Automotive Chip Market size was valued at USD 49.78 billion in 2024, and the total Automotive Chip revenue is expected to grow at a CAGR of 9.4% from 2025 to 2032, reaching nearly USD 102.14 billion.Automotive Chip Market Overview

Automotive chips are particularly semiconductors designed for vehicles, which enable tasks such as engine control, security system (ADAS), infotainment, and electric powertrain. They include microcontroller (MCU), power management ICs, sensors, and connectivity modules, strict automotive-grade reliability (AEC-Q100) and security (ISO 26262) standards. These chips ensure excessive temperature, vibration and long-life cycle (10–15 years). Automotive chip markets increase demand from electric vehicles (EVS), ADAS and connected cars, which increases the annual growth up to 12%+. However, the supply remains forced by limited semiconductor FAB capacity, geopolitical stress and prolonged lead time (6+ months). While new fabs are planned (e.g., TSMC in Arizona, Infineon in Germany), a lack of deficiency remains in Legacy Nodes (40NM-90NM), keeping prices high. Long-term contracts are secured for stabilizing automakers' supply chains. The expansion of capacity is expected to reduce the imbalance by 2026–2027. The Asia-Pacific (APAC) dominated the demand of the Automotive Chip Market, led by China, Japan, and South Korea, fueled by EV adoption. Top players include Renesas (Japan), Samsung (Korea), and HiSilicon (China), driving innovation in power and AI chips. The report includes the analysis of the impact of the COVID-19 lockdown on the revenue of market leaders, followers, and disrupters. Since lockdown was implemented differently in different regions and countries, the impact of the same is also different by regions and segments. The report has covered the current short-term and long-term impact on the market, same projected to help decision makers prepare the outline for short-term and long-term strategies for companies by region.To Know About The Research Methodology :- Request Free Sample Report

To Know About the Research Methodology

The automotive chip market is not only benefiting from the growth of the electric and autonomous vehicle market but also from the increased connectivity features in modern cars. As cars become more connected, they require more advanced chips to handle the data processing and communication needs. The chips are used in various applications such as telematics, wireless charging, and advanced navigation systems. With the rise of 5G networks, the demand for automotive chips that can handle the increased data transfer speeds is also on the rise. The automotive chip market is expected to continue growing at a significant rate throughout the forecast period. The automotive industry is becoming increasingly dependent on chips to power the cars of the future. Tesla had an internal chip design team as early as five years ago. The original focus was on MCUs. Later, the car manufacturer shifted chip design to power modules. For example, Hyundai Motor announced the establishment of a chip design team on September 4, while CRRC and BYD directly included the wafer factory in the scope of vertical integration. A CPU chip for the automotive system called the Snapdragon Ride Flex SoC was introduced by Qualcomm Technologies, Inc. It manages assisted driving as well as cockpit features like entertainment. Taiwan Semiconductor Manufacturing Co. launched new software to make it easier for customers developing high-tech computer chips for automotive to benefit from its most recent innovations. The largest contract maker of semiconductors in the world is TSMC. Many of the largest chip manufacturers serving the automotive sector, including NXP Semiconductor and STMicroelectronics NV (STM.DE), use TSMC to produce their components.Automotive Chip Market Recent Technology Trend

Possibility to mitigate yield limitations by combining several node sizes In recent years, after decades of successful development toward smaller node sizes, semiconductor players appear to have reached physical limitations, especially in ensuring economic yields. Since monolithic SoCs are designed as fully integrated chips, all parts need to be on the same small node size. For chip designers, this leads to a trade-off, as small node sizes are beneficial for HPC but not ideal for certain other parts, such as analog functions. By disaggregating the monolithic chip into Chiplets, this need for one node size is removed, as each Chiplet’s node size can be chosen individually. From a yield perspective, this is very interesting: One small defect on a large, fully integrated monolithic SoC leads to the waste of the entire chip. Whereas in Chiplet Systems, the defect will only impact the single Chiplet where the defect is located, while other Chiplets are not affected. Overall, Chiplet Systems come with yield and cost benefits due to the disaggregation into different node sizes. High scalability and modularity High scalability and modularity For monolithic SoCs, changes to parts of a chip lead to a redesign (at least partly) of the whole SoC, which results in high R&D costs. In Chiplet Systems, a single Chiplet can be interchanged and replaced. This step is possible without a re-design of the architecture as long as the architecture was designed correctly and the modifications/changes stay within certain limits. The development effort for modular solutions addressing scalability or customization requests from OEMs might be significantly reduced in this way. Chiplet Systems can therefore serve as a bridging technology in hybrid E/E architectures and also as an alternative alongside monolithic SoCs in future centralized compute architectures.Automotive Chip Market Dynamics

Growing shift towards the use of electric and hybrid vehicles reduces vehicle emissions, to Drive Market Automotive Chip Growth Motor vehicles not running on fossil fuels, such as electric vehicles, hybrid electric vehicles,Solar-powered vehicles are the primary choice for alternative technologies of powering an engine that does not involve petroleum. Increasing the use of electric and hybrid vehicles will help reduce fuel costs for consumers, minimize air pollution due to a reduction in greenhouse gases (GHGs), improve air quality in urban areas, and lower dependence on fossil fuels. The adoption of electrified vehicles will lead to a significant rise in demand for new automotive ICs, microprocessors, and sensors. Global Automotive Chip Shortage Slows Market Growth Amid Supply Chain Disruptions to Restrain the Automotive Chip Market The automotive chip market faces significant restraints due to persistent supply chain disruptions, hampering production and delaying vehicle deliveries. The COVID-19 pandemic exacerbated semiconductor shortages, while geopolitical tensions and raw material scarcities further strained supply. Automakers are forced to reduce output, leading to revenue losses and inflated chip prices. Despite rising demand for electric and connected vehicles, production bottlenecks limit market expansion. Efforts to ramp up chip fabrication capacity are underway, but long lead times and high investment costs delay relief. As a result, the automotive chip market growth is projected to slow in the near term, with recovery dependent on stabilized supply chains and increased semiconductor manufacturing resilience. Temperature Sensitivity and High Entry Costs to Create Automotive Chip Market Challenge The wide variety in temperatures inside and outside cars is the largest issue with automobile electronics. Lack of cooling prevents chips from malfunctioning and aging too quickly. Performance chips raise emissions, harm the engine, and result in misfires when they are exposed to higher temperatures. Developing automotive chip applications requires significant investment in research, development, and testing. The complexity of automotive systems and the strict requirements for reliability and safety contribute to the high cost of chip development. The cost barrier prevents smaller players from entering the market and limits innovation.Automotive Chip Market Segment Analysis

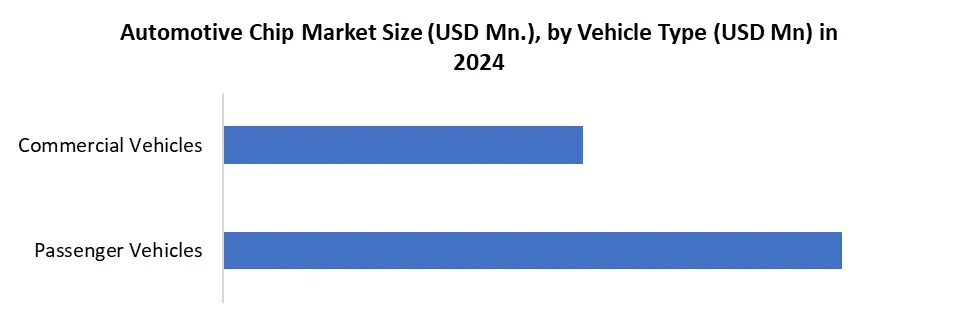

Based on Vehicle Type, the Passenger Vehicles Segment has dominated the Automotive Chip Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to the larger share compared to commercial vehicles. The surge in demand for advanced driver-assistance systems (ADAS), infotainment, and electric vehicles (EVs) in passenger cars drove higher semiconductor consumption. Rising consumer preference for connected and autonomous features further boosted chip usage. In contrast, commercial vehicles, though increasingly adopting telematics and automation, had lower production volumes and slower tech integration rates. Additionally, stringent emissions norms and fleet electrification in some regions supported growth, but passenger vehicles remained the primary driver due to higher sales volumes and faster adoption of advanced electronic systems.

Automotive Chip Market Regional Analysis

The Asia Pacific region held the largest share of 40 % in 2024. Thailand, India, Japan, South Korea, China, and the Rest of Asia-Pacific are evaluated for the Asia-Pacific automotive Chip market growth analysis. Japan leads in terms of raw materials, small active-passive components, and equipment regarding semiconductors in the region. Also, the country has a significant advantage in upstream semiconductor materials along the semiconductor value chain. In addition, the country is capable of meeting the high standards of purity required for semiconductor materials. The rising demand for electric vehicles and government measures encouraging the adoption of electric vehicles are the main factors driving the growth of the automotive chip market in the area. Also, the region is experiencing a marked increase in vehicle production, which is projected to support the growth of the automotive chip industry in the area. TSMC and Samsung competed for dominance in the wafer foundry sector, stemming from the growing popularity of smartphones. The winner was determined by securing orders for application processors from tech giants like Apple, Qualcomm, and MediaTek. TSMC's outperformance showcased Taiwan's aggressive investments in semiconductor equipment. NFC chip is one of the key NFC products available with various applications such as contactless mobile payments, information sharing, and information security. These chips produce a short-range radio signal used for sensitive financial and authentication data transmission. In Japan, several leading market players are actively developing NFC-based cashless payment devices and readers for the Japanese market, showing the rising adoption of NFC chips. Additionally, private organizations are also adopting NFC technology, which is expected to boost the growth of the near-field communication market in Japan. The government of South Korea approved a service that enables the consumer to authenticate mobile payment by tapping a contactless card, which helps increase the need for NFC chips in South Korea. The rising penetration of smartphones also drives the market through the forecast period. The uncertainties surrounding technological competition between China and the US have also interrupted the global supply chain; for example, smartphone and network device manufacturers have stocked up on semiconductor components. Multinational companies have also held inventory volumes above their normal levels to offset the potential loss owing to the uncertainty of the entire market.Automotive Chip Market Competitive Landscape

The automotive chip market is fiercely competitive, in which NXP Semiconductor and Infineon Technologies dominate the sector. In 2024, NXP Semiconductor reported USD xx billion in automotive revenue, driven by the strong demand for ADAS, EV Powertrains and In-WHYCLE networking. Infineon Technologies recorded USD xx billion in automotive sales, affected by its leadership in electrical semiconductor and microcontroller solutions for electric and connected vehicles. Both companies continue to invest heavily in R&D and secure their positions as market leaders in a rapidly electrified and autonomous-operated industry to capitalize on the growing need for advanced automotive electronics.

Date Company Name Headquarter Country Recent Development Jan 8, 2024 NXP Semiconductors Netherlands Launched S32 CoreRide platform for software-defined vehicles, integrating safety and security features Mar 12, 2024 Infineon Technologies Germany Released AURIX TC4x microcontrollers with AI acceleration for autonomous driving systems May 18, 2024 Renesas Electronics Japan Completed acquisition of Altium ($6.1B) to strengthen automotive electronics design capabilities Jul 25, 2024 Texas Instruments USA Opened new 300mm wafer fab in Texas to boost production of automotive analog chips Sep 30, 2024 STMicroelectronics Switzerland Secured multi-year contract with BMW to supply silicon carbide power modules for EVs Automotive Chip Market Scope: Inquire before buying

Global Automotive Chip Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 49.78 Bn. Forecast Period 2025 to 2032 CAGR: 9.4% Market Size in 2032: USD 102.14 Bn. Segments Covered: by Component Type Logic ICs Analog ICs Microcontrollers & Microprocessors Memory by Vehicle Type Passenger Vehicles Commercial Vehicles by Application Type Chassis Powertrain Safety Telematics & Infotainment Body Electronics Automotive Chip Market, Key Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Automotive Chip Market, Key Players

North America Automotive Chip Market Key Players: 1. Texas Instruments (TI) - Dallas, Texas 2. Intel (Mobileye) - Santa Clara, California 3. ON Semiconductor - Phoenix, Arizona 4. Microchip Technology - Chandler, Arizona 5. Qualcomm - San Diego, California Europe Automotive Chip Market Top Players 1. Infineon Technologies – Neubiberg, Germany 2. STMicroelectronics – Geneva, Switzerland 3. NXP Semiconductors – Eindhoven, Netherlands 4. Robert Bosch – Gerlingen, Germany 5. ams-OSRAM – Premstätten, Austria APAC Automotive Chip Market Top Players: 1. Renesas Electronics – Tokyo, Japan 2. Samsung Semiconductor – Suwon, South Korea 3. ROHM Semiconductor – Kyoto, Japan 4. Huawei HiSilicon – Shenzhen, China 5. UNISOC – Shanghai, China Frequently Asked Questions: 1] What segments are covered in the Automotive Chip Market report? Ans. The segments covered in the Automotive Chip Market report are based on Component Type, Application Type, and Vehicle Class. 2] Which region is expected to hold the highest share in the Automotive Chip Market? Ans. The Asia Pacific region is expected to hold the highest share of the Automotive Chip Market. 3] What is the market size of the Automotive Chip Market by 2032? Ans. The market size of the Automotive Chip Market by 2030 will be USD 102.14 billion. 4] What is the forecast period for the Automotive Chip Market? Ans. The Forecast period for the Automotive Chip Market is 2025- 2032.

1. Automotive Chip Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Fumed Silica Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Headquarter 2.4.3. Business Segment 2.4.4. End-user Segment 2.4.5. Revenue (2024) 2.4.6. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Fumed Silica Market: Dynamics 3.1. Region-wise Trends of Automotive Chip Market 3.1.1. North America Automotive Chip Market Trends 3.1.2. Europe Automotive Chip Market Trends 3.1.3. Asia Pacific Automotive Chip Market Trends 3.1.4. Middle East and Africa Automotive Chip Market Trends 3.1.5. South America Automotive Chip Market Trends 3.2. Automotive Chip Market Dynamics 3.2.1. Global Automotive Chip Market Drivers 3.2.1.1. Increasing Power Outages 3.2.1.2. Technological Advancements 3.2.2. Global Automotive Chip Market Restraints 3.2.3. Global Automotive Chip Market Opportunities 3.2.3.1. Expansion in Emerging Markets 3.2.4. Global Automotive Chip Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government regulations on data privacy 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Fumed Silica Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 4.1.1. Logic ICs 4.1.2. Analog ICs 4.1.3. Microcontrollers & Microprocessors 4.1.4. Memory 4.2. Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 4.2.1. Passenger Vehicles 4.2.2. Commercial Vehicles 4.3. Automotive Chip Market Size and Forecast, By Application Type (2024-2032) 4.3.1. Chassis 4.3.2. Powertrain 4.3.3. Safety 4.3.4. Telematics & Infotainment 4.3.5. Body Electronics 4.4. Automotive Chip Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Automotive Chip Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 5.1.1. Logic ICs 5.1.2. Analog ICs 5.1.3. Microcontrollers & Microprocessors 5.1.4. Memory 5.2. North America Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 5.2.1. Passenger Vehicles 5.2.2. Commercial Vehicles 5.3. North America Automotive Chip Market Size and Forecast, By Application Type (2024-2032) 5.3.1. Chassis 5.3.2. Powertrain 5.3.3. Safety 5.3.4. Telematics & Infotainment 5.3.5. Body Electronics 5.4. North America Automotive Chip Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 5.4.1.1.1. Logic ICs 5.4.1.1.2. Analog ICs 5.4.1.1.3. Microcontrollers & Microprocessors 5.4.1.1.4. Memory 5.4.1.2. United States Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.1.2.1. Passenger Vehicles 5.4.1.2.2. Commercial Vehicles 5.4.1.3. United States Automotive Chip Market Size and Forecast, By End-User (2024-2032) 5.4.1.3.1. Chassis 5.4.1.3.2. Powertrain 5.4.1.3.3. Safety 5.4.1.3.4. Telematics & Infotainment 5.4.1.3.5. Body Electronics 5.4.2. Canada 5.4.2.1. Canada Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 5.4.2.1.1. Logic ICs 5.4.2.1.2. Analog ICs 5.4.2.1.3. Microcontrollers & Microprocessors 5.4.2.1.4. Memory 5.4.2.2. Canada Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.2.2.1. Passenger Vehicles 5.4.2.2.2. Commercial Vehicles 5.4.2.3. Canada Automotive Chip Market Size and Forecast, By Application Type (2024-2032) 5.4.2.3.1. Chassis 5.4.2.3.2. Powertrain 5.4.2.3.3. Safety 5.4.2.3.4. Telematics & Infotainment 5.4.2.3.5. Body Electronics 5.4.2.4. Mexico Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 5.4.2.4.1. Logic ICs 5.4.2.4.2. Analog ICs 5.4.2.4.3. Microcontrollers & Microprocessors 5.4.2.4.4. Memory 5.4.2.5. Mexico Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.2.5.1. Passenger Vehicles 5.4.2.5.2. Commercial Vehicles 5.4.2.6. Mexico Automotive Chip Market Size and Forecast, By Application Type (2024-2032) 5.4.2.6.1. Chassis 5.4.2.6.2. Powertrain 5.4.2.6.3. Safety 5.4.2.6.4. Telematics & Infotainment 5.4.2.6.5. Body Electronics 6. Europe Automotive Chip Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.2. Europe Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.3. Europe Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4. Europe Automotive Chip Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.1.2. United Kingdom Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.1.3. United Kingdom Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4.2. France 6.4.2.1. France Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.2.2. France Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.2.3. France Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.3.2. Germany Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.3.3. Germany Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.4.2. Italy Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.4.3. Italy Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.5.2. Spain Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.5.3. Spain Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.6.2. Sweden Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.6.3. Sweden Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.7.2. Austria Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.7.3. Austria Automotive Chip Market Size and Forecast, Application Type (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 6.4.8.2. Rest of Europe Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.8.3. Rest of Europe Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7. Asia Pacific Automotive Chip Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.2. Asia Pacific Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.3. Asia Pacific Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4. Asia Pacific Automotive Chip Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.1.2. China Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.1.3. China Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.2.2. S Korea Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.2.3. S Korea Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.3.2. Japan Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.3.3. Japan Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.4. India 7.4.4.1. India Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.4.2. India Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.4.3. India Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.5.2. Australia Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.5.3. Australia Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.6.2. Indonesia Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.6.3. Indonesia Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.7.2. Philippines Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.7.3. Philippines Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.8.2. Malaysia Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.8.3. Malaysia Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.9.2. Vietnam Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.9.3. Vietnam Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.10.2. Thailand Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.10.3. Thailand Automotive Chip Market Size and Forecast, Application Type (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.11.3. Rest of Asia Pacific Automotive Chip Market Size and Forecast, Application Type (2024-2032) 8. Middle East and Africa Automotive Chip Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 8.2. Middle East and Africa Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 8.3. Middle East and Africa Automotive Chip Market Size and Forecast, Application Type (2024-2032) 8.4. Middle East and Africa Automotive Chip Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 8.4.1.2. South Africa Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.1.3. South Africa Automotive Chip Market Size and Forecast, Application Type (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 8.4.2.2. GCC Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.2.3. GCC Automotive Chip Market Size and Forecast, Application Type (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 8.4.3.2. Nigeria Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.3.3. Nigeria Automotive Chip Market Size and Forecast, Application Type (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 8.4.4.2. Rest of ME&A Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.4.3. Rest of ME&A Automotive Chip Market Size and Forecast, Application Type (2024-2032) 9. South America Automotive Chip Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 9.2. South America Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 9.3. South America Automotive Chip Market Size and Forecast, Application Type (2024-2032) 9.4. South America Automotive Chip Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 9.4.1.2. Brazil Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 9.4.1.3. Brazil Automotive Chip Market Size and Forecast, Application Type (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 9.4.2.2. Argentina Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 9.4.2.3. Argentina Automotive Chip Market Size and Forecast, Application Type (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Automotive Chip Market Size and Forecast, By Component Type (2024-2032) 9.4.3.2. Rest of South America Automotive Chip Market Size and Forecast, By Vehicle Type (2024-2032) 9.4.3.3. Rest of South America Automotive Chip Market Size and Forecast, Application Type (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Players) 10.1. Texas Instruments (TI) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Intel (Mobileye) 10.3. ON Semiconductor 10.4. Microchip Technology 10.5. Qualcomm 10.6. Infineon Technologies 10.7. STMicroelectronics 10.8. NXP Semiconducto 10.9. Robert Bosch 10.10. ams-OSRAM 10.11. Renesas Electronics 10.12. Samsung Semiconductor 10.13. ROHM Semiconductor 10.14. Huawei HiSilicon 10.15. UNISOC 11. Key Findings 12. Analyst Recommendations 13. Automotive Chip Market: Research Methodology