The Cell Sorting Market was valued at USD 262.6 Million in 2024 is expected to grow at a CAGR of 8.2 % from 2025 to 2032, reaching nearly USD 493.3 Million by 2032.Cell Sorting Market Overview

Cell sorting is a critical process that involves isolating and separating cells from biological samples based on their type and characteristics. The technology is broadly categorized into three primary methods: single-cell sorting, fluorescence-activated cell sorting (FACS), and magnetic-activated cell sorting (MACS). Among these, FACS is the most commonly used method due to its high precision, ability to analyze multiple parameters simultaneously, and versatility across applications. The global cell sorting market covers the manufacturing, deployment, and utilization of instruments and reagents required for isolating cells in clinical, pharmaceutical, and research settings. The increasing demand for personalized medicine and single-cell analysis, which necessitates precise cell separation and characterization this factor significantly boost the market. Ongoing innovations in sorting technologies are also enabling higher throughput and greater accuracy, further expanding the market. Regionally, North America dominated the cell sorting market in 2024, driven by strong funding for biomedical research and development, extensive clinical adoption of immunotherapies, and early integration of cutting-edge sorting platforms, particularly within the United States. The clinical research sector and hospitals accounted for the largest end-user base, fueled by the growing need for accurate cell analysis in diagnostics, immunotherapy, and other targeted treatments. This strong demand in healthcare and research continues to drives the market’s growth trajectory.To know about the Research Methodology :- Request Free Sample Report

Cell Sorting Market Dynamics

Rising Prevalence of Chronic Diseases to drive the Cell Sorting Market The increasing global burden of chronic diseases such as cancer, autoimmune disorders, and cardiovascular conditions is a primary driver fueling the growth of the Cell Sorting Market. According to the World Health Organization, chronic diseases account for over 70% of global deaths, underscoring the urgent need for advanced diagnostic and therapeutic tools. Cell sorting technologies enable precise isolation and analysis of specific cell populations, which is essential for early disease diagnosis, biomarker identification, and monitoring treatment efficacy. The growing demand for personalized and targeted therapies, including immunotherapies and stem cell treatments, further accelerates cell sorting adoption. For instance, cancer immunotherapy heavily relies on isolating tumor-infiltrating lymphocytes, improving patient-specific treatment outcomes. Additionally, regenerative medicine benefits from purified stem cells, vital for tissue repair in degenerative diseases. Advanced healthcare infrastructure and substantial biopharma investments drives demand of Cell Sorting. Germany and UK, supported by government funding, show strong growth in cell-based therapy research. Asia-Pacific is the fastest-growing market, with countries such as India and China investing heavily in healthcare and biotechnology to address rising diabetes and cancer rates. Japan’s aging population also contributes to increasing demand. Canada similarly rising adoption driven by growing chronic disease incidence. Stringent Regulatory Approvals and Quality Control Requirements Limits the growth of Cell Sorting Market Cell sorting instruments, classified as medical devices, must comply with strict regulations such as the U.S. FDA’s 510(k) or PMA approvals and Europe’s CE marking under the EU Medical Device Regulation (MDR). Similar regulatory bodies in Japan (PMDA), India (CDSCO), and Canada enforce comprehensive safety, efficacy, and quality standards for market entry. These regulatory processes are often lengthy and costly, requiring extensive clinical trials, validation studies, and detailed documentation. This delays the introduction of innovative cell sorting technologies and raises development costs, limiting accessibility and market growth. Additionally, manufacturers must adhere to strict Quality Management Systems such as ISO 13485 and Good Manufacturing Practices (GMP), adding complexity and expense to production. Regulatory oversight extends to consumables such as reagents and antibodies, which require separate clearances, further complicating commercialization. Smaller and emerging companies face significant challenges in meeting these high compliance costs, hindering competition against established players like BD Biosciences and Thermo Fisher Scientific. Since the implementation of the EU MDR in 2021, regulatory scrutiny has intensified, tightening market access and restraining growth. These stringent approvals and quality controls act as key barriers in the cell sorting market. Integration of AI and Automation creates lucrative growth opportunities to the Cell Sorting Market AI-powered algorithms enable real-time cell identification and sorting decisions, minimizing human error and increasing throughput critical for applications like immunotherapy and cancer research. Automated systems also maintain high purity and viability, supporting complex biomedical workflows. AI facilitates multiparameter analysis by simultaneously interpreting cellular markers, morphology, and functional traits, enabling accurate classification of heterogeneous cell populations beyond manual capabilities. Automation reduces the need for skilled operators, lowering contamination risks and improving reproducibility, while enabling labs to scale operations efficiently. Advances in microfluidics combined with AI have led to portable, cost-effective cell sorting devices suitable for point-of-care diagnostics and decentralized testing. AI-driven predictive analytics further optimize research and clinical outcomes by forecasting cell behavior and quality control. Notably, Thermo Fisher Scientific’s 2021 acquisition of AI-enabled cell sorting assets exemplifies market momentum, while recent research at the Medical University of South Carolina highlights AI’s role in refining personalized cancer therapies.Cell Sorting Market Segment Analysis

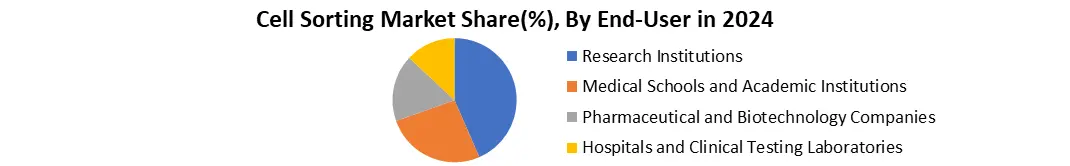

Based on Product, Cell Sorting Market segmented into Cell Sorters, Reagents and Consumables, and Services. The Cell Sorter dominated the Product segment in year 2024. Due to their critical role in enabling precise isolation and analysis of specific cell populations. Cell sorters are the core instruments that perform the actual separation of cells based on various parameters such as size, fluorescence, and surface markers, making them indispensable in both clinical diagnostics and research applications. The rising demand for advanced, high-throughput, and multiparameter sorting systems has driven growth in this segment. Innovations such as integration with AI, automation, and microfluidic technologies have enhanced sorting speed, accuracy, and efficiency, further boosting adoption. Additionally, increasing investments in cancer immunotherapy, stem cell research, and regenerative medicine have propelled the need for sophisticated cell sorters. In contrast, reagents, consumables, and services, while essential, act as supporting elements, making cell sorters the primary revenue-generating product segment in 2024.Based on End-User, Cell Sorting Market segmented into Research Institutions, Medical Schools and Academic Institutions, Pharmaceutical and Biotechnology Companies, and Hospitals and Clinical Testing Laboratories. The Research Institutions segment dominated the end user segment in 2024. Due to their intensive focus on biomedical research, drug discovery, and advanced cellular studies. These institutions require high-precision cell sorting technologies to isolate specific cell populations for experiments involving immunology, oncology, regenerative medicine, and genomics. The growing emphasis on understanding complex diseases and developing novel therapies has driven significant adoption in this sector. Research institutions benefit from strong funding support, enabling investment in Innovative cell sorting systems integrated with AI and automation. For example, leading organizations like the Broad Institute and the Max Planck Institute utilize advanced cell sorters for single-cell analysis and personalized medicine research. Their extensive use of multiparameter sorting accelerates scientific discoveries and innovation. Compared to hospitals and clinical labs, research institutions have broader applications and higher throughput needs, making them the dominant end users in 2024.

Cell Sorting Market Regional Insights

North America dominated the Cell Sorting Market in 2024. The substantial government investment, advanced healthcare infrastructure, and a strong research ecosystem helps to drive the market The U.S. government, primarily through the National Institutes of Health (NIH), allocates billions annually toward biomedical research, focusing on cell-based therapies, cancer, immunology, and precision medicine. This public funding accelerates innovation and widespread adoption of advanced cell sorting technologies in both clinical and research settings. The region’s strong prevalence of chronic diseases, affecting nearly 40% of the population, further fuels demand for precision diagnostics and personalized treatments relying on cell sorting instruments. North America is also home to pioneering companies such as Becton Dickinson, Beckman Coulter, Bio-Rad Laboratories, and Thermo Fisher Scientific, which lead continuous R&D efforts to develop high-throughput, automated, and AI-integrated cell sorting platforms. In addition to government support, private sector investments and partnerships between biotech firms and clinical researchers enhance market growth and commercialization of novel technologies. The United States, capturing approximately 85.6% of the regional market, benefits from world-class hospitals, top-tier research universities, and strong biopharma clusters, reinforcing North America’s dominance in the cell sorting industry. Cell Sorting Market Competitive Landscape The cell sorting market is highly competitive, with key players like Becton, Dickinson and Company (BD), Thermo Fisher Scientific and Bio-Rad Laboratories dominating the industry. BD leads with advanced flow cytometry-based sorters like the BD FACSymphony, integrating AI for high-throughput analysis, catering to cancer and immunology research. Thermo Fisher focuses on automation and compact systems, like the BigFoot Spectral Cell Sorter, enhancing accessibility for clinical and academic labs. Bio-Rad excels in droplet-based sorting with its S3e Cell Sorter, targeting single cell genomics and precision medicine. Companies maintain dominance by strategic acquisitions, R&D investments and collaborations with biotech firms, ensuring cutting-edge innovations. Miltenyi Biotec and Sony Biotechnology are expanding in microfluidics and imaging-based sorting, niche markets like CAR-T therapy. The Asia Pacific region is emerging as growth hub, Sysmex and On-Chip Biotechnologies developing cost-effective, portable solutions. The competitive edge of top players lies in their technological superiority, global distribution networks and strong regulatory compliance, making them preferred choices in both research and clinical applications. Cell Sorting Market Key TrendsCell Sorting Market Recent Development • In May 20, 2024: The BD FACS Discover S8 Cell Sorter was showcased at the CYTO 2023 conference held from May 20-24 in Montréal. Now available for global order online and via local sales representatives, this advanced cell sorting system highlights BD Biosciences’ latest innovation. • In October 9, 2023: The FP7000 Spectral Cell Sorter has been launched, offering advanced capabilities with support for over 44 colors, 6 lasers, and 182 detectors, enabling high-parameter cell sorting for complex research applications. This cutting-edge system is designed to meet the growing demand for multiparameter analysis in biomedical research and clinical diagnostics. The FP7000 is scheduled to be available to customers by summer 2025, marking a significant advancement in cell sorting technology. • In September 12, 2024: Cellares announced a joint development integrating Sony’s CGX10 cell isolation and sorting technology into its automated Cell Shuttle™ therapy platform. This collaboration combines Sony’s advanced cell sorting capabilities with Cellares’ innovative automation system to enhance the efficiency and precision of cell therapy manufacturing. The integration aims to streamline workflows, improve scalability, and accelerate the development of personalized cell therapies, marking a significant step forward in automated cell processing solutions.

Trend Description Impact on Market Technological Advancements High demand for high-speed, high-accuracy cell sorters (e.g., AI-integrated, multi-parameter sorting). Drives innovation, boosts adoption in research & clinical diagnostics. Rising Demand in Biomedical Research Growing use in immunology, cancer research, and stem cell studies. Expands market growth, especially in the academic & pharmaceutical sectors. Shift to Automated & Compact Systems Preference for benchtop and portable cell sorters with minimal manual intervention Increases accessibility for small labs and point-of-care diagnostics. Cell Sorting Market Scope: Inquire before buying

Cell Sorting Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 262.6 Mn. Forecast Period 2025 to 2032 CAGR: 8.2% Market Size in 2032: USD 493.3 Mn. Segments Covered: by Product Cell Sorters Reagents and Consumables Services by Technology Fluorescence-based Droplet Cell Sorting Jet-in-air Cell Sorting Cuvette-based Cell Sorting Magnetic-activated Cell Sorting MEMS - Microfluidics by Type of Cell Adult Stem Cells CAR-T Cells Circulating Fetal Cells Others by Size of Cell < 5 µm 5-10 µm 10-15 µm 15-25 µm > 25 µm by Application Research Clinical by End-User Research Institutions Medical Schools and Academic Institutions Pharmaceutical and Biotechnology Companies Hospitals and Clinical Testing Laboratories Cell Sorting Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Sweden, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, GCC, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South America)Cell Sorting Market Key Players

North America 1. Becton, Dickinson and Company (United States) 2. Thermo Fisher Scientific Inc. (United States) 3. Bio-Rad Laboratories, Inc. (United States) 4. Beckman Coulter, Inc. (United States) 5. Miltenyi Biotec Inc. (United States) 6. Sony Biotechnology Inc. (United States) 7. Union Biometrica, Inc. (United States) Europe 8. Miltenyi Biotec GmbH (Germany) 9. Sysmex Partec GmbH (Germany) 10. Owl biomedical (Germany) 11. NanoCellect Biomedical, Inc. (Germany) 12. Apogee Flow Systems Ltd. (United Kingdom) Asia Pacific 14. Sony Corporation (Japan) 15. Sysmex Corporation (Japan) 16. On-Chip Biotechnologies Co., Ltd. (Japan) 17. Tomocube Inc. (South Korea) 18. Union Biometrica KK (Japan) 19. Nexcelom Bioscience LLC (China) Middle East and Africa 20. BioCell Medical Solutions (Israel) 21. Ziv Medical Center Research Institute (Israel) South America 22. BioTecnologia Brasil (Brazil) 23. ImunoDiagnostica (Brazil) 24. Cytocentrics AG (Argentina)FAQ:

1] What are the Major Key players in the Cell Sorting Market? Ans. The top companies in the Cell Sorting Market are Becton, Dickinson and Company, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Beckman Coulter, Inc., Miltenyi Biotec GmbH, Sony Corporation, Sysmex Corporation, and Cytek Biosciences, Inc. 2] Which region has the largest share in the Cell Sorting Market? Ans. The North America region held the highest share in 2024. 3] What is the market size of the Cell Sorting Market by 2032? Ans. The market size of the Cell Sorting Market by 2032 is expected to reach USD 493.3 million. 4] What is the forecast period for the Cell Sorting Market? Ans. The forecast period for the Cell Sorting Market is 2025 to 2032. 5] What was the market size of the Cell Sorting Market in 2024? Ans. The market size of the Cell Sorting Market in 2024 was valued at USD 262.6 million.

1. Cell Sorting Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Cell Sorting Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Cell Sorting Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Cell Sorting Market: Dynamics 3.1. Cell Sorting Market Trends by Region 3.1.1. North America Cell Sorting Market Trends 3.1.2. Europe Cell Sorting Market Trends 3.1.3. Asia Pacific Cell Sorting Market Trends 3.1.4. Middle East and Africa Cell Sorting Market Trends 3.1.5. South America Cell Sorting Market Trends 3.2. Cell Sorting Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cell Sorting Market Drivers 3.2.1.2. North America Cell Sorting Market Restraints 3.2.1.3. North America Cell Sorting Market Opportunities 3.2.1.4. North America Cell Sorting Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cell Sorting Market Drivers 3.2.2.2. Europe Cell Sorting Market Restraints 3.2.2.3. Europe Cell Sorting Market Opportunities 3.2.2.4. Europe Cell Sorting Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cell Sorting Market Drivers 3.2.3.2. Asia Pacific Cell Sorting Market Restraints 3.2.3.3. Asia Pacific Cell Sorting Market Opportunities 3.2.3.4. Asia Pacific Cell Sorting Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cell Sorting Market Drivers 3.2.4.2. Middle East and Africa Cell Sorting Market Restraints 3.2.4.3. Middle East and Africa Cell Sorting Market Opportunities 3.2.4.4. Middle East and Africa Cell Sorting Market Challenges 3.2.5. South America 3.2.5.1. South America Cell Sorting Market Drivers 3.2.5.2. South America Cell Sorting Market Restraints 3.2.5.3. South America Cell Sorting Market Opportunities 3.2.5.4. South America Cell Sorting Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Cell Sorting Industry 3.8. Analysis of Government Schemes and Initiatives For Cell Sorting Industry 3.9. Cell Sorting Market Trade Analysis 3.10. The Global Pandemic Impact on Cell Sorting Market 4. Cell Sorting Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Cell Sorting Market Size and Forecast, by Product (2024-2032) 4.1.1. Cell Sorters 4.1.2. Reagents and Consumables 4.1.3. Services 4.2. Cell Sorting Market Size and Forecast, by Technology (2024-2032) 4.2.1. Fluorescence-based Droplet Cell Sorting 4.2.2. Jet-in-air Cell Sorting 4.2.3. Cuvette-based Cell Sorting 4.2.4. Magnetic-activated Cell Sorting 4.2.5. MEMS - Microfluidics 4.3. Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 4.3.1. Adult Stem Cells 4.3.2. CAR-T Cells 4.3.3. Circulating Fetal Cells 4.3.4. Others 4.4. Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 4.4.1. < 5 µm 4.4.2. 5-10 µm 4.4.3. 10-15 µm 4.4.4. 15-25 µm 4.4.5. > 25 µm 4.5. Cell Sorting Market Size and Forecast, by Application (2024-2032) 4.5.1. Research 4.5.2. Clinical 4.6. Cell Sorting Market Size and Forecast, by End-User (2024-2032) 4.6.1. Research Institutions 4.6.2. Medical Schools and Academic Institutions 4.6.3. Pharmaceutical and Biotechnology Companies 4.6.4. Hospitals and Clinical Testing Laboratories 4.7. Cell Sorting Market Size and Forecast, by Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Cell Sorting Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Cell Sorting Market Size and Forecast, by Product (2024-2032) 5.1.1. Cell Sorters 5.1.2. Reagents and Consumables 5.1.3. Services 5.2. North America Cell Sorting Market Size and Forecast, by Technology (2024-2032) 5.2.1. Fluorescence-based Droplet Cell Sorting 5.2.2. Jet-in-air Cell Sorting 5.2.3. Cuvette-based Cell Sorting 5.2.4. Magnetic-activated Cell Sorting 5.2.5. MEMS - Microfluidics 5.3. North America Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 5.3.1. Adult Stem Cells 5.3.2. CAR-T Cells 5.3.3. Circulating Fetal Cells 5.3.4. Others 5.4. North America Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 5.4.1. < 5 µm 5.4.2. 5-10 µm 5.4.3. 10-15 µm 5.4.4. 15-25 µm 5.4.5. > 25 µm 5.5. North America Cell Sorting Market Size and Forecast, by Application (2024-2032) 5.5.1. Research 5.5.2. Clinical 5.6. North America Cell Sorting Market Size and Forecast, by End-User (2024-2032) 5.6.1. Research Institutions 5.6.2. Medical Schools and Academic Institutions 5.6.3. Pharmaceutical and Biotechnology Companies 5.6.4. Hospitals and Clinical Testing Laboratories 5.7. North America Cell Sorting Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. United States Cell Sorting Market Size and Forecast, by Product (2024-2032) 5.7.1.1.1. Cell Sorters 5.7.1.1.2. Reagents and Consumables 5.7.1.1.3. Services 5.7.1.2. United States Cell Sorting Market Size and Forecast, by Technology (2024-2032) 5.7.1.2.1. Fluorescence-based Droplet Cell Sorting 5.7.1.2.2. Jet-in-air Cell Sorting 5.7.1.2.3. Cuvette-based Cell Sorting 5.7.1.2.4. Magnetic-activated Cell Sorting 5.7.1.2.5. MEMS - Microfluidics 5.7.1.3. United States Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 5.7.1.3.1. Adult Stem Cells 5.7.1.3.2. CAR-T Cells 5.7.1.3.3. Circulating Fetal Cells 5.7.1.3.4. Others 5.7.1.4. United States Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 5.7.1.4.1. < 5 µm 5.7.1.4.2. 5-10 µm 5.7.1.4.3. 10-15 µm 5.7.1.4.4. 15-25 µm 5.7.1.4.5. > 25 µm 5.7.1.5. United States Cell Sorting Market Size and Forecast, by Application (2024-2032) 5.7.1.5.1. Research 5.7.1.5.2. Clinical 5.7.1.6. United States Cell Sorting Market Size and Forecast, by End-User (2024-2032) 5.7.1.6.1. Research Institutions 5.7.1.6.2. Medical Schools and Academic Institutions 5.7.1.6.3. Pharmaceutical and Biotechnology Companies 5.7.1.6.4. Hospitals and Clinical Testing Laboratories 5.7.2. Canada 5.7.2.1. Canada Cell Sorting Market Size and Forecast, by Product (2024-2032) 5.7.2.1.1. Cell Sorters 5.7.2.1.2. Reagents and Consumables 5.7.2.1.3. Services 5.7.2.2. Canada Cell Sorting Market Size and Forecast, by Technology (2024-2032) 5.7.2.2.1. Fluorescence-based Droplet Cell Sorting 5.7.2.2.2. Jet-in-air Cell Sorting 5.7.2.2.3. Cuvette-based Cell Sorting 5.7.2.2.4. Magnetic-activated Cell Sorting 5.7.2.2.5. MEMS - Microfluidics 5.7.2.3. Canada Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 5.7.2.3.1. Adult Stem Cells 5.7.2.3.2. CAR-T Cells 5.7.2.3.3. Circulating Fetal Cells 5.7.2.3.4. Others 5.7.2.4. Canada Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 5.7.2.4.1. < 5 µm 5.7.2.4.2. 5-10 µm 5.7.2.4.3. 10-15 µm 5.7.2.4.4. 15-25 µm 5.7.2.4.5. > 25 µm 5.7.2.5. Canada Cell Sorting Market Size and Forecast, by Application (2024-2032) 5.7.2.5.1. Research 5.7.2.5.2. Clinical 5.7.2.6. Canada Cell Sorting Market Size and Forecast, by End-User (2024-2032) 5.7.2.6.1. Research Institutions 5.7.2.6.2. Medical Schools and Academic Institutions 5.7.2.6.3. Pharmaceutical and Biotechnology Companies 5.7.2.6.4. Hospitals and Clinical Testing Laboratories 5.7.3. Mexico 5.7.3.1. Mexico Cell Sorting Market Size and Forecast, by Product (2024-2032) 5.7.3.1.1. Cell Sorters 5.7.3.1.2. Reagents and Consumables 5.7.3.1.3. Services 5.7.3.2. Mexico Cell Sorting Market Size and Forecast, by Technology (2024-2032) 5.7.3.2.1. Fluorescence-based Droplet Cell Sorting 5.7.3.2.2. Jet-in-air Cell Sorting 5.7.3.2.3. Cuvette-based Cell Sorting 5.7.3.2.4. Magnetic-activated Cell Sorting 5.7.3.2.5. MEMS - Microfluidics 5.7.3.3. Mexico Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 5.7.3.3.1. Adult Stem Cells 5.7.3.3.2. CAR-T Cells 5.7.3.3.3. Circulating Fetal Cells 5.7.3.3.4. Others 5.7.3.4. Mexico Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 5.7.3.4.1. < 5 µm 5.7.3.4.2. 5-10 µm 5.7.3.4.3. 10-15 µm 5.7.3.4.4. 15-25 µm 5.7.3.4.5. > 25 µm 5.7.3.5. Mexico Cell Sorting Market Size and Forecast, by Application (2024-2032) 5.7.3.5.1. Research 5.7.3.5.2. Clinical 5.7.3.6. Mexico Cell Sorting Market Size and Forecast, by End-User (2024-2032) 5.7.3.6.1. Research Institutions 5.7.3.6.2. Medical Schools and Academic Institutions 5.7.3.6.3. Pharmaceutical and Biotechnology Companies 5.7.3.6.4. Hospitals and Clinical Testing Laboratories 6. Europe Cell Sorting Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.2. Europe Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.3. Europe Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.4. Europe Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.5. Europe Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.6. Europe Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7. Europe Cell Sorting Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.1.2. United Kingdom Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.1.3. United Kingdom Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.1.4. United Kingdom Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.1.5. United Kingdom Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.1.6. United Kingdom Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7.2. France 6.7.2.1. France Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.2.2. France Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.2.3. France Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.2.4. France Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.2.5. France Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.2.6. France Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.3.2. Germany Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.3.3. Germany Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.3.4. Germany Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.3.5. Germany Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.3.6. Germany Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.4.2. Italy Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.4.3. Italy Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.4.4. Italy Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.4.5. Italy Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.4.6. Italy Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.5.2. Spain Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.5.3. Spain Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.5.4. Spain Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.5.5. Spain Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.5.6. Spain Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.6.2. Sweden Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.6.3. Sweden Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.6.4. Sweden Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.6.5. Sweden Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.6.6. Sweden Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7.7. Austria 6.7.7.1. Austria Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.7.2. Austria Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.7.3. Austria Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.7.4. Austria Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.7.5. Austria Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.7.6. Austria Cell Sorting Market Size and Forecast, by End-User (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Cell Sorting Market Size and Forecast, by Product (2024-2032) 6.7.8.2. Rest of Europe Cell Sorting Market Size and Forecast, by Technology (2024-2032) 6.7.8.3. Rest of Europe Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 6.7.8.4. Rest of Europe Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 6.7.8.5. Rest of Europe Cell Sorting Market Size and Forecast, by Application (2024-2032) 6.7.8.6. Rest of Europe Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7. Asia Pacific Cell Sorting Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.3. Asia Pacific Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.4. Asia Pacific Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.5. Asia Pacific Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.6. Asia Pacific Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7. Asia Pacific Cell Sorting Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.1.2. China Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.1.3. China Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.1.4. China Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.1.5. China Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.1.6. China Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.2.2. S Korea Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.2.3. S Korea Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.2.4. S Korea Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.2.5. S Korea Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.2.6. S Korea Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.3.2. Japan Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.3.3. Japan Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.3.4. Japan Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.3.5. Japan Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.3.6. Japan Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.4. India 7.7.4.1. India Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.4.2. India Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.4.3. India Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.4.4. India Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.4.5. India Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.4.6. India Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.5.2. Australia Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.5.3. Australia Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.5.4. Australia Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.5.5. Australia Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.5.6. Australia Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.6.2. Indonesia Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.6.3. Indonesia Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.6.4. Indonesia Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.6.5. Indonesia Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.6.6. Indonesia Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.7.2. Malaysia Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.7.3. Malaysia Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.7.4. Malaysia Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.7.5. Malaysia Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.7.6. Malaysia Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.8. Vietnam 7.7.8.1. Vietnam Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.8.2. Vietnam Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.8.3. Vietnam Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.8.4. Vietnam Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.8.5. Vietnam Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.8.6. Vietnam Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.9. Taiwan 7.7.9.1. Taiwan Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.9.2. Taiwan Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.9.3. Taiwan Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.9.4. Taiwan Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.9.5. Taiwan Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.9.6. Taiwan Cell Sorting Market Size and Forecast, by End-User (2024-2032) 7.7.10. Rest of Asia Pacific 7.7.10.1. Rest of Asia Pacific Cell Sorting Market Size and Forecast, by Product (2024-2032) 7.7.10.2. Rest of Asia Pacific Cell Sorting Market Size and Forecast, by Technology (2024-2032) 7.7.10.3. Rest of Asia Pacific Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 7.7.10.4. Rest of Asia Pacific Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 7.7.10.5. Rest of Asia Pacific Cell Sorting Market Size and Forecast, by Application (2024-2032) 7.7.10.6. Rest of Asia Pacific Cell Sorting Market Size and Forecast, by End-User (2024-2032) 8. Middle East and Africa Cell Sorting Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Cell Sorting Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Cell Sorting Market Size and Forecast, by Technology (2024-2032) 8.3. Middle East and Africa Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 8.4. Middle East and Africa Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 8.5. Middle East and Africa Cell Sorting Market Size and Forecast, by Application (2024-2032) 8.6. Middle East and Africa Cell Sorting Market Size and Forecast, by End-User (2024-2032) 8.7. Middle East and Africa Cell Sorting Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Cell Sorting Market Size and Forecast, by Product (2024-2032) 8.7.1.2. South Africa Cell Sorting Market Size and Forecast, by Technology (2024-2032) 8.7.1.3. South Africa Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 8.7.1.4. South Africa Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 8.7.1.5. South Africa Cell Sorting Market Size and Forecast, by Application (2024-2032) 8.7.1.6. South Africa Cell Sorting Market Size and Forecast, by End-User (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Cell Sorting Market Size and Forecast, by Product (2024-2032) 8.7.2.2. GCC Cell Sorting Market Size and Forecast, by Technology (2024-2032) 8.7.2.3. GCC Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 8.7.2.4. GCC Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 8.7.2.5. GCC Cell Sorting Market Size and Forecast, by Application (2024-2032) 8.7.2.6. GCC Cell Sorting Market Size and Forecast, by End-User (2024-2032) 8.7.3. Nigeria 8.7.3.1. Nigeria Cell Sorting Market Size and Forecast, by Product (2024-2032) 8.7.3.2. Nigeria Cell Sorting Market Size and Forecast, by Technology (2024-2032) 8.7.3.3. Nigeria Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 8.7.3.4. Nigeria Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 8.7.3.5. Nigeria Cell Sorting Market Size and Forecast, by Application (2024-2032) 8.7.3.6. Nigeria Cell Sorting Market Size and Forecast, by End-User (2024-2032) 8.7.4. Rest of ME&A 8.7.4.1. Rest of ME&A Cell Sorting Market Size and Forecast, by Product (2024-2032) 8.7.4.2. Rest of ME&A Cell Sorting Market Size and Forecast, by Technology (2024-2032) 8.7.4.3. Rest of ME&A Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 8.7.4.4. Rest of ME&A Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 8.7.4.5. Rest of ME&A Cell Sorting Market Size and Forecast, by Application (2024-2032) 8.7.4.6. Rest of ME&A Cell Sorting Market Size and Forecast, by End-User (2024-2032) 9. South America Cell Sorting Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Cell Sorting Market Size and Forecast, by Product (2024-2032) 9.2. South America Cell Sorting Market Size and Forecast, by Technology (2024-2032) 9.3. South America Cell Sorting Market Size and Forecast, by Type of Cell(2024-2032) 9.4. South America Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 9.5. South America Cell Sorting Market Size and Forecast, by Application (2024-2032) 9.6. South America Cell Sorting Market Size and Forecast, by End-User (2024-2032) 9.7. South America Cell Sorting Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Cell Sorting Market Size and Forecast, by Product (2024-2032) 9.7.1.2. Brazil Cell Sorting Market Size and Forecast, by Technology (2024-2032) 9.7.1.3. Brazil Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 9.7.1.4. Brazil Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 9.7.1.5. Brazil Cell Sorting Market Size and Forecast, by Application (2024-2032) 9.7.1.6. Brazil Cell Sorting Market Size and Forecast, by End-User (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Cell Sorting Market Size and Forecast, by Product (2024-2032) 9.7.2.2. Argentina Cell Sorting Market Size and Forecast, by Technology (2024-2032) 9.7.2.3. Argentina Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 9.7.2.4. Argentina Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 9.7.2.5. Argentina Cell Sorting Market Size and Forecast, by Application (2024-2032) 9.7.2.6. Argentina Cell Sorting Market Size and Forecast, by End-User (2024-2032) 9.7.3. Rest Of South America 9.7.3.1. Rest Of South America Cell Sorting Market Size and Forecast, by Product (2024-2032) 9.7.3.2. Rest Of South America Cell Sorting Market Size and Forecast, by Technology (2024-2032) 9.7.3.3. Rest Of South America Cell Sorting Market Size and Forecast, by Type of Cell (2024-2032) 9.7.3.4. Rest Of South America Cell Sorting Market Size and Forecast, by Size of Cell (2024-2032) 9.7.3.5. Rest Of South America Cell Sorting Market Size and Forecast, by Application (2024-2032) 9.7.3.6. Rest Of South America Cell Sorting Market Size and Forecast, by End-User (2024-2032) 10. Company Profile: Key Players 10.1. Becton, Dickinson and Company (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Thermo Fisher Scientific Inc. (United States) 10.3. Bio-Rad Laboratories, Inc. (United States) 10.4. Beckman Coulter, Inc. (United States) 10.5. Miltenyi Biotec Inc. (United States) 10.6. Sony Biotechnology Inc. (United States) 10.7. Union Biometrica, Inc. (United States) 10.8. Miltenyi Biotec GmbH (Germany) 10.9. Sysmex Partec GmbH (Germany) 10.10. Owl biomedical (Germany) 10.11. NanoCellect Biomedical, Inc. (Germany) 10.12. Apogee Flow Systems Ltd. (United Kingdom) 10.13. Sony Corporation (Japan) 10.14. Sysmex Corporation (Japan) 10.15. On-Chip Biotechnologies Co., Ltd. (Japan) 10.16. Tomocube Inc. (South Korea) 10.17. Union Biometrica KK (Japan) 10.18. Nexcelom Bioscience LLC (China) 10.19. BioCell Medical Solutions (Israel) 10.20. Ziv Medical Center Research Institute (Israel) 10.21. BioTecnologia Brasil (Brazil) 10.22. ImunoDiagnostica (Brazil) 10.23. Cytocentrics AG (Argentina) 11. Key Findings 12. Industry Recommendations 13. Cell Sorting Market: Research Methodology 14. Terms and Glossary