Global Bio Optics Market size was valued at USD 1.8 Bn. in 2022 and the total Bio Optics revenue is expected to grow by 6.3 % from 2023 to 2029, reaching nearly USD 2.8 Bn.Bio Optics Market Overview:

Bio optics is the application of light-based technologies for imaging, analysis, and manipulation of biological samples and systems. The bio optics market has witnessed significant growth in recent years thanks to advancements in optical technologies, increasing research and development activities in the life sciences, and rising demand for minimally invasive medical procedures. The market encompasses a wide range of products and applications, including microscopy systems, spectroscopy devices, optical coherence tomography systems, biophotonics tools, and optical sensors. The bio optics market benefits from the continuous growth of biomedical research and life sciences. Optical techniques are widely used in areas such as cell biology, neuroscience, genetics, and drug discovery. The demand for bio optics products is driven by the need to visualize and analyze biological structures, processes, and interactions at various scales. The increasing healthcare expenditure across the globe has a positive impact on the bio optics market. Governments and private organizations are investing in advanced medical technologies to improve healthcare infrastructure. This investment drives the adoption of bio optics devices in hospitals, clinics, and research institutes. Minimally invasive procedures are gaining popularity due to their advantages, such as reduced patient discomfort, faster recovery, and shorter hospital stays. Bio optics technologies, such as endoscopy and optical biopsy, play a crucial role in guiding and monitoring these procedures, thereby boosting market growth.To know about the Research Methodology :- Request Free Sample Report

Bio Optics Market Dynamics:

Bio Optics Market Drivers Increasing Focus on Point-of-Care Applications Drives Bio Optics Market Growth The growing emphasis on point-of-care applications is a significant driver propelling the growth of the bio optics market. Point-of-care applications refer to the use of bio optics technologies in healthcare settings outside traditional laboratories, bringing diagnostics and monitoring closer to patients. Bio optics technologies, such as handheld imaging devices and portable spectroscopy systems, enable rapid and accurate diagnostics at the point of care. These devices provide real-time analysis of biological samples, allowing for on-the-spot detection of diseases, infections, or specific biomarkers. Point-of-care diagnostics improve patient outcomes by enabling timely interventions and reducing the need for sample transportation and centralized laboratory testing. Point-of-care bio optics technologies are particularly valuable in remote or resource-limited settings, where access to centralized laboratories and healthcare facilities is limited. Portable and robust bio optics devices are deployed in these settings to provide essential diagnostic capabilities, enabling healthcare professionals to make informed decisions and initiate appropriate treatments without delays. The rise of home healthcare and self-monitoring trends have created a demand for user-friendly and accessible bio optics devices. For example, handheld devices that allow patients to monitor glucose levels, measure vital signs or conduct self-examinations provide convenience and empowerment to individuals managing chronic conditions. Bio optics technologies designed for easy-to-use home monitoring contribute to patient engagement, disease management, and preventive care. The integration of bio optics with telemedicine platforms enables remote imaging and consultation, growing access to specialized healthcare services. Healthcare providers can remotely guide the use of bio optics devices or interpret imaging results in real-time, enabling virtual consultations, remote diagnostics, and treatment planning. This enhances patient care in situations where in-person visits may be challenging or not feasible. Bio optics technologies deployed at the point of care facilitate real-time research and surveillance activities. These technologies enable the collection of data in diverse patient populations, aiding in the understanding of disease patterns, monitoring outbreaks, and evaluation of treatment effectiveness. Point-of-care research and surveillance contribute to public health initiatives and facilitate evidence-based decision-making. Bio Optics Market Restraint Regulatory Challenges and Compliance Hurdles Limit Bio Optics Market Growth Regulatory challenges and compliance hurdles pose significant restraints on the growth of the bio optics market. These challenges encompass various regulatory frameworks, standards, and compliance requirements that govern the development, manufacturing, and commercialization of bio optics technologies. Bio optics technologies, especially those used in medical applications, are subject to rigorous regulatory approval processes. These processes involve extensive testing, safety evaluations, and clinical trials to ensure the efficacy, safety, and quality of the devices. Obtaining regulatory approvals are time-consuming and costly, delaying market entry and hindering market growth. Bio optics technologies need to comply with various regulatory standards and requirements, such as Good Manufacturing Practices (GMP), ISO certifications, and medical device regulations. Meeting these compliance requirements involves implementing robust quality management systems, conducting regular audits, and maintaining documentation, which can be resource-intensive for manufacturers and impact the speed of product development and commercialization. The use of bio optics technologies in research and diagnostics raises ethical concerns and privacy considerations. As these technologies involve the collection and analysis of sensitive biological and medical data, ensuring patient privacy, data protection, and informed consent becomes paramount. Complying with ethical guidelines and privacy regulations adds complexity and cost to the development and deployment of bio optics solutions. The regulatory challenges and compliance hurdles in the bio optics market impose constraints on product development timelines, market entry, and whole growth. Overcoming these challenges necessitates proactive engagement with regulatory authorities, investing in compliance measures, and ensuring adherence to ethical and privacy standards. Bio Optics Market Opportunity Advancements in Fluorescence Imaging Techniques Propel Growth of Bio Optics Market The field of fluorescence imaging has witnessed significant progress in the development of novel fluorescent probes. These probes exhibit improved brightness, photostability, and specificity for targeting specific biomarkers or cellular structures. For example, the introduction of genetically encoded fluorescent proteins, such as green fluorescent protein (GFP) and red fluorescent protein (RFP), has revolutionized the field by enabling the visualization of specific proteins within live cells. Moreover, the use of fluorescence imaging in cancer research exemplifies its impact. Researchers have developed fluorescent probes that specifically bind to cancer biomarkers, allowing for the visualization and detection of cancer cells in real time. This facilitates the identification of tumor boundaries during surgical procedures, improving the precision of tumor resection and reducing the risk of leaving cancerous tissue behind. Alongside fluorescent probe development, significant advancements have been made in fluorescence imaging systems. These systems incorporate improved detector technologies, optical filters, and imaging algorithms to enhance image quality, sensitivity, and resolution. Additionally, the integration of fluorescence imaging with other modalities, such as multiphoton microscopy or optical coherence tomography, further grows its capabilities. In the field of neuroscience, advancements in fluorescence imaging techniques, such as calcium imaging, have allowed researchers to study the activity of individual neurons or neural networks in real-time. Using genetically encoded calcium indicators combined with high-resolution fluorescence microscopy, researchers monitor neuronal activity and investigate brain function, contributing to their understanding of neurological disorders. Moreover, these advancements in fluorescence imaging techniques not only enable more precise and detailed visualization of biological samples but also facilitate the study of dynamic cellular processes and molecular interactions. Driving innovation and growing the capabilities of fluorescence imaging, the bio optics market experiences growth, leading to a wide range of applications in biomedical research, diagnostics, and therapeutics.Bio Optics Market Segment Analysis:

Based on the Device, Optical Coherence Tomography (OCT) segment dominated the market in the year 2021 and is expected to do the same during the forecast period in the bio optics market. OCT is a non-invasive imaging technique that uses light waves to capture high-resolution, cross-sectional images of biological tissues in real time. It has gained significant prominence in various medical fields, including ophthalmology, cardiology, dermatology, and oncology. OCT enables visualization of tissue microstructures at a cellular and subcellular level, providing valuable insights into tissue morphology, composition, and pathology. Its applications range from diagnosing and monitoring eye conditions like macular degeneration and diabetic retinopathy to guiding cardiovascular interventions and assessing skin diseases. The non-invasive nature, high-resolution imaging capabilities, and real-time visualization offered by OCT have propelled its dominance in the bio optics market.Based on the Technology, The Raman Spectroscopy segment dominated the market in the year 2021 and is expected to do the same during the forecast period. It is a powerful analytical technique that provides detailed molecular information about biological samples. Raman spectroscopy works by illuminating a sample with laser light, and the scattered light is analyzed to determine the vibrational and rotational modes of molecules present in the sample. This information allows researchers to identify and characterize various compounds, including proteins, nucleic acids, lipids, and metabolites, without the need for extensive sample preparation. Raman spectroscopy has found broad applications in biomedical research, such as studying cell and tissue composition, identifying disease biomarkers, and monitoring drug interactions within living cells. Its non-destructive nature, high specificity, and ability to analyze samples in their native state make Raman spectroscopy a dominant technology in the bio optics market.

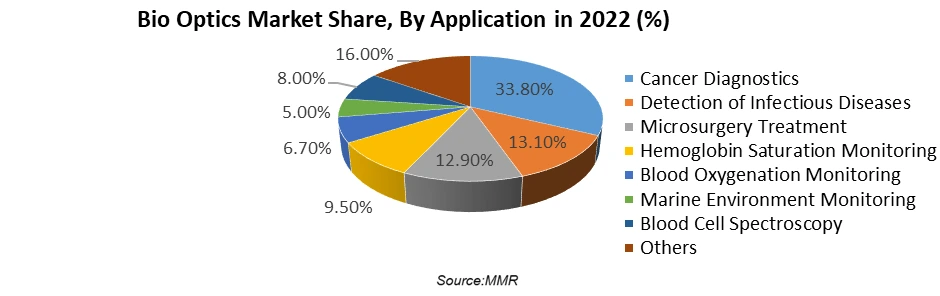

Based on the Application, the Cancer Diagnostics segment dominated the market in the year 2021 and is expected to do the same during the forecast period. Bio optics technologies play a crucial role in cancer diagnostics by providing non-invasive imaging and analysis of cancerous tissues. Techniques such as optical coherence tomography (OCT), fluorescence imaging, and Raman spectroscopy are utilized to detect and characterize cancer cells, assess tumor margins, and monitor treatment responses. These technologies offer high-resolution imaging, molecular profiling, and real-time visualization of tissue structures and biomarkers associated with cancer. By enabling early detection, accurate staging, and personalized treatment planning, bio optics in cancer diagnostics significantly improves patient outcomes and facilitates precision medicine approaches. The dominant presence of bio optics in cancer diagnostics reflects its critical role in advancing the understanding and management of cancer, ultimately leading to improved patient care.

Bio Optics Market Regional Insights:

Europe dominated the market in the year 2021 and is expected to do the same during the forecast period. Europe has a strong presence of leading bio optics companies, research institutes, and academic centers, making it a hub for technological advancements and innovations in the field. The region boasts advanced healthcare infrastructure, a high level of healthcare expenditure, and a focus on promoting research and development in the life sciences sector. The United Kingdom (UK) stands out as a dominant country within Europe for bio optics. The UK has a thriving biomedical research community, with renowned universities and research institutions driving advancements in bio optics technologies. The country has a strong emphasis on healthcare innovation and is home to several key players in the bio optics industry, including manufacturers, developers, and service providers. In the UK, bio optics technologies are widely used in healthcare applications such as ophthalmology, oncology, and minimally invasive surgeries. The National Health Service (NHS), the UK's public healthcare system, has integrated bio optics technologies into its diagnostic and treatment protocols, contributing to their widespread adoption. The UK's commitment to research and development, coupled with supportive government initiatives, fosters the growth of the bio optics market. The country's focus on precision medicine and personalized healthcare further drives the demand for advanced bio optics technologies. The presence of leading research institutions, strong healthcare infrastructure, and a supportive ecosystem for innovation positions the UK as a dominant player in the bio optics market within Europe.Bio Optics Market Scope: Inquire before buying

Bio Optics Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1.8 Bn. Forecast Period 2023 to 2029 CAGR: 6.3% Market Size in 2029: US $ 2.8 Bn. Segments Covered: by Device 1.Endoscopy System 2.Optical Microscopy 3.Optical Coherence Tomography 4.Multimodal Imaging 5.Optical Biosensors 6.Fluorescence Imaging System by Technology 1.Automotive 2.Consumer Electronics 3.Industrial 4.Power 5.Others by Application 1.Cancer Diagnostics 2.Detection of Infectious Diseases 3.Microsurgery Treatment 4.Hemoglobin Saturation Monitoring 5.Blood Oxygenation Monitoring 6.Marine Environment Monitoring 7.Blood Cell Spectroscopy 8.Others Bio Optics Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bio Optics Market Key Players

1.Carl Zeiss AG 2.Leica Microsystems 3.Nikon Corporation 4.Olympus Corporation 5.Hamamatsu Photonics K.K. 6.PerkinElmer, Inc. 7.Bruker Corporation 8. Becton, Dickinson and Company 9.Thermo Fisher Scientific Inc. 10.Danaher Corporation 11. Abbott Laboratories 12. Lumenis Ltd. 13.Ziemer Group 14.Topcon Corporation 15.Novartis AG 16.Medtronic PLC 17.Johnson & Johnson Services, Inc. 18. Hoya Corporation 19. Essilor International S.A. 20. GE Healthcare Frequently Asked Questions: 1] What segments are covered in the Global Bio Optics Market report? Ans. The segments covered in the Bio Optics Market report are based on Device, Technology, Application, and Region. 2] Which region is expected to hold the highest share in the Global Bio Optics Market? Ans. The North America region is expected to hold the highest share of the Bio Optics Market. 3] What is the market size of the Global Bio Optics Market by 2029? Ans. The market size of the Bio Optics Market by 2029 is expected to reach US$ 2.8 Bn. 4] What is the forecast period for the Global Bio Optics Market? Ans. The forecast period for the Bio Optics Market is 2023-2029. 5] What was the market size of the Global Bio Optics Market in 2021? Ans. The market size of the Bio Optics Market in 2021 was valued at US$ 1.8 Bn.

1. Bio Optics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Bio Optics Market: Dynamics 2.1. Bio Optics Market Trends by Region 2.1.1. North America Bio Optics Market Trends 2.1.2. Europe Bio Optics Market Trends 2.1.3. Asia Pacific Bio Optics Market Trends 2.1.4. Middle East and Africa Bio Optics Market Trends 2.1.5. South America Bio Optics Market Trends 2.2. Bio Optics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Bio Optics Market Drivers 2.2.1.2. North America Bio Optics Market Restraints 2.2.1.3. North America Bio Optics Market Opportunities 2.2.1.4. North America Bio Optics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Bio Optics Market Drivers 2.2.2.2. Europe Bio Optics Market Restraints 2.2.2.3. Europe Bio Optics Market Opportunities 2.2.2.4. Europe Bio Optics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Bio Optics Market Drivers 2.2.3.2. Asia Pacific Bio Optics Market Restraints 2.2.3.3. Asia Pacific Bio Optics Market Opportunities 2.2.3.4. Asia Pacific Bio Optics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Bio Optics Market Drivers 2.2.4.2. Middle East and Africa Bio Optics Market Restraints 2.2.4.3. Middle East and Africa Bio Optics Market Opportunities 2.2.4.4. Middle East and Africa Bio Optics Market Challenges 2.2.5. South America 2.2.5.1. South America Bio Optics Market Drivers 2.2.5.2. South America Bio Optics Market Restraints 2.2.5.3. South America Bio Optics Market Opportunities 2.2.5.4. South America Bio Optics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Bio Optics Industry 2.8. Analysis of Government Schemes and Initiatives For Bio Optics Industry 2.9. Bio Optics Market Trade Analysis 2.10. The Global Pandemic Impact on Bio Optics Market 3. Bio Optics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Bio Optics Market Size and Forecast, by Device (2022-2029) 3.1.1. Endoscopy System 3.1.2. Optical Microscopy 3.1.3. Optical Coherence Tomography 3.1.4. Multimodal Imaging 3.1.5. Optical Biosensors 3.1.6. Fluorescence Imaging System 3.2. Bio Optics Market Size and Forecast, by Technology (2022-2029) 3.2.1. Automotive 3.2.2. Consumer Electronics 3.2.3. Industrial 3.2.4. Power 3.2.5. Others 3.3. Bio Optics Market Size and Forecast, by Application (2022-2029) 3.3.1. Cancer Diagnostics 3.3.2. Detection of Infectious Diseases 3.3.3. Microsurgery Treatment 3.3.4. Hemoglobin Saturation Monitoring 3.3.5. Blood Oxygenation Monitoring 3.3.6. Marine Environment Monitoring 3.3.7. Blood Cell Spectroscopy 3.3.8. Others 3.4. Bio Optics Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Bio Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Bio Optics Market Size and Forecast, by Device (2022-2029) 4.1.1. Endoscopy System 4.1.2. Optical Microscopy 4.1.3. Optical Coherence Tomography 4.1.4. Multimodal Imaging 4.1.5. Optical Biosensors 4.1.6. Fluorescence Imaging System 4.2. North America Bio Optics Market Size and Forecast, by Technology (2022-2029) 4.2.1. Automotive 4.2.2. Consumer Electronics 4.2.3. Industrial 4.2.4. Power 4.2.5. Others 4.3. North America Bio Optics Market Size and Forecast, by Application (2022-2029) 4.3.1. Cancer Diagnostics 4.3.2. Detection of Infectious Diseases 4.3.3. Microsurgery Treatment 4.3.4. Hemoglobin Saturation Monitoring 4.3.5. Blood Oxygenation Monitoring 4.3.6. Marine Environment Monitoring 4.3.7. Blood Cell Spectroscopy 4.3.8. Others 4.4. North America Bio Optics Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Bio Optics Market Size and Forecast, by Device (2022-2029) 4.4.1.1.1. Endoscopy System 4.4.1.1.2. Optical Microscopy 4.4.1.1.3. Optical Coherence Tomography 4.4.1.1.4. Multimodal Imaging 4.4.1.1.5. Optical Biosensors 4.4.1.1.6. Fluorescence Imaging System 4.4.1.2. United States Bio Optics Market Size and Forecast, by Technology (2022-2029) 4.4.1.2.1. Automotive 4.4.1.2.2. Consumer Electronics 4.4.1.2.3. Industrial 4.4.1.2.4. Power 4.4.1.2.5. Others 4.4.1.3. United States Bio Optics Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Cancer Diagnostics 4.4.1.3.2. Detection of Infectious Diseases 4.4.1.3.3. Microsurgery Treatment 4.4.1.3.4. Hemoglobin Saturation Monitoring 4.4.1.3.5. Blood Oxygenation Monitoring 4.4.1.3.6. Marine Environment Monitoring 4.4.1.3.7. Blood Cell Spectroscopy 4.4.1.3.8. Others 4.4.2. Canada 4.4.2.1. Canada Bio Optics Market Size and Forecast, by Device (2022-2029) 4.4.2.1.1. Endoscopy System 4.4.2.1.2. Optical Microscopy 4.4.2.1.3. Optical Coherence Tomography 4.4.2.1.4. Multimodal Imaging 4.4.2.1.5. Optical Biosensors 4.4.2.1.6. Fluorescence Imaging System 4.4.2.2. Canada Bio Optics Market Size and Forecast, by Technology (2022-2029) 4.4.2.2.1. Automotive 4.4.2.2.2. Consumer Electronics 4.4.2.2.3. Industrial 4.4.2.2.4. Power 4.4.2.2.5. Others 4.4.2.3. Canada Bio Optics Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Cancer Diagnostics 4.4.2.3.2. Detection of Infectious Diseases 4.4.2.3.3. Microsurgery Treatment 4.4.2.3.4. Hemoglobin Saturation Monitoring 4.4.2.3.5. Blood Oxygenation Monitoring 4.4.2.3.6. Marine Environment Monitoring 4.4.2.3.7. Blood Cell Spectroscopy 4.4.2.3.8. Others 4.4.3. Mexico 4.4.3.1. Mexico Bio Optics Market Size and Forecast, by Device (2022-2029) 4.4.3.1.1. Endoscopy System 4.4.3.1.2. Optical Microscopy 4.4.3.1.3. Optical Coherence Tomography 4.4.3.1.4. Multimodal Imaging 4.4.3.1.5. Optical Biosensors 4.4.3.1.6. Fluorescence Imaging System 4.4.3.2. Mexico Bio Optics Market Size and Forecast, by Technology (2022-2029) 4.4.3.2.1. Automotive 4.4.3.2.2. Consumer Electronics 4.4.3.2.3. Industrial 4.4.3.2.4. Power 4.4.3.2.5. Others 4.4.3.3. Mexico Bio Optics Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Cancer Diagnostics 4.4.3.3.2. Detection of Infectious Diseases 4.4.3.3.3. Microsurgery Treatment 4.4.3.3.4. Hemoglobin Saturation Monitoring 4.4.3.3.5. Blood Oxygenation Monitoring 4.4.3.3.6. Marine Environment Monitoring 4.4.3.3.7. Blood Cell Spectroscopy 4.4.3.3.8. Others 5. Europe Bio Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Bio Optics Market Size and Forecast, by Device (2022-2029) 5.2. Europe Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.3. Europe Bio Optics Market Size and Forecast, by Application (2022-2029) 5.4. Europe Bio Optics Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.1.2. United Kingdom Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.1.3. United Kingdom Bio Optics Market Size and Forecast, by Application(2022-2029) 5.4.2. France 5.4.2.1. France Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.2.2. France Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.2.3. France Bio Optics Market Size and Forecast, by Application(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.3.2. Germany Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.3.3. Germany Bio Optics Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.4.2. Italy Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.4.3. Italy Bio Optics Market Size and Forecast, by Application(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.5.2. Spain Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.5.3. Spain Bio Optics Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.6.2. Sweden Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.6.3. Sweden Bio Optics Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.7.2. Austria Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.7.3. Austria Bio Optics Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Bio Optics Market Size and Forecast, by Device (2022-2029) 5.4.8.2. Rest of Europe Bio Optics Market Size and Forecast, by Technology (2022-2029) 5.4.8.3. Rest of Europe Bio Optics Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Bio Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Bio Optics Market Size and Forecast, by Device (2022-2029) 6.2. Asia Pacific Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.3. Asia Pacific Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Bio Optics Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.1.2. China Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.1.3. China Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.2.2. S Korea Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.2.3. S Korea Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.3.2. Japan Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.3.3. Japan Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.4.2. India Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.4.3. India Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.5.2. Australia Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.5.3. Australia Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.6.2. Indonesia Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.6.3. Indonesia Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.7.2. Malaysia Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.7.3. Malaysia Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.8.2. Vietnam Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.8.3. Vietnam Bio Optics Market Size and Forecast, by Application(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.9.2. Taiwan Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.9.3. Taiwan Bio Optics Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Bio Optics Market Size and Forecast, by Device (2022-2029) 6.4.10.2. Rest of Asia Pacific Bio Optics Market Size and Forecast, by Technology (2022-2029) 6.4.10.3. Rest of Asia Pacific Bio Optics Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Bio Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Bio Optics Market Size and Forecast, by Device (2022-2029) 7.2. Middle East and Africa Bio Optics Market Size and Forecast, by Technology (2022-2029) 7.3. Middle East and Africa Bio Optics Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Bio Optics Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Bio Optics Market Size and Forecast, by Device (2022-2029) 7.4.1.2. South Africa Bio Optics Market Size and Forecast, by Technology (2022-2029) 7.4.1.3. South Africa Bio Optics Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Bio Optics Market Size and Forecast, by Device (2022-2029) 7.4.2.2. GCC Bio Optics Market Size and Forecast, by Technology (2022-2029) 7.4.2.3. GCC Bio Optics Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Bio Optics Market Size and Forecast, by Device (2022-2029) 7.4.3.2. Nigeria Bio Optics Market Size and Forecast, by Technology (2022-2029) 7.4.3.3. Nigeria Bio Optics Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Bio Optics Market Size and Forecast, by Device (2022-2029) 7.4.4.2. Rest of ME&A Bio Optics Market Size and Forecast, by Technology (2022-2029) 7.4.4.3. Rest of ME&A Bio Optics Market Size and Forecast, by Application (2022-2029) 8. South America Bio Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Bio Optics Market Size and Forecast, by Device (2022-2029) 8.2. South America Bio Optics Market Size and Forecast, by Technology (2022-2029) 8.3. South America Bio Optics Market Size and Forecast, by Application(2022-2029) 8.4. South America Bio Optics Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Bio Optics Market Size and Forecast, by Device (2022-2029) 8.4.1.2. Brazil Bio Optics Market Size and Forecast, by Technology (2022-2029) 8.4.1.3. Brazil Bio Optics Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Bio Optics Market Size and Forecast, by Device (2022-2029) 8.4.2.2. Argentina Bio Optics Market Size and Forecast, by Technology (2022-2029) 8.4.2.3. Argentina Bio Optics Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Bio Optics Market Size and Forecast, by Device (2022-2029) 8.4.3.2. Rest Of South America Bio Optics Market Size and Forecast, by Technology (2022-2029) 8.4.3.3. Rest Of South America Bio Optics Market Size and Forecast, by Application (2022-2029) 9. Global Bio Optics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Bio Optics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Carl Zeiss AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Leica Microsystems 10.3. Nikon Corporation 10.4. Olympus Corporation 10.5. Hamamatsu Photonics K.K. 10.6. PerkinElmer, Inc. 10.7. Bruker Corporation 10.8. Becton, Dickinson and Company 10.9. Thermo Fisher Scientific Inc. 10.10. Danaher Corporation 10.11. Abbott Laboratories 10.12. Lumenis Ltd. 10.13. Ziemer Group 10.14. Topcon Corporation 10.15. Novartis AG 10.16. Medtronic PLC 10.17. Johnson & Johnson Services, Inc. 10.18. Hoya Corporation 10.19. Essilor International S.A. 10.20. GE Healthcare 11. Key Findings 12. Industry Recommendations 13. Bio Optics Market: Research Methodology 14. Terms and Glossary