, and increased growth in Asia are among these causes. Production and development, as well as auxiliary services provided by biopharmaceutical contract manufacturers, exhibit stable global market growth during the forecast period. Many CMOs have boosted their capacity by building new facilities or purchasing biomanufacturing facilities from pharmaceutical and biotechnology companies.Biopharmaceutical CMO & CRO Market Regional Insights:

North America region is expected to dominate the Biopharmaceutical CMO & CRO Market during the forecast period 2021-2029. This is due to the presence of many service providers in the region. In addition, CMOS makes a considerable number of approved products in the United States. Several small and mid-sized biopharmaceutical companies (SMEs) may not have the resources or finances to set up facilities with well-equipped resources. As a result, there is more interdependence between CMOs and SMEs in the US, resulting in the US market's domination. Asia Pacific region is expected to grow rapidly at a CAGR of 5.0% during the forecast period 2021-2029. Biopharmaceutical contract manufacturing in China is expected to be driven by the development of biologics pipelines by Chinese enterprises. In terms of biopharmaceutical CMOs and overall biopharmaceutical manufacturing capability, China will become Asia's single most powerful player. China's biopharmaceutical companies are pursuing open-minded strategies that emphasize single-use technology. The Asia Pacific is moving forward in a coordinated manner, with the rapid increase of production capacity and the resolution of quality difficulties. More progress in biopharmaceutical infrastructure and the fastest-growing economy, with quality control in GMP processes handled. The Asia Pacific region is driving global market growth through government coordination of planning and funding for pharmaceutical and biotechnological companies. Strict FDA regulations and standards for new product launches assist biopharmaceutical companies in achieving a high degree of quality in their manufacturing and product development operations.The objective of the report is to present a comprehensive analysis of the Biopharmaceutical CMO & CRO Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Biopharmaceutical CMO & CRO Market dynamic, structure by analyzing the market segments and projecting the Biopharmaceutical CMO & CRO Market size. Clear representation of competitive analysis of key players by Source Type, price, financial position, product portfolio, growth strategies, and regional presence in the Biopharmaceutical CMO & CRO Market make the report investor’s guide.

Biopharmaceutical CMO & CRO Market Scope: Inquire before buying

Biopharmaceutical CMO & CRO Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 29.42 Bn. Forecast Period 2022 to 2029 CAGR: 6.7% Market Size in 2029: US $ 49.43 Bn. Segments Covered: by Source • Mammalian • Non-mammalian by Service Type • Contract Manufacturing • Contract Research by Product • Biologics • Biosimilars Biopharmaceutical CMO & CRO Market, by Region

• North America • Europe • Asia Pacific • South America • The Middle East and AfricaBiopharmaceutical CMO & CRO Market Key Players are:

• Lonza • Rentschler Biopharma SE • Boehringer Ingelheim GmbH • JRS Pharma • Inno Biologics Sdn Bhd • ProBioGen AG • BIOMEVA GmbH • FUJIFILM Diosynth Biotechnologies Inc • Samsung BioLogics • TOYOBO Biologics CO. LTD. • CMC Biologics • Patheon • AbbVie Inc. • Binex Co. Ltd. • WuXi Biologics • ACG Biologics • PRA Health Sciences IncFrequently Asked Questions:

1] What segments are covered in Biopharmaceutical CMO & CRO Market report? Ans. The segments covered in Biopharmaceutical CMO & CRO Market report are based on Source, Service Type, and Product. 2] Which region is expected to hold the highest share in the Biopharmaceutical CMO & CRO Market? Ans. North America is expected to hold the highest share in the Biopharmaceutical CMO & CRO Market. 3] Who are the top key players in the Biopharmaceutical CMO & CRO Market? Ans. Lonza, Rentschler Biopharma SE, Boehringer Ingelheim GmbH, JRS Pharma, and Inno Biologics Sdn Bhd are the top key players in the Biopharmaceutical CMO & CRO Market. 4] Which segment holds the largest market share in the Biopharmaceutical CMO & CRO market by 2029? Ans. Mammalian source segment is expected to hold the largest market share in the Biopharmaceutical CMO & CRO market by 2029. 5] What is the market size of the Biopharmaceutical CMO & CRO market by 2029? Ans. The market size of the Biopharmaceutical CMO & CRO market is expected to reach US $49.43 Bn. by 2029. 6] What was the market size of the Biopharmaceutical CMO & CRO market in 2021? Ans. The market size of the Biopharmaceutical CMO & CRO market was worth US $29.42 Bn. in 2021.

1. Biopharmaceutical CMO & CRO Market: Research Methodology 2. Biopharmaceutical CMO & CRO Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Biopharmaceutical CMO & CRO Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Biopharmaceutical CMO & CRO Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Biopharmaceutical CMO & CRO Market Segmentation 4.1 Biopharmaceutical CMO & CRO Market, by Source (2021-2029) • Mammalian • Non-mammalian 4.2 Biopharmaceutical CMO & CRO Market, by Service Type (2021-2029) • Contract Manufacturing • Contract Research 4.3 Biopharmaceutical CMO & CRO Market, by Product (2021-2029) • Biologics • Biosimilars 5. North America Biopharmaceutical CMO & CRO Market (2021-2029) 5.1 Biopharmaceutical CMO & CRO Market, by Source (2021-2029) • Mammalian • Non-mammalian 5.2 Biopharmaceutical CMO & CRO Market, by Service Type (2021-2029) • Contract Manufacturing • Contract Research 5.3 Biopharmaceutical CMO & CRO Market, by Product (2021-2029) • Biologics • Biosimilars 5.4 North America Biopharmaceutical CMO & CRO Market, by Country (2021-2029) • United States • Canada • Mexico 6. Asia Pacific Biopharmaceutical CMO & CRO Market (2021-2029) 6.1. Asia Pacific Biopharmaceutical CMO & CRO Market, by Source (2021-2029) 6.2. Asia Pacific Biopharmaceutical CMO & CRO Market, by Service Type (2021-2029) 6.3. Asia Pacific Biopharmaceutical CMO & CRO Market, by Product (2021-2029) 6.4. Asia Pacific Biopharmaceutical CMO & CRO Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. The Middle East and Africa Biopharmaceutical CMO & CRO Market (2021-2029) 7.1 The Middle East and Africa Biopharmaceutical CMO & CRO Market, by Source (2021-2029) 7.2. The Middle East and Africa Biopharmaceutical CMO & CRO Market, by Service Type (2021-2029) 7.3. The Middle East and Africa Biopharmaceutical CMO & CRO Market, by Product (2021-2029) 7.4. The Middle East and Africa Biopharmaceutical CMO & CRO Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Biopharmaceutical CMO & CRO Market (2021-2029) 8.1. Latin America Biopharmaceutical CMO & CRO Market, by Source (2021-2029) 8.2. Latin America Biopharmaceutical CMO & CRO Market, by Service Type (2021-2029) 8.3. Latin America Biopharmaceutical CMO & CRO Market, by Product (2021-2029) 8.4. Latin America Biopharmaceutical CMO & CRO Market, by Country (2021-2029) • Brazil • Argentina • Rest Of Latin America 9. European Biopharmaceutical CMO & CRO Market (2021-2029) 9.1. European Biopharmaceutical CMO & CRO Market, by Source (2021-2029) 9.2. European Biopharmaceutical CMO & CRO Market, by Service Type (2021-2029) 9.3. European Biopharmaceutical CMO & CRO Market, by Product (2021-2029) 9.4. European Biopharmaceutical CMO & CRO Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Lonza 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Rentschler Biopharma SE 10.3. Boehringer Ingelheim GmbH 10.4. JRS Pharma 10.5. Inno Biologics Sdn Bhd 10.6. ProBioGen AG 10.7. BIOMEVA GmbH 10.8. FUJIFILM Diosynth Biotechnologies Inc 10.9. Samsung BioLogics 10.10. TOYOBO Biologics CO. LTD. 10.11. CMC Biologics 10.12. Patheon 10.13. AbbVie Inc. 10.14. Binex Co. Ltd. 10.15. WuXi Biologics 10.16. ACG Biologics 10.17. PRA Health Sciences Inc