Global Automotive In-Vehicle Payment Market valued at USD 5.02 Bn. in 2024, projected to reach USD 16.46 Bn. by 2032, growing at 16% CAGR.Automotive In-Vehicle Payment Market Overview

Automotive in-vehicle payment refers to the technology that enables drivers to make real-time transactions, such as for fuel, tolls, parking, and food, directly from their car’s infotainment system. It uses integrated payment gateways, e-wallets, and connected platforms. The Automotive In-Vehicle Payment Market is witnessing strong growth due to their rising availability and demand for connected vehicles and digital payment technologies. As more automakers integrate payment solutions into infotainment systems, supply is expanding through collaborations with fintech and tech providers. North America dominates the market by its advanced automotive infrastructure and strong digital ecosystem, followed by Europe and Asia Pacific, where EV adoption and mobile wallet usage are accelerating. Major players like General Motors, Tesla, Mastercard, Visa, and BMW are actively shaping the market through partnerships and in-car payment innovations. End-users include both private vehicle owners, who use these systems for fuel, tolls, and parking, and commercial fleets, which benefit from streamlined expense management and operational efficiency. The report also helps in understanding the Global Automotive In-Vehicle Payment Market dynamics, structure by analyzing the market segments and projecting the Global market. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Automotive In-Vehicle Payment Market makes the report an investor’s guide.To know about the Research Methodology :- Request Free Sample Report

Automotive In-Vehicle Payment Market Dynamic

Growing demand of contactless payments to drive the Automotive In-Vehicle Payment Market Growth

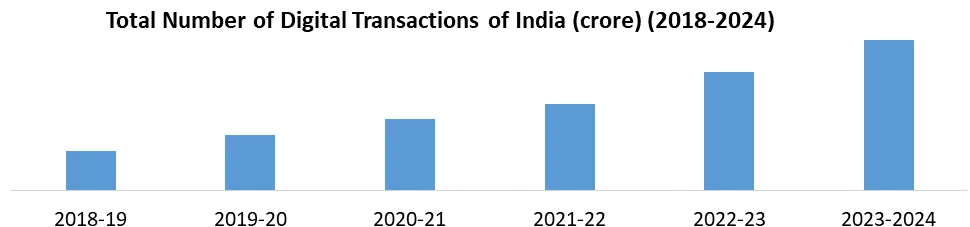

Government has imposed lockdown guidelines during COVID-19 which boost the demand of online payment, in recent time people are adopting online payment over cash payment, which is expected to spike the growth of automotive in-vehicle payment market. As per MMR’s analysis in FY 2022-23 around 9,192 crore digital payment transactions have recorded in India. Automotive industries are adopting in-vehicle payment system for more efficiency and streamline transaction at fuel pump. Thus, the demand for contactless payments by the people is expected to show growth in automotive in-vehicle payment market. The cutting-edge development in automobile industry, in the near future is contributing to the automotive in-vehicle payment market. Numerous automobile companies are adopting the in-vehicle payment system such as Mercedes-Benz, Car IQ, BMW AG by collaborating with the online payment companies such as Mastercard, Visa. Such collaboration is augmenting the growth of automotive in-vehicle market in 2023 and is expected to continue during the forecast period. In addition, automobile industry’s ability to linked the car and mobile payment solutions is made possible by Internet of Things (IoT). More specifically, the Internet of Things (IoT) makes it easier to connect and integrate real world items like cars and currency with the digital realm.

Data Security Concerns to Restrain the Automotive In-Vehicle Payment Market

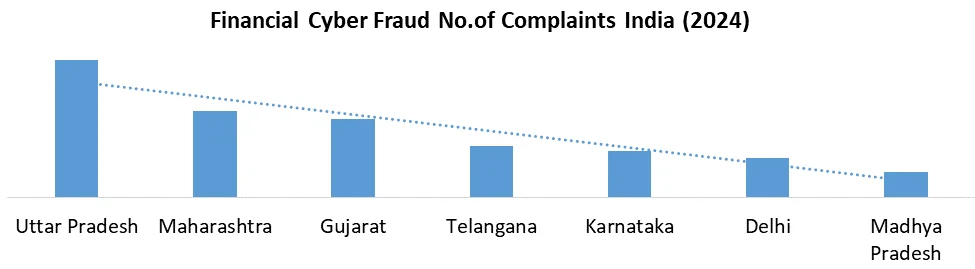

Technology comes with pros and cons, so it is necessary to identify the threats that come with mobile payment applications. Transactions between customers and merchants are controlled and handled by a single financial institute. Thus, the centralized financial institute or a third party is required for the entire transactions. Complete transaction depends on the financial institute if the third party not able to maintain proper security measures the data get leaked, these security concerns hinder the growth of global automotive in-vehicle payment market. The biggest threat for both consumer and service provider is the possibility of system hacks and gaining access to private and sensitive data. These very concerns are among the main causes of the publics and consumer’s reluctance to grant manufacturers access to car information and telematics data. The system breaches and data hacking prevented by constructing robust firewalls and protection measures, but the additional costs associated with these technologies make the whole system costly. The high-cost security technologies act as restraints in emerging and underdeveloped countries. Thus, the security concerns and high-cost systems to prevent fraud hinder the global automotive in-vehicle payment market in emerging countries, which a constraint for the market during the forecast period.

Automotive In-Vehicle Payment Market Segment Analysis

Based on Application, the Fuel/EV Charging Stations segment led the highest market share, and is expected to continue it in the forecast Period. The increasing adoption of automotive and electric vehicles is contributing to the growth of the Fuel/EV charging segment. The majority population is adopting online payment for every purpose, and high adoption of personalized vehicles is increasing the growth of fuel/EV charging stations. In addition, high payments processed at fuel and electric vehicle charging stations are the reason for the surge in demand. As per the MMR’s analysis, 47.2% of daily commuters were observed utilizing connection applications at gas stations. EV infrastructure continues to expand, and automakers continue to release more and more EVs; these factors are projected to propel the demand for fuel/EV charging stations throughout the forecast period. The food & Coffee segment is expected to be the fastest-growing segment during the forecast period in the Automotive In-Vehicle Payment Market. Food and coffee are sold for a higher price than any other item in the past, and are consumed widely, particularly while traveling to and from offices or workplaces. Lack of time for in-car payment systems is predicted to increase in order to reduce the amount of time customers must wait while purchasing food. The use of in-vehicle payment services is becoming more and more common in emerging countries, and the payment option is quite convenient because it saves time. Based on payment mode, e-wallets dominated the Automotive In-Vehicle Payment Market in 2024, due to their seamless integration with connected car systems and infotainment platforms. They are offering quick, contactless transactions for tolls, fuel, and parking, enhancing user convenience. Also, E-wallets like Apple Pay and Google Pay are widely supported by smartphone-linked systems, making them easy to use. Their strong security features, like tokenization and biometric authentication, further boost user trust. As the world moves toward digital and cashless payments, e-wallets continue to outpace traditional options like RFID and credit cards. In January 2025, AISIN partnered with Sheeva.AI to launch one-tap in-vehicle payments using e-wallet technology, allowing drivers to pay for fuel, parking, tolls, and charging directly through the infotainment system with secure, location-based automation.Automotive In-Vehicle Payment Market Regional Analysis

North America dominated the automotive in-vehicle payment market in 2024 and is projected to continue its growth during the forecast period. The emerging technologies in North America is likely to surge in demand of the automotive in-vehicle payment market in the region. The existence prominent market players in the region such as Visa, Mastercard, Amazon Web Services, PayPal Holding Inc coupled with the automotive like Ford Motor Company, General Motors Company, IBM Corporation and Honda are developing in-vehicle payment systems, which are propelling the growth of automotive in-vehicle payment market in the region and is anticipated to continue the growth throughout the forecast period. Asia-Pacific is anticipated to be the fastest-growing region during the forecast period. Growing numbers of connected vehicles in Asia-Pacific key countries such as India, China, Japan, and others are expected to contribute to the growth of the market in the region. In addition, the heavy traffic in the region and growing public preference for contactless payment methods are probably going to boost the adoption of in-car payment services. Asia-Pacific is a developing region in-car payment services are still in the introduction stage. The linked cars are becoming more and more common, and infrastructure and connectivity are developing.Automotive In-Vehicle Payment Market Competitive Landscape

In the Automotive Vehicle Payment Market, General Motors, Tesla, Mastercard, and Visa are recognized as top key players by their strong innovation strategies and influential roles in shaping the future of connected mobility. General Motors is focusing on enhancing vehicle intelligence through partnerships, like with NVIDIA, and is actively expanding its hands-free driving and payment features across global markets. Tesla is leading with a fully integrated ecosystem, offering seamless in-app vehicle payments, financing, and subscription services, setting a benchmark for digital mobility. Mastercard is enabling secure in-car payment experiences by collaborating with automakers and fintech companies, providing virtual cards and embedded payment solutions. Also, Visa is playing a critical role by launching integration programs that allow fintechs and automakers to embed secure, real-time payment capabilities directly into vehicle systems. These companies are considered market leaders because of their proactive approach to partnerships, technological integration, and ability to influence large-scale adoption of in-vehicle commerce.Automotive In-Vehicle Payment Market Key Trends

Key Trends Description Integration of Digital Wallets Vehicles now support Apple Pay, Google Pay, Samsung Pay, etc., for seamless payments inside the car for tolls, fuel, parking, and food. Embedded Payments Platforms OEMs are creating branded payment ecosystems like FordPay and Mercedes Pay to offer a seamless, proprietary transaction experience. Fintech & Payment Provider Partnerships Collaborations with Visa, Mastercard, PayPal, and Car IQ enable secure, tokenized in-car payments and real-time transactions. Automotive In-Vehicle Payment Market Key Recent Development

• In March 18, 2025, General Motors (USA) announced that it is collaborating with NVIDIA by using the NVIDIA DRIVE AGX platform for in-vehicle hardware and NVIDIA Omniverse for digital twin simulations to enhance AI-driven vehicle experiences and manufacturing processes. • In May 26, 2025, General Motors Middle East launched its Super Cruise hands-free driving system and digital road-mapping technology in Oman, Kuwait, and Bahrain, expanding its ADAS capabilities in the region. • April 29, 2025, Mastercard (USA), invested $300 million in Corpay, acquiring approximately a 3% stake, and entered a strategic partnership to deliver virtual card solutions and scale cross-border B2B payment services. • In May 21, 2025, Visa (USA) launched the Visa Commercial Integrated Partners program, allowing fintechs such as Car IQ to integrate Visa’s virtual and fleet payment systems directly into vehicle apps through advanced APIs. • In January 7, 2025, Toyota Motor (Japan), became part of an advanced automotive ecosystem leveraging NVIDIA DRIVE AGX Orin, in collaboration with companies like Continental and Aurora, to power AI-based connected and autonomous vehicle systems.Automotive In-Vehicle Payment Market Scope: Inquiry Before Buying

Automotive In-Vehicle Payment Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.02 Bn. Forecast Period 2025 to 2032 CAGR: 16% Market Size in 2032: USD 16.46 Bn. Segments Covered: by Payment Mode RFID, QR Code e-wallet Credit or Debit Card by Component Type ECU Code Scanner Camera by Application Fuel/EV Charging Stations Parking Spaces Toll Booths Food & Coffee by Technology Long Range Radio Frequency Identification Bluetooth Low Energy Automotive In-Vehicle Payment By Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Automotive In-Vehicle Payment key players are:

North America 1. General Motors (USA) 2. Ford Motor Company (USA) 3. Tesla (USA) 4. Amazon (USA) 5. Google (USA) 6. PayPal (USA) 7. Mastercard (USA) 8. Visa (USA) 9. IBM (USA) Europe 10. ZF Friedrichshafen (Germany) 11. BMW Group (Germany) 12. Daimler (Germany) 13. Mercedes-Benz Group (Germany) 14. Volkswagen (Germany) 15. Jaguar Land Rover (UK) 16. Continental (Germany) 17. Infineon Technologies (Germany) Asia Pacific 18. Honda Motor (Japan) 19. Hyundai Motor (South Korea) 20. Toyota Motor (Japan) 21. Nissan Motor (Japan) 22. Alibaba (China) 23. SAIC Motor (China) 24. Yinwang Intelligent Technology (China) Middle East & Africa 25. Gilbarco Veeder-Root (USA) 26. Shell (UK) South America 27. EmbraerX (Brazil)Frequently Asked Questions

1. What are the growth drivers for the Automotive In-Vehicle Payment Market? Ans. The increasing demand for contactless payments and emerging technologies in the automotive industry is expected to be the major driver for the Automotive In-Vehicle Payment market. 2. What is the major restraint for the Automotive In-Vehicle Payment Market growth? Ans. Security concerns related to data leaks are expected to be the major restraining factor for the Automotive In-Vehicle Payment market growth. 3. Which region is expected to lead the global Automotive In-Vehicle Payment Market during the forecast period? Ans. North America is expected to lead the global Automotive In-Vehicle Payment market during the forecast period. 4. What is the projected market size & growth rate of the Automotive In-Vehicle Payment Market? Ans. The Global Automotive In-Vehicle Payment Market size was valued at USD 5.02 Billion in 2024, and the total Automotive In-Vehicle Payment revenue is expected to grow at a CAGR of 16% from 2025 to 2032, reaching nearly USD 16.46 Billion. 5. What segments are covered in the Automotive In-Vehicle Payment Market report? Ans. The segments covered in the Automotive In-Vehicle Payment market report are Component Type, Application, Technology, Payment Mode, and Region.

1. Automotive In-Vehicle Payment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive In-Vehicle Payment Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Automotive In-Vehicle Payment Market: Dynamics 3.1. Region wise Trends of Automotive In-Vehicle Payment Market 3.1.1. North America Automotive In-Vehicle Payment Market Trends 3.1.2. Europe Automotive In-Vehicle Payment Market Trends 3.1.3. Asia Pacific Automotive In-Vehicle Payment Market Trends 3.1.4. Middle East and Africa Automotive In-Vehicle Payment Market Trends 3.1.5. South America Automotive In-Vehicle Payment Market Trends 3.2. Automotive In-Vehicle Payment Market Dynamics 3.2.1. Global Automotive In-Vehicle Payment Market Drivers 3.2.1.1. Rising EV Adoption 3.2.1.2. Digital Payment Demand 3.2.2. Global Automotive In-Vehicle Payment Market Restraints 3.2.3. Global Automotive In-Vehicle Payment Market Opportunities 3.2.3.1. Fleet Payment Solutions 3.2.3.2. Smart City Integration 3.2.4. Global Automotive In-Vehicle Payment Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government Incentives 3.4.2. Urban Mobility Policies 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Automotive In-Vehicle Payment Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 4.1.1. RFID, 4.1.2. QR Code 4.1.3. e-wallet 4.1.4. Credit or Debit Card 4.2. Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 4.2.1. ECU 4.2.2. Code Scanner 4.2.3. Camera 4.3. Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 4.3.1. Fuel/EV Charging Stations 4.3.2. Parking Spaces 4.3.3. Toll Booths 4.3.4. Food & Coffee 4.4. Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 4.4.1. Long Range Radio Frequency 4.4.2. Identification 4.4.3. Bluetooth 4.4.4. Low Energy 4.5. Automotive In-Vehicle Payment Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Automotive In-Vehicle Payment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 5.1.1. RFID, 5.1.2. QR Code 5.1.3. e-wallet 5.1.4. Credit or Debit Card 5.2. North America Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 5.2.1. ECU 5.2.2. Code Scanner 5.2.3. Camera 5.3. North America Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 5.3.1. Fuel/EV Charging Stations 5.3.2. Parking Spaces 5.3.3. Toll Booths 5.3.4. Food & Coffee 5.4. North America Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 5.4.1. Long Range Radio Frequency 5.4.2. Identification 5.4.3. Bluetooth 5.4.4. Low Energy 5.5. North America Automotive In-Vehicle Payment Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 5.5.1.1.1. RFID, 5.5.1.1.2. QR Code 5.5.1.1.3. e-wallet 5.5.1.1.4. Credit or Debit Card 5.5.1.2. United States Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 5.5.1.2.1. ECU 5.5.1.2.2. Code Scanner 5.5.1.2.3. Camera 5.5.1.3. United States Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. Fuel/EV Charging Stations 5.5.1.3.2. Parking Spaces 5.5.1.3.3. Toll Booths 5.5.1.3.4. Food & Coffee 5.5.1.4. United States Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 5.5.1.4.1. Long Range Radio Frequency 5.5.1.4.2. Identification 5.5.1.4.3. Bluetooth 5.5.1.4.4. Low Energy 5.5.2. Canada 5.5.2.1. Canada Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 5.5.2.1.1. RFID, 5.5.2.1.2. QR Code 5.5.2.1.3. e-wallet 5.5.2.1.4. Credit or Debit Card 5.5.2.2. Canada Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 5.5.2.2.1. ECU 5.5.2.2.2. Code Scanner 5.5.2.2.3. Camera 5.5.2.3. Canada Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. Fuel/EV Charging Stations 5.5.2.3.2. Parking Spaces 5.5.2.3.3. Toll Booths 5.5.2.3.4. Food & Coffee 5.5.2.4. Canada Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 5.5.2.4.1. Long Range Radio Frequency 5.5.2.4.2. Identification 5.5.2.4.3. Bluetooth 5.5.2.4.4. Low Energy 5.5.3. Mexico 5.5.3.1. Mexico Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 5.5.3.1.1. RFID, 5.5.3.1.2. QR Code 5.5.3.1.3. e-wallet 5.5.3.1.4. Credit or Debit Card 5.5.3.2. Mexico Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 5.5.3.2.1. ECU 5.5.3.2.2. Code Scanner 5.5.3.2.3. Camera 5.5.3.3. Mexico Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. Fuel/EV Charging Stations 5.5.3.3.2. Parking Spaces 5.5.3.3.3. Toll Booths 5.5.3.3.4. Food & Coffee 5.5.3.4. Mexico Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 5.5.3.4.1. Long Range Radio Frequency 5.5.3.4.2. Identification 5.5.3.4.3. Bluetooth 5.5.3.4.4. Low Energy 6. Europe Automotive In-Vehicle Payment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.2. Europe Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.3. Europe Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.4. Europe Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5. Europe Automotive In-Vehicle Payment Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.1.2. United Kingdom Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.1.3. United Kingdom Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5.2. France 6.5.2.1. France Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.2.2. France Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.2.3. France Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.3.2. Germany Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.3.3. Germany Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.4.2. Italy Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.4.3. Italy Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.5.2. Spain Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.5.3. Spain Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.6.2. Sweden Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.6.3. Sweden Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.7.2. Russia Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.7.3. Russia Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Russia Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 6.5.8.2. Rest of Europe Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 6.5.8.3. Rest of Europe Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7. Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.2. Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.3. Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5. Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.1.2. China Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.1.3. China Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.2.2. S Korea Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.2.3. S Korea Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.3.2. Japan Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.3.3. Japan Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.4. India 7.5.4.1. India Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.4.2. India Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.4.3. India Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.5.2. Australia Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.5.3. Australia Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.6.2. Indonesia Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.6.3. Indonesia Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.7.2. Malaysia Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.7.3. Malaysia Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Malaysia Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.8.2. Philippines Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.8.3. Philippines Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Philippines Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.9.2. Thailand Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.9.3. Thailand Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Thailand Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.10.2. Vietnam Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.10.3. Vietnam Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Vietnam Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 7.5.11.2. Rest of Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 8. Middle East and Africa Automotive In-Vehicle Payment Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 8.2. Middle East and Africa Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 8.3. Middle East and Africa Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 8.5. Middle East and Africa Automotive In-Vehicle Payment Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 8.5.1.2. South Africa Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 8.5.1.3. South Africa Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 8.5.2.2. GCC Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 8.5.2.3. GCC Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 8.5.3.2. Egypt Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 8.5.3.3. Egypt Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Egypt Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 8.5.4.2. Nigeria Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 8.5.4.3. Nigeria Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Nigeria Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 8.5.5.2. Rest of ME&A Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 8.5.5.3. Rest of ME&A Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 8.5.5.4. Rest of ME&A Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 9. South America Automotive In-Vehicle Payment Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 9.2. South America Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 9.3. South America Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 9.4. South America Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 9.5. South America Automotive In-Vehicle Payment Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 9.5.1.2. Brazil Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 9.5.1.3. Brazil Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 9.5.2.2. Argentina Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 9.5.2.3. Argentina Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 9.5.3.2. Colombia Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 9.5.3.3. Colombia Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Colombia Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 9.5.4.2. Chile Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 9.5.4.3. Chile Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 9.5.4.4. Chile Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 9.5.5. Rest of South America 9.5.5.1. Rest of South America Automotive In-Vehicle Payment Market Size and Forecast, By Payment Mode (2024-2032) 9.5.5.2. Rest of South America Automotive In-Vehicle Payment Market Size and Forecast, By Component Type (2024-2032) 9.5.5.3. Rest of South America Automotive In-Vehicle Payment Market Size and Forecast, By Application (2024-2032) 9.5.5.4. Rest of South America Automotive In-Vehicle Payment Market Size and Forecast, By Technology (2024-2032) 10. Company Profile: Key Players 10.1. General Motors (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Ford Motor Company (USA) 10.3. Tesla (USA) 10.4. Amazon (USA) 10.5. Google (USA) 10.6. PayPal (USA) 10.7. Mastercard (USA) 10.8. Visa (USA) 10.9. IBM (USA) 10.10. ZF Friedrichshafen (Germany) 10.11. BMW Group (Germany) 10.12. Daimler (Germany) 10.13. Mercedes-Benz Group (Germany) 10.14. Volkswagen (Germany) 10.15. Jaguar Land Rover (UK) 10.16. Continental (Germany) 10.17. Infineon Technologies (Germany) 10.18. Honda Motor (Japan) 10.19. Hyundai Motor (South Korea) 10.20. Toyota Motor (Japan) 10.21. Nissan Motor (Japan) 10.22. Alibaba (China) 10.23. SAIC Motor (China) 10.24. Yinwang Intelligent Technology (China) 10.25. Gilbarco Veeder-Root (USA) 10.26. Shell (UK) 10.27. EmbraerX (Brazil) 11. Key Findings 12. Industry Recommendations 13. Automotive In-Vehicle Payment Market: Research Methodology