The Europe Embedded Security Market size was valued at USD 3.09 billion in 2024, and the total Revenue is expected to grow at a CAGR of 5.9 % from 2025 to 2032, reaching nearly USD 4.89 billion.Europe Embedded Security Market Overview:

The MMR report provides an extensive analysis of the Europe Embedded Security Market, covering the regional threat landscape, including IoT/device attacks, data breach trends, ICS attack rates, and emerging vectors such as AI/ML-enabled malware and firmware exploits. It examines protection and resilience frameworks, encompassing EU regulatory initiatives like NIS2 and the Cyber Resilience Act, breach response strategies, proactive monitoring, and employee training programs. The report also analyzes adoption metrics and market penetration by enterprise size and industry, integration with existing IT infrastructure, ROI and cost-benefit considerations, and key adoption barriers. Pricing, licensing, and business models are evaluated, including hardware versus software approaches, tiered pricing, TCO, and the shift toward subscription-based models. the study covers the patent and innovation landscape, technological advancements in secure boot, firmware protection, AI/ML-based intrusion detection, cloud-edge security approaches, and trusted execution environments. The ecosystem and vendor landscape, investment trends, M&A activities, and strategic collaborations are also detailed, alongside the regulatory and compliance framework encompassing GDPR, industry-specific standards, Cyber Resilience Act implications, and AI transparency considerations, providing a 360-degree view for strategic decision-making. The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.To know about the Research Methodology :- Request Free Sample Report Embedded system security is an important process used to reduce the vulnerabilities along with providing protection against different threats in software that are running on embedded devices. It is mostly found in IT fields, and the embedded system security further comprises of a conscientious approach for making hardware design along with coding as well as added security software thereby giving an adherence for best practices with the experts. The Europe embedded security market is segmented into security type, product, and application. Based on security type, the market is classified into content protection, authentication and access management, and payment. On the basis of product, the market for embedded security includes hardware security module, secure element and embedded sim, hardware tokens, and trusted platform module. Automotive, industrial, wearables, smart identity cards, smartphones and tablets, computers, payment processing and cards are the various application areas for embedded security market in Europe. Countries in Europe understand the importance of embedded security and each year the embedded world exhibition and conference in Nuremberg offers the embedded companies an opportunity to gather information regarding new products as well as innovations further developing valuable contacts within the industry. Synopsys Software Integrity Group (SIG) for example provides a platform of technologically advanced solutions to improve the quality and security of software. Application of this platform includes automated analysis along with testing of technologies that are integrated seamlessly within the software development process. This further enables organizations to detect as well as remediate defects, vulnerabilities, or any sort of compliance issues throughout the software development lifecycle further boosting the importance of embedded systems and its security. The benefits of embedded security are huge. These risks are substantial with the catastrophic consequences in today’s world. These security systems are linked through the Internet of Things security that remains a broad issue with multiple dimensions. Protection against reverse engineering, software replication prevented, maximum integrity protection of the application, feature-on-demand activation, and flexible management of access rights are some of the security functions delivered by the embedded security. Europe has been one of the key region when it comes to technological development and usage of new technologies and security systems for various industry verticals. Optimizing the industrial function and smart connected devices are some of the major factors to drive the Embedded Security application hugely for Embedded Security in Europe.

Europe Embedded Security Market Segment Analysis

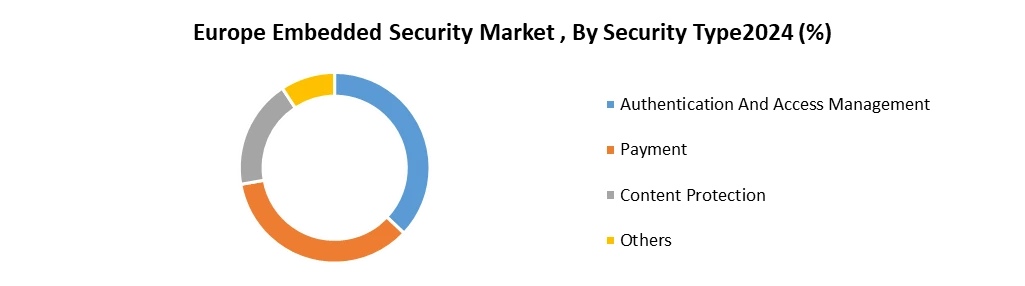

Based on the Component, In 2024, Hardware is expected to dominate the Europe Embedded Security Market, driven by the widespread use of secure elements (SEs), Trusted Platform Modules (TPMs), and Hardware Security Modules (HSMs) across automotive, industrial, and IoT applications. The emphasis on device-level protection, tamper resistance, and cryptographic key storage makes hardware-based solutions essential for compliance with stringent European cybersecurity regulations. Software holds a significant share owing to its critical role in managing firmware protection, authentication protocols, and real-time threat monitoring, enabling flexible integration with existing enterprise security architectures. Meanwhile, the Service segment including consulting, integration, and managed security services is witnessing rapid growth as enterprises seek expert support for implementing and maintaining embedded security frameworks, particularly in cloud-connected and legacy system environments. Overall, Hardware leads in market value due to its foundational role in secure device architecture, while Service is projected to grow the fastest, driven by increasing demand for customization, lifecycle management, and regulatory compliance across Europe.Based on the Security Type, In 2024, Authentication and Access Management is expected to dominate the Europe Embedded Security Market due to its widespread integration across automotive, industrial, and consumer electronics applications to ensure device identity, secure boot, and user authentication in compliance with GDPR and NIS2 directives. Payment security holds a substantial share, driven by the proliferation of digital payments, contactless transactions, and secure elements in POS terminals, wearables, and mobile devices. Content Protection is gaining importance with the expansion of digital media, OTT platforms, and connected entertainment systems requiring encryption and DRM technologies to safeguard intellectual property. Others, including secure communication protocols, data encryption modules, and firmware protection solutions, contribute to specialized industrial and defense-grade applications. Overall, Authentication and Access Management leads in value and deployment breadth, while Payment and Content Protection segments are poised for faster growth, supported by regulatory compliance, fintech innovation, and rising demand for secure digital ecosystems across Europe.

Europe Embedded Security market Key Highlights:

• Europe Embedded Security market size analysis and forecast • Comprehensive study and analysis of market drivers, restraints, and opportunities influencing the growth of the Europe Embedded Security market • Europe Embedded Security Market segmentation on the basis of security type, product, application, and geography • Europe Embedded Security Market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of the study • Europe Embedded Security Market analysis and forecast for major countries has been provided. • Profiling of key industry players, their strategic perspective, and analysis of core competencies • Competitive landscape of the key players operating in the Europe Embedded Security Market including competitive developments, investments, and strategic expansionYears that have been considered for the study are as follows:

• Base Year – 2018 • Estimated Year – 2019 • Forecast Period – 2019 to 2026 For company profiles, 2016 has been considered as the base year. In cases, wherein information was unavailable for the base year, the years prior to it have been considered.Europe Embedded Security market Research Methodology:

The market is estimated by triangulation of data points obtained from various sources and feeding them into a simulation model created individually for each market. The data points are obtained from paid and unpaid sources along with paid primary interviews with key opinion leaders (KOLs) in the market. KOLs from both, demand and supply side were considered while conducting interviews to get the unbiased idea of the market. This exercise was done at the country level to get the fair idea of the market in countries considered for this study. Later this country-specific data was accumulated to come up with regional numbers and then arrive at the market value for Europe Embedded Security MarketEurope Embedded Security market Key Target Audience:

• Embedded security technology platform developers • Raw material and material testing equipment suppliers • Embedded security original design manufacturers (ODMs) • Embedded security original equipment manufacturers (OEMs) • End-users/enterprise-users • Research institutes and organizations • Government bodies, venture capitalists, and private equity firms • Market research and consulting firms • Enterprise data center professionalsThe Scope of the Europe Embedded Security Market: Inquire before buying

Europe Embedded Security Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.09 Bn. Forecast Period 2025 to 2032 CAGR: 5.9% Market Size in 2032: USD 4.89 Bn. Segments Covered: by Component Hardware Secure Element Embedded SIM Trusted Platform Modules Hardware Security Modules Hardware Token Software Service by Security Type Authentication And Access Management Payment Content Protection Others by Deployment On-premise Cloud by End-User Automotive Healthcare Consumer Electronics Telecommunications Aerospace & defense Others Europe Embedded Security Market, by Region

• Europe • UK • Germany • Italy • France • Russia • Spain • OthersEurope Embedded Security market Geographic Analysis:

• Breakdown of UK Embedded Security market • Breakdown of Germany Embedded Security market • Breakdown of Italy Embedded Security market • Breakdown of France Embedded Security market • Breakdown of Russia Embedded Security market • Breakdown of Spain Embedded Security market • Breakdown of Others Embedded Security marketSome of the key players of the Europe Embedded Security market include:

1. Infineon Technologies AG 2. STMicroelectronics NV 3. Renesas Electronics Corp. 4. NXP Semiconductors NV 5. Qualcomm Inc. 6. IDEMIA 7. Thales Group 8. emproof B.V. 9. ELSYS Design 10. Hitex 11. Kudelski Group 12. NewTec GmbH 13. Riscure 14. in-tech GmbH 15. Secure-IC 16. IAR 17. AO Kaspersky Lab 18. Exein 19. ProvenRun 20. emlix GmbH 21. PHYTEC Messtechnik GmbH 22. OthersFrequently Asked Questions:

1] What segments are covered in the Europe Embedded Security Market report? Ans. The segments covered in the Europe Embedded Security Market report are based on Component, Security Type, Deployment, End-Use, and Country. 2] What is the market size of the Europe Embedded Security Market by 2032? Ans. The market size of the Europe Embedded Security Market by 2032 is USD 4.89 Bn. 3] What is the growth rate of the Europe Embedded Security Market? Ans. The Europe Embedded Security Market is growing at a CAGR of 5.9 % during the forecasting period 2025-2032. 4] What was the market size of the Europe Embedded Security Market in 2024? Ans. The market size of the Europe Embedded Security Market in 2024 was USD 3.09 Bn. 5] What major key players are covered in the Market report?? Ans. The major key players in the market are Infineon Technologies AG, STMicroelectronics NV, Renesas Electronics Corp., NXP Semiconductors NV, Qualcomm Inc., IDEMIA, Others

1. Europe Embedded Security Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Country 2. Europe Embedded Security Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. End Use 2.3.5. Revenue 2024 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. R&D Investment 2.3.9. Certification Levels 2.3.10. Patents 2.3.11. Innovation/Upgradation 2.3.12. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Europe Embedded Security Market: Dynamics 3.1. Europe Embedded Security Market Trends 3.2. Europe Embedded Security Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Europe Embedded Security Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Regional Threat Landscape – Europe 4.1. Average IoT/device attacks in Europe (2019–2024) 4.2. Data protection breach incidents and trends 4.3. Attack rates in industrial control systems (ICS) by sub-region 4.4. Emerging attack vectors targeting connected embedded devices (AI/ML-enabled malware, firmware exploits) 5. Protection & Resilience Frameworks 5.1. EU regulatory initiatives (NIS2 Directive, Cyber Resilience Act) 5.2. Effective breach response in European enterprises 5.3. Best practices for proactive threat detection and continuous monitoring 5.4. Employee training & awareness programs for embedded system security 6. Adoption Metrics & Market Penetration 2024 6.1. Adoption rates by enterprise size (SMEs vs. Large Enterprises) of embedded security 6.2. Industry-wise adoption of embedded security frameworks 6.3. Integration with existing IT & security infrastructure in European enterprises 6.4. ROI & cost-benefit analysis of embedded security investments (Hardware + Cloud Services) 6.5. Key barriers to adoption (Cost, Skills Gap, Interoperability, Regulation) 7. Pricing, Licensing, and Business Models 7.1. Hardware-Based vs. Software Licensing in Embedded Security 7.2. Tiered pricing models by device volume & industry complexity 7.3. Total cost of ownership (TCO) for enterprise deployments in Europe 7.4. ROI and payback period analysis for OEMs and end-users 7.5. Shift toward subscription & service-based embedded security models 8. Infrastructure & Integration Considerations 8.1. Role of Secure Elements, TPMs, and Hardware Security Modules (HSMs) 8.2. Challenges of integrating embedded security in legacy systems 8.3. Secure Over-the-Air (OTA) updates & cloud-edge security integration 8.4. Data encryption, authentication & key management requirements 8.5. Vendor lock-in risks & interoperability challenges across European supply chains 9. Patent & Innovation Landscape in Europe 9.1. Patent filing trends in embedded hardware & secure communication protocols 9.2. Academic-Industry collaborations in European research clusters 9.3. Emerging innovations — Post-Quantum Cryptography, AI-Driven Embedded Security, Edge AI Security 9.4. Roadmap of technology maturation for automotive, healthcare, and industrial use cases 10. Technological Advancements in Embedded Security 10.1. Advancements in secure boot, firmware protection & device identity management 10.2. AI/ML integration for real-time intrusion detection at the embedded level 10.3. Cloud-Native vs. Edge-Based Embedded Security Approaches 10.4. Self-learning and automated security updates for connected devices 10.5. Advances in visualization & dashboards for security monitoring 10.6. Cross-industry adoption of Trusted Execution Environments (TEE) 11. Ecosystem & Vendor Landscape in Europe 11.1. Leading European OEMs integrating embedded security (Automotive, Healthcare, IIoT) 11.2. Global semiconductor & security vendors active in Europe 11.3. Cloud & edge providers enabling embedded security services 11.4. Role of startups & open-source projects in driving innovation 11.5. Strategic collaborations between European enterprises, research labs, and policy institutions 12. Investment & Strategic Landscape 12.1. European investment trends in embedded security startups 12.2. Venture capital, private equity & EU strategic funding programs 12.3. Mergers & acquisitions in the European embedded security ecosystem 12.4. Intellectual property & patent acquisitions by leading players 12.5. Future roadmap: Federated Learning, Quantum-Safe Security, AI-Enhanced Embedded Systems 13. Regulatory & Compliance Framework in Europe 13.1. EU data privacy & security standards impacting embedded security (GDPR, NIS2 Directive) 13.2. Industry-specific compliance requirements (Automotive ISO 21434, Healthcare MDR, Industrial IEC 62443, Telecom ENISA Guidelines) 13.3. Cyber Resilience Act & its implications for device manufacturers 13.4. Push for AI transparency & explainability in security applications 13.5. Comparative analysis: European standards vs. North America & Asia-Pacific approaches 14. Europe Embedded Security Market: Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 14.1. Europe Embedded Security Market Size and Forecast, By Component (2024-2032) 14.1.1. Hardware 14.1.1.1. Secure Element 14.1.1.2. Embedded SIM 14.1.1.3. Trusted Platform Modules 14.1.1.4. Hardware Security Modules 14.1.1.5. Hardware Token 14.1.2. Software 14.1.3. Service 14.2. Europe Embedded Security Market Size and Forecast, By Security Type (2024-2032) 14.2.1. Authentication And Access Management 14.2.2. Payment 14.2.3. Content Protection 14.2.4. Others 14.3. Europe Embedded Security Market Size and Forecast, By Deployment (2024-2032) 14.3.1. On-premise 14.3.2. Cloud 14.4. Europe Embedded Security Market Size and Forecast, By End-Use (2024-2032) 14.4.1. Automotive 14.4.2. Healthcare 14.4.3. Consumer Electronics 14.4.4. Telecommunications 14.4.5. Aerospace & defense 14.4.6. Others 14.5. Europe Embedded Security Market Size and Forecast, By Country (2024-2032) 14.5.1. United Kingdom 14.5.2. France 14.5.3. Germany 14.5.4. Italy 14.5.5. Spain 14.5.6. Sweden 14.5.7. Russia 14.5.8. Rest of Europe 15. Company Profile: Key Players 15.1. Infineon Technologies AG 15.1.1. Company Overview 15.1.2. Business Portfolio 15.1.3. Financial Overview 15.1.4. SWOT Analysis 15.1.5. Strategic Analysis 15.2. STMicroelectronics NV 15.3. Renesas Electronics Corp. 15.4. NXP Semiconductors NV 15.5. Qualcomm Inc. 15.6. IDEMIA 15.7. Thales Group 15.8. emproof B.V. 15.9. ELSYS Design 15.10. Hitex 15.11. Kudelski Group 15.12. NewTec GmbH 15.13. Riscure 15.14. in-tech GmbH 15.15. Secure-IC 15.16. IAR 15.17. AO Kaspersky Lab 15.18. Exein 15.19. ProvenRun 15.20. emlix GmbH 15.21. PHYTEC Messtechnik GmbH 15.22. Others 16. Key Findings 17. Analyst Recommendations 18. Europe Embedded Security Market – Research Methodology