The Frozen Food Market size was valued at USD 3.52 Billion in 2025 and is expected to grow at a CAGR of 3.9 % from 2025 to 2032, reaching nearly USD 4.6 Billion for the forecasted period.Market Overview

The Global Frozen Food Market has evolved into a structurally essential component of the modern food system. In 2024, North America accounted for around 35% of global market value, representing nearly USD 70 billion in retail sales. The region operates over 1,700 public cold storage facilities with more than 4.2 billion cubic feet of freezer capacity, reflecting the capital intensity behind frozen food scalability. Frozen food demand has shown strong inflation resistance. Between 2020 and 2023, US frozen fruit and vegetable prices increased by 25%, with nearly 75 % driven by inflation, limiting real price growth to roughly 6%. This price stability, combined with longer shelf life and reduced food waste, has reinforced frozen food’s value proposition during periods of economic uncertainty. Europe remains a high-volume, operationally efficient market, distributing over 31.5 Billion frozen food units per day through over 220,000 grocery outlets. Average store assortments reflect deep category penetration. Asia Pacific is the fastest-growing region, supported by a consumer base exceeding 3 billion people. China contributes roughly 30% of regional demand, driven by cold-chain investments and urban retail expansion.To know about the Research Methodology :- Request Free Sample Report

Frozen Food Market: A Comprehensive Analysis of the Top Players, Key Drivers, Trends, and Opportunities bundle reports

1. North America Frozen Food Market (Single User $ 2600) 2. Asia Pacific Frozen Food Market (Single User $ 2600) 3. Europe Frozen Food Market (Single User $ 2900) 4. Middle East and Africa Frozen Food Market (Single User $ 2900) 5. South America Frozen Food Market (Single User $ 2600)Market Dynamics

Demand Drivers

Frozen food consumption is anchored in convenience, cost efficiency, and cold-chain expansion. In Europe, 7 out of 10 consumers consume frozen food two to four times per week, while 2 out of 10 consume it up to nine times weekly, indicating routine integration into household diets. Time efficiency is a key factor, with 27% of consumers saving up to one hour per meal, particularly relevant in urban and dual-income households. Technological advancements have improved product quality and consumer trust. Blast freezing and individual quick-freezing account for over 52% of global freezing methods, preserving texture and nutrients. Frozen vegetables such as peas retain up to 30% more vitamin C than fresh equivalents after one week of storage. Appliance adoption further supports demand, with over 60% of UK households owning air fryers, accelerating sales of frozen snacks and ready meals.Report 1: North America Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

Market Constraints

Despite scale advantages, the market faces perception and infrastructure constraints. While 60% of European consumers view frozen food as nutritionally comparable to fresh, only 21% recognize its nutritional superiority, highlighting a persistent perception gap. Among consumers aged 18 to 24, only 29% associate frozen food with nutritional parity, compared with 72% among those aged 55 and above. Physical storage remains a constraint, with 27% of consumers citing limited freezer space as a barrier to higher consumption. On the supply side, frozen food production is capital intensive. Retail freezer installations can exceed USD 40,000 per unit, while labor costs in US frozen food manufacturing rose by over 11% between 2021 and 2022, pressuring margins for small and mid-sized processors.Growth Opportunities

Growth opportunities are emerging from sustainability alignment, premiumization, and digital retail. In Europe, around 45% of consumers purchase frozen food to reduce food waste, a significant factor in a region generating over 60 Billion tonnes of food waste annually. Frozen food’s long shelf life and portion control capabilities position it as a practical waste-reduction solution. Online grocery adoption continues to expand category access. In 2020, 51% of consumers shopped for groceries online, and 82% of those included frozen food in their baskets, supported by improvements in last-mile cold logistics. Product innovation in plant-based meals, premium ready meals, and functional nutrition is driving higher average selling prices and margin expansion.Report 2: Asia Pacific Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

Market Segmentation

By Product Type Frozen ready meals represent the largest value segment, accounting for 31 to 34% of global revenues, driven by premium offerings in North America and Europe. Frozen fruits and vegetables generated approximately USD 90.6 billion in 2024, supported by strong retail and foodservice demand. Frozen snacks and bakery products account for over 37% of global consumption, benefiting from air-fryer compatibility and convenience-led innovation. Frozen desserts contribute roughly 23% of market value, balancing indulgent and health-focused product lines.By Category Ready-to-cook products dominate global volumes, representing over 63% of consumption, particularly in multi-person households across Asia Pacific. Ready-to-eat products are growing faster in urban markets, with the US accounting for nearly 58% of North American ready-to-eat demand. Report 3: Europe Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

Regional Outlook

North America remains the highest-value market, supported by integrated processing and distribution networks. Canada contributes more than 415 Billion frozen meal units annually, while Mexico records high-volume consumption through convenience retail, with leading chains selling over 300,000 frozen food units per day. Report 4: Middle East and Africa Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts. Europe’s market is characterized by strong private-label penetration and intra-regional trade. In 2021, the region imported nearly USD 3 billion of frozen vegetables, with over 90% sourced within Europe, reinforcing supply-chain resilience. Asia Pacific is the fastest-growing region, driven by cold-chain investment and e-commerce penetration. Between 2023 and 2024, more than 45 automated cold storage facilities were commissioned across the region, including 29 in China and India. E-commerce platforms across China, India, and South Korea collectively delivered over 640 Billion frozen SKUs, reflecting rapid digitization of frozen food distribution. Report 5: South America Frozen Food Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.Competitive Landscape

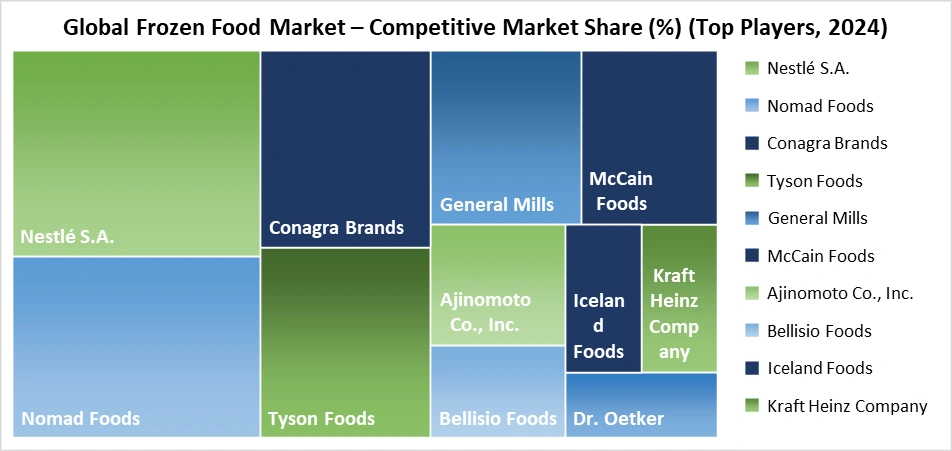

The Frozen Food Market is shaped by a clear divide between scale-driven multinationals and regionally focused specialists. Nestlé sets the benchmark, with its frozen portfolio generating over USD 12 billion globally, anchored in ready meals and strong penetration across North America and Western Europe. In Europe, Nomad Foods operates as a category consolidator, commanding leadership in frozen vegetables and fish with €3.1 billion in revenue and deep private-label style efficiency at branded scale. McCain Foods remains structurally dominant in frozen potatoes and snacks, supplying both retail and foodservice channels across more than 160 countries. In the US, Conagra Brands and General Mills compete on frozen meals and convenience formats, using aggressive pricing and brand breadth to defend shelf space. Protein-heavy players like Tyson Foods and Maple Leaf Foods leverage integrated meat supply chains to control cost and volume. Meanwhile, companies such as Dr. Oetker, Ajinomoto, Nichirei, Iceland Foods, and Schwan’s win through specialization, excelling in bakery, ethnic meals, and direct-to-consumer freezer models.

Frozen Food Market Scope: Inquire before buying

Frozen Food Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 3.52 Bn. Forecast Period 2026 to 2032 CAGR: 3.9% Market Size in 2032: USD 4.6 Bn. Segments Covered: by Product Fruits & Vegetables Frozen Fruits Berries Mango Chunks Others Vegetables Cauliflower Broccoli Bell paper Carrot Beans Mushroom Avocado Corn Others Frozen Potatoes French Fries Others Dairy Products Bakery Products Proofed Fully Baked Meat & Seafood Products Poultry Red Meat Fish & Seafood Plant Based Protein RTE Meals Pet Food Others by Type Raw Material Half Cooked RTE by Freezing Technique Individual Quick Freezing Blast Freezing Belt Freezing by Distribution Channel Food Service Retail Hypermarkets & Supermarkets Convenience Stores Online Offline Frozen Food Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Frozen Food Market, Major Key Players

1. Conagra Brands 2. General Mills 3. Tyson Foods 4. The Kraft Heinz Company 5. Bellisio Foods 6. J&J Snack Foods 7. Schwan’s Company 8. Rich Products Corporation 9. Maple Leaf Foods 10. McCain Foods 11. Nomad Foods 12. Nestlé S.A 13. Iceland Foods 14. Dr. Oetker 15. Associated British Foods 16. Vandemoortele 17. Ajinomoto Co., Inc. 18. Nichirei Corporation 19. Maruha Nichiro 20. Shishi He Deming Seafood Co. Ltd. 21. Omar International Pvt. Ltd. 22. Mother Dairy 23. Sanquan Food 24. OOB Organic 25. ITC Limited 26. Bon Appetit 27. BRF S.A 28. JBS Foods 29. Grupo Bimbo 30. Vida Foods Frequently Asked Questions 1. What will be the forecast period in the market report? Ans. The forecast period, considered for the global Frozen Food Market, is 2026 to 2032. 2. What is the total market value of the Global Frozen Food Market Report? Ans. The global Frozen Food Market size was USD 3.52 billion in 2025 and is estimated to reach USD 4.6 billion in 2032, growing at a CAGR of 3.9% from 2025 to 2032. 3. Which product categories hold the largest market share? Ans. Frozen ready meals and frozen snacks together account for over 60% of global market value, while frozen fruits and vegetables remain the most stable volume segment. 4. Which regions dominate frozen food consumption? Ans. North America leads with nearly 38% of global market share, followed by Europe. Asia Pacific is the fastest-growing region. 5. Which product categories hold the largest market share? Ans. Frozen ready meals and frozen snacks together account for over 60% of global market value, while frozen fruits and vegetables remain the most stable volume segment.

1. Frozen Food Market Introduction 1.1. Executive Summary 1.2. Market Size (2025) & Forecast (2026-2032), 1.3. Market Size (Value in USD Billion) and Market Share (%) – By Segments, Regions, and Country 2. Global Frozen Food Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Global Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. End User Segment 2.3.5. Distribution Channel 2.3.6. Pricing Strategy 2.3.7. New Product Innovation Rate 2.3.8. R&D Investment 2.3.9. Revenue (2024) by Region 2.3.10. Revenue Growth Rate (Y-O-Y) 2.3.11. Profit Margin (%) 2.3.12. Market Share (%) by Region 2.3.13. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Frozen Food Market: Dynamics 3.1. Frozen Food Market Trends 3.2. Frozen Food Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 4. Production Analysis 4.1. Global Production Volumes by Product Category 4.2. Production Capacity and Utilization by Region 4.3. Manufacturing Footprint of Leading Players 4.4. Emerging Production Hubs and Investments 4.5. Seasonal Production Trends and Cyclical Patterns 4.6. Technological Advancements in Production Processes 5. Consumption Analysis 5.1. Regional Consumption Volumes and Value 5.2. Consumption Patterns by Product Category 5.3. Urban vs Rural Consumption Behavior 5.4. Household vs Foodservice Consumption Trends 5.5. Seasonal and Cultural Consumption Variations 5.6. Growth Drivers for Consumer Adoption 6. Trade Analysis (2025) 6.1. Global Export and Import Volumes by Product Type 6.2. Key Exporting and Importing Countries 6.3. Regional Trade Flow Patterns 6.4. Impact of Tariffs, Trade Policies, and Regulations 6.5. Emerging Export Opportunities and Markets 6.6. Cross-border Supply Chain Challenges 7. Pricing Analysis (2020-2025) 7.1. Average Market Prices by Product Category and Region 7.2. Price Trends of Leading Brands 7.3. Impact of Raw Material and Energy Costs 7.4. Regional Price Differentials and Premium Segments 7.5. Discounting and Promotional Pricing Strategies 7.6. Correlation Between Price and Consumer Demand 8. Supply Chain Analysis 8.1. Raw Material Sourcing and Procurement Trends 8.2. Cold Chain Infrastructure and Logistics Efficiency 8.3. Distribution Challenges Across Regions 8.4. Sustainability and Green Supply Chain Initiatives 8.5. Supplier Consolidation and Strategic Partnerships 8.6. Risk Management and Contingency Planning 9. Consumer Behavior Analysis 9.1. Purchase Drivers and Preferences 9.2. Health, Convenience, and Lifestyle Trends 9.3. Urban vs Tier-2/3 City Adoption 9.4. E-commerce and Direct-to-Consumer Influence 9.5. Brand Loyalty and Private Label Adoption 9.6. Shifts in Dietary Preferences (Plant-based, Organic) 10. Demand Landscape 10.1. Overall Market Demand and Growth Drivers 10.2. Product-wise and Regional Demand Analysis 10.3. Forecasts and Emerging Opportunities 10.4. Impact of Demographics and Income Levels 10.5. Demand Influencers: Urbanization, Work-from-Home, Eating Out Trends 10.6. Future Scenarios for Frozen Food Demand 11. Technology and Product Innovation 11.1. Innovations in Processing and Preservation 11.2. Packaging Solutions and Shelf-life Extension 11.3. Plant-based, Organic, and Health-focused Products 11.4. Automation and Robotics in Manufacturing 11.5. R&D Trends and New Product Launches 11.6. Collaboration Between Startups and Established Players 12. Distribution and Retail Channel Analysis 12.1. Modern Trade: Supermarkets and Hypermarkets 12.2. E-commerce and Online Grocery Penetration 12.3. Traditional Retail: Grocery and Convenience Stores 12.4. Foodservice and Institutional Channels 12.5. Private Label vs Branded Product Distribution 12.6. Regional Channel Mix and Emerging Trends 13. Frozen Food Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 13.1. Frozen Food Market Size and Forecast, By Product (2025-2032) 13.1.1. Fruits & Vegetables 13.1.1.1. Frozen Fruits 13.1.1.1.1. Berries 13.1.1.1.2. Mango Chunks 13.1.1.1.3. Others 13.1.1.2. Vegetables 13.1.1.2.1. Cauliflower 13.1.1.2.2. Broccoli 13.1.1.2.3. Bell paper 13.1.1.2.4. Carrot 13.1.1.2.5. Beans 13.1.1.2.6. Mushroom 13.1.1.2.7. Avocado 13.1.1.2.8. Corn 13.1.1.2.9. Others 13.1.1.3. Frozen Potatoes 13.1.1.4. French Fries 13.1.1.5. Others 13.1.2. Dairy Products 13.1.3. Bakery Products 13.1.3.1. Proofed 13.1.3.2. Fully Baked 13.1.4. Meat & Seafood Products 13.1.4.1. Poultry 13.1.4.2. Red Meat 13.1.4.3. Fish & Seafood 13.1.5. Plant Based Protein 13.1.6. RTE Meals 13.1.7. Pet Food 13.1.8. Others 13.2. Frozen Food Market Size and Forecast, By Type (2025-2032) 13.2.1. Raw Material 13.2.2. Half Cooked 13.2.3. RTE 13.3. Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 13.3.1. Individual Quick Freezing 13.3.2. Blast Freezing 13.3.3. Belt Freezing 13.4. Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 13.4.1. Food Service 13.4.2. Retail 13.4.2.1. Hypermarkets & Supermarkets 13.4.2.2. Convenience Stores 13.4.2.3. Online 13.4.2.4. Offline 13.5. Frozen Food Market Size and Forecast, By Region (2025-2032) 13.5.1. North America 13.5.2. Europe 13.5.3. Asia Pacific 13.5.4. Middle East and Africa 13.5.5. South America 14. North America Frozen Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 14.1. North America Frozen Food Market Size and Forecast, By Product (2025-2032) 14.2. North America Frozen Food Market Size and Forecast, By Type (2025-2032) 14.3. North America Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 14.4. North America Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 14.5. North America Frozen Food Market Size and Forecast, By Country (2025-2032) 14.5.1. United States 14.5.1.1. United States Frozen Food Market Size and Forecast, By Product (2025-2032) 14.5.1.2. United States Frozen Food Market Size and Forecast, By Type (2025-2032) 14.5.1.3. United States Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 14.5.1.4. United States Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 14.5.2. Canada 14.5.2.1. Canada Frozen Food Market Size and Forecast, By Product (2025-2032) 14.5.2.2. Canada Frozen Food Market Size and Forecast, By Type (2025-2032) 14.5.2.3. Canada Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 14.5.2.4. Canada Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 14.5.3. Mexico 14.5.3.1. Mexico Frozen Food Market Size and Forecast, By Product (2025-2032) 14.5.3.2. Mexico Frozen Food Market Size and Forecast, By Type (2025-2032) 14.5.3.3. Mexico Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 14.5.3.4. Mexico Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 15. Europe Frozen Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 15.1. Europe Frozen Food Market Size and Forecast, By Product (2025-2032) 15.2. Europe Frozen Food Market Size and Forecast, By Type (2025-2032) 15.3. Europe Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 15.4. Europe Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 15.4.1. United Kingdom 15.4.2. France 15.4.3. Germany 15.4.4. Italy 15.4.5. Spain 15.4.6. Sweden 15.4.7. Russia 15.4.8. Rest of Europe 16. Asia Pacific Frozen Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 16.1. Asia Pacific Frozen Food Market Size and Forecast, By Product (2025-2032) 16.2. Asia Pacific Frozen Food Market Size and Forecast, By Type (2025-2032) 16.3. Asia Pacific Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 16.4. Asia Pacific Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 16.4.1. China 16.4.2. S Korea 16.4.3. Japan 16.4.4. India 16.4.5. Australia 16.4.6. Indonesia 16.4.7. Malaysia 16.4.8. Vietnam 16.4.9. Taiwan 16.4.10. Thailand 16.4.11. Philippines 16.4.12. Rest of Asia Pacific 17. Middle East and Africa Frozen Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032 17.1. Middle East and Africa Frozen Food Market Size and Forecast, By Product (2025-2032) 17.2. Middle East and Africa Frozen Food Market Size and Forecast, By Type (2025-2032) 17.3. Middle East and Africa Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 17.4. Middle East and Africa Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 17.4.1. South Africa 17.4.2. GCC 17.4.3. Nigeria 17.4.4. Egypt 17.4.5. Turkey 17.4.6. Rest of ME&A 18. South America Frozen Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032 18.1. South America Frozen Food Market Size and Forecast, By Product (2025-2032) 18.2. South America Frozen Food Market Size and Forecast, By Type (2025-2032) 18.3. South America Frozen Food Market Size and Forecast, By Freezing Technique (2025-2032) 18.4. South America Frozen Food Market Size and Forecast, By Distribution Channel (2025-2032) 18.4.1. Brazil 18.4.2. Argentina 18.4.3. Colombia 18.4.4. Chile 18.4.5. Peru 18.4.6. Rest Of South America 19. Company Profile: Key Players 19.1. Conagra Brands 19.1.1. Company Overview 19.1.2. Business Portfolio 19.1.3. Financial Overview 19.1.4. SWOT Analysis 19.1.5. Strategic Analysis 19.1.6. Recent Developments 19.2. General Mills 19.3. Tyson Foods 19.4. The Kraft Heinz Company 19.5. Bellisio Foods 19.6. J&J Snack Foods 19.7. Schwan’s Company 19.8. Rich Products Corporation 19.9. Maple Leaf Foods 19.10. McCain Foods 19.11. Nomad Foods 19.12. Nestlé S.A 19.13. Iceland Foods 19.14. Dr. Oetker 19.15. Associated British Foods 19.16. Vandemoortele 19.17. Ajinomoto Co., Inc. 19.18. Nichirei Corporation 19.19. Maruha Nichiro 19.20. Shishi He Deming Seafood Co. Ltd. 19.21. Omar International Pvt. Ltd. 19.22. Mother Dairy 19.23. Sanquan Food 19.24. OOB Organic 19.25. ITC Limited 19.26. Bon Appetit 19.27. BRF S.A 19.28. JBS Foods 19.29. Grupo Bimbo 19.30. Vida Foods 20. Key Findings 21. Strategic Moves & Industry Outlook 22. Global Frozen Food Market: Research Methodology