The Artificial Intelligence in Agriculture Market size was valued at USD 2.44 Billion in 2024, and the total revenue is expected to grow at CAGR of 21.5 % from 2025 to 2032, reaching nearly USD 11.59 Billion. The MMR report provides analysis of the Artificial Intelligence in Agriculture market by covering the regulatory and policy landscape, including global regulations, data privacy, cybersecurity, regional policy support, and certification standards for AI solutions. It evaluates pricing and market economics, with detailed pricing trends by technology, ROI and value proposition assessment, total cost of ownership, regional price comparisons, and the impact of government incentives and subsidies on adoption. The report further examines AI adoption and maturity levels across farm sizes and regions, highlighting readiness, barriers, productivity impacts, and sustainability outcomes. In addition, it delivers deep insights into the technological and innovation landscape, tracking emerging AI advancements, R&D initiatives, and strategic collaborations shaping agricultural productivity. The study also analyzes investment and funding trends, including venture capital, private equity, government funding, and M&A activity. Finally, it presents real-world use cases and implementation insights, showcasing practical applications, ROI outcomes, best practices, and challenges associated with deploying AI solutions across farming and agro-tech ecosystems. According to UN Food and Agriculture Organization, the population will rise by 9.8 billion by 2050. Conversely, only 4% further land will come under farming by then. In this perspective, use of advance technological solutions to make cultivation more efficient, remains one of the greatest requirements. While, AI sees many direct use across sectors, i.e. AI-powered solutions will not only empower farmers to do better with less, it will also increase quality and assure faster go to market for crops. The report directed towards how AI can transform the agriculture landscape, the use of drone-made image processing techniques, exactitude farming landscape, the future of agriculture, challenges and overall Artificial Intelligence in Agriculture market position in forecast period.To know about the Research Methodology :- Request Free Sample Report

Artificial Intelligence in Agriculture Market Scope

Agriculture is seeing prompt implementation of AI and Machine Learning (ML) both in terms of agricultural products and in-field agriculture techniques. Intellectual computing in specific, is all set to become the most disruptive technology in agriculture service sector as it can understand, learn, and respond to different circumstances to rise efficacy. Providing some of these solutions as a service such as chatbot or other conversational platform to all the farmers will help them keep pace with technological innovations as well as apply the same in their day-to-day farming to obtain the benefits of this service. Now, Microsoft is working with 175 farmers in India to deliver counselling services for sowing, land and fertilizer. This initiative has previously resulted in 30% higher yield per hectare on an average compared to last year.Artificial Intelligence in Agriculture Market Industry Dynamics

Drivers

Growth driven by IOT Large volumes of data get produced every day together with structured and unstructured format. These re-count to data on historic weather pattern, soil reports, new research, rainfall, pest invasion, images from drones and cameras. Intellectual IOT solutions can sense all this data and deliver strong perceptions to increase yield. Proximity Sensing and Remote Sensing are two technologies which are mainly used for intelligent data fusion. This supports in soil characterization based on the soil below the surface in a specific place. Hardware solutions like Rowbot are already coupling data collecting software with robotics to formulate the best fertilizer for growing corns as well to other activities to maximize output.Image-based insight generation

Exactitude farming is one of the maximum discussed areas in farming today. Drone-based images can support in in-depth field analysis, crop observing and scanning of fields. Computer vision technology, IOT and drone data can be collective to assure rapid actions by farmers. Feeds from drone image data can create alerts in real time to increase the speed of precision farming. Companies such as Aerialtronics have employed IBM Watson IoT Platform and the Visual Recognition APIs in commercial drones for image analysis in real time. More or less areas where computer vision technology can be put to utilization in Disease detection, Crop readiness identification, Field management, etc.Health monitoring of crops

Remote sensing techniques together with hyper spectral imaging and 3d laser scanning are crucial to create crop metrics thru thousands of acres. It has the likely to lead in a revolutionary change regarding of how farmlands are observed by farmers both from time and effort outlook. This technology will also be utilized to monitor crops along their complete lifecycle containing report generation in case of anomalies. Automation techniques in irrigation and enabling farmers With regard to human intensive processes in farming, irrigation is one of the process. Machines trained on historic weather pattern, soil quality and kind of crops to be grown, can automate irrigation and amplify overall yield. With close to 65-75% of the world’s fresh water being utilized in irrigation, automation can assist to farmers for better management of their water problems.Artificial Intelligence in Agriculture Market Challenges

Lack of familiarity with high tech machine learning solutions However, AI offers huge opportunities for application in agriculture, there still exists a lack of awareness with high tech machine learning solutions in farms across most of the region in a globe. Introduction of farming to external factors like weather conditions, soil situations and existence of pests is relatively high. Similarly, AI systems also require a lot of data to train machines and to make accurate predictions.Artificial Intelligence in Agriculture Market Segment Analysis

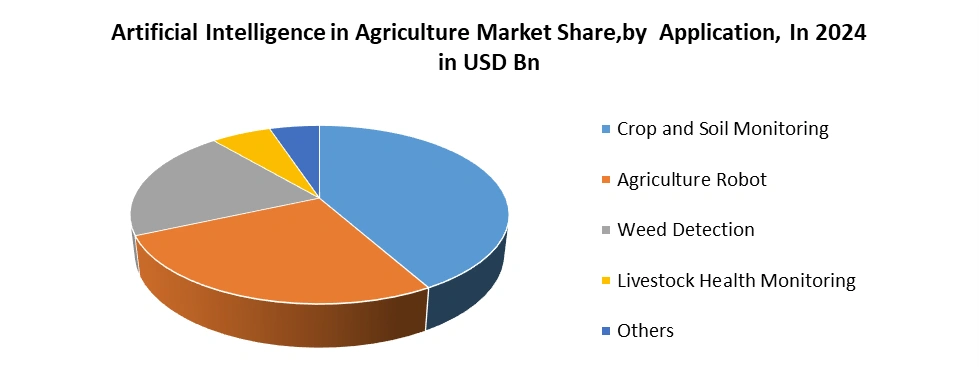

Based on the Technology, in 2024, Machine Learning dominates the Artificial Intelligence in Agriculture Market due to its widespread use in yield prediction, crop health monitoring, and precision farming decision-making. Computer Vision follows, driven by applications in crop disease detection, weed identification, and automated harvesting through drones and smart imaging systems. Predictive Analytics is gaining strong adoption for weather forecasting, demand planning, and resource optimization, supporting risk mitigation in farming operations. Natural Language Processing (NLP) plays a growing role in voice-enabled advisory platforms, farm management software, and multilingual farmer support systems, particularly in emerging economies. The Others segment, including robotics intelligence and expert systems, contributes to niche applications such as autonomous farm equipment and smart irrigation, supporting the gradual expansion of advanced AI capabilities across the agricultural value chain. Based on Application, in 2024, Crop and Soil Monitoring holds the largest share in the Artificial Intelligence in Agriculture Market, driven by strong adoption of AI-enabled sensors, drones, and analytics for real-time field assessment and yield optimization. Agriculture Robots are witnessing rapid growth due to increasing labor shortages and rising demand for automated planting, harvesting, and spraying solutions. Weed Detection is gaining traction as AI-powered image recognition improves precision spraying and reduces herbicide usage, supporting sustainable farming practices. Livestock Health Monitoring is expanding steadily, supported by AI-based tracking, disease prediction, and productivity management in dairy and poultry farming. The Others segment includes applications such as smart irrigation, farm management platforms, and supply chain optimization, contributing to broader AI integration across agricultural operations.

Artificial Intelligence in Agriculture Market Trends

Agricultural Drones to Amplify the Growth of Market As global population anticipated to reach over 9.8 billion by 2050, agricultural consumption is anticipated to rise by a massive 75%, where drones have now been mainstreamed for smart farming supporting farmers in a range of tasks from analysis and planning to the real planting of crops, and the ensuing observing of fields to determine health and growth. Also, drones prepared with hyperspectral, multispectral, or thermal sensors are capable to detect areas that need changes in irrigation. Once crops have started growing, these sensors are capable to estimate their vegetation index, and indicator of health through AI, by determining the crop’s heat signature.Artificial Intelligence in Agriculture Market Geographic Overview

Europe is estimated to account for the largest market growth due to their farmers manage almost half of the land area for agriculture and it makes dominant industry in Europe. Trend in observing and reporting utensils for indoor and outdoor farms, and delivering a visualization of the farmer’s intact production using computer vision and AI are increasing the AI market in agriculture. The European Soil Data Centre (ESDAC) is the thematic center for soil associated data in Europe, where its goal is to be the single reference point for and to host all appropriate soil data and statistics at European level. AI firms are handling 'Internet of the Soil', which is a software and hardware solution for observing soil conditions like humidity, temperature, electrical conductivity, and more in European countries. Their sensors connect wirelessly to a cloud-based platform where it can be retrieved by any internet connected device. Berlin-based InFarm has urbanized a vertical indoor farming system using IoT, Big Data, and cloud analytics, which can be employed in supermarkets, restaurants, local distribution warehouses, permitting businesses to grow their own fresh crop on site to deliver to customers. It is already inaugural indoor farms in 1,000 locations in Germany, and expanding in other European markets, which rises the AI in agriculture market. North America is evaluated as second largest market for AI in agriculture in the worldwide. The growth of the market is attributed to the high selection of trend setting innovations and item in agriculture part. Asia Pacific is estimated to meet high growth rate in the forecast period due to the rising demand from emerging nations, for instance, India and China. Also, rising adoption of the mechanical technology and IoT devices in agriculture is additionally evaluated to drive the Artificial Intelligence in Agriculture market. The report covers the market leaders, followers and new entrants in the industry with the market dynamics by region. It will also help to understand the position of each player in the market by region, by segment with their expansion plans, R&D expenditure and organic & in-organic growth strategies. Long term association, strategic alliances, supply chain agreement and M&A activities are covered in the report in detail from 2014 to 2019. Expected alliances and agreement in forecast period will give future course of action in the market to the readers. More than ten companies are profiled, benchmarked in the report on different parameters that will help reader to gain insight about the market in minimum time. The objective of the report is to present a comprehensive analysis of the Global Artificial Intelligence in Agriculture Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants by Vehicle. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by Vehicle on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Artificial Intelligence in Agriculture Market dynamics, structure by analyzing the market segments and project the Global Artificial Intelligence in Agriculture Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Artificial Intelligence in Agriculture Market make the report investor’s guide.Artificial Intelligence in Agriculture Market Scope : Inquire before buying

Global Artificial Intelligence in Agriculture Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.44 Bn. Forecast Period 2025 to 2032 CAGR: 21.5% Market Size in 2032: USD 11.59 Bn. Segments Covered: by Technology Computer Vision Machine Learning Predictive Analytics Natural Language Processing (NLP) Others by Component Hardware Services Solution by Developmet Mode Cloud On-premise Hybrid by Type of Enterprise Large Small and Medium Enterprise (SMEs) by Application Agriculture Robot Crop and Soil Monitoring Weed Detection Livestock Health Monitoring Others by End User Farms & Agricultural Producers Agro-Tech Companies Agrochemical Companies Research Institutes Others Artificial Intelligence in Agriculture Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Key Players Operated in Market Includes:

1. Deere & Company 2. Microsoft Corporation 3. IBM Corporation 4. AWS 5. Global Agriculture 6. Bayer AG 7. Climate LLC. 8. Farmers Edge Inc. 9. Granular Inc. 10. AgEagle Aerial Systems Inc 11. Raven Industries Inc. 12. AGCO Corporation 13. Gamaya SA 14. Trimble Inc. 15. CropIn 16. Intello Labs 17. The Conservation Foundation 18. Fasal 19. Blue River Technology 20. Taranis 21. InData Labs 22. Itransition 23. Syngenta 24. Tule Technologies Inc. 25. Others Frequently Asked Questions: 1] What segments are covered in the Artificial Intelligence in Agriculture Market report? Ans. The segments covered in the Artificial Intelligence in Agriculture Market report are based on Technology, Component, Deployment Mode, Type of Enterprise, Application, End-User and region 2] Which region is expected to hold the highest share of the Artificial Intelligence in Agriculture Market? Ans. The North America region is expected to hold the highest share of the Artificial Intelligence in Agriculture Market. 3] What is the market size of the Artificial Intelligence in Agriculture Market by 2032? Ans. The market size of the Artificial Intelligence in Agriculture Market by 2032 is USD 11.59 Bn. 4] What is the growth rate of the Artificial Intelligence in Agriculture Market? Ans. The Global Artificial Intelligence in Agriculture Market is growing at a CAGR of 21.5 % during the forecasting period 2025-2032. 5] What was the market size of the Artificial Intelligence in Agriculture Market in 2024? Ans. The market size of the Artificial Intelligence in Agriculture Market in 2024 was USD 2.44 Bn.

1. Artificial Intelligence in Agriculture Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Artificial Intelligence in Agriculture Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Market Share (%) by Region 2.3.5. Growth Rate (%) 2.3.6. Revenue 2024 2.3.7. Profit Margin (%) 2.3.8. R&D Investments 2.3.9. Growth Rate (Y-O-Y) (%) 2.3.10. Technological innovation 2.3.11. Adoption & Implementation Impact 2.3.12. Customer Retention & Satisfaction 2.3.13. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Artificial Intelligence in Agriculture Market: Dynamics 3.1. Artificial Intelligence in Agriculture Market Trends 3.2. Artificial Intelligence in Agriculture Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Artificial Intelligence in Agriculture Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Regulatory & Policy Landscape 4.1. Global Regulations for AI in Agriculture 4.2. Data Privacy, Cybersecurity & Compliance Policies 4.3. Regional Policies Supporting AI Adoption 4.4. Certifications & Standards for AI Tools & Solutions 5. Pricing Analysis & Market Economics (2024) 5.1. Pricing Analysis By Technology (2019-2024) 5.2. ROI & Value Proposition for Enterprises 5.3. Cost-Benefit Analysis of AI Adoption in Agriculture 5.4. Comparative Pricing Analysis Across Regions 5.5. Total Cost of Ownership (TCO) of AI Solutions 5.6. Impact of Government Incentives, Subsidies & Funding on Adoption 6. Adoption & Maturity Analysis 6.1. Adoption of AI Technologies Across Small, Medium, and Large Farms 6.2. Regional Adoption Trends Across North America, Europe, Asia-Pacific, etc. 6.3. Assessment of Technology Maturity and Readiness Levels 6.4. Key Challenges and Barriers to AI Adoption in Agriculture 6.5. Opportunities to Accelerate Adoption and Market Penetration 6.6. Impact of AI Adoption on Productivity, Efficiency, and Sustainability 7. Technological Landscape & Innovation 7.1. Comprehensive Analysis of AI Technologies Transforming Agriculture 7.2. Emerging and Disruptive AI Innovations Driving Efficiency and Productivity 7.3. Global Technology Adoption Trends, Barriers, and Growth Patterns 7.4. Key Research, Development Initiatives, and Strategic Collaborations 7.5. Impact of Technological Innovation on Farm Productivity, Sustainability, and Profitability 8. Investment & Funding Trends 8.1. Venture Capital and Private Equity in AI-Driven Agriculture 8.2. Strategic Investments By Agri-Tech and Technology Providers 8.3. Government Grants, Subsidies, and Incentives for AI Adoption 8.4. Mergers, Acquisitions, and Partnerships Driving Market Growth 8.5. Investment Impact on Technology Innovation and Farm Adoption 9. Use Cases & Implementation Insights 9.1. Real-World AI Implementation in Farming Operations 9.2. Key Use Cases: Precision Farming, Crop Monitoring, Livestock, Irrigation 9.3. Operational Benefits and ROI of AI in Agriculture 9.4. Lessons from Successful AI Deployments on Farms and Agro-Tech Platforms 9.5. Best Practices for Sustainable, Ethical, and Effective AI Adoption 9.6. Challenges and Strategies for AI Implementation Across Farms 10. Artificial Intelligence in Agriculture Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 10.1. Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 10.1.1. Computer Vision 10.1.2. Machine Learning 10.1.3. Predictive Analytics 10.1.4. Natural Language Processing (NLP) 10.1.5. Others 10.2. Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 10.2.1. Hardware 10.2.2. Services 10.2.3. Solution 10.3. Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 10.3.1. Cloud 10.3.2. On-premise 10.3.3. Hybrid 10.4. Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 10.4.1. Large 10.4.2. Small and Medium Enterprise (SMEs) 10.5. Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 10.5.1. Agriculture Robot 10.5.2. Crop and Soil Monitoring 10.5.3. Weed Detection 10.5.4. Livestock Health Monitoring 10.5.5. Others 10.6. Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 10.6.1. Farms & Agricultural Producers 10.6.2. Agro-Tech Companies 10.6.3. Agrochemical Companies 10.6.4. Research Institutes 10.6.5. Others 10.7. Artificial Intelligence in Agriculture Market Size and Forecast, By Region (2024-2032) 10.7.1. North America 10.7.2. Europe 10.7.3. Asia Pacific 10.7.4. Middle East and Africa 10.7.5. South America 11. North America Artificial Intelligence in Agriculture Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 11.1. North America Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 11.1.1. Computer Vision 11.1.2. Machine Learning 11.1.3. Predictive Analytics 11.1.4. Natural Language Processing (NLP) 11.1.5. Others 11.2. North America Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 11.2.1. Hardware 11.2.2. Services 11.2.3. Solution 11.3. North America Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 11.3.1. Cloud 11.3.2. On-premise 11.3.3. Hybrid 11.4. North America Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 11.4.1. Large 11.4.2. Small and Medium Enterprise (SMEs) 11.5. North America Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 11.5.1. Agriculture Robot 11.5.2. Crop and Soil Monitoring 11.5.3. Weed Detection 11.5.4. Livestock Health Monitoring 11.5.5. Others 11.6. North America Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 11.6.1. Farms & Agricultural Producers 11.6.2. Agro-Tech Companies 11.6.3. Agrochemical Companies 11.6.4. Research Institutes 11.6.5. Others 11.7. North America Artificial Intelligence in Agriculture Market Size and Forecast, by Country (2024-2032) 11.7.1. United States 11.7.1.1. United States Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 11.7.1.2. United States Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 11.7.1.3. United States Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 11.7.1.4. United States Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 11.7.1.5. United States Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 11.7.1.6. United States Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 11.7.2. Canada 11.7.2.1. Canada Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 11.7.2.2. Canada Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 11.7.2.3. Canada Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 11.7.2.4. Canada Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 11.7.2.5. Canada Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 11.7.2.6. Canada Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 11.7.3. Mexico 11.7.3.1. Mexico Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 11.7.3.2. Mexico Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 11.7.3.3. Mexico Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 11.7.3.3.1. 11.7.3.4. Mexico Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 11.7.3.5. Mexico Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 11.7.3.6. Mexico Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 12. Europe Artificial Intelligence in Agriculture Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 12.1. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 12.2. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 12.3. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 12.4. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 12.5. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 12.6. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 12.7. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 12.8. Europe Artificial Intelligence in Agriculture Market Size and Forecast, By Country (2024-2032) 12.8.1. United Kingdom 12.8.2. France 12.8.3. Germany 12.8.4. Italy 12.8.5. Spain 12.8.6. Sweden 12.8.7. Russia 12.8.8. Rest of Europe 13. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 13.1. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 13.2. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 13.3. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 13.4. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 13.5. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 13.6. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 13.7. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 13.8. Asia Pacific Artificial Intelligence in Agriculture Market Size and Forecast, by Country (2024-2032) 13.8.1. China 13.8.2. S Korea 13.8.3. Japan 13.8.4. India 13.8.5. Australia 13.8.6. Indonesia 13.8.7. Malaysia 13.8.8. Philippines 13.8.9. Thailand 13.8.10. Vietnam 13.8.11. Rest of Asia Pacific 14. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 14.1. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 14.2. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 14.3. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 14.4. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 14.5. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 14.6. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 14.7. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 14.8. Middle East and Africa Artificial Intelligence in Agriculture Market Size and Forecast, By Country (2024-2032) 14.8.1. South Africa 14.8.2. GCC 14.8.3. Nigeria 14.8.4. Rest of ME&A 15. South America Artificial Intelligence in Agriculture Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 15.1. South America Artificial Intelligence in Agriculture Market Size and Forecast, By Technology (2024-2032) 15.2. South America Artificial Intelligence in Agriculture Market Size and Forecast, By Component (2024-2032) 15.3. South America Artificial Intelligence in Agriculture Market Size and Forecast, By Deployment Mode (2024-2032) 15.4. South America Artificial Intelligence in Agriculture Market Size and Forecast, By Type of Enterprise (2024-2032) 15.5. South America Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 15.6. South America Artificial Intelligence in Agriculture Market Size and Forecast, By Application (2024-2032) 15.7. South America Artificial Intelligence in Agriculture Market Size and Forecast, By End-User (2024-2032) 15.8. South America Artificial Intelligence in Agriculture Market Size and Forecast, By Country (2024-2032) 15.8.1. Brazil 15.8.2. Argentina 15.8.3. Colombia 15.8.4. Chile 15.8.5. Rest of South America 16. Company Profile: Key Players 16.1. Deere & Company 16.1.1. Company Overview 16.1.2. Business Portfolio 16.1.3. Financial Overview 16.1.4. SWOT Analysis 16.1.5. Strategic Analysis 16.1.6. Recent Developments 16.2. Microsoft Corporation 16.3. IBM Corporation 16.4. AWS 16.5. Global Agriculture 16.6. Bayer AG 16.7. Climate LLC. 16.8. Farmers Edge Inc. 16.9. Granular Inc. 16.10. AgEagle Aerial Systems Inc 16.11. Raven Industries Inc. 16.12. AGCO Corporation 16.13. Gamaya SA 16.14. Trimble Inc. 16.15. CropIn 16.16. Intello Labs 16.17. The Conservation Foundation 16.18. Fasal 16.19. Blue River Technology 16.20. Taranis 16.21. InData Labs 16.22. Itransition 16.23. Syngenta 16.24. Tule Technologies Inc. 16.25. Others 17. Key Findings 18. Analyst Recommendations & Strategic Insights 18.1. Market Entry and Expansion Strategies for New Players 18.2. Investment Priorities and Funding Opportunities in AI Agriculture 18.3. Adoption Roadmap for Small, Medium, and Large Farms 18.4. Technology Implementation and Integration Best Practices 18.5. Partnership and Collaboration Opportunities for Agri-Tech Companies 19. Artificial Intelligence in Agriculture Market – Research Methodology