The Antimicrobial Additives market size was estimated at USD 40.30 Bn. in 2024 and is projected to reach USD 78.55 Bn. by 2032, growing at a CAGR of 8.7% from 2025 to 2032.Antimicrobial Additives Market Overview

Antimicrobial additives are important compounds used to inhibit the growth of bacteria, fungi, and other microbes in a range of materials. They are used in many industries, from healthcare to packaging, construction, textiles, and consumer goods. Antimicrobial additives allow improved hygienic performance and durability of products. Following the COVID-19 pandemic, Antimicrobial Additives Market has been on the rise with the future demand driven by health awareness during the pandemic, hospital-acquired infection control, and increasing quantities of plastics used in the food and medical packaging marketplace. Some big companies leading the market are Microban International and Avient Corporation, where they are developing durable, high-performance antimicrobial masterbatches for consumer and medical applications.To know about the Research Methodology :- Request Free Sample Report Asia Pacific led the global antimicrobial additives market in 2024, with countries such as China, India, Japan, and South Korea being manufacturing powerhouses. Rapid urbanization, the continuous growth of healthcare systems and infrastructure, with increasing consumer demand for hygienic products, lead to the dominance of the Asia Pacific region. North America and Europe appear to be the primary growth areas with sustainable and compliant regulations focusing on the next generation of solutions. Companies such as BASF, PPG Industries, and Sanitized AG are working on silver-free, biodegradable additives in the development of sustainable coatings, medical devices, coatings, and smart home appliances. Technological advancements have been driving trends toward the incorporation of antimicrobial properties into smart textiles, biodegradable packaging, and transportation interiors. There is a growing use of these technologies in high-quality hygiene products, consumer electronics, and utility items. Significant changes and increased adoption are expected as more user-friendly and safe products become available, encouraging consumer interest and driving Antimicrobial Additives Market growth.

Global Antimicrobial Additives Market Dynamics

Low Cost of Manufacturing to Drive Antimicrobial Additives Market Growth The manufacturing sector remains a critical driver of economic development, especially in cost-sensitive industries like chemicals and additives. The Asia Pacific region led by countries such as China, India, Vietnam, and Indonesia offers significant advantages in terms of low labor costs, abundant raw materials, and government incentives for industrial production. As manufacturing costs rise in developed regions, there is an observable shift in production facilities toward these cost-effective hubs. This trend has had a direct impact on the global antimicrobial additives market, as manufacturers seek to reduce operational costs while maintaining production efficiency and quality. The Asia Pacific region is emerging as a key manufacturing base for antimicrobial additives used in applications ranging from plastics, paints and coatings to textiles and healthcare. This shift is expected to substantially contribute to the overall growth of the global antimicrobial additives market in the coming years. Stringent Environmental Regulations on Chemical Additives to Restrain Antimicrobial Additives Market Operations and Raise R&D Costs The antimicrobial additives market faces significant restraints due to increasing environmental concerns and stringent regulations surrounding the use of synthetic and potentially toxic chemical agents. These additives commonly used in plastics, textiles, paints, and healthcare products often contain substances like triclosan, silver ions, and quaternary ammonium compounds, which may persist in the environment and impact aquatic ecosystems. The disposal of manufacturing waste and the leaching of additives from end-use products into soil and water bodies raise ecological and health concerns, such as the development of antimicrobial resistance and bioaccumulation in aquatic organisms. As a result, regulatory bodies like the EPA (U.S.), REACH (EU), and others in Asia-Pacific are enforcing strict usage thresholds and requiring eco-toxicological assessments. This scenario compels companies to divert considerable resources toward R&D for developing biodegradable, non-toxic, and sustainable antimicrobial solutions, thereby increasing production costs and delaying market entry for new products. Growing Adoption of Biodegradable and Non-Toxic Antimicrobial Materials to Create Antimicrobial Additives Market Opportunities Amid rising regulatory pressure from governments, environmental watchdogs, and growing awareness among consumers, manufacturers in the antimicrobial additives market are increasingly shifting toward the development of biodegradable and eco-friendly antimicrobial solutions. The global push to reduce environmental toxicity and curb antimicrobial resistance is encouraging the use of naturally derived agents such as essential oils, chitosan, zinc-based compounds, and plant-based antimicrobials in various applications including textiles, medical devices, packaging, and consumer goods. This shift is unlocking new market potential, particularly in sectors like healthcare and food packaging, where the demand for safe, sustainable, and non-leaching antimicrobial additives is accelerating. Manufacturers investing in R&D for green formulations stand to benefit significantly from this evolving preference, opening doors to partnerships with environmentally conscious brands and compliance with international green certifications.Antimicrobial Additives Market Segment Analysis:

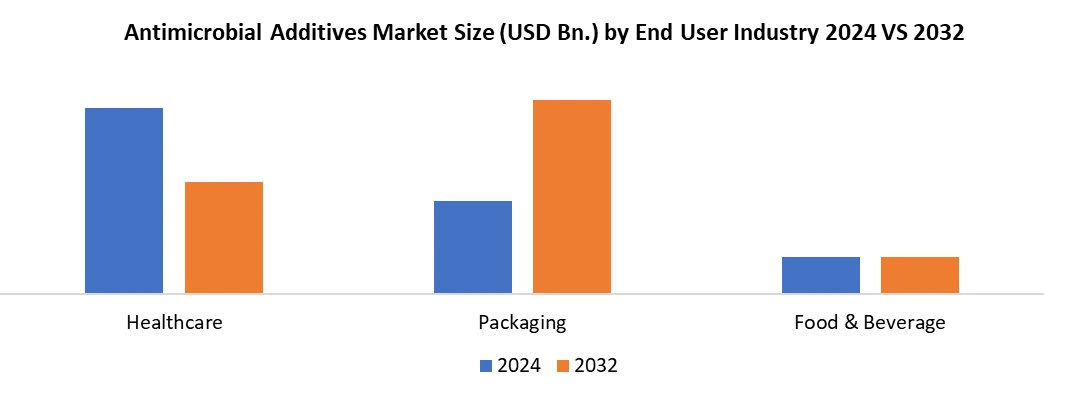

Based on Application, the Antimicrobial Additives Market is segmented into plastic & polymers, paints coatings, textiles &fabrics, and ceramics. The plastic segment held the largest share of around 36%in the year 2024. These antimicrobial additives for plastics are integrated into the material during the manufacturing process to provide lasting protection from microbes. Antimicrobial compounds are extremely beneficial for specialty, industrial, and decorative coatings. For instance, when used with paints, silver-based additives provide protective solutions that are affordable. When used on paper, metal, and plastic, the additives added to inks and lacquers provide a long-lasting top-coat protection. Pulp and paper is a much diversified sector because it includes specialist papers for newsprint, tissue manufacture, and currency printing, as well as paperboards used in packaging. As dirt can quickly accumulate on paper, paper products need to be microbe-resistant before being used in various end-use applications. Based on Types, the Antimicrobial Additives Market is segmented into Inorganic antimicrobial additives and organic antimicrobial additives. The inorganic antimicrobial additives led the highest market share, accounting for 59%share revenue in 2024. The inorganic antimicrobials are more likely to be incorporated into the moulded plastic products. These additives are based on the metal ions., The additional biocidal effect of the inorganic antimicrobial additives of killing the organism and preventing the production of the organism is one of the factors that has lead the inorganic compounds a dominating segment. When combined with goods and materials like paints and coatings, organic antimicrobial additives offer enduring defence against biodegradation as well as stain- and odour-producing bacteria. For instance, triclosan uses a chemical process to stop the growth of microorganisms, which penetrates and damages their cell walls. The harm to other cell activities caused by the perforation and exclusion of the metabolites prohibits microorganisms like bacteria and algae from reproducing. Due to the sales and usage of triclosan and OBPA being prohibited due to their high levels of toxicity, the organic type category is anticipated to increase slowly during the projected period. Based on End User Industry, the healthcare end-use sector dominated the global market in 2024, accounting for around 30% of total sales. Due to the increasing demand for healthcare products as a result of the ageing population, the segment is anticipated to increase at the quickest CAGR from 2025 to 2032. Particularly in the case of Healthcare-Associated Infections, the healthcare environment is crucial (HAIs). Hospital acquired infections (HAIs), which develop in patients while they are hospitalised, can be devastating and are typically brought on by bacteria that are resistant to antibiotics. The use of additives in the food and beverage industry's shelving, flooring, food processing equipment, ice makers, storage containers, water coolers, and water hydration systems is expected to support the food and beverage end-use segment's significant growth rate during the forecast period.

Antimicrobial Additives Market Regional Insights:

In 2024, the Asia Pacific region controlled 40% share of global sales, dominated the market. The market is being driven by the expansion of the key end-use sectors including transportation, healthcare, building, food and beverage, and packaging. The demand for the product is expected to expand due to the strong production bases of the automotive industries in China, Japan, and India as well as rising passenger vehicle sales. Additionally, the government of India's implementation of beneficial policies like Foreign Direct Investments (FDI) and Make in India is anticipated to open up a wide range of growth potential for the automobile sector. The objective of the report is to present a comprehensive analysis of the global Antimicrobial Additives Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Antimicrobial Additives Market dynamic and structure by analyzing the market segments and projecting the Antimicrobial Additives Market size. Clear representation of competitive analysis of key players by Design, price, financial position, Instrumentation Technology portfolio, growth strategies, and regional presence in the Antimicrobial Additives Market makes the report an investor’s guide.Global Antimicrobial Additives Market Competitive Landscape

The antimicrobial additives sector in the Asia Pacific region is experiencing high intensity rivalry as regional companies like Sanitized AG Asia Pacific and Sciessent Asia are focusing on different strategic aspects like textile applications, trust of regulatory agencies, and sustainability in products. Based in Switzerland, the segments of Sanitized AG Asia Pacific are the largest and strongest in countries like China, India, and Japan. During 2024, they were able to significantly improve their revenues and profitability with their antimicrobial textile additives and hygiene function products used in apparel, home textiles and technical textiles. Actor Sanitized helps manufacturers use OEKO-TEX certified products and works with local manufacturers to provide built-in antimicrobial protection following Asia's environmentally-focused health regulations. Due to the focus for Sciessent Asia on healthcare, sportswear, and water- resistant applications, they emerged in the antimicrobial market as a regional subsidiary of the U.S. headquartered Sciessent which provides antimicrobial solutions. Their products like Agion (silver-based antimicrobial) and ActiveXL (odor control) have been welcomed by Asian countries due to the increase in consumer attention towards hygiene and the large increase of textile exports in Asia. In 2024, Sciessent Asia began to deepen its regional partnership with local fabric mills and garment manufacturers by pushing a sustainable and customizable additive model.Global Antimicrobial Additives Market Recent Developments

• In May 2025, Microban International (USA/Global) unveiled its next-gen antimicrobial additive “SilverShield Ultra,” featuring enhanced controlled-release silver ion technology with proven efficacy against drug-resistant bacteria and fungi. Designed for long-term protection in high-touch surfaces, the additive is being integrated into kitchen appliances, healthcare furnishings, and consumer electronics. The rollout has begun in the U.S. and Western Europe. • Feb 2025, Sanitized AG (Switzerland) launched textile-specific antimicrobial additive, “Sanitized T 99-19,” which uses zinc pyrithione-free technology and meets new EU REACH regulations. The company highlighted its use in sportswear, socks, and upholstery in response to rising demand for safer and sustainable textile protection. • April 2025, Milliken & Company (USA) introduced its plant-based antimicrobial solution “BioSmart Renew” aiming at the sustainable textiles and medical garments market. The product is bleach-activated and achieves up to 99.9% pathogen reduction, while being 100% biodegradable. Milliken is initially targeting healthcare and institutional uniform manufacturers in North America and Asia Pacific. Antimicrobial Additives Market Key Trends

Category Key Trend Example Product Market Impact Sustainable Formulations Shift toward eco-friendly, biodegradable, and non-toxic additives Milliken BioSmart Renew Accelerated adoption in medical textiles and uniforms; growing preference for green certifications Silver-Based Technologies Advanced silver ion delivery systems for long-term microbial protection Microban SilverShield Ultra Increased demand in healthcare, consumer electronics, and kitchen appliances across global markets Regulatory Compliance Development of REACH- and EPA-compliant additives for textiles and plastics Sanitized® T 99-19 Enhanced trust and adoption among EU manufacturers; compliant substitutes gaining share Sector-Specific Customization Tailored formulations for industrial, hospitality, and hygiene product use TroyZ-910 for HVAC & automotive Boosted usage in B2B sectors (hotels, transport); specialized demand rising in Asia Pacific Antimicrobial Additives Market Scope: Inquire before buying

Global Antimicrobial Additives Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 40.30 Bn. Forecast Period 2025 to 2032 CAGR: 8.7% Market Size in 2032: USD 78.55 Bn. Segments Covered: by Application Type Plastic Paints & Coatings Pulp & Paper Others by Type Inorganic Antimicrobial Additives Organic Antimicrobial Additives Others by End User Industry Healthcare Packaging Food & Beverages Antimicrobial Additives Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Antimicrobial Additives Market, key players

North America 1. DuPont de Nemours, Inc. – Wilmington, Delaware, USA 2. Microban International – Huntersville, North Carolina, USA 3. Avient Corporation – Avon Lake, Ohio, USA 4. Milliken Chemical – Spartanburg, South Carolina, USA Europe 1. BASF SE - Germany 2. Clariant AG-Switzerland 3. Sanitized AG - Switzerland 4. Biocote Ltd. - UK 5. Lonza Group AG - Switzerland 6. LyondellBasell Industries N.V. - Netherlands Asia Pacific 1. Troy Corporation (now part of Arxada) – Tokyo, Japan (Asia-Pacific regional HQ) 2. Sciessent LLC – Hong Kong (Asia-Pacific operations hub) 3. Nobel Corporation – Mumbai, India 4. Shandong IRO Biocide Chemicals Co., Ltd. – Zibo, Shandong, China Frequently Asked Questions: 1. What is the study period of the Global Antimicrobial Additives market? Ans. The Global Antimicrobial Additives Market is studied from 2024-2032. 2. What is the growth rate of Antimicrobial Additives Market? Ans. The Global Antimicrobial Additives Market is growing at a CAGR of 8.7% over the forecast period. 3. What is the market size of the Antimicrobial Additives Market by 2032? Ans. The market size of the Antimicrobial Additives Market by 2032 is expected to reach at USD 78.55 Bn. 4. What is the forecast period for the Antimicrobial Additives Market? Ans. The forecast period for the Antimicrobial Additives Market is 2025-2032. 5. What was the market size of the Antimicrobial Additives Market in 2024? Ans. The market size of the Antimicrobial Additives Market in 2024 was valued at USD 40.30 Bn.

1. Antimicrobial Additives Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Antimicrobial Additives Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Antimicrobial Additives Market: Dynamics 3.1. Region-wise Trends of Antimicrobial Additives Market 3.1.1. North America Antimicrobial Additives Market Trends 3.1.2. Europe Antimicrobial Additives Market Trends 3.1.3. Asia Pacific Antimicrobial Additives Market Trends 3.1.4. Middle East and Africa Antimicrobial Additives Market Trends 3.1.5. South America Antimicrobial Additives Market Trends 3.2. Antimicrobial Additives Market Dynamics 3.2.1. Global Antimicrobial Additives Market Drivers 3.2.1.1. Rising demand for Hygiene and Sanitisation in healthcare 3.2.1.2. Increasing use of antimicrobial agents 3.2.2. Global Antimicrobial Additives Market Restraints 3.2.3. Global Antimicrobial Additives Market Opportunities 3.2.3.1. Rising Demand for Healthcare Sector 3.2.3.2. Growth of Packaging Industry 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Political 3.4.2. Economic 3.4.3. Social 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Antimicrobial Additives Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 4.1.1. Plastic 4.1.2. Paints & Coatings 4.1.3. Pulp & Paper 4.1.4. Others 4.2. Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 4.2.1. Inorganic Antimicrobial Additives 4.2.2. Organic Antimicrobial Additives 4.2.3. Others 4.3. Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 4.3.1. Food and Beverage 4.3.2. Healthcare 4.3.3. Packaging 4.4. Antimicrobial Additives Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Antimicrobial Additives Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 5.1.1. Plastic 5.1.2. Paints & Coatings 5.1.3. Pulp & Paper 5.1.4. Others 5.2. North America Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 5.2.1. Inorganic Antimicrobial Additives 5.2.2. Organic Antimicrobial Additives 5.2.3. Others 5.3. North America Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 5.3.1. Food and Beverage 5.3.2. Healthcare 5.3.3. Packaging 5.4. North America Antimicrobial Additives Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 5.4.1.1.1. Plastic 5.4.1.1.2. Paints & Coatings 5.4.1.1.3. Pulp & Paper 5.4.1.1.4. Others 5.4.1.2. United States Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 5.4.1.2.1. Inorganic Antimicrobial Additives 5.4.1.2.2. Organic Antimicrobial Additives 5.4.1.2.3. Others 5.4.1.3. United States Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 5.4.1.3.1. Food and Beverage 5.4.1.3.2. Healthcare 5.4.1.3.3. Packaging 5.4.2. Canada 5.4.2.1. Canada Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 5.4.2.1.1. Plastic 5.4.2.1.2. Paints & Coatings 5.4.2.1.3. Pulp & Paper 5.4.2.1.4. Others 5.4.2.2. Canada Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 5.4.2.2.1. Inorganic Antimicrobial Additives 5.4.2.2.2. Organic Antimicrobial Additives 5.4.2.2.3. Others 5.4.2.3. Canada Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 5.4.2.3.1. Food and Beverage 5.4.2.3.2. Healthcare 5.4.2.3.3. Packaging 5.4.3. Mexico 5.4.3.1. Mexico Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 5.4.3.1.1. Plastic 5.4.3.1.2. Paints & Coatings 5.4.3.1.3. Pulp & Paper 5.4.3.1.4. Others 5.4.3.2. Mexico Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 5.4.3.2.1. Inorganic Antimicrobial Additives 5.4.3.2.2. Organic Antimicrobial Additives 5.4.3.2.3. Others 5.4.3.3. Mexico Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 5.4.3.3.1. Food and Beverage 5.4.3.3.2. Healthcare 5.4.3.3.3. Packaging 6. Europe Antimicrobial Additives Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.2. Europe Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.3. Europe Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4. Europe Antimicrobial Additives Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.1.2. United Kingdom Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.1.3. United Kingdom Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4.2. France 6.4.2.1. France Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.2.2. France Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.2.3. France Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.3.2. Germany Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.3.3. Germany Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.4.2. Italy Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.4.3. Italy Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.5.2. Spain Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.5.3. Spain Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.6.2. Sweden Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.6.3. Sweden Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.7.2. Austria Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.7.3. Austria Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 6.4.8.2. Rest of Europe Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 6.4.8.3. Rest of Europe Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7. Asia Pacific Antimicrobial Additives Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.2. Asia Pacific Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.3. Asia Pacific Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4. Asia Pacific Antimicrobial Additives Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.1.2. China Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.1.3. China Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.2.2. S Korea Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.2.3. S Korea Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.3.2. Japan Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.3.3. Japan Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.4. India 7.4.4.1. India Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.4.2. India Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.4.3. India Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.5.2. Australia Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.5.3. Australia Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.6.2. Indonesia Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.6.3. Indonesia Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.7.2. Philippines Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.7.3. Philippines Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.8.2. Malaysia Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.8.3. Malaysia Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.9.2. Vietnam Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.9.3. Vietnam Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.10.2. Thailand Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.10.3. Thailand Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 7.4.11.3. Rest of Asia Pacific Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 8. Middle East and Africa Antimicrobial Additives Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 8.2. Middle East and Africa Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 8.3. Middle East and Africa Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 8.4. Middle East and Africa Antimicrobial Additives Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 8.4.1.2. South Africa Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 8.4.1.3. South Africa Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 8.4.2.2. GCC Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 8.4.2.3. GCC Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 8.4.3.2. Nigeria Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 8.4.3.3. Nigeria Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 8.4.4.2. Rest of ME&A Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 8.4.4.3. Rest of ME&A Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 9. South America Antimicrobial Additives Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 9.2. South America Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 9.3. South America Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 9.4. South America Antimicrobial Additives Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 9.4.1.2. Brazil Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 9.4.1.3. Brazil Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 9.4.2.2. Argentina Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 9.4.2.3. Argentina Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Antimicrobial Additives Market Size and Forecast, By Application Type (2024-2032) 9.4.3.2. Rest of South America Antimicrobial Additives Market Size and Forecast, By Type (2024-2032) 9.4.3.3. Rest of South America Antimicrobial Additives Market Size and Forecast, By End User Industry (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. BASF SE (Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Lonza Group (Switzerland) 10.3. Clariant AG (Switzerland) 10.4. Microban International (USA) 10.5. Sanitized AG (Switzerland) 10.6. Dow Chemical Company (USA) 10.7. Biocote Limited (UK) 10.8. A. Schulman, Inc. (USA) (now part of LyondellBasell) 10.9. LyondellBasell Industries Holdings B.V. (Netherlands) 10.10. Milliken Chemical (USA) 10.11. Plastics Color Corporation (PCC) (USA) 10.12. Parx Plastics N.V. (Netherlands) 10.13. Troy Corporation (USA) (now part of Arxada) 10.14. Life Materials Technologies Ltd. (Thailand) 10.15. PolyOne Corporation (USA) (now rebranded as Avient Corporation) 11. Key Findings 12. Analyst Recommendations 13. Antimicrobial Additives Market: Research Methodology