Global Biliary Stents Market size was valued at USD 148.15 Mn. in 2024 and the total Biliary Stents Market is expected to grow by 5.1 % from 2025 to 2032, reaching nearly USD 220.56 Mn.Biliary Stents Market Overview:

The Biliary stents are small, tube-shaped devices made from plastic or metal that help clear blockages in the bile ducts. These obstructions may result from tumors, strictures (narrowed ducts), or leaks, causing symptoms like jaundice, pain, and digestive difficulties.The biliary stents market has witnessed significant technological advancements, evolving from simple plastic tubes to sophisticated self-expandable metal stents (SEMS), including fully covered, partially covered, and emerging biodegradable variants. These modern stents feature improved flexibility, thinner walls for enhanced patency, and anti-migration designs, addressing both benign and malignant biliary obstructions. Innovations such as drug-eluting stents, radiofrequency ablation-assisted stents, and surface coatings to reduce bacterial biofilm formation are increasingly integrated into clinical practice. Additionally, minimally invasive procedures such as endoscopic retrograde cholangiopancreatography (ERCP) have become standard care globally, driving the demand for advanced stent technologies. Epidemiologically, biliary diseases affect hundreds of millions worldwide, with approximately 251.6 million cases reported globally in 2021. Regions such as East Asia including China and Japan show the highest incidence rates, particularly for gallbladder and biliary tract cancers, contributing to heightened stent demand. Western Europe also reports a significant disease burden, while South Asia shows a relatively lower but steady prevalence. The patient population is skewed toward older age groups and females, both of which experience higher rates of biliary tract disorders. This demographic trend, coupled with lifestyle-related disease increases, fuels growing procedural volumes and stent utilization.To know about the Research Methodology :- Request Free Sample Report Regionally, the market dynamics reflect varying healthcare infrastructure and disease patterns. Asia Pacific benefits from a rapidly aging population, rising hepatobiliary disorders, and government support for medical tourism, leading to fast Biliary Stents Market growth . North America and Europe maintain steady demand driven by gallstone diseases, pancreatic cancer incidence, and widespread adoption of minimally invasive ERCP procedures. Japan remains a key market for advanced stent technologies, particularly radiofrequency ablation-assisted stents. Meanwhile, emerging markets in the Middle East and Latin America are gradually increasing biliary stent use, supported by improving tertiary care facilities and increasing awareness of minimally invasive treatment options.

Biliary Stents Market Dynamics

Rising Prevalence of Biliary Duct Disorders to Drive Biliary Stents Market Growth The global biliary stents market is experiencing substantial growth, largely because of the increasing prevalence of biliary duct disorders worldwide. Diseases such as biliary strictures, malignant biliary obstruction, bile duct leaks, and cholangiocarcinoma are becoming more widespread due to the aging global population and sedentary lifestyles, which contribute to a higher incidence of these conditions. Gallbladder and biliary tract diseases surged from approximately 127 million cases in 1990 to 193.5 million cases in 2021, with projections indicating an additional 20.3% increase by 2035. This rise is attributed not only to population growth but also to improved disease detection and reporting. Enhanced diagnostic procedures, including endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC), have improved early detection of biliary conditions, enabling timely and effective treatment interventions. These advanced imaging techniques are increasing the demand for biliary stents, which help restore bile flow and prevent complications during minimally invasive surgeries. Additionally, the healthcare sector’s growing focus on less invasive treatment options encourages the adoption of sophisticated stent technologies.Geographically, higher prevalence rates in regions such as Southeast Asia where liver fluke infections elevate bile duct cancer riskand Western Europe further expand the market. Gender and age trends also play a role, as biliary diseases predominantly affect older adults, with women showing higher incidence but men exhibiting higher mortality in some regions.As public and medical community awareness around biliary health rises, the demand for efficient, safe, and advanced biliary stents continues to drive sustained growth in this dynamic market. Alternative Treatments limits the Biliary Stents Market growth The growth of the biliary stents market is restrained by the availability and preference for alternative treatments, which differ across countries and clinical contexts. Surgical biliary drainage remains a significant alternative, especially for patients with longer life expectancy or complex obstructions. Though more invasive, surgical bypass offers a potentially permanent solution preferred in certain healthcare settings. For example, meta-analyses in pancreatic cancer patients show that surgical bypass can be as effective as stenting but involves higher initial morbidity and longer recovery, which affects stent adoption in some regions. Endoscopic biliary sphincterotomy (EBS) without stent placement is another key alternative, particularly for bile leaks post-surgery such as cholecystectomy. Studies have shown that EBS alone leads to faster leak resolution, fewer repeat interventions, and lower costs compared to combined EBS and stenting. A 2020 involving more than 58 patients with bile leaks found that EBS alone was more efficient, making it a preferred choice in specific clinical scenarios. Cost considerations also limit the growth of metal stents, as plastic stents remain a viable alternative for patients with shorter life expectancy due to their lower upfront cost despite needing frequent replacements.European and North American studies highlight the preference for plastic stents when life expectancy is under 4-6 months, while self-expanding metal stents (SEMS) are reserved for longer survival cases.Emerging technologies such as irradiation and drug-eluting stents pose competitive pressure on conventional biliary stents, further restricting market growth. Biodegradable Stent Innovation Creates Growth Opportunities in the Biliary Stents Market The introduction of biodegradable and bioresorbable biliary stents is set to transform the biliary stents market. Unlike traditional plastic or metal stents, these next-generation devices naturally degrade within the body after therapy, eliminating the need for removal procedures. This innovation is expected to significantly reduce post-operative care costs and minimize patient discomfort and economic burden associated with additional interventions. Ongoing research and clinical trials are paving the way for biodegradable stents to become a mainstream option, especially for patients with benign strictures or obstructions. Their cost-effectiveness, convenience, and lower risk profile offer promising avenues for market growth and differentiation in a competitive landscape. Clinically, biodegradable stents made from polymers such as polydioxanone and polylactic acid degrade within 12 days to 11 weeks, achieving success rates between 85% and 95% in treating benign biliary strictures outperforming traditional balloon dilation, which has about a 70% success rate. These stents maintain radial force during degradation, preventing stricture recurrence and reducing complications like pancreatitis and cholangitis. In complex surgeries such as pancreaticoduodenectomy (PD), the biodegradable stents reduce biliary fistula incidence and shorten anastomosis time, improving outcomes. Additionally, their successful use in pediatric liver transplant patients highlights expanded applications.With multiple clinical trials underway to validate safety and efficacy, biodegradable stents are poised to drive sustained innovation and growth in the biliary stents market.Global Biliary Stents Market Segment Analysis

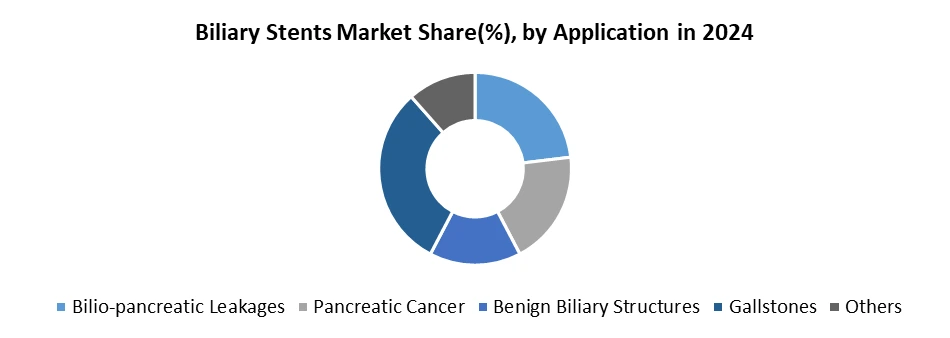

Based on Type, Biliary Stents Market is segmented into metal , polymer and plastic .The metal biliary stents segment held the largest share in 2024 in the Biliary Stents Market. Its superior durability and effectiveness in managing biliary obstructions. Made from materials like self-expanding metal, these stents offer higher radial strength, which helps maintain bile duct patency for longer periods compared to plastic or polymer stents. Metal stents also reduce the need for frequent replacements, lowering overall treatment costs and patient discomfort. They are especially preferred for malignant strictures where long-term patency is crucial. Additionally, advances in metal stent designs, including drug-eluting options, enhance their therapeutic performance by reducing restenosis and infection risks. These advantages make metal biliary stents the preferred choice among healthcare providers, driving their dominance in the Biliary Stents Market.Based on Application, Biliary Stents Market is segmented into Bilio-pancreatic Leakages , Pancreatic Cancer , Benign Biliary Structures , Gallstones , and Others. The gallstones segment held the largest share in 2024. The rising incidence of gallstone-related issues necessitates effective and minimally invasive treatment options. Biliary stents designed specifically for gallstone management offer a targeted approach, aiding in alleviating symptoms and promoting smoother bile flow. Advancements in stent technology, including improved materials and design, enhance efficacy in addressing gallstone-related complications. The growing awareness among healthcare professionals and patients regarding the advantages of using stents for gallstone management further boosts the demand for such specialized devices. As a result, the gallstone stents segment is poised for sustained growth within the broader market.

Biliary Stents Market Regional Insights

North America dominated the Biliary Stents Market in 2024, because of rising demand for minimally invasive procedures. The American Cancer Society reports around 8,000 new cases of bile duct cancer (cholangiocarcinoma) annually in the U.S., highlighting a significant healthcare challenge. Biliary stents serve as crucial tools to manage bile duct cancer complications, such as tumor-caused obstructions or narrowing. The growing number of cases directly fuels demand for biliary stents, emphasizing their key role in North American healthcare.In this region, the U.S. commands the largest market share. Increasing cancer incidence and greater awareness of early diagnosis fuel market growth. For example, Cleveland Clinic data shows acute and chronic pancreatitis cause about 275,000 and 86,000 hospital stays annually in the U.S., respectively. With 20% of acute cases classified as severe, healthcare providers rely on biliary stents to treat related complications. This high number of hospitalizations underscores the critical role biliary stents play in the U.S. healthcare system and supports market growth. The Asia Pacific region will experience the fastest growth during the forecast period. Increasing patient numbers and a growing presence of major healthcare providers in developing economies like India and China drive this growth. Government programs, such as India’s Tertiary Care Cancer Centers (TCCC) scheme, which funds cancer treatment centers, boost demand for biliary stents.Japan shifts its healthcare focus from nursing to preventive care to control rising costs. In 2023, Olympus acquired South Korean stent manufacturer Taewoong Medical for approximately USD 370 million. This strategic move strengthens Olympus’s medical device portfolio and drives growth in Japan’s biliary stents market by introducing advanced technologies and expanding treatment options.Biliary Stents Market Competitive Landscape The biliary stents market remains highly competitive, led by global Medtech giants focusing on innovation, minimally invasive technologies, and advanced stent designs. Key players like Boston Scientific Corporation (U.S.) and Olympus Corporation (Japan) dominate the market by expanding their specialized biliary stent offerings and forming strategic partnerships to develop comprehensive biliary therapy solutions.Boston Scientific has strengthened its position with product launches such as the Advanix Biliary Plastic Stents and WallFlex Metal Stents, which enhance stent placement control and long-term patency. Meanwhile, Olympus has expanded its biliary stents portfolio through exclusive agreements, including the HANAROSTENT™ Biliary Self-Expandable Metal Stents (SEMS) from M.I.Tech, leveraging its global reach in endoscopic devices.Both companies invest heavily in next-generation stents, advanced delivery systems, and collaborative innovations. These efforts aim to meet the growing global demand for safer, faster, and more effective biliary interventions, reinforcing their leadership and driving biliary stents market growth.

Biliary Stents Market Recent Trends

Biliary Stents Market Recent Development • In October 2021, Boston Scientific received FDA clearance and CE Mark for its Advanix Biliary Plastic Stents, designed to treat benign and malignant biliary strictures. Featuring the NaviFlex RX Delivery System, these stents offer improved deliverability, repositioning, and enhanced duct patency, supporting minimally invasive, effective treatment across diverse patient anatomies. • In February 2023, Olympus acquired Taewoong Medical Co., Ltd., a Korean gastrointestinal stent manufacturer, to strengthen its Gastrointestinal EndoTherapy portfolio by integrating advanced expertise and technology from the acquisition. • In November 2021, B. Braun partnered with REVA Medical to distribute Fantom Encore, a bioresorbable scaffold designed for coronary interventions. • In October 2020, Olympus launched the StoneMasterV and VorticCatchV EndoTherapy devices, aiming to improve efficiency in managing and retrieving bile duct stones during endoscopic retrograde cholangiopancreatography (ERCP). • In 2025 Olympus Corporation (Japan) added the HANAROSTENT Biliary SEMS (uncovered) to its EndoTherapy list for U.S. use in 2025, with exclusive distribution via M.I.Tech. The stent is recognized for its unique braided design providing balanced radial/axial forces and recapturability, enhancing conformability and anti-migration performance. • In 2025 CONMED Corporation (US) is promoting the GORE VIABIL Short Wire Biliary Endoprosthesis, a fully covered metal stent with anti-migration and non-foreshortening deployment technologies. Clinical updates emphasize high primary patency and limited reintervention rates, with benefits from precise stent placement. • In 2025 M.I.Tech (South Korea) continues global rollout and composition improvements of the HANAROSTENT Biliary Stent, an uncovered SEMS featuring a hook cross-nitinol design with flared ends for enhanced conformability and anti-migration. Olympus distributes this stent in the U.S.

Category Key Trend Example Product Market Impact Product Innovation Launch of preloaded delivery systems for better procedural control and faster placement Advanix™ Biliary Plastic Stents (Boston Scientific) Enhances procedural efficiency, improves patency, and supports minimally invasive adoption, strengthening competitive positioning Advanced Design Focus on unique stent designs that offer balanced radial/axial forces and anti-migration features HANAROSTENT®Biliary Stent with hook cross-nitinol design (M.I.Tech) Reduces complications like migration, improves patient safety, and supports differentiation in a competitive market Clinical Performance Emphasis on high primary patency and non-foreshortening technology for covered stents GORE VIABIL Short Wire Biliary Endoprosthesis (CONMED) Increases procedure success rates, reduces reintervention need, and appeals to hospitals and surgeons focused on long-term patient outcomes Biliary Stents Market Scope: Inquiry Before Buying

Global Biliary Stents Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 148.15 Mn. Forecast Period 2025 to 2032 CAGR: 5.1% Market Size in 2032: USD 220.56 Mn. Segments Covered: by Type Metal Polymer Plastic by Application Bilio-pancreatic Leakages Pancreatic Cancer Benign Biliary Structures Gallstones Others by End Use Hospitals Ambulatory Surgical Centers Others Biliary Stents Market, by Region

North America (United States, Canada, Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Rest of South America)Biliary Stents Market, Key Players are

North America Biliary Stents Market Key Players 1. Boston Scientific (U.S.) 2. Cook Medical (USA) 3. Medtronic plc (USA) 4. Becton, Dickinson and Company (BD) (USA) 5. Cardinal Health (USA) 6. CONMED Corporation (USA) 7. Stryker Corporation (USA) 8. Merit Medical Systems, Inc. (USA) Europe Biliary Stents Market Key Players 1. Olympus Corporation (Japan) 2. B. Braun Melsungen AG (Germany) 3. ENDO-FLEX GmbH (Germany) 4. M.I.Tech (South Korea) 5. Meril Life Sciences (India) 6. Richard Wolf GmbH (Germany) 7. KARL STORZ (Germany) Asia Pacific Biliary Stents Market Key Players 1. Taewoong Medical Co., Ltd. (South Korea) 2. Mediwood (South Korea) 3. ENDO-FLEX GmbH (Germany) 4. MicroPort (China) 5. OrbusNeich (Hong Kong) 6. S & G Biotech (South Korea)Frequently Asked Questions:

1. Which region has the largest share in the Global Biliary Stents Market? Ans: The North America region held the highest share in 2024. 2. What is the growth rate of the Global Biliary Stents Market? Ans: The Global Market is expected to grow at a CAGR of 5.1% during the forecast period 2025-2032. 3. What is the scope of the Global Biliary Stents Market report? Ans: The Global Biliary Stents Market report helps with the PESTEL, PORTER, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Biliary Stents Market? Ans: The important key players in the Global Biliary Stents Market are – Cook Group (U.S.), CONMED Corporation (U.S.), Becton, Dickinson & Company (U.S.), Medtronic plc (U.S.), Cardinal Health (U.S.), Merit Medical Systems (U.S.), Abbott (U.S.), etc. 5. What is the study period of this market? Ans: The Global Biliary Stents Market is studied from 2025 to 2032.

1. Biliary Stents Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Biliary Stents Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Biliary Stents Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Biliary Stents Market: Dynamics 3.1. Biliary Stents Market Trends by Region 3.1.1. North America Biliary Stents Market Trends 3.1.2. Europe Biliary Stents Market Trends 3.1.3. Asia Pacific Biliary Stents Market Trends 3.1.4. Middle East and Africa Biliary Stents Market Trends 3.1.5. South America Biliary Stents Market Trends 3.2. Biliary Stents Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Biliary Stents Market Drivers 3.2.1.2. North America Biliary Stents Market Restraints 3.2.1.3. North America Biliary Stents Market Opportunities 3.2.1.4. North America Biliary Stents Market Challenges 3.2.2. Europe 3.2.2.1. Europe Biliary Stents Market Drivers 3.2.2.2. Europe Biliary Stents Market Restraints 3.2.2.3. Europe Biliary Stents Market Opportunities 3.2.2.4. Europe Biliary Stents Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Biliary Stents Market Drivers 3.2.3.2. Asia Pacific Biliary Stents Market Restraints 3.2.3.3. Asia Pacific Biliary Stents Market Opportunities 3.2.3.4. Asia Pacific Biliary Stents Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Biliary Stents Market Drivers 3.2.4.2. Middle East and Africa Biliary Stents Market Restraints 3.2.4.3. Middle East and Africa Biliary Stents Market Opportunities 3.2.4.4. Middle East and Africa Biliary Stents Market Challenges 3.2.5. South America 3.2.5.1. South America Biliary Stents Market Drivers 3.2.5.2. South America Biliary Stents Market Restraints 3.2.5.3. South America Biliary Stents Market Opportunities 3.2.5.4. South America Biliary Stents Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Biliary Stents Industry 3.8. Analysis of Government Schemes and Initiatives For Biliary Stents Industry 3.9. Biliary Stents Market Trade Analysis 3.10. The Global Pandemic Impact on Biliary Stents Market 4. Biliary Stents Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Biliary Stents Market Size and Forecast, by Type (2024-2032) 4.1.1. Metal 4.1.2. Polymer 4.1.3. Plastic 4.2. Biliary Stents Market Size and Forecast, by Application (2024-2032) 4.2.1. Bilio-pancreatic Leakages 4.2.2. Pancreatic Cancer 4.2.3. Benign Biliary Structures 4.2.4. Gallstones 4.2.5. Others 4.3. Biliary Stents Market Size and Forecast, by End use (2024-2032) 4.3.1. Hospitals 4.3.2. Ambulatory Surgical Centers 4.3.3. Others 4.4. Biliary Stents Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Biliary Stents Market Size and Forecast, by Type (2024-2032) 5.1.1. Metal 5.1.2. Polymer 5.1.3. Plastic 5.2. North America Biliary Stents Market Size and Forecast, by Application (2024-2032) 5.2.1. Bilio-pancreatic Leakages 5.2.2. Pancreatic Cancer 5.2.3. Benign Biliary Structures 5.2.4. Gallstones 5.2.5. Others 5.3. North America Biliary Stents Market Size and Forecast, by End use (2024-2032) 5.3.1. Hospitals 5.3.2. Ambulatory Surgical Centers 5.3.3. Others 5.4. North America Biliary Stents Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Biliary Stents Market Size and Forecast, by Type (2024-2032) 5.4.1.1.1. Metal 5.4.1.1.2. Polymer 5.4.1.1.3. Plastic 5.4.1.2. United States Biliary Stents Market Size and Forecast, by Application (2024-2032) 5.4.1.2.1. Bilio-pancreatic Leakages 5.4.1.2.2. Pancreatic Cancer 5.4.1.2.3. Benign Biliary Structures 5.4.1.2.4. Gallstones 5.4.1.2.5. Others 5.4.1.3. United States Biliary Stents Market Size and Forecast, by End use (2024-2032) 5.4.1.3.1. Hospitals 5.4.1.3.2. Ambulatory Surgical Centers 5.4.1.3.3. Others 5.4.2. Canada 5.4.2.1. Canada Biliary Stents Market Size and Forecast, by Type (2024-2032) 5.4.2.1.1. Metal 5.4.2.1.2. Polymer 5.4.2.1.3. Plastic 5.4.2.2. Canada Biliary Stents Market Size and Forecast, by Application (2024-2032) 5.4.2.2.1. Bilio-pancreatic Leakages 5.4.2.2.2. Pancreatic Cancer 5.4.2.2.3. Benign Biliary Structures 5.4.2.2.4. Gallstones 5.4.2.2.5. Others 5.4.2.3. Canada Biliary Stents Market Size and Forecast, by End use (2024-2032) 5.4.2.3.1. Hospitals 5.4.2.3.2. Ambulatory Surgical Centers 5.4.2.3.3. Others 5.4.3. Mexico 5.4.3.1. Mexico Biliary Stents Market Size and Forecast, by Type (2024-2032) 5.4.3.1.1. Metal 5.4.3.1.2. Polymer 5.4.3.1.3. Plastic 5.4.3.2. Mexico Biliary Stents Market Size and Forecast, by Application (2024-2032) 5.4.3.2.1. Bilio-pancreatic Leakages 5.4.3.2.2. Pancreatic Cancer 5.4.3.2.3. Benign Biliary Structures 5.4.3.2.4. Gallstones 5.4.3.2.5. Others 5.4.3.3. Mexico Biliary Stents Market Size and Forecast, by End use (2024-2032) 5.4.3.3.1. Hospitals 5.4.3.3.2. Ambulatory Surgical Centers 5.4.3.3.3. Others 6. Europe Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.2. Europe Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.3. Europe Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4. Europe Biliary Stents Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.1.2. United Kingdom Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.1.3. United Kingdom Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4.2. France 6.4.2.1. France Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.2.2. France Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.2.3. France Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.3.2. Germany Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Germany Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.4.2. Italy Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.4.3. Italy Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.5.2. Spain Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Spain Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.6.2. Sweden Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Sweden Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.7.2. Austria Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Austria Biliary Stents Market Size and Forecast, by End use (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Biliary Stents Market Size and Forecast, by Type (2024-2032) 6.4.8.2. Rest of Europe Biliary Stents Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Rest of Europe Biliary Stents Market Size and Forecast, by End use (2024-2032) 7. Asia Pacific Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4. Asia Pacific Biliary Stents Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.1.2. China Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.1.3. China Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.2.2. S Korea Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.2.3. S Korea Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.3.2. Japan Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Japan Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.4. India 7.4.4.1. India Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.4.2. India Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.4.3. India Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.5.2. Australia Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.5.3. Australia Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.6.2. Indonesia Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.6.3. Indonesia Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.7.2. Malaysia Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.7.3. Malaysia Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.8.2. Vietnam Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.8.3. Vietnam Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.9.2. Taiwan Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.9.3. Taiwan Biliary Stents Market Size and Forecast, by End use (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Biliary Stents Market Size and Forecast, by Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Biliary Stents Market Size and Forecast, by Application (2024-2032) 7.4.10.3. Rest of Asia Pacific Biliary Stents Market Size and Forecast, by End use (2024-2032) 8. Middle East and Africa Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Biliary Stents Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Biliary Stents Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Biliary Stents Market Size and Forecast, by End use (2024-2032) 8.4. Middle East and Africa Biliary Stents Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Biliary Stents Market Size and Forecast, by Type (2024-2032) 8.4.1.2. South Africa Biliary Stents Market Size and Forecast, by Application (2024-2032) 8.4.1.3. South Africa Biliary Stents Market Size and Forecast, by End use (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Biliary Stents Market Size and Forecast, by Type (2024-2032) 8.4.2.2. GCC Biliary Stents Market Size and Forecast, by Application (2024-2032) 8.4.2.3. GCC Biliary Stents Market Size and Forecast, by End use (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Biliary Stents Market Size and Forecast, by Type (2024-2032) 8.4.3.2. Nigeria Biliary Stents Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Nigeria Biliary Stents Market Size and Forecast, by End use (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Biliary Stents Market Size and Forecast, by Type (2024-2032) 8.4.4.2. Rest of ME&A Biliary Stents Market Size and Forecast, by Application (2024-2032) 8.4.4.3. Rest of ME&A Biliary Stents Market Size and Forecast, by End use (2024-2032) 9. South America Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Biliary Stents Market Size and Forecast, by Type (2024-2032) 9.2. South America Biliary Stents Market Size and Forecast, by Application (2024-2032) 9.3. South America Biliary Stents Market Size and Forecast, by End use(2024-2032) 9.4. South America Biliary Stents Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Biliary Stents Market Size and Forecast, by Type (2024-2032) 9.4.1.2. Brazil Biliary Stents Market Size and Forecast, by Application (2024-2032) 9.4.1.3. Brazil Biliary Stents Market Size and Forecast, by End use (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Biliary Stents Market Size and Forecast, by Type (2024-2032) 9.4.2.2. Argentina Biliary Stents Market Size and Forecast, by Application (2024-2032) 9.4.2.3. Argentina Biliary Stents Market Size and Forecast, by End use (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Biliary Stents Market Size and Forecast, by Type (2024-2032) 9.4.3.2. Rest Of South America Biliary Stents Market Size and Forecast, by Application (2024-2032) 9.4.3.3. Rest Of South America Biliary Stents Market Size and Forecast, by End use (2024-2032) 10. Company Profile: Key Players 10.1. Boston Scientific (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cook Medical (USA) 10.3. Medtronic plc (USA) 10.4. Becton, Dickinson and Company (BD) (USA) 10.5. Cardinal Health (USA) 10.6. CONMED Corporation (USA) 10.7. Stryker Corporation (USA) 10.8. Merit Medical Systems, Inc. (USA) 10.9. Olympus Corporation (Japan) 10.10. B. Braun Melsungen AG (Germany) 10.11. ENDO-FLEX GmbH (Germany) 10.12. M.I.Tech (South Korea) 10.13. Meril Life Sciences (India) 10.14. Richard Wolf GmbH (Germany) 10.15. KARL STORZ (Germany) 10.16. Taewoong Medical Co., Ltd. (South Korea) 10.17. Mediwood (South Korea) 10.18. ENDO-FLEX GmbH (Germany) 10.19. MicroPort (China) 10.20. OrbusNeich (Hong Kong) 10.21. S & G Biotech (South Korea) 11. Key Findings 12. Industry Recommendations 13. Biliary Stents Market: Research Methodology 14. Terms and Glossary