Global Autonomous Truck Market size was valued at USD 39.89 Bn. in 2024 and the total Global Autonomous Truck Market revenue is expected to grow at a CAGR of 13.7% from 2025 to 2032, reaching nearly USD 111.42 Bn. by 2032.Global Autonomous Truck Market Overview

Global Autonomous Truck Market has been growing by increasing demand from logistics providers, freight operators, OEMs and technology integrators. Growing need for driverless operations, real time monitoring, delivery efficiency and enhanced road safety is accelerating market adoption. Growing applications of autonomous trucks across long haul freight, last mile delivery, mining and construction sectors underline their role in reshaping both traditional logistics and smart transportation ecosystems. Technological advancements such as LIDAR integration, AI based navigation, V2X communication, remote diagnostics and cloud-based fleet orchestration are enhancing the safety, precision and operational efficiency of autonomous trucking systems. Autonomous Truck Market is supported by increasing regulatory efforts towards autonomous vehicle testing, electrification trends, and need for sustainable, scalable logistics solutions. The emphasis on reducing driver shortages, optimizing fuel consumption and enabling 24/7 goods operations is fuelling adoption across commercial fleet operators, e-commerce networks and industrial supply chains. North America dominates autonomous truck market, driven by region’s vast interstate freight network, supportive state level testing frameworks, substantial venture funding and early commercial pilots operating driver out runs on corridors such as Dallas Houston and Phoenix El Paso. The mature telematics ecosystem, strong presence of autonomous driving software firms, and partnerships between traditional truck OEMs and AI startups reinforce the region’s leadership position, giving North America more than one third of global revenue in 2024. Key players in autonomous truck market include Daimler Truck, Volvo Group, PACCAR Inc., Tesla Inc., Aurora Innovation and Kodiak Robotics. Companies are focusing on product innovation, expanding AI based autonomous driving platforms, forging logistics partnerships and investing in sustainable, connected and intelligent transport technologies to meet the growing global demand. Report covers Global autonomous truck market dynamics, structure by analysing market segments and projecting Global autonomous truck market size. Clear representation of competitive analysis of key players By Type, price, financial position, product portfolio, growth strategies and regional presence in Global autonomous truck market.To know about the Research Methodology :- Request Free Sample Report

Global Autonomous Truck Market Dynamics

Autonomous Trucks Fulfilling E-Commerce Demands to Drive Market Growth

Rising e-commerce has led to an increase in the volume of goods being shipped worldwide, creating a demand for more efficient and cost-effective transportation solutions. Autonomous truck helps to meet demand by providing a reliable and efficient means of transporting over long distances. The adoption of Technology, particularly in the fields of artificial intelligence (AI), Machine learning, Sensor technology, and connectivity, has enabled the development and deployment of autonomous trucks. Technology allows trucks to perceive. Their surroundings, make real-time decisions and navigate complex environments without human intervention.Sensor Dependability and Workforce Displacement to Restrain Global Autonomous Truck Market

One of the main challenges in autonomous driving is maintaining the dependability and accuracy of the sensors and algorithms used to guide the vehicle. Systems accurately detect and respond to a range of road conditions as well as ensuring the safety and security of the vehicle's software and hardware are essential for the functioning of the vehicle with autonomous technology. The innovation this technology is bringing to the logistics industry is pushing the sector to certain challenges with job losses and new skill requirements. Truck drivers and other workers in the logistics sector lose their jobs because of the deployment of autonomously driven trucks. The deployment of autonomous driving trucks could significantly affect economies and the environment. Along with the potential for more efficiency and cost savings, also has the potential to have a smaller negative impact on the environment and emissions.Global Autonomous Truck Market Segment Analysis

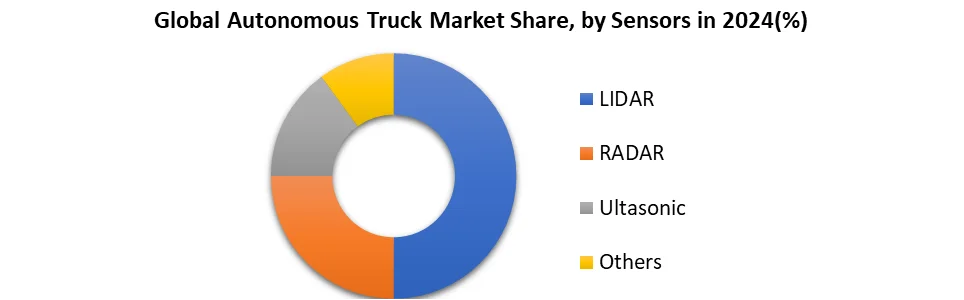

By Sensor types, the Automotive LIDAR sensor is the dominant segment with a market share of 50% in 2024. LIDAR systems help monitor the surrounding area and visualize the road in three dimensions. Instead of using electromagnetic energy, LIDAR uses laser pulses. The light emitted by LIDAR is ultraviolet, visible, and near-infrared (Bergvall & Gustavson, 2017, pp. 9-10). The narrow light beam of a LIDAR system increases accuracy over a RADAR system. When LIDAR is paired with RADAR, the systems are capable of recognizing road signs, other vehicles, lanes, traffic lights, pedestrians, and any obstacles in front of the vehicle with a range of up to 200 meters. Ouster is a renowned developer of LiDAR-powered sensors. It develops LiDAR sensors with short, mid, and long-range to support 3D sensing and high-resolution applications. The company provides solid-state LiDAR sensors with a custom SPAD detector and VCSEL laser chip. Manufacturers use robotic automation and ADAS. Autonomous trucking company Plus has agreed with Ouster to use its LIDARS in Plus’ autonomous trucks for deployment across the USA, China, and Europe. Quanergy develops AI-powered LiDAR sensing solutions and continues to partner with players like Fabrinet to improve its development process of LiDAR sensors across the world. In terms of LiDAR sensing and AI-based sensing solutions, the company offers software and hardware solutions. It also offers several products like mechanical LiDAR sensors, perception software, and solid-state LiDAR sensors. The company’s LiDAR based on Optical Phased Array (OPA) technology has reached an industry-first range of 250 m, making it ideal for use in autonomous trucks. Aeva’s mission is to bring the next wave of perception to a broad range of applications from automated driving to industrial robotics, consumer electronics, consumer health, security, and beyond. Aeva is transforming autonomy with its groundbreaking sensing and perception technology that integrates all key LiDAR components onto a silicon photonics chip in a compact module. Aeva 4D LiDAR sensors uniquely detect instant velocity in addition to 3D position, allowing autonomous devices like vehicles and robots to make more intelligent and safe decisions.

Global Autonomous Truck Market Regional Analysis

North America held the largest market share of 40% in 2024. The most compelling argument for Autonomous truck operation is the severe driver shortage across the world. In the United States, the gap is estimated to be around 80,000 drivers. Autonomous trucking is the only sustainable relief for the bottleneck. 24/7 availability boosts the capacity utilization of the installed fleet significantly. Enhanced fuel efficiency and unprecedented safety add to the benefits of autonomous trucks. Bright perspectives have attracted billions of dollars from various investors. The Top 5 autonomous trucking players in the U.S. alone have collected funds exceeding USD 10 bn since 2018. Level 1 features are predominant in the medium and heavy commercial vehicle (MHCV) segment, with an estimated 45% penetration. The commercial launch of Level 2 features started the year. By 2032, Level 4 autonomous trucks account for transportation of 6.4% of general freight by ton-miles in the United States, leading to savings of USD 4.75 billion in annual freight costs. Driven by the regulatory stimulus, Level 1 and Level 2 features are expected to grow exponentially to reach estimated cumulative sales of 1.1 million units (penetration of 88%) by 2032. Level 4 trucks are expected to be commercialized post-2025 in countries spearheading autonomous mobility transition with progressive government policies, innovation, infrastructure, and societal acceptance. Europe is a significant market for autonomous trucks, with Germany, the United Kingdom, and France being the major contributors to the market's growth. Owing to the development of advanced technologies such as AI and ADAS for autonomous driving. In Europe and the United States of America, measures are being taken to put a regulatory framework in place to control the use and deployment of autonomous driving vehicles, with a focus on safety, reliability, and other risks associated with the use of autonomous technology in general and trucks in particular.Global Autonomous Truck Market Competitive Landscape

Top key players in global autonomous truck market include Daimler Truck, Volvo Group, PACCAR Inc. Tesla Inc. and Aurora Innovation. Companies are focused on continuous innovation in autonomous driving systems, AI based navigation and development of scalable, safe and sustainable autonomous goods transport solutions. Manufacturers are designing cost effective and technologically advanced autonomous trucks for applications in long haul logistics, hub to hub transportation, last-mile delivery and industrial freight movement. Daimler Truck is known for advanced Freightliner autonomous vehicle platforms, offering SAE Level 4 enabled solutions that meet fleet demand for safety, fuel efficiency and continuous operation with minimal human intervention. Company emphasizes system integration, sensor fusion and steering systems to deliver robust autonomous performance. Tesla Inc. is pioneering autonomous capability through its proprietary Full Self Driving (FSD) software and electric Semi platform, combining EV innovation with autonomous driving to redefine sustainable freight mobility. Volvo Group and PACCAR Inc. are investing heavily in R&D driven autonomous technologies, emphasizing modular autonomy platforms, long range sensor fusion and integration of autonomous capabilities into next generation electric and diesel truck fleets. companies are positioning themselves at forefront of freight automation, combining AI, connectivity and hardware innovation to meet growing demand for efficient, safe and future ready logistics solutions.Global Autonomous Truck Market Trends

1. Rise of Level 4 Autonomy Pilots Growing deployment of SAE Level 4 autonomous trucks in controlled routes such as hub-to-hub and interstate corridors especially in North America demonstrates increasing real world viability and regulatory tolerance for driver-out operations. 2. Shift Toward Electrification Many autonomous truck projects are being paired with electric powertrains, combining sustainability with automation. Companies like Tesla and Volvo are aligning zero-emission goals with autonomous operations. 3. Integration of AI and Deep Learning Advanced AI algorithms are being integrated into perception, planning, and control systems, enabling more accurate obstacle detection, decision-making, and real-time response to complex traffic environments.Global Autonomous Truck Market Recent Development

1. On June 24, 2025, Aurora Innovation (USA) Aurora Innovation announced the successful completion of its first driver-out autonomous truck shipment for FedEx on a commercial Dallas-to-Houston freight corridor. This milestone marks progress toward commercial deployment of its Aurora Driver system. 2. May 14, 2025, Volvo Autonomous Solutions (Sweden) Volvo Group launched a new autonomous transport solution for mining and quarry operations in collaboration with Holcim. The solution features self-driving electric trucks operating in confined industrial zones in Europe. 3. February 28, 2025, Tesla Inc. (USA) announced the expansion of its Semi truck testing fleet, equipped with Full Self-Driving (FSD) software, in Nevada and Texas. The company is preparing for broader deployment across North America by early 2026. 4. December 5, 2024, Iveco Group (Italy) Iveco announced a joint venture with Chinese AV startup Pony.ai to develop autonomous trucks for the European and Asian logistics markets, targeting Level 4 driving systems integrated into Iveco heavy-duty platforms.Autonomous Truck Market Scope: Inquire before buying

Global Autonomous Truck Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 39.89 Bn. Forecast Period 2025 to 2032 CAGR: 13.7% Market Size in 2032: USD 111.42 Bn. Segments Covered: by Sensors LIDAR RADAR Ultrasonic Others by Truck Type Light-duty Trucks Medium-duty Truck Heavy-duty Trucks by Level of Autonomy Level 1 Level 2 Level 3 Level 4 by ADAS Features Adaptive Cruise Control Automatic Emergency Braking Highway Pilot Intelligent Park Assist (IPA), Lane Assist (LA) Others Autonomous Truck Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Global Autonomous Truck Market Key Players

North America 1. PACCAR Inc. (USA) 2. Tesla Inc. (USA) 3. Aurora Innovation (USA) 4. Navistar International Corporation (USA) 5. General Motors (USA) 6. Nikola Corporation (USA) 7. Peterbilt Motors Company (USA) 8. International Trucks (USA) 9. Mack Trucks (USA) Europe 10. Daimler Truck AG (Germany) 11. Volvo Group (Sweden) 12. Scania AB (Sweden) 13. MAN Truck & Bus (Germany) 14. Iveco Group (Italy) 15. Renault Trucks (France) 16. DAF Trucks (Netherlands) 17. Mercedes-Benz Trucks (Germany) Asia-Pacific 18. FAW Jiefang (China) 19. Dongfeng Motor Corporation (China) 20. SAIC Motor Corporation (China) 21. BYD Auto Co., Ltd. (China) 22. Hyundai Motor Company (South Korea) 23. Tata Motors (India) 24. Ashok Leyland (India) 25. Hino Motors, Ltd. (Japan) 26. Isuzu Motors (Japan) 27. UD Trucks (Japan)FAQs:

1. Which region has the largest share in the Autonomous Truck Market? Ans: The North America region held the highest share in 2024 in the Autonomous Truck Market. 2. What are the key factors driving the growth of the Autonomous Truck Market? Ans: Rapid growth in e-commerce and demand for faster, more consistent deliveries to boost the Autonomous Truck Market growth. 3. Who are the key competitors in the Autonomous Truck Market? Ans: Daimler Truck, Volvo Group, PACCAR Inc., Tesla Inc. are the key competitors in the Autonomous Truck Market. 4. What are the opportunities for the Autonomous Truck Market? Ans: Integration with Electric and Hydrogen Powertrains create opportunities in the Autonomous Truck Market. 5. Which sensor segment dominates the Autonomous Truck Market? Ans: The LIDAR sensor segment dominated the Autonomous Truck Market.

1. Autonomous Truck Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Autonomous Truck Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Autonomous Truck Market: Dynamics 3.1. Region-wise Trends of Autonomous Truck Market 3.1.1. North America Autonomous Truck Market Trends 3.1.2. Europe Autonomous Truck Market Trends 3.1.3. Asia Pacific Autonomous Truck Market Trends 3.1.4. Middle East and Africa Autonomous Truck Market Trends 3.1.5. South America Autonomous Truck Market Trends 3.2. Autonomous Truck Market Dynamics 3.2.1. Autonomous Truck Market Drivers 3.2.1.1. Growth of E-Commerce and Delivery Needs 3.2.1.2. Demand for 24/7 Logistics Operations 3.2.2. Autonomous Truck Market Restraints 3.2.3. Autonomous Truck Market Opportunities 3.2.3.1. Electrification of Autonomous Fleets 3.2.3.2. Integration with Smart Cities & Highways 3.2.4. Autonomous Truck Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Driver Shortage Impact 3.4.2. Cost Savings in Logistics 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Autonomous Truck Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 4.1.1. LIDAR 4.1.2. RADAR 4.1.3. Ultrasonic 4.1.4. Others 4.2. Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 4.2.1. Light-duty Trucks 4.2.2. Medium-duty Truck 4.2.3. Heavy-duty Trucks 4.3. Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 4.3.1. Level 1 4.3.2. Level 2 4.3.3. Level 3 4.3.4. Level 4 4.4. Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 4.4.1. Adaptive Cruise Control 4.4.2. Automatic Emergency Braking 4.4.3. Highway Pilot 4.4.4. Intelligent Park Assist (IPA), 4.4.5. Lane Assist (LA) 4.4.6. Others 4.5. Autonomous Truck Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Autonomous Truck Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 5.1.1. LIDAR 5.1.2. RADAR 5.1.3. Ultrasonic 5.1.4. Others 5.2. North America Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 5.2.1. Light-duty Trucks 5.2.2. Medium-duty Truck 5.2.3. Heavy-duty Trucks 5.3. North America Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 5.3.1. Level 1 5.3.2. Level 2 5.3.3. Level 3 5.3.4. Level 4 5.4. North America Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 5.4.1. Adaptive Cruise Control 5.4.2. Automatic Emergency Braking 5.4.3. Highway Pilot 5.4.4. Intelligent Park Assist (IPA), 5.4.5. Lane Assist (LA) 5.4.6. Others 5.5. North America Autonomous Truck Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 5.5.1.1.1. LIDAR 5.5.1.1.2. RADAR 5.5.1.1.3. Ultrasonic 5.5.1.1.4. Others 5.5.1.2. United States Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 5.5.1.2.1. Light-duty Trucks 5.5.1.2.2. Medium-duty Truck 5.5.1.2.3. Heavy-duty Trucks 5.5.1.3. United States Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 5.5.1.3.1. Level 1 5.5.1.3.2. Level 2 5.5.1.3.3. Level 3 5.5.1.3.4. Level 4 5.5.1.4. United States Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 5.5.1.4.1. Adaptive Cruise Control 5.5.1.4.2. Automatic Emergency Braking 5.5.1.4.3. Highway Pilot 5.5.1.4.4. Intelligent Park Assist (IPA), 5.5.1.4.5. Lane Assist (LA) 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 5.5.2.1.1. LIDAR 5.5.2.1.2. RADAR 5.5.2.1.3. Ultrasonic 5.5.2.1.4. Others 5.5.2.2. Canada Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 5.5.2.2.1. Light-duty Trucks 5.5.2.2.2. Medium-duty Truck 5.5.2.2.3. Heavy-duty Trucks 5.5.2.3. Canada Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 5.5.2.3.1. Level 1 5.5.2.3.2. Level 2 5.5.2.3.3. Level 3 5.5.2.3.4. Level 4 5.5.2.4. Canada Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 5.5.2.4.1. Adaptive Cruise Control 5.5.2.4.2. Automatic Emergency Braking 5.5.2.4.3. Highway Pilot 5.5.2.4.4. Intelligent Park Assist (IPA), 5.5.2.4.5. Lane Assist (LA) 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 5.5.3.1.1. LIDAR 5.5.3.1.2. RADAR 5.5.3.1.3. Ultrasonic 5.5.3.1.4. Others 5.5.3.2. Mexico Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 5.5.3.2.1. Light-duty Trucks 5.5.3.2.2. Medium-duty Truck 5.5.3.2.3. Heavy-duty Trucks 5.5.3.3. Mexico Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 5.5.3.3.1. Level 1 5.5.3.3.2. Level 2 5.5.3.3.3. Level 3 5.5.3.3.4. Level 4 5.5.3.4. Mexico Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 5.5.3.4.1. Adaptive Cruise Control 5.5.3.4.2. Automatic Emergency Braking 5.5.3.4.3. Highway Pilot 5.5.3.4.4. Intelligent Park Assist (IPA), 5.5.3.4.5. Lane Assist (LA) 5.5.3.4.6. Others 6. Europe Autonomous Truck Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.2. Europe Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.3. Europe Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.4. Europe Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5. Europe Autonomous Truck Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.1.2. United Kingdom Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.1.3. United Kingdom Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.1.4. United Kingdom Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5.2. France 6.5.2.1. France Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.2.2. France Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.2.3. France Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.2.4. France Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.3.2. Germany Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.3.3. Germany Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.3.4. Germany Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.4.2. Italy Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.4.3. Italy Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.4.4. Italy Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.5.2. Spain Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.5.3. Spain Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.5.4. Spain Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.6.2. Sweden Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.6.3. Sweden Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.6.4. Sweden Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.7.2. Russia Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.7.3. Russia Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.7.4. Russia Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 6.5.8.2. Rest of Europe Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 6.5.8.3. Rest of Europe Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 6.5.8.4. Rest of Europe Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7. Asia Pacific Autonomous Truck Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.2. Asia Pacific Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.3. Asia Pacific Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.4. Asia Pacific Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5. Asia Pacific Autonomous Truck Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.1.2. China Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.1.3. China Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.1.4. China Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.2.2. S Korea Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.2.3. S Korea Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.2.4. S Korea Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.3.2. Japan Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.3.3. Japan Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.3.4. Japan Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.4. India 7.5.4.1. India Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.4.2. India Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.4.3. India Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.4.4. India Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.5.2. Australia Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.5.3. Australia Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.5.4. Australia Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.6.2. Indonesia Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.6.3. Indonesia Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.6.4. Indonesia Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.7.2. Malaysia Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.7.3. Malaysia Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.7.4. Malaysia Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.8.2. Philippines Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.8.3. Philippines Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.8.4. Philippines Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.9.2. Thailand Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.9.3. Thailand Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.9.4. Thailand Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.10.2. Vietnam Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.10.3. Vietnam Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.10.4. Vietnam Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 7.5.11.2. Rest of Asia Pacific Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 7.5.11.4. Rest of Asia Pacific Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 8. Middle East and Africa Autonomous Truck Market Size and Forecast (by Value in USD Million) (2024-2032) 8.1. Middle East and Africa Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 8.2. Middle East and Africa Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 8.3. Middle East and Africa Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 8.4. Middle East and Africa Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 8.5. Middle East and Africa Autonomous Truck Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 8.5.1.2. South Africa Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 8.5.1.3. South Africa Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 8.5.1.4. South Africa Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 8.5.2.2. GCC Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 8.5.2.3. GCC Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 8.5.2.4. GCC Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 8.5.3.2. Egypt Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 8.5.3.3. Egypt Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 8.5.3.4. Egypt Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 8.5.4.2. Nigeria Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 8.5.4.3. Nigeria Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 8.5.4.4. Nigeria Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 8.5.5.2. Rest of ME&A Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 8.5.5.3. Rest of ME&A Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 8.5.5.4. Rest of ME&A Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 9. South America Autonomous Truck Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. South America Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 9.2. South America Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 9.3. South America Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 9.4. South America Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 9.5. South America Autonomous Truck Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 9.5.1.2. Brazil Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 9.5.1.3. Brazil Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 9.5.1.4. Brazil Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 9.5.2.2. Argentina Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 9.5.2.3. Argentina Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 9.5.2.4. Argentina Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 9.5.3.2. Colombia Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 9.5.3.3. Colombia Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 9.5.3.4. Colombia Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 9.5.4.2. Chile Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 9.5.4.3. Chile Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 9.5.4.4. Chile Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Autonomous Truck Market Size and Forecast, By Sensors (2024-2032) 9.5.5.2. Rest Of South America Autonomous Truck Market Size and Forecast, By Truck Type (2024-2032) 9.5.5.3. Rest Of South America Autonomous Truck Market Size and Forecast, By Level of Autonomy (2024-2032) 9.5.5.4. Rest Of South America Autonomous Truck Market Size and Forecast, By ADAS Features (2024-2032) 10. Company Profile: Key Players 10.1 PACCAR Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2 Tesla Inc. (USA) 10.3 Aurora Innovation (USA) 10.4 Navistar International Corporation (USA) 10.5 General Motors (USA) 10.6 Nikola Corporation (USA) 10.7 Peterbilt Motors Company (USA) 10.8 International Trucks (USA) 10.9 Mack Trucks (USA) 10.10 Daimler Truck AG (Germany) 10.11 Volvo Group (Sweden) 10.12 Scania AB (Sweden) 10.13 MAN Truck & Bus (Germany) 10.14 Iveco Group (Italy) 10.15 Renault Trucks (France) 10.16 DAF Trucks (Netherlands) 10.17 Mercedes-Benz Trucks (Germany) 10.18 FAW Jiefang (China) 10.19 Dongfeng Motor Corporation (China) 10.20 SAIC Motor Corporation (China) 10.21 BYD Auto Co., Ltd. (China) 10.22 Hyundai Motor Company (South Korea) 10.23 Tata Motors (India) 10.24 Ashok Leyland (India) 10.25 Hino Motors, Ltd. (Japan) 10.26 Isuzu Motors (Japan) 10.27 UD Trucks (Japan) 11 Key Findings 12 Industry Recommendations 13 Autonomous Truck Market: Research Methodology