Anthocyanin Market size is expected to reach nearly US$ 476.81 Mn by 2029 with the CAGR of 4.32% during the forecast period. According to Maximize Market Research, the Global Anthocyanin market is expected to grow at a moderate growth rate and reach a significant market value by the end of the forecast period. Global Anthocyanin Market report is a comprehensive analysis of the industry, market, and key players. The report has covered the market by demand and supply-side by segments. The Global Anthocyanin Market report also provides trends by market segments, technology, and investment with a competitive landscape.Anthocyanin Market Overview:

Anthocyanin is water-dissolvable phytochemicals with a customary red to blue concealing. It is a flavorless and scentless flavonoid that is ordinarily found in verdant food varieties, for instance, berries, cabbage, purple grapes and beets among others. Anthocyanin furthermore goes probably as a malignant growth anticipation specialist, unfriendly to negatively vulnerable, quieting, against microbial, and microcirculation improvement. Anthocyanin has incredibly high use in the food and drink industry as a colorant. Besides its functional properties, it also has a wide extent of clinical benefits give it a tendency as a pressing fixing in most sustenance things. Their diverse clinical benefits join being an adversary of ominously defenseless, unfriendly to microbial, quieting and against oxidant. Overall interest for anthocyanin is driven by creating interest for concealing added substances in the sustenance and beverages industry. Uses of anthocyanin in the sustenance and drink industry are as a food colorant. The extending interest for strong food things is needed to help the interest for anthocyanin as soon as possible. It is typical that in time it will be the supported kind of colorant in view of its sweeping number of clinical benefits when diverged from various colorants.To know about the Research Methodology :- Request Free Sample Report

Anthocyanin Market Dynamics:

The overall market for anthocyanin has seen a basic ascent in several years owing to the rising care concerning the clinical benefits of anthocyanin and their rising game plan of utilization over different endeavors. The supporting money related conditions of making countries, for instance, India, China, Brazil, and Argentina in the earlier years and the resultant climb in obtaining impact of purchasers have helped increase the use of anthocyanin-rich sustenances over these countries. The usage of anthocyanin-rich things is furthermore credited to the changing lifestyle of the buyers, which, accordingly, is powered by the rising care about prosperity and wellbeing among customers. As demonstrated by an assessment circulated, conventional confirmation of anthocyanin helps in diminishing the peril of coronary ailment, respiratory messes and as most unique cell support help in expecting threatening development and fight against oxidative mischief among various benefits. Most buyers looking for sustenance things that served their need to keep up a strong lifestyle and most things miss the mark on this property of being sound. The thought of anthocyanin as a colorant will help the element of clinical benefits for a thing give it a greater customer base. Extending application scope in drugs and distinguishing strength drugs is assessed to support anthocyanin market advancement over the assessed time period. Unparalleled properties, for instance, microcirculation improvement, antagonistic to microbial, quieting and against touchy joined with additional clinical benefits are endeavored to extend market advancement in this segment over the figure time period. Anthocyanin has been found amazing in infirmities, for instance, threatening development, diabetes, mental reduction, and a couple of cardiovascular afflictions. Speedy urbanization and extending extra cash are various components that are depended upon to move anthocyanin market improvement particularly in rising economies, for instance, China, India, and Brazil over the check time period. Moreover, changing utilization design joined with a development in the strong food request is one more factor expected to fuel the anthocyanin request all through the accompanying seven years. Moving client inclinations towards strong and engaging packaged food and drink things are anticipated to incite regular item focuses improvement. A couple of government rules concerning anthocyanin use are predicted to conflictingly impact market improvement over the not all that removed. Major Growth Driven By Blue Wine Trend: Food makers are moving their concentration towards added substances, fixings, and colorants, for example, anthocyanin that advances the wellbeing profile of food items, trying to adapt up to the changing purchaser inclinations. One such pattern saw across the end-use industry is the blue wine pattern. Blue isn't affirmed as a wine tone in Spain, which brought about the underlying boycott of the blue wine. In the wake of stepping through various guidelines and administrative noise, it was gone through, being added into the classification of 'other cocktails'. Produced using grapes, having anthocyanin, the high blue shade in its skin, the wine gets a characteristic blue tone. Advancing its way into the French market, the blue wine pattern is probably going to push the development of the anthocyanin market. Purple food sources are arising as a mainstream decision among purchasers for both the shading and the related medical advantages. The purple food upset referred to across different pieces of the world is relied upon to push the development of the anthocyanin market as far as extraction. Exploration has uncovered that the most elevated substance of cancer prevention agent movement and anthocyanin in tropical purple organic products were java plum followed by yam, tomi-tomi, and Bali grape. As analysts have connected anthocyanin to expanded life span, the purple food sources entrance is straightforwardly connected to the anthocyanin market development. Market Competition and Strategies: Imaginative thing improvement fulfilling client needs is depended upon to be a key methodology received by these organizations over the estimated time period. Creative promotion and advertising procedures are needed to build market infiltration in forte portions all through the accompanying seven years. Web-based media stages are depended upon to be used for an enormous scope to expand client base and piece of the pie. Associations, M&A, joint endeavors, and development of existing offices are depended upon to be some various systems embraced by significant market members to expand their offer in the impending future. Sensient Technologies Corporation has gained the common shading business of a Peru-based normal food and fixing company—GlobeNatural—in the year 2018. This essential securing was engaged at item portfolio upgrade and improvement of assembling capacities of the parent organization CHR Hansen Holding A/S has zeroed in on developing its common shading business situated in North America in the year 2018 by securing an assembling office arranged in Wisconsin. This development has empowered to serve the developing necessities of clients through their recognizable and restrictive contributions Bowman Daniels Midland Company (ADM) has declared a proposed procurement of a global producer of creature sustenance items—Neovia, in the year 2018. To offer expansion to the organization's incorporated creature nourishment portfolio.Recent Developments:

• In March 2019, Chicago based Archer Daniels Midland had reported that it had consented to an arrangement to procure Ziegler Group, a European provider of fixings with characteristic citrus flavor. The arrangement comes not long after ADM finished the procurement of Winter Haven, a Florida - based citrus flavor provider, Florida Chemicals Co. The mix of the over two organizations will promptly situate ADM for development as the world chief in normal citrus fixings, with a full scope of inventive citrus arrangements and framework for food, drinks and scents. • In March 2017, FMC Corporation declared that it had procured part of DuPont's Crop Protection business. This obtaining will grow its portfolio and FMC will exploit DuPont's R&D capacities and pipeline definition skill to the degree that it will better serve its clients.Anthocyanin Market Segment Analysis:

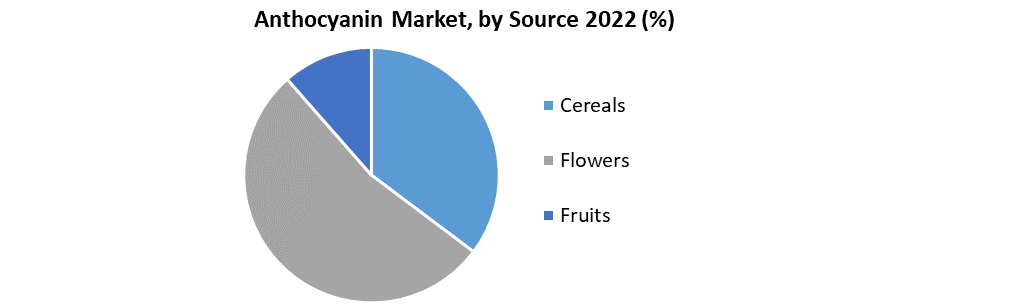

On the basis of end-use, the market is segmented into Animal Feed, Cosmetics & Personal Care, Food & Beverage Industry, Nutraceutical Industry and Pharmaceutical Industry. Among end users, the food and drinks industry is most likely going to lead the market in 2022. The example is presumably going to remain unaltered over the range of the figure time period. The food and refreshments industry section added the best piece of wages to the overall market in 2022. The food and drinks industry is projected to hold market strength all through the figure time period. The course of action of utilizations of Anthocyanin in a grouping of food and reward things is huge when appeared differently in relation to applications in other key end-client organizations. The helpful effects of anthocyanin, inferable from their foe of oxidative, neuroprotective, and against dangerous development nature, have made them suitable for application in drug things moreover. Thusly, the interest for anthocyanin in the social protection part has seen a huge climb in two or three years, making the drug business one of the critical allies of the overall anthocyanin market's turn of events. Thusly, the drug divide is seen as the most appealing application section of the overall anthocyanin market all through a few years, expected to enrol the most reassuring 4.6% CAGR from 2023 through 2029. On the basis of product, the market is segmented into Cyanidin, Delphinidin, Malvidin, Pelargonidin, Peonidin and Petunidin. The utilization of mitigating food sources fundamentally plants rich in anthocyanins may assist with controlling irritation. Cyanidin from cherries lightens joint pain in a creature model and diminishes the serum level of malonaldehyde, which is a biomarker to quantify the degree of oxidative pressure. Cyanidin stifle the provocative impact of zymosan in rodents.) It can have significant ramifications for the avoidance of nitric oxide intervened fiery illnesses. There are various examinations showing the counter disease exercises of cyanidin. The counter disease and against mutagenic properties of this anthocyanin is straightforwardly connected to its cell reinforcement properties. In-vivo and in-vitro considers are connecting cyanidin to a decreased danger of leukaemia, cellular breakdown in the lungs, colon malignant growth, skin disease and prostate disease. Cyanidin incites disease cell apoptosis, lessens oxidative harm to DNA, represses cell development and abatement malignancy cell multiplication. On the basis of source, the market is segmented into Cereals, Flowers and Fruits.

Anthocyanin Market Regional Analysis:

Europe market is one of the key territorial business sectors for Anthocyanin to the extent responsibility of pay to the overall market, regarded at most elevated income share and is assessed to hold market strength all through the measure time period. The U.K. is the pioneer for the commonplace market. In any case, the usage of anthocyanin in the area has persevered through a rotted post the necessity of tough precepts and rules concerning the utilization of designed food tints in various things. In Europe, every normal food concealing that has been asserted for use is surveyed by the Scientific Committee on Food (SCF), which includes a get-together of sensible experts from each part state designated by the European Commission. This is needed to bring about a slight decline in the area's proposal in the overall anthocyanin market by 2029, with the Asia Pacific ascending as the accompanying high-likely client over the period someplace in the scope of 2023 and 2029. The Asia Pacific anthocyanin market is needed to show an exceptionally reassuring and critical CAGR over the said period. China and India are expected to be the leaders in the area inferable from expanding food and drink request combined with developing buyer discretionary cash flow. South America is dared to observe extensive development in the market inferable from expanding sound item interest as containers and drinks. Future interest is relied upon to come from arising economies including Mexico, Brazil, China, and India. North America market is right now driving the anthocyanin market, with the U.S. what's more, Canada being the critical allies of the colossal interest for the same. In addition, a couple of associations working in the field of anthocyanin have strong proximity in the space too. Likewise, inferable from the mind-boggling closeness of the food and drink, singular thought, and drug undertakings in the U.S., clients have wide admittance to an arrangement of anthocyanin pervaded things. The interest for anthocyanin in North America is needed to notice a vital flood in the midst of the assessed time period.Anthocyanin Market Scope: Inquire before buying

Anthocyanin Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 354.63 Mn. Forecast Period 2023 to 2029 CAGR: 4.32% Market Size in 2029: US $ 476.81 Mn. Segments Covered: by Product • Cyanidin • Delphinidin • Malvidin • Pelargonidin • Peonidin • Petunidin by Source • Cereals • Flowers • Fruits by End-Use • Animal Feed • Cosmetics & Personal Care • Food & Beverage Industry • Nutraceutical Industry • Pharmaceutical Industry Anthocyanin Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Anthocyanin Market Key Players are:

• Archer Daniel Midlands Co • CHR Hansen A/S • D.D. Williamson and Co. Inc • FMC Corporation • GNT Group • Kalsec Inc. • Naturex S.A. • Sensient Technologies Corp • Symrise A.G. • Synthite Industries. • Lake International Technologies • Food Ingredient Solutions LLC • American Color Research Center, Inc. (ACRC) • ColorMaker • Vinayak Ingredients India Pvt Ltd • Fiorio Colori • FRUTAROM NATURAL SOLUTIONS. Frequently Asked Questions: 1. Which region has the largest share in Global Anthocyanin Market? Ans: Europe region held the highest share in 2022. 2. What is the growth rate of Global Anthocyanin Market? Ans: The Global Anthocyanin Market is growing at a CAGR of 4.32% during forecasting period 2023-2029. 3. What is scope of the Global Anthocyanin Market report? Ans: Global Anthocyanin Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Anthocyanin Market? Ans: The important key players in the Global Anthocyanin Market are – Archer Daniel Midlands Co, CHR Hansen A/S, D.D. Williamson and Co. Inc, FMC Corporation, GNT Group, Kalsec Inc., Naturex S.A., Sensient Technologies Corp, Symrise A.G., Synthite Industries., Lake International Technologies, Food Ingredient Solutions LLC, American Color Research Center, Inc., ColorMaker, Vinayak Ingredients India Pvt Ltd, Fiorio Colori, and FRUTAROM NATURAL SOLUTIONS. 5. What is the study period of this Market? Ans: The Global Anthocyanin Market is studied from 2022 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary End-Use 2.3.2. Primary Research 2.3.2.1. Data from Primary End-Use 2.3.2.2. Breakdown of Primary End-Use 3. Executive Summary: Anthocyanin Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Anthocyanin 3.4. Geographical Snapshot of the Anthocyanin Market, By Manufacturer share 4. Anthocyanin Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute End-Use 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Anthocyanin Market 5. Supply Side and Demand Side Indicators 6. Anthocyanin Market Analysis and Forecast, 2022-2029 6.1. Anthocyanin Market Size & Y-o-Y Growth Analysis. 7. Anthocyanin Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 7.1.1. Animal Feed 7.1.2. Cosmetics & Personal Care 7.1.3. Food & Beverage Industry 7.1.4. Nutraceutical Industry 7.1.5. Pharmaceutical Industry 7.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 7.2.1. Cyanidin 7.2.2. Delphinidin 7.2.3. Malvidin 7.2.4. Pelargonidin 7.2.5. Peonidin 7.2.6. Petunidin 7.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 7.3.1. Cereals 7.3.2. Flowers 7.3.3. Fruits 8. Anthocyanin Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. Asia Pacific Anthocyanin Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 9.1.1. Animal Feed 9.1.2. Cosmetics & Personal Care 9.1.3. Food & Beverage Industry 9.1.4. Nutraceutical Industry 9.1.5. Pharmaceutical Industry 9.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 9.2.1. Cyanidin 9.2.2. Delphinidin 9.2.3. Malvidin 9.2.4. Pelargonidin 9.2.5. Peonidin 9.2.6. Petunidin 9.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 9.3.1. Cereals 9.3.2. Flowers 9.3.3. Fruits 10. North America Anthocyanin Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Anthocyanin Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 11.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 12. Canada Anthocyanin Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 12.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 13. Mexico Anthocyanin Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 13.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 14. Europe Anthocyanin Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 14.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 14.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 15. Europe Anthocyanin Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K Anthocyanin Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 16.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 17. France Anthocyanin Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 17.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 18. Germany Anthocyanin Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 18.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 19. Italy Anthocyanin Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 19.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 20. Spain Anthocyanin Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 20.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 21. Sweden Anthocyanin Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 21.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 22. CIS Countries Anthocyanin Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 22.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 23. Rest of Europe Anthocyanin Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 23.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 24. Asia Pacific Anthocyanin Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 24.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 24.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 25. Asia Pacific Anthocyanin Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Anthocyanin Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 26.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 27. India Anthocyanin Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 27.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 28. Japan Anthocyanin Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 28.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 29. South Korea Anthocyanin Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 29.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 30. Australia Anthocyanin Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 30.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 31. ASEAN Anthocyanin Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 31.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 32. Rest of Asia Pacific Anthocyanin Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 32.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 33. Middle East Africa Anthocyanin Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 33.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 33.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 34. Middle East Africa Anthocyanin Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Anthocyanin Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 35.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 36. GCC Countries Anthocyanin Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 36.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 37. Egypt Anthocyanin Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 37.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 38. Nigeria Anthocyanin Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 38.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 39. Rest of ME&A Anthocyanin Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 39.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 40. South America Anthocyanin Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 40.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 40.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 41. South America Anthocyanin Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Anthocyanin Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 42.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 43. Argentina Anthocyanin Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 43.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 44. Rest of South America Anthocyanin Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By End-Use, 2022-2029 44.2. Market Size (Value) Estimates & Forecast By Product, 2022-2029 44.3. Market Size (Value) Estimates & Forecast By Source, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Anthocyanin Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Herbs & Spices, Presence, Market Share, Fiber End-Use and R&D Investment 45.2.2. New End-Use Launches and End-Use Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Archer Daniel Midlands Co 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. End-Use Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. CHR Hansen A/S 45.3.3. D.D. Williamson and Co. Inc 45.3.4. FMC Corporation 45.3.5. GNT Group 45.3.6. Kalsec Inc. 45.3.7. Naturex S.A. 45.3.8. Sensient Technologies Corp 45.3.9. Symrise A.G. 45.3.10. Synthite Industries. 45.3.11. Lake International Technologies 45.3.12. Food Ingredient Solutions LLC 45.3.13. American Color Research Center, Inc. (ACRC) 45.3.14. ColorMaker 45.3.15. Vinayak Ingredients India Pvt Ltd 45.3.16. Fiorio Colori 45.3.17. FRUTAROM NATURAL SOLUTIONS.