The Global Aniline Market size was valued at USD 11.45 Billion in 2024 and the market is expected to grow at a CAGR of 7% from 2025 to 2032, reaching nearly USD 19.8 Billion by 2032Aniline Market Overview

The organic compound known as Aniline comes from the Portuguese anil 'indigo shrub', yet still contains -in as a derived substance. As its basic structure includes both a phenyl group (−C6H5) and an amino group (−NH2), aniline exists as the simplest aromatic amine. The organic compound aniline exists with the chemical formulation C₆H₅NH₂, where a phenyl group combines with an amino group. Global Aniline Market has dual purposes in the chemical industry because it serves as both an important industrially used basic chemical and an essential raw material for advanced manufacturing of specialised chemicals. The major production Distribution Channel of aniline involves making industrial chemical precursors, which lead to polyurethane production as well as dyes and other manufacturing chemicals. The typical fishy odour typical of volatile amines also exists in this compound. When ignited, Aniline starts burning with specific aromatic compound smoke-producing flames. It is toxic to humans. The Global Aniline Market moves forward by increasing production capacities and supply chain efficiency, as well as developing sustainable practices to fulfil the rising industry demand for aniline. The aniline market is heavily dependent on automotive, construction, and textiles because these sectors are major consumers or utilizers of aniline to make polyurethane foams, along with rubber processing chemicals and dyes. The Aniline Market aims to find novel manufacturing process methods that decrease environmental impact and fulfil mandatory regulations while supporting environmental preservation and business expansion.To know about the Research Methodology :- Request Free Sample Report

Aniline Market Dynamics

Sustainability and Green Chemistry Initiatives To Boost The Demand In the Aniline Market Environmental initiatives about sustainability, together with green chemistry programs, compete as main focus areas. Bio Distribution Channel-derived production processes use plant sugars to eliminate the need for fossil fuels while decreasing environmental carbon releases. Organisations work to recycle GIobal Aniline Market while developing sustainable systems which support worldwide sustainable development initiatives. Industrial output efficiency receives continuous improvement because of recent developments in chemical engineering. Sustainable manufacturing takes shape from two main advances: better catalytic processes and the use of automation and artificial intelligence systems, which decrease energy usage and waste production to help create cheaper production. Stringent Environmental Regulation and Volatility in Raw Material Price To Drive Significant Market Growth Due to its toxic qualities Global Aniline Market leads nations to create worldwide safety regulations for its use. Meeting worldwide regulations for Aniline demands substantial expenses in protecting workplace safety, together with developing environmentally conscious manufacturing processes, leading to possible higher production costs. Aniline manufacturers require substantial benzene amounts which are derived from crude oil components, to operate. Unstable crude oil market prices drive changes in benzene costs, resulting in unstable production expenses for aniline producers. The market growth faces threats because alternative chemicals can successfully replace aniline in various distribution channels. Industries choose alternative chemicals as replacements because these substances present cost savings and fewer regulatory hurdles. Innovations of new aniline derivation products and investing in research and development to boost market growth Aniline serves as a primary starting material during MDI production for making polyurethane foam products extensively utilised in industries. The polyurethane foams require high industry demand in construction, building and automotive manufacturing, as well as furniture Distribution Channels, because they provide insulation and cushioning benefits. The growing construction industry in developing areas will lead to higher demand for polyurethane materials thus resulting in increased aniline consumption. The automotive industry makes polyurethane components by using aniline-derived MDI for the production of automotive interior and seating materials. The increasing global vehicle manufacturing and lightweight automotive and fuel-efficient vehicle trends create a major business potential for the GIobal Aniline Market. Health and Environmental Issues Associated with Aniline Market Growth The chemical compound aniline possesses toxicity properties that potentially lead to cancer diagnosis. The human body experiences two severe medical conditions along with methemoglobinemia after contact with aniline. Due to rigorous environmental and safety regulations enforced by regulatory bodies, companies need to pay higher compliance costs to manufacturers. The basic raw material used in producing the Global Aniline Market comes from benzene, while the crude oil market changes regulate its price. The cost stability of producing aniline depends on market oil price fluctuations because it affects profit margins. Competing materials and alternative chemical compounds seek to substitute aniline usage in particular manufacturing, Distribution channels, including polymers and dyes. Competitive companies employing alternative eco-friendly or cost-effective materials will attempt to reduce aniline market control.Aniline Market Segment Analysis

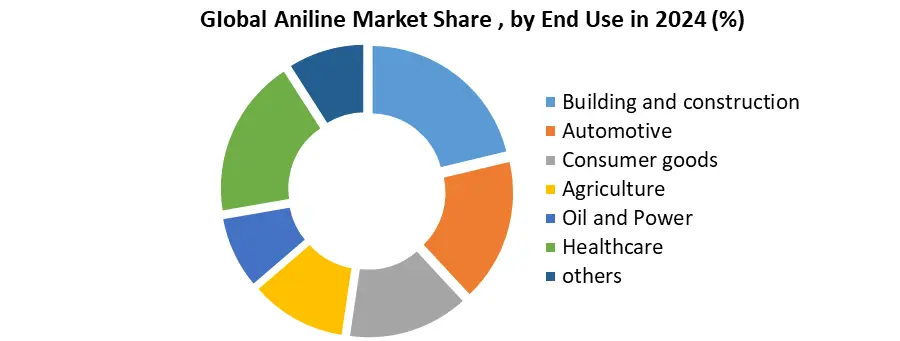

Based on application, the Aniline market is segmented into Methylene Diphenyl Isocyanate, Rubber Processing Chemicals, Dyes and Pigments, Speciality Fibres, Agricultural Chemicals, and others. The Methylene Diphenyl Isocyanate segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. Methylene Diphenyl Isocyanate functions as an aromatic isocyanate, which the industry utilises for making polyurethane foams together with resins. The manufacturing process of this product begins with the global aniline market, as it becomes one of the major aniline-based product Distribution Channels. Rigid Foam for building insulation, refrigerators, and thermal insulation panels. Flexible Foam serves multiple purposes, such as furniture making and mattress production, and car seat manufacturing etc. Spray foam insulation, sealants, adhesives, and protective coatings. Polyurethane foams are used for building multiple interior components and seat cushions, and dashboards, together with acoustic insulation. Methylene Diphenyl Isocyanate polyurethane foam materials guarantee insulation inside refrigerators and freezers, as well as HVAC systems. The manufacturing industry utilises Methylene Diphenyl Isocyanate-based elastomers to produce shoe soles along with athletic equipment. Protective foams for packaging sensitive devices and electrical insulation.Based on End user, the market is segmented into Building and Construction, Automotive, Consumer Goods, Agriculture, Oil and Power, Healthcare, and Others. The healthcare segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. The pharmaceutical and healthcare sector relies heavily on the Global Aniline market for its use as an intermediate to create multiple APIs alongside diagnostic substances and analgesics. The production of azo dyes, together with methylene blue, uses aniline derivatives as raw materials. Staining agents for histology and microbiology. Imaging and contrast agents. Biomarker detection in cancer and infection research. The chemical substance aniline allows industrial production of vital drug intermediates that carry an aromatic amine functional group. People worldwide take Paracetamol (Acetaminophen) as a pain reliever and fever reducer because Aniline functions as its direct precursor. Phenacetin served as an analgesic and antipyretic drug during historical times, yet it was removed from the market because of toxicity-related concerns. Aniline Derivatives, Aromatic amines for API production. Used in antibiotics, antivirals, and anti-inflammatory drugs.

Aniline Market Regional Insights

The Asia-Pacific dominant and fastest-growing global aniline market, expanding within the Asia-Pacific territory because it retains more than 55% of the worldwide demand. Rapid industrialization alongside urban infrastructure expansion and expanding end-use industries, including construction as well as automotive and textiles, and pharmaceuticals, is what drives the Asian-Pacific aniline market growth. The manufacturing process of MDI requires extensive heavy usage for both construction, Distribution Channels, and appliance insulation. The automotive industry is being expanded by using aniline-based PU foams. Major exporter of azo dyes and rubber chemicals. Domestic self-sufficiency in aniline production. The efforts to develop bio-based MDI substitutes need enhanced financial investment. The implementation of stricter environmental regulations has become necessary for improving industrial cleaning processes. Large-scale production of paracetamol and other Global Aniline Market-based APIs. Industries dealing with textile dyeing operated on a massive scale with aniline derivatives. The increasing automotive industry, together with real estate development, drives polyurethane demand. North America makes up a 15–18% share of the worldwide Global aniline market demand in its well-built and supervised market segment. The region develops high-quality aniline derivatives for MDI chemical production and pharmaceuticals, together with coatings and rubber processing purposes. MDI production for rigid polyurethane foams in insulation panels. Automotive foams and lightweight materials. Pharmaceutical intermediates (e.g., acetaminophen production). Rubber chemicals for tires and conveyor belts. The aerospace along defence industries implement dyes and coatings in their operations. Fabrication of eco-friendly buildings and implementation of energy-saving insulation systems form a key part of this initiative. Advanced R&D in bio-based Global Aniline Market and recyclable PU systems. High demand for eco-friendly dyes and chemicals. The pharmaceutical industry segments under FDA regulation stimulate the growth of high-purity aniline utilisation.Aniline Market Competitive Landscape

The company Covestro developed new technologies for bio-based GIobal Aniline Market production from renewable carbon materials. GNFC increased its MDI production capacity to decrease India's dependence on imported materials. The company expanded its export operation of MDI and downstream products throughout Europe and the Middle East. The company deployed its aniline synthesis process from plant biomass in Leverkusen with a pilot plant last February 2024. Circular grade entered a supply contract with Encina to obtain chemically recycled feedstock for enhancing their circular economy objectives in January 2024. The renewable production of the global aniline market relies on natural resources while lowering dependence on petroleum products used as raw materials. The production methods receive enhancements that raise yield levels and decrease environmental effects. Increasing Distribution Channels in MDI production for polyurethane foams. The automotive sector, together with the construction sector, shows increasing demand. Advancements in sustainable production technologies.Aniline Market Scope: Inquire before buying

Aniline Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 11.45 Bn. Forecast Period 2025 to 2032 CAGR: 7% Market Size in 2032: USD 19.8 Bn. Segments Covered: by Technology Nitration of Benzene Green Chemistry (Bio-based Aniline) by Application Methylene Diphenyl Isocyanate Rubber Processing Chemicals Dyes and Pigments Specialty Fibers Agricultural Chemicals Others by Distribution Channel Direct Sales Distributors / Traders Online Platforms Others by End-User Building and Construction Automotive Consumer Goods Agriculture Oil and Power Healthcare Others Aniline Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and Rest of ME&A) South America (Brazil, Argentina, and the Rest of South America)Aniline Market Key Players are:

North America 1. Huntsman Corporation - USA. 2. Dow Chemical Company - USA. 5. Wanhua Chemical Group Co., Ltd. – USA Asia-Pacific 1. Sinopec Nanjing Chemical Industries Co., Ltd - China, 2. Wanhua Chemical Group Co., Ltd – China 3. Jilin Connell Chemical Industry Co., Ltd - China, 4. Mitsui Chemicals, Inc - Japan, 5. SP Chemicals Holdings Ltd - China. 6. Hindustan Organic Chemicals Limited (HOCL) – India Europe 1. BASF SE – Germany 2. Versalis S.p.A. – Italy 3. INEOS Group Limited - London, 4. Brenntag SE – Germany 5. Tosoh Corporation - Japan, 6. Jilin Connell Chemical Industry Co., Ltd. - China, Middle East and Africa 1. SABIC (Saudi Basic Industries Corporation) - Saudi Arabia 2. Sasol Limited - South Africa 3. Farabi Petrochemicals Group - Saudi Arabia 4. Hindustan Organic Chemicals Limited (HOCL) – India 5. Clariant AG – Switzerland 6. Croda International plc – Spain 7. LyondellBasell Industries N.V. – south Africa South America 1. Braskem S.A. – Brazil 2. Unipar Carbocloro S/A - Brazil 3. Oxiteno - Brazil 4. Rhodia – Brazil 5. Nitro Química – Brazil 6. Oxiteno – Brazil 7. Allnex – Brazil 8. Evonik Industries - BraziFrequently Asked Questions:

1. What is the study period of this Market? Ans: The Global Aniline Market is studied from 2024 to 2032 2. What is the scope of the Global Aniline Market report? Ans: The Global Aniline Market report helps with the COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. Which region has the largest share in the Global Aniline Market? Ans: The Asia Pacific region held the highest share in 2024. 4. Who are the key players in the Global Aniline Market? Ans: Sinopec Nanjing Chemical Industries Co., Ltd, Wanhua Chemical Group Co., Ltd, Jilin Connell Chemical Industry Co., Ltd, Mitsui Chemicals, Inc - Japan, SP Chemicals Holdings Ltd. 5. What is the growth rate of Global Aniline Market? Ans: The Global Aniline Market is growing at a CAGR of 7% during the forecast period 2024-2032.

1. Global Aniline Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Aniline Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Service Segment 2.2.3. End-User Segment 2.2.4. Revenue (2024) 2.2.5. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Global Aniline Market: Dynamics 3.1. Global Aniline Market Trends 3.2. Global Aniline Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Global Aniline Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 4.1. Global Aniline Market Size and Forecast, By Technology (2025-2032) 4.1.1. Nitration of Benzene 4.1.2. Green Chemistry 4.2. Global Aniline Market Size and Forecast, By Application (2025-2032) 4.2.1. Methylene Diphenyl Isocyanate 4.2.2. Rubber Processing Chemicals 4.2.3. Dyes and Pigments 4.2.4. Specialty Fibers 4.2.5. Agricultural Chemicals 4.2.6. Others 4.3. Global Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 4.3.1. Direct Sales 4.3.2. Distributors / Traders 4.3.3. Online Platforms 4.3.4. Others 4.4. Global Aniline Market Size and Forecast, By End-User (2025-2032) 4.4.1. Building and Construction 4.4.2. Automotive 4.4.3. Consumer Goods 4.4.4. Agriculture 4.4.5. Oil and Power 4.4.6. Healthcare 4.4.7. Others 4.5. Global Aniline Market Size and Forecast, By Region (2025-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Aniline Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 5.1. North America Aniline Market Size and Forecast, By Technology (2025-2032) 5.1.1. Nitration of Benzene 5.1.2. Green Chemistry 5.2. North America Aniline Market Size and Forecast, By Application (2025-2032) 5.2.1. Methylene Diphenyl Isocyanate 5.2.2. Rubber Processing Chemicals 5.2.3. Dyes and Pigments 5.2.4. Specialty Fibers 5.2.5. Agricultural Chemicals 5.2.6. Others 5.3. North America Aniline Market Size and Forecast, By Distribution channel (2025-2032) 5.3.1. Direct Sales 5.3.2. Distributors / Traders 5.3.3. Online Platforms 5.3.4. Others 5.4. North America Aniline Market Size and Forecast, By End-User (2025-2032) 5.4.1. Building and Construction 5.4.2. Automotive 5.4.3. Consumer Goods 5.4.4. Agriculture 5.4.5. Oil and Power 5.4.6. Healthcare 5.4.7. Others 5.5. North America Aniline Market Size and Forecast, by Country (2025-2032) 5.5.1. United States 5.5.1.1. United States Aniline Market Size and Forecast, By Technology (2025-2032) 5.5.1.1.1. Nitration of Benzene 5.5.1.1.2. Green Chemistry 5.5.1.2. United States Aniline Market Size and Forecast, By Application (2025-2032) 5.5.1.2.1. Methylene Diphenyl Isocyanate 5.5.1.2.2. Rubber Processing Chemicals 5.5.1.2.3. Dyes and Pigments 5.5.1.2.4. Specialty Fibers 5.5.1.2.5. Agricultural Chemicals 5.5.1.2.6. Others 5.5.1.3. United States Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 5.5.1.3.1. Direct Sales 5.5.1.3.2. Distributors / Traders 5.5.1.3.3. Online Platforms 5.5.1.3.4. Others 5.5.1.4. United States Aniline Market Size and Forecast, By End-User (2025-2032) 5.5.1.4.1. Building and Construction 5.5.1.4.2. Automotive 5.5.1.4.3. Consumer Goods 5.5.1.4.4. Agriculture 5.5.1.4.5. Oil and Power 5.5.1.4.6. Healthcare 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Aniline Market Size and Forecast, By Technology (2025-2032) 5.5.2.1.1. Nitration of Benzene 5.5.2.1.2. Green Chemistry 5.5.2.2. Canada Aniline Market Size and Forecast, By Application (2025-2032) 5.5.2.2.1. Methylene Diphenyl Isocyanate 5.5.2.2.2. Rubber Processing Chemicals 5.5.2.2.3. Dyes and Pigments 5.5.2.2.4. Specialty Fibers 5.5.2.2.5. Agricultural Chemicals 5.5.2.2.6. Others 5.5.2.3. Canada Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 5.5.2.3.1. Direct Sales 5.5.2.3.2. Distributors / Traders 5.5.2.3.3. Online Platforms 5.5.2.3.4. Others 5.5.2.4. Canada Aniline Market Size and Forecast, By End-User (2025-2032) 5.5.2.4.1. Building and Construction 5.5.2.4.2. Automotive 5.5.2.4.3. Consumer Goods 5.5.2.4.4. Agriculture 5.5.2.4.5. Oil and Power 5.5.2.4.6. Healthcare 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Aniline Market Size and Forecast, By Technology (2025-2032) 5.5.3.1.1. Nitration of Benzene 5.5.3.1.2. Green Chemistry 5.5.3.2. Mexico Aniline Market Size and Forecast, By Application (2025-2032) 5.5.3.2.1. Methylene Diphenyl Isocyanate 5.5.3.2.2. Rubber Processing Chemicals 5.5.3.2.3. Dyes and Pigments 5.5.3.2.4. Specialty Fibers 5.5.3.2.5. Agricultural Chemicals 5.5.3.2.6. Others 5.5.3.3. Mexico Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 5.5.3.3.1. Direct Sales 5.5.3.3.2. Distributors / Traders 5.5.3.3.3. Online Platforms 5.5.3.3.4. Others 5.5.3.4. Mexico Aniline Market Size and Forecast, By End-User (2025-2032) 5.5.3.4.1. Building and Construction 5.5.3.4.2. Automotive 5.5.3.4.3. Consumer Goods 5.5.3.4.4. Agriculture 5.5.3.4.5. Oil and Power 5.5.3.4.6. Healthcare 5.5.3.4.7. Others 6. Europe Aniline Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 6.1. Europe Aniline Market Size and Forecast, By Technology (2025-2032) 6.2. Europe Aniline Market Size and Forecast, By Application (2025-2032) 6.3. Europe Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.4. Europe Aniline Market Size and Forecast, By End-User (2025-2032) 6.5. Europe Aniline Market Size and Forecast, by Country (2025-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.1.2. United Kingdom Aniline Market Size and Forecast, By Application (2025-2032) 6.5.1.3. United Kingdom Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.1.4. United Kingdom Aniline Market Size and Forecast, By End-User (2025-2032) 6.5.2. France 6.5.2.1. France Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.2.2. France Aniline Market Size and Forecast, By Application (2025-2032) 6.5.2.3. France Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.2.4. France Aniline Market Size and Forecast, By End-User (2025-2032) 6.5.3. Germany 6.5.3.1. Germany Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.3.2. Germany Aniline Market Size and Forecast, By Application (2025-2032) 6.5.3.3. Germany Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.3.4. Germany Aniline Market Size and Forecast, By End-User (2025-2032) 6.5.4. Italy 6.5.4.1. Italy Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.4.2. Italy Aniline Market Size and Forecast, By Application (2025-2032) 6.5.4.3. Italy Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.4.4. Italy Aniline Market Size and Forecast, By End-User (2025-2032) 6.5.5. Spain 6.5.5.1. Spain Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.5.2. Spain Aniline Market Size and Forecast, By Application (2025-2032) 6.5.5.3. Spain Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.5.4. Spain Aniline Market Size and Forecast, By End-User (2025-2032) 6.5.6. Sweden 6.5.6.1. Sweden Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.6.2. Sweden Aniline Market Size and Forecast, By Application (2025-2032) 6.5.6.3. Sweden Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.6.4. Sweden Aniline Market Size and Forecast, By End-User (2025-2032) 6.5.7. Russia 6.5.7.1. Russia Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.7.2. Russia Aniline Market Size and Forecast, By Application (2025-2032) 6.5.7.3. Russia Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.7.4. Russia Aniline Market Size and Forecast, By End-User (2025-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Aniline Market Size and Forecast, By Technology (2025-2032) 6.5.8.2. Rest of Europe Aniline Market Size and Forecast, By Application (2025-2032) 6.5.8.3. Rest of Europe Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 6.5.8.4. Rest of Europe Aniline Market Size and Forecast, By End-User (2025-2032) 7. Asia Pacific Aniline Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 7.1. Asia Pacific Aniline Market Size and Forecast, By Technology (2025-2032) 7.2. Asia Pacific Aniline Market Size and Forecast, By Application (2025-2032) 7.3. Asia Pacific Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.4. Asia Pacific Aniline Market Size and Forecast, By End-User (2025-2032) 7.5. Asia Pacific Aniline Market Size and Forecast, by Country (2025-2032) 7.5.1. China 7.5.1.1. China Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.1.2. China Aniline Market Size and Forecast, By Application (2025-2032) 7.5.1.3. China Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.1.4. China Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.2. S Korea 7.5.2.1. S Korea Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.2.2. S Korea Aniline Market Size and Forecast, By Application (2025-2032) 7.5.2.3. S Korea Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.2.4. S Korea Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.3. Japan 7.5.3.1. Japan Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.3.2. Japan Aniline Market Size and Forecast, By Application (2025-2032) 7.5.3.3. Japan Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.3.4. Japan Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.4. India 7.5.4.1. India Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.4.2. India Aniline Market Size and Forecast, By Application (2025-2032) 7.5.4.3. India Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.4.4. India Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.5. Australia 7.5.5.1. Australia Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.5.2. Australia Aniline Market Size and Forecast, By Application (2025-2032) 7.5.5.3. Australia Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.5.4. Australia Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.6.2. Indonesia Aniline Market Size and Forecast, By Application (2025-2032) 7.5.6.3. Indonesia Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.6.4. Indonesia Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.7.2. Malaysia Aniline Market Size and Forecast, By Application (2025-2032) 7.5.7.3. Malaysia Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.7.4. Malaysia Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.8. Philippines 7.5.8.1. Philippines Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.8.2. Philippines Aniline Market Size and Forecast, By Application (2025-2032) 7.5.8.3. Philippines Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.8.4. Philippines Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.9. Thailand 7.5.9.1. Thailand Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.9.2. Thailand Aniline Market Size and Forecast, By Application (2025-2032) 7.5.9.3. Thailand Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.9.4. Thailand Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.10.2. Vietnam Aniline Market Size and Forecast, By Application (2025-2032) 7.5.10.3. Vietnam Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.10.4. Vietnam Aniline Market Size and Forecast, By End-User (2025-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Aniline Market Size and Forecast, By Technology (2025-2032) 7.5.11.2. Rest of Asia Pacific Aniline Market Size and Forecast, By Application (2025-2032) 7.5.11.3. Rest of Asia Pacific Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 7.5.11.4. Rest of Asia Pacific Aniline Market Size and Forecast, By End-User (2025-2032) 8. Middle East and Africa Aniline Market Size and Forecast (by Value in USD Million) (2024-2032 8.1. Middle East and Africa Aniline Market Size and Forecast, By Technology (2025-2032) 8.2. Middle East and Africa Aniline Market Size and Forecast, By Application (2025-2032) 8.3. Middle East and Africa Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 8.4. Middle East and Africa Aniline Market Size and Forecast, By End-User (2025-2032) 8.5. Middle East and Africa Aniline Market Size and Forecast, by Country (2025-2032) 8.5.1. South Africa 8.5.1.1. South Africa Aniline Market Size and Forecast, By Technology (2025-2032) 8.5.1.2. South Africa Aniline Market Size and Forecast, By Application (2025-2032) 8.5.1.3. South Africa Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 8.5.1.4. South Africa Aniline Market Size and Forecast, By End-User (2025-2032) 8.5.2. GCC 8.5.2.1. GCC Aniline Market Size and Forecast, By Technology (2025-2032) 8.5.2.2. GCC Aniline Market Size and Forecast, By Application (2025-2032) 8.5.2.3. GCC Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 8.5.2.4. GCC Aniline Market Size and Forecast, By End-User (2025-2032) 8.5.3. Egypt 8.5.3.1. Egypt Aniline Market Size and Forecast, By Technology (2025-2032) 8.5.3.2. Egypt Aniline Market Size and Forecast, By Application (2025-2032) 8.5.3.3. Egypt Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 8.5.3.4. Egypt Aniline Market Size and Forecast, By End-User (2025-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Aniline Market Size and Forecast, By Technology (2025-2032) 8.5.4.2. Nigeria Aniline Market Size and Forecast, By Application (2025-2032) 8.5.4.3. Nigeria Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 8.5.4.4. Nigeria Aniline Market Size and Forecast, By End-User (2025-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Aniline Market Size and Forecast, By Technology (2025-2032) 8.5.5.2. Rest of ME&A Aniline Market Size and Forecast, By Application (2025-2032) 8.5.5.3. Rest of ME&A Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 8.5.5.4. Rest of ME&A Aniline Market Size and Forecast, By End-User (2025-2032) 9. South America Aniline Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 9.1. South America Aniline Market Size and Forecast, By Technology (2025-2032) 9.2. South America Aniline Market Size and Forecast, By Application (2025-2032) 9.3. South America Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 9.4. South America Aniline Market Size and Forecast, By End-User (2025-2032) 9.5. South America Aniline Market Size and Forecast, by Country (2025-2032) 9.5.1. Brazil 9.5.1.1. Brazil Aniline Market Size and Forecast, By Technology (2025-2032) 9.5.1.2. Brazil Aniline Market Size and Forecast, By Application (2025-2032) 9.5.1.3. Brazil Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 9.5.1.4. Brazil Aniline Market Size and Forecast, By End-User (2025-2032) 9.5.2. Argentina 9.5.2.1. Argentina Aniline Market Size and Forecast, By Technology (2025-2032) 9.5.2.2. Argentina Aniline Market Size and Forecast, By Application (2025-2032) 9.5.2.3. Argentina Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 9.5.2.4. Argentina Aniline Market Size and Forecast, By End-User (2025-2032) 9.5.3. Colombia 9.5.3.1. Colombia Aniline Market Size and Forecast, By Technology (2025-2032) 9.5.3.2. Colombia Aniline Market Size and Forecast, By Application (2025-2032) 9.5.3.3. Colombia Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 9.5.3.4. Colombia Aniline Market Size and Forecast, By End-User (2025-2032) 9.5.4. Chile 9.5.4.1. Chile Aniline Market Size and Forecast, By Technology (2025-2032) 9.5.4.2. Chile Aniline Market Size and Forecast, By Application (2025-2032) 9.5.4.3. Chile Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 9.5.4.4. Chile Aniline Market Size and Forecast, By End-User (2025-2032) 9.5.5. Rest of South America 9.5.5.1. Rest of South America Aniline Market Size and Forecast, By Technology (2025-2032) 9.5.5.2. Rest of South America Aniline Market Size and Forecast, By Application (2025-2032) 9.5.5.3. Rest of South America Aniline Market Size and Forecast, By Distribution Channel (2025-2032) 9.5.5.4. Rest of South America Aniline Market Size and Forecast, By End-User (2025-2032) 10. Company Profile: Key Players 10.1. PayPal Holdings, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Sinopec Nanjing Chemical Industries Co., Ltd - China, 10.3. Wanhua Chemical Group Co., Ltd – China 10.4. Jilin Connell Chemical Industry Co., Ltd - China, 10.5. Mitsui Chemicals, Inc - Japan, 10.6. SP Chemicals Holdings Ltd - China. 10.7. Hindustan Organic Chemicals Limited (HOCL) – India 10.8. Huntsman Corporation - USA. 10.9. Dow Chemical Company - USA. 10.10. Covestro AG – Germany 10.11. BASF SE – Germany 10.12. Versalis S.p.A. – Italy 10.13. INEOS Group Limited - London, 10.14. Brenntag SE – Germany 10.15. SABIC (Saudi Basic Industries Corporation) - Saudi Arabia 10.16. Sasol Limited - South Africa 10.17. Farabi Petrochemicals Group - Saudi Arabia 10.18. Braskem S.A. – Brazil 10.19. Unipar Carbocloro S/A - Brazil 10.20. Oxiteno - Brazil 10.21. Rhodia – Brazil 10.22. Nitro Química – Brazil 10.23. Oxiteno – Brazil 10.24. Allnex – Brazil 10.25. Jilin Connell Chemical Industry Co., Ltd. - China, 11. Key Findings 12. Industry Recommendations 13. Global Aniline Market: Research Methodology