Automotive Mass Air Flow (MAF) Sensors Market was valued at US $ 13.60 Mn. in 2022. Automotive Mass Air Flow (MAF) Sensors Market size is estimated to grow at a CAGR of 3 %. The market is expected to reach a value of US $ 16.72 Mn. in 2029.Automotive Mass Air Flow (MAF) Sensors Market Overview:

Automotive mass air flow (MAF) sensors are one of the most important components of an automobile's electronic fuel injection system. The MAF sensor is located between the vehicle engine's intake manifold and air filter. The MAF sensor's main job is to detect the mass air flow, or how much air gets into an internal combustion engine. The engine control unit requires information about mass air flow in order to balance and deliver the correct fuel mass to the engine. Air density varies in car applications depending on forced induction, ambient temperature, and altitude. As a result, mass air flow sensors, rather than volumetric flow sensors, are more appropriate in automobile applications for estimating the quantity of air intake in each cylinder. Unlike a vane air flow meter, which employs a spring loaded flop, mass air flow sensors have no moving elements. Electrical current is used by MAF sensors to monitor airflow. Along with the mass air flow sensor, an intake air temperature sensor and an oxygen sensor are frequently added. The air/fuel ratio of the engine may be accurately monitored and regulated when a mass air flow sensor is used in conjunction with an oxygen sensor.To know about the Research Methodology:- Request Free Sample Report

Market Trends:

• Potential of the Market - The automotive air flow market is still considered to be in its development, with a long way to go before it reaches its full potential for growth and need for automotive air flow sensors. The rise in concerns about pollution and emissions, as well as the widespread use of automotive air flow sensors in the modern automobile industry around the world, is a major driver driving the growth of the automotive mass air flow sensor market. The automotive mass air flow sensor market is expected to grow significantly in the forecast period, with North America leading the way, followed by Europe and Asia-Pacific. The surge in demand for commercial cars, the growing need to replace older vehicles, and the fast changing automotive infrastructure are all factors contributing to this increase in demand for air flow meters. • Demand for electric vehicles is increasing - Electric vehicle market penetration has been witnessed across the globe by the automotive industry. Government subsidies and perks, such as those granted by India's government, are pushing consumers to buy electric automobiles. The growth of internal combustion vehicles (ICE) and parts is being influenced by the rise in demand and market share of electronic cars. The impact of this may be seen in the industry, as OEMs of internal combustion cars are expanding their product lines and creating electrical vehicle components as well. Electric vehicles are seen as a viable alternative to internal combustion engines, reducing demand for ICE parts.Automotive Mass Air Flow (MAF) Sensors Market Dynamics:

The benefits offered by these sensors, such as increased engine performance, superior engine control, fast response time, high resistance and durability, and reduced airflow restriction, are driving the global automotive mass air flow sensors market. Furthermore, increased global car production is driving MAF sensor sales upward. However, common symptoms of mass air flow sensor issues include running lean under load or rich at idle, harsh stalls, and a reduction in fuel economy. During the forecast period, the automotive mass airflow (MAF) sensors market is expected to grow due to an increase in the automotive sector and manufacturing of commercial and passenger vehicles. The automotive mass airflow (MAF) sensors market is growing due to factors such as enhanced engine performance, superior engine control, fast response time, high resistance and durability, and reduced airflow restriction. Similarly, during the projected period, the global increase in vehicle production and sales will drive the expansion of the automotive mass airflow (MAF) sensors market.Automotive Mass Air Flow (MAF) Sensors Market Segment Analysis:

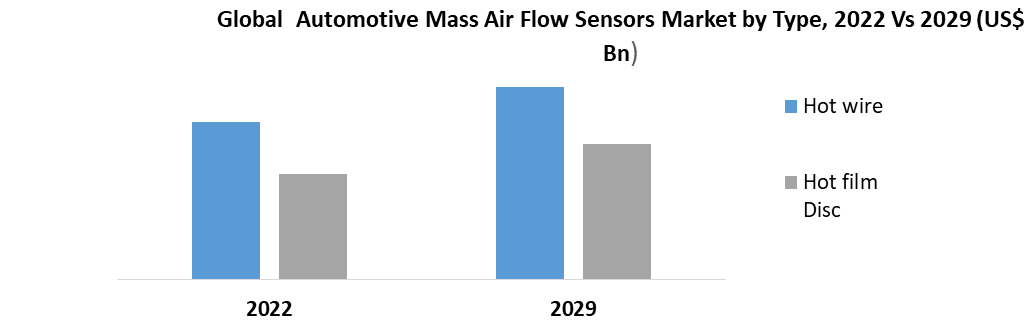

Based on Type, the market is sub-segmented into hot wire and hot film disc. Despite their modest differences in construction, both types of MAF sensors compute the quantity of gasoline required to maintain the optimum fuel mixture by measuring the density and volume of air entering the engine. Because of the benefits associated with this type of mass air flow sensor, such as low airflow restriction, smaller overall packages, quick response to changes in airflow, low cost, and no requirement for separate temperature and pressure sensors, hot-wire type mass air flow sensors are most commonly used in modern automobiles. In 2022, the hot wire segment had the greatest market share of xx %, and this is likely to continue throughout the forecast period. These two segments, despite having the identical design, are utilized to calculate the amount of fuel required to maintain the proper fuel mixture. During the forecast period, factors such as reduced airflow restriction, smaller overall packaging, quick response to changes in airflow, cheap cost, and no demand for separate temperature and pressure sensors are likely to promote the growth of the hot wire segment.

Automotive Mass Air Flow (MAF) Sensors Market Regional Insights:

North America, Europe, Asia Pacific, and the Rest of the World make up the Global Automotive Mass Air Flow (MAF) Sensors Market. The regions of North America and Europe currently hold the largest market share and are expected to continue to grow and dominate the Global Automotive Mass Air Flow (MAF) Sensors Market over the forecast period. The objective of the report is to present a comprehensive analysis of the Automotive Mass Air Flow (MAF) Sensors Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help understand the Automotive Mass Air Flow (MAF) Sensors Market dynamic and structure by analyzing the market segments and projecting the Automotive Mass Air Flow (MAF) Sensors Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Automotive Mass Air Flow (MAF) Sensors Market make the report investor’s guide.Automotive Mass Air Flow (MAF) Sensors Market Scope: Inquire before buying

Global Automotive Mass Air Flow (MAF) Sensors Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 13.60 Mn. Forecast Period 2023 to 2029 CAGR: 3% Market Size in 2029: US $ 16.72 Mn. Segments Covered: by Type • Hot wire • Hot film Disc by Design of MAF Sensor • Variable voltage output design • Frequency output design Automotive Mass Air Flow (MAF) Sensors Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Automotive Mass Air Flow (MAF) Sensors Market Key Players are:

• Robert Bosch GmbH • Denso Corporation • Delphi Automotive PLC • Dorman • Hitachi Automotive Systems Ltd • ACDelco • Continental AG • General Motors Co. • HELLA GmbH & Co. KGaA • Sensata Technologies Inc • TE Connectivity Ltd • Valeo SA • First Sensor AG • Honeywell • Analog DevicesFrequently Asked Questions:

1] What segments are covered in the Automotive Mass Air Flow (MAF) Sensors Market report? Ans. The segments covered in the Automotive Mass Air Flow (MAF) Sensors Market report are based on Type and Design of MAF Sensor 2] Which region is expected to hold the highest share in the Automotive Mass Air Flow (MAF) Sensors Market? Ans. The Asia pacific region is expected to hold the highest share in the Automotive Mass Air Flow (MAF) Sensors Market. 3] What is the market size of the Automotive Mass Air Flow (MAF) Sensors Market by 2029? Ans. The market size of the Automotive Mass Air Flow (MAF) Sensors Market is expected to reach US $ 16.72 Mn. by 2029 4] What is the forecast period for the Automotive Mass Air Flow (MAF) Sensors Market? Ans. The Forecast period for the Automotive Mass Air Flow (MAF) Sensors Market is 2023-2029. 5] What was the market size of the Automotive Mass Air Flow (MAF) Sensors Market in 2022? Ans. The market size of the Automotive Mass Air Flow (MAF) Sensors Market in 2022 was worth US $ 13.60 Mn

1. Global Automotive Mass Air Flow (MAF) Sensors Market Size: Research Methodology 2. Global Automotive Mass Air Flow (MAF) Sensors Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Automotive Mass Air Flow (MAF) Sensors Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Automotive Mass Air Flow (MAF) Sensors Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Automotive Mass Air Flow (MAF) Sensors Market Size Segmentation 4.1. Global Automotive Mass Air Flow (MAF) Sensors Market Size, by Type (2023-2029) • Hot wire • Hot film Disc 4.2. Global Automotive Mass Air Flow (MAF) Sensors Market Size, by Design of MAF Sensor (2023-2029) • Variable voltage output design • Frequency output design 5. North America Automotive Mass Air Flow (MAF) Sensors Market (2023-2029) 5.1. North America Automotive Mass Air Flow (MAF) Sensors Market Size, by Type (2023-2029) • Hot wire • Hot film Disc 5.2. North America Automotive Mass Air Flow (MAF) Sensors Market Size, by Design of MAF Sensor (2023-2029) • Variable voltage output design • Frequency output design 5.3. North America Automotive Mass Air Flow (MAF) Sensors Market, by Country (2023-2029) • United States • Canada • Mexico 6. European Automotive Mass Air Flow (MAF) Sensors Market (2023-2029) 6.1. European Automotive Mass Air Flow (MAF) Sensors Market, by Type (2023-2029) 6.2. European Automotive Mass Air Flow (MAF) Sensors Market Size, by Design of MAF Sensor (2023-2029) 6.3. European Automotive Mass Air Flow (MAF) Sensors Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Automotive Mass Air Flow (MAF) Sensors Market (2023-2029) 7.1. Asia Pacific Automotive Mass Air Flow (MAF) Sensors Market, by Type (2023-2029) 7.2. Asia Pacific Automotive Mass Air Flow (MAF) Sensors Market Size, by Design of MAF Sensor (2023-2029) 7.3. Asia Pacific Automotive Mass Air Flow (MAF) Sensors Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Automotive Mass Air Flow (MAF) Sensors Market (2023-2029) 8.1. Middle East and Africa Automotive Mass Air Flow (MAF) Sensors Market, by Type (2023-2029) 8.2. Middle East and Africa America Automotive Mass Air Flow (MAF) Sensors Market Size, by Design of MAF Sensor (2023-2029) 8.3. Middle East and Africa Automotive Mass Air Flow (MAF) Sensors Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Automotive Mass Air Flow (MAF) Sensors Market (2023-2029) 9.1. Latin America Automotive Mass Air Flow (MAF) Sensors Market, by Type (2023-2029) 9.2. Latin America Automotive Mass Air Flow (MAF) Sensors Market Size, by Design of MAF Sensor (2023-2029) 9.3. Latin America Automotive Mass Air Flow (MAF) Sensors Market, by Country (2023-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Robert Bosch GmbH 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Denso Corporation 10.3. Delphi Automotive PLC 10.4. Dorman 10.5. Hitachi Automotive Systems Ltd 10.6. ACDelco 10.7. Continental AG 10.8. General Motors Co. 10.9. HELLA GmbH & Co. KGaA 10.10. Sensata Technologies Inc 10.11. TE Connectivity Ltd 10.12. Valeo SA 10.13. First Sensor AG 10.14. Honeywell 10.15. Analog Devices