Automotive front end module market was valued at USD 121.54 Bn in 2023 and is expected to reach USD 166.07 Bn by 2030, at a CAGR of 4.56 % during the forecast period.Automotive Front End Module Market Overview

Automotive Front-End Modules are multipiece assemblies that integrate a large number of components, which include forward lighting, radiators and cooling fans, Air Conditioning (A/C) condensers, Grille-Opening Reinforcement (GOR) panels, crumple zones, bumpers with decorative fascia, hood latches, electronics and wiring.To know about the Research Methodology:-Request Free Sample Report The Automotive Front End Module Market is experiencing growth fuelled by the increasing vehicle production and demand for lightweight modules. This market is segmented by components, vehicle type, material, and region, with significant innovations and advancements shaping its landscape. In particular, the passenger vehicle segment within the Automotive Front End Module Market is expected to see the fastest growth due to evolving safety standards and emission regulations. Additionally, the composites segment is gaining traction due to its strength-to-weight ratio, which aligns with industry trends towards weight reduction and enhanced safety. Regionally, Asia Pacific leads the growth in the Automotive Front End Module Market, supported by the automotive production boom in China, and rising income levels. Challenges such as competition from aftermarket players and the need for continual innovation are present but the overall outlook remains positive with technology and regulatory drivers steering the market forward.

Automotive Front End Module Market Dynamics

Rising electric car sale in emerging regions is boosting demand for pre-assembled automotive front ends module. The surge in global electric car sales, which is expected to increase their market share to nearly one-fifth, is significantly impacting the automotive front end module market. As the industry adjusts to this change, there is a growing demand for front end modules that meet the specific requirements of electric vehicles (EVs). Front end modules for electric vehicles differ from those in traditional cars because they need battery cooling systems, lightweight materials to increase driving range, and specific designs for electric components. The fast growth in electric vehicle sales, especially in key markets like China, Europe, and the United States, is pushing for new innovations in front end modules. These innovations include better aerodynamics and advanced sensors to enhance efficiency and safety. As the industry moves towards electric mobility, it is changing how front-end modules are made and the materials used, aiming to cut vehicle emissions and boost energy efficiency. This rapid growth in electric vehicle adoption is profoundly impacting the Automotive Front-End Modules market by driving demand for specialized modules that support the unique requirements of EVs. Innovations in automotive front-end modules Modular front ends are revolutionizing passenger vehicle design and assembly by incorporating automotive front-end modules (FEMs). These modules merge various components like lighting, cooling systems, and electronics into single, pre-assembled units, simplifying manufacturing and enhancing vehicle design through standardized part integration. This modular approach reduces production costs by 20 to 30 percent, facilitates global vehicle platform strategies, and allows for model differentiation with customizable exteriors. FEMs improve production ergonomics, streamline engine installation, and ensure better dimensional accuracy of the vehicle's front end. Material advancements in FEMs support diverse vehicle needs with options ranging from all-metal to hybrid and all-composite structures. Although adoption has been slower in North America compared to Europe and Asia, the benefits of FEMs are gaining recognition, indicating a trend towards more integrated and cost-effective manufacturing solutions in the automotive industry. The integration of modular front ends using automotive front-end modules is positively transforming the automotive market by streamlining manufacturing processes, reducing costs, and enhancing vehicle design and quality, setting a trend for more efficient and adaptable vehicle production worldwide. North American automotive industry set for expansion in composite FEMs, driven by integration benefits and regulatory compliance. The future of automotive front-end modules (FEMs) in North America is set to see increased adoption of composite FEM carriers as manufacturers and supply chains recognize the benefits of integration, weight reduction, and cost savings. Trends indicate a shift towards using more long glass-reinforced thermoplastics, particularly polypropylene compounds, processed via direct long-fiber thermoplastics (D-LFT) methods. This is supported by advancements in manufacturing technologies that accommodate these materials either through completely new systems or adaptable solutions for existing equipment. Additionally, the industry's move towards smaller, lightweight vehicles and increasing familiarity with long-glass fibre materials will likely boost the use of full composite FEMs. Meanwhile, successful FEM strategies focusing on part integration and quality finish are expected to continue, while the emphasis on compliance with stringent regulatory standards like CAFE and pedestrian-protection is driving innovation in FEM materials, processes, and designs to achieve cost-effectiveness and reduced weight. The shift towards composite FEM carriers, driven by the benefits of integration, weight reduction, and advanced manufacturing technologies, along with regulatory compliance, is poised to significantly propel automotive front end module market growth by enhancing vehicle efficiency and sustainability in North America. Some of the changes in FEM carrier designs In the past ten years, front-end module carrier designs have undergone significant transformations, including variations in materials, processes, secondary operations, and the extent of component integration. Below are some noteworthy examples of these applications.

Vehicle Material/Design Key Features and Benefits Audi A2 Injection molded hybrid (steel and short-glass nylon 6) 30% mass reduction, 5% direct cost saving, 20% cost avoidance, strong mechanical bond between steel and composite BMW Mini Cooper All-composite (long-fiber polypropylene, LFT-PP) First use of LFT-PP; 30% weight reduction, 25% cost saving, 20 fewer parts, enhanced NVH compared to steel Kia Cerato Injection molded hybrid (steel and glass fiber nylon 6) First use of in-mold assembly; 40% mass reduction, 30% cost saving, $3 USD cost avoidance, improved stiffness-to-weight ratio, enhanced NVH Volkswagen Polo Bonded hybrid (steel and long-glass PP) World's first bonded hybrid design; increased stiffness, load distribution, and load-bearing capacity, developed specific adhesive Jeep Wrangler Bonded system (steel tubes and long-glass PP) First hybrid carrier on a body-on-frame vehicle; 15% mass reduction, 25% cost saving, $250,000 USD cost avoidance, improved joint stiffness and durability Ford Edge All-composite long-glass PP Reduced weight and costs vs. steel/hybrid systems; facilitated open-architecture vehicle build, improved assembly line access Automotive Front End Module Market Segment Analysis

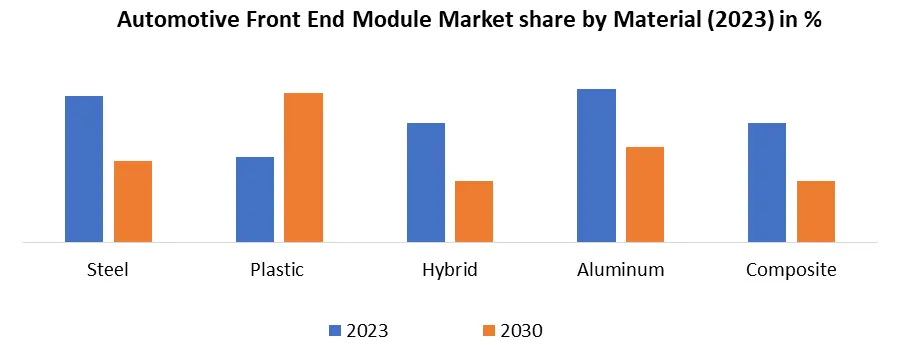

Based on Vehicle, The Passenger Vehicle segment is expected to be the fastest-growing in the Automotive Front End Module Market during the forecast period. This growth is driven by the escalating demand for passenger vehicles, bolstered by rising production rates and an increasing emphasis on safety features that provide robust protection. Additionally, the need to meet stringent emission standards is pushing manufacturers to adopt innovative technologies that not only enhance vehicle safety but also minimize environmental impact. These factors collectively contribute to the heightened demand for front-end modules in passenger vehicles, which is significantly higher than in previous years. Based on Material, the market is segmented by Steel, Plastic, Hybrid, Aluminium, Composite. The Composites segment is expected to capture a significant market share in the automotive front end module market during the forecast period. The global increase in passenger vehicle production driven by rapid urbanization, and the heightened emphasis on driver and passenger safety which demands materials with superior properties. Composites are particularly valued for their high strength-to-weight ratios, excellent corrosion resistance, and ease of fabrication. Moreover, the ability of composites to integrate multiple functions into single components simplifies assembly processes, reduces manufacturing costs, and decreases the overall vehicle weight. These advantages make composites highly desirable in the automotive front end module market, paving the way for greater opportunities and automotive front end module market growth.

Automotive Front End Module Market Regional Insight

Asia Pacific is expected to experience robust growth, projected at a CAGR of xx% during the forecast period. The region's market growth is driven by the strong manufacturing bases in countries like Japan, South Korea, China, and India, coupled with emerging economies in these areas. Factors such as rising disposable incomes, rapid advancements in transportation technologies due to evolving regulations, and the increasing population are set to create substantial opportunities in the automotive front end module market. Particularly, China, as the world's largest automobile producer, is spearheading growth through government incentives that promote the use of vehicles with greater fuel efficiency and reduced emissions, further energizing the market in this region.Automotive Front End Module Market Scope: Inquire before buying

Automotive Front End Module Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 121.54 Bn. Forecast Period 2024 to 2030 CAGR: 4.56% Market Size in 2030: US$ 166.07 Bn. Segments Covered: by Application Side Door Latch Hood Latch Tailgate Latch Back Seat Latch by Material Steel Plastic Hybrid Aluminium Composite by Vehicle Passenger Vehicle Light Commercial Vehicle Automotive Front End Module Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Automotive Front End Module Key Players include:

1. Aisin Seiki Co., Ltd. - Japan 2. Mitsui Mining and Smelting Co., Ltd. - Japan 3. Kiekert AG - Germany 4. Magna International - Canada 5. Prabha Engineering Pvt. Ltd - India 6. Strattec Security Co. - United States 7. U-Shin, Ltd. - Japan 8. Shivani Locks Pvt. Ltd. - India 9. Brose Fahrzeugteile Gmbh & Co. - Germany 10. Inteva Products, LLC. - United States 11. Minda VAST Access Systems Pvt. Ltd. - India 12. DENSO CORPORATION - Japan 13. MAHLE GmbH - Germany 14. Faurecia - France 15. Calsonic Kansei Corporation - Japan 16. HYUNDAI MOBIS - South Korea 17. Plastic Omnium - France 18. SMRPBV - Netherlands 19. SL Corporation - South Korea 20. Valeo - France 21. Montaplast GmbH - Germany 22. Hanon Systems - South Korea Frequently asked Questions: 1. What is Automotive Front-End Module? Ans: The front-end module is crucial as it consolidates multiple components into a single, pre-assembled unit, streamlining the manufacturing and assembly processes for automakers. This efficient integration not only reduces assembly time and costs but also cuts down on vehicle weight, thereby boosting fuel efficiency and reducing emissions; moreover, it utilizes a diverse range of materials like steel, plastics, composites, and hybrids to optimize durability, weight, and cost. 2. How are technological advancements driving innovation in Automotive Front-End Modules? Ans: As the automotive industry moves towards more sustainable practices, there is an increased focus on making FEMs more eco-friendly. This includes using recyclable materials and designing components that are easier to disassemble at the end of the vehicle's life cycle. 3. Why is the electronic segment dominating the Automotive Front-End Modules market? Ans: The automotive industry is heavily invested in features like advanced driver-assistance systems (ADAS), autonomous driving, and improved fuel efficiency. These features all rely heavily on electronic components that are being integrated into FEMs. 4. How does Automotive Front-End Modules benefit the Passenger Vehicle sector? Ans: With components consolidated into a modular unit, repairs and maintenance can be more straightforward, as the entire module can be accessed or replaced without disassembling multiple individual parts. This is particularly beneficial for end-users in terms of both time and cost.

1. Automotive Front End Module Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Front End Module Market: Dynamics 2.1. Automotive Front End Module Market Trends by Region 2.1.1. North America Automotive Front End Module Market Trends 2.1.2. Europe Automotive Front End Module Market Trends 2.1.3. Asia Pacific Automotive Front End Module Market Trends 2.1.4. Middle East and Africa Automotive Front End Module Market Trends 2.1.5. South America Automotive Front End Module Market Trends 2.2. Automotive Front End Module Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Front End Module Market Drivers 2.2.1.2. North America Automotive Front End Module Market Restraints 2.2.1.3. North America Automotive Front End Module Market Opportunities 2.2.1.4. North America Automotive Front End Module Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Front End Module Market Drivers 2.2.2.2. Europe Automotive Front End Module Market Restraints 2.2.2.3. Europe Automotive Front End Module Market Opportunities 2.2.2.4. Europe Automotive Front End Module Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Front End Module Market Drivers 2.2.3.2. Asia Pacific Automotive Front End Module Market Restraints 2.2.3.3. Asia Pacific Automotive Front End Module Market Opportunities 2.2.3.4. Asia Pacific Automotive Front End Module Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Front End Module Market Drivers 2.2.4.2. Middle East and Africa Automotive Front End Module Market Restraints 2.2.4.3. Middle East and Africa Automotive Front End Module Market Opportunities 2.2.4.4. Middle East and Africa Automotive Front End Module Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Front End Module Market Drivers 2.2.5.2. South America Automotive Front End Module Market Restraints 2.2.5.3. South America Automotive Front End Module Market Opportunities 2.2.5.4. South America Automotive Front End Module Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive Front End Module Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Front End Module Industry 2.9. Automotive Front End Module Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive Front End Module Market 3. Automotive Front End Module Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 3.1.1. Side Door Latch 3.1.2. Hood Latch 3.1.3. Tailgate Latch 3.1.4. Back Seat Latch 3.2. Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 3.2.1. Steel 3.2.2. Plastic 3.2.3. Hybrid 3.2.4. Aluminium 3.2.5. Composite 3.3. Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 3.3.1. Passenger Vehicle 3.3.2. Light Commercial Vehicle 3.4. Automotive Front End Module Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Automotive Front End Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 4.1.1. Side Door Latch 4.1.2. Hood Latch 4.1.3. Tailgate Latch 4.1.4. Back Seat Latch 4.2. North America Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 4.2.1. Steel 4.2.2. Plastic 4.2.3. Hybrid 4.2.4. Aluminium 4.2.5. Composite 4.3. North America Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 4.3.1. Passenger Vehicle 4.3.2. Light Commercial Vehicle 4.4. North America Automotive Front End Module Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 4.4.1.1.1. Side Door Latch 4.4.1.1.2. Hood Latch 4.4.1.1.3. Tailgate Latch 4.4.1.1.4. Back Seat Latch 4.4.1.2. United States Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 4.4.1.2.1. Steel 4.4.1.2.2. Plastic 4.4.1.2.3. Hybrid 4.4.1.2.4. Aluminium 4.4.1.2.5. Composite 4.4.1.3. United States Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 4.4.1.3.1. Passenger Vehicle 4.4.1.3.2. Light Commercial Vehicle 4.4.2. Canada 4.4.2.1. Canada Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 4.4.2.1.1. Side Door Latch 4.4.2.1.2. Hood Latch 4.4.2.1.3. Tailgate Latch 4.4.2.1.4. Back Seat Latch 4.4.2.2. Canada Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 4.4.2.2.1. Steel 4.4.2.2.2. Plastic 4.4.2.2.3. Hybrid 4.4.2.2.4. Aluminium 4.4.2.2.5. Composite 4.4.2.3. Canada Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 4.4.2.3.1. Passenger Vehicle 4.4.2.3.2. Light Commercial Vehicle 4.4.3. Mexico 4.4.3.1. Mexico Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 4.4.3.1.1. Side Door Latch 4.4.3.1.2. Hood Latch 4.4.3.1.3. Tailgate Latch 4.4.3.1.4. Back Seat Latch 4.4.3.2. Mexico Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 4.4.3.2.1. Steel 4.4.3.2.2. Plastic 4.4.3.2.3. Hybrid 4.4.3.2.4. Aluminium 4.4.3.2.5. Composite 4.4.3.3. Mexico Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 4.4.3.3.1. Passenger Vehicle 4.4.3.3.2. Light Commercial Vehicle 5. Europe Automotive Front End Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.2. Europe Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.3. Europe Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4. Europe Automotive Front End Module Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.1.2. United Kingdom Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.1.3. United Kingdom Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4.2. France 5.4.2.1. France Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.2.2. France Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.2.3. France Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.3.2. Germany Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.3.3. Germany Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.4.2. Italy Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.4.3. Italy Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.5.2. Spain Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.5.3. Spain Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.6.2. Sweden Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.6.3. Sweden Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.7.2. Austria Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.7.3. Austria Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 5.4.8.2. Rest of Europe Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 5.4.8.3. Rest of Europe Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6. Asia Pacific Automotive Front End Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.3. Asia Pacific Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4. Asia Pacific Automotive Front End Module Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.1.2. China Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.1.3. China Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.2.2. S Korea Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.2.3. S Korea Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.3.2. Japan Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.3.3. Japan Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.4. India 6.4.4.1. India Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.4.2. India Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.4.3. India Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.5.2. Australia Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.5.3. Australia Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.6.2. Indonesia Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.6.3. Indonesia Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.7.2. Malaysia Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.7.3. Malaysia Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.8.2. Vietnam Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.8.3. Vietnam Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.9.2. Taiwan Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.9.3. Taiwan Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 6.4.10.2. Rest of Asia Pacific Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 6.4.10.3. Rest of Asia Pacific Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 7. Middle East and Africa Automotive Front End Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 7.3. Middle East and Africa Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 7.4. Middle East and Africa Automotive Front End Module Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 7.4.1.2. South Africa Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 7.4.1.3. South Africa Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 7.4.2.2. GCC Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 7.4.2.3. GCC Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 7.4.3.2. Nigeria Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 7.4.3.3. Nigeria Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 7.4.4.2. Rest of ME&A Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 7.4.4.3. Rest of ME&A Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 8. South America Automotive Front End Module Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 8.2. South America Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 8.3. South America Automotive Front End Module Market Size and Forecast, by Vehicle(2023-2030) 8.4. South America Automotive Front End Module Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 8.4.1.2. Brazil Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 8.4.1.3. Brazil Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 8.4.2.2. Argentina Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 8.4.2.3. Argentina Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Automotive Front End Module Market Size and Forecast, by Application (2023-2030) 8.4.3.2. Rest Of South America Automotive Front End Module Market Size and Forecast, by Material (2023-2030) 8.4.3.3. Rest Of South America Automotive Front End Module Market Size and Forecast, by Vehicle (2023-2030) 9. Global Automotive Front End Module Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automotive Front End Module Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Aisin Seiki Co., Ltd. - Japan 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Mitsui Mining and Smelting Co., Ltd. - Japan 10.3. Kiekert AG - Germany 10.4. Magna International - Canada 10.5. Prabha Engineering Pvt. Ltd - India 10.6. Strattec Security Co. - United States 10.7. U-Shin, Ltd. - Japan 10.8. Shivani Locks Pvt. Ltd. - India 10.9. Brose Fahrzeugteile Gmbh & Co. - Germany 10.10. Inteva Products, LLC. - United States 10.11. Minda VAST Access Systems Pvt. Ltd. - India 10.12. DENSO CORPORATION - Japan 10.13. MAHLE GmbH - Germany 10.14. Faurecia - France 10.15. Calsonic Kansei Corporation - Japan 10.16. HYUNDAI MOBIS - South Korea 10.17. Plastic Omnium - France 10.18. SMRPBV - Netherlands 10.19. SL Corporation - South Korea 10.20. Valeo - France 10.21. Montaplast GmbH - Germany 10.22. Hanon Systems - South Korea 11. Key Findings 12. Industry Recommendations 13. Automotive Front End Module Market: Research Methodology 14. Terms and Glossary