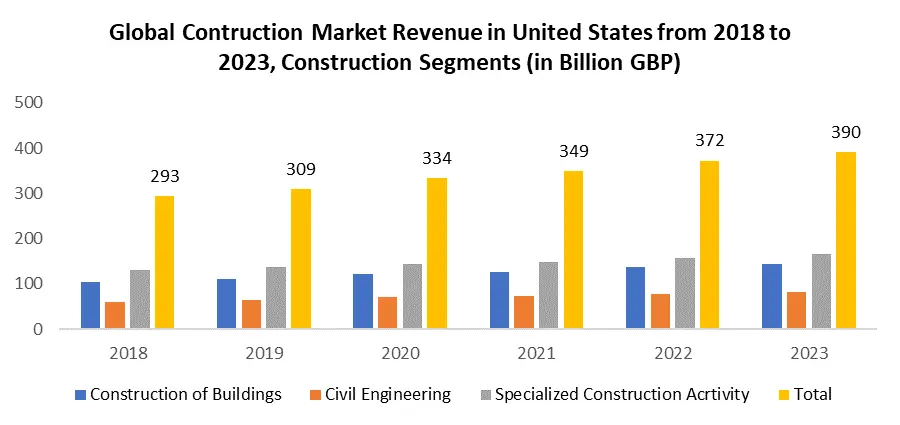

Global Artificial Intelligence Construction Market size was valued at USD 1.06 Bn in 2023 and is expected to reach USD 8.5 Bn by 2030, at a CAGR of 34.7 %. Artificial Intelligence Construction Market encompasses a suite of technological solutions that leverage AI's capabilities to optimize various facets of the construction industry. These innovative software applications employ machine learning, data analytics, and automation to revolutionize efficiency, precision, safety, and decision-making throughout the construction lifecycle. By analyzing copious project data and patterns, AI construction software offers invaluable insights, predictions, and recommendations, empowering stakeholders to make informed decisions and streamline operations. These tools provide multifaceted functionalities, ranging from predicting potential delays and refining resource allocation to identifying defects and suggesting design enhancements. Ultimately, AI construction software aims to transform the industry by leveraging AI's prowess to surmount challenges, curtail cost overruns, heighten productivity, and forge safer, more efficient construction processes.To know about the Research Methodology:-Request Free Sample Report Artificial Intelligence Construction Market helps in project planning and scheduling optimizations, design and engineering refinements, precise cost estimation, and strategic budgeting. AI aids in judicious resource allocation, streamlining document management, facilitating client communication through AI-driven chatbots, and furnishing robust performance analytics. AI empowers construction teams by furnishing data-centric insights, automating repetitive tasks, and underpinning intelligent decision-making across the project continuum. Selecting appropriate AI construction software entails considerations of tailored features for project planning, scheduling, resource allocation, and risk analysis, which are cornerstones influencing project timelines and deliverables. Moreover, seamless integration with existing systems, user-friendly interfaces, and robust support and training options are imperative for optimal software utilization. The growth of the Artificial Intelligence Construction market is significantly driven by the industry's pursuit of enhanced efficiency and productivity. AI addresses perennial challenges like project delays, cost overruns, and resource mismanagement by streamlining operations, optimizing workflows, and mitigating risks. Machine learning algorithms and data-driven insights enable predictive analytics for project timelines, cost estimation, and resource allocation, minimizing delays and overruns. AI facilitates intricate design simulations, reducing waste, enhancing sustainability, and revolutionizing on-site operations through robotics and automation, ultimately elevating productivity and ensuring secure work environments. North America leads the Artificial Intelligence Construction Market particularly the United States and Canada, owing to their technological advancements, robust tech ecosystems, infrastructure, and proactive government initiatives that foster AI innovation and adoption in construction practices. North America's emphasis on efficiency aligns well with AI-powered solutions, contributing significantly to its dominance in driving AI integration within the construction sector.

Artificial Intelligence Construction Market Driver

Driving Forces of Artificial Intelligence Construction Market Innovations, Government Advocacy, and Technological Synergy Propel Industry Transformation The landscape of the Artificial Intelligence Construction Market is continuously evolving, driven by ongoing advancements in AI algorithms, machine learning, and data processing capabilities. This dynamic environment empowers AI tools to continually evolve, adapting to become more sophisticated, flexible, and efficient. These innovations lead to tailored AI solutions designed explicitly for the construction sector. These AI-driven tools offer a spectrum of capabilities, from predictive analytics anticipating equipment failures to real-time defect detection using computer vision systems. These transformative advancements are revolutionizing traditional construction practices, significantly enhancing operational efficiency and project outcomes. At the forefront of this transformation lies the integration of cutting-edge AI technology with automation and robotics within the Artificial Intelligence Construction Market. This integration heralds a new era of efficiency, where robots seamlessly execute tasks like bricklaying, welding, and site inspections. These AI-powered machines not only accelerate project timelines but also significantly reduce errors, ushering in a new paradigm for construction practices that prioritize precision and expediency. Robust government advocacy for AI within the Artificial Intelligence Construction Market plays a pivotal role in propelling this transformative wave. Governments globally recognize AI's potential to revolutionize the construction industry and allocate substantial funds towards its research, development, and implementation. Supportive regulatory frameworks are instituted to encourage widespread AI adoption in construction, fostering collaboration among stakeholders while providing guidelines for the ethical and safe utilization of AI-driven technologies. Governments incentivize AI adoption within the construction sector by offering financial incentives, tax breaks, and subsidies to companies embracing AI technologies. They also launch initiatives aimed at raising awareness, providing comprehensive training, and advocating best practices for seamlessly integrating AI into construction operations. This strategic promotion of innovation encourages partnerships among industry players, academia, and research institutions, fostering the creation of tailored AI solutions uniquely designed to address the construction sector's specific needs. The synergy between cutting-edge AI technology and proactive government advocacy creates an enabling environment within the Artificial Intelligence Construction Market. This environment accelerates innovation, stimulates investment, and propels the industry toward a future characterized by heightened efficiency, enhanced safety, and remarkable technological advancement. AI Revolutionizing Construction: Elevating Efficiency, Safety, and Sustainability Artificial Intelligence (AI) Construction Market is the relentless pursuit of enhanced efficiency and productivity within the industry. Construction endeavors contend with persistent challenges like project delays, cost overruns, and resource mismanagement. AI technology emerges as a transformative solution, offering streamlined operations, optimized workflows, and risk mitigation capabilities. Utilizing machine learning algorithms and data-driven insights, AI enables predictive analytics, significantly impacting project timelines, cost estimation accuracy, and resource allocation efficiency. By harnessing AI's capabilities, construction professionals can minimize delays and cost overruns, ensuring smoother project execution. AI also facilitates intricate design simulations, aiding in optimal structural planning and energy efficiency, thereby reducing waste and bolstering sustainability efforts. The integration of robotics and automation driven by AI technologies further revolutionizes on-site operations. These AI-powered systems execute repetitive tasks with precision and remarkable speed, significantly augmenting overall productivity levels within construction projects. Moreover, AI's role in enhancing safety practices cannot be overstated. Through real-time monitoring and predictive maintenance, AI ensures secure work environments, actively preventing accidents and minimizing risks to personnel and assets. The construction industry's increasing focus on safety, sustainability, and operational efficiency positions AI as a pivotal driver in reshaping traditional practices. By leveraging AI's capabilities to address inherent challenges, the construction sector charts a path toward heightened efficiency, cost-effectiveness, and safety standards, ultimately defining a new era of construction methodologies. Artificial Intelligence Construction Market Restraint Despite the promising potential of Artificial Intelligence in revolutionizing construction practices, the Artificial Intelligence Construction Market encounters two significant restraints that demand thoughtful consideration. The foremost challenge arises from the substantial initial investment and cost barriers associated with implementing AI solutions. Companies navigating this market must grapple with considerable upfront expenses encompassing hardware, software, data infrastructure, and workforce training. For smaller construction firms constrained by limited budgets, these financial hurdles prove particularly daunting. Furthermore, quantifying the Return on Investment (ROI) from AI in the short term remains challenging, complicating the justification of these initial expenditures. While the long-term benefits, including increased efficiency and productivity, are indisputable, demonstrating and measuring them early in the process becomes an impediment. The second restraint within the Artificial Intelligence Construction Market stems from data challenges and infrastructure gaps. AI's efficacy heavily relies on high-quality data, yet the construction industry often grapples with fragmented data spread across diverse platforms and formats. This lack of data standardization and integration impedes the effective learning of AI models, hindering the generation of precise insights. Moreover, building and sustaining the requisite IT infrastructure to support AI-powered solutions pose significant challenges, especially for smaller companies. Establishing reliable data storage, ensuring adequate computing power, and implementing robust cyber security measures necessitate ongoing investment and specialized expertise. To navigate these constraints, a multifaceted approach is crucial within the Artificial Intelligence Construction Market. Collaboration between government bodies and industry stakeholders can stimulate AI adoption by co-funding initiatives, spearheading pilot projects, and advocating standardized data management practices. Developing cost-effective, scalable AI solutions tailored to suit the requirements of smaller firms could enhance accessibility and affordability. Focusing on demonstrating clear ROI through tangible examples showcasing AI's efficacy in enhancing efficiency and profitability becomes paramount in building trust and fostering wider adoption. Investing in upskilling and reskilling the workforce to proficiently handle AI integration and data management emerges as a critical necessity for successful implementation within the Artificial Intelligence Construction Market. Embracing collaborative knowledge sharing to navigate data challenges and infrastructure gaps collectively further fortifies the industry's prospects. By addressing these pivotal restraints, the AI Construction Market can surmount obstacles and unlock its full potential, marking a significant stride toward reshaping the construction industry's future. This journey emphasizes not only technological advancements but also the creation of a collaborative ecosystem fostering innovation and empowering participants of varying scales to harness AI's capabilities for a brighter construction landscape.Artificial Intelligence Construction Market Trends

Integration of IoT and AI for Enhanced Construction Management The convergence of Artificial Intelligence with the Internet of Things (IoT) stands as a pivotal trend reshaping the Artificial Intelligence Construction Market. This integration enables real-time data collection from interconnected devices and sensors embedded within construction equipment and sites. AI algorithms process this wealth of data, offering actionable insights for optimized project management, predictive maintenance, and resource allocation. The amalgamation of AI and IoT fosters improved decision-making, boosting operational efficiency and productivity in construction projects. This trend underscores a shift towards smarter, data-driven construction practices within the Artificial Intelligence Construction Market. Rise of AI-Driven Building Information Modeling (BIM) Solutions Another prominent trend in the Artificial Intelligence Construction Market is the ascent of AI-powered Building Information Modeling (BIM) solutions. AI augments BIM frameworks by harnessing machine learning algorithms to analyze vast volumes of construction data. This integration enhances BIM's capabilities, enabling predictive analytics, risk assessment, and design optimization. AI-driven BIM systems facilitate real-time collaboration among stakeholders, streamlining communication and fostering efficient decision-making throughout the project lifecycle. This trend signifies a transformative leap towards more sophisticated, data-driven design and construction methodologies within the Artificial Intelligence Construction Market. These trends illustrate the evolving landscape within the Artificial Intelligence Construction Industry, highlighting the industry's progression towards data-driven, technologically advanced construction practices.

Artificial Intelligence Construction Market Segment Analysis

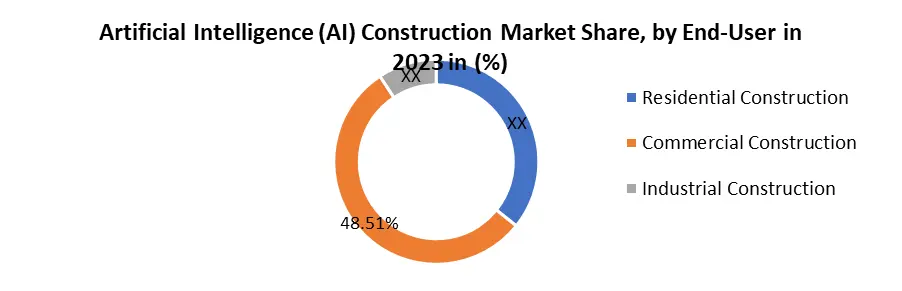

Based on Component, In the Artificial Intelligence Construction Market, the Solutions segment stands as the dominant force. These AI-driven solutions encompass a spectrum of offerings, including predictive analytics, AI-enabled project management tools, and computer vision systems. The prominence of solutions arises from their transformative impact on construction practices. AI-powered solutions streamline operations, optimize resource allocation, and enhance decision-making throughout project lifecycles. They offer real-time insights, enabling proactive risk mitigation and efficiency improvements. Additionally, the scalability and adaptability of AI solutions cater to diverse project requirements, fueling their widespread adoption. As the core driver of innovation and efficiency, the Solutions segment leads the AI Construction Market, marking a paradigm shift towards smarter, data-driven construction methodologies. Based on Technology, In the landscape of the Artificial Intelligence Construction Market, the Computer Vision segment emerges as the most dominant technology. Computer vision plays a pivotal role in revolutionizing construction practices by enabling real-time analysis of visual data from construction sites. Its applications range from progress monitoring and defect detection to safety compliance assessments. This dominance is evident in countries like the United States, China, and the United Kingdom, where substantial investments and advancements in computer vision technology have bolstered construction innovation. The accuracy and efficiency of computer vision algorithms in identifying and analyzing on-site conditions contribute significantly to operational excellence and risk management, propelling its prominence within the AI Construction Market.Based on Application In the realm of the Artificial Intelligence Construction Market, the Predictive Maintenance segment emerges as the most dominant application area. Predictive maintenance powered by AI algorithms is revolutionizing construction practices by proactively identifying potential equipment failures before they occur. This segment's dominance is conspicuous in countries like the United States, Japan, and Germany, where substantial investments in predictive maintenance technologies have been pivotal in advancing construction innovation. The capability to forecast machinery breakdowns enables efficient scheduling of repairs, minimizes downtime, and optimizes resource allocation. This application significantly enhances operational efficiency and cost-effectiveness, positioning predictive maintenance as a cornerstone of AI-driven advancements within the construction industry. Based on End-User, In the Artificial Intelligence Construction Market, the Commercial Construction segment emerges as the most dominant end-user sector. This dominance is particularly pronounced in countries like the United States, China, and the United Kingdom, where significant advancements and investments in AI technologies have reshaped commercial construction practices. The prominence of commercial construction arises from its complex project requirements and the increasing demand for innovative solutions to optimize operations. AI integration in this sector enhances project management, facilitates data-driven decision-making, and streamlines complex workflows. Additionally, the scale and diversity of commercial construction projects necessitate sophisticated AI solutions, fostering widespread adoption and driving the segment's dominance within the AI Construction Market.

Artificial Intelligence Construction Market Regional Analysis

The global Artificial Intelligence Construction Market sees North America, particularly led by the US and Canada, held the largest market share in 2023. Its commanding position owes much to a fusion of advanced technological ecosystems, an unwavering emphasis on productivity and efficiency, and substantial governmental backing. This collective strength places North America at the forefront of innovation within the construction industry. The region's prowess in Artificial Intelligence construction is underpinned by an advanced tech landscape. Robust infrastructure, coupled with abundant access to capital and a vibrant tech culture, propels the swift evolution and widespread adoption of cutting-edge AI solutions across construction sectors. Emphasizing efficiency and cost-effectiveness, the construction industry in North America prioritizes AI-powered tools and automation, amplifying their attractiveness and integration across various facets of construction operations. Further augmenting its supremacy, proactive government initiatives, inclusive of research grants and pilot programs, actively accelerate the adoption curve of AI technology in construction. This support bridges technological gaps, fostering an environment conducive to innovation and rapid AI integration. Recent advancements within North America's Artificial Intelligence Construction Market are marked by a focus on robotics and automation. Renowned corporations like Caterpillar and Trimble spearhead the development of sophisticated AI-powered robots, revolutionizing critical construction tasks such as welding, bricklaying, and comprehensive site surveying. Predictive maintenance emerges as a key focus area, leveraging Artificial Intelligence tools to preempt equipment failures and avert costly downtime. This optimization strategy efficiently manages fleet operations and project schedules, ensuring seamless workflows. Sustainability also emerges as a pivotal facet facilitated by AI, fostering resource optimization, waste reduction, and the implementation of energy-efficient solutions within construction practices. North America's Artificial Intelligence Construction Market features an array of influential players, comprising established industry leaders and innovative startups. Notable figures such as Autodesk, Trimble, Caterpillar, and Sketchbox showcase groundbreaking initiatives, integrating AI into construction practices. These key players exemplify North America's commitment to driving innovation and redefining construction paradigms through AI integration. The Asia Pacific region, anchored by prominent countries like China and Japan, stands at the forefront of the global Artificial Intelligence Construction Market driving swift advancements and displaying exponential growth. Its ascendancy is attributed to several pivotal factors, distinguishing it as a hub for innovation and rapid adoption of AI technology within the construction sector. The Asia Pacific region stands as a beacon of rapid transformation within the global Artificial Intelligence Construction Market Led by economic powerhouses such as China, Japan, South Korea, and India, this region showcases remarkable dominance and substantial growth driven by governmental emphasis on technological advancement. With significant investments in AI research and development, coupled with ambitious infrastructure projects, the region has become a hotbed for AI integration in construction practices. Leveraging skilled labor, robust manufacturing capabilities, and synergy between innovation and infrastructure expansion, the Asia Pacific Artificial Intelligence Construction Market witness’s noteworthy trends, including prefabrication optimization, burgeoning adoption of Building Information Modeling (BIM) with AI, and the advancement of smart city development. Key players like China State Construction Engineering Corporation, Baidu, Komatsu, and Samsung C&T are pioneering AI-driven solutions, propelling the region's role as a leader in reshaping the future of construction through innovative technology. Asia Pacific's Artificial Intelligence Construction Market is thriving due to significant governmental investments in technological advancement, notably in China, Japan, and South Korea. These efforts bolster AI research, development, and adoption within the construction sector. The region's ambitious infrastructure projects align seamlessly with AI's capabilities, driving its integration. Furthermore, Asia Pacific boasts a skilled labor force and strong manufacturing capacities, creating an optimal environment for AI technology in construction. Recent advancements include optimizing prefabrication, expanding Building Information Modeling (BIM) with AI, and leveraging AI for smart city development. Key players like China State Construction Engineering Corporation, Baidu, Komatsu, and Samsung C&T are leading this innovation, driving the region's progress in reshaping the future of construction. Asia Pacific's Artificial Intelligence Construction Market showcases remarkable growth factors, including significant government investments in technological development, especially in China, Japan, and South Korea. The region's alignment of ambitious infrastructure projects with AI's potential propels its integration into construction practices. Asia Pacific's skilled labor pool and robust manufacturing capabilities provide a fertile ground for AI adoption. Recent advancements include optimizing prefabrication, expanding AI-integrated BIM, and utilizing AI for smart city development. Key players like China State Construction Engineering Corporation, Baidu, Komatsu, and Samsung C&T lead this transformation, cementing Asia Pacific's pivotal role in shaping the future of construction through innovative technology.The scope of the Artificial Intelligence (AI) Construction Market : Inquire before buying

Global Artificial Intelligence Construction Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.06 Bn. Forecast Period 2024 to 2030 CAGR: 34.7% Market Size in 2030: US $ 8.5 Bn. Segments Covered: by Component Solutions Services by Technology Machine Learning Natural Language Processing (NLP) Computer Vision Others by Application Project Management Field Management Risk Management Predictive Maintenance Others by End User Residential Construction Commercial Construction Industrial Construction Artificial Intelligence Construction Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria, and Rest of ME&A)Artificial Intelligence Construction Key players

North America: 1. Autodesk (US) 2. Trimble (US) 3. Caterpillar (US) 4. Bentley Systems (US) 5. Sketchbox (US) 6. Finning International (Canada) 7. Oracle Corporation (US) 8. NVIDIA Corporation (US) 9. IBM Corporation (US) 10. Boston Dynamics (US) 11. Procore Technologies (US) Europe 1. RIB Software (Germany) 2. Trimble Navigation (UK) 3. Dassault Systèmes (France) 4. Bouygues Construction (France) 5. ABB (Switzerland) 6. Siemens AG (Germany) 7. Schneider Electric (France) 8. Skanska (Sweden) 9. Strabag SE (Austria) 10. Skanska AB (Sweden) Asia Pacific 1. China State Construction Engineering Corporation (China) 2. Baidu (China) 3. Komatsu (Japan) 4. Mitsubishi Heavy Industries (Japan) 5. Samsung C&T (South Korea) 6. Buildots (Israel) 7. Constructive AI (Australia) 8. Wizdom (India) 9. Hitachi Construction Machinery (Japan) 10. Hyundai Engineering & Construction (South Korea) 11. L&T Construction (India) 12. China Communications Construction Company (China) 13. Fujita Corporation (Japan) Frequently Asked Questions: 1] What is the growth rate of the Global Artificial Intelligence Construction Market? Ans. The Global Artificial Intelligence Construction Market is growing at a significant rate of 34.7 % during the forecast period. 2] Which region is expected to dominate the Global Artificial Intelligence Construction Market? Ans. North America held a significant share in the global Artificial Intelligence Construction market, primarily due to advanced healthcare infrastructure, a higher prevalence of respiratory diseases, and a well-established market for medical devices. 3] What is the expected Global Artificial Intelligence Construction Market size by 2030? Ans. The Artificial Intelligence Construction Market size is expected to reach USD 8.5 Bn by 2030. 4] Which are the top players in the Global Artificial Intelligence Construction Market? Ans. The major top players in the Global Artificial Intelligence Construction Market are North American giants like Inogen & Philips dominate globally, but Asia's rising stars like Teijin & Foshan Kaiya challenge their reign. 5] What are the factors driving the Global Artificial Intelligence Construction Market growth? Ans. The Global Artificial Intelligence Construction Market growth is primarily propelled by increasing cases of respiratory disorders like COPD, technological advancements improving device efficiency and portability, rising elderly population susceptible to respiratory conditions, and the convenience of at-home oxygen therapy. Additionally, the COVID-19 pandemic accentuated the demand for these devices, driving market expansion due to the virus's impact on respiratory health worldwide. 6] Which country held the largest Global Artificial Intelligence Construction Market share in 2023? Ans. The United States held the largest Artificial Intelligence Construction Market share in 2023.

1. Artificial Intelligence Construction Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Artificial Intelligence Construction Market: Dynamics 2.1. Artificial Intelligence Construction Market Trends by Region 2.1.1. North America Artificial Intelligence Construction Market Trends 2.1.2. Europe Artificial Intelligence Construction Market Trends 2.1.3. Asia Pacific Artificial Intelligence Construction Market Trends 2.1.4. Middle East and Africa Artificial Intelligence Construction Market Trends 2.1.5. South America Artificial Intelligence Construction Market Trends 2.2. Artificial Intelligence Construction Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Artificial Intelligence Construction Market Drivers 2.2.1.2. North America Artificial Intelligence Construction Market Restraints 2.2.1.3. North America Artificial Intelligence Construction Market Opportunities 2.2.1.4. North America Artificial Intelligence Construction Market Challenges 2.2.2. Europe 2.2.2.1. Europe Artificial Intelligence Construction Market Drivers 2.2.2.2. Europe Artificial Intelligence Construction Market Restraints 2.2.2.3. Europe Artificial Intelligence Construction Market Opportunities 2.2.2.4. Europe Artificial Intelligence Construction Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Artificial Intelligence Construction Market Drivers 2.2.3.2. Asia Pacific Artificial Intelligence Construction Market Restraints 2.2.3.3. Asia Pacific Artificial Intelligence Construction Market Opportunities 2.2.3.4. Asia Pacific Artificial Intelligence Construction Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Artificial Intelligence Construction Market Drivers 2.2.4.2. Middle East and Africa Artificial Intelligence Construction Market Restraints 2.2.4.3. Middle East and Africa Artificial Intelligence Construction Market Opportunities 2.2.4.4. Middle East and Africa Artificial Intelligence Construction Market Challenges 2.2.5. South America 2.2.5.1. South America Artificial Intelligence Construction Market Drivers 2.2.5.2. South America Artificial Intelligence Construction Market Restraints 2.2.5.3. South America Artificial Intelligence Construction Market Opportunities 2.2.5.4. South America Artificial Intelligence Construction Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Artificial Intelligence Construction Industry 2.9. The Global Pandemic Impact on Artificial Intelligence Construction Market 2.10. Artificial Intelligence Construction Price Trend Analysis (2021-23) 3. Artificial Intelligence Construction Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 3.1.1. Solutions 3.1.2. Services 3.2. Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 3.2.1. Machine Learning 3.2.2. Natural Language Processing (NLP) 3.2.3. Computer Vision 3.2.4. Others 3.3. Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 3.3.1. Project Management 3.3.2. Field Management 3.3.3. Risk Management 3.3.4. Predictive Maintenance 3.3.5. Others 3.4. Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 3.4.1. Residential Construction 3.4.2. Commercial Construction 3.4.3. Industrial Construction 3.5. Artificial Intelligence Construction Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Artificial Intelligence Construction Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 4.1.1. Solutions 4.1.2. Services 4.2. North America Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 4.2.1. Machine Learning 4.2.2. Natural Language Processing (NLP) 4.2.3. Computer Vision 4.2.4. Others 4.3. North America Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 4.3.1. Project Management 4.3.2. Field Management 4.3.3. Risk Management 4.3.4. Predictive Maintenance 4.3.5. Others 4.4. North America Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 4.4.1. Residential Construction 4.4.2. Commercial Construction 4.4.3. Industrial Construction 4.5. North America Artificial Intelligence Construction Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Solutions 4.5.1.1.2. Services 4.5.1.2. United States Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 4.5.1.2.1. Machine Learning 4.5.1.2.2. Natural Language Processing (NLP) 4.5.1.2.3. Computer Vision 4.5.1.2.4. Others 4.5.1.3. United States Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Project Management 4.5.1.3.2. Field Management 4.5.1.3.3. Risk Management 4.5.1.3.4. Predictive Maintenance 4.5.1.3.5. Others 4.5.1.4. United States Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 4.5.1.4.1. Residential Construction 4.5.1.4.2. Commercial Construction 4.5.1.4.3. Industrial Construction 4.5.2. Canada 4.5.2.1. Canada Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Solutions 4.5.2.1.2. Services 4.5.2.2. Canada Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 4.5.2.2.1. Machine Learning 4.5.2.2.2. Natural Language Processing (NLP) 4.5.2.2.3. Computer Vision 4.5.2.2.4. Others 4.5.2.3. Canada Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Project Management 4.5.2.3.2. Field Management 4.5.2.3.3. Risk Management 4.5.2.3.4. Predictive Maintenance 4.5.2.3.5. Others 4.5.2.4. Canada Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 4.5.2.4.1. Residential Construction 4.5.2.4.2. Commercial Construction 4.5.2.4.3. Industrial Construction 4.5.3. Mexico 4.5.3.1.1. Mexico Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1.1. Solutions 4.5.3.1.1.2. Services 4.5.3.1.2. Mexico Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 4.5.3.1.2.1. Machine Learning 4.5.3.1.2.2. Natural Language Processing (NLP) 4.5.3.1.2.3. Computer Vision 4.5.3.1.2.4. Others 4.5.3.1.3. Mexico Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 4.5.3.1.3.1. Project Management 4.5.3.1.3.2. Field Management 4.5.3.1.3.3. Risk Management 4.5.3.1.3.4. Predictive Maintenance 4.5.3.1.3.5. Others 4.5.3.1.4. Mexico Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 4.5.3.1.4.1. Residential Construction 4.5.3.1.4.2. Commercial Construction 4.5.3.1.4.3. Industrial Construction 5. Europe Artificial Intelligence Construction Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.2. Europe Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.4. Europe Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5. Europe Artificial Intelligence Construction Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.1.3. United Kingdom Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5.2. France 5.5.2.1. France Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.2.3. France Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.3.3. Germany Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.4.3. Italy Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.5.3. Spain Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.6.3. Sweden Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.7.3. Austria Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 5.5.8.3. Rest of Europe Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Artificial Intelligence Construction Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5. Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.1.3. China Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.2.3. S Korea Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.3.3. Japan Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.4. India 6.5.4.1. India Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.4.3. India Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.5.3. Australia Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.6.3. Indonesia Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.7.3. Malaysia Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.8.3. Vietnam Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.9.3. Taiwan Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 6.5.10.3. Rest of Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Artificial Intelligence Construction Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 7.5. Middle East and Africa Artificial Intelligence Construction Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. South Africa Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. GCC Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Nigeria Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. Rest of ME&A Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 8. South America Artificial Intelligence Construction Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 8.2. South America Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 8.3. South America Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 8.4. South America Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 8.5. South America Artificial Intelligence Construction Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 8.5.1.3. Brazil Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 8.5.2.3. Argentina Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Artificial Intelligence Construction Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America Artificial Intelligence Construction Market Size and Forecast, by Technology (2023-2030) 8.5.3.3. Rest Of South America Artificial Intelligence Construction Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Artificial Intelligence Construction Market Size and Forecast, by End-User (2023-2030) 9. Global Artificial Intelligence Construction Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Artificial Intelligence Construction Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Autodesk (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Awards Received by the Firm 10.1.6. Recent Developments 10.2. Trimble (US) 10.3. Caterpillar (US) 10.4. Bentley Systems (US) 10.5. Sketchbox (US) 10.6. Finning International (Canada) 10.7. Oracle Corporation (US) 10.8. NVIDIA Corporation (US) 10.9. IBM Corporation (US) 10.10. Boston Dynamics (US) 10.11. Procore Technologies (US) 10.12. RIB Software (Germany) 10.13. Trimble Navigation (UK) 10.14. Dassault Systèmes (France) 10.15. Bouygues Construction (France) 10.16. ABB (Switzerland) 10.17. Siemens AG (Germany) 10.18. Schneider Electric (France) 10.19. Skanska (Sweden) 10.20. Strabag SE (Austria) 10.21. Skanska AB (Sweden) 10.22. China State Construction Engineering Corporation (China) 10.23. Baidu (China) 10.24. Komatsu (Japan) 10.25. Mitsubishi Heavy Industries (Japan) 10.26. Samsung C&T (South Korea) 10.27. Buildots (Israel) 10.28. Constructive AI (Australia) 10.29. Wizdom (India) 10.30. Hitachi Construction Machinery (Japan) 10.31. Hyundai Engineering & Construction (South Korea) 10.32. L&T Construction (India) 10.33. China Communications Construction Company (China) 10.34. Fujita Corporation (Japan) 11. Key Findings 12. Industry Recommendations 13. Artificial Intelligence Construction Market: Research Methodology