The Continuous Fiber Composites Market size was valued at USD 2.64 Bn in 2022 and the total Continuous Fiber Composites Market is expected to grow at a CAGR of 4.98% from 2023 to 2029, reaching nearly USD 3.71 Bn.Continuous Fiber Composites Definition:

Continuous fiber composites are a type of composite material composed of high-strength fibers that are uniformly embedded in a matrix material. These fibers are typically long and aligned in a specific direction, providing excellent mechanical properties to the material. Unlike chopped or discontinuous fiber composites, continuous fiber composites have fibers that run parallel to each other, resulting in enhanced strength, stiffness, and durability. These composites are widely used in industries such as aerospace, automotive, sports, and construction for the production of lightweight and high-performance structural components.The continuous fiber composites market is experiencing significant growth and is expected to continue growing in the coming years. Continuous fiber composites offer many advantages over traditional materials, such as metals and plastics, including high strength-to-weight ratio, excellent fatigue resistance, corrosion resistance, and design flexibility. These properties make continuous fiber composites highly desirable in industries such as aerospace, automotive, marine, sporting goods, and construction. North America, Europe, and Asia Pacific are the major regions driving the growth of the continuous fiber composites market. These regions have a strong presence of key players in the aerospace, automotive, and sporting goods industries, along with significant investments in research and development. Emerging economies in Asia Pacific, such as China and India, are witnessing rapid industrialization and urbanization, which is further boosting the demand for continuous fiber composites. Continuous Fiber Composites Market: Scope for innovations for Key players Operating in the market Key players operating in the continuous fiber composites market have significant scope for innovation to stay competitive and capture new opportunities. • Continuous fiber composites can be further improved by developing new fiber types and matrix materials. For example, Hexcel Corporation has been working on the development of advanced carbon fiber reinforcements, such as HexTow® HM54, which offers higher strength and modulus for demanding applications in aerospace and other industries. • Innovations in manufacturing processes can lead to improved efficiency and cost reduction. For instance, Automated Dynamics, a manufacturer of advanced composite structures, has developed innovative automated fiber placement (AFP) and tape laying systems that enable precise and rapid placement of continuous fibers for complex shapes and structures. • Key players can focus on developing sustainable continuous fiber composites using bio-based or recycled materials. For instance, Teijin Limited has introduced a plant-derived bio-based continuous fiber called Biofront®, which is used to reinforce thermoplastic composites, reducing reliance on fossil fuel-based materials. • Innovations in design and simulation tools can assist in optimizing the performance and cost-efficiency of continuous fiber composites. An example is the development of simulation software, such as Digimat by e-Xstream Engineering (a subsidiary of MSC Software), which enables accurate prediction of the behavior and performance of continuous fiber composites during the design phase.

Continuous Fiber Composites Market Overview:

Continuous Fiber Composites Market Dynamics:

The Global Continuous Fiber Composites Market dynamics are thoroughly studied and explained in the MMR report, which helps reader to understand emerging market trends, drivers, restraints, opportunities, and challenges at global and regional level for the Continuous Fiber Composites Market. Some of the driving factors are illustrate below, their detailed explanation is discussed in the report with other supporting: Growing Demand for Sustainable Materials: Continuous fiber composites made from bio-based or recycled materials align with the increasing focus on sustainability and environmental responsibility. These materials offer reduced reliance on fossil fuel-based resources and contribute to a more circular economy. Governments and regulatory bodies are implementing stricter environmental regulations and standards to mitigate climate change, reduce pollution, and promote sustainability. Industries are encouraged to adopt sustainable materials and practices to comply with these regulations. Continuous fiber composites, being lightweight and energy-efficient, align with these regulatory requirements, making them an attractive choice for environmentally conscious companies.To know about the Research Methodology :- Request Free Sample Report Corporate Social Responsibility (CSR): Various companies are integrating sustainability into their corporate strategies as part of their CSR initiatives. They aim to reduce their environmental impact, enhance their brand reputation, and meet the growing expectations of customers who prefer sustainable products. Continuous fiber composites, with their potential for resource conservation and reduced waste generation, align with these CSR goals. Rising Construction Industry In Developed Countries The construction industry is experiencing a growing demand for continuous fiber composites due to their various beneficial properties and advantages. Developed countries often prioritize the renewal and modernization of their infrastructure, including roads, bridges, railways, and buildings. Continuous fiber composites offer advantages such as high strength, durability, and lightweight characteristics, making them suitable for enhancing existing structures or constructing new infrastructure. Continuous fiber composites provide architects and designers with greater freedom in terms of design possibilities. They can be molded into various shapes and sizes, allowing for the creation of unique and visually appealing structures that meet the aesthetic demands of modern architecture. Continuous Fiber Composites Market challenges Recycling and End-of-Life Considerations: The recycling and disposal of continuous fiber composites can be challenging due to their complex composite structure and mix of different materials. Developing efficient and cost-effective recycling technologies for composite materials is an ongoing challenge. Proper end-of-life management and sustainable disposal methods are crucial to minimize environmental impact. Limited Scalability of Manufacturing Processes: Some manufacturing processes for continuous fiber composites, such as automated fiber placement (AFP) and tape laying, may have limitations in terms of scalability and production rates. Increasing production volumes to meet growing demand can be challenging, particularly for large and complex structures. Regulatory and Certification Requirements: The continuous fiber composites market is subject to various regulatory and certification requirements. Meeting these requirements can be time-consuming and costly for manufacturers. Ensuring compliance with standards related to safety, fire resistance, environmental impact, and structural performance can pose challenges for market players.

Continuous Fiber Composites Market Segment Analysis:

Based on Reinforcement Type, Glass Fiber Composites is expected to witness a CAGR of over 5.14% during the forecast period. Glass fiber composites find extensive applications in industries such as automotive, construction, aerospace, marine, and consumer goods. They are utilized in various structural components, including body panels, chassis, wind turbine blades, pipes, and pressure vessels. The dominance of glass fiber composites can be attributed to several factors, including their cost-effectiveness, availability, and well-established manufacturing processes. Glass fibers are relatively inexpensive compared to other types of continuous fibers, making them a popular choice for a wide range of applications.Based on Resin Type, the Thermoset Composite Resins segment held the highest share of 62% in 2022 and is expected to continue its dominant position during the forecast period. Thermoset composite resins have indeed represented the largest segment for continuous fiber composites. Thermoset resins, such as epoxy, polyester, and vinyl ester, are widely used as matrix materials in continuous fiber composites due to their excellent mechanical properties, chemical resistance, and adhesion to fibers. These resins undergo a curing process that transforms them from a liquid or semi-liquid state into a solid, cross-linked structure, providing the composite with enhanced strength and durability. The choice of thermoset composite resins is driven by their ability to effectively bond with continuous fibers, such as carbon, glass, or aramid, resulting in a strong and stiff composite material. The thermoset resins provide the necessary matrix to transfer loads to the fibers and protect them from environmental factors. This combination of fibers and thermoset resins offers high-performance characteristics, making them suitable for a wide range of applications.

Continuous Fiber Composites Market Regional Insights:

North America Continuous Fiber Composites Market is expected to witness a CAGR of over 5.22% during the forecast period. The dominance of glass fiber composites in the continuous fiber composites market can be attributed to several factors. One key factor is the presence of major aircraft manufacturers like Boeing and Airbus, who extensively utilize composites for manufacturing airframe parts, interior panels, and other components. The aerospace industry's reliance on composites has significantly contributed to the prominence of glass fiber composites. Furthermore, the increasing demand for lightweight vehicles is expected to drive the growth of the regional market. As industries prioritize fuel efficiency and environmental sustainability, the use of composites, including glass fiber composites, becomes crucial in reducing the weight of vehicles without compromising strength and safety. The presence of these major aircraft manufacturers and the growing demand for lightweight vehicles have synergistically propelled the growth of the Continuous Fiber Composites market in the region. The Asia Pacific region is poised to experience substantial growth from 2023 to 2029, primarily driven by the rising product demand from key industries like automotive and aerospace. This growth can be attributed to factors such as increasing disposable income levels among consumers and rapid urbanization in emerging countries such as China and India. As disposable income levels rise, consumers in these countries are increasingly able to afford automobiles and air travel, leading to a surge in demand for continuous fiber composites in these industries. Additionally, the rapid urbanization in these countries is driving the need for infrastructure development, including the construction of roads, bridges, and buildings, which further boosts the demand for continuous fiber composites. These factors combined are expected to fuel the expansion of the Continuous Fiber Composites Market in the Asia Pacific region during the forecast period.Continuous Fiber Composites Market Country-wise Insights:

The continuous fiber composites market exhibits varying trends and dynamics across different countries. In the United States, the market is driven by the strong presence of aerospace, automotive, and construction industries. The demand for lightweight and high-performance materials in these sectors contributes to the market's growth. China, on the other hand, stands out as a major player with its rapidly growing automotive and construction industry. The country's focus on infrastructure development, rising disposable income levels, and urbanization fuels the demand for continuous fiber composites. In Germany, a prominent market in Europe, the automotive and aerospace industries play a crucial role. The country's engineering expertise and emphasis on innovation contribute to the growth of the market, supported by stringent environmental regulations and sustainability initiatives. Japan showcases a well-established automotive and electronics industry, driving the demand for continuous fiber composites. Technological advancements and the focus on lightweight materials further propel the Continuous Fiber Composites Market growth in Japan.Continuous Fiber Composites Market Scope: Inquire before buying

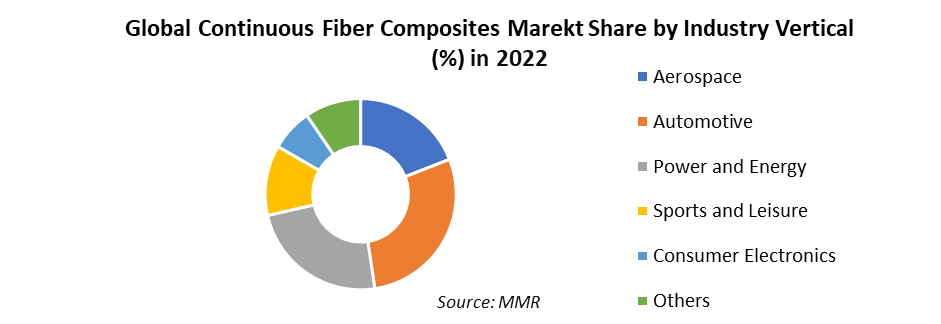

Continuous Fiber Composites Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 2.64 Bn Forecast Period 2023 to 2029 CAGR: 4.98% Market Size in 2029: USD 3.71 Bn Segments Covered: by Resin Type 1.Thermoset Composite Resins 2.Thermoplastic Composite Resins by Reinforcement Type 1. Glass Fiber Composites 2.Carbon Fiber Composites 3.Others by Product Type 1.Woven Fabric 2.Non-Crimp Fabric 3.Unidirectional Tape 4.Others by Industry Vertical 1.Aerospace 2.Automotive 3.Power and Energy 4.Sports and Leisure 5.Consumer Electronics 6.Others Continuous Fiber Composites Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Continuous Fiber Composites Market Key Players:

1.TenCate 2.QIYI Tech 3.Ningbo Huaye Material Technology 4. Polystrand 5. Zhejiang Double Fish Plastics 6. AXIA Materials 7. LANXESS 8.Celanese 9. Tri-Mack 10. Guangzhou Kingfa Carbon Fiber 11.Lingol 12.Aonix 13.Chomarat Textiles Industries 14.Gurit Holding AG 15.Hexcel Corporation 16.Johns Manville Corporation 17.Owens Corning Corporation 18.Saertex GmbH & Co. KG 19.Solvay S.A 20.Toray Industries Inc, etc. FAQs: 1] What segments are covered in the Global Continuous Fiber Composites Market report? Ans. The segments covered in the Continuous Fiber Composites report are based on Resin Type, Reinforcement Type, Product Type, Industry Vertical and Region. 2] Which region is expected to hold the highest share in the Global Continuous Fiber Composites Market during the forecast period? Ans. North America region is expected to hold the highest share of the Continuous Fiber Composites Market during the forecast period. 3] What is the market size of the Global Continuous Fiber Composites by 2029? Ans. The market size of the Continuous Fiber Composites by 2029 is expected to reach US$ 3.71 Bn. 4] What is the forecast period for the Global Continuous Fiber Composites Market? Ans. The forecast period for the Continuous Fiber Composites Market is 2023-2029. 5] What was the market size of the Global Continuous Fiber Composites in 2022? Ans. The market size of the Continuous Fiber Composites in 2021 was valued at US$ 2.64 Bn.

1. Continuous Fiber Composites Market: Research Methodology 2. Continuous Fiber Composites Market: Executive Summary 3. Continuous Fiber Composites Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Continuous Fiber Composites Market: Dynamics 4.1. Continuous Fiber Composites Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Continuous Fiber Composites Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Continuous Fiber Composites Market Restraints 4.4. Continuous Fiber Composites Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 4.10. COVID-19 Impact on the Global Continuous Fiber Composites Market 5. Continuous Fiber Composites Market: Segmentation (by Value USD) 5.1. Continuous Fiber Composites Market, By Resin Type (2022-2029) 5.1.1. Thermoset Composite Resins 5.1.2. Thermoplastic Composite Resins 5.2. Continuous Fiber Composites Market, By Reinforcement Type (2022-2029) 5.2.1. Glass Fiber Composites 5.2.2. Carbon Fiber Composites 5.2.3. Others 5.3. Continuous Fiber Composites Market, by Product Type (2022-2029) 5.3.1. Woven Fabric 5.3.2. Non-Crimp Fabric 5.3.3. Unidirectional Tape 5.3.4. Others 5.4. Continuous Fiber Composites Market, by Industry Vertical (2022-2029) 5.4.1. Aerospace 5.4.2. Automotive 5.4.3. Power and Energy 5.4.4. Sports and Leisure 5.4.5. Consumer Electronics 5.4.6. Others 5.5. Continuous Fiber Composites Market, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Continuous Fiber Composites Market (by Value USD) 6.1. North America Continuous Fiber Composites Market, By Resin Type (2022-2029) 6.1.1. Thermoset Composite Resins 6.1.2. Thermoplastic Composite Resins 6.2. North America Continuous Fiber Composites Market, By Reinforcement Type (2022-2029) 6.2.1. Glass Fiber Composites 6.2.2. Carbon Fiber Composites 6.2.3. Others 6.3. North America Continuous Fiber Composites Market, by Product Type (2022-2029) 6.3.1. Woven Fabric 6.3.2. Non-Crimp Fabric 6.3.3. Unidirectional Tape 6.3.4. Others 6.4. North America Continuous Fiber Composites Market, by Industry Vertical (2022-2029) 6.4.1. Aerospace 6.4.2. Automotive 6.4.3. Power and Energy 6.4.4. Sports and Leisure 6.4.5. Consumer Electronics 6.4.6. Others 6.5. North America Continuous Fiber Composites Market, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Continuous Fiber Composites Market (by Value USD) 7.1. Europe Continuous Fiber Composites Market, By Resin Type (2022-2029) 7.2. Europe Continuous Fiber Composites Market, By Reinforcement Type (2022-2029) 7.3. Europe Continuous Fiber Composites Market, by Product Type (2022-2029) 7.4. Europe Continuous Fiber Composites Market, by Industry Vertical (2022-2029) 7.5. Europe Continuous Fiber Composites Market, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Continuous Fiber Composites Market (by Value USD) 8.1. Asia Pacific Continuous Fiber Composites Market, By Resin Type (2022-2029) 8.2. Asia Pacific Continuous Fiber Composites Market, By Reinforcement Type (2022-2029) 8.3. Asia Pacific Continuous Fiber Composites Market, by Product Type (2022-2029) 8.4. Asia Pacific Continuous Fiber Composites Market, by Industry Vertical (2022-2029) 8.5. Asia Pacific Continuous Fiber Composites Market, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Continuous Fiber Composites Market (by Value USD) 9.1. Middle East and Africa Continuous Fiber Composites Market, By Resin Type (2022-2029) 9.2. Middle East and Africa Continuous Fiber Composites Market, By Reinforcement Type (2022-2029) 9.3. Middle East and Africa Continuous Fiber Composites Market, by Product Type (2022-2029) 9.4. Middle East and Africa Continuous Fiber Composites Market, by Industry Vertical (2022-2029) 9.5. Middle East and Africa Continuous Fiber Composites Market, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Continuous Fiber Composites Market (by Value USD) 10.1. South America Continuous Fiber Composites Market, By Resin Type (2022-2029) 10.2. South America Continuous Fiber Composites Market, By Reinforcement Type (2022-2029) 10.3. South America Continuous Fiber Composites Market, by Product Type (2022-2029) 10.4. South America Continuous Fiber Composites Market, by Industry Vertical (2022-2029) 10.5. South America Continuous Fiber Composites Market, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. TenCate 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. QIYI Tech 11.3. Ningbo Huaye Material Technology 11.4. Polystrand 11.5. Zhejiang Double Fish Plastics 11.6. AXIA Materials 11.7. LANXESS 11.8. Celanese 11.9. Tri-Mack 11.10. Guangzhou Kingfa Carbon Fiber 11.11. Lingol 11.12. Aonix 11.13. Chomarat Textiles Industries 11.14. Gurit Holding AG 11.15. Hexcel Corporation 11.16. Johns Manville Corporation 11.17. Owens Corning Corporation 11.18. Saertex GmbH & Co. KG 11.19. Solvay S.A 11.20. Toray Industries Inc, etc 12. Key Findings 13. Industry Recommendation