Global Fixed Tilt Solar PV Market size was valued at USD 1.66 Bn. in 2024, and the total Fixed Tilt Solar PV Market revenue is expected to grow by 10.71% from 2025 to 2032, reaching nearly USD 3.75 Bn.Fixed Tilt Solar PV Market Overview:

Fixed tilt solar PV systems are one of the most common mounting configurations in solar energy generation, especially in large utility-scale and commercial ground-mounted solar applications. These systems typically fix the solar panel angle during the day and are a more direct and cost-saving solution over tracking systems. Since their inception, fixed tilt technology has matured from simply steel frame prototypes to highly designed, pre-assembled aluminum or hot-dipped galvanized steel structures that simplify and minimize the installation processes, incur cheaper fabrication and shipping costs, and maintain proper performance under negative environmental conditions. The fixed tilt solar mounting market is driven by many global trends such as increasing momentum towards renewables, widespread decarbonization targets, and the desperate need for scalable, connected grid solar in many developing and developed economies alike. Large fixed tilt solar installations, for example, tend to thrive in sunny, flat, and low-cost land areas such as the southwestern United States, the Middle East, and Australia and India because of both the reduced cost of land and the amount of solar irradiance received. The report covered the primary market drivers, including lower capital cost than tracking systems, simplicity of installation, compatibility with high-efficiency bifacial or monofacial modules, etc. The main segments in the market include technology type (crystalline silicon, thin film), application (on-grid, off-grid), end-user (utility, commercial, residential), and region. First Solar Inc., Trina Solar Limited, Canadian Solar Inc., JinkoSolar Holdings Co. Ltd., and Solar FlexRack are examples of companies operating in the global fixed tilt solar PV market. All companies mentioned provide integrated module-and-mounting solutions aimed at balancing performance with costs. The report also outlines how changed structural engineering improvements, domestic manufacturing policies, and increased hybrid integration with battery storage are fundamentally changing the fixed tilt solar PV market. Some recent trends within the market have included increased use of pre-assembled racking systems, with increased integrations with AI-enabled monitoring abilities, and in general, more deployments in agrivoltaic and off-grid energy access segments.To know about the Research Methodology :- Request Free Sample Report

Global Fixed Tilt Solar PV Market Dynamics

Rising Demand for Renewable Energy Integration to Drive Fixed Tilt Solar PV Market Growth Global urgency to address climate change, diminish carbon emissions, and phase out fossil fuels are all big drivers for investment in renewable energy sources. Countries and international organizations are making ambitious commitments around growing the amount of renewable energy in the total power generation portfolio, with solar energy being a key element in this shift. Fixed tilt solar PV systems are becoming more popular in utility-scale solar farms as low-cost capital systems, with a simple design and harnessing the sun on a large scale. These systems are appealing in regions with high solar irradiance levels and a stable sunlight pattern, as they can provide a consistent energy output with minimal maintenance. Technological Advancements in Electrical and Mechanical Design to Create Opportunities in Fixed Tilt Solar PV Market Increase in competition in the fixed tilt solar PV space is driving innovation in both system design and improvements in materials performance, both of which are increasing cost-effectiveness even for long-term usage scenarios. Improving electrical and mechanical engineering makes better module layouts with better wiring scenarios and tilt angles that take advantage of as much solar energy potential as possible over the course of the year. On the mechanical side, manufacturers are creating mounting structures that provide better durability and corrosion resistance in areas that have extreme weather conditions, while also being mindful of material costs and installation time as workforce counts continue to remain at a premium. Lightweight aluminum frames, pre-assembled components, and modular designs are reducing labor costs on site while increasing the scalability of fixed tilt systems specifically for utility-scale projects. Declining PV Panel Prices and Margin Pressures to Drive Fixed Tilt Solar PV Market Growth The continual decline in solar PV panel prices has helped to spur global adoption, and is now a large cost and schedule risk for fixed tilt solar PV projects. First cost has come down undeniably for solar installations, making projects easier and more scalable, but this downward trajectory has created even more competition and reduced return in what is already a cost-conscious industry. When module prices drop, expected revenues per unit of installed capacity decrease as well, particularly in power purchase agreement (PPA)-driven markets, where electricity tariffs are also decreasing. As a result, developers are often facing downward pricing pressure from utilities, and downward pricing pressure from government auctions, making it increasingly harder to maintain healthy ROIs.Global Fixed Tilt Solar PV Market Segment Analysis

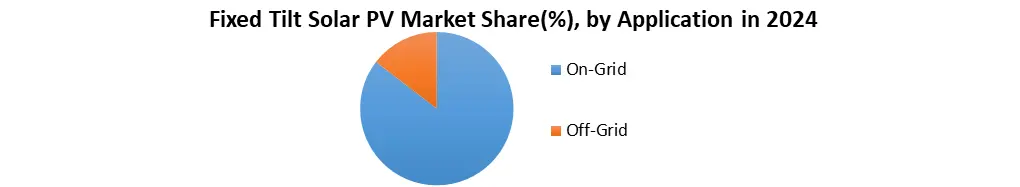

Based on technology, the market is classified into crystalline silicone, thin film, and others. Due to rising installations of the residential solar equipment, the crystalline silicone category is likely to hold the greatest share of the Fixed Tilt Solar PV Market over the forecast period of 2025-2032. However, due to the reducing cost & high efficiency of the equipment, the thin film segment is predicted to increase at the quickest rate throughout the projection period. Based on the application, the market is classified into on-grid and off-grid. The on-grid sector had the biggest market share in 2024, but due to increased installations in remote locations, the off-grid segment is predicted to grow at the fastest CAGR over the forecast period.

Fixed Tilt Solar PV Market Regional Insights

Due to massive investments in solar power production in the region, Asia-Pacific has the largest share of the market. Rising environmental issues have caused Asia-Pacific countries to rapidly adopt solar energy. Furthermore, some governments intend to phase out electricity generation from conventional sources like coal and nuclear power. The rising degree of public knowledge about the benefits of renewable energy is a significant boost for the fixed tilt solar PV sector. India, one of Asia's largest solar markets, plans to install 100 gigawatts of solar power system infrastructure by the end of 2024. In Europe, solar power accounts for a significant portion of the energy mix. Solar power provided 3.6 percent of the total electricity generated in Europe in 2024. According to Bloomberg NEF, by 2040, this contribution will have increased to 20%. As a result, the market in Europe is expected to grow throughout the forecast period due to an increase in electricity generation using solar power. In the year 2024, there was a 1.3 percent decrease in energy emissions across Europe. Furthermore, several European countries have made the transition to adopting lower-carbon energy sources. During the last few years, the European region's energy import dependency has been between 53 and 55 percent. Fixed Tilt Solar PV Market Competitive Landscape The market has competition in the Fixed Tilt Solar PV space with large global solar module manufacturers and EPC solution providers focused on the utility-style and commercial sectors. Major competitors like First Solar Inc (USA) and Trina Solar Limited (China) have the largest market share, with a full integrated module-to-mounting solution offering, and continual advancement in structural engineering. First Solar Inc. has revenue of USD XX billion in 2024, notably recognizing a portion of this revenue from utility-scale projects, utilizing its Series 6 and Series 7 thin-film modules installed with fixed tilt racking systems. In 2025, First Solar partnered with TerraSmart to better leverage the advantages of fixed tilt PV solutions under the U.S. domestic content scope exception. Trina Solar Limited has revenue of USD XX billion in 2024, equating to a 24% annual increase, with the advance of the company's global expansion of TrinaPro platforms and FixOrigin fixed tilt structures designed for extreme environments accounting for the majority of the company's total revenue. Both companies continue to invest in high-efficiency modules, rapid deployment mounting capabilities, and EPC in the respective nations they operate, given the rapidly changing solar energy landscape. Fixed Tilt Solar PV Market Recent Development • In January 2025, First Solar Inc. (USA) entered into a strategic partnership with TerraSmart to combine First Solar's Series 7 TR1 thin film modules with its fixed tilt racking systems to meet the domestic content requirements of the U.S. Inflation Reduction Act and offer a fully domestic ground mount solution. • Trina Solar Limited (China) launched its FixOrigin fixed tilt racking system- compatible with high power bifacial modules rated at 710 W+ and designed for cost-effective deployment in all terrains and extreme conditions; Trina also deployed over 1,100 FixOrigin systems early in 2025 at a 49.9 MW solar + storage hybrid plant in Essex, UK. • In 2024–2025, Unirac Inc. (USA) enhanced its Ground Fixed Tilt (GFT) system with shared rail styles and single post orientations at 20°/30° tilt, providing labor efficiencies and foundation flexibility, in addition to offering a warranty for 25 years. • Canadian Solar Inc. (Canada) continues to offer turnkey EPC approaches for fixed tilt ground-mounted systems, and is also actively growing its greenfield manufacturing presence in North America in 2025 (project developments across modules, inverters, and EPC approaches). • JinkoSolar Holding Co. Ltd. (China), in 2025, continued to be a Tier 1 supplier, capable of supplying high-efficiency fixed tilt compatible modules to many utility-scale projects globally, and maintaining its well-recognized bankability among large financial institutions/review committees. Fixed Tilt Solar PV Market Recent Trends

Category Key Trend Example Product Market Impact Solar PV Modules Shift toward high-efficiency N-type TOPCon and bifacial panels Canadian Solar TOPBiHiKu 660 Wp module 20–25% higher yield in off-grid setups, especially in remote commercial locations Project Development Co-location of fixed tilt solar with agriculture (agrivoltaics) Trina Solar FixOrigin system in agro-solar farms Dual land use enhances land productivity and community acceptance in rural areas. Energy Storage Systems Expansion of LFP-based modular battery storage for off-grid scalability Canadian Solar SolBank 3.0 Plus, Schneider Villaya Flex 35% growth in rural deployment and commercial off-grid microgrids Fixed Tilt Solar PV Market Scope: Inquiry Before Buying

Fixed Tilt Solar PV Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.66 Bn. Forecast Period 2025 to 2032 CAGR: 10.71% Market Size in 2032: USD 3.75 Bn. Segments Covered: by Technology Crystalline Silicone Thin Film Others by Application On-Grid Off-Grid by Mounting Type Ground Mounted Rooftop Mounted Fixed Tilt Solar PV Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Fixed Tilt Solar PV Market Key Players

North America 1. First Solar Inc. (USA) 2. Canadian Solar Inc. (Canada) 3. Unirac (USA) 4. Solar FlexRack (USA) 5. RBI Solar (USA) 6. GameChange Solar (USA) Europe 1. Juwi Solar Inc. (Germany) 2. Engie Solar (France) 3. Sharp Solar Energy Solutions Group (Germany) 4. Mounting Systems GmbH (Germany) 5. Schletter Group (Germany) 6. Solar Steel (Spain) Asia Pacific 1. Wuxi Suntech Power Co., Ltd. (China) 2. Yingli Solar (China) 3. Trina Solar Limited (China) 4. JinkoSolar Holding Co. Ltd. (China)Frequently Asked Questions:

1. Which region has the largest share in the Global Fixed Tilt Solar PV Market? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Fixed Tilt Solar PV Market? Ans: The Global Market is expected to grow at a CAGR of 10.71% during the forecast period 2025-2032. 3. What is the scope of the Global Fixed Tilt Solar PV Market report? Ans: The Global Fixed Tilt Solar PV Market report helps with the PESTEL, Porter's, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Fixed Tilt Solar PV Market? Ans: The important key players in the Global Fixed Tilt Solar PV Market are - Wuxi Suntech Power Co. Ltd. (China), Yingli Solar (China), Trina Solar Limited (China), JinkoSolar Holding Co. Ltd. (China), etc. 5. What is the study period of this Fixed Tilt Solar PV Market? Ans: The Global Fixed Tilt Solar PV Market is studied from 2024 to 2032.

1. Fixed Tilt Solar PV Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Fixed Tilt Solar PV Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Fixed Tilt Solar PV Market: Dynamics 3.1. Region-wise Trends of Fixed Tilt Solar PV Market 3.1.1. North America Fixed Tilt Solar PV Market Trends 3.1.2. Europe Fixed Tilt Solar PV Market Trends 3.1.3. Asia Pacific Fixed Tilt Solar PV Market Trends 3.1.4. Middle East and Africa Fixed Tilt Solar PV Market Trends 3.1.5. South America Fixed Tilt Solar PV Market Trends 3.2. Fixed Tilt Solar PV Market Dynamics 3.2.1. Global Fixed Tilt Solar PV Market Drivers 3.2.1.1. Rising Demand for Renewable Energy Integration 3.2.2. Global Fixed Tilt Solar PV Market Restraints 3.2.3. Global Fixed Tilt Solar PV Market Opportunities 3.2.3.1. Technological Advancements in Electrical and Mechanical Design 3.2.4. Global Fixed Tilt Solar PV Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government Incentives 3.4.2. Cost Competitiveness 3.4.3. Rural Electrification Demand 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Fixed Tilt Solar PV Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 4.1.1. Crystalline Silicone 4.1.2. Thin Film 4.1.3. Others 4.2. Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 4.2.1. On-Grid 4.2.2. Off-Grid 4.3. Fixed Tilt Solar PV Market Size and Forecast, By Mounting Type (2024-2032) 4.3.1. Ground Mounted 4.3.2. Rooftop Mounted 4.4. Fixed Tilt Solar PV Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Fixed Tilt Solar PV Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 5.1.1. Crystalline Silicone 5.1.2. Thin Film 5.1.3. Others 5.2. North America Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 5.2.1. On-Grid 5.2.2. Off-Grid 5.3. North America Fixed Tilt Solar PV Market Size and Forecast, By Mounting Type (2024-2032) 5.3.1. Ground Mounted 5.3.2. Rooftop Mounted 5.4. North America Fixed Tilt Solar PV Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 5.4.1.1.1. Crystalline Silicone 5.4.1.1.2. Thin Film 5.4.1.1.3. Others 5.4.1.2. United States Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. On-Grid 5.4.1.2.2. Off-Grid 5.4.1.3. United States Fixed Tilt Solar PV Market Size and Forecast, By Mounting Type (2024-2032) 5.4.1.3.1. Ground Mounted 5.4.1.3.2. Rooftop Mounted 5.4.2. Canada 5.4.2.1. Canada Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 5.4.2.1.1. Crystalline Silicone 5.4.2.1.2. Thin Film 5.4.2.1.3. Others 5.4.2.2. Canada Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. On-Grid 5.4.2.2.2. Off-Grid 5.4.2.3. Canada Fixed Tilt Solar PV Market Size and Forecast, By Mounting Type (2024-2032) 5.4.2.3.1. Ground Mounted 5.4.2.3.2. Rooftop Mounted 5.4.3. Maxico 5.4.3.1. Mexico Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 5.4.3.1.1. Crystalline Silicone 5.4.3.1.2. Thin Film 5.4.3.1.3. Others 5.4.3.2. Mexico Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 5.4.3.2.1. On-Grid 5.4.3.2.2. Off-Grid 5.4.3.3. Mexico Fixed Tilt Solar PV Market Size and Forecast, By Mounting Type (2024-2032) 5.4.3.3.1. Ground Mounted 5.4.3.3.2. Rooftop Mounted 6. Europe Fixed Tilt Solar PV Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.2. Europe Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.3. Europe Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4. Europe Fixed Tilt Solar PV Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.1.2. United Kingdom Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4.2. France 6.4.2.1. France Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.2.2. France Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.3.2. Germany Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.4.2. Italy Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.5.2. Spain Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.6.2. Sweden Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.7.2. Austria Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 6.4.8.2. Rest of Europe Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7. Asia Pacific Fixed Tilt Solar PV Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.2. Asia Pacific Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4. Asia Pacific Fixed Tilt Solar PV Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.1.2. China Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.2.2. S Korea Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.3.2. Japan Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.4. India 7.4.4.1. India Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.4.2. India Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.5.2. Australia Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.6.2. Indonesia Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.7.2. Philippines Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.8.2. Malaysia Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.9.2. Vietnam Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.10.2. Thailand Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 7.4.11.2. Rest of Asia Pacific Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 8. Middle East and Africa Fixed Tilt Solar PV Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 8.2. Middle East and Africa Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 8.4. Middle East and Africa Fixed Tilt Solar PV Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 8.4.1.2. South Africa Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 8.4.2.2. GCC Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 8.4.3.2. Nigeria Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 8.4.4.2. Rest of ME&A Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 9. South America Fixed Tilt Solar PV Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 9.2. South America Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 9.3. South America Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 9.4. South America Fixed Tilt Solar PV Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 9.4.1.2. Brazil Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 9.4.2.2. Argentina Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Fixed Tilt Solar PV Market Size and Forecast, By Technology (2024-2032) 9.4.3.2. Rest of South America Fixed Tilt Solar PV Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Fixed Tilt Solar PV Market Size and Forecast, Mounting Type (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Mounting Type Players) 10.1. First Solar Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Canadian Solar Inc. (Canada) 10.3. Unirac (USA) 10.4. Solar FlexRack (USA) 10.5. RBI Solar (USA) 10.6. GameChange Solar (USA) 10.7. Juwi Solar Inc. (Germany) 10.8. Engie Solar (France) 10.9. Sharp Solar Energy Solutions Group (Germany) 10.10. Mounting Systems GmbH (Germany) 10.11. Schletter Group (Germany) 10.12. Solar Steel (Spain) 10.13. Wuxi Suntech Power Co. Ltd. (China) 10.14. Yingli Solar (China) 10.15. Trina Solar Limited (China) 10.16. JinkoSolar Holding Co. Ltd. (China) 11. Key Findings 12. Analyst Recommendations 13. Fixed Tilt Solar PV Market: Research Methodology