Global CNC Machine Market size was valued at USD 100.61 Bn. in 2024, and the total CNC Machine Market revenue is expected to grow by 8.7 % from 2025 to 2032, reaching nearly USD 196.1 Bn.CNC Machine Market Overview:

CNC (Computer Numerical Control) Machines use coded commands programmed precisely into a computer to automate machines that are normally operated manually. CNC machines perform machining tasks and are generally composed of milling, turning, cutting, or drilling tools. With the increasing demands placed upon the automotive, aerospace, electronics, healthcare, and metal fabrication industries to increase productivity, efficiency and precision, CNC Machines are experiencing growth in the market. The increase in CNC machines becoming more widely available in developed as well as developing countries, with examples of industrial automation trends emerging in pace with Industry 4.0. The North America region dominates the CNC Machine Market advanced manufacturing infrastructure, growing adoption of automation and Industry 4.0 technologies, strong presence of key market players, and demand from industries such as aerospace, automotive, and defences. Asia Pacific and Europe followed with significant consumption and production of CNC Machines. CNC Machine Key Players, including DMG Mori, Haas Automation, FANUC, Siemens AG, and Yamazaki Mazak, provide useful insights regarding their company contributions and strategies going forward. The report includes end-user contributions based on sector to signify the research about total contribution with heavy documentation and metrics regarding contributions from both the automotive and aerospace industries, upcoming opportunities for continued growth within the CNC Machine Market.To know about the Research Methodology :- Request Free Sample Report

CNC Machine Market Dynamics:

Increasing Demand for Precision and Automation Drives CNC Machine Adoption in Smart Manufacturing CNC machines have a level of precision, complexity, and reproducibility compared to manual machining. For example, industries such as automotive, aerospace, and defence rely on CNC systems more to produce complex parts that have high tolerances. The advancement through high-level software systems such as CAD, CAM, and ERP systems improves production speed and accuracy and enables preventive and predictive maintenance.many CNC machines operate with new features such as contour machining and automation, which again increases manufacturing flexibility. Emerging Technologies and Industry Applications are a lucrative Opportunity for the CNC Machine Market The use of IoT and machine learning technologies enables operators to monitor performance and receive alerts on mount performance, utilizing smartphones or PC's, greatly improving interaction with the operator and control of the operations. Mass production industries, particularly automotive, aerospace, military, and energy, are now using CNC systems to provide high-precision, standardized components. Furthermore, the power sector, which relies on customized parts and continuous operation, is more commonly using CNC machines to improve productivity and alter/reinforce failure rates. Skill Gaps and High Costs to hamper CNC Machine Market Growth A highly skilled workforce is required, including G-code, CAD/CAM software, and machinery troubleshooting capability. The high-level investment associated with modern CNC machinery, especially AI and IoT-enabled machines, proves to be a formidable barrier for SMEs. There continues to be limited opportunity for SMEs to consider CNC machinery in cost-sensitive markets, especially where overhead and markup margins are restricted. Barriers to Adoption and Complexity in Maintenance Limit the CNC Machine Market Growth The increase in complex maintenance requirements and potential for downtime due to software issues or mechanical problems hamper the CNC Machine Market growth. There is no adoption of CNC technologies in certain low-tech manufacturing areas of the developing world because of a lack of awareness, inadequate infrastructure, and continued reliance on traditional machining. These inhibiting factors represent limited utilization of CNC machine development and market utility within developing economies.CNC Machine Market Segment Analysis:

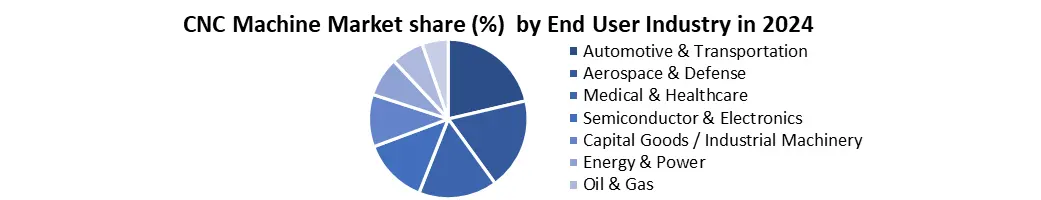

Based on Product Type, the Lathe Machine Segment is expected to dominate the CNC Machine Market during the forecast period. It utilizes a computer-controlled rotating chuck to securely hold and spin the workpiece, while a cutting tool moves along multiple axes to shape the material with high precision. Ideal for producing symmetrical components such as cylinders, cones, and discs, CNC lathes are essential for creating parts with tight tolerances and complex geometries, particularly in industries requiring high accuracy and efficiency. Milling Machines are CNC machines due to their versatility, allowing them to operate such as a lathe CNC machine; they can cut, drill, and contour components in metals, plastics, composites and others. Precision, speed, repeatability and adaptability have made milling machines reign supreme in the automotive and aerospace sectors and other industries producing complex, high-tolerance components. Coupled with modern technologies such as CAD/CAM capabilities or automation, milling machines enhance productivity and efficiency. Based on End User Industry, the Automotive & Transportation segment held the CNC Machine Market in 2024 and is expected to continue its dominance over the forecast period. The increasing demand as the sector requires precision, efficient and scalable manufacturing capabilities to produce complex components such as engine blocks, gear systems, brake and chassis components. As consumer expectations grow in performance, safety and customization, manufacturers are relying on CNC machines to deliver high-quality parts with a tight tolerance and consistent quality. The increasing demand for electric vehicles (EVs) and lighter parts has driven the market to accept new machining solutions. The focus of the transportation sector on automation and addressing lengthy production cycles to enable cost-effective mass production further solidifies the stronghold of CNC technologies.

Regional Insights of CNC Machine Market:

The North American region dominated CNC machine Industry focused in the United States. In North America, the industries that are using CNC machines for automation is being driven by growth from the aerospace and defence sectors. The Europe CNC machine industry is the next largest, especially in Germany and Italy that are focused on precision engineering and sustainability, while using modern CNC technologies with an emphasis on the integrated evolution of Industry 4.0. The Asia-Pacific CNC Machine Market has kept growing due to rapid industrialization in China, Japan, India and South Korea, driven by demand for CNC machines in the automotive, electronics and heavy industries. In South America, the market is growing quickly in the automotive and metal fabrication sectors, while Brazil and Mexico are leading the way, and there is a growing interest in lower-cost, used and refurbished CNC machines. The Middle East & Africa is developing as more economies, UAE, Arabia and South Africa, are diversifying their economies and expanding the demand for CNC systems in construction and mining applications. Competitive Landscape of the CNC Machine Market: The key global players, such as DMG Mori, Yamazaki Mazak, Haas Automation, FANUC, Siemens AG, and Okuma Corporation, dominate the market. They provide normalized offerings, a global manufacturing presence, and a focus on physical constants (digital twin technology, IoT, automation potential). Asia-Pacific is a significant regional competitor for the CNC Machine sector due to manufacturing capacity (particularly China, Japan, South Korea), where Europe and North America have a strong footprint based on their historical economic base and their manufacturing needs for precision products. The strategic actions such as acquisitions, partnerships with automation or technical firms, and geographic expansion into Asia. The report provides CNC Machine Market share and competitive metrics such as product development, innovation, geographical presence, and service capabilities to assess how companies are competing to lead the market. Recent key developments in the CNC Machine Market • June 2025, USA – CloudNC (British US innovation) launched its AI-powered CAM Assist software in the U.S., automating up to 80% of CNC programming tasks to overcome the machinist labor shortage and dramatically reduce setup times. • May 2025, North America (Mexico/USA) – Accelerated nearshoring led U.S. and Mexican manufacturing firms to install 2,600 twin spindle lathes in Q1 2024 to support EV plant production across the U.S.–Mexico corridor. • March 2025, Europe – Germany’s commitment to energy efficiency under the Green Deal spurred 480 retrofit projects, upgrading 2,150 legacy CNC machines with regenerative servo drives that save ~0.9 kWh per deceleration. • April 2023, India (Asia) – Mitsubishi Electric India formed a strategic partnership with SolidCAM to integrate high-speed CAM software into their CNC systems, aimed at diverse sectors including automotive, medical, and aerospace. • July 2022, APAC (China) – DMG MORI acquired KURAKI, a specialist in horizontal boring and milling, enhancing its capabilities in heavy-duty CNC machining and reinforcing its Industry 4.0-led digital solution. Key trends in the CNC Machine market 1. Adoption of 5-Axis and Multi-Axis CNC Machines • Manufacturers are increasingly adopting 5-axis CNC machines for complex and high-precision parts in aerospace, defense, and automotive industries. • Example: The market for 5-axis CNC machines is expected to grow at a CAGR of 7.3% from 2024 to 2030, due to demand for advanced milling and drilling operations. 2. Integration of Industrial IoT (IIoT) and Automation • The use of smart CNC machines integrated with sensors, real-time monitoring, and remote diagnostics is on the rise. • Example: Over 40% of new CNC machines sold in 2024 were equipped with IoT-enabled interfaces to optimize predictive maintenance and machine utilization. 3. Rise in Demand from EV and Aerospace Sectors • The growing production of electric vehicles (EVs) and aircraft components is driving demand for precision machining. • Example: CNC machine deployment in the automotive sector rose by 22% in 2023, largely due to the surge in EV battery casing and motor housing production.CNC Machine Market Scope: Inquire before buying

CNC Machine Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 100.61 Bn. Forecast Period 2025 to 2032 CAGR: 8.7% Market Size in 2032: USD 196.1 Bn. Segments Covered: by Offering Machines Parts & Accessories Services by Product Type Milling Machines Machining Centers Lathe Machines Laser Machines Drilling Machines Grinding Machines Electrical Discharge Machines Others by End-User Industry Automotive & Transportation Aerospace & Defense Medical & Healthcare Semiconductor & Electronics Capital Goods / Industrial Machinery Energy & Power Oil & Gas Others CNC Machine Market, By Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Leading Manufacturers in the CNC Machine Market are:

North America 1. Haas Automation Inc. – USA 2. Hurco Companies, Inc. – USA 3. Hardinge Inc. – USA 4. FANUC America Corporation – USA 5. Flow International Corporation – USA Europe 1. DMG Mori AG – Germany 2. Gildemeister Italiana S.p.A. – Italy 3. Fagor Automation – Spain 4. Starrag Group Holding AG – Switzerland 5. EMCO GmbH – Austria Asia-Pacific 1. Yamazaki Mazak Corporation – Japan 2. Okuma Corporation – Japan 3. FANUC Corporation – Japan 4. Hyundai WIA Corporation – South Korea 5. Makino Milling Machine Co., Ltd. – Japan Middle East & Africa 1. MTAB Engineers Pvt. Ltd. – India 2. Electronica Hitech Machine Tools Pvt. Ltd. – India 3. AL Ruqee Machine Tools Co. Ltd. – Saudi Arabia 4. Fadal Engineering – Distributors in UAE and South Africa 5. Machine Tools Africa (MTA) South America 1. ROMI S.A. – Brazil 2. Indústrias Nardini S.A. – Brazil 3. Beyeler Machinery South America – Brazil 4. Maquitec S.A. – ArgentinaFAQ’S:

1) What was the CNC Machine Market size in 2024? Answer: The CNC Machine Market was valued at 100.61 billion in 2024. 2) Which product segment is dominating the CNC Machine Market? Answer: The Lathe machine segment is dominating the market due to the increasing use of multiaxis tooling in the mechanism by various end users. 3) What are the key players in the CNC Machine Market? Answer: FANUC Corporation, Amada Machine Tools Co. Ltd., Yamazaki Mazak Corporation, JTEKT Corporation, Trumpf, Schuler AG, Hyundai WIA, Mitsubishi Heavy Industries Machine Tools Ltd., Makino, MAG IAS GmbH, KOMATSU Ltd., XYZ Machine Tools, ANCA Group, Okuma Corporation, SIEMENS, HAAS Automation, DMG MORI 4) Which factor acts as the driving factor for the growth of the CNC Machine Market? Answer: Advantages of CNC machines, including increased precision, speed, and flexibility, as well as features such as contour machining, which permits cutting of contoured forms, including those protruding from the surface, are the factors driving the market growth. 5) What factors are restraining the growth of the CNC Machine Market? Answer: The high cost of maintenance for CNC machines and robots is a restraining factor hampering the market growth.

1. CNC Machine Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion and Volume in Units) - By Segments, Regions, and Country 2. CNC Machine Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. Revenue (2024) 2.3.5. Market Share (%) 2024 2.3.6. Market Expansion Strategies 2.3.7. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. CNC Machine Market: Dynamics 3.1. CNC Machine Market: Market Trends 3.2. CNC Machine Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the CNC Machine Market 4. CNC Machine Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 4.1. CNC Machine Market Size and Forecast, By Offering (2024-2032) 4.1.1. Machines 4.1.2. Parts & Accessories 4.1.3. Services 4.2. CNC Machine Market Size and Forecast, By Product Type (2024-2032) 4.2.1. Milling Machines 4.2.2. Machining Centers 4.2.3. Lathe Machines 4.2.4. Laser Machines 4.2.5. Drilling Machines 4.2.6. Grinding Machines 4.2.7. Electrical Discharge Machines 4.2.8. Others 4.3. CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 4.3.1. Automotive & Transportation 4.3.2. Aerospace & Defense 4.3.3. Medical & Healthcare 4.3.4. Semiconductor & Electronics 4.3.5. Capital Goods / Industrial Machinery 4.3.6. Energy & Power 4.3.7. Oil & Gas 4.3.8. Others 4.4. CNC Machine Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America CNC Machine Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 5.1. North America CNC Machine Market Size and Forecast, By Offering (2024-2032) 5.1.1. Machines 5.1.2. Parts & Accessories 5.1.3. Services 5.2. North America CNC Machine Market Size and Forecast, By Product Type (2024-2032) 5.2.1. Milling Machines 5.2.2. Machining Centers 5.2.3. Lathe Machines 5.2.4. Laser Machines 5.2.5. Drilling Machines 5.2.6. Grinding Machines 5.2.7. Electrical Discharge Machines 5.2.8. Others 5.3. North America CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 5.3.1. Automotive & Transportation 5.3.2. Aerospace & Defense 5.3.3. Medical & Healthcare 5.3.4. Semiconductor & Electronics 5.3.5. Capital Goods / Industrial Machinery 5.3.6. Energy & Power 5.3.7. Oil & Gas 5.3.8. Others 5.4. North America CNC Machine Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States CNC Machine Market Size and Forecast, By Offering (2024-2032) 5.4.1.1.1. Machines 5.4.1.1.2. Parts & Accessories 5.4.1.1.3. Services 5.4.1.2. United States CNC Machine Market Size and Forecast, By Product Type (2024-2032) 5.4.1.2.1. Milling Machines 5.4.1.2.2. Machining Centers 5.4.1.2.3. Lathe Machines 5.4.1.2.4. Laser Machines 5.4.1.2.5. Drilling Machines 5.4.1.2.6. Grinding Machines 5.4.1.2.7. Electrical Discharge Machines 5.4.1.2.8. Others 5.4.1.3. United States CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 5.4.1.3.1. Automotive & Transportation 5.4.1.3.2. Aerospace & Defense 5.4.1.3.3. Medical & Healthcare 5.4.1.3.4. Semiconductor & Electronics 5.4.1.3.5. Capital Goods / Industrial Machinery 5.4.1.3.6. Energy & Power 5.4.1.3.7. Oil & Gas 5.4.1.3.8. Others 5.4.2. Canada 5.4.2.1. Canada CNC Machine Market Size and Forecast, By Offering (2024-2032) 5.4.2.1.1. Machines 5.4.2.1.2. Parts & Accessories 5.4.2.1.3. Services 5.4.2.2. Canada CNC Machine Market Size and Forecast, By Product Type (2024-2032) 5.4.2.2.1. Milling Machines 5.4.2.2.2. Machining Centers 5.4.2.2.3. Lathe Machines 5.4.2.2.4. Laser Machines 5.4.2.2.5. Drilling Machines 5.4.2.2.6. Grinding Machines 5.4.2.2.7. Electrical Discharge Machines 5.4.2.2.8. Others 5.4.2.3. Canada CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 5.4.2.3.1. Automotive & Transportation 5.4.2.3.2. Aerospace & Defense 5.4.2.3.3. Medical & Healthcare 5.4.2.3.4. Semiconductor & Electronics 5.4.2.3.5. Capital Goods / Industrial Machinery 5.4.2.3.6. Energy & Power 5.4.2.3.7. Oil & Gas 5.4.2.3.8. Others 5.4.3. Mexico 5.4.3.1. Mexico CNC Machine Market Size and Forecast, By Offering (2024-2032) 5.4.3.1.1. Machines 5.4.3.1.2. Parts & Accessories 5.4.3.1.3. Services 5.4.3.2. Mexico CNC Machine Market Size and Forecast, By Product Type (2024-2032) 5.4.3.2.1. Milling Machines 5.4.3.2.2. Machining Centers 5.4.3.2.3. Lathe Machines 5.4.3.2.4. Laser Machines 5.4.3.2.5. Drilling Machines 5.4.3.2.6. Grinding Machines 5.4.3.2.7. Electrical Discharge Machines 5.4.3.2.8. Others 5.4.3.3. Mexico CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 5.4.3.3.1. Automotive & Transportation 5.4.3.3.2. Aerospace & Defense 5.4.3.3.3. Medical & Healthcare 5.4.3.3.4. Semiconductor & Electronics 5.4.3.3.5. Capital Goods / Industrial Machinery 5.4.3.3.6. Energy & Power 5.4.3.3.7. Oil & Gas 5.4.3.3.8. Others 6. Europe CNC Machine Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 6.1. Europe CNC Machine Market Size and Forecast, By Offering (2024-2032) 6.2. Europe CNC Machine Market Size and Forecast, By Product Type (2024-2032) 6.3. Europe CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 6.4. Europe CNC Machine Market Size and Forecast, By Country (2024-2032) 6.4.1. United Kingdom 6.4.2. France 6.4.3. Germany 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific CNC Machine Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 7.1. Asia Pacific CNC Machine Market Size and Forecast, By Offering (2024-2032) 7.2. Asia Pacific CNC Machine Market Size and Forecast, By Product Type (2024-2032) 7.3. Asia Pacific CNC Machine Market Size and Forecast, By End-User Industry 2024-2032) 7.4. Asia Pacific CNC Machine Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.2. S Korea 7.4.3. Japan 7.4.4. India 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippines 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa CNC Machine Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 8.1. Middle East and Africa CNC Machine Market Size and Forecast, By Offering (2024-2032) 8.2. Middle East and Africa CNC Machine Market Size and Forecast, By Product Type (2024-2032) 8.3. Middle East and Africa CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 8.4. Middle East and Africa CNC Machine Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.2. GCC 8.4.3. Nigeria 8.4.4. Rest of ME&A 9. South America CNC Machine Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Units) (2024-2032) 9.1. South America CNC Machine Market Size and Forecast, By Offering (2024-2032) 9.2. South America CNC Machine Market Size and Forecast, By Product Type (2024-2032) 9.3. South America CNC Machine Market Size and Forecast, By End-User Industry (2024-2032) 9.4. South America CNC Machine Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1. Haas Automation Inc. – USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Hurco Companies, Inc. – USA 10.3. Hardinge Inc. – USA 10.4. FANUC America Corporation – USA 10.5. Flow International Corporation – USA 10.6. DMG Mori AG – Germany 10.7. Gildemeister Italiana S.p.A. – Italy 10.8. Fagor Automation – Spain 10.9. Starrag Group Holding AG – Switzerland 10.10. EMCO GmbH – Austria 10.11. Yamazaki Mazak Corporation – Japan 10.12. Okuma Corporation – Japan 10.13. FANUC Corporation – Japan 10.14. Hyundai WIA Corporation – South Korea 10.15. Makino Milling Machine Co., Ltd. – Japan 10.16. MTAB Engineers Pvt. Ltd. – India 10.17. Electronica Hitech Machine Tools Pvt. Ltd. – India 10.18. AL Ruqee Machine Tools Co. Ltd. – Saudi Arabia 10.19. Fadal Engineering – Distributors in UAE and South Africa 10.20. Machine Tools Africa (MTA) 10.21. ROMI S.A. – Brazil 10.22. Indústrias Nardini S.A. – Brazil 10.23. Beyeler Machinery South America – Brazil 10.24. Maquitec S.A. – Argentina 11. Key Findings 12. Analyst Recommendations 13. CNC Machine Market – Research Methodology