The Cruise Market size was valued at USD 17.98 Billion in 2024 and the total Cruise revenue is expected to grow at a CAGR of 7.97% from 2025 to 2032, reaching nearly USD 33.21 Billion.Cruise Market Overview and Scope

The cruise market is a thriving sector in the travel and tourism industry, offering unique experiences to global travellers. The report analyses the global cruise market, including market trends, production, distribution, consumption and growth potential. Research on market factors: demographics, urbanisation, technology and consumer preferences. Report on e-commerce's impact on last-mile delivery in the cruise industry. Research on logistics tech innovations and challenges in maintaining operations and customer satisfaction in the cruise industry. Report on cruise industry trends: omnichannel demand, automation/robotics adoption, sustainable logistics and blockchain-based supply chain integration. This study analyses the use of cloud-based cruise management systems with AI and machine learning to improve operational efficiency and decision-making.To know about the Research Methodology :- Request Free Sample Report North America, Europe, Asia, South America, Africa and the Middle East. Insights on regional variations in cruise networks, infrastructure, regulations and consumer behaviour are comprehensive. The report emphasises sustainability in cruise systems, focusing on waste reduction, efficient packaging and renewable energy integration for transportation and on-board activities. The report evaluates top cruise market providers, analysing their strategies, products, market positions and M&A activities. This study examines how global economic conditions, trade regulations and policies impact the cruise industry. Report for cruise industry stakeholders with valuable insights and analysis. Aims to inform decision-making, identify growth opportunities and navigate the changing cruise market. Report analyses the global cruise industry with a focus on sustainability, innovation and consumer trends. Report analyses current trends, drivers, challenges and opportunities in cruise market. Provides stakeholders with insights to improve operations, simplify supply chains and leverage industry opportunities.

Cruise Market Dynamics

Various factors impact the growth and landscape of the market. Factors drive Cruise Market growth. Efficient management and operations are key to driving growth in the cruise ship market. Cruise companies aim to improve their services and enhance passenger experiences. Itinerary planning, entertainment, amenities and customer service impact satisfaction and demand. Growing demand for unique vacation experiences has boosted the Market. Cruise industry expanding due to convenience, luxury and entertainment. Cruise lines prioritise safety, health protocols and sustainability to address traveller concerns and ensure a positive experience. Tech advances drive Cruise Market growth and innovation. Cruise companies are adopting digitalization and technology to improve their operations. Offering advanced booking systems, onboard automation, IoT connectivity and personalised digital experiences for passengers. Cruise companies are using data analytics and AI to improve decision-making, optimise resources and enhance customer engagement. Cruise Market prioritises environmental sustainability. Cruise companies invest in eco-friendly initiatives to reduce environmental impact. Adopt cleaner fuels, implement waste management and recycling programmes and use energy-efficient technologies on ships. Sustainability aligns with environmental goals and meets expectations of eco-conscious travellers. Cruise industry competition is challenging for industry players. Cruise companies differentiate through unique itineraries, onboard experiences and exceptional customer service. Competitive market, companies innovate and invest in ships, amenities and entertainment to attract and retain passengers. Cruise lines must stay competitive by adapting to changing consumer preferences and anticipating emerging trends. Geopolitical changes and regulations pose challenges for the Market. Cruise lines face challenges with regulations, safety standards and immigration policies in different destinations. Ensuring compliance with regulations and addressing geopolitical uncertainties are key concerns for their operations. Cruise market offers growth and success opportunities. Increasing demand for themed, niche and expedition cruises presents opportunities for cruise companies to meet specific customer preferences. Using digital technologies like VR and AR can improve the pre-cruise experience by letting passengers virtually explore destinations and onboard facilities. Customised marketing, loyalty programmes and collaborations with travel agents and online platforms can aid cruise companies in drawing and retaining clients. The Cruise Market is influenced by various factors. Factors like cruise ship management, demand for unique vacations, technology, sustainability and competition shape the industry. Cruise companies must adapt to market dynamics to succeed in a competitive industry and meet traveller expectations.Global Cruise Market Segment Analysis

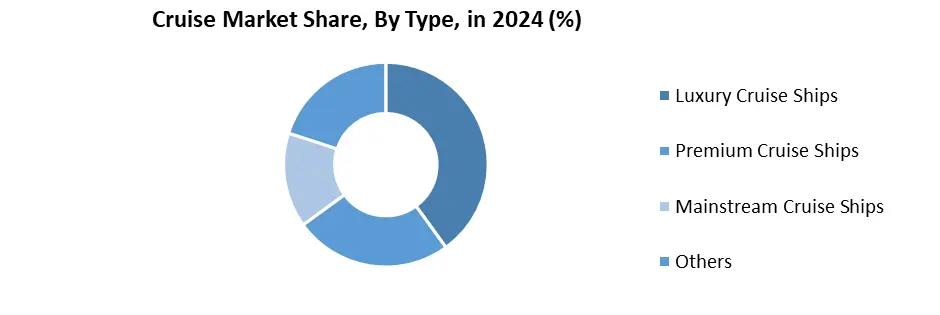

Based on Type, The Luxury Cruise Ships segment caters to affluent travelers seeking exclusive, high-end experiences with personalized services and premium amenities. In 2024, this segment was valued at approximately USD xx billion, accounting for around 15% of the global cruise market, and is projected to expand rapidly as demand for ultra-luxury and expedition-style voyages rises among high-net-worth individuals. Operators such as Regent Seven Seas Cruises, Silversea Cruises, and Seabourn dominate this space with smaller vessels, gourmet dining, curated shore excursions, and exotic itineraries to destinations such as Antarctica, the Galápagos, and the Arctic. The Premium Cruise Ships segment, comprising nearly 30–32% of global revenue, targets upper-middle-class travelers who prioritize comfort, immersive experiences, and high-quality service without the exclusivity of luxury cruises. Brands like Celebrity Cruises and Princess Cruises lead this category, offering refined onboard experiences, enhanced culinary options, and destination-rich itineraries across regions such as the Mediterranean and Alaska. The Mainstream Cruise Ships segment remains the largest contributor, capturing roughly 50–55% of the total cruise market in 2024, supported by strong brand presence, affordable pricing, and high passenger capacity. Operators such as Carnival Cruise Line, Royal Caribbean International, and MSC Cruises dominate this category, offering family-oriented itineraries, extensive entertainment options, and short-to-medium-duration voyages. The Others category including niche and adventure cruise types like river and expedition cruises accounts for about 3–5% of the market, but is growing rapidly as travelers increasingly seek smaller, sustainable, and destination-focused experiences. Overall, as the global Cruise Market valued at USD xx billion in 2024 is projected to reach USD xx billion by 2032 at a 6.7% CAGR, diversification across cruise types will remain a key driver of growth and passenger engagement.

Regional Analysis

Regional analysis of the cruise market provides insights on market dynamics, cultural influences and buying patterns in specific locations. Regional trends are vital for cruise companies to customize offerings and marketing strategies to meet specific passenger demands. North America dominates the cruise market with established infrastructure and strong cruise culture. Strong cruise industry with advanced ports and diverse options in the region. US and Canada are North America's primary markets. Cruise lines offer diverse routes to popular locations such as the Caribbean, Alaska and Mexico. Europe is a major market for cruises, with diverse destinations and cultural experiences. The Mediterranean is a popular cruise destination for its historic cities, picturesque coastlines and cultural heritage. High demand for Northern European cruises to Norway and the Baltic. Euro cruise lines focus on immersive experiences and diverse passenger preferences. Asia Pacific shows potential for cruise industry growth. Cruise tourism is increasing in China, Japan and Australia due to rising disposable incomes, a growing middle class and a desire for unique travel experiences. Cruise lines cater to Asian preferences with customised amenities, dining and entertainment. South America has potential for cruise market, with Brazil and Argentina as key players. Geographic diversity and natural attractions such as the Amazon River and Galapagos Islands are appealing to cruise travellers. Global travellers seek cultural immersion and exotic landscapes on South American cruises. Middle East and Africa presents opportunities and challenges in the cruise market. Dubai is a major hub for luxurious cruise tourism with access to the Arabian Gulf. Regional cruise options are shaped by cultural influences and authenticity. Regulations and port infrastructure in some African countries hinder market growth. Regional traits, culture and market dynamics influence cruise companies' strategies and offerings. Customised offerings by cruise lines based on regional trends and consumer demands improve passenger satisfaction. Regional differences are important for cruise companies to reap market opportunities and establish a global presence.Global Cruise Market Competitive Analysis

The cruise industry is highly competitive with global, regional and niche players competing for market share. Carnival Corp., Royal Caribbean, Norwegian Cruise Line Holdings and MSC Cruises are major players in the global cruise market. Top companies with large fleets, varied itineraries and strong brand recognition are industry leaders. Cruise lines invest heavily in fleet expansion, renovation and innovation to stay competitive. New ships with innovative features, amenities and entertainment options are introduced to attract and retain passengers. Companies enhance onboard experiences with dining, entertainment and activities for different passenger demographics. Regional and niche cruise lines are important in certain markets, alongside major players. Luxury cruise companies such as Regent Seven Seas Cruises, Crystal Cruises and Seabourn cater to affluent travellers with customised services and upscale experiences. River cruise companies like Viking and AmaWaterways focus on inland waterway trips, providing personalised and engaging adventures. Newcomers in the cruise industry tend to target specific regions or niche markets. Companies differentiate by unique itineraries, themes, or catering to specific demographics. Expedition cruise companies target adventure travellers with trips to remote locations such as Antarctica and the Galapagos. Tech and digitalization are crucial for cruise companies to remain competitive. Cruise lines invest in advanced onboard technologies to improve passenger experience, such as high-speed internet, interactive entertainment systems and mobile apps. They use digital marketing, social media and online booking to attract customers and increase direct bookings. Cruise market often involves partnerships and collaborations. Cruise lines partner with tourism boards, airlines and hotels to enhance travel experiences and appeal to diverse passengers. Strategic alliances help cruise companies expand itineraries, access new markets and offer unique shore excursions. Competitive analysis is vital for cruise companies to maintain a competitive edge. Market research includes tracking competitors, spotting trends and evaluating customer preferences. Market analysis helps cruise lines adjust offerings, pricing and marketing to stay competitive in the global industry.Cruise Market Scope : Inquire Before Buying

Global Cruise Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 17.98 Bn. Forecast Period 2025 to 2032 CAGR: 7.97% Market Size in 2032: USD 33.21 Bn. Segments Covered: by Type Luxury Cruise Ships Premium Cruise Ships Mainstream Cruise Ships Others by Size Small Ships (Under 500 passengers) Medium Ships (500-1500 passengers) Large Ships (1500+ passengers) by Propulsion Diesel-Powered Cruise Ships LNG-Powered Cruise Ships Hybrid Cruise Ships Electric Cruise Ships Others by Application Vacation Cruises Themed Cruises Others Cruise Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cruise Market, Key Players

1. SAP SE 2. Meyer Werft GmbH & Co. KG 3. Carnival 4. Royal Caribbean Group 5. Norwegian Cruise Line Holdings Ltd. 6. MSC Cruises 7. Disney Cruise Line 8. Viking Cruises 9. Genting Hong Kong 10. Ponant Cruises 11. Celestyal Cruises 12. Chantiers de l'Atlantique 13. Mitsubishi Heavy Industries, Ltd 14. Lloyd Werft Bremerhaven AG 15. Seabourn Cruise Line 16. Princess Cruises 17. Silversea Cruises 18. Norwegian Cruise Line Holdings 19. Disney Cruise Line 20. Holland America Line 21. Celebrity Cruises 22. Costa Cruises 23. Cunard Line 24. AIDA Cruises 25. P&O Cruises 26. Viking Cruise 27. Azamara 28. Marella Cruises 29. Fred. Olsen Cruise Lines 30.OthersFrequently Asked Questions:

1. How has the cruise market been affected by the COVID-19 pandemic? Ans: The cruise market has been significantly impacted by the COVID-19 pandemic, with widespread disruptions, suspensions of operations and stringent health and safety protocols. 2. What is the expected cruise market size by 2032? Ans: The expected cruise market size by 2032 is USD 33.21 Bn. 3. How do cruise companies ensure passenger safety and security on board their ships? Ans: Cruise companies prioritize passenger safety and security through rigorous safety protocols, emergency response plans, trained crew members, surveillance systems and adherence to international maritime regulations. 4. What are the popular cruise destinations and itineraries offered by cruise lines? Ans: Popular cruise destinations include the Caribbean, Mediterranean, Alaska, Northern Europe, Asia and South America, with itineraries ranging from short trips to longer voyages exploring multiple ports of call. 5. How do cruise companies differentiate their offerings and cater to different passenger demographics, such as families, couples and solo travellers? Ans: Cruise companies differentiate their offerings by providing diverse onboard activities, entertainment options, dining experiences and accommodations tailored to different passenger demographics, ensuring a memorable, personalized experience for each group.

1. Cruise Market: Executive Summary 1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032), 1.1.2. Market Size (USD Million) and Market Share (%) - By Segments, Regions and Country 2. Global Cruise Market: Competitive Landscape 2.1 MMR Competition Matrix 2.2 Cruise Market : Competitive Positioning 2.3 Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Segment 2.3.4. Fleet Size & Capacity 2.3.5. Onboard Amenities & Services 2.3.6. Pricing Models 2.3.7. Technology & Innovation 2.3.8. Onboard Amenities & Services 2.3.9. Sustainability Initiatives 2.3.10. Customer Satisfaction & Ratings 2.3.11. Marketing & Distribution Effectiveness 2.3.12. R&D Investment 2.3.13. Revenue (2024) 2.3.14. Market Share (%) 2.3.15. Revenue Growth Rate (YoY) 2.3.16. Geographic Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Market Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.1.1 Drivers 3.1.2 Restraints 3.1.3 Opportunities 3.1.4 Challenges 3.2 PORTER’s Five Forces Analysis 3.3 PESTLE Analysis 3.4 Analysis of Government Schemes and Initiatives on the Industry 4 Regulatory Overview 4.1 Safety regulations and industry standards for shipbuilding and operations 4.2 Health protocols for passengers and crew 4.3 Licensing, certification, and compliance requirements 4.4 Other applicable regional or international regulations 5 Pricing & Revenue Analysis (2024) 5.1 Average ticket price by cruise type (2019–2024) 5.2 Revenue trends and growth forecasts 5.3 Profitability benchmarks by cruise segment 5.4 Ancillary revenue streams: excursions, onboard dining, and entertainment 5.5 Impact of promotions, discounts, and loyalty programs on revenue 5.6 Comparison of revenue per passenger across different cruise categories 6 Investment & Strategic Opportunities 6.1 Expansion opportunities in emerging regions 6.2 Potential for themed, luxury, or expedition cruises 6.3 Collaboration with ports, tourism boards, and travel agencies 6.4 Strategic partnerships with technology providers for onboard innovation 6.5 Investment in eco-friendly and energy-efficient ships 6.6 Risk and opportunity analysis for stakeholders 7 Consumer Insights & Behavior 7.1 Passenger demographics: age, income, and travel preferences 7.2 Travel purpose: leisure, adventure, family, or business 7.3 Booking patterns: online, travel agents, or direct bookings 7.4 Influence of lifestyle, social media, and experiences on cruise choice 7.5 Passenger spending behavior onboard (excursions, dining, entertainment) 7.6 Emerging trends in consumer preferences (eco-conscious travel, wellness) 8 Supply Chain & Port Infrastructure Analysis 8.1 Overview of major cruise ports globally and regionally 8.2 Port capacity, docking facilities, and accessibility for different ship sizes 8.3 Key suppliers in the cruise ecosystem (shipbuilders, fuel providers, onboard services) 8.4 Logistics challenges: fuel supply, maintenance, and turnaround efficiency 8.5 Emerging port developments and expansion projects 8.6 Strategic importance of port partnerships and regional collaborations 9 Marketing & Distribution Channels 9.1 Overview of cruise booking channels: online, travel agents, OTAs, direct bookings 9.2 Promotional strategies adopted by key cruise operators 9.3 Role of social media, influencer marketing, and digital campaigns 9.4 Regional variations in customer acquisition and booking trends 9.5 Loyalty programs, memberships, and repeat customer engagement 9.6 Marketing effectiveness and ROI analysis across channels 10 Innovation & Size Adoption 10.1 Smart ships: IoT, onboard connectivity, and passenger personalization 10.2 AI-based analytics for customer experience and operational efficiency 10.3 Automation and robotics in cruise operations and services 10.4 Advanced propulsion and fuel-efficient technologies 10.5 Digital booking platforms and mobile apps for passenger engagement 10.6 Emerging technology trends in sustainability and operational efficiency 11 Sustainability & ESG Initiatives 11.1 Environmental impact mitigation: emissions reduction, fuel efficiency, and alternative fuels 11.2 Waste management and recycling practices onboard 11.3 Water treatment, energy conservation, and sustainable resource use 11.4 Compliance with international environmental regulations (IMO, MARPOL, etc.) 11.5 Corporate Social Responsibility (CSR) initiatives and community engagement 11.6 ESG reporting, certifications, and sustainability benchmarks 12 Fleet and Capacity Analysis 12.1 Global Fleet Size and Ship Orderbook Overview 12.2 Cruise Ship Construction Pipeline (2024–2030) 12.3 Fleet Distribution by Cruise Type and Operator 12.4 Average Passenger Capacity and Fleet Age Analysis 12.5 Shipbuilding Trends and Leading Shipyards 13 Port Infrastructure and Destination Analysis 13.1 Global Cruise Port Network Overview 13.2 Key Regional Cruise Hubs and Their Capacities 13.3 Port Upgrades, Expansion Projects, and Investments 13.4 Economic Contribution to Local Tourism Economies 13.5 Case Study: Smart and Sustainable Cruise Ports 14 Production and Shipbuilding Hotspots 14.1 Overview of Global Cruise Shipbuilding Capacity 14.2 Leading Shipbuilding Nations and Key Yards 14.3 Cost and Time Analysis of Cruise Ship Construction 14.4 Role of European and Asian Shipbuilders in Supply Chain 14.5 Investment Trends in Cruise Ship Manufacturing 15 Thematic and Luxury Cruise Analysis 15.1 Rise of Boutique, Culinary, and Adventure Cruises 15.2 High-Net-Worth Passenger Targeting and Customization 15.3 Growth of Charter Cruises and Private Voyages 15.4 Experiential Tourism and Brand Differentiation 15.5 Future Trends in Ultra-Luxury Cruise Experiences 16 Statistical Insights and Market Indicators 16.1 Global Passenger Volume Growth (2018–2032) 16.2 Occupancy Rates and Average Cabin Utilization 16.3 Revenue per Passenger (RPP) and Revenue per Available Cabin (RevPAC) 16.4 Global Fleet Capacity and Utilization Ratios 16.5 Booking Lead Times and Seasonality Patterns 16.6 Cruise Pricing Index (By Destination and Class) 16.7 Economic Impact Metrics: Employment, Port Revenue, and Tourism Multipliers 16.8 Comparative Statistics: Ocean vs. River vs. Expedition Cruises 17 Cruise Market: Global Market Size and Forecast By Segmentation (by Value in USD Billion) (2024-2032) 17.1 Cruise Market Size and Forecast, By Type (2024-2032) 17.1.1 Luxury Cruise Ships 17.1.2 Premium Cruise Ships 17.1.3 Mainstream Cruise Ships 17.1.4 Others 17.2 Cruise Market Size and Forecast, By Size (2024-2032) 17.2.1 Small Ships (Under 500 passengers) 17.2.2 Medium Ships (500-1500 passengers) 17.2.3 Large Ships (1500+ passengers) 17.3 Cruise Market Size and Forecast, By Propulsion (2024-2032) 17.3.1 Diesel-Powered Cruise Ships 17.3.2 LNG-Powered Cruise Ships 17.3.3 Hybrid Cruise Ships 17.3.4 Electric Cruise Ships 17.3.5 Others 17.4 Cruise Market Size and Forecast, By Application (2024-2032) 17.4.1 Vacation Cruises 17.4.2 Themed Cruises 17.4.3 Others 17.5 Cruise Market Size and Forecast, By Region(2024-2032) 17.5.1 North America 17.5.2 Europe 17.5.3 Asia Pacific 17.5.4 South America 17.5.5 MEA 18 North America Cruise Market Size and Forecast By Segmentation (by Value in USD Billion) (2024-2032) 18.1 North America Cruise Market Size and Forecast, By Type (2024-2032) 18.1.1 Luxury Cruise Ships 18.1.2 Premium Cruise Ships 18.1.3 Mainstream Cruise Ships 18.1.4 Others 18.2 North America Cruise Market Size and Forecast, By Size (2024-2032) 18.2.1 Small Ships (Under 500 passengers) 18.2.2 Medium Ships (500-1500 passengers) 18.2.3 Large Ships (1500+ passengers) 18.3 North America Cruise Market Size and Forecast, By Propulsion (2024-2032) 18.3.1 Diesel-Powered Cruise Ships 18.3.2 LNG-Powered Cruise Ships 18.3.3 Hybrid Cruise Ships 18.3.4 Electric Cruise Ships 18.3.5 Others 18.4 North America Cruise Market Size and Forecast, By Application (2024-2032) 18.4.1 Vacation Cruises 18.4.2 Themed Cruises 18.4.3 Others 18.5 North America Cruise Market Size and Forecast, By Country (2024-2032) 18.5.1 United States 18.5.1.1 United States Cruise Market Size and Forecast, By Type (2024-2032) 18.5.1.1.1 Luxury Cruise Ships 18.5.1.1.2 Premium Cruise Ships 18.5.1.1.3 Mainstream Cruise Ships 18.5.1.1.4 Others 18.5.1.2 United States Cruise Market Size and Forecast, By Size (2024-2032) 18.5.1.2.1 Small Ships (Under 500 passengers) 18.5.1.2.2 Medium Ships (500-1500 passengers) 18.5.1.2.3 Large Ships (1500+ passengers) 18.5.1.3 United States Cruise Market Size and Forecast, By Propulsion (2024-2032) 18.5.1.3.1 Diesel-Powered Cruise Ships 18.5.1.3.2 LNG-Powered Cruise Ships 18.5.1.3.3 Hybrid Cruise Ships 18.5.1.3.4 Electric Cruise Ships 18.5.1.3.5 Others 18.5.1.4 United States Cruise Market Size and Forecast, By Application (2024-2032) 18.5.1.4.1 Vacation Cruises 18.5.1.4.2 Themed Cruises 18.5.1.4.3 Others 18.5.2 Canada 18.5.2.1 Canada Cruise Market Size and Forecast, By Type (2024-2032) 18.5.2.1.1 Luxury Cruise Ships 18.5.2.1.2 Premium Cruise Ships 18.5.2.1.3 Mainstream Cruise Ships 18.5.2.1.4 Others 18.5.2.2 Canada Cruise Market Size and Forecast, By Size (2024-2032) 18.5.2.2.1 Small Ships (Under 500 passengers) 18.5.2.2.2 Medium Ships (500-1500 passengers) 18.5.2.2.3 Large Ships (1500+ passengers) 18.5.2.3 Canada Cruise Market Size and Forecast, By Propulsion (2024-2032) 18.5.2.3.1 Diesel-Powered Cruise Ships 18.5.2.3.2 LNG-Powered Cruise Ships 18.5.2.3.3 Hybrid Cruise Ships 18.5.2.3.4 Electric Cruise Ships 18.5.2.3.5 Others 18.5.2.4 Canada Cruise Market Size and Forecast, By Application (2024-2032) 18.5.2.4.1 Vacation Cruises 18.5.2.4.2 Themed Cruises 18.5.2.4.3 Others 18.5.3 Mexico 18.5.3.1 Mexico Cruise Market Size and Forecast, By Type (2024-2032) 18.5.3.1.1 Luxury Cruise Ships 18.5.3.1.2 Premium Cruise Ships 18.5.3.1.3 Mainstream Cruise Ships 18.5.3.1.4 Others 18.5.3.2 Mexico Cruise Market Size and Forecast, By Size (2024-2032) 18.5.3.2.1 Small Ships (Under 500 passengers) 18.5.3.2.2 Medium Ships (500-1500 passengers) 18.5.3.2.3 Large Ships (1500+ passengers) 18.5.3.3 Mexico Cruise Market Size and Forecast, By Propulsion (2024-2032) 18.5.3.3.1 Diesel-Powered Cruise Ships 18.5.3.3.2 LNG-Powered Cruise Ships 18.5.3.3.3 Hybrid Cruise Ships 18.5.3.3.4 Electric Cruise Ships 18.5.3.3.5 Others 18.5.3.4 Mexico Cruise Market Size and Forecast, By Application (2024-2032) 18.5.3.4.1 Vacation Cruises 18.5.3.4.2 Themed Cruises 18.5.3.4.3 Others 19 Europe Cruise Market Size and Forecast By Segmentation (by Value in USD Billion) (2024-2032) 19.1 Europe Cruise Market Size and Forecast, By Type (2024-2032) 19.2 Europe Cruise Market Size and Forecast, By Size (2024-2032) 19.3 Europe Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.4 Europe Cruise Market Size and Forecast, By Application (2024-2032) 19.5 Europe Cruise Market Size and Forecast, By Country (2024-2032) 19.5.1 United Kingdom 19.5.1.1 United Kingdom Cruise Market Size and Forecast, By Type (2024-2032) 19.5.1.2 United Kingdom Cruise Market Size and Forecast, By Size (2024-2032) 19.5.1.3 United Kingdom Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.1.4 United Kingdom Cruise Market Size and Forecast, By Application (2024-2032) 19.5.2 France 19.5.2.1 France Cruise Market Size and Forecast, By Type (2024-2032) 19.5.2.2 France Cruise Market Size and Forecast, By Size (2024-2032) 19.5.2.3 France Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.2.4 France Cruise Market Size and Forecast, By Application (2024-2032) 19.5.3 Germany 19.5.3.1 Germany Cruise Market Size and Forecast, By Type (2024-2032) 19.5.3.2 Germany Cruise Market Size and Forecast, By Size (2024-2032) 19.5.3.3 Germany Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.3.4 Germany Cruise Market Size and Forecast, By Application (2024-2032) 19.5.4 Italy 19.5.4.1 Italy Cruise Market Size and Forecast, By Type (2024-2032) 19.5.4.2 Italy Cruise Market Size and Forecast, By Size (2024-2032) 19.5.4.3 Italy Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.4.4 Italy Cruise Market Size and Forecast, By Application (2024-2032) 19.5.5 Spain 19.5.5.1 Spain Cruise Market Size and Forecast, By Type (2024-2032) 19.5.5.2 Spain Cruise Market Size and Forecast, By Size (2024-2032) 19.5.5.3 Spain Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.5.4 Spain Cruise Market Size and Forecast, By Application (2024-2032) 19.5.6 Sweden 19.5.6.1 Sweden Cruise Market Size and Forecast, By Type (2024-2032) 19.5.6.2 Sweden Cruise Market Size and Forecast, By Size (2024-2032) 19.5.6.3 Sweden Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.6.4 Sweden Cruise Market Size and Forecast, By Application (2024-2032) 19.5.7 Austria 19.5.7.1 Austria Cruise Market Size and Forecast, By Type (2024-2032) 19.5.7.2 Austria Cruise Market Size and Forecast, By Size (2024-2032) 19.5.7.3 Austria Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.7.4 Austria Cruise Market Size and Forecast, By Application (2024-2032) 19.5.8 Rest of Europe 19.5.8.1 Rest of Europe Cruise Market Size and Forecast, By Type (2024-2032) 19.5.8.2 Rest of Europe Cruise Market Size and Forecast, By Size (2024-2032) 19.5.8.3 Rest of Europe Cruise Market Size and Forecast, By Propulsion (2024-2032) 19.5.8.4 Rest of Europe Cruise Market Size and Forecast, By Application (2024-2032) 20 Asia Pacific Cruise Market Size and Forecast By Segmentation (by Value in USD Billion) (2024-2032) 20.1 Asia Pacific Cruise Market Size and Forecast, By Type (2024-2032) 20.2 Asia Pacific Cruise Market Size and Forecast, By Size (2024-2032) 20.3 Asia Pacific Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.4 Asia Pacific Cruise Market Size and Forecast, By Application (2024-2032) 20.5 Asia Pacific Cruise Market Size and Forecast, By Country (2024-2032) 20.5.1 China 20.5.1.1 China Cruise Market Size and Forecast, By Type (2024-2032) 20.5.1.2 China Cruise Market Size and Forecast, By Size (2024-2032) 20.5.1.3 China Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.1.4 China Cruise Market Size and Forecast, By Application (2024-2032) 20.5.2 S Korea 20.5.2.1 S Korea Cruise Market Size and Forecast, By Type (2024-2032) 20.5.2.2 S Korea Cruise Market Size and Forecast, By Size (2024-2032) 20.5.2.3 S Korea Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.2.4 S Korea Cruise Market Size and Forecast, By Application (2024-2032) 20.5.3 Japan 20.5.3.1 Japan Cruise Market Size and Forecast, By Type (2024-2032) 20.5.3.2 Japan Cruise Market Size and Forecast, By Size (2024-2032) 20.5.3.3 Japan Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.3.4 Japan Cruise Market Size and Forecast, By Application (2024-2032) 20.5.4 India 20.5.4.1 India Cruise Market Size and Forecast, By Type (2024-2032) 20.5.4.2 India Cruise Market Size and Forecast, By Size (2024-2032) 20.5.4.3 India Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.4.4 India Cruise Market Size and Forecast, By Application (2024-2032) 20.5.5 Australia 20.5.5.1 Australia Cruise Market Size and Forecast, By Type (2024-2032) 20.5.5.2 Australia Cruise Market Size and Forecast, By Size (2024-2032) 20.5.5.3 Australia Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.5.4 Australia Cruise Market Size and Forecast, By Application (2024-2032) 20.5.6 Malaysia 20.5.6.1 Malaysia Cruise Market Size and Forecast, By Type (2024-2032) 20.5.6.2 Malaysia Cruise Market Size and Forecast, By Size (2024-2032) 20.5.6.3 Malaysia Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.6.4 Malaysia Cruise Market Size and Forecast, By Application (2024-2032) 20.5.7 Vietnam 20.5.7.1 Vietnam Cruise Market Size and Forecast, By Type (2024-2032) 20.5.7.2 Vietnam Cruise Market Size and Forecast, By Size (2024-2032) 20.5.7.3 Vietnam Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.7.4 Vietnam Cruise Market Size and Forecast, By Application (2024-2032) 20.5.8 Thailand 20.5.8.1 Thailand Cruise Market Size and Forecast, By Type (2024-2032) 20.5.8.2 Thailand Cruise Market Size and Forecast, By Size (2024-2032) 20.5.8.3 Thailand Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.8.4 Thailand Cruise Market Size and Forecast, By Application (2024-2032) 20.5.9 Indonesia 20.5.9.1 Indonesia Cruise Market Size and Forecast, By Type (2024-2032) 20.5.9.2 Indonesia Cruise Market Size and Forecast, By Size (2024-2032) 20.5.9.3 Indonesia Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.9.4 Indonesia Cruise Market Size and Forecast, By Application (2024-2032) 20.5.10 Philippines 20.5.10.1 Philippines Cruise Market Size and Forecast, By Type (2024-2032) 20.5.10.2 Philippines Cruise Market Size and Forecast, By Size (2024-2032) 20.5.10.3 Philippines Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.10.4 Philippines Cruise Market Size and Forecast, By Application (2024-2032) 20.5.11 Rest of Asia Pacific 20.5.11.1 Rest of Asia Pacific Cruise Market Size and Forecast, By Type (2024-2032) 20.5.11.2 Rest of Asia Pacific Cruise Market Size and Forecast, By Size (2024-2032) 20.5.11.3 Rest of Asia Pacific Cruise Market Size and Forecast, By Propulsion (2024-2032) 20.5.11.4 Rest of Asia Pacific Cruise Market Size and Forecast, By Application (2024-2032) 21 South America Cruise Market Size and Forecast By Segmentation (by Value in USD Billion) (2024-2032) 21.1 South America Cruise Market Size and Forecast, By Type (2024-2032) 21.2 South America Cruise Market Size and Forecast, By Size (2024-2032) 21.3 South America Cruise Market Size and Forecast, By Propulsion (2024-2032) 21.4 South America Cruise Market Size and Forecast, By Application (2024-2032) 21.5 South America Cruise Market Size and Forecast, By Country (2024-2032) 21.5.1 Brazil 21.5.1.1 Brazil Cruise Market Size and Forecast, By Type (2024-2032) 21.5.1.2 Brazil Cruise Market Size and Forecast, By Size (2024-2032) 21.5.1.3 Brazil Cruise Market Size and Forecast, By Propulsion (2024-2032) 21.5.1.4 Brazil Cruise Market Size and Forecast, By Application (2024-2032) 21.5.2 Argentina 21.5.2.1 Argentina Cruise Market Size and Forecast, By Type (2024-2032) 21.5.2.2 Argentina Cruise Market Size and Forecast, By Size (2024-2032) 21.5.2.3 Argentina Cruise Market Size and Forecast, By Propulsion (2024-2032) 21.5.2.4 Argentina Cruise Market Size and Forecast, By Application (2024-2032) 21.5.3 Colombia 21.5.3.1 Colombia Cruise Market Size and Forecast, By Type (2024-2032) 21.5.3.2 Colombia Cruise Market Size and Forecast, By Size (2024-2032) 21.5.3.3 Colombia Cruise Market Size and Forecast, By Propulsion (2024-2032) 21.5.3.4 Colombia Cruise Market Size and Forecast, By Application (2024-2032) 21.5.4 Chile 21.5.4.1 Chile Cruise Market Size and Forecast, By Type (2024-2032) 21.5.4.2 Chile Cruise Market Size and Forecast, By Size (2024-2032) 21.5.4.3 Chile Cruise Market Size and Forecast, By Propulsion (2024-2032) 21.5.4.4 Chile Cruise Market Size and Forecast, By Application (2024-2032) 21.5.5 Peru 21.5.5.1 Peru Cruise Market Size and Forecast, By Type (2024-2032) 21.5.5.2 Peru Cruise Market Size and Forecast, By Size (2024-2032) 21.5.5.3 Peru Cruise Market Size and Forecast, By Propulsion (2024-2032) 21.5.5.4 Peru Cruise Market Size and Forecast, By Application (2024-2032) 21.5.6 Rest Of South America 21.5.6.1 Rest Of South America Cruise Market Size and Forecast, By Type (2024-2032) 21.5.6.2 Rest Of South America Cruise Market Size and Forecast, By Size (2024-2032) 21.5.6.3 Rest Of South America Cruise Market Size and Forecast, By Propulsion (2024-2032) 21.5.6.4 Rest Of South America Cruise Market Size and Forecast, By Application (2024-2032) 22 Middle East and Africa Cruise Market Size and Forecast By Segmentation (by Value in USD Billion) (2024-2032) 22.1 Middle East and Africa Cruise Market Size and Forecast, By Type (2024-2032) 22.2 Middle East and Africa Cruise Market Size and Forecast, By Size (2024-2032) 22.3 Middle East and Africa Cruise Market Size and Forecast, By Propulsion (2024-2032) 22.4 Middle East and Africa Cruise Market Size and Forecast, By Application (2024-2032) 22.5 Middle East and Africa Cruise Market Size and Forecast, By Country (2024-2032) 22.5.1 South Africa 22.5.1.1 South Africa Cruise Market Size and Forecast, By Type (2024-2032) 22.5.1.2 South Africa Cruise Market Size and Forecast, By Size (2024-2032) 22.5.1.3 South Africa Cruise Market Size and Forecast, By Propulsion (2024-2032) 22.5.1.4 South Africa Cruise Market Size and Forecast, By Application (2024-2032) 22.5.2 GCC 22.5.2.1 GCC Cruise Market Size and Forecast, By Type (2024-2032) 22.5.2.2 GCC Cruise Market Size and Forecast, By Size (2024-2032) 22.5.2.3 GCC Cruise Market Size and Forecast, By Propulsion (2024-2032) 22.5.2.4 GCC Cruise Market Size and Forecast, By Application (2024-2032) 22.5.3 Nigeria 22.5.3.1 Nigeria Cruise Market Size and Forecast, By Type (2024-2032) 22.5.3.2 Nigeria Cruise Market Size and Forecast, By Size (2024-2032) 22.5.3.3 Nigeria Cruise Market Size and Forecast, By Propulsion (2024-2032) 22.5.3.4 Nigeria Cruise Market Size and Forecast, By Application (2024-2032) 22.5.4 Egypt 22.5.4.1 Egypt Cruise Market Size and Forecast, By Type (2024-2032) 22.5.4.2 Egypt Cruise Market Size and Forecast, By Size (2024-2032) 22.5.4.3 Egypt Cruise Market Size and Forecast, By Propulsion (2024-2032) 22.5.4.4 Egypt Cruise Market Size and Forecast, By Application (2024-2032) 22.5.5 Turkey 22.5.5.1 Turkey Cruise Market Size and Forecast, By Type (2024-2032) 22.5.5.2 Turkey Cruise Market Size and Forecast, By Size (2024-2032) 22.5.5.3 Turkey Cruise Market Size and Forecast, By Propulsion (2024-2032) 22.5.5.4 Turkey Cruise Market Size and Forecast, By Application (2024-2032) 22.5.6 Rest Of MEA 22.5.6.1 Rest Of MEA Cruise Market Size and Forecast, By Type (2024-2032) 22.5.6.2 Rest Of MEA Cruise Market Size and Forecast, By Size (2024-2032) 22.5.6.3 Rest Of MEA Cruise Market Size and Forecast, By Propulsion (2024-2032) 22.5.6.4 Rest Of MEA Cruise Market Size and Forecast, By Application (2024-2032) 23 Company Profile: Key Players 23.1 SAP SE 23.1.1 Overview 23.1.2 Business Portfolio 23.1.3 Financial Overview 23.1.4 SWOT Analysis 23.1.5 Strategic Analysis 23.1.6 Recent Developments 23.2 Meyer Werft GmbH & Co. KG 23.3 Carnival 23.4 Royal Caribbean Group 23.5 Norwegian Cruise Line Holdings Ltd. 23.6 MSC Cruises 23.7 Disney Cruise Line 23.8 Viking Cruises 23.9 Genting Hong Kong 23.10 Ponant Cruises 23.11 Celestyal Cruises 23.12 Chantiers de l'Atlantique 23.13 Mitsubishi Heavy Industries, Ltd 23.14 Lloyd Werft Bremerhaven AG 23.15 Seabourn Cruise Line 23.16 Princess Cruises 23.17 Silversea Cruises 23.18 Norwegian Cruise Line Holdings 23.19 Disney Cruise Line 23.20 Holland America Line 23.21 Celebrity Cruises 23.22 Costa Cruises 23.23 Cunard Line 23.24 AIDA Cruises 23.25 P&O Cruises 23.26 Viking Cruise 23.27 Azamara 23.28 Marella Cruises 23.29 Fred. Olsen Cruise Lines 24 Key Findings 25 Analyst Recommendations 26 Cruise Market – Research Methodology