The Frozen Yogurt Market size was valued at USD 1.89 Billion in 2024 and the total Frozen Yogurt revenue is expected to grow at a CAGR of 4.1% from 2025 to 2032, reaching nearly USD 2.61 Billion.Frozen Yogurt Market Overview:

The frozen yogurt sector is a sought-after dessert delight in its own right, with a diverse range of tastes and experiences. A recent survey by Maximize found that almost 85% of Americans prefer frozen yogurt to ice cream, gelato, and other popular frozen desserts. For the past year, the business has been growing, thanks to increased consumer demand for healthier desserts and creative product offerings. While the many chains that have grown to take advantage of strong demand are now beginning to consolidate, there are still plenty of prospects for the entrepreneur.To know about the Research Methodology:- Request Free Sample Report

Frozen Yogurt Market Dynamics:

Consumers' increased health consciousness, rising demand for low-fat, low-sugar desserts such as frozen yoghurt, and the growing need for a substitute to unhealthy desserts, since frozen yoghurts meet both of these needs, are the key reasons driving the frozen yoghurt market. The frozen yoghurt industry is growing due to rising sales of frozen yoghurt, particularly through online channels, where online shops offer a broad range of frozen yoghurt, online stores offer lucrative discounts or coupons, and children's need for a refreshing ice-cream alternative. The frozen yoghurt market is influenced by children's inclination for chilled treats during the summer months, increased penetration of organized players, and rising demand for non-dairy items manufactured from almond milk and soymilk. Also, a young adult female is a typical customer. Consumers aged 18-35 account for about 42 percent of sales, while those over 51 account for only 7.5 percent. According to some estimations, women account for more than 70% of the industry's revenue. Also, in the forecast period of 2025 to 2032, the launch of a growing range of frozen yoghurts expands the profitable potential for frozen yoghurt market participants. In addition, there has been a significant trend toward self-service options. During the current market boom, this model has dominated, with self-service outlets accounting for 69 percent of all locations. Additionally, the launch of vegan frozen yoghurt in a variety of flavors, as well as the use of natural tastes, is expected to provide substantial revenue prospects for companies in the market. For example, Yogurtland is thrilled to announce the expansion of its brand with the launch of a new fast-casual concept, Holsom by Yogurtland. On the other hand, the increasing number of alternatives for frozen yogurt is the main factor that may act as an obstacle to the growth of the frozen yogurt market. Also, Consumers prefer a product that is expected to have good taste and low content of sugar and fat present in it at the same time is the main challenge for the frozen yogurt market.COVID-19 Impact- Frozen Yogurt Market:

The market's fall has been aided by market closures, a rise and fall in demand for certain goods and beverages, and market closures. The food services sector, as well as other food industries including bakery, beverage offerings, and dairy, has seen a considerable drop in revenue. Revenue creation in the food services sector, as well as other food businesses such as bread, beverage servings, and dairy, has declined dramatically since January , resulting in decreasing frozen yogurt sales. For example, due to the current pandemic situation, Menchie's announced to close all of their Northeast Ohio and Erie, PA locations permanently. For the same reason, the government is increasing its funding in flavor R&D that is focused on an audience. In addition, major market players are developing strategies with a variety of favorable characteristics that will aid the frozen yogurt market's expansion over the forecast period (2025-2032).Frozen Yogurt Market Segment Analysis:

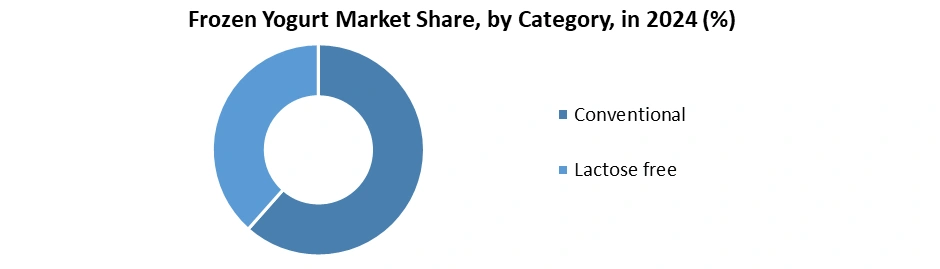

Based on Product Type, The dairy-based frozen yogurt segment continues to dominate the global market, contributing to over xx% of global revenue in 2024. This category remains popular due to its creamy texture, higher protein levels, and familiarity among traditional yogurt consumers. Major manufacturers such as General Mills, Amul, and Nestlé continue to expand dairy-based SKUs with indulgent flavors and probiotic-rich formulations. With the Frozen Yogurt Market valued at USD xx Billion in 2024, dairy-based products account for nearly USD xx Billion, and the segment is projected to maintain strong demand through 2032 as premium dairy formulations grow across North America, Europe, and APAC. The non-dairy frozen yogurt category has rapidly gained traction, supported by rising veganism and lactose-intolerance prevalence. In 2024, non-dairy variants held xx% share, representing approx. USD xx Million, driven by innovations in almond-, coconut-, and oat-based formulations. Soy remains a niche but steady contributor, while oat-based frozen yogurt is growing fastest due to its clean-label perception and neutral flavor base. By 2032, non-dairy formats are expected to capture a significantly higher share as plant-based preferences strengthen across younger urban consumers in the US, Europe, and selective Asian markets.Based on Category, The market is categorized into Conventional and Lactose-Free frozen yogurt offerings. Conventional frozen yogurt remains the largest segment, contributing nearly xxx % of global consumption in 2024, supported by strong brand familiarity and lower pricing. However, the Lactose-Free category is gaining substantial momentum, representing around xxx % of the market, fueled by the increasing prevalence of lactose intolerance (affecting nearly xxx % of the global population) and consumer preference for gut-friendly, easier-to-digest frozen desserts. The expansion of lactose-free dairy inputs and broader retail availability is further driving adoption across North America, Europe, and parts of Asia-Pacific.

Frozen Yogurt Market Regional Insights:

North America is expected to account for 42% of the frozen yoghurt market growth. In North America, the United States is the leading frozen yoghurt market. Thanks to newly created substances with considerable health benefits, alternative sweeteners, and novel flavor profiles, the latest wave of robust growth has been seen over the coming years. For instance, in nearly 121 million gallons servings of frozen yoghurt are served annually in the United States. Also, the large number of key manufactures operated in the US with remarkable shares, such as Menchie’s with 13.6%, TCBY with 10.8%, Yogurtland with 10.6%, sweet Frog with 10.4%, and Red Mango with 7.8%. Emerging economies like China, India, and Japan, among others, witness great opportunities to generate revenue for the Asian frozen yogurt market in the future. The need for nutritious foods driven the expansion of India's yoghurt business, which is expected to reach $1 billion by . Due to both foreign and domestic franchise brands, the market is broad and offers a wide range of items. The prominent players of yoghurt franchises in drive offer world-class milkshakes, premium gelato ice cream, natural ice creams and desserts, and fresh frozen yoghurt, among other things. The greatest yoghurt franchises in India focus on low-fat, high-fiber, gluten-free, and other healthy foods. The objective of the report is to present a comprehensive analysis of the Frozen Yogurt to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Frozen Yogurt dynamics, structure by analyzing the market segments and project the Frozen Yogurt size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Frozen Yogurt make the report investor’s guide.Frozen Yogurt Market Scope: Inquire before buying

Global Frozen Yogurt Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.89 Bn. Forecast Period 2025 to 2032 CAGR: 4.1% Market Size in 2032: USD 2.61 Bn. Segments Covered: by Product Type Dairy-Based Non-Dairy Based Soy Almond Coconut Oat Others by Category Conventional Lactose free by Nature Organic non-organic product by Fat Contents Full Fat Low fat (0.5%-2%) No fat (<0.5%) by Variant Flavor Mango Strawberry Chocolate Banana Pineapple Others Non-Flavored by Price Range Economy/Budget Mid-Range Premium by Packaging Type Cups and Tubs Cones and Sticks Glass Jars Flexible Pouches Others by Distribution Channel Offline Sales Channel Hypermarkets/Supermarkets Departmental Stores Convenience Store Others Online Sales Channel Company Website E-commerce Platform Others by End Use Household Food Service HORECA (Hotels, Restaurants, Cafés) Quick-Service Restaurants (QSRs) Ice Cream & Dessert Parlors Institutional Frozen Yogurt Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Frozen Yogurt Market, Key Players:

North America 1. Yogurtland 2. Mrs. Fields 3. The Hain Celestial Group 4. Honey Hill Farms 5. Crest Foods 6. Nancy's Yogurt 7. Groupe Lactalis 8. Mixmi 9. Wallaby Organic Europe 10. Danone 11. Glenisk 12. Groupe Lactalis 13. Weeel 14. Savencia Fromage and Dairy 15. Snog APAC 16. Jining Xueyuan Dairy 17. Simple Love Yogurt 18. Meiji Co., Ltd. 19. Yili Group 20. Mengniu Dairy 21. Amul Middle East and Africa 22. Saudia Dairy and Foodstuff Company 23. Almarai 24. Al Rawabi Dairy Company South America 25. Lacteas Garcia Baquero 26. Grupo LalaFrequently Asked Questions:

1. Which region has the largest share in Frozen Yogurt Market? Ans: North America holds the highest share in 2024. 2. What is the growth rate of Frozen Yogurt Market? Ans: The Frozen Yogurt Market is growing at a CAGR of 4.1% during forecasting period 2025-2032. 3. What segments are covered in Frozen Yogurt market? Ans: Frozen Yogurt Market is segmented into type, product type, flavor, distribution channel and region. 4. Who are the key players in Frozen Yogurt market? Ans: The important key players in the Frozen Yogurt Market are - Chocolate Shoppe Ice Cream Company, Frosty Boy, Golden Spoon, Handel's Homemade Ice Cream & Yogurt, I Can't Believe It's Yogurt!, Llaollao, Menchie's Frozen Yogurt, Orange Leaf Frozen Yogurt, Pinkberry, Red Mango, Sour Sally, Sweet Frog, TCBY, Tutti Frutti Frozen Yogurt, Wakaberry, Yogen Früz, Yogoberry, Yogurt Mountain, Yogurtland, and Yumilicious. 5. What was the Global Frozen Yogurt Market size in 2024? Ans: The Global Frozen Yogurt Market size was USD 1.89 Billion in 2024.

1. Frozen Yogurt Market: Executive Summary 1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032), 1.1.2. Market Size (USD Million) and (Volume in Liters) and Market Share (%) - By Segments, Regions and Country 2. Global Frozen Yogurt Market: Competitive Landscape 2.1 MMR Competition Matrix 2.2 Frozen Yogurt Market : Competitive Positioning 2.3 Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Flavor & Variant Diversity 2.3.5. Technology Adoption 2.3.6. Production capacity (Liters) 2.3.7. Innovation & New Product Development 2.3.8. Marketing & Branding 2.3.9. Pricing Strategy 2.3.10. Sustainability & Environmental Practices 2.3.11. Consumer Insights & Preferences 2.3.12. Packaging & Format Innovation 2.3.13. Market Share (%) 2024 2.3.14. Revenue, 2024 2.3.15. R&D Investment 2.3.16. Global Reach 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Market Share Analysis 2.6.1. Global Market Share of Key Players (2024) 2.6.2. Regional Market Share – North America, Europe, APAC, MEA, South America 2.6.3. Segment-wise Market Share – Dairy vs Non-Dairy, Premium vs Economy 2.7. Technological Capabilities 2.7.1. Processing & Manufacturing Technology Adoption 2.7.2. Production Capacity & Facility Locations 2.7.3. R&D and New Product Development Capabilities 2.7.4. Automation & Quality Control Measures 2.8. Marketing & Brand Positioning 2.8.1. Branding & Advertising Strategies 2.8.2. Social Media & Digital Marketing Presence 2.8.3. Loyalty Programs & Consumer Engagement Initiatives 2.8.4. Promotional & Seasonal Campaigns 2.9. Distribution & Channel Strategy 2.9.1. Offline Retail Presence – Supermarkets, Hypermarkets, Specialty Stores 2.9.2. Foodservice & HORECA Channel Penetration 2.9.3. Online & Direct-to-Consumer (D2C) Presence 2.9.4. Regional Distribution Strengths & Gaps 2.10. Pricing Analysis 2.10.1. Price Benchmarking by Product Type (Dairy-Based vs Non-Dairy) 2.10.2. Price Segmentation Across Economy, Mid-Range, and Premium Products 2.10.3. Regional Pricing Comparison (North America, Europe, APAC, MEA, South America) 2.10.4. Price Trends Over the Last 5 Years (2019–2024) 2.10.5. Pricing Strategies Adopted by Key Players (Promotional, Value-Pack, Premiumization) 3. Market Dynamics 3.1. Frozen Yogurt Market Trends 3.2. Frozen Yogurt Market Dynamics 3.1.1 Drivers 3.1.2 Restraints 3.1.3 Opportunities 3.1.4 Challenges 3.2 PORTER’s Five Forces Analysis 3.3 PESTLE Analysis 3.4 Analysis of Government Schemes and Initiatives on the Industry 4 Regulatory, Safety & Compliance Framework 4.1 Global Food Safety Standards for Frozen Desserts 4.2 Dairy & Non-Dairy Compliance: FDA, EFSA & Regional Norms 4.3 Organic & Clean-Label Certification Requirements 4.4 Sugar, Fat & Additive Regulation Standards 4.5 Labeling, Allergen Declaration & Packaging Regulations 5 Product & Ingredient Analysis 5.1 Dairy-Based vs Non-Dairy Ingredient Composition 5.2 Fat Content & Sugar Formulation Benchmarking 5.3 Probiotic Strains & Functional Additive Evaluation 5.4 Flavor Systems & Sweetener Technologies 5.5 Clean-Label, Natural & High-Protein Product Innovations 6 Technology Analysis 6.1 Overview of Frozen Yogurt Processing Technologies 6.2 Soft-Serve vs Packaged Frozen Yogurt Technologies 6.3 Ingredient & Formulation Technologies (Stabilizers, Emulsifiers, Probiotics, Sweeteners) 6.4 Innovations in Low-Sugar, Non-Fat, Vegan & Clean-Label Processing 6.5 Machinery & Equipment Benchmarking (Soft-Serve Machines, Batch Freezers, Filling Lines) 6.6 Quality Control & Product Testing Technologies 7 Production Analysis (2024) 7.1 Frozen Yogurt Manufacturing Process Flow 7.2 Frozen Yogurt Production by Region (North America, Europe, APAC, MEA, South America) 7.3 Raw Material Sourcing & Ingredient Handling 7.4 Production Cost Structure (Raw Materials, Energy, Labor, Packaging) 7.5 Cold Chain Management & Storage Stability Requirements 7.6 Yield Optimization & Waste Reduction Practices 7.7 Plant Layout, Automation & Production Capacity Planning 8 Supply Chain Analysis 8.1 Raw Material Sourcing & Quality Management 8.2 Supplier Network Structure (Ingredients, Packaging, Additives) 8.3 Manufacturing & Processing Flow – Dairy / Plant-Based / Specialty 8.4 Cold Chain, Storage & Inventory Management 8.5 Distribution Models – Retail, HoReCa, E-Commerce 8.6 Regional Supply Chain Challenges & Bottlenecks 8.7 Supply Chain Risk Assessment & Mitigation Strategies 9 Pricing Analysis (2024) 9.1 Price Structure by Product Type (2019-2024) 9.2 Price Comparison: Dairy vs Non-Dairy Frozen Yogurt 9.3 Pricing Across Economical, Mid-Range & Premium Segments 9.4 Regional Price Benchmarking 9.5 Impact of Raw Material Costs (Milk, Almond, Coconut, Oat) 10 Innovation & New Product Development Trends 10.1 New Flavor Introductions & Seasonal Variants 10.2 Plant-Based, Vegan & Alternative Protein Innovations 10.3 Low-Sugar, Sugar-Free & Functional Formulation Trends 10.4 Clean-Label, Organic & Probiotic-Enhanced Products 10.5 Technology-Driven Product Enhancements (Soft-Serve Machines, Dispensing Systems, Automation) 11 Consumer Insights & Demand Analysis 11.1 Dairy vs Non-Dairy Consumption Preference Trends 11.2 Taste, Texture, Sweetness & Flavor Innovation Drivers 11.3 Packaging Preferences (Consumer Perception & Convenience) 11.4 Consumption Occasions – Home, Cafés, QSRs, On-the-Go, Events 11.5 Health, Wellness & Clean-Label Influence on Purchase Behavior 11.6 Price Sensitivity, Brand Loyalty & Switching Behavior 12 Distribution Channel Analysis 12.1 Offline Retail Performance (Supermarkets, Hypermarkets, Convenience Stores) 12.2 Role & Growth of Specialty Frozen Yogurt Shops 12.3 Foodservice Demand – QSR, HoReCa, Dessert Parlors & Catering 12.4 Online Retail & D2C Expansion Dynamics 12.5 Emergence of Cloud Kitchens & Frozen Dessert Delivery Models 12.6 Regional Distribution Strengths, Gaps & Channel Profitability 13 Marketing, Branding & Consumer Engagement Trends 13.1 Advertising & Promotional Strategies for Frozen Yogurt Brands 13.2 Digital & Social Media Marketing Trends 13.3 Loyalty Programs & Customer Retention Initiatives 13.4 Packaging as a Marketing Tool (Design, Messaging & Convenience) 13.5 Experiential Marketing & In-Store Engagement (Sampling, Events, Pop-Ups) 13.6 Influence of Health & Wellness Messaging on Brand Perception 14 Investment Landscape 14.1 Strategic Mergers, Acquisitions & Joint Ventures in the Frozen Yogurt Market 14.2 Private Equity, Venture Capital & Funding Trends Across Key Players 14.3 Expansion & Greenfield Projects by Leading Manufacturers 14.4 Investment Focus in Plant-Based, Functional & Innovative Products 14.5 Regional Investment Opportunities & Emerging Markets 14.6 Investment Risks, Returns & Market Entry Considerations for New Players 15 Sustainability & Environmental Impact 15.1 Sustainable Packaging Innovations (Bioplastics, Recycled PET, Paper Options) 15.2 Waste Reduction, Recycling & Circular Initiatives 15.3 Carbon Footprint Assessment of Production & Distribution 15.4 Plant-Based Frozen Yogurt as Sustainability Driver 15.5 Energy Efficiency Measures in Processing & Storage 15.6 Water Optimization & Wastewater Management 16 Packaging Analysis & Trends 16.1 Packaging Formats & Materials – Cups, Tubs, Cones, Flexible Pouches, Glass, Others 16.2 Packaging Design & Branding Influence on Consumer Choice 16.3 Sustainability & Eco-Friendly Packaging Trends – Bioplastics, Recycled PET, Paper Options 16.4 Packaging for Shelf Life, Cold Chain & Product Stability 16.5 Innovative / Functional Packaging – Single-Serve, Portion Control, Convenience 16.6 Regional Packaging Preferences & Market Adaptation 17 Consumption Analysis (2024) 17.1 Per Capita Frozen Yogurt Consumption by Region (North America, Europe, APAC, MEA, South America) 17.2 Household vs Out-of-Home Consumption Trends 17.3 Consumption by Product Type (Dairy-Based vs Non-Dairy) 17.4 Consumption by Fat Content and Flavor Preference 17.5 Seasonal & Occasional Consumption Patterns 17.6 Emerging Consumption Trends – Health-Conscious, Functional, and Plant-Based Preferences 18 Global Frozen Yogurt Market :Size and Forecast By Segmentation (By Value in USD Billion & Volume in Liters) (2024-2032) 18.1 Global Frozen Yogurt Market Size and Forecast, By Product Type 18.1.1 Dairy-Based 18.1.2 Non-Dairy Based 18.1.2.1 Soy 18.1.2.2 Almond 18.1.2.3 Coconut 18.1.2.4 Oat 18.1.2.5 Others 18.2 Global Frozen Yogurt Market Size and Forecast, By Category 18.2.1 Conventional 18.2.2 Lactose free 18.3 Global Frozen Yogurt Market Size and Forecast, By Nature 18.3.1 Organic 18.3.2 non-organic product 18.4 Global Frozen Yogurt Market Size and Forecast, By Fat contents 18.4.1 Full Fat 18.4.2 Low fat (0.5%-2%) 18.4.3 No fat (<0.5%) 18.5 Global Frozen Yogurt Market Size and Forecast, By Variant 18.5.1 Flavor 18.5.1.1 Mango 18.5.1.2 Strawberry 18.5.1.3 Chocolate 18.5.1.4 Banana 18.5.1.5 Pineapple 18.5.1.6 Others 18.5.2 Non-Flavored 18.6 Global Frozen Yogurt Market Size and Forecast, By Price Range 18.6.1 Economy/Budget 18.6.2 Mid-Range 18.6.3 Premium 18.7 18.7. Global Frozen Yogurt Market Size and Forecast, By Packaging Type 18.7.1 Cups and Tubs 18.7.2 Cones and Sticks 18.7.3 Glass Jars 18.7.4 Flexible Pouches 18.7.5 Others 18.8 18.8. Global Frozen Yogurt Market Size and Forecast, By Distribution Channel 18.8.1 Offline Sales Channel 18.8.1.1 Hypermarkets/Supermarkets 18.8.1.2 Departmental Stores 18.8.1.3 Convenience Store 18.8.1.4 Others 18.8.2 Online Sales Channel 18.8.2.1 Company Website 18.8.2.2 E-commerce Platform 18.8.2.3 Others 18.9 18.9. Global Frozen Yogurt Market Size and Forecast, By End User 18.9.1 Household 18.9.2 Food Service 18.9.2.1 HORECA (Hotels, Restaurants, Cafés) 18.9.2.2 Quick-Service Restaurants (QSRs) 18.9.2.3 Ice Cream & Dessert Parlors 18.9.3 Institutional 18.10 Frozen Yogurt Market Size and Forecast, By Region(2024-2032) 18.10.1 North America 18.10.2 Europe 18.10.3 Asia Pacific 18.10.4 South America 18.10.5 MEA 19 North America Frozen Yogurt Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Liters) (2024-2032) 19.1.1 North America Market Size and Forecast, By Product Type 19.1.2 North America Market Size and Forecast, By Category 19.1.3 North America Market Size and Forecast, By Nature 19.1.4 North America Market Size and Forecast, By Fat contents 19.1.5 North America Market Size and Forecast, By Variant 19.1.6 North America Market Size and Forecast, By Price Range 19.1.7 North America Market Size and Forecast, By Packaging Type 19.1.8 North America Market Size and Forecast, By Distribution Channel 19.1.9 North America Market Size and Forecast, By End User 19.1.10 North America Market Size and Forecast, By Country 19.1.10.1 United States 19.1.10.1.1 United States Market Size and Forecast, By Product Type 19.1.10.1.2 United States Market Size and Forecast, By Category 19.1.10.1.3 United States Market Size and Forecast, By Nature 19.1.10.1.4 United States Market Size and Forecast, By Fat contents 19.1.10.1.5 United States Market Size and Forecast, By Variant 19.1.10.1.6 United States Market Size and Forecast, By Price Range 19.1.10.1.7 United States Market Size and Forecast, By Distribution Channel 19.1.10.1.8 United States Market Size and Forecast, By Packaging Type 19.1.10.1.9 United States Market Size and Forecast, By End User 19.1.10.2 Canada 19.1.10.3 Mexico 20 Europe Frozen Yogurt Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Liters) (2024-2032) 20.1 Europe Market Size and Forecast, By Product Type 20.2 Europe Market Size and Forecast, By Category 20.3 Europe Market Size and Forecast, By Nature 20.4 Europe Market Size and Forecast, By Fat contents 20.5 Europe Market Size and Forecast, By Variant 20.6 Europe Market Size and Forecast, By Price Range 20.7 Europe Market Size and Forecast, By Packaging Type 20.8 Europe Market Size and Forecast, By Distribution Channel 20.9 Europe Market Size and Forecast, By End User 20.10 Europe Market Size and Forecast, By Country 20.10.1 United Kingdom 20.10.2 France 20.10.3 Germany 20.10.4 Italy 20.10.5 Spain 20.10.6 Sweden 20.10.7 Russia 20.10.8 Netherlands 20.10.9 Rest of Europe 21 Asia Pacific Frozen Yogurt Market Size and Forecast By Segmentation (By Value USD Million and ) (2024-2032) 21.1 Asia Pacific Market Size and Forecast, By Product Type 21.2 Asia Pacific Market Size and Forecast, By Category 21.3 Asia Pacific Market Size and Forecast, By Nature 21.4 Asia Pacific Market Size and Forecast, By Fat contents 21.5 Asia Pacific Market Size and Forecast, By Variant 21.6 Asia Pacific Market Size and Forecast, By Price Range 21.7 Asia Pacific Market Size and Forecast, By Packaging Type 21.8 Asia Pacific Market Size and Forecast, By Distribution Channel 21.9 Asia Pacific Market Size and Forecast, By End User 21.10 Asia Pacific Market Size and Forecast, By Country 21.10.1 China 21.10.2 Japan 21.10.3 South Korea 21.10.4 India 21.10.5 Australia 21.10.6 Malaysia 21.10.7 Thailand 21.10.8 Vietnam 21.10.9 New Zealand 21.10.10 Philippines 21.10.11 Rest of Asia Pacific 22 Middle East and Africa Frozen Yogurt Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Liters) (2024-2032) 22.1 Middle East and Africa Market Size and Forecast, By Product Type 22.2 Middle East and Africa Market Size and Forecast, By Category 22.3 Middle East and Africa Market Size and Forecast, By Nature 22.4 Middle East and Africa Market Size and Forecast, By Ingredients 22.5 Middle East and Africa Market Size and Forecast, By Variant 22.6 Middle East and Africa Market Size and Forecast, By Price Range 22.7 Middle East and Africa Market Size and Forecast, By Packaging Type 22.8 Middle East and Africa Market Size and Forecast, By Distribution Channel 22.9 Middle East and Africa Market Size and Forecast, By End User 22.10 Middle East and Africa Market Size and Forecast, By Country 22.10.1 South Africa 22.10.2 GCC 22.10.3 Nigeria 22.10.4 Egypt 22.10.5 Turkey 22.10.6 Rest of ME&A 23 South America Frozen Yogurt Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in Liters) (2024-2032) 23.1 South America Market Size and Forecast, By Product Type 23.2 South America Market Size and Forecast, By Category 23.3 South America Market Size and Forecast, By Nature 23.4 South America Market Size and Forecast, By Fat contents 23.5 South America Market Size and Forecast, By Variant 23.6 South America Market Size and Forecast, By Price Range 23.7 South America Market Size and Forecast, By Packaging Type 23.8 South America Market Size and Forecast, By Distribution Channel 23.9 South America Market Size and Forecast, By End User 23.10 South America Market Size and Forecast, By Country 23.10.1 Brazil 23.10.2 Argentina 23.10.3 Colombia 23.10.4 Chile 23.10.5 Peru 23.10.6 Rest Of South America 24 Company Profile: Key Players 24.1 General Mills, Inc 24.1.1 Overview 24.1.2 Business Portfolio 24.1.3 Financial Overview 24.1.4 SWOT Analysis 24.1.5 Strategic Analysis 24.1.6 Recent Developments 24.2 Scott Brothers Dairy 24.3 Honey Hill Farms 24.4 Nestlé 24.5 Amul 24.6 I Can't Believe It's Yogurt (ICBIY) 24.7 Yogurtland 24.8 Menchie’s Frozen Yogurt 24.9 Red Mango 24.10 Pinkberry 24.11 TCBY 24.12 llaollao 24.13 Yogen Früz 24.14 Orange Leaf Frozen Yogurt 24.15 SweetFrog Enterprises 24.16 Yasso 24.17 Mother Dairy 24.18 Unilever PLC 24.19 HP Hood LLC. 24.20 Frosty Boy 24.21 Danone S.A. 24.22 Lakeview Farms(Noosa Frozen Yogurt) 24.23 Bulla Dairy Foods 25 Key Findings 26 Strategic Outlook & Future Opportunities 27 Global Frozen Yogurt Market – Research Methodology