The Global Engineering Plastic Compound Market size was valued at USD 302.04 Billion in 2024, and the total Engineering Plastic Compound Market revenue is expected to grow at a CAGR of 7.9% from 2025 to 2032, reaching nearly USD 554.93 Billion.Engineering Plastic Compound Market Overview

Engineering plastics, known as construction plastics, can be used for the most demanding applications in terms of mechanical strength, heat resistance, and resistance to chemical attack. In many cases, engineering plastics are an excellent alternative to metals, glass, or even ceramics. With function integrated design and construction as well as sophisticated production methods, customized compounds can be used for realizing high-quality and cost-efficient components. They offer a unique potential for innovation in a wide variety of applications, such as automotive and industrial, renewable energy, medical technology, and transport. Compounding with its specific possibilities is the key to achieving the necessary material properties. The engineering plastics compounding systems by BUSS are the support for the production of such specialized materials.To know about the Research Methodology:-Request Free Sample Report The demand for engineering plastic compounds is seeing a strong growth, which is inspired by their better performance in motor vehicles, electrical, and industrial applications. Industries shift toward lightweight, durable, and sustainable materials, supply chains are scaling to meet evolving needs with customized, high-performance solutions. Strategic sourcing and innovation are important for maintaining a competitive edge, ensuring timely distribution and quality stability between fluctuations in global markets, to lead the company in this dynamic and price-driven scenario. The Asia-Pacific region dominated the engineering plastic compound market due to rapid industrialization and automotive growth, especially in China and India. Leading businesses consist of BASF SE, SABIC, Dow Inc., Covestro AG, and DSM, recognized for their innovation and strong global distribution networks. The report consists of precise data and other appropriate information about the market for engineering plastic compounds, such as market trends, sales reviews, recent developments (both current and expected), SWOT analysis of Companies, PESTLE analysis, Porter's five forces analysis, and details on other potential revenue generation prospects in unexplored operational areas. The engineering plastic compounds market research covers current industry competitors' threats and difficulties, as well as those posed by possible new market entrants. The report includes an analysis at the regional and countrywide levels that incorporates the forces of supply and demand that are influencing the market's growth, a competitive landscape that includes the market shares of the major players as well as new initiatives and business strategies adopted by those players, and thorough company profiles that include information on the products offered, significant financial data, recent developments, SWOT analysis, and business strategies used by the major market players.

Engineering Plastic Compound Market Recent Trends

High-Performance Polymers for EVs • Developing flame-retardant PPS & PBT for battery components • Research on self-extinguishing PA66 for charging infrastructure • Nanocomposite coatings for thermal management in battery packs 2. Sustainable Material Innovations • Bio-based PA610 & PA56 from renewable feedstocks • Chemical recycling of PC/ABS blends for the circular economy • Ocean plastic-derived compounds for automotive applicationsEngineering Plastic Compound Market Dynamics

Surging Demand from Electric Vehicle (EV) Manufacturing to Boost the Engineering Plastic Compound Market Growth The rapid global shift toward electric mobility is significantly boosting demand for engineering plastic compounds. EVs require lightweight, high-performance materials to replace metals in battery housings, charging connectors, and thermal management systems. Polymers like PPS, PBT, and flame-retardant PA66 are critical for their heat resistance, electrical insulation, and weight reduction properties. With EV production projected to grow at a 25% CAGR (2025-2032), plastic compounders are innovating to meet stringent safety and durability standards. For instance, PPS-based compounds now enable thinner, lighter battery components that withstand 200°C+ temperatures. This trend is further accelerated by government mandates like the EU’s 2035 ICE ban, pushing automakers to adopt advanced plastics. The EV sector could account for 30% of engineering plastic demand by 2032, creating a $15B+ opportunity for high-performance formulations. Volatile Raw Material Prices and Supply Chain Disruptions are the Major Restraints for the Engineering Plastic Compound Market Key feedstocks like benzene (for PA6) and bisphenol-A (for PC) are subject to price swings due to crude oil volatility and trade restrictions. For example, the 2023 EU benzene shortage caused PA6 prices to spike by 40%, squeezing manufacturer margins. Additionally, regional conflicts and shipping bottlenecks disrupt glass fiber and flame-retardant additive supplies, delaying production. Smaller compounders struggle to absorb these costs, leading to consolidation in the market. While long-term contracts and bio-alternatives (e.g., bio-based PA) are emerging solutions, raw material instability remains a top industry concern, potentially slowing adoption in price-sensitive sectors like consumer electronics. Circular Economy Trends and the Growing Role of Recycled Engineering Plastics: Unlocking New Opportunities for the Engineering Plastic Compound Market The push for sustainability is unlocking a USD 8–10B opportunity in recycled and bio-based engineering plastics. Advanced recycling technologies now enable depolymerization of PA6/PA66 from carpet waste and chemical recycling of PC from e-waste, achieving virgin-like quality. Major players like SABIC and BASF are investing in closed-loop systems, while regulations like the EU’s PPWR mandate 30% recycled content in packaging and automotive plastics by 2032. Startups are also innovating with ocean plastic-derived POM and carbon-fiber-reinforced recycled PA for high-value applications. This shift not only meets ESG goals but also offers 10–15% cost savings versus virgin polymers, attracting automakers and electronics brands. The recycled engineering plastics segment could grow at 12% CAGR through 2032, driven by circular economy policies and corporate net-zero commitments.Engineering Plastic Compound Market Segment Analysis

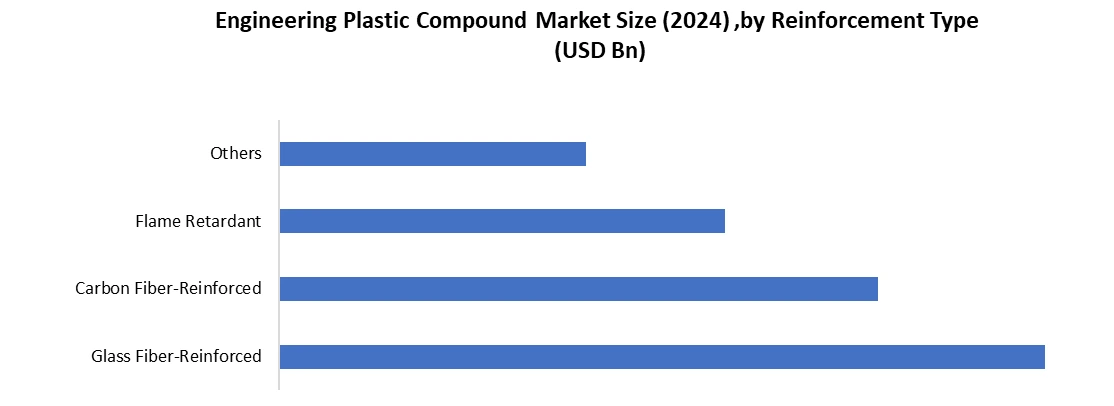

Based on Reinforcement Type The Engineering Plastic Compound Market is segmented into Glass Fiber-Reinforced, Carbon Fiber-Reinforced, Flame Retardant, and Others. The Glass Fiber-Reinforced segment dominates the Engineering Plastic Compound Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance by their optimal balance of performance and cost-efficiency. These materials, particularly PA6-GF30 and PP-GF20 grades, deliver exceptional strength-to-weight ratios (up to 50% lighter than metals) while costing 60-70% less than carbon fiber alternatives. Key sectors like automotive (under-the-hood components, structural parts) and electrical enclosures rely on them for stiffness, dimensional stability, and corrosion resistance. Though carbon fiber-reinforced plastics are growing faster in premium applications (aerospace, luxury EVs), glass fiber remains the volume leader due to its broader affordability and manufacturability. Flame-retardant variants are also gaining traction, especially in EV battery housings and 5G infrastructure, but still trail glass fiber in total market penetration.

Engineering Plastic Compound Market Regional Analysis

The Asia-Pacific (APAC) region dominated the global engineering plastic compound market, driven by China’s booming EV and electronics sectors. North America follows with 25-30% market share, fueled by advanced applications in aerospace (PEEK, PPS) and automotive lightweighting. Europe, particularly Germany, Germany leading in high-performance compounds for automotive and industrial uses, while sustainability regulations boost bio-based plastic adoption. Emerging markets like India and Southeast Asia are growing, supported by manufacturing shifts from China and local EV production. The Middle East & Africa and south America remain smaller but are expanding in oil & gas and construction applications, leveraging corrosion-resistant polymers. APAC’s cost-competitive production and North America’s innovation edge position these regions as key growth engines, with global market value projected to exceed USD 650 billion by 2032.Engineering Plastic Compound Market Competitive Landscape

The global engineering plastic compound market is dominated by BASF SE, SABIC, and DuPont, with 2024 revenues of USD 6.8B, USD 5.2B, and USD 4.5B, respectively, driven by their strong portfolios in high-performance polymers such as PA, PC, and PBT for automotive and electronics. These leaders compete through continuous R&D (e.g., BASF’s Ultramid Advanced for EVs), strategic acquisition and regional expansion. Lanxess and Covestro focus on permanent solutions, including bio-based PA and recycled PC/ABS, while Mitsubishi leads in high-temperature LCP and PPS for 5G and EV applications. Celanese differentiates with acetal copolymer innovations, and the flame-ion for the lithium-ion batteries is accelerated in the launder-retardant compounds. Regional players such as Kingfa Science (China) and RTP Company (U.S.) are gaining traction through cost-effective characteristic compounds, intensifying price competition. Startups such as EconCore (recycled Honeycom Composite) are an emerging niche with lightweighting technologies. The market is moving towards the model of the circular economy, with top firms investing to maintain dominance in chemical recycling and AI-operated material development (Dupont). Engineering Plastic Compound Market Recent Development 1. BASF SE 15 May 2024: Launched Ultramid Advanced N3H bio-based PA6.6 22 January 2025 (planned): Start of commercial production for chemically recycled PA6 in Ludwigshafen 2. SABIC 3 April 2024: Introduced LNP THERMOCOMP FR-AD PPS compound 14 October 2025 (scheduled): New flame-retardant PC/ABS production line in Saudi Arabia 3. Lanxess 27 February 2024: Commercialized Durethan ECO PA6 18 June 2025 (announced): New PBT compounding facility in China 4. Mitsubishi Chemical 9 January 2024: Novarex PC-1101 optical-grade PC introduction 30 September 2025 (planned): Biodegradable PHA pilot plant operational in Japan 5. DuPont 7 March 2024: Released Zytel HTN PPA for 5G applications 5 November 2025 (confirmed): Opening of circular economy innovation center in GenevaEngineering Plastic Compound Market Scope: Inquire before buying

Global Engineering Plastic Compound Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 302.04 Bn. Forecast Period 2025 to 2032 CAGR: 7.9% Market Size in 2032: USD 554.93 Bn. Segments Covered: by Polymer Type Polycarbonate (PC) Polyamide (PA) Polymethyl Methacrylate (PMMA) Polyacetal / Polyoxymethylene (POM) Polyethylene Terephthalate (PET) Polybutylene Terephthalate (PBT) Polyphenylene Oxide (PPO) / PPE Blends Fluoropolymers (PTFE and other fluoropolymers) Polyphenylene Sulfide (PPS) Acrylonitrile Butadiene Styrene (ABS) Styrene‑Acrylonitrile (SAN) Thermoplastic Elastomers (TPEs) TPE‑s: Styrenic Block Copolymers TPE‑o: Thermoplastic Polyolefin Elastomers TPE‑v: Thermoplastic Vulcanizates TPE‑u: Thermoplastic Polyurethanes TPE‑e: Thermoplastic Copolyesters TPE‑a: Thermoplastic Polyamides Others by Reinforcement Type Glass Fiber-Reinforced Carbon Fiber-Reinforced Flame Retardant Others by Processing Method Injection Molding Extrusion Blow Molding Compression Molding Others by End-User Industry Automotive Electrical & Electronics Packaging Industrial & Machinery Building & Construction Medical Others Engineering Plastic Compound Market, by Region

• North America (United States, Canada, Mexico) • Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, the Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) • Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) • South America (Brazil, Argentina, Colombia, Chile, Rest of South America)North America Engineering Plastic Compound Market Key Players

1. DuPont (U.S.) 2. Celanese Corporation (U.S.) 3. RTP Company (U.S.) 4. SABIC Innovative Plastics (U.S./Saudi HQ but major NA operations) 5. LyondellBasell (U.S.) Europe Engineering Plastic Compound Market Key Players 1. BASF SE (Germany) 2. Lanxess (Germany) 3. Covestro (Germany) 4. Arkema (France) 5. Solvay((Belgium) Asia Pacific Engineering Plastic Compound Market Key Players 1. Mitsubishi Chemical Corporation (Japan) 2. Toray Industries (Japan) 3. Teijin Limited (Japan) 4. Kingfa Science & Technology (China) 5. CHIMEI Corporation (Taiwan) 6. LG Chem (South Korea) Middle East and Africa Engineering Plastic Compound Market Key Players 1. SABIC (Saudi Arabia) - Regional market leader 2. Borouge (UAE, JV between ADNOC & Borealis) 3. Advanced Petrochemical Company (Saudi Arabia) 4. National Petrochemical Industrial Company (NATPET) (Saudi Arabia) South America Engineering Plastic Compound Market Key Players 1. Braskem (Brazil) - Market leader in Latin America 2. Elekeiroz (Brazil) 3. Mossi & Ghisolfi (M&G Group)Frequently Asked Questions:

1. What is the study period of the market? Ans. The Global Engineering Plastic Compound Market is studied from 2024-2032. 2. What is the growth rate of the Engineering Plastic Compound Market? Ans. The Engineering Plastic Compound Market is growing at a CAGR of 7.9% over the forecast period. 3. What is the market size of the Engineering Plastic Compound Market by 2032? Ans. The market size of the Information Technology Market by 2032 is expected to reach USD 554.93 Bn. 4. What is the forecast period for the Engineering Plastic Compound Market? Ans. The forecast period for the Engineering Plastic Compound Market is 2025-2032. 5. What was the market size of the Engineering Plastic Compound Market in 2024? Ans. The market size of the Engineering Plastic Compound Market in 2024 was valued at USD 302.04 Bn.

1. Engineering Plastic Compound Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Engineering Plastic Compound Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Engineering Plastic Compound Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Engineering Plastic Compound Market: Dynamics 3.1. Engineering Plastic Compound Market Trends by Region 3.1.1. North America Engineering Plastic Compound Market Trends 3.1.2. Europe Engineering Plastic Compound Market Trends 3.1.3. Asia Pacific Engineering Plastic Compound Market Trends 3.1.4. Middle East and Africa Engineering Plastic Compound Market Trends 3.1.5. South America Engineering Plastic Compound Market Trends 3.2. Engineering Plastic Compound Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Engineering Plastic Compound Market Drivers 3.2.1.2. North America Engineering Plastic Compound Market Restraints 3.2.1.3. North America Engineering Plastic Compound Market Opportunities 3.2.1.4. North America Engineering Plastic Compound Market Challenges 3.2.2. Europe 3.2.2.1. Europe Engineering Plastic Compound Market Drivers 3.2.2.2. Europe Engineering Plastic Compound Market Restraints 3.2.2.3. Europe Engineering Plastic Compound Market Opportunities 3.2.2.4. Europe Engineering Plastic Compound Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Engineering Plastic Compound Market Drivers 3.2.3.2. Asia Pacific Engineering Plastic Compound Market Restraints 3.2.3.3. Asia Pacific Engineering Plastic Compound Market Opportunities 3.2.3.4. Asia Pacific Engineering Plastic Compound Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Engineering Plastic Compound Market Drivers 3.2.4.2. Middle East and Africa Engineering Plastic Compound Market Restraints 3.2.4.3. Middle East and Africa Engineering Plastic Compound Market Opportunities 3.2.4.4. Middle East and Africa Engineering Plastic Compound Market Challenges 3.2.5. South America 3.2.5.1. South America Engineering Plastic Compound Market Drivers 3.2.5.2. South America Engineering Plastic Compound Market Restraints 3.2.5.3. South America Engineering Plastic Compound Market Opportunities 3.2.5.4. South America Engineering Plastic Compound Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Engineering Plastic Compound Industry 3.8. Analysis of Government Schemes and Initiatives For Engineering Plastic Compound Industry 3.9. Engineering Plastic Compound Market Trade Analysis 3.10. The Global Pandemic Impact on Engineering Plastic Compound Market 4. Engineering Plastic Compound Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 4.1.1. Polycarbonate (PC) 4.1.2. Polyamide (PA) 4.1.3. Polymethyl Methacrylate (PMMA) 4.1.4. Polyacetal / Polyoxymethylene (POM) 4.1.5. Polyethylene Terephthalate (PET) 4.1.6. Polybutylene Terephthalate (PBT) 4.1.7. Polyphenylene Oxide (PPO) / PPE Blends 4.1.8. Fluoropolymers (PTFE and other fluoropolymers) 4.1.9. Polyphenylene Sulfide (PPS) 4.1.10. Acrylonitrile Butadiene Styrene (ABS) 4.1.11. Styrene‑Acrylonitrile (SAN) 4.1.12. Others 4.2. Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 4.2.1. Glass Fiber-Reinforced 4.2.2. Carbon Fiber-Reinforced 4.2.3. Flame Retardant 4.2.4. Others 4.3. Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 4.3.1. Injection Molding 4.3.2. Extrusion 4.3.3. Blow Molding 4.3.4. Compression Molding 4.3.5. Others 4.4. Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 4.4.1. Automotive 4.4.2. Electrical & Electronics 4.4.3. Packaging 4.4.4. Industrial & Machinery 4.4.5. Building & Construction 4.4.6. Medical 4.4.7. Others 4.5. Engineering Plastic Compound Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Engineering Plastic Compound Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 5.1.1. Polycarbonate (PC) 5.1.2. Polyamide (PA) 5.1.3. Polymethyl Methacrylate (PMMA) 5.1.4. Polyacetal / Polyoxymethylene (POM) 5.1.5. Polyethylene Terephthalate (PET) 5.1.6. Polybutylene Terephthalate (PBT) 5.1.7. Polyphenylene Oxide (PPO) / PPE Blends 5.1.8. Fluoropolymers (PTFE and other fluoropolymers) 5.1.9. Polyphenylene Sulfide (PPS) 5.1.10. Acrylonitrile Butadiene Styrene (ABS) 5.1.11. Styrene‑Acrylonitrile (SAN) 5.1.12. Others 5.2. North America Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 5.2.1. Glass Fiber-Reinforced 5.2.2. Carbon Fiber-Reinforced 5.2.3. Flame Retardant 5.2.4. Others 5.3. North America Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 5.3.1. Injection Molding 5.3.2. Extrusion 5.3.3. Blow Molding 5.3.4. Compression Molding 5.3.5. Others 5.4. North America Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 5.4.1. Automotive 5.4.2. Electrical & Electronics 5.4.3. Packaging 5.4.4. Industrial & Machinery 5.4.5. Building & Construction 5.4.6. Medical 5.4.7. Others 5.5. North America Engineering Plastic Compound Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 5.5.1.1.1. Polycarbonate (PC) 5.5.1.1.2. Polyamide (PA) 5.5.1.1.3. Polymethyl Methacrylate (PMMA) 5.5.1.1.4. Polyacetal / Polyoxymethylene (POM) 5.5.1.1.5. Polyethylene Terephthalate (PET) 5.5.1.1.6. Polybutylene Terephthalate (PBT) 5.5.1.1.7. Polyphenylene Oxide (PPO) / PPE Blends 5.5.1.1.8. Fluoropolymers (PTFE and other fluoropolymers) 5.5.1.1.9. Polyphenylene Sulfide (PPS) 5.5.1.1.10. Acrylonitrile Butadiene Styrene (ABS) 5.5.1.1.11. Styrene‑Acrylonitrile (SAN) 5.5.1.1.12. Others 5.5.1.2. United States Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 5.5.1.2.1. Glass Fiber-Reinforced 5.5.1.2.2. Carbon Fiber-Reinforced 5.5.1.2.3. Flame Retardant 5.5.1.2.4. Others 5.5.1.3. United States Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 5.5.1.3.1. Injection Molding 5.5.1.3.2. Extrusion 5.5.1.3.3. Blow Molding 5.5.1.3.4. Compression Molding 5.5.1.3.5. Others 5.5.1.4. United States Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 5.5.1.4.1. Automotive 5.5.1.4.2. Electrical & Electronics 5.5.1.4.3. Packaging 5.5.1.4.4. Industrial & Machinery 5.5.1.4.5. Building & Construction 5.5.1.4.6. Medical 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 5.5.2.1.1. Polycarbonate (PC) 5.5.2.1.2. Polyamide (PA) 5.5.2.1.3. Polymethyl Methacrylate (PMMA) 5.5.2.1.4. Polyacetal / Polyoxymethylene (POM) 5.5.2.1.5. Polyethylene Terephthalate (PET) 5.5.2.1.6. Polybutylene Terephthalate (PBT) 5.5.2.1.7. Polyphenylene Oxide (PPO) / PPE Blends 5.5.2.1.8. Fluoropolymers (PTFE and other fluoropolymers) 5.5.2.1.9. Polyphenylene Sulfide (PPS) 5.5.2.1.10. Acrylonitrile Butadiene Styrene (ABS) 5.5.2.1.11. Styrene‑Acrylonitrile (SAN) 5.5.2.1.12. Others 5.5.2.2. Canada Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 5.5.2.2.1. Glass Fiber-Reinforced 5.5.2.2.2. Carbon Fiber-Reinforced 5.5.2.2.3. Flame Retardant 5.5.2.2.4. Others 5.5.2.3. Canada Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 5.5.2.3.1. Injection Molding 5.5.2.3.2. Extrusion 5.5.2.3.3. Blow Molding 5.5.2.3.4. Compression Molding 5.5.2.3.5. Others 5.5.2.4. Canada Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 5.5.2.4.1. Automotive 5.5.2.4.2. Electrical & Electronics 5.5.2.4.3. Packaging 5.5.2.4.4. Industrial & Machinery 5.5.2.4.5. Building & Construction 5.5.2.4.6. Medical 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 5.5.3.1.1. Polycarbonate (PC) 5.5.3.1.2. Polyamide (PA) 5.5.3.1.3. Polymethyl Methacrylate (PMMA) 5.5.3.1.4. Polyacetal / Polyoxymethylene (POM) 5.5.3.1.5. Polyethylene Terephthalate (PET) 5.5.3.1.6. Polybutylene Terephthalate (PBT) 5.5.3.1.7. Polyphenylene Oxide (PPO) / PPE Blends 5.5.3.1.8. Fluoropolymers (PTFE and other fluoropolymers) 5.5.3.1.9. Polyphenylene Sulfide (PPS) 5.5.3.1.10. Acrylonitrile Butadiene Styrene (ABS) 5.5.3.1.11. Styrene‑Acrylonitrile (SAN) 5.5.3.1.12. Others 5.5.3.2. Mexico Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 5.5.3.2.1. Glass Fiber-Reinforced 5.5.3.2.2. Carbon Fiber-Reinforced 5.5.3.2.3. Flame Retardant 5.5.3.2.4. Others 5.5.3.3. Mexico Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 5.5.3.3.1. Injection Molding 5.5.3.3.2. Extrusion 5.5.3.3.3. Blow Molding 5.5.3.3.4. Compression Molding 5.5.3.3.5. Others 5.5.3.4. Mexico Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 5.5.3.4.1. Automotive 5.5.3.4.2. Electrical & Electronics 5.5.3.4.3. Packaging 5.5.3.4.4. Industrial & Machinery 5.5.3.4.5. Building & Construction 5.5.3.4.6. Medical 5.5.3.4.7. Others 6. Europe Engineering Plastic Compound Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.2. Europe Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.3. Europe Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.4. Europe Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5. Europe Engineering Plastic Compound Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.1.2. United Kingdom Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.1.3. United Kingdom Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.1.4. United Kingdom Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5.2. France 6.5.2.1. France Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.2.2. France Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.2.3. France Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.2.4. France Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.3.2. Germany Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.3.3. Germany Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.3.4. Germany Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.4.2. Italy Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.4.3. Italy Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.4.4. Italy Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.5.2. Spain Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.5.3. Spain Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.5.4. Spain Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.6.2. Sweden Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.6.3. Sweden Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.6.4. Sweden Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.7.2. Austria Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.7.3. Austria Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.7.4. Austria Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 6.5.8.2. Rest of Europe Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 6.5.8.3. Rest of Europe Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 6.5.8.4. Rest of Europe Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7. Asia Pacific Engineering Plastic Compound Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.2. Asia Pacific Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.3. Asia Pacific Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.4. Asia Pacific Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5. Asia Pacific Engineering Plastic Compound Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.1.2. China Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.1.3. China Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.1.4. China Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.2.2. S Korea Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.2.3. S Korea Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.2.4. S Korea Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.3.2. Japan Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.3.3. Japan Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.3.4. Japan Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.4. India 7.5.4.1. India Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.4.2. India Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.4.3. India Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.4.4. India Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.5.2. Australia Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.5.3. Australia Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.5.4. Australia Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.6.2. Indonesia Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.6.3. Indonesia Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.6.4. Indonesia Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.7.2. Malaysia Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.7.3. Malaysia Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.7.4. Malaysia Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.8.2. Vietnam Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.8.3. Vietnam Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.8.4. Vietnam Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.9.2. Taiwan Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.9.3. Taiwan Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.9.4. Taiwan Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 7.5.10.4. Rest of Asia Pacific Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 8. Middle East and Africa Engineering Plastic Compound Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 8.2. Middle East and Africa Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 8.3. Middle East and Africa Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 8.4. Middle East and Africa Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 8.5. Middle East and Africa Engineering Plastic Compound Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 8.5.1.2. South Africa Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 8.5.1.3. South Africa Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 8.5.1.4. South Africa Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 8.5.2.2. GCC Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 8.5.2.3. GCC Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 8.5.2.4. GCC Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 8.5.3.2. Nigeria Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 8.5.3.3. Nigeria Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 8.5.3.4. Nigeria Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 8.5.4.2. Rest of ME&A Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 8.5.4.3. Rest of ME&A Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 8.5.4.4. Rest of ME&A Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 9. South America Engineering Plastic Compound Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 9.2. South America Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 9.3. South America Engineering Plastic Compound Market Size and Forecast, by Processing Method(2024-2032) 9.4. South America Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 9.5. South America Engineering Plastic Compound Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 9.5.1.2. Brazil Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 9.5.1.3. Brazil Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 9.5.1.4. Brazil Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 9.5.2.2. Argentina Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 9.5.2.3. Argentina Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 9.5.2.4. Argentina Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Engineering Plastic Compound Market Size and Forecast, by Polymer Type (2024-2032) 9.5.3.2. Rest Of South America Engineering Plastic Compound Market Size and Forecast, by Reinforcement Type (2024-2032) 9.5.3.3. Rest Of South America Engineering Plastic Compound Market Size and Forecast, by Processing Method (2024-2032) 9.5.3.4. Rest Of South America Engineering Plastic Compound Market Size and Forecast, by End User Industry (2024-2032) 10. Company Profile: Key Players 10.1. DuPont (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Celanese Corporation (U.S.) 10.3. RTP Company (U.S.) 10.4. SABIC Innovative Plastics (U.S./Saudi HQ but major NA operations) 10.5. LyondellBasell (U.S.) 10.6. BASF SE (Germany) 10.7. Lanxess (Germany) 10.8. Covestro (Germany) 10.9. Arkema (France) 10.10. Solvay((Belgium) 10.11. Mitsubishi Chemical Corporation (Japan) 10.12. Toray Industries (Japan) 10.13. Teijin Limited (Japan) 10.14. Kingfa Science & Technology (China) 10.15. CHIMEI Corporation (Taiwan) 10.16. LG Chem (South Korea) 10.17. SABIC (Saudi Arabia) - Regional market leader 10.18. Borouge (UAE, JV between ADNOC & Borealis) 10.19. Advanced Petrochemical Company (Saudi Arabia) 10.20. National Petrochemical Industrial Company (NATPET) (Saudi Arabia) 10.21. Braskem (Brazil) - Market leader in Latin America 10.22. Elekeiroz (Brazil) 10.23. Mossi & Ghisolfi (M&G Group) 11. Key Findings 12. Industry Recommendations 13. Engineering Plastic Compound Market: Research Methodology 14. Terms and Glossary