Global Airport Surveillance Radar Market size was valued at USD 9.94 Bn in 2024 and total Airport Surveillance Radar Market revenue is expected to reach USD 18.47 Bn by 2032, at a CAGR of 8.05% over the forecast period.Airport Surveillance Radar Market Overview:

Airport surveillance radar refers to the systems used to detect, track and monitor the aircraft in and around the airports, including primary radar (transponder-independent) and secondary radar (transponder-neutral). The airport surveillance radar market has been increasing due to increasing air traffic, strict safety rules and modernization of aging systems. Primary radars dominate for reliability, while secondary radar (eg ADS-B) is growing rapidly for efficiency. North America Airport surveillance dominated the airport surveillance radar market in 2024, supported by FAA Mandates, major hub expansion (eg, LX, JFK) and Defence-Sector Investment in Advanced Radar Tech. The region's lead is reinforced by innovations such as AI-managed chaos filtering and space-based ADS-B integration. Meanwhile, the Asia-Pacific was the fastest-growing market by airport infrastructure projects in India and China. Leading companies such as Raytheon (US), Thales (France), and Indra (Spain) compete on accurate, automation and cyber security. Commercial airport (70% demand) modernization projects (eg, FAA's Nextgen) increase the airport surveillance radar market, while military airbase (25%) adopt dual use radar for defence-government synonyms. The airport surveillance radar industry is projected to proceed with trends such as hybrid radar system, drone detection and digital twin-able air traffic management.To know about the Research Methodology:-Request Free Sample Report

Airport Surveillance Radar Market Dynamics:

Air Traffic Growth to Boost the Airport Surveillance Radar Market

As air travel demand rises, airports seek to enhance their surveillance capabilities to ensure safe and efficient operations. Airport surveillance radar systems are important in monitoring aircraft movements within terminal airspace, providing essential data for air traffic controllers to manage traffic flow and prevent collisions. With the expansion of global aviation networks and the emergence of new airports, there's a heightened demand for advanced radar technologies that offer enhanced detection capabilities, improved reliability, and greater coverage. Factors such as modernization initiatives, regulatory mandates for airspace management, and the need to upgrade aging radar infrastructure contribute to market growth. Thus, the escalating air traffic necessitates investments in airport surveillance radar systems, driving the growth of the Airport Surveillance Radar market to meet the evolving demands of the aviation industry. The Airport Surveillance Radar market is experiencing a significant surge driven by the strong growth in air traffic, particularly in the domestic aviation sector of India. Despite facing challenges such as elevated aviation turbine fuel (ATF) prices and currency depreciation, the industry has witnessed a remarkable recovery in air passenger traffic, with cumulative domestic passenger numbers for the first eight months of the year 2024 surpassing pre-COVID levels by 5%. This growth trajectory reflects a year-on-year increase of 17%, indicating a strong resurgence in air travel demand. The surge in air traffic necessitates the modernization and expansion of airport infrastructure, including surveillance radar systems, to ensure safe and efficient operations. With airlines deploying higher capacities, albeit still below pre-COVID levels, there's a growing need for advanced radar systems to manage increased air traffic volume and maintain airspace safety. Therefore, the demand for Airport Surveillance Radar is rapidly growing.Strict Regulatory Challenges to Restrain the Airport Surveillance Radar Market

Strict regulatory challenges related to airport surveillance radar significantly impede Airport Surveillance Radar Market growth. Regulatory bodies impose stringent standards and guidelines to ensure the safety and efficiency of air traffic management, often requiring compliance with specific technical specifications and certification processes for radar systems. Meeting these requirements is time-consuming and costly for radar manufacturers and airport operators, leading to delays in system upgrades and installations. Regulatory changes or updates necessitate retrofitting existing radar infrastructure, further adding to the complexity and expense. Disparities in regulations across different regions or countries create compliance hurdles for multinational airports or radar suppliers, hindering Airport Surveillance Radar Market growth and interoperability. These regulatory challenges also discourage innovation and investment in next-generation radar technologies, as companies hesitate to introduce new products due to uncertainties regarding regulatory approval. To mitigate these limitations, collaboration between industry stakeholders and regulatory bodies is crucial to streamline certification processes, harmonize standards, and foster an environment conducive to innovation while ensuring compliance with safety and security requirements. Airport Surveillance Radar (ASR) is a critical component of air traffic control systems. Here are some related rules and regulations regarding surveillance radar systemsTechnological Advancements to Create Lucrative Growth Opportunities for the Airport Surveillance Radar Market growth

Technological advancements in Airport Surveillance Radar (ASR) offer lucrative growth opportunities by enhancing safety, efficiency, and integration within modern air traffic management systems. Innovations such as Automatic Dependent Surveillance-Broadcast (ADS-B) and Integrated Terminal Weather System (ITWS) improve situational awareness and decision-making, driving demand for ASR systems that seamlessly integrate these functionalities. The Radar Divestiture Program and the adoption of System Wide Information Management (SWIM) create avenues for ASR vendors to update legacy systems and facilitate data sharing, respectively. Also, advancements in Trajectory Operations (TBO) and 5G adoption enable predictive analytics and real-time data transfer, enhancing airspace management and operational efficiency. Integration of Artificial Intelligence (AI) supports air traffic controllers in analysis and decision-making, while Remote Tower Concepts reduce costs and centralize control. These advancements collectively drive the need for more advanced and integrated ASR solutions, presenting significant growth opportunities for vendors in the Airport Surveillance Radar market.Airport Surveillance Radar Market Segment Analysis:

Based on Product Type, Airport Surveillance Radar Market is segmented into Primary and Secondary Radar. Primary Radar segment dominated in 2024, accounting for 65% of the global market share due to its critical role in detecting and tracking aircraft independent of transponder signals, ensuring redundancy and safety in adverse conditions (e.g., transponder failures or non-cooperative aircraft). While Secondary Surveillance Radar (SSR) relies on transponder responses for ADS-B and Mode S data integration, Primary Radar remains indispensable for military, remote, and low-visibility operations, with growth driven by modernization programs in Asia-Pacific (30% of demand) and FAA/EU mandates for dual-system redundancy. Based on the Application, the Surface Movement Surveillance sub segment dominated the application segment of the Airport Surveillance Radar Market in the year 2024. Surface Movement Surveillance radar systems are crucial for monitoring aircraft and vehicle movements on airport runways, taxiways, and aprons. Safety on the ground is paramount in aviation, and these systems help prevent collisions, ensure efficient ground operations, and maintain overall airport safety. With the increasing emphasis on airport capacity and operational efficiency, there's a growing demand for advanced Surface Movement Surveillance systems equipped with features like multilateration and advanced data processing capabilities. These systems offer enhanced accuracy, coverage, and situational awareness, allowing airports to optimize their ground operations and maximize throughput. Regulatory bodies often impose strict requirements for surface movement surveillance to ensure compliance with safety standards, further driving the adoption of these radar systems.Airport Surveillance Radar Market: Regional Analysis

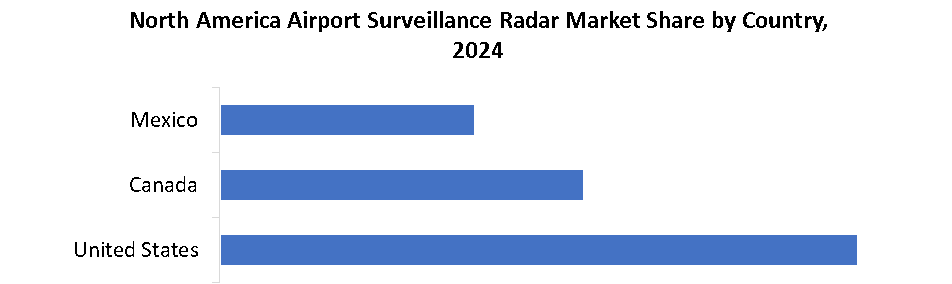

North America has historically dominated the Airport Surveillance Radar industry. The region is home to some of the world's busiest airports, including Hartsfield-Jackson Atlanta International Airport, Los Angeles International Airport, and Chicago O'Hare International Airport. The high volume of air traffic in North America necessitates robust surveillance radar systems to ensure safe and efficient operations. Stringent regulatory requirements imposed by the Federal Aviation Administration (FAA) drive the adoption of advanced ASR technologies in the region. The FAA continually updates and enhances regulations to improve airspace management and aviation safety, creating a consistent demand for innovative radar solutions. North America boasts a mature aerospace and defence industry with a strong focus on research and development. Major radar manufacturers such as Raytheon Technologies, Northrop Grumman, and Lockheed Martin are headquartered in the region, contributing to technological advancements and market leadership. The ongoing modernization initiatives, such as the FAA's NextGen program, aim to upgrade air traffic management infrastructure and implement cutting-edge surveillance technologies like Automatic Dependent Surveillance-Broadcast (ADS-B), further consolidating North America's dominance in the Airport Surveillance Radar market.

Airport Surveillance Radar Market Competitive Landscape:

Honeywell International Inc. holds 12% of the global airport surveillance radar market (2024), with revenue estimates $ 220 million, operated by its ASR-12 primary radar and smartpath ground-based growth system (GBAS In 2024, Honeywell secured a $50M FAA contract to modernize U.S. terminal-area radars, competing with Raytheon (18% share) and Thales (15%). However, its growth lags behind Indra Sistemas (14% CAGR) in Europe/Asia due to slower adoption of AI-integrated radar systems. In 2025, Honeywell launched RDR-7000, a dual-mode (Primary/Secondary) radar with 30% lower power consumption, targeting emerging markets like India (where BEL dominates 35% share). Despite strong FAA partnerships, Honeywell faces margin pressures from Chinese rivals (CETC) offering 40% cheaper systems, limiting its Asia-Pacific expansion beyond its core North American (40% of sales) and Middle Eastern (25%) markets. Strategic focus includes GBAS and drone-detection radars, projected to grow through 2025.Airport Surveillance Radar Market Key Trends:

AI & Machine Learning Integration: AI-powered radar systems are enhancing target classification and false-alarm reduction (e.g., Thales’ AI-based clutter filtering). Hybrid Primary-Secondary Radar Systems: Dual-mode radars (e.g., Honeywell’s RDR-7000) combine transponder-independent tracking (Primary) with ADS-B data (Secondary). Drone Detection & Counter-UAS Solutions: Radars now integrate RF sensors and LiDAR to detect rogue drones (e.g., Raytheon’s KRFS radar).Airport Surveillance Radar Market Key Developments:

Raytheon Technologies Corporation (US): May 2024: Launched the AN/SPY-6(V)3 Air Traffic Surveillance Radar, enhancing long-range detection (up to 250 nautical miles) for busy hubs like Dubai International. L3Harris Technologies (US) (formerly Harris Corporation): March 2025: Secured a $75M contract with the FAA to upgrade ASR-11 radars with AI-driven weather filtering, reducing false alarms by 35%. Thales Group (France): January 2025: Introduced Star NG, the world’s first fully digital secondary radar, offering 50% lower power consumption and compatibility with Space-Based ADS-B. HENSOLDT (Germany): October 2024: Deployed TRML-4D at Munich Airport, combining AESA radar tech with drone detection, achieving 95% threat identification accuracy. NEC Corporation (Japan): February 2025: Partnered with Japan’s Civil Aviation Bureau to trial AI-powered surface movement radars, cutting runway incursions by 40% in Tokyo Haneda.Airport Surveillance Radar Market scope : Inquire before buying

Global Airport Surveillance Radar Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.94 Bn. Forecast Period 2025 to 2032 CAGR: 8.05% Market Size in 2032: USD 18.47 Bn. Segments Covered: by Product Type Primary Radar Secondary Radar by Application Terminal Area Surveillance En-route Surveillance Surface Movement Surveillance Others Airport Surveillance Radar Market, by region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Airport Surveillance Radar Market, Key players

North America 1. Raytheon Technologies Corporation (US) 2. Harris Corporation (US) 3. Sierra Nevada Corporation (US) 4. Northrop Grumman Corporation (US) 5. Lockheed Martin Corporation (US) 6. Honeywell International Inc. (US) 7. L3Harris Technologies, Inc. (US) 8. Telephonics Corporation (US) 9. DeTect, Inc. (US) 10. Exelis Inc. (US) Europe 11. Thales Group (France) 12. HENSOLDT (Germany) 13. Leonardo S.p.A. (Italy) 14. Indra Sistemas (Spain) 15. Saab AB (Sweden) 16. BAE Systems plc (United Kingdom) 17. Terma A/S (Denmark) 18. Frequentis AG (Austria) 19. Cobham plc (United Kingdom) 20. ERA a.s. (Czech Republic) 21. COMSOFT GmbH (Germany) Asia Pacific 22. NEC Corporation (Japan) 23. China Electronics Technology Group (China) Middle East & Africa 24. Advanced Electronics Company (AEC) (Saudi Arabia)Frequently Asked Questions

1] What segments are covered in the Global Airport Surveillance Radar Market report? Ans. The segments covered in the Airport Surveillance Radar Market report are based on Product Type, Application, and Regions. 2] Which region is expected to hold the highest share of the Global Airport Surveillance Radar Market? Ans. The North America region is expected to hold the highest share of the Airport Surveillance Radar Market. 3] What is the market size of the Global Airport Surveillance Radar Market by 2032? Ans. The market size of the Airport Surveillance Radar Market by 2032 is expected to reach US$ 18.47 Bn. 4] What was the market size of the Global Airport Surveillance Radar Market in 2023? Ans. The market size of the Airport Surveillance Radar Market in 2024 was valued at US$ 9.94 Bn. 5] Key players in the Airport Surveillance Radar Market. Ans. Raytheon Technologies Corporation (United States), Harris Corporation (United States), Northrop Grumman Corporation (United States), Lockheed Martin Corporation (United States) and Honeywell International Inc. (United States)

1. Airport Surveillance Radar Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Airport Surveillance Radar Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Airport Surveillance Radar Market: Dynamics 3.1. Airport Surveillance Radar Market Trends 3.1.1. North America Airport Surveillance Radar Market Trends 3.1.2. Europe Airport Surveillance Radar Market Trends 3.1.3. Asia Pacific Airport Surveillance Radar Market Trends 3.1.4. Middle East and Africa Airport Surveillance Radar Market Trends 3.1.5. South America Airport Surveillance Radar Market Trends 3.2. Airport Surveillance Radar Market Dynamics 3.2.1. Airport Surveillance Radar Market Drivers 3.2.1.1. Air Traffic Growth 3.2.2. Airport Surveillance Radar Market Restraints 3.2.3. Airport Surveillance Radar Market Opportunities 3.2.3.1. Technological Advancements 3.2.4. Airport Surveillance Radar Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.4.1. Noise Pollution Laws 3.4.2. Drone Threats 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Airport Surveillance Radar Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Primary Radar 4.1.2. Secondary Radar 4.2. Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 4.2.1. Terminal Area Surveillance 4.2.2. En-route Surveillance 4.2.3. Surface Movement Surveillance 4.2.4. Others 4.3. Airport Surveillance Radar Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Airport Surveillance Radar Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Primary Radar 5.1.2. Secondary Radar 5.2. North America Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 5.2.1. Terminal Area Surveillance 5.2.2. En-route Surveillance 5.2.3. Surface Movement Surveillance 5.2.4. Others 5.3. North America Airport Surveillance Radar Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 5.3.1.1.1. Primary Radar 5.3.1.1.2. Secondary Radar 5.3.1.2. United States Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 5.3.1.2.1. Terminal Area Surveillance 5.3.1.2.2. En-route Surveillance 5.3.1.2.3. Surface Movement Surveillance 5.3.1.2.4. Others 5.3.2. Canada 5.3.2.1. Canada Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 5.3.2.1.1. Primary Radar 5.3.2.1.2. Secondary Radar 5.3.2.2. Canada Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 5.3.2.2.1. Terminal Area Surveillance 5.3.2.2.2. En-route Surveillance 5.3.2.2.3. Surface Movement Surveillance 5.3.2.2.4. Others 5.3.3. Mexico 5.3.3.1. Mexico Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 5.3.3.1.1. Primary Radar 5.3.3.1.2. Secondary Radar 5.3.3.2. Mexico Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 5.3.3.2.1. Terminal Area Surveillance 5.3.3.2.2. En-route Surveillance 5.3.3.2.3. Surface Movement Surveillance 5.3.3.2.4. Others 6. Europe Airport Surveillance Radar Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.3. Europe Airport Surveillance Radar Market Size and Forecast, By Distribution Channel (2024-2032) 6.4. Europe Airport Surveillance Radar Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.1.2. United Kingdom Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.2.2. France Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.3.2. Germany Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.4.2. Italy Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.5.2. Spain Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.6.2. Sweden Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.7.2. Russia Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 6.4.8.2. Rest of Europe Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Airport Surveillance Radar Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Airport Surveillance Radar Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.1.2. China Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.2.2. S Korea Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.3.2. Japan Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.4. India 7.3.4.1. India Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.4.2. India Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.5.2. Australia Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.6.2. Indonesia Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.7.2. Malaysia Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.8. Philippines 7.3.8.1. Philippines Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.8.2. Philippines Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.9. Thailand 7.3.9.1. Thailand Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.9.2. Thailand Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.10. Vietnam 7.3.10.1. Vietnam Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.10.2. Vietnam Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Airport Surveillance Radar Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Airport Surveillance Radar Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 8.3.1.2. South Africa Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 8.3.2.2. GCC Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 8.3.3. Egypt 8.3.3.1. Egypt Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 8.3.3.2. Egypt Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 8.3.4. Nigeria 8.3.4.1. Nigeria Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 8.3.4.2. Nigeria Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 8.3.5. Rest of ME&A 8.3.5.1. Rest of ME&A Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 8.3.5.2. Rest of ME&A Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 9. South America Airport Surveillance Radar Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 9.3. South America Airport Surveillance Radar Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 9.3.1.2. Brazil Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 9.3.2.2. Argentina Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 9.3.3.2. Colombia Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 9.3.4. Chile 9.3.4.1. Chile Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 9.3.4.2. Chile Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 9.3.5. Rest Of South America 9.3.5.1. Rest Of South America Airport Surveillance Radar Market Size and Forecast, By Product Type (2024-2032) 9.3.5.2. Rest Of South America Airport Surveillance Radar Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. Raytheon Technologies Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Harris Corporation 10.3. Sierra Nevada Corporation 10.4. Northrop Grumman Corporation 10.5. Lockheed Martin Corporation 10.6. Honeywell International Inc. 10.7. L3Harris Technologies, Inc. 10.8. Telephonics Corporation 10.9. DeTect, Inc. 10.10. Exelis Inc. 10.11. Thales Group 10.12. HENSOLDT 10.13. Leonardo S.p.A. 10.14. Indra Sistemas 10.15. Saab AB 10.16. BAE Systems plc 10.17. Terma A/S 10.18. Frequentis AG 10.19. Cobham plc 10.20. ERA a.s. 10.21. COMSOFT GmbH 10.22. NEC Corporation 10.23. China Electronics Technology Group 10.24. Advanced Electronics Company (AEC) 11. Key Findings 12. Industry Recommendations 13. Airport Surveillance Radar Market: Research Methodology