The Baby Food Market size was valued at USD 96.92 Billion in 2024 and the total Baby Food revenue is expected to grow at a CAGR of 6.7% from 2025 to 2032, reaching nearly USD 162.83 Billion.Baby Food Market Overview

Baby food, a specialized category of food products is an important source of nutrition for infants and young children transitioning from breastfeeding or formula feeding to solid foods. These products are carefully formulated to meet the nutritional requirements of babies, providing essential vitamins, minerals, and macronutrients vital for their growth and development. Typically, available in several forms such as purees, cereals, snacks, and beverages, baby food caters to different stages of an infant's feeding journey, ranging from the early stages of introducing solids to more complex textures and flavors as they grow older. The formulation of baby food includes the age-appropriateness of ingredients, texture consistency, and nutritional balance to support optimal health and development. The baby food market is characterized by a diverse range of offerings from global as well as regional manufacturers, encompassing organic, conventional, and specialty products tailored to meet the evolving preferences and dietary needs of infants and toddlers. Safety and quality standards are paramount in the production of baby food, with rigorous testing and regulatory oversight ensuring adherence to strict guidelines to guarantee the safety and well-being of young consumers.To know about the Research Methodology :- Request Free Sample Report The demographic shifts, such as rising birth rates and urbanization, significantly drive the demand for baby food products. With more families opting for urban living and dual-income households, the need for convenient and readily available baby food options escalates, propelling market growth. The changing lifestyles and cultural preferences have encouraged an increased reliance on packaged and processed foods, including baby food, as parents seek quick and hassle-free feeding solutions for their infants and toddlers. The increasing awareness regarding the critical role of early childhood nutrition and the advantages of breastfeeding has led parents to seek out high-quality, nutritionally balanced baby food alternatives. Baby Food manufacturers are responding to this demand by offering a diverse array of products tailored to meet the specific dietary requirements of infants and young children, including organic, natural, and allergen-free options. Advancements in food processing techniques and formulations have facilitated the creation of innovative and convenient baby food offerings that boast extended shelf life, portability, and ease of preparation, stimulating Baby Food Market growth.

Baby Food Market Trend

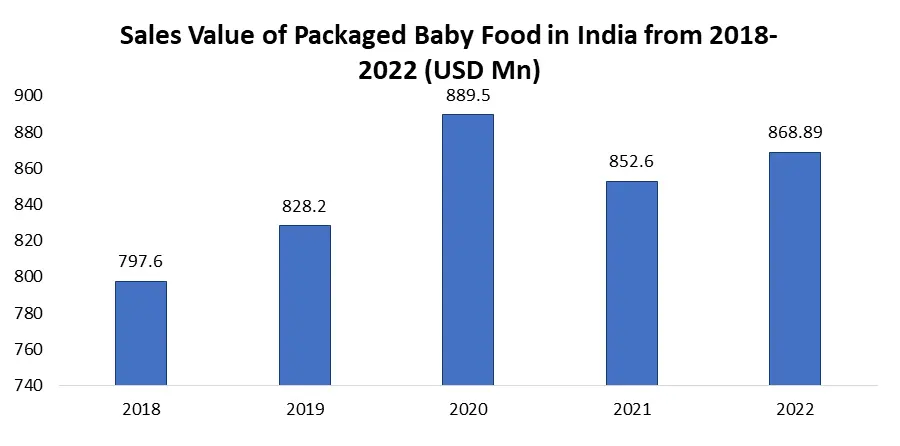

Growing Emphasis on Sustainability and Eco-Friendly Packaging Solutions Increasingly, consumers across several industries, including food and beverage, are prioritizing sustainability and seeking products that align with their environmental values. As parents become more mindful of their purchasing decisions, opting for products packaged in eco-friendly materials to reduce waste and minimize their carbon footprint. The Baby Food Market is influenced by a surge in environmental awareness, driven by escalating plastic pollution, particularly from single-use plastics endangering the planet's health. Recognizing the urgency of the situation, many baby food manufacturers are transitioning towards sustainable packaging alternatives including biodegradable materials and recyclable plastics, to mitigate their environmental impact. Sustainability prompts brands to innovate and adopt greener packaging solutions to differentiate themselves. By embracing eco-friendly packaging, companies not only cater to the growing demand for sustainable products but also enhance brand loyalty among environmentally conscious consumers. In the Baby Food Market, adopting sustainable packaging practices yields financial advantages by cutting waste disposal expenses and enhancing operational efficiency. The regulatory initiatives and industry standards are driving the shift towards sustainable packaging, with governments and organizations advocating for the reduction of single-use plastics and the promotion of eco-friendly alternatives. In the baby food market, the sales value of packaged products in India is increasing due to a heightened focus on sustainability and eco-friendly packaging solutions. Consumer demand for environmentally conscious options is driving manufacturers to innovate in packaging practices to align with these preferences.

Baby Food Market Dynamics

Increasing Demand for Organic and Natural Baby Food Products to Boost Market Growth Parents today are more conscious about the quality and safety of the food they provide to their infants and toddlers, driving them to seek out alternatives that are perceived as healthier and safer. Organic and natural baby food products have gained popularity due to their perceived benefits, including the absence of synthetic additives, pesticides, and genetically modified organisms (GMOs). Concerns about the potential adverse effects of artificial colors, flavors and preservatives commonly found in conventional baby food have led many parents to opt for organic options, believing them to be a safer choice for their children's health. The increasing prevalence of food allergies and sensitivities among infants and toddlers has contributed to the increasing demand for organic and natural baby food products which boost the Baby Food Market. Parents are more vigilant about potential allergens and ingredients that trigger adverse reactions in their children, prompting them to choose organic options that are free from common allergens and known irritants. The rise of the clean-label movement has boosted the demand for transparent and minimally processed baby food products, with parents seeking products with simple and recognizable ingredients. The shift towards cleaner and more natural eating habits is driven by concerns about the long-term health implications of consuming heavily processed and artificially enhanced foods. Manufacturers are increasingly focusing on developing organic and natural baby food products to cater to this increasing consumer demand. AI-Powered Customization Revolutionizes is a lucrative opportunity for the Baby Food Market In the rapidly evolving industry of infant nutrition, the baby food market is undergoing a profound transformation fueled by the revolutionary power of AI-driven customization. Departing from traditional mass manufacturing approaches, this paradigm shift acknowledges the unique nutritional needs of each child, offering tailored solutions that optimize growth and development. By harnessing data-driven insights, AI algorithms craft personalized recipes based on factors such as age, weight, allergies, and developmental milestones, ensuring optimal nutrient intake at every stage. This dynamic adaptation to evolving dietary requirements not only promotes healthier outcomes but also empowers parents with greater control over their child's diet, mitigating concerns over allergies and sensitivities. AI-powered platforms foster a sense of community and support among caregivers, providing access to resources and peer networks that enhance the overall baby food experience. From a business perspective, AI-driven customization for brands to differentiate themselves in the Baby Food Market while driving positive societal change by promoting healthier eating habits and fostering inclusivity. As we embrace this era of technological innovation, AI-powered customization emerges as a beacon of progress, reshaping the future of infant nutrition with compassion, insight and boundless possibility. Concerns Regarding the Safety and Quality of Ingredients Used in Baby Food Products to hamper Market Growth Parents are increasingly vigilant about the foods they introduce to their babies, recognizing the critical role nutrition plays in early childhood development. In the baby food market, issues like contaminants, harmful additives, or questionable sourcing have made consumers lose trust and led to increased regulatory oversight. As a result, parents are more likely to scrutinize ingredient labels, seek out organic or natural options, and demand transparency from manufacturers regarding their sourcing, manufacturing processes, and safety protocols. Companies operating in the market navigate complex regulatory landscapes and invest in rigorous quality control measures to ensure the safety and purity of their products. Failure to address these concerns effectively leads to reputational damage and loss of market share, making it imperative for companies to prioritize the safety and quality of ingredients used in baby food products to maintain consumer trust and competitiveness in the market.Baby Food Market Segment Analysis

By Product Type, the market is segmented into Infant Formula, Baby Meals, Baby Snacks and Others. Infant Formula is expected to dominate product Type for the baby food market over the forecast period. Infant formula stands as a vital nutritional option for babies, especially during their initial 4 to 6 months, if breast milk is insufficient or unavailable. Available in powdered, concentrated liquid, and ready-to-use forms, these formulas are meticulously crafted to supply essential nutrients vital for infants' growth and development. The primary variants of infant formulas encompass standard cow's milk-based options, fortified with iron and widely tolerated; soy-based formulas, suitable for lactose-intolerant infants or those adhering to a vegetarian diet; partially hydrolyzed formulas, aiding easier digestion and alleviating gas and fussiness; hypoallergenic formulas, crucial for babies with milk protein allergies or other allergic conditions; and lactose-free formulas, ideal for infants with galactosemia or lactose intolerance. The specialized formulas cater to infants with specific health concerns like reflux, prematurity, or malabsorption syndromes, ensuring tailored nutrition to address their distinct requirements. Infant formula maintains dominance as the primary product type in the baby food market due to its essential role as a nutritional substitute or supplement for infants who are not breastfed or partially breastfed. Universally needed and meticulously formulated to provide complete nutrition akin to breast milk, infant formula provides unparalleled convenience and accessibility for caregivers, available in various forms for easy preparation and feeding. Endorsed by healthcare professionals and trusted by parents, infant formula enjoys widespread brand loyalty and trust, fostering repeat purchases and long-term customer relationships. Ongoing technological advancements in formula development enhance product quality, safety, and efficacy, solidifying its position as a cornerstone of infant nutrition. The indispensable need for infant nutrition, combined with the convenience, medical endorsements, brand loyalty, and technological advancements associated with infant formula, collectively contribute to its dominance within the baby food market.

Baby Food Market Regional Insights

North America dominated the Baby Food Market in 2024 and is expected to continue its dominance during the forecast period. North America has an economic landscape characterized by high levels of disposable income among its populace. This financial resilience enables parents to prioritize the nutritional needs of their infants and invest more readily in premium and convenience-driven baby food products. Companies operating in the North American baby food market assistances from a consumer base that is willing to pay a premium for products perceived to offer superior quality, convenience, and nutritional value. The regional cultural ethos, which embraces packaged and processed foods across various segments, extends particularly to the baby food sector. This cultural inclination towards convenience foods is particularly pronounced in the United States, where hectic lifestyles and time constraints compel many parents to seek out readily available, pre-packaged baby food options. This leads to the industry for packaged baby foods, including purees, snacks, and ready-to-eat meals, which has flourished, with manufacturers providing the demand for quick, hassle-free solutions to infant feeding. The regional baby food market is driven due to the growing awareness of the importance of early childhood nutrition among parents. Increasingly, parents are recognizing the essential that nutrition plays in their children's development, leading to a heightened demand for baby food products that are not only convenient but also nutritionally fortified and free from harmful additives. This evolving consumer consciousness has prompted manufacturers to innovate and diversify their product offerings, with an emphasis on clean labels, organic ingredients, and transparency in sourcing and manufacturing practices.Global Baby Food Market Scope: Inquire before buying

Global Baby Food Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 96.92 Bn. Forecast Period 2025 to 2032 CAGR: 6.7% Market Size in 2032: USD 162.83 Bn. Segments Covered: by Product Type Infant Formula Baby Meals Baby Snacks Others by Nature Organic Inorganic by Distribution Channel Supermarkets/Hypermarkets Online Retail Pharmacies/Drugstores Specialty Stores Others Baby Food Market, By Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Baby Food Key Players

Global 1. Nestle S.A. (Vevey, Switzerland) 2. Danone (Paris, France) 3. Abbott Laboratories (Chicago, Illinois, USA) 4. Mead Johnson Nutrition (Reckitt Benckiser) (Chicago, Illinois, USA) 5. Hero Group (Lenzburg, Switzerland) North America 1. Gerber Products Company (Arlington, Virginia, USA) 2. The Kraft Heinz Company (Chicago, Illinois, USA) 3. Beech-Nut Nutrition Corporation (Amsterdam, New York, USA) 4. Plum Organics (Campbell Soup Company) (Emeryville, California, USA) 5. Happy Family Brands (Danone) (New York City, New York, USA) 6. Parent's Choice (Walmart) (Bentonville, Arkansas, USA) 7. Earth's Best (The Hain Celestial Group) (Lake Success, New York, USA) 8. Sprout Foods, Inc. (Materne North America Corp.) (Purchase, New York, USA) Europe 1. Cow & Gate (Danone) (London, United Kingdom) 2. HiPP GmbH & Co. Vertrieb KG ( Pfaffenhofen an der Ilm, Germany) 3. Organix Brands Ltd (Hero Group) (Bournemouth, United Kingdom) 4. Plum Baby (Purity Foods Ltd) (London, United Kingdom) 5. Peter Rabbit Organics Ltd (London, United Kingdom) 6. Holle Baby Food GmbH (Riehen, Switzerland) 7. Little Freddie UK Ltd (London, United Kingdom) Frequently Asked Questions: 1] What is the growth rate of the Global Baby Food Market? Ans. The Global Baby Food Market is growing at a significant rate of 6.7% during the forecast period. 2] Which region is expected to dominate the Global Baby Food Market? Ans. North America is expected to dominate the Baby Food Market during the forecast period. 3] What is the expected Global Baby Food Market size by 2032? Ans. The Baby Food Market size is expected to reach USD 162.83 Billion by 2032. 4] Which are the top players in the Global Baby Food Market? Ans. The major top players in the Global Baby Food Market are Nestle S.A. (Vevey, Switzerland),Danone (Paris, France),Abbott Laboratories (Chicago, Illinois, USA),Mead Johnson Nutrition (Reckitt Benckiser) (Chicago, Illinois, USA),Hero Group (Lenzburg, Switzerland), Gerber Products Company (Arlington, Virginia, USA) Others. 5] What are the factors driving the Global Baby Food Market growth? Ans. Rising awareness of infant nutrition and urbanization and changing lifestyles are expected to drive market growth during the forecast period.

1. Baby Food Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Baby Food Market: Dynamics 2.1. Baby Food Market Trends by Region 2.1.1. North America Baby Food Market Trends 2.1.2. Europe Baby Food Market Trends 2.1.3. Asia Pacific Baby Food Market Trends 2.1.4. Middle East and Africa Baby Food Market Trends 2.1.5. South America Baby Food Market Trends 2.2. Baby Food Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Baby Food Market Drivers 2.2.1.2. North America Baby Food Market Restraints 2.2.1.3. North America Baby Food Market Opportunities 2.2.1.4. North America Baby Food Market Challenges 2.2.2. Europe 2.2.2.1. Europe Baby Food Market Drivers 2.2.2.2. Europe Baby Food Market Restraints 2.2.2.3. Europe Baby Food Market Opportunities 2.2.2.4. Europe Baby Food Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Baby Food Market Drivers 2.2.3.2. Asia Pacific Baby Food Market Restraints 2.2.3.3. Asia Pacific Baby Food Market Opportunities 2.2.3.4. Asia Pacific Baby Food Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Baby Food Market Drivers 2.2.4.2. Middle East and Africa Baby Food Market Restraints 2.2.4.3. Middle East and Africa Baby Food Market Opportunities 2.2.4.4. Middle East and Africa Baby Food Market Challenges 2.2.5. South America 2.2.5.1. South America Baby Food Market Drivers 2.2.5.2. South America Baby Food Market Restraints 2.2.5.3. South America Baby Food Market Opportunities 2.2.5.4. South America Baby Food Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Baby Food Industry 2.8. Analysis of Government Schemes and Initiatives For Baby Food Industry 2.9. Baby Food Market Trade Analysis 2.10. The Global Pandemic Impact on Baby Food Market 3. Baby Food Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Baby Food Market Size and Forecast, by Product Type (2024-2032) 3.1.1. Infant Formula 3.1.2. Baby Meals 3.1.3. Baby Snacks 3.1.4. Others 3.2. Baby Food Market Size and Forecast, by Nature (2024-2032) 3.2.1. Organic 3.2.2. Inorganic 3.3. Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 3.3.1. Supermarkets/Hypermarkets 3.3.2. Online Retail 3.3.3. Pharmacies/Drugstores 3.3.4. Specialty Stores 3.3.5. Others 3.4. Baby Food Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Baby Food Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Infant Formula 4.1.2. Baby Meals 4.1.3. Baby Snacks 4.1.4. Others 4.2. North America Baby Food Market Size and Forecast, by Nature (2024-2032) 4.2.1. Organic 4.2.2. Inorganic 4.3. North America Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.1. Supermarkets/Hypermarkets 4.3.2. Online Retail 4.3.3. Pharmacies/Drugstores 4.3.4. Specialty Stores 4.3.5. Others 4.4. North America Baby Food Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Baby Food Market Size and Forecast, by Product Type (2024-2032) 4.4.1.1.1. Infant Formula 4.4.1.1.2. Baby Meals 4.4.1.1.3. Baby Snacks 4.4.1.1.4. Others 4.4.1.2. United States Baby Food Market Size and Forecast, by Nature (2024-2032) 4.4.1.2.1. Organic 4.4.1.2.2. Inorganic 4.4.1.3. United States Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.1.3.1. Supermarkets/Hypermarkets 4.4.1.3.2. Online Retail 4.4.1.3.3. Pharmacies/Drugstores 4.4.1.3.4. Specialty Stores 4.4.1.3.5. Others 4.4.2. Canada 4.4.2.1. Canada Baby Food Market Size and Forecast, by Product Type (2024-2032) 4.4.2.1.1. Infant Formula 4.4.2.1.2. Baby Meals 4.4.2.1.3. Baby Snacks 4.4.2.1.4. Others 4.4.2.2. Canada Baby Food Market Size and Forecast, by Nature (2024-2032) 4.4.2.2.1. Organic 4.4.2.2.2. Inorganic 4.4.2.3. Canada Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.2.3.1. Supermarkets/Hypermarkets 4.4.2.3.2. Online Retail 4.4.2.3.3. Pharmacies/Drugstores 4.4.2.3.4. Specialty Stores 4.4.2.3.5. Others 4.4.3. Mexico 4.4.3.1. Mexico Baby Food Market Size and Forecast, by Product Type (2024-2032) 4.4.3.1.1. Infant Formula 4.4.3.1.2. Baby Meals 4.4.3.1.3. Baby Snacks 4.4.3.1.4. Others 4.4.3.2. Mexico Baby Food Market Size and Forecast, by Nature (2024-2032) 4.4.3.2.1. Organic 4.4.3.2.2. Inorganic 4.4.3.3. Mexico Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.3.3.1. Supermarkets/Hypermarkets 4.4.3.3.2. Online Retail 4.4.3.3.3. Pharmacies/Drugstores 4.4.3.3.4. Specialty Stores 4.4.3.3.5. Others 5. Europe Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.2. Europe Baby Food Market Size and Forecast, by Nature (2024-2032) 5.3. Europe Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4. Europe Baby Food Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.1.2. United Kingdom Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.1.3. United Kingdom Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.2. France 5.4.2.1. France Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.2.2. France Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.2.3. France Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.3.2. Germany Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.3.3. Germany Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.4.2. Italy Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.4.3. Italy Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.5.2. Spain Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.5.3. Spain Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.6.2. Sweden Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.6.3. Sweden Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.7.2. Austria Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.7.3. Austria Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Baby Food Market Size and Forecast, by Product Type (2024-2032) 5.4.8.2. Rest of Europe Baby Food Market Size and Forecast, by Nature (2024-2032) 5.4.8.3. Rest of Europe Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6. Asia Pacific Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.2. Asia Pacific Baby Food Market Size and Forecast, by Nature (2024-2032) 6.3. Asia Pacific Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4. Asia Pacific Baby Food Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.1.2. China Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.1.3. China Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.2.2. S Korea Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.2.3. S Korea Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.3.2. Japan Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.3.3. Japan Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.4. India 6.4.4.1. India Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.4.2. India Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.4.3. India Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.5.2. Australia Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.5.3. Australia Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.6.2. Indonesia Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.6.3. Indonesia Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.7.2. Malaysia Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.7.3. Malaysia Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.8.2. Vietnam Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.8.3. Vietnam Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.9.2. Taiwan Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.9.3. Taiwan Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Baby Food Market Size and Forecast, by Product Type (2024-2032) 6.4.10.2. Rest of Asia Pacific Baby Food Market Size and Forecast, by Nature (2024-2032) 6.4.10.3. Rest of Asia Pacific Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 7. Middle East and Africa Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Baby Food Market Size and Forecast, by Product Type (2024-2032) 7.2. Middle East and Africa Baby Food Market Size and Forecast, by Nature (2024-2032) 7.3. Middle East and Africa Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4. Middle East and Africa Baby Food Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Baby Food Market Size and Forecast, by Product Type (2024-2032) 7.4.1.2. South Africa Baby Food Market Size and Forecast, by Nature (2024-2032) 7.4.1.3. South Africa Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Baby Food Market Size and Forecast, by Product Type (2024-2032) 7.4.2.2. GCC Baby Food Market Size and Forecast, by Nature (2024-2032) 7.4.2.3. GCC Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Baby Food Market Size and Forecast, by Product Type (2024-2032) 7.4.3.2. Nigeria Baby Food Market Size and Forecast, by Nature (2024-2032) 7.4.3.3. Nigeria Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Baby Food Market Size and Forecast, by Product Type (2024-2032) 7.4.4.2. Rest of ME&A Baby Food Market Size and Forecast, by Nature (2024-2032) 7.4.4.3. Rest of ME&A Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 8. South America Baby Food Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Baby Food Market Size and Forecast, by Product Type (2024-2032) 8.2. South America Baby Food Market Size and Forecast, by Nature (2024-2032) 8.3. South America Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.4. South America Baby Food Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Baby Food Market Size and Forecast, by Product Type (2024-2032) 8.4.1.2. Brazil Baby Food Market Size and Forecast, by Nature (2024-2032) 8.4.1.3. Brazil Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Baby Food Market Size and Forecast, by Product Type (2024-2032) 8.4.2.2. Argentina Baby Food Market Size and Forecast, by Nature (2024-2032) 8.4.2.3. Argentina Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Baby Food Market Size and Forecast, by Product Type (2024-2032) 8.4.3.2. Rest Of South America Baby Food Market Size and Forecast, by Nature (2024-2032) 8.4.3.3. Rest Of South America Baby Food Market Size and Forecast, by Distribution Channel (2024-2032) 9. Global Baby Food Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Baby Food Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nestle S.A. (Vevey, Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Danone (Paris, France) 10.3. Abbott Laboratories (Chicago, Illinois, USA) 10.4. Mead Johnson Nutrition (Reckitt Benckiser) (Chicago, Illinois, USA) 10.5. Hero Group (Lenzburg, Switzerland) 10.6. Gerber Products Company (Arlington, Virginia, USA) 10.7. The Kraft Heinz Company (Chicago, Illinois, USA) 10.8. Beech-Nut Nutrition Corporation (Amsterdam, New York, USA) 10.9. Plum Organics (Campbell Soup Company) (Emeryville, California, USA) 10.10. Happy Family Brands (Danone) (New York City, New York, USA) 10.11. Parent's Choice (Walmart) (Bentonville, Arkansas, USA) 10.12. Earth's Best (The Hain Celestial Group) (Lake Success, New York, USA) 10.13. Sprout Foods, Inc. (Materne North America Corp.) (Purchase, New York, USA) 10.14. Cow & Gate (Danone) (London, United Kingdom) 10.15. HiPP GmbH & Co. Vertrieb KG ( Pfaffenhofen an der Ilm, Germany) 10.16. Organix Brands Ltd (Hero Group) (Bournemouth, United Kingdom) 10.17. Plum Baby (Purity Foods Ltd) (London, United Kingdom) 10.18. Peter Rabbit Organics Ltd (London, United Kingdom) 10.19. Holle Baby Food GmbH (Riehen, Switzerland) 10.20. Little Freddie UK Ltd (London, United Kingdom) 11. Key Findings 12. Industry Recommendations 13. Baby Food Market: Research Methodology 14. Terms and Glossary