Cold Chain Packaging Market size was valued at USD 27.29 Bn. in 2024 and the total Global Cold Chain Packaging Market revenue is expected to grow at a CAGR of 12.2% from 2025 to 2032, reaching nearly USD 68.54 Bn. by 2032.Cold Chain Packaging Market Overview

Cold chain packaging is known as specialized packaging used to maintain a specific temperature range for perishable or temperature sensitive products during storage and transportation. Cold Chain Packaging Market has been growing by increasing demand from pharmaceutical manufacturers, biologics developers, clinical researchers and specialty food producers. Rising focus on temperature-sensitive therapeutics, vaccine stability and long-lasting preservation of perishable goods is accelerating market adoption. Increasing application of cold chain packaging across biopharmaceutical logistics, fresh food transportation, clinical trial sample distribution and temperature-controlled e-commerce deliveries is reshaping traditional supply chains and supporting rise of integrated cold logistics solutions. Technological advancements like phase change materials, vacuum insulated panels, IoT enabled temperature monitoring, and AI assisted route optimization are enhancing efficiency, safety and traceability in cold chain packaging systems. Market is supported by rising healthcare and food safety regulations, growing awareness of product integrity in end to end logistics and global shift toward biologic therapies, organ transport and premium perishable food exports. North America dominated Cold Chain Packaging Market in 2024, driven by region’s advanced logistics infrastructure, high R&D investments, increasing demand for biologic drugs and established pharmaceutical and food supply chains. Key players in Cold Chain Packaging Market include Sonoco ThermoSafe, Cold Chain Technologies and Pelican Biothermal. Companies are focusing on pharmaceutical grade thermal packaging solutions, expanding insulated shipping portfolios, forming strategic collaborations and investing in sustainable and validated packaging technologies to meet growing global demand. Report covers cold chain packaging market dynamics, structure by analysing market segments and projecting Global cold chain packaging market size. Clear representation of competitive analysis of key players By Type, price, financial position, product portfolio, growth strategies and regional presence in Global cold chain packaging market.To know about the Research Methodology :- Request Free Sample Report

Cold Chain Packaging Market Dynamics

Increasing demand for Perishable Goods to boosts the Cold Chain Packaging market growth The demand for perishable goods including fresh food, pharmaceuticals, and biologics is increasing globally. Cold chain packaging ensures the preservation of the quality and freshness of these products during storage and transportation, boosting the demand for such packaging solutions. The growth of e-commerce and online grocery shopping has increased the need for efficient cold-chain packaging solutions. Consumers expect their perishable products to be delivered in optimal condition, which needs proper insulation and temperature control during transit. There is an increasing focus on sustainability and minimizing environmental impact across industries. Cold chain packaging manufacturers are encouraging on developing eco-friendly solutions including recyclable materials and reusable packaging systems, to meet the increasing demand for sustainable packaging options. Expansion of the Pharmaceutical Industry to fuel Cold Chain Packaging Market Growth The pharmaceutical industry produces a wide range of medications, vaccines, biologics, and other healthcare products that are temperature-sensitive and need specific temperature control throughout the supply chain. Cold chain packaging ensures that these products maintain their stability, efficacy and safety by protecting them from temperature excursions. The increasing aging population and the prevalence of chronic diseases resulted to increase in the demand for healthcare products. This increased demand leads to higher production as well as distribution of vaccines, pharmaceuticals and biologics. This resulted in to increase in the requirement for reliable cold-chain packaging solutions to manage product integrity. Pharmaceutical companies operate globally and distribute their products to several regions and countries and boosts the Cold Chain Packaging Market growth. High costs hamper the Cold Chain Packaging Market growth Cold chain packaging needs specialized materials with good insulation properties, temperature-monitoring devices and refrigerants to maintain the desired temperature range. Compared to conventional packaging materials, these materials and technologies come at a higher cost. The cost of acquiring and implementing these specialized components has been increasing the overall packaging expenses. Cold chain packaging includes additional handling and packaging requirements to ensure temperature control and product integrity. This involves the use of refrigerated trucks, temperature-controlled storage facilities and specialized packaging techniques. Cold chain packaging necessitates the use of temperature monitoring systems including data loggers or real-time monitoring devices. These systems support tracking and recording temperature fluctuations during storage and transportation. The cost of these monitoring systems such as their installation maintenance contributes to the overall expenses of cold chain packaging. All these factors increase the overall costs of cold chain packaging operations and hamper the Cold Chain Packaging Market growth.Cold Chain Packaging Market Segment Analysis

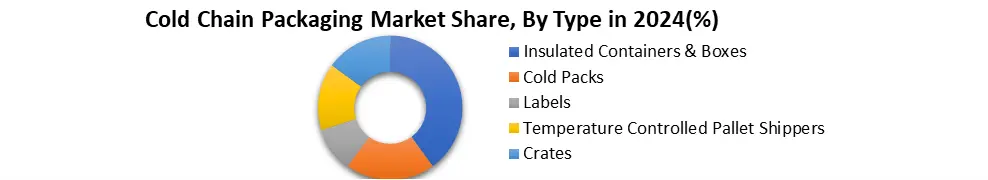

Based on Type, the market is segmented into Crates, Insulated Container & Boxes, Cold Packs Labels and Temperature Controlled Pallet Shippers. The dominant sector in the Cold Chain Packaging Market was the insulated container and boxes segment, which accounted for over 57% of the revenue in 2024. This significant share can be attributed to the growing demand for reusable insulated containers in various sectors like food processing, as well as for storing fruits and vegetables. Additionally, within this segment, there are further classifications based on payload size, including large, medium, small, extra small, and petite. Moreover, the market has been segmented based on products, such as crates, cold packs, labels, and temperature-controlled pallet shippers. Specifically, the crates segment is subdivided into applications like dairy, pharmaceuticals, fisheries, and horticulture.

Cold Chain Packaging Market Regional Analysis

North America dominated the Cold Chain Packaging Market in 2024, driven by strong biopharmaceutical production ecosystem, advanced cold logistics infrastructure and stringent regulatory standards for temperature sensitive products. Region’s high R&D expenditure, growing demand for biologics and vaccines and established pharmaceutical and food distribution networks are fueling consistent investment in high performance cold chain solutions. Rising clinical trial activity, expanding specialty drug pipelines and increasing consumer preference for fresh and frozen foods further reinforce North America’s leadership in cold chain packaging innovation, safety and adoption. Cold Chain Packaging Market Competitive Landscape Report covers 20 key players in Cold Chain Packaging Market, including a strategic mix of market leaders, market challengers, market followers and niche players. Market leaders such as Sonoco ThermoSafe and Cold Chain Technologies dominate global supply and thermal packaging innovation. Companies lead in pharmaceutical grade insulation systems, regulatory compliant solutions and advanced temperature control technologies for high value biologics and vaccines. Market challengers like Pelican BioThermal and Softbox Systems Ltd. are investing heavily in sustainable cold chain packaging solutions and increasing their reach across clinical trial logistics, specialty food transportation and biopharmaceutical markets. Market followers such as Intelsius and Cryopak Industries Inc. are offering reliable, cost-effective cold packaging products for use in diagnostic kits, perishables and routine pharmaceutical distribution, targeting steady growth in mainstream applications. Niche players including va-Q-tec AG and ACH Foam Technologies focus on specific product lines for reusable thermal shippers, last mile delivery systems and emerging precision medicine logistics. These players deliver localized value through modular design, affordability and region-specific regulatory alignment, supporting customized solutions in global cold chain ecosystems. Cold Chain Packaging Market Trends • Rising Adoption of Reusable Packaging Solutions Growing environmental concerns and regulatory pressure are accelerating the shift toward reusable cold chain packaging. Companies are investing in durable, returnable systems with validated thermal performance to reduce waste, cut lifecycle costs, and meet sustainability goals. • Integration of IoT and Smart Sensors Increased demand for real-time shipment tracking has led to widespread integration of IoT-enabled devices in cold chain packaging. These smart sensors monitor temperature, humidity, and shock, ensuring compliance with quality standards and reducing spoilage risk. • Surge in Biopharmaceutical and Vaccine Logistics Global expansion of biologics, mRNA-based therapies, and vaccine distribution particularly post-pandemic has intensified the need for high-performance thermal packaging solutions that ensure product integrity throughout complex global supply chains. Cold Chain Packaging Market Recent Development • On May 22, 2025, Peli BioThermal (U.S) Launched IoT enabled shippers featuring real time monitoring, RFID/GPS sensors, cloud dashboards and patented thermal chamber designs. Also transitioned major facilities to 100% renewable electricity. • March 25, 2025, Sonoco ThermoSafe (U.S) published an industry survey highlighting sustainability as the top priority among cold-chain supply chain professionals, with increased use of recyclable and reusable thermal packaging.Cold Chain Packaging Market Scope : Inquire Before Buying

Cold Chain Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 27.29 Bn. Forecast Period 2025 to 2032 CAGR: 12.2% Market Size in 2032: USD 68.54 Bn. Segments Covered: by Type Crates Insulated Container & Boxes Cold Packs Labels Temperature Controlled Pallet Shippers by Material Insulating Material Refrigerants Hydrocarbon by End Use Industry Food & Beverages Pharmaceutical Cosmetics & Personal Care Chemical Others Cold Chain Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Cold Chain Packaging Market, Key Players

North America 1. Cold Chain Technologies (USA) 2. Peli BioThermal (USA) 3. Sonoco ThermoSafe (USA) 4. ACH Foam Technologies (USA) 5. Cryopak (Canada) 6. CREOPACK (Canada) 7. Sealed Air Corporation (USA) 8. Chill-Pak (USA) 9. Pelican Products (USA) 10. Cascades Inc. (Canada) Europe 11. Sofrigam (France) 12. Intelsius (United Kingdom) 13. Tempack (Spain) 14. Softbox Systems (United Kingdom) 15. va-Q-tec (Germany) 16. Clip-Lok SimPak (Denmark) 17. Clondalkin Group (Netherlands) 18. DS Smith Packaging (United Kingdom) Asia-Pacific 19. Orora Group (Australia) South America 20. Iosbag (Brazil) 21. Termolar (Brazil) 22. Frigelar (Brazil)FAQs:

1. Which region has the largest share in the Cold Chain Packaging Market? Ans: The North America region held the highest share in 2024 in the Cold Chain Packaging Market. 2. What are the key factors driving the growth of the Cold Chain Packaging Market? Ans: Increasing demand for Perishable Goods to boost the Cold Chain Packaging Market growth. 3. Who are the key competitors in the Cold Chain Packaging Market? Ans: Sonoco ThermoSafe, Cold Chain Technologies, and Pelican BioThermal are the key competitors in the Cold Chain Packaging Market. 4. What are the opportunities for the Cold Chain Packaging Market? Ans: Rising Demand for Biologics & mRNA Therapies create opportunities in the Cold Chain Packaging Market. 5. Which type segment dominates the Cold Chain Packaging Market? Ans: The insulated container and boxes segment dominated the Cold Chain Packaging Market.

1. Cold Chain Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cold Chain Packaging Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Cold Chain Packaging Market: Dynamics 3.1. Region wise Trends of Cold Chain Packaging Market 3.1.1. North America Cold Chain Packaging Market Trends 3.1.2. Europe Cold Chain Packaging Market Trends 3.1.3. Asia Pacific Cold Chain Packaging Market Trends 3.1.4. Middle East and Africa Cold Chain Packaging Market Trends 3.1.5. South America Cold Chain Packaging Market Trends 3.2. Cold Chain Packaging Market Dynamics 3.2.1. Cold Chain Packaging Market Drivers 3.2.1.1. Surge in Biologics and Vaccine Demand 3.2.1.2. Expansion of Global Clinical Trials 3.2.2. Cold Chain Packaging Market Restraints 3.2.3. Cold Chain Packaging Market Opportunities 3.2.3.1. Rise in Personalized Medicine and mRNA Therapies 3.2.3.2. Demand for Reusable and Eco-Friendly Packaging 3.2.4. Cold Chain Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Pharmaceutical Trade Regulations 3.4.2. Growth In Pharmaceutical and Perishable Food Exports 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Cold Chain Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 4.1.1. Crates 4.1.2. Insulated Container & Boxes 4.1.3. Cold Packs 4.1.4. Labels 4.1.5. Temperature Controlled Pallet Shippers 4.2. Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 4.2.1. Insulating Material 4.2.2. Refrigerants 4.2.3. Hydrocarbon 4.3. Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 4.3.1. Food & Beverages 4.3.2. Pharmaceutical 4.3.3. Cosmetics & Personal Care 4.3.4. Chemical 4.3.5. Others 4.4. Cold Chain Packaging Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Cold Chain Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 5.1.1. Crates 5.1.2. Insulated Container & Boxes 5.1.3. Cold Packs 5.1.4. Labels 5.1.5. Temperature Controlled Pallet Shippers 5.2. North America Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 5.2.1. Insulating Material 5.2.2. Refrigerants 5.2.3. Hydrocarbon 5.3. North America Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 5.3.1. Food & Beverages 5.3.2. Pharmaceutical 5.3.3. Cosmetics & Personal Care 5.3.4. Chemical 5.3.5. Others 5.4. North America Cold Chain Packaging Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Crates 5.4.1.1.2. Insulated Container & Boxes 5.4.1.1.3. Cold Packs 5.4.1.1.4. Labels 5.4.1.1.5. Temperature Controlled Pallet Shippers 5.4.1.2. United States Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 5.4.1.2.1. Insulating Material 5.4.1.2.2. Refrigerants 5.4.1.2.3. Hydrocarbon 5.4.1.3. Others United States Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 5.4.1.3.1. Food & Beverages 5.4.1.3.2. Pharmaceutical 5.4.1.3.3. Cosmetics & Personal Care 5.4.1.3.4. Chemical 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Crates 5.4.2.1.2. Insulated Container & Boxes 5.4.2.1.3. Cold Packs 5.4.2.1.4. Labels 5.4.2.1.5. Temperature Controlled Pallet Shippers 5.4.2.2. Canada Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 5.4.2.2.1. Insulating Material 5.4.2.2.2. Refrigerants 5.4.2.2.3. Hydrocarbon 5.4.2.3. Canada Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 5.4.2.3.1. Food & Beverages 5.4.2.3.2. Pharmaceutical 5.4.2.3.3. Cosmetics & Personal Care 5.4.2.3.4. Chemical 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 5.4.3.1.1. Crates 5.4.3.1.2. Insulated Container & Boxes 5.4.3.1.3. Cold Packs 5.4.3.1.4. Labels 5.4.3.1.5. Temperature Controlled Pallet Shippers 5.4.3.2. Mexico Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 5.4.3.2.1. Insulating Material 5.4.3.2.2. Refrigerants 5.4.3.2.3. Hydrocarbon 5.4.3.3. Mexico Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 5.4.3.3.1. Food & Beverages 5.4.3.3.2. Pharmaceutical 5.4.3.3.3. Cosmetics & Personal Care 5.4.3.3.4. Chemical 5.4.3.3.5. Others 6. Europe Cold Chain Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.2. Europe Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.3. Europe Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4. Europe Cold Chain Packaging Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.1.3. United Kingdom Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4.2. France 6.4.2.1. France Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.2.3. France Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.3.3. Germany Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.4.3. Italy Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.5.3. Spain Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.6.3. Sweden Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.7.3. Austria Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 6.4.8.3. Rest of Europe Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7. Asia Pacific Cold Chain Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.3. Asia Pacific Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4. Asia Pacific Cold Chain Packaging Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.1.3. China Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.2.3. S Korea Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.3.3. Japan Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.4. India 7.4.4.1. India Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.4.3. India Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.5.3. Australia Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.6.3. Indonesia Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.7.3. Philippines Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.8.3. Malaysia Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.9.3. Vietnam Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.10.3. Thailand Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 7.4.11.3. Rest of Asia Pacific Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 8. Middle East and Africa Cold Chain Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 8.3. Middle East and Africa Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 8.4. Middle East and Africa Cold Chain Packaging Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 8.4.1.3. South Africa Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 8.4.2.3. GCC Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 8.4.3.3. Nigeria Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 8.4.4.3. Rest of ME&A Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 9. South America Cold Chain Packaging Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 9.2. South America Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 9.3. South America Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 9.4. South America Cold Chain Packaging Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 9.4.1.3. Brazil Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 9.4.2.3. Argentina Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Cold Chain Packaging Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Cold Chain Packaging Market Size and Forecast, By Material (2024-2032) 9.4.3.3. Rest of South America Cold Chain Packaging Market Size and Forecast, By End Use Industry (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1 Cold Chain Technologies (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2 Peli BioThermal (USA) 10.3 Sonoco ThermoSafe (USA) 10.4 ACH Foam Technologies (USA) 10.5 Cryopak (Canada) 10.6 CREOPACK (Canada) 10.7 Sealed Air Corporation (USA) 10.8 Chill-Pak (USA) 10.9 Pelican Products (USA) 10.10 Cascades Inc. (Canada) 10.11 Sofrigam (France) 10.12 Intelsius (United Kingdom) 10.13 Tempack (Spain) 10.14 Softbox Systems (United Kingdom) 10.15 va-Q-tec (Germany) 10.16 Clip-Lok SimPak (Denmark) 10.17 Clondalkin Group (Netherlands) 10.18 DS Smith Packaging (United Kingdom) 10.19 Orora Group (Australia) 10.20 Iosbag (Brazil) 10.21 Termolar (Brazil) 10.22 Frigelar (Brazil) 10 Key Findings 11 Analyst Recommendations 12 Cold Chain Packaging Market: Research Methodology