The Europe Frozen Food Market size was valued at USD 58.12 Billion in 2024 and is expected to reach USD 87.19 Billion by 2032, at a CAGR of 5.2%Europe Frozen Food Market: Overview

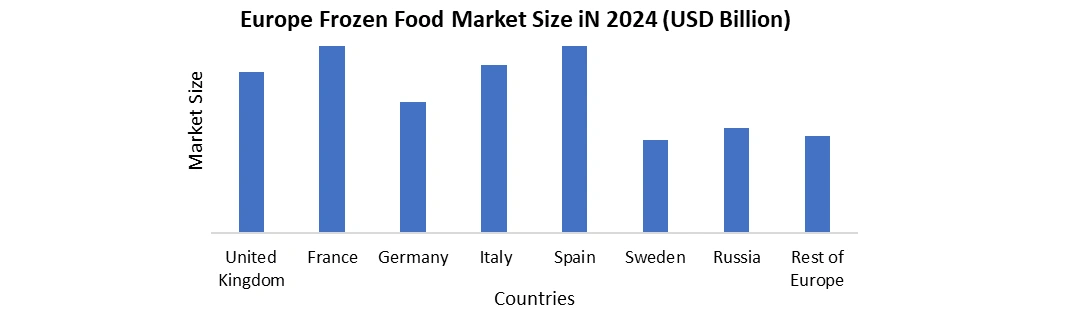

The Europe Frozen Food Market continues to witness strong growth driven by lifestyle shifts, wider freezer ownership, and expanding retail distribution. More than 75% of European consumers now keep a continuous stock of frozen products at home, reflecting rising trust in quality, safety, and nutrition retention. The region’s frozen food penetration rate has surpassed 80% across Western Europe, supported by robust cold-chain networks and advanced retail infrastructure. Key markets such as Germany, France, the UK, Italy, Spain, Belgium, and the Netherlands account for nearly 70% of regional frozen food sales, with Germany alone representing one of the highest per-capita frozen food consumption levels in Europe. Frozen bakery, frozen snacks, and frozen seafood are among the fastest-growing categories, recording mid-single-digit annual growth rates. Digitalisation further boosts market growth, with online grocery adoption rising by over 25% since 2020, strengthening demand for temperature-controlled home delivery. European consumers increasingly seek premium, clean-label frozen foods, with nearly half of shoppers preferring products free from artificial additives. Innovation in gourmet frozen meals, artisanal bakery, and ready-to-cook meal kits is reshaping the competitive landscape, positioning Europe as a global leader in high-quality frozen food solutions.To know about the Research Methodology :- Request Free Sample Report

Europe Frozen Food Market: Dynamics

Convenience & changing lifestyles in Europe to drive the Frozen Food Market The Europe Frozen Food Market is experiencing strong growth as convenience, time-saving food options, and ready-to-eat meals become central to consumer lifestyles. Rising time poverty, hectic work schedules, and the expansion of dual-income and small households are accelerating the demand for easy-to-prepare frozen meals, frozen bakery products, frozen vegetables, frozen seafood, and plant-based frozen foods. According to MMR Report, 44% of European consumers purchase frozen meals specifically for convenience, while 68% of households buy ready-to-eat frozen meals at least once a month, underscoring the growing reliance on frozen products for daily meal planning. Rapid urbanisation, strong penetration of online grocery shopping, home delivery, and click-and-collect services continue to fuel market expansion. Consumers increasingly prefer portion-controlled, cost-effective, and long-shelf-life frozen food products, especially in urban centres. Additionally, the rise of single-person households now accounting for nearly 37% of EU homes supports higher adoption of frozen convenience foods. These lifestyle and demographic trends position the Europe Frozen Food Market for sustained growth, driven by convenience, digital retail expansion, and the rising popularity of high-quality, nutritious frozen food solutions. High energy & cold-chain costs Limits the Europe Frozen Food Market Growth The Europe Frozen Food Market faces major challenges due to high energy prices, soaring cold-chain logistics costs, and tightening EU sustainability regulations. Industrial electricity prices across Europe remained 35–50% higher than pre-pandemic levels, sharply increasing the cost of freezing, blast chilling, and cold storage operations. Markets such as Germany, Italy, Spain, and the UK reported significant spikes in cold-warehouse expenses, forcing manufacturers to raise prices and reducing competitiveness versus chilled and ambient foods. Europe’s cold-chain logistics costs surged 20–30% since 2021, driven by diesel inflation, reefer truck shortages, and higher maintenance costs. Retailers also face rising refrigeration bills many supermarkets report 10–15% yearly increases leading to reduced shelf space for frozen foods. Additionally, EU Green Deal policies and F-gas restrictions require costly upgrades to energy-efficient and low-GWP refrigeration systems. These pressures collectively restrain the market by limiting SKU expansion, squeezing margins, and challenging small and mid-size frozen food producers. Plant-based & functional frozen products create lucrative growth opportunities to the market The strongest opportunity for the Europe Frozen Food Market lies in the rapid expansion of plant-based frozen foods and functional frozen products, supported by shifting dietary habits and clean-label demand. Europe is now the world’s largest plant-based food region, exceeding USD 6–7 billion, with frozen vegan meals, frozen plant-based snacks, and meat-free alternatives growing above 10% annually. Rising health consciousness is boosting demand for high-protein frozen meals, high-fibre bowls, low-salt clean-label recipes, and functional frozen yogurts and smoothies, with the segment projected to grow with highest CAGR. The consumption patterns reinforce this trend: 60% of Gen Z in Europe consumes frozen vegetables and plant-based frozen snacks weekly, accelerating category adoption. Major retailers such as Tesco, Carrefour, Aldi, and Lidl continue expanding vegan and “free-from” frozen shelves, signalling strong consumer pull. As frozen formats preserve nutrients and extend shelf life, they offer the ideal platform for innovation in healthy, sustainable, and plant-based frozen foods across Europe.Europe Frozen Food Market Segment Analysis

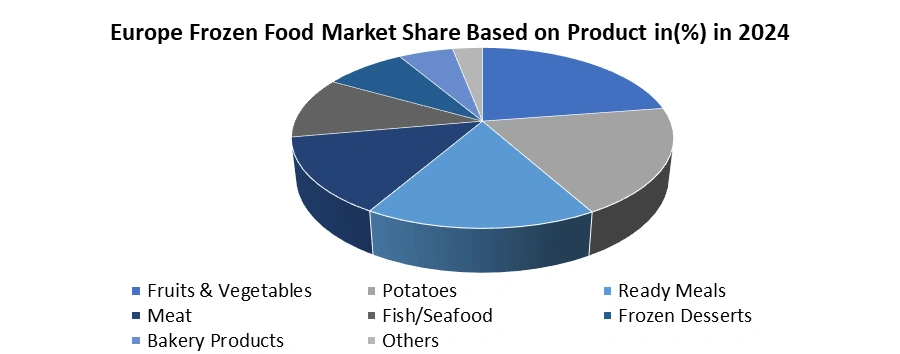

Based On Product, the Europe Frozen Food Market is segmented into Fruits & Vegetables, Potatoes, Ready Meals, Meat, Fish/Seafood, Frozen Desserts, Bakery Products, Others. because it met rising demand for healthy, affordable, and easily accessible food options. As fresh produce prices increased across Europe, consumers shifted toward frozen fruits and vegetables for stable year-round supply and consistent quality. This segment also benefited from advanced IQF freezing technology, which helps retain nutrients, texture, and flavour, making frozen produce a preferred choice for smoothies, home cooking, meal kits, and vegan diets. Climate-related disruptions and seasonal shortages further pushed retailers and households to rely on frozen alternatives for reliable availability. Supermarkets expanded their frozen aisles, giving more visibility to berries, peas, spinach, avocado, and vegetable mixes, driving strong category rotation. The segment also gained from Europe’s efficient cold-chain infrastructure, which supports fast processing after harvest, reducing waste and improving sustainability key factors influencing buyer decisions. Private-label brands strengthened the category by offering organic frozen vegetables and budget-friendly assortments. As a result, the Fruits & Vegetables category emerged as the leading product segment in the Europe Frozen Food Market.

Europe Frozen Food Market: Regional Analysis

Germany dominated the European frozen food market in 2024. Due to its strong cold-chain infrastructure, advanced freezing technologies, and high consumer adoption of convenient and premium frozen products. The country accounts for the largest share of Europe’s frozen food consumption, supported by a mature retail ecosystem and widespread household freezer penetration. Germany’s leadership is further strengthened by innovations such as IQF (Individual Quick Freezing), AI-enabled smart freezers, and automated warehouse systems that ensure consistent quality and safety. Major companies such as FRoSTA, Apetito, and Coppenrath & Wiese continue to introduce clean-label frozen meals, sustainable bakery lines, and energy-efficient production methods, shaping regional competition. Government regulations promoting food safety, sustainability, and recyclable frozen-food packaging have accelerated the adoption of eco-friendly materials and advanced logistics solutions. Germany is also one of Europe’s largest importers of frozen vegetables and berries, reflecting strong demand for ready-to-cook and nutritious frozen options. Real-time market trends show rising purchases of frozen ready meals, bakery, and plant-based foods, supported by busy lifestyles, urbanisation, and increasing preference for long-shelf-life products. As a result, Germany remains the powerhouse of the Europe Frozen Food Market, leading in innovation, technology integration, sustainable packaging, and cold-chain excellence.

Europe Frozen Food Market Competitive Landscape:

The Europe Frozen Food Market is highly competitive, driven by continuous product innovation, strong cold-chain infrastructure, and rising demand for convenient, long-shelf-life foods. Leading players such as Nomad Foods, Nestlé, Dr. Oetker, McCain, FRoSTA, Iceland Foods, and Picard are expanding their portfolios with healthier frozen ready meals, premium bakery items, plant-based frozen foods, and clean-label formulations. Companies are adopting IQF technology, AI-enabled temperature monitoring, automated warehouses, and energy-efficient freezers to enhance product quality and strengthen the regional cold-chain network. Sustainability is a major differentiator, with brands shifting to recyclable and eco-friendly frozen food packaging. Retailers across Europe are also investing in e-commerce fulfilment and rapid-delivery platforms to boost frozen food accessibility. Strategic partnerships, new flavour innovations, and digital supply-chain systems are shaping competitiveness. As consumer demand rises for convenience, affordability, and nutrition, companies are focusing on frozen food innovation, green manufacturing, and advanced logistics to lead the Europe Frozen Food Market.Europe Frozen Food Market: Research Development

In March 2025, Belgium’s Vandemoortele agreed to acquire French frozen bakery specialist Délifrance, forming Europe’s largest frozen bakery producer. The combined company offer expanded production capacity and a wide product portfolio, strengthening its presence across supermarkets, foodservice channels, and bakery chains throughout Europe and Asia.Europe Frozen Food Market Scope: Inquire before buying

Europe Frozen Food Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 58.12 Bn. Forecast Period 2025 to 2032 CAGR: 5.2% Market Size in 2032: USD 87.19 Bn. Segments Covered: by Product Fruits & Vegetables Fruits Berries Tropical Fruits Citrus Fruits Grapes Stone Fruits Others Vegetables Peas Broccoli Cauliflower Carrot Bell Paper Beans Mushroom Avocado Corn Others Potatoes Ready Meals Meat Fish/Seafood Frozen Desserts Bakery Products Others by Consumption Food Services Retail by Type Raw Material Half Cooked Ready to Eat by Freezing Technology Individual Quick Freezing (IQF) Blast Freezing Belt Freezing by Distribution Channel Food Service Retail Hypermarkets & Supermarkets Convenience Stores Online Others Europe Frozen Food Market by Region

Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia and the Rest of Europe)Europe Frozen Food Market Key Players

1. Nomad Foods Ltd. 2. Nestlé S.A. 3. Unilever PLC 4. McCain Foods Ltd. 5. Dr. Oetker (Dr. August Oetker KG) 6. FRoSTA AG 7. Iceland Foods Ltd. 8. JBS S.A. 9. Orkla ASA 10. The Kraft Heinz Company 11. Ajinomoto Co., Inc. 12. Aryzta AG 13. BRF S.A. 14. Cargill, Inc. 15. Congelados Cientocinco S.L. 16. THIS.CO 17. Ultracongelados Virto S.A.U. 18. Lantmännen Unibake International 19. Apetito 20. Picard Surgelés.Frequently Asked Questions:

1. What are the growth drivers for the Europe Frozen Food Market? Ans. The increasing prevalence of changing life style and ready to ready to eat food expected to be the major driver for the Market. 2. What is the major restraint for the Europe Frozen Food Market growth? Ans. Stringent government regulations are expected to be the major restraining factor for the Europe Frozen Food Market growth. 3. Which country is expected to lead the global Europe Frozen Food Market during the forecast period? Ans. Germany is expected to lead the global Europe Frozen Food Market during the forecast period. 4. What is the projected Europe Military Land Vehicle Market size & growth rate of the Europe Frozen Food Market? Ans. The Europe Frozen Food Market size was valued at USD 58.12 Billion in 2022 and the total Anime revenue is expected to grow at a CAGR of 5.2% from 2023 to 2029, reaching nearly USD 87.19 Billion.

1. Europe Frozen Food Market: Research Methodology 2. Europe Frozen Food Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Europe Frozen Food Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Type Segment 3.3.3. End User Segment 3.3.4. Revenue (2024) 3.3.5. Headquarter 3.4. Mergers and Acquisitions Details 4. Pricing Analysis 4.1. Global Price Trends 4.2. Price Segmentation (Premium, Mid-range, Economy) 4.3. Regional Price Comparison 4.4. Cost Structure Analysis 4.5. Factors Influencing Pricing 4.6. Forecast of Price Dynamics 5. Europe Frozen Food Market: Dynamics 5.1. Europe Frozen Food Market Trends by Region 5.2. Europe Frozen Food Market Dynamics 5.2.1.1. Drivers 5.2.1.2. Restraints 5.2.1.3. Opportunities 5.2.1.4. Challenges 5.3. PORTER’s Five Forces Analysis 5.4. PESTLE Analysis 5.5. Value Chain Analysis 5.6. Analysis of Government Schemes and Initiatives for Europe Frozen Food Market 6. Europe Frozen Food Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 6.1. Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.1.1. Fruits & Vegetables 6.1.1.1. Fruits 6.1.1.1.1. Berries 6.1.1.1.2. Tropical Fruits 6.1.1.1.3. Citrus Fruits 6.1.1.1.4. Grapes 6.1.1.1.5. Stone Fruits 6.1.1.1.6. Others 6.1.1.2. Vegetables 6.1.1.2.1. Peas 6.1.1.2.2. Broccoli 6.1.1.2.3. Cauliflower 6.1.1.2.4. Carrot 6.1.1.2.5. Bell Paper 6.1.1.2.6. Beans 6.1.1.2.7. Mushroom 6.1.1.2.8. Avocado 6.1.1.2.9. Corn 6.1.1.2.10. Others 6.1.2. Potatoes 6.1.3. Ready Meals 6.1.4. Meat 6.1.5. Fish/Seafood 6.1.6. Frozen Desserts 6.1.7. Bakery Products 6.1.8. Others 6.2. Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.2.1. Food Services 6.2.2. Retail 6.3. Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.3.1. Raw Material 6.3.2. Half Cooked 6.3.3. Ready to Eat 6.4. Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.4.1. Individual Quick Freezing (IQF) 6.4.2. Blast Freezing 6.4.3. Belt Freezing 6.5. Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.1. Food Service 6.5.2. Retail 6.5.3. Hypermarkets & Supermarkets 6.5.4. Convenience Stores 6.5.5. Online 6.5.6. Others 6.6. Europe Europe Frozen Food Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.6.1.2. United Kingdom Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.6.1.3. United Kingdom Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.6.1.4. United Kingdom Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.6.1.5. United Kingdom Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.2. France 6.6.2.1. France Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.6.2.2. France Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.6.2.3. France Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.6.2.4. France Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.6.2.5. France Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.6.3.2. Germany Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.6.3.3. Germany Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.6.3.4. Germany Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.6.3.5. Germany Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.6.4.2. Italy Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.6.4.3. Italy Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.6.4.4. Italy Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.6.4.5. Italy Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.6.5.2. Spain Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.6.5.3. Spain Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.6.5.4. Spain Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.6.5.5. Spain Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.6. Russia 6.6.6.1. Russia Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.6.6.2. Russia Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.6.6.3. Russia Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.6.6.4. Russia Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.6.6.5. Russia Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.7. Rest of Europe 6.6.7.1. Rest of Europe Europe Frozen Food Market Size and Forecast, By Product (2024-2032) 6.6.7.2. Rest of Europe Europe Frozen Food Market Size and Forecast, By Consumption (2024-2032) 6.6.7.3. Rest of Europe Europe Frozen Food Market Size and Forecast, By Type (2024-2032) 6.6.7.4. Rest of Europe Europe Frozen Food Market Size and Forecast, By Freezing Technology (2024-2032) 6.6.7.5. Rest of Europe Europe Frozen Food Market Size and Forecast, By Distribution Channel (2024-2032) 7. Company Profile: Key Players 7.1. Nomad Foods Ltd. 7.1.1. Company Overview 7.1.2. Business Portfolio 7.1.3. Financial Overview 7.1.4. SWOT Analysis 7.1.5. Strategic Analysis 7.1.6. Recent Developments 7.2. Nestlé S.A. 7.3. Unilever PLC 7.4. McCain Foods Ltd. 7.5. Dr. Oetker (Dr. August Oetker KG) 7.6. FRoSTA AG 7.7. Iceland Foods Ltd. 7.8. JBS S.A. 7.9. Orkla ASA 7.10. The Kraft Heinz Company 7.11. Ajinomoto Co., Inc. 7.12. Aryzta AG 7.13. BRF S.A. 7.14. Cargill, Inc. 7.15. Congelados Cientocinco S.L. 7.16. THIS.CO 7.17. Ultracongelados Virto S.A.U. 7.18. Lantmännen Unibake International 7.19. Apetito 7.20. Picard Surgelés. 8. Key Findings 9. Analyst Recommendations