The Europe Thermal Imaging Market size was valued at USD 3.48 Billion in 2022 and the total Europe Thermal Imaging Market revenue is expected to grow at a CAGR of 10.2 % from 2023 to 2029, reaching nearly USD 6.87 Billion.Europe Thermal Imaging Market Overview

The Thermal Imaging market witnessed outstanding growth in Europe, the escalating demand for thermal cameras across diverse sectors, such as industrial, commercial, and military. These highly versatile thermal imaging cameras are proficient in detecting temperature variations in objects, making them invaluable tools for identifying potential hazards, preventing equipment breakdowns, and enhancing overall efficiency in various industries this factor significantly accelerates the growth of Europe’s Thermal Imaging Market. Among the primary applications of thermal imaging cameras, building inspections, energy auditing, predictive maintenance, fire fighting, law enforcement, and surveillance stand out prominently. In the industrial domain, these cameras play an important role in monitoring equipment health, swiftly detecting anomalies that could signal impending failures, thereby enabling proactive maintenance measures to be taken. Additionally, they contribute significantly to optimizing energy usage in buildings by identifying areas with heat loss and suggesting energy-efficient improvements. The diverse range of benefits and applications of thermal imaging cameras propelled their adoption across various sectors, signifying their indispensable value in enhancing safety, productivity, and resource optimization. The ongoing technological advancements and increasing awareness about Thermal Imaging advantages, the thermal imaging market is expected to continue its growth in the future. The qualitative and quantitative approaches are included in the report to analyze the Market data. To know deeper information on the Europe Thermal Imaging Market penetration, competitive structure, pricing, and demand analysis are involved in the report. The report includes historical data, present and future trends, competitive environment of the Europe Thermal Imaging industry.To know about the Research Methodology :- Request Free Sample Report

Europe Thermal Imaging Market Dynamics:

Europe Thermal Imaging Market Drivers Increasing Adoption in Various Industries Drives the Thermal Imaging Market Growth in Europe The increasing adoption of thermal imaging in various industries is driving the Europe Thermal Imaging Market. As the technology evolved and become more accessible, thermal imaging found applications in sectors such as aerospace, defence, automotive, healthcare, industrial, and surveillance. In the aerospace industry, thermal is important in aircraft maintenance and inspections. It helps identify potential issues in engines, heat shields, and other critical components, ensuring the safety and reliability of the flight. Furthermore, thermal imaging helps in detecting hotspots and friction-related problems in aircraft braking systems, preventing accidents and reducing downtime. The defence sector is widely included thermal imaging for surveillance, reconnaissance, and target acquisition purposes. Thermal cameras identify human and vehicle heat signatures in low-light or adverse weather conditions, providing a significant advantage in strategic situations. Additionally, thermal imaging enhances situational awareness, helping troops detect potential threats and navigate challenging environments. In the automotive industry, thermal imaging is gained prominence in advanced driver-assistance systems (ADAS). It improves pedestrian detection and helps drivers navigate safely during low-visibility conditions, such as fog or darkness. Furthermore, thermal imaging is valuable for detecting potential faults in the vehicle's electrical systems and other components, contributing to enhanced vehicle safety and reliability. Industrial applications of thermal imaging are vast and include predictive maintenance, energy efficiency assessments, and process monitoring. By identifying equipment anomalies and energy loss, industries optimize their operations, reduce downtime, and cut costs. For example, thermal imaging pinpoint overheating electrical components before they fail, preventing costly breakdowns and hazards. In the surveillance domain, thermal imaging provides a distinct advantage over traditional cameras, as it can capture images in total darkness and adverse weather conditions. Rising Demand in Automotive Industry Boosts the Growth of Thermal Imaging Market in Europe. The integration into advanced driver-assistance systems drives the growth of the Europe Thermal Imaging Market which is becoming increasingly predominant in modern vehicles. ADAS technology’s purpose is to enhance vehicle safety and provide assistance and automation for various driving tasks. Thermal imaging, when combined with other sensors like cameras and radars, offers unique benefits that contribute to safer driving experiences. One of the significant applications of thermal imaging in the automotive industry is pedestrian detection. Traditional camera-based systems face challenges in recognizing pedestrians in low-light conditions. However, thermal imaging cameras detect the heat signatures released by pedestrians and other living objects, making them more reliable in identifying potential risks. For example, if a pedestrian is crossing a poorly lit street at night, thermal imaging detects their presence even in the absence of visible light, alerting the driver of the vehicle to take appropriate action to avoid risk. Thermal imaging helps in detecting animals and other objects that are not easily visible through conventional sensors. This capability is particularly valuable in rural areas, where animals might suddenly appear on the road, posing a significant risk to drivers. The vehicle safety standards become more stringent and consumers prioritize safety features, the demand for thermal imaging in ADAS is rising. Manufacturers and automotive companies are increasingly incorporating thermal imaging technology into their vehicles to offer enhanced safety and reduce the likelihood of accidents caused by poor visibility and recognition of hazards, ultimately leading to a safer driving environment for everyone on the road this factor significantly helps to drive the Europe Thermal Imaging Market growth. For Example, Vehicle manufacturing is a strategic industry in the EU, where 13.1 million cars, vans, trucks, and buses are manufactured per year. Automobile manufacturers operate some 164 vehicle assembly and production plants in the European Union. For Instance, According to the MMR study report The European auto industry is a global player, delivering quality ‘Made in Europe’ products around the world, and generating a €101.9 billion trade surplus for the EU.According to the MMR study report, the number of registered vehicles in 2019-20 increased by 0.9% to 38.6 million, of which 31.8 million were cars. Light goods vehicles constitute the second-largest group of registered vehicles with 10.6% in 2019-20, followed by motorcycles (3.3%), other vehicles (2%), and heavy goods vehicles (1.3%). Buses and coaches accounted for just 0.4% of all registered vehicles during the year. Europe Thermal Imaging Market Restrain: Rapid Changing Technology Hampers the Europe Thermal Imaging Market Growth Technological advancements restraining factors for the Europe Thermal Imaging Market. As the technology evolves, new and improved solutions emerge, potentially outpacing or substituting existing thermal imaging technologies. Nowadays, remarkable progress in various imaging technologies, such as LiDAR, radar-based imaging, and advanced computer vision techniques. These alternatives offer distinct advantages, which limit the traditional thermal imaging market. The rise of multispectral and hyperspectral imaging is one of the primary advancements impacting the thermal imaging market. These technologies provide enhanced spectral resolution, allowing the capture of detailed information across multiple wavelengths. Different thermal imaging, which relies on infrared radiation, multispectral and hyperspectral sensors capture visible, near-infrared, and thermal data simultaneously. For example, in the agricultural sector, drones equipped with multispectral sensors assess crop health, detect diseases, and optimize irrigation by analyzing plant stress indicators across different wavelengths. This comprehensive data is more valuable than traditional thermal imaging, which mainly provides temperature-related information. Additionally, advancements in artificial intelligence and machine learning empowered computer vision technologies to perform complex tasks traditionally reserved for thermal imaging. AI-powered cameras detect anomalies, monitor security, and even estimate temperatures with impressive accuracy. This versatility could potentially reduce the need for dedicated thermal imaging devices in some applications. Europe Thermal Imaging Market Opportunity: Rising Demand for Security and Surveillance creates lucrative growth opportunities for the Europe Thermal Imaging Market. Surveillance and security are essential components of modern society, encompassing various practices and technologies aimed at safeguarding people, assets, and critical infrastructure from potential threats. In this context, thermal imaging technology is significant and valuable to enhancing surveillance and security measures. Thermal imaging cameras operate based on detecting and capturing the heat emitted by objects and living beings. Unlike traditional visible light cameras, which rely on ambient lighting conditions, thermal cameras produce images even in complete darkness or challenging weather conditions such as fog, smoke, or heavy rain. This ability makes them particularly valuable for surveillance purposes, where continuous monitoring is essential, regardless of the time of day or environmental factors this will create ample growth opportunities for Europe Thermal Imaging Market. For example, thermal imaging in surveillance is its application in border control and immigration management. Many countries in the European region utilize thermal cameras to monitor their borders and detect unauthorized crossings. These cameras are strategically positioned to survey remote and rugged areas where traditional surveillance methods may be impractical. The thermal cameras identify human and animal heat signatures, allowing border patrol agents to differentiate between genuine border crossers and potential threats. Thermal Imaging provides real-time monitoring capabilities in all lighting conditions, thermal imaging helps authorities maintain better border security and respond promptly to security breaches.

Europe Thermal Imaging Market Segment Analysis

Based on Solutions, the Hardware segment dominated the solution segment of the Europe Thermal Imaging Market in the year 2022. The high demand for thermal imaging cameras in various applications. During the forecast period, the hardware segment is the largest segment, while the software and services segments are projected to exhibit higher growth rates. The thermal imaging camera market offers a diverse range of products, from basic to high-end models, with decreasing costs that render them increasingly accessible for various applications. As a result, thermal imaging cameras are becoming more affordable, expanding their usability across a broader user base. Thermal imaging modules are used to integrate thermal imaging capabilities into other devices, such as smartphones and drones. Thermal imaging software is used to process and analyze thermal imaging data. Increasing demand for smartphones significantly boosts the Europe Thermal Imaging Market growth.Based on Product Type, The Fixed thermal cameras segment is expected to dominate the Product type Europe Thermal Imaging Market in the year 2022. Thermal cameras are the most common type of thermal imaging product. They are used in security and surveillance, industrial inspection, and medical diagnosis. Thermal scopes are used for long-range viewing and target acquisition. The military and Defence used thermal cameras. Fixed thermal cameras, also known as fixed-mount thermal. These cameras are stationary and do not have the ability to pan, tilt, or zoom like their PTZ counterparts. Instead, they offer a fixed field of view that covers a specific area or target of interest. Therefore, the fixed thermal cameras segment significantly dominates the Europe Thermal Imaging Market.

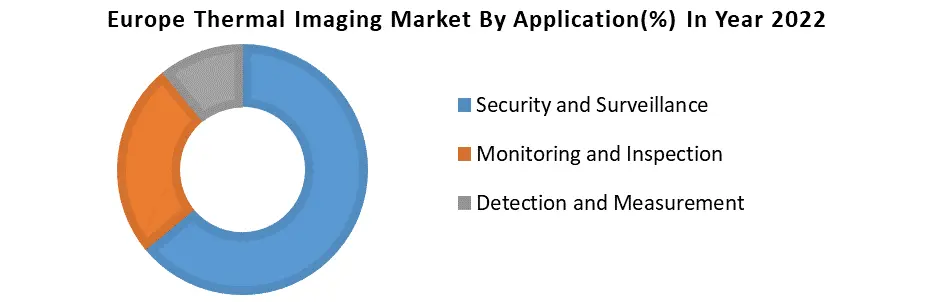

Based on the Application, the security and surveillance segment dominated the Application segment of Europe Thermal Imaging Market in the year 2022. Thermal imaging cameras offer unique advantages in security and surveillance applications, enabling efficient monitoring and detection even in challenging lighting and environmental conditions. Thermal imaging cameras are commonly used for perimeter security in critical infrastructure, military installations, industrial facilities, and commercial properties. They detect intrusions and trespassers, including individuals and vehicles, by sensing the heat emitted by these objects. Thermal cameras excel in low-light or no-light environments, providing continuous surveillance throughout the day and night. In border control and law enforcement applications, thermal imaging helps monitor borders, coastlines, and remote areas, enhancing the detection of illegal border crossings, smuggling activities, and human trafficking. The security and surveillance segment is continuously evolving, the technological advancements such as higher-resolution thermal sensors, advanced analytics, and integration with other security systems. As a result, thermal imaging continues to enhance security measures and enable proactive responses to potential threats in various European regions.

Europe Thermal Imaging Market Regional Insight

France dominated the Europe Thermal Imaging Market in the year 2022. France is the largest market for thermal imaging in Europe, accounting largest share of the Market. The country's strong defense and security sector is a major driver of the market, as is the increasing use of thermal imaging in the industrial and healthcare sectors. Thermal imaging technology finds application in industries like security, building diagnostics, and surveillance, enhancing safety and efficiency. For instance, in the security sector, thermal imaging cameras are utilized for perimeter protection of critical infrastructure and industrial facilities. These cameras detect intruders even in complete darkness or adverse weather conditions, providing real-time alerts to security personnel. This enables proactive responses to potential threats, preventing unauthorized access and safeguarding valuable assets. In building diagnostics, thermal imaging helps identify energy inefficiencies, insulation problems, and HVAC malfunctions. By conducting thermal inspections, building managers optimize energy usage, reduce operational costs, and create more comfortable environments for occupants. The broad range of applications and the continuous advancements in thermal imaging technology make it a valuable asset for various industries in France, contributing to the growth of the thermal imaging market in Europe.Europe Thermal Imaging Market Scope: Inquire before buying

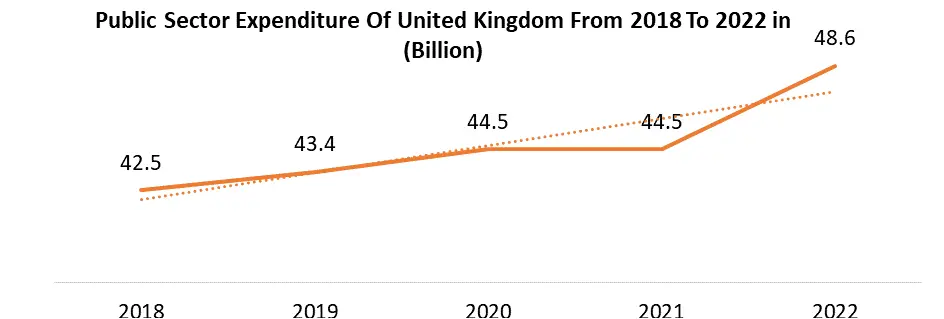

Europe Thermal Imaging Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.48 Billion. Forecast Period 2023 to 2029 CAGR: 10.2% Market Size in 2029: US $ 6.87 Billion. Segments Covered: by Solution Hardware Software Services by Product Type Fixed Thermal Cameras Handheld Thermal Cameras by Applications Security and Surveillance Monitoring and Inspection Detection and Measurement by End-User Aerospace and Defense Automotive Healthcare and Life Sciences Oil and Gas Food and Beverages Other End Users Europe Thermal Imaging Key Players:

1. FLIR Systems, Inc. 2. Axis Communications AB 3. Testo SE & Co. KGaA 4. Opgal Optronic Industries Ltd. 5. Seek Thermal, Inc. 6. BAE Systems 7. Elbit Systems 8. Raytheon Company 9. MicroEpsilon 10. Xenics 11. Thermal Imaging Services (UK) Ltd. 12. Ti Thermal Imaging LTD. 13. Pixel Thermographics 14. Honeywell International, Inc. 15. Lockheed Martin Corporation 16. Thermoteknix SystemsFAQs:

1] What segments are covered in the Europe Thermal Imaging Market report? Ans. The segments covered in the Europe Thermal Imaging Market report based on, Solutions, Product Type, Application, End-user, and Countries. 2] Which region is expected to hold the highest share in the Europe Thermal Imaging Market? Ans. France is expected to hold the highest share of the Europe Thermal Imaging Market. 3] What was the market size of the Europe Thermal Imaging Market by 2022? Ans. The market size of the Europe Thermal Imaging Market by 2022 is US$ 3.48 Bn. 4] What is the forecast period for the Europe Thermal Imaging Market? Ans. The forecast period for the Europe Thermal Imaging Market is 2023-2029. 5] What is the market size of the Europe Thermal Imaging Market in 2029? Ans. The market size of the Europe Thermal Imaging Market in 2029 is valued at US$ 6.87 Bn.

1. Europe Thermal Imaging Market: Research Methodology 2. Europe Thermal Imaging Market: Executive Summary 3. Europe Thermal Imaging Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Europe Thermal Imaging Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Europe Thermal Imaging Market: Segmentation (by Value USD and Volume Units) 5.1. Europe Thermal Imaging Market, by Solutions(2022-2029) 5.1.1. Hardware 5.1.2. Software 5.1.3. Services 5.2. Europe Thermal Imaging Market, by Product Type(2022-2029) 5.2.1. Fixed Thermal Cameras 5.2.2. Handheld Thermal Cameras 5.3. Europe Thermal Imaging Market, by Application (2022-2029) 5.3.1. Security and Surveillance 5.3.2. Monitoring and Inspection 5.3.3. Detection and Measurement 5.4. Europe Thermal Imaging Market, by End-User (2022-2029) 5.4.1. Aerospace and Defense 5.4.2. Automotive 5.4.3. Healthcare and Life Sciences 5.4.4. Oil and Gas 5.4.5. Food and Beverages 5.4.6. Other End Users 5.5. Europe Thermal Imaging Market, by Country (2022-2029) 5.5.1. UK 5.5.2. France 5.5.3. Germany 5.5.4. Italy 5.5.5. Spain 5.5.6. Sweden 5.5.7. Austria 5.5.8. Rest of Europe 6. Company Profile: Key players 6.1. FLIR Systems, Inc. 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Axis Communications AB 6.3. Testo SE & Co. KGaA 6.4. Opgal Optronic Industries Ltd. 6.5. Seek Thermal, Inc. 6.6. BAE Systems 6.7. Elbit Systems 6.8. Raytheon Company 6.9. MicroEpsilon 6.10. Xenics 6.11. Thermal Imaging Services (UK) Ltd. 6.12. Ti Thermal Imaging LTD. 6.13. Pixel Thermographics 6.14. Honeywell International, Inc. 6.15. Lockheed Martin Corporation 6.16. Thermoteknix Systems 7. Key Findings 8. Industry Recommendation