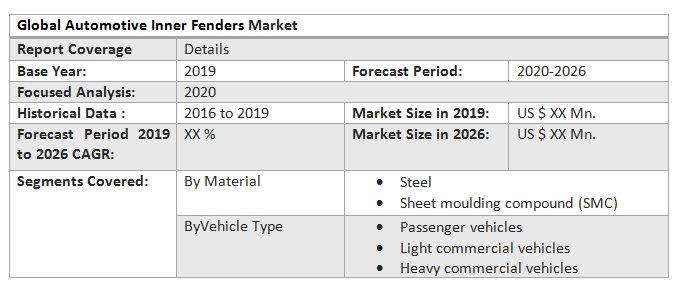

Global Automotive Inner Fenders Market is expected to grow at a CAGR of 4.6% during the forecast period and is expected to reach US$ 478.88 Mn by 2026.Global Automotive Inner Fenders Market Overview

Inner fenders border both from and rear wheel of a vehicle to prevent rocks, liquids, mud and sand from being thrown at other vehicles and walkers. All types of vehicles use automotive inner fenders. In the U.K. fenders are also known as wing and in India and Sri Lanka they are known as mudguard. This report providesa detailed information according to region and contribution of all segments to the growth of the Automotive Inner Fenders Market.Global Automotive Inner Fenders Market Dynamics

One of the leading drivers for market growth of inner fenders market is demand for M&HCV. Increase in industrialization and urbanization in developing countries like India and china expects need for housing and infrastructure. Thus, increase in construction is expected to drive the market for M&HCV vehicles for raw material transportation in the real estate projects. Asia is expected to boost the market of commercial vehicle due to rise in mining and construction activities, which in turn is driving demand for the growth of automotive inner fenders. Automotive manufacturers such as Volvo Car Corp., Daimler AG and BMW AG among others are expected to increase production and sale of electric vehicles in future due to increasing demand of fuel efficient and low emission electric and hybrid vehicles across the world. Thus, expanding the automotive fenders market during the forecast period.Global Automotive Inner Fenders Market Segment Analysis

Global Automotive Inner Fenders Market Segment, by Material:

By material, the automotive inner fenders market is segmented into steel and sheet molding compound (SMC). The materials like steel and sheet metal compounds are used for making inner fenders in an automobile. Sometimes steel is replaced by sheet metal compound to reduce the weight of vehicle which subsequently increases fuel efficiency of vehicle by increasing vehicle mileage. There is increase in the utilization of non-corrosive materials in the automotive inner fenders market as inner fenders are prone to get rusted due to mud and road debris. With the use of non-corrosive material such as thermoplastic can help inner fenders from getting rusted and thus increasing life span. Also, these thermoplastic wheel liners can be easily replaced as they are fitted with screws, bolts, and clips.Global Automotive Inner Fenders Market Segment, by Vehicle Type:

Passenger Car segment is projected to grow at a 4.5% CAGR to reach XX Million Units during forecast period. Industrialization and urbanization lead to the fast growth of countries in Asia Pacific. Factors such as reduced interest rates, drop in fuel prices, the recovering economy in developing countries are expected to drive the segments growth in the automotive inner fenders market.To know about the Research Methodology :- Request Free Sample Report

Global Automotive Inner Fenders Market Regional Analysis

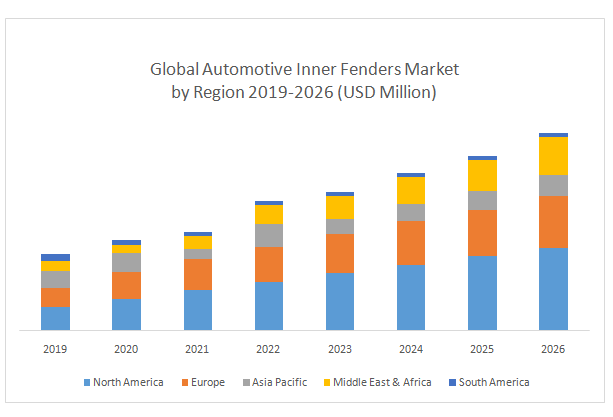

APAC dominated the global automotive inner fenders market during 2019 and is expected to drive the market growth during the forecast period. North America holds maximum share of automotive inner fenders market as the light commercial vehicles in North America is expanding at significant pace due to extensive usage of these vehicles to transport daily goods in the region.U.S. is the second largest automotive and passenger vehicle market in the world. Germany is the fourth largest market for passenger vehicles in the world, followed by japan and India, which are the third and fifth largest passenger vehicle markets in the world. Asia pacific is expected to increase the rise for commercial vehicles due to infrastructure and rising construction activities. These commercial vehicles transport raw material, which subsequently increases the growth of automotive inner fenders for commercial vehicles. Along with that,the sale for passenger vehicles is expected to increase across the globe, which consequently increases the demand for automotive inner fenders during the forecast period.

Global Automotive Inner Fenders Market Scope: Inquire before buying

Global Automotive Inner Fenders Market, by Region:

• North America • Asia pacific • Europe • Middle East and Africa • South AmericaGlobal Automotive Inner Fenders Market Key Players

• Samvardhana Motherson Group (India) • Gordon Auto Body Parts Co. Ltd. (Taiwan) • Great Bestcam Co. Ltd (GBC, Taiwan) • Auto Depot Co.Ltd. (Thailand) • Auto Metal Direct (the U.S) • Glasstek (the U.S) • Lokari (Germany) • Pacific Auto Company (the U.S.) • Webeka engineering • LinYi Xin Mai Chi Auto • Canghzou Baoda

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Automotive Inner Fenders Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Automotive Inner Fenders Market 3.4. Geographical Snapshot of the Automotive Inner Fenders Market, By Manufacturer share 4. Global Automotive Inner Fenders Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Automotive Inner Fenders Market 5. Supply Side and Demand Side Indicators 6. Global Automotive Inner Fenders Market Analysis and Forecast, 2019-2027 6.1. Global Automotive Inner Fenders Market Size & Y-o-Y Growth Analysis. 7. Global Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 7.1.1. Steel 7.1.2. Sheet moulding compound (SMC) 7.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 7.2.1. Passenger vehicles 7.2.2. Light commercial vehicles 7.2.3. Heavy commercial vehicles 8. Global Automotive Inner Fenders Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2027 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 9.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 9.1.1. Steel 9.1.2. Sheet moulding compound (SMC) 9.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 9.2.1. Passenger vehicles 9.2.2. Light commercial vehicles 9.2.3. Heavy commercial vehicles 10. North America Automotive Inner Fenders Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 11.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 12. Canada Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 12.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 12.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 13. Mexico Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 13.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 13.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 14. Europe Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 14.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 14.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 15. Europe Automotive Inner Fenders Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 16.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 16.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 17. France Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 17.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 17.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 18. Germany Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 18.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 18.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 19. Italy Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 19.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 19.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 20. Spain Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 20.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 20.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 21. Sweden Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 21.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 21.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 22. CIS CountriesAutomotive Inner Fenders Market Analysis and Forecasts, 2019-2027 22.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 22.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 23. Rest of Europe Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 23.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 23.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 24. Asia Pacific Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 24.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 24.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 25. Asia Pacific Automotive Inner Fenders Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 26.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 26.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 27. India Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 27.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 27.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 28. Japan Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 28.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 28.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 29. South Korea Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 29.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 29.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 30. Australia Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 30.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 30.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 31. ASEAN Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 31.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 31.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 32. Rest of Asia Pacific Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 32.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 32.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 33. Middle East Africa Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 33.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 33.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 34. Middle East Africa Automotive Inner Fenders Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 35.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 35.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 36. GCC Countries Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 36.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 36.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 37. Egypt Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 37.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 37.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 38. Nigeria Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 38.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 38.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 39. Rest of ME&A Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 39.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 39.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 40. South AmericaAutomotive Inner Fenders Market Analysis and Forecasts, 2019-2027 40.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 40.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 41. South America Automotive Inner Fenders Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 42.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 42.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 43. Argentina Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 43.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 43.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 44. Rest of South America Automotive Inner Fenders Market Analysis and Forecasts, 2019-2027 44.1. Market Size (Value) Estimates & ForecastBy Material, 2019-2027 44.2. Market Size (Value) Estimates & ForecastBy Vehicle Type, 2019-2027 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Automotive Inner Fenders Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Applications 45.2.3.2. M&A Key Players, Forward Integration and Backward Integration 45.3. Company Profile : Key Players 45.3.1. Pacific Auto Company (the U.S.) 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Samvardhana Motherson Group (India) 45.3.3. Gordon Auto Body Parts Co. Ltd. (Taiwan) 45.3.4. Great Bestcam Co. Ltd (GBC, Taiwan) 45.3.5. Auto Depot Co.Ltd. (Thailand) 45.3.6. Auto Metal Direct (the U.S) 45.3.7. Glasstek (the U.S) 45.3.8. Lokari (Germany) 45.3.9. Pacific Auto Company (the U.S.) 45.3.10. LinYi Xin Mai Chi Auto 45.3.11. Canghzou Baoda 45.3.12. Webeka engineering 46. Primary Key Insights