Global Gasoline Direct Injection (GDI) System Market size was valued at USD 9.9 Bn in 2022 and is expected to reach USD 19.91 Bn by 2029, at a CAGR of 10.5 %.Gasoline Direct Injection (GDI) System Market Overview

Gasoline Direct Injection (GDI) engines have been offering an optimum combination. Optimizing and controlling vehicle performance at the accurate cost point needs a broad range of semiconductor solutions that are particularly designed to ensure compliance with emissions regulations. GDI systems deliver better fuel control and atomization, leading to more efficient combustion, which resulted in improved fuel economy compared to traditional fuel injection systems. The advancements in GDI technology, consumer demand for performance and efficiency and growing adoption of OEM are the driving factors for the market growth. The report includes a comprehensive analysis of the Gasoline Direct Injection (GDI) System market's trends, forecasts and monetary values. The market report focuses on the drivers, challenges and major restraints of the Gasoline Direct Injection (GDI) System industry. The qualitative and quantitative approaches are included in the report for the analysis of market data. The bottom-up approach was used for the Gasoline Direct Injection (GDI) System market size estimation.Gasoline Direct Injection (GDI) System Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Gasoline Direct Injection (GDI) System Market Dynamics

Drivers Fuel Efficiency and Performance of Gasoline Direct Injection (GDI) System to Boost the Market Growth With increasing concerns about fuel costs and environmental sustainability, consumers are growingly seeking vehicles that provide better fuel efficiency. GDI systems have the ability to deliver precise fuel injections directly into the combustion chamber, leading to improved fuel atomization and combustion efficiency. This resulted in better fuel economy compared with traditional port fuel injection systems. As consumers give preference to fuel-efficient vehicles, the demand for GDI-equipped cars increases, which boosts the Gasoline Direct Injection (GDI) System market. Stringent emission regulations established by governments need automakers to minimize vehicle emissions substantially. GDI systems are effective in achieving lower emissions due to they enhance the combustion process, reducing the formation of pollutants including nitrogen oxides (NOx) and particulate matter. To meet these emission standards, automakers are adopting GDI systems, making them a required component in achieving compliance and avoiding penalties. GDI systems improve fuel efficiency and enhance engine performance. By providing fuel directly into the combustion chamber, GDI enables more precise control of the air-fuel mixture, leading to better combustion and power output. This resulted in improved responsiveness, acceleration and overall driving experience, which are valued by consumers. As car buyers prioritize fuel efficiency as well as performance, GDI-equipped vehicles become more prevalent in the market. The automotive industry has been trending towards integrating turbocharging to meet higher fuel efficiency without compromising performance. GDI systems work particularly well in association with these trends as they allow for higher compression ratios and improved combustion in smaller engines. As automakers downsize engines to meet fuel economy targets, GDI systems become increasingly more relevant.Growing Automotive Industry to Drive the Gasoline Direct Injection (GDI) System Market Growth

With the increasing expansion of the automotive industry, there is a higher demand for automotive components such as GDI systems. As more vehicles are being produced, the requirement for advanced and efficient fuel injection technologies such as GDI increases proportionally. As the automotive industry evolves, there is a continuous bear for innovation and technological advancements. GDI systems have more efficient methods of offering fuel to the engine, delivering better fuel economy and improved performance. As automakers focus to gear their vehicles with the latest technologies to meet consumer demands, GDI systems become an essential feature in modern vehicles. Consumers are becoming more conscious of fuel efficiency and environmental impact when choosing vehicles. GDI systems provide both improved fuel efficiency and enhanced engine performance, making them attractive to consumers. Automakers respond to consumer preferences by adopting GDI technology in their vehicle models, driving the market growth. Downsizing engines and incorporating turbocharging have become trends in the automotive industry to improve fuel efficiency while maintaining performance. GDI systems are well-suited for these applications, making them a preferred choice for automakers as they develop new models. Original Equipment Manufacturers (OEMs) are driving the adoption of GDI systems which boost the Gasoline Direct Injection (GDI) System Market growth. As major automakers incorporate GDI technology into their vehicle models, it becomes a standard feature that boosts market growth. Continuous research and development efforts in GDI system technology have led to improved performance, cost-effectiveness and reliability. These advancements promotes automakers to adopt GDI systems in their vehicles, making them an extended feature in the market. Gasoline Direct Injection (GDI) System Market Trend Stricter emission regulations Governments and environmental agencies have been encouraging stricter emission standards in the automotive industry to minimize harmful pollutants including carbon dioxide (CO2), nitrogen oxides (NOx) and particulate matter (PM). GDI systems provide improved fuel efficiency and better control over combustion, which supports vehicles meet these stringent emission norms more effectively. With growing environmental awareness among consumers, there is an increasing demand for vehicles that have lower carbon footprints and produce fewer emissions. GDI systems reduce emissions, making them a preferable option for automakers looking to deliver greener alternatives. Many countries and regions have implemented Corporate Average Fuel Economy (CAFE) regulations that authorize automakers to meet specific fuel efficiency targets across their fleet. GDI systems enhance fuel efficiency and meet these standards. Governments have offered incentives or subsidies to enforce the adoption of cleaner and more fuel-efficient technologies such as GDI systems. These incentives have been fuelling Gasoline Direct Injection (GDI) System Market. GDI systems have improved over time, becoming more efficient as well as cost-effective. As technology advances, the implementation of GDI systems in vehicles becomes a more attractive option for automakers to meet emission standards. International agreements such as the Paris Agreement focus to limit global warming and promote countries to take action to minimize greenhouse gas emissions. Stricter emission regulations align with these global efforts and encourage the adoption of cleaner technologies including the Gasoline Direct Injection (GDI) System. Gasoline Direct Injection (GDI) System Market restraints High Manufacturing Costs to restrain the Market growth The increased manufacturing costs of GDI systems have been translating into higher prices for vehicles equipped with this technology. As a result, consumers have found GDI-equipped vehicles relatively more expensive compared to vehicles with traditional fuel injection systems. This price difference has been impeding some potential buyers from selecting GDI-equipped vehicles, particularly in price-sensitive markets. When manufacturing costs are higher for GDI systems, automakers have found it demanding to provide GDI-equipped vehicles at prices that are competitive with substitute powertrain options including conventional internal combustion engines. The high manufacturing costs of GDI systems have limited their adoption in several vehicle regions or segments, which hamper Gasoline Direct Injection (GDI) System Market.Gasoline Direct Injection (GDI) System Market Segment Analysis

Based on component, the market is segmented into Fuel Injectors, Fuel Pumps, Electronic Control Units (ECUs) and others. Electronic Control Units (ECUs) dominated the largest Gasoline Direct Injection (GDI) System Market share in 2022. ECUs act as the central brain of the Gasoline Direct Injection (GDI) system. They collect data from several sensors including throttle position, air temperature, engine speed and oxygen levels, to accurately calculate the optimal fuel injection duration and timing. This level of control allows for superior fuel efficiency and engine performance. Gasoline Direct Injection (GDI) System systems provide fuel directly into the combustion chamber at high pressure, leading to efficient fuel atomization and combustion. The ECU's control ensures that the right amount of fuel is injected at the right time, which leads to improved minimized emissions and fuel efficiency. ECUs are programmable units, which means they have been reprogrammed to accommodate various engine configurations. This flexibility makes GDI systems more compatible and versatile with different vehicle models and engine sizes. ECUs in GDI systems have been communicating and integrating with other vehicle systems including the exhaust, transmission and emissions control systems. This integration optimizes overall vehicle performance and enables coordinated operations. In recent years, there have been significant advancements in ECU technology, making them more efficient and cost-effective. These developments have resulted to increase in the adoption of GDI systems in modern vehicles, which drive the Gasoline Direct Injection (GDI) System Market growth. In the car, ECUs are used as engine or power steering control, for comfort features such as window or seat adjustments. For instance, the airbag ECU. In the event of a crash, this ECU receives input data, detects if someone occupies a particular seat, and communicates with the actuators to deploy the appropriate airbag.Global Gasoline Direct Injection (GDI) System Market Share, By Component in 2022 (%)

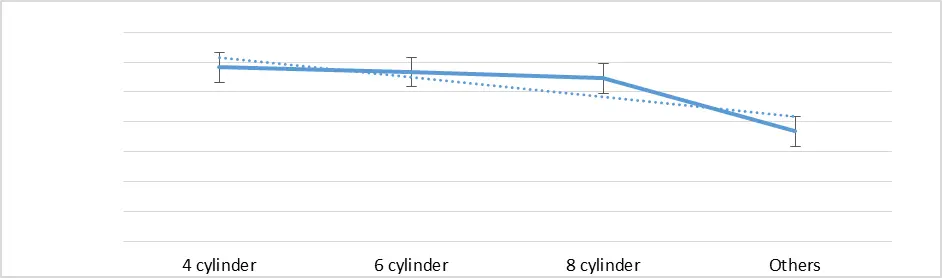

Based Engine Type, the market is categorized into 4 cylinder, 6 cylinder, 8 cylinder and others. 4 cylinder segment dominated the market in the year 2022 is expected to have the highest CAGR for the Gasoline Direct Injection (GDI) System Market during the forecast period. 4-cylinder engines are utilized in passenger cars, which make up a substantial portion of the automotive market. GDI technology has better fuel efficiency and performance benefits and since it has been adopted in passenger cars. As compared to larger engine configurations, 4-cylinder engines are more fuel-efficient. GDI technology complements this efficiency by delivering enhanced control over fuel delivery, resulting in improved mileage and minimized emissions. The 4-cylinder engines are smaller engines that produce fewer emissions rather than larger engines, particularly in the gasoline direct injection systems context. Gasoline Direct Injection (GDI) technology allows for more numerous control over the fuel injection process, resulting in more efficient combustion. Building 4-cylinder engines has low costly for manufacturers compared with larger engines with more cylinders. This cost-efficient has been passed on to consumers, which makes vehicles equipped with 4-cylinder GDI engines more cost-effective. 4-cylinder engines are an effective choice for compact cars as they push a balance between size and performance. Advancements in turbocharging, engine technology and direct injection have significantly improved the performance of 4-cylinder engines. The advanced 4-cylinder GDI engines have been providing respectable power and acceleration to make them more engaging to a broader range of consumers.

Global Gasoline Direct Injection (GDI) System Market Share, By Engine Type in 2022 (%)

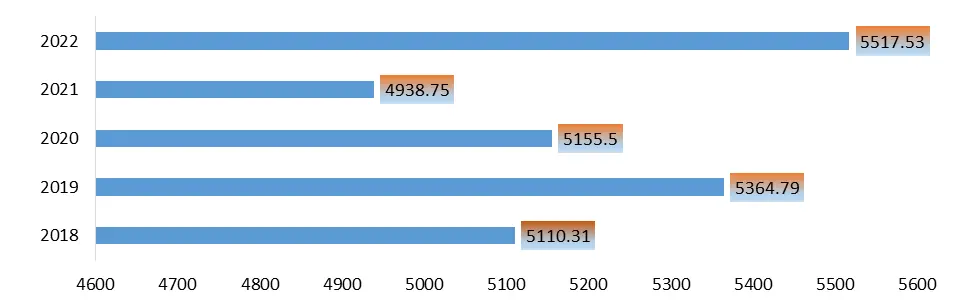

Gasoline Direct Injection (GDI) System Competitive Landscape The report offers Competitive benchmarking of the Gasoline Direct Injection (GDI) System industry through Gasoline Direct Injection (GDI) System Market revenue, share and size of the key players. The report provides such type of competitive landscape of all Gasoline Direct Injection (GDI) System Key Players to assist new market entrants. It also gives information about the analysis of the Competitive Landscape in the Gasoline Direct Injection (GDI) System industry structure, highlighting the key players and their strategies. Some of the key players are Delphi (United Kingdom), Park-Ohio (US), Bosch (Germany), Stanadyne (US), Hitachi (Japan), Schaeffler (Germany), Infineon (Germany), Denso (Japan), Valeo (France), Keihin (Japan), Continental (Germany), Renesas (Japan), Magneti Marelli (Italy), MSR-Jebsen Technologies (Hong Kong), Eaton Corporation (Ireland), a Hyundai Transys (South Korea) and others. Many of the key players conducted research and development activities to enhance their product portfolio. For instance, Stanadyne (US): In 2022, the company unveils a new hydrogen fuel injector: This fuel injector for medium-duty and heavy-duty commercial vehicle powertrains. The company has developed a multipurpose port injector for providing compressed natural gas, hydrogen and dimethyl ether (DME) fuels. This developed hydrogen fuel injector has been increasing the demand for the Gasoline Direct Injection (GDI) System which help to enhance the company's product portfolio. In addition, In 2022, the Solid Oxide Fuel Cells, have a vital role in Cutting CO2 Emissions and this help to increase the production of the Gasoline Direct Injection (GDI) System which helps to minimize environmental pollution.Denso's global revenue from 2018-2022 (in Billion Japanese Yen)

Gasoline Direct Injection (GDI) System Market Regional Insights

Asia Pacific held the largest Gasoline Direct Injection (GDI) System Market share of 43% in the year 2022 and is expected to dominate the market in the forecast period. The rising middle-class population in developing economies including China and India has increased disposable income, resulting in growth in vehicle ownership rates. The demand for GDI-equipped vehicles has increased as consumers become more conscious of environmental impact and fuel efficiency. Many countries have implemented stricter emissions regulations to conflict air pollution and reduce greenhouse gas emissions. Gasoline Direct Injection systems provide exceptional combustion efficiency, resulting in lower CO2 emissions and improved environmental performance. There has been an increase in demand for automobiles with rapid economic growth and urbanization. Consumers are growingly seeking vehicles that deliver better fuel efficiency and lower operating costs, making GDI-equipped cars a preferable choice due to their capability to improve fuel economy. Advancements in GDI technology increase their reliability, efficiency and cost-effectiveness. Manufacturers in the Asia-Pacific region have been incorporating these advancements into their vehicle models, engaging consumers who compute performance and fuel efficiency.Automotive Component Market Size In India From 2018-2022 (in USD Bn)

Governments of Asia Pacific have provided incentives and support to encourage the adoption of cleaner as well as more fuel-efficient vehicles. These incentives include subsidies, tax benefits and minimized registration fees for GDI-equipped cars, promoting consumers to select such vehicles. Environmental concerns and awareness regarding air pollution and climate change have been on the increase in the region. This has resulted in a shift in consumption including the availability of better-quality gasoline and fuel distribution networks, which have contributed to the Gasoline Direct Injection (GDI) System industry growth. GDI systems need a high-pressure fuel delivery system to inject fuel directly into the combustion chamber. The advancements in high-pressure fuel pump technology components have been improving system efficiency and minimized emissions. As a result, the automotive component market has a significant effect on the Market. For Instance, consider the Automotive Component Market in India.

Gasoline Direct Injection (GDI) System Market Scope: Inquire Before Buying

Gasoline Direct Injection (GDI) System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 9.9 Bn. Forecast Period 2023 to 2029 CAGR: 10.5 % Market Size in 2029: US $ 19.91 Bn. Segments Covered: by Component Fuel Injectors Fuel Pumps Electronic Control Units Others by Engine Type 4 cylinder 6 cylinder 8 cylinder Others by Vehicle Type Passenger Cars Commercial Vehicles by Sales Channel Original Equipment Manufacturer Aftermarket Gasoline Direct Injection (GDI) System Market , by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)Gasoline Direct Injection (GDI) System Market Key Players are:

1. Delphi 2. Park-Ohio 3. Bosch 4. Stanadyne 5. Hitachi 6. Schaeffler 7. Infineon 8. Denso 9. Valeo 10. Keihin 11. Continental 12. Renesas 13. Magneti Marelli 14. MSR-Jebsen Technologies 15. Eaton Corporation 16. Mitsubishi Electric Corp. 17. Bajaj Auto Ltd 18. Nostrum Energy (US) 19. Westport (Canada) Hi-Vol (US).https://www.bosch.com/ 20. Volkswagen (Germany) 21. Ford Motor Company (US) 22. Hyundai Motor Company (South Korea) 23. Toyota Motor Corporation (Japan) 24. Tata Motors (India) 25. Mahindra & Mahindra Ltd (India)Frequently Asked Questions:

1] What is the growth rate of the Global Market? Ans. The Global Market is growing at a significant rate of 10.5 % during the forecast period. 2] Which region is expected to dominate the Global Market? Ans. Asia Pacific is expected to dominate the Gasoline Direct Injection (GDI) System Market during the forecast period. 3] What is the expected Global Gasoline Direct Injection (GDI) System Market size by 2029? Ans. The Gasoline Direct Injection (GDI) System Market size is expected to reach USD 19.91 Bn by 2029. 4] Which are the top players in the Global Gasoline Direct Injection (GDI) System Market? Ans. The major top players in the Global Gasoline Direct Injection (GDI) System Market are Delphi (United Kingdom), Park-Ohio (US), Bosch (Germany), Stanadyne (US), Hitachi (Japan), Schaeffler (Germany), Infineon (Germany), Denso (Japan), Valeo (France), Keihin (Japan), Continental (Germany), Renesas (Japan), Magneti Marelli (Italy), MSR-Jebsen Technologies (Hong Kong), Eaton Corporation (Ireland), a Hyundai Transys (South Korea) and Others. 5] What are the factors driving the Global Gasoline Direct Injection (GDI) System Market growth? Ans. The fuel efficiency and performance of Gasoline Direct Injection (GDI) Systems and growth in the automotive industry are expected to drive market growth during the forecast period.

1. Gasoline Direct Injection (GDI) System Market: Research Methodology 2. Gasoline Direct Injection (GDI) System Market: Executive Summary 3. Gasoline Direct Injection (GDI) System Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Gasoline Direct Injection (GDI) System Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Gasoline Direct Injection (GDI) System Market Size and Forecast by Segments (by Value USD and Volume Units ) 5.1. Gasoline Direct Injection (GDI) System Market Size and Forecast, by Component (2022-2029) 5.1.1. Electronic Control Units(ECUs) 5.1.2. Fuel Injectors 5.1.3. Fuel Pumps 5.1.4. Others 5.2. Gasoline Direct Injection (GDI) System Market Size and Forecast, by Engine Type (2022-2029) 5.2.1. 4 cylinder 5.2.2. 6 cylinder 5.2.3. 8 cylinder 5.2.4. Others 5.3. Gasoline Direct Injection (GDI) System Market Size and Forecast, by Vehicle (2022-2029) 5.3.1. Passenger Cars 5.3.2. Light Commercial Vehicles(LCVs) 5.4. Gasoline Direct Injection (GDI) System Market Size and Forecast, by Sales Channel (2022-2029) 5.4.1. OEM (Original Equipment Manufacturer) 5.4.2. Aftermarket 5.5. Gasoline Direct Injection (GDI) System Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Gasoline Direct Injection (GDI) System Market Size and Forecast by Segments (by Value USD and Volume Units ) 6.1. North America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Component (2022-2029) 6.1.1. Electronic Control Units(ECUs) 6.1.2. Fuel Injectors 6.1.3. Fuel Pumps 6.1.4. Others 6.2. North America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Engine Type (2022-2029) 6.2.1. 4 cylinder 6.2.2. 6 cylinder 6.2.3. 8 cylinder 6.2.4. Others 6.3. North America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Vehicle (2022-2029) 6.3.1. Passenger Cars 6.3.2. Light Commercial Vehicles(LCVs) 6.4. North America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Sales Channel (2022-2029) 6.4.1. OEM (Original Equipment Manufacturer) 6.4.2. Aftermarket 6.5. North America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Gasoline Direct Injection (GDI) System Market Size and Forecast by Segments (by Value USD and Volume Units ) 7.1. Europe Gasoline Direct Injection (GDI) System Market Size and Forecast, by Component (2022-2029) 7.1.1. Electronic Control Units(ECUs) 7.1.2. Fuel Injectors 7.1.3. Fuel Pumps 7.1.4. Others 7.2. Europe Gasoline Direct Injection (GDI) System Market Size and Forecast, by Engine Type (2022-2029) 7.2.1. 4 cylinder 7.2.2. 6 cylinder 7.2.3. 8 cylinder 7.2.4. Others 7.3. Europe Gasoline Direct Injection (GDI) System Market Size and Forecast, by Vehicle (2022-2029) 7.3.1. Passenger Cars 7.3.2. Light Commercial Vehicles(LCVs) 7.4. Europe Gasoline Direct Injection (GDI) System Market Size and Forecast, by Sales Channel (2022-2029) 7.4.1. OEM (Original Equipment Manufacturer) 7.4.2. Aftermarket 7.5. Europe Gasoline Direct Injection (GDI) System Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Gasoline Direct Injection (GDI) System Market Size and Forecast by Segments (by Value USD and Volume Units ) 8.1. Asia Pacific Gasoline Direct Injection (GDI) System Market Size and Forecast, by Component (2022-2029) 8.1.1. Electronic Control Units(ECUs) 8.1.2. Fuel Injectors 8.1.3. Fuel Pumps 8.1.4. Others 8.2. Asia Pacific Gasoline Direct Injection (GDI) System Market Size and Forecast, by Engine Type (2022-2029) 8.2.1. 4 cylinder 8.2.2. 6 cylinder 8.2.3. 8 cylinder 8.2.4. Others 8.3. Asia Pacific Gasoline Direct Injection (GDI) System Market Size and Forecast, by Vehicle (2022-2029) 8.3.1. Passenger Cars 8.3.2. Light Commercial Vehicles(LCVs) 8.4. Asia Pacific Gasoline Direct Injection (GDI) System Market Size and Forecast, by Sales Channel (2022-2029) 8.4.1. OEM (Original Equipment Manufacturer) 8.4.2. Aftermarket 8.5. Asia Pacific Gasoline Direct Injection (GDI) System Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Gasoline Direct Injection (GDI) System Market Size and Forecast by Segments (by Value USD and Volume Units ) 9.1. Middle East and Africa Gasoline Direct Injection (GDI) System Market Size and Forecast, by Component (2022-2029) 9.1.1. Electronic Control Units(ECUs) 9.1.2. Fuel Injectors 9.1.3. Fuel Pumps 9.1.4. Others 9.2. Middle East and Africa Gasoline Direct Injection (GDI) System Market Size and Forecast, by Engine Type (2022-2029) 9.2.1. 4 cylinder 9.2.2. 6 cylinder 9.2.3. 8 cylinder 9.2.4. Others 9.3. Middle East and Africa Gasoline Direct Injection (GDI) System Market Size and Forecast, by Vehicle (2022-2029) 9.3.1. Passenger Cars 9.3.2. Light Commercial Vehicles(LCVs) 9.4. Middle East and Africa Gasoline Direct Injection (GDI) System Market Size and Forecast, by Sales Channel (2022-2029) 9.4.1. OEM (Original Equipment Manufacturer) 9.4.2. Aftermarket 9.5. Middle East and Africa Gasoline Direct Injection (GDI) System Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Gasoline Direct Injection (GDI) System Market Size and Forecast by Segments (by Value USD and Volume Units ) 10.1. South America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Component (2022-2029) 10.1.1. Electronic Control Units(ECUs) 10.1.2. Fuel Injectors 10.1.3. Fuel Pumps 10.1.4. Others 10.2. South America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Engine Type (2022-2029) 10.2.1. 4 cylinder 10.2.2. 6 cylinder 10.2.3. 8 cylinder 10.2.4. Others 10.3. South America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Vehicle (2022-2029) 10.3.1. Passenger Cars 10.3.2. Light Commercial Vehicles(LCVs) 10.4. South America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Sales Channel (2022-2029) 10.4.1. OEM (Original Equipment Manufacturer) 10.4.2. Aftermarket 10.5. South America Gasoline Direct Injection (GDI) System Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Av Concepts, Inc(US) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Delphi (United Kingdom) 11.3. Park-Ohio (US) 11.4. Bosch (Germany) 11.5. Stanadyne (US) 11.6. Hitachi (Japan) 11.7. Schaeffler (Germany) 11.8. Infineon (Germany) 11.9. Denso (Japan) 11.10. Valeo (France) 11.11. Keihin (Japan) 11.12. Continental (Germany) 11.13. Renesas (Japan)