The Alzheimer’s Therapeutics Market was valued at USD 6.28 Bn in 2024, and the total revenue of the Global Alzheimer’s Therapeutics Market is expected to grow at a CAGR of 8.27% from 2025 to 2032, reaching nearly USD 11.86 Bn. by 2032.Alzheimer’s Therapeutics Market Overview

Alzheimer's disease (AD) is a neurodegenerative disorder that damages the brain's nerve cells or neurons, resulting in memory loss, thinking and language difficulties, and behavioural abnormalities. The number of individuals living with Alzheimer's disease is rapidly increasing, yet only around one in every four persons with the condition gets identified. The increased prevalence of Alzheimer's disease, as well as the approval of disease-modifying medicines, are expected to drive the Alzheimer’s Therapeutics Market growth.To know about the Research Methodology:- Request Free Sample Report Alzheimer’s Therapeutics Market Key drivers include the rising prevalence of AD among ageing populations and advancements in biomarker-based diagnostics, enhancing early detection and drug development. Demand is growing as global AD cases increase, while supply remains constrained by high clinical trial failure rates, particularly in late-stage disease-modifying drugs. North America dominated the Alzheimer’s Therapeutics Market in 2024, by robust R&D and high AD prevalence, and Europe follows with strong pharmaceutical innovation. Leading players, such as Biogen, Eli Lilly, and Roche, lead with anti-amyloid therapy and strategic collaboration. End users, including hospitals and specialty clinics, contribute significantly to market growth. Regulatory hurdles and drug approval controversies, such as the FDA’s conditional approval of Aduhelm, impact market dynamics, with pricing and reimbursement challenges in key regions. The report covered Alzheimer’s therapeutics market dynamics, structure, by analyzing market segments and projecting the Alzheimer’s therapeutics market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Alzheimer’s Therapeutics Market.

Alzheimer’s Therapeutics Market Dynamics

High adoption of Biomarkers in Diagnosis and Drug Development to boost Alzheimer’s Therapeutics Market Growth The development of novel diagnostic procedures is becoming increasingly critical to enhancing precision in early Alzheimer's disease (AD) diagnosis. As a result, biomarkers are being studied to improve the efficacy of diagnosis. Biomarkers are neurochemical signs that are used to identify illness risk or occurrence. These biomarkers can be utilized in a variety of medication development procedures; however, they are most typically used as supplementary diagnostic measures for the clinical diagnosis of Alzheimer's disease. Several biomarkers are used to detect different stages of Alzheimer's disease. Examples include beta-amyloid and tau levels in CSF fluid and imaging-detectable brain abnormalities. Data from various clinical studies have shown that the basic AD cerebrospinal fluid (CSF) biomarkers, such as amyloid- (A42), total tau (T-tau), and phosphorylated tau (P-tau), represent important aspects of AD pathology. As a result, biomarkers are increasingly being utilized in drug research to increase the success rate and cost-effectiveness of rational drug development. A huge number of clinical investigations have repeatedly demonstrated that these biomarkers can provide diagnostically useful information in the early stages of the disease. Additionally, recent technological advancements in fully automated assays have made it possible to test these biomarkers with great accuracy and stability. Microtubule-binding region tau (MTBR tau) was discovered in the fluid surrounding the brain and spinal cord by scientists at Washington University School of Medicine in Missouri in 2020. Doctors would be able to quantify tau protein levels using this MTBR tau fluid biomarker, allowing them to assess the stage of the illness without the requirement for a brain scan, and it might be used to screen patients before they show indications of cognitive deterioration. Rising Mortality and the Need for Advanced Treatments to Drive Alzheimer’s Therapeutics Market Growth Alzheimer’s disease (AD) has become a major threat to public health, due to the increasing number of infected persons. According to the Alzheimer's Association Report, around 121,499 AD deaths were registered in the United States in 2019. As a result, Alzheimer's disease is the sixth-leading cause of mortality in the United States, and the fifth-leading cause of death for people 65 and older. As the number of individuals suffering from Alzheimer's disease and mortality related to the condition rises, new medicines for the disease's detection and treatment are desperately needed. According to the Alzheimer's Association, if the illness's beginning is delayed by five years, the prevalence of the condition can be reduced by half. Many pipeline medications function through neurotransmitter systems to improve cognition or regulate neuropsychiatric disorders. However, some of these pipeline compounds are aimed toward disease-modifying medicines, which prevent, postpone, or reduce the course of Alzheimer's disease and solely target the underlying pathophysiologic pathways.Trial Failures in Alzheimer’s Drug Development to Restrain the Alzheimer’s Therapeutics Market The increasing number of disease-modifying drugs in the early stages of trials suggests that the industry is more focused on developing blockbuster products that can cure the disease; however, a decreasing proportion of disease-modifying therapies in later phases suggests that trial failure rates are significantly higher, particularly for disease-modifying drugs. Eli Lilly and Company stated in February 2020 that the analysis undertaken by the Washington University School of Medicine in the Dominantly Inherited Alzheimer Network Trials Unit (DIAN-TU) Study revealed that solanezumab did not reach the main objective. as a result, the company announced that it did not plan to pursue a submission for solanezumab in people with dominantly inherited Alzheimer's disease (DIAD), also known as autosomal dominant Alzheimer's disease, based on the result of the primary endpoint. Besides, smaller biotech companies, huge pharmaceutical corporations have also experienced multiple failures in late-phase clinical studies. For example, in 2019, Biogen and Eisai Co., Ltd announced the cancellation of the global Phase 3 studies ENGAGE and EMERGE, which were meant to assess the effectiveness and safety of aducanumab in patients with moderate cognitive impairment attributable to Alzheimer's disease and mild Alzheimer's disease dementia. The trials were discontinued due to the findings of a futility study undertaken by an independent data monitoring committee, which revealed that the trials were unlikely to reach their main aim upon completion. As a result, the failure of these late-stage medications has significantly hampered the global growth of the Alzheimer's therapeutics market.

Alzheimer’s Therapeutics Market Segment Analysis

Based on Therapeutics, the Cholinesterase inhibitors segment held the largest market share of about 68% and dominated the Alzheimer’s Therapeutics market in 2024. and is expected to hold the largest market share over the forecast period. Cholinesterase inhibitors, commonly known as acetylcholinesterase inhibitors, are a type of medication that prevents the natural breakdown of acetylcholine, a neurotransmitter. Cholinesterase inhibitors suppress the enzyme cholinesterase, which is responsible for the breakdown of acetylcholine neurotransmitters in the body. Cholinesterase inhibitors are routinely recommended to treat symptoms linked to memory, thinking, language, judgment, and other mental processes because they have been shown to modestly slow the loss of brain function in persons suffering from mild to moderate Alzheimer's disease. The most common cholinesterase inhibitor medications on the market nowadays are donepezil, galantamine, rivastigmine, and memantine. Based on the diagnostics, the Brain Imaging segment dominated the Alzheimer’s therapeutics diagnostics market in 2024. This is primarily due to its widespread use in clinical settings for early and accurate detection of Alzheimer related brain changes, such as amyloid plaques and hippocampal atrophy. Techniques like PET and MRI scans offer non-invasive, real-time visualization, which makes them the preferred diagnostic tool among neurologists. Additionally, the growing adoption of AI-enhanced imaging technologies is improving diagnostic precision and further boosting demand for brain imaging over CSF tests, which are more invasive and less accessible.Alzheimer’s Therapeutics Market Regional Insights

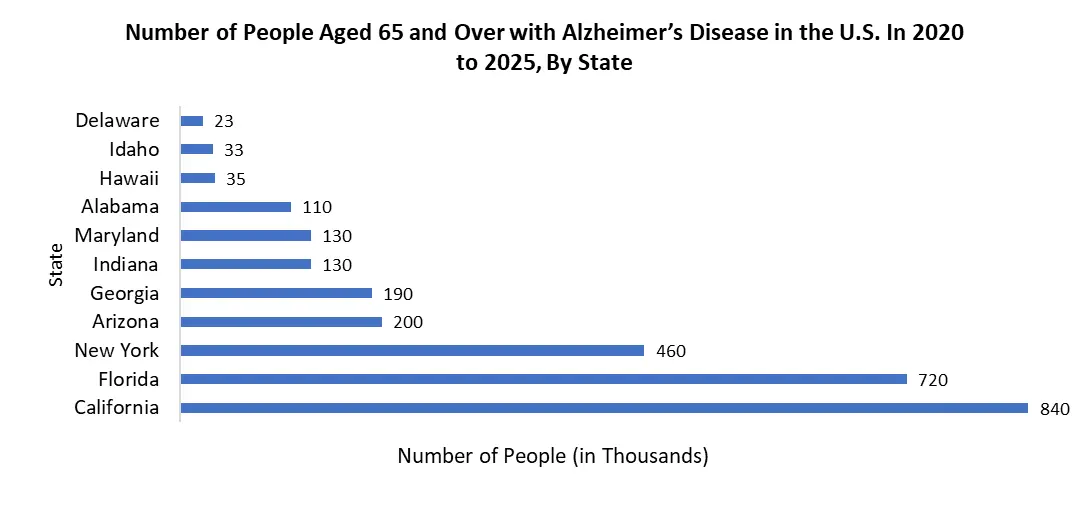

North America held the largest market share of about 38% and dominated the market in 2024. The region is expected to grow at a CAGR of about 18.9% and maintain its dominance at the end of the forecast period. The high prevalence of Alzheimer's disease and the region's ageing population, as well as significant investment in research & development activities and the launch of new products, are expected to be the primary growth drivers for the North American Alzheimer's Therapeutics market. For example, the Chief Science Officer of the Alzheimer's Society of Canada indicated in an interview in June 2021 that "during the next ten years, it's predicted that more than one million individuals in Canada will be living with dementia." This indicates that the increase in the prevalence of Alzheimer’s in the North American region is expected to increase the demand for diagnostic and therapeutic products for Alzheimer’s, which may drive Alzheimer’s Therapeutics market growth during the forecast period. However, the region's ageing population is expected to increase the prevalence of Alzheimer's disease, as the geriatric population is more vulnerable to neurodegenerative disorders like Alzheimer's because it is an age-related disease. According to the United Nations' World Population Ageing Highlights report for 2019, the US geriatric (aged 65 and up) population was 53,340,00 in 2019, 6,602,000 in Canada, and 9,462,000 in Mexico, and by 2050, it is expected to rise to 26,416,000 in Mexico, 11,436,000 in Canada, and 84,813,000 in the United States. The United States is expected to grow at a CAGR of about 18.8% and hold a major market share of the North American Alzheimer’s Therapeutics market during the forecast period. The high prevalence of Alzheimer’s disease amongst the U.S. population, new product launches by key competitors, the growing geriatric population, and the presence of robust healthcare infrastructure for Alzheimer’s detection and therapeutics are expected to drive the U.S. Alzheimer’s therapeutics market. According to the Alzheimer's Association's March 2021 study, roughly 6.2 million individuals aged 65 and older in the United States are living with Alzheimer's-Related dementia, with this figure expected to rise to 13.8 million by 2060.

Alzheimer’s Therapeutics Market Competitive Landscape

The Alzheimer’s therapeutics market is highly competitive, with key players like Biogen, Eli Lilly, Roche, Novartis, and Eisai leading the industry through innovative strategies. Biogen, with FDA-approved drug Aducanumab, focusing on amyloid beta targeting, controversy over efficacy. Eli Lilly is advancing with Donanemab, anti-amyloid therapy showing promising clinical results, reinforcing leadership in neurodegenerative research. Roche and its subsidiary Genentech are developing Gantenerumab, another anti-amyloid monoclonal antibody, leveraging strong R&D capabilities. Novartis is exploring preventive approaches through partnerships and early-stage immunotherapies. Eisai, in collaboration with Biogen, launched Lecanemab (Leqembi), the first disease-modifying therapy to receive full FDA approval, demonstrating clinical benefits in slowing Alzheimer’s progression. Companies are dominated by their strong pipeline, strategic collaboration, and substantial investment in precision medicine and biomarker research. Focus on targeted therapies, early intervention, and regulatory success sets them apart, while smaller firms like Alzheon and TauRx explore alternative mechanisms like tau protein inhibition. Competition remains high, with innovation and clinical validation being key differentiators in this high-stakes market.Alzheimer’s Therapeutics Market Key Trends

Key Trend Description Focus on Disease-Modifying Therapies (DMTs) Growing emphasis on drugs targeting the underlying causes of Alzheimer’s (e.g., amyloid plaques, tau tangles) rather than just symptom management. FDA approval of drugs like lecanemab and aducanumab (anti-amyloid antibodies) highlights this shift. Biomarker-Driven Drug Development Increased use of biomarkers (e.g., amyloid PET scans, CSF tests, blood-based biomarkers) for early diagnosis, patient stratification, and monitoring treatment efficacy in clinical trials. Personalised Medicine & Precision Therapeutics Advancements in genetic research (e.g., APOE4 targeting) and AI-driven drug discovery are being made to develop tailored treatments based on individual patient profiles. Alzheimer’s Therapeutics Market Recent Development

• Eisai Co. Ltd. (Japan) March 25, 2025 – Leqembi (lecanemab) receives the Prime Minister’s Award at Japan’s Technology Management & Innovation Awards for pioneering the first early‑Alzheimer’s treatment developed in Japan. April 14, 2025 – Announces that the EU Appeal Committee has completed deliberations on its Marketing Authorisation Application; decision now pending the European Commission. • Biogen Inc. (United States) January 14, 2025 – The FDA accepts its Biologics License Application for a subcutaneous formulation of Leqembi targeting early Alzheimer’s, with a PDUFA date set for August 31, 2025. • BioArctic AB (Sweden) March 25, 2025 – As part of the Eisai release, BioArctic’s contribution to Leqembi was highlighted when it received Japan’s Prime Minister’s award.Alzheimer’s Therapeutics Market Scope: Inquire before buying

Global Alzheimer’s Therapeutics Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.28 Bn. Forecast Period 2025 to 2032 CAGR: 8.27% Market Size in 2032: USD 11.86 Bn. Segments Covered: by Therapeutics Cholinesterase Inhibitors NMDA Receptor Antagonist Combination Drug Pipeline Drugs by Diagnostics Brain Imaging CFS Test for Alzheimer's Disease by End User Hospital Pharmacy Retail Pharmacy E-commerce Alzheimer’s Therapeutics Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Alzheimer’s Therapeutics Market, Key Players

North America 1. Biogen (United States) 2. Eli Lilly and Company (United States) 3. Pfizer Inc. (United States) 4. Johnson & Johnson (United States) 5. AbbVie Inc. (United States) 6. Alzheon (United States) 7. Amgen Inc. (United States) 8. Bristol Myers Squibb (United States) 9. Merck & Co. (United States) 10. Amneal Pharmaceuticals Inc. (United States) Europe 11. Roche Holding AG (Switzerland) 12. Novartis AG (Switzerland) 13. TauRx Therapeutics (United Kingdom) 14. AstraZeneca plc (United Kingdom) 15. Bayer AG (Germany) 16. H. Lundbeck A/S (Denmark) Asia-Pacific 17. Eisai Co. Ltd. (Japan) 18. Dr. Reddy’s Laboratories Ltd (India) 19. Aurobindo Pharma Ltd (India) 20. Macleods Pharmaceuticals Ltd (India) 21. Sun Pharmaceutical Industries Ltd (India) 22. Takeda Pharmaceutical Company Ltd (Japan) Middle East & Africa 23. Aspen Pharmacare (South Africa) South America 24. Eurofarma Laboratórios (Brazil) 25. Grupo Bagó (Argentina)Frequently Asked Questions:

1] What are the leading market players active in the Alzheimer’s Therapeutics Market? Ans. The top players in the Alzheimer’s Therapeutics market in 2024 include Biogen, Eli Lilly and Company, Roche Holding AG, Eisai Co. Ltd., Pfizer Inc., Novartis AG, Johnson & Johnson, and AbbVie Inc. 2] What are the growth drivers for the Alzheimer’s Therapeutics market? Ans. The increasing automotive sector, increasing commercialization, growing building activity, rapidly changing customer preferences for customized automobiles, as well as increased demand for lightweight and fuel-efficient vehicles, are expected to be the major drivers for the Alzheimer’s Therapeutics market. 3] What is the major restraint for the Alzheimer’s Therapeutics market growth? Ans. The Stringent Regulations on Alzheimer’s Therapeutics adoption are expected to be the major restraining factor for the Alzheimer’s Therapeutics market growth. 4] What is the projected market size & growth rate of the Alzheimer’s Therapeutics Market? Ans. The Alzheimer’s Therapeutics Market size was valued at USD 6.28 Bn. in 2024, and the total Alzheimer’s Therapeutics revenue is expected to grow at a CAGR of 8.27% from 2025 to 2032, reaching nearly USD 11.86 Bn. 5] What segments are covered in the Alzheimer’s Therapeutics Market report? Ans. The segments covered in the Alzheimer’s Therapeutics market report are Therapeutics, Diagnostics, End-user, and Region.

1. Alzheimer’s Therapeutics Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Alzheimer’s Therapeutics Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Alzheimer’s Therapeutics Market: Dynamics 3.1. Region-wise Trends of Alzheimer’s Therapeutics Market 3.1.1. North America Alzheimer’s Therapeutics Market Trends 3.1.2. Europe Alzheimer’s Therapeutics Market Trends 3.1.3. Asia Pacific Alzheimer’s Therapeutics Market Trends 3.1.4. Middle East and Africa Alzheimer’s Therapeutics Market Trends 3.1.5. South America Alzheimer’s Therapeutics Market Trends 3.2. Alzheimer’s Therapeutics Market Dynamics 3.2.1. Alzheimer’s Therapeutics Market Drivers 3.2.1.1. Biomarker-Based Diagnosis Adoption 3.2.1.2. Growing AD Prevalence 3.2.2. Alzheimer’s Therapeutics Market Restraints 3.2.3. Alzheimer’s Therapeutics Market Opportunities 3.2.3.1. Drug Pipeline Expansion 3.2.3.2. Early Diagnosis Innovation 3.2.4. Alzheimer’s Therapeutics Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Regulatory approvals for new therapies 3.4.2. Rising healthcare expenditure 3.4.3. Innovations in diagnostic assays 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Alzheimer’s Therapeutics Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 4.1.1. Cholinesterase Inhibitors 4.1.2. NMDA Receptor Antagonist 4.1.3. Combination Drug 4.1.4. Pipeline Drugs 4.2. Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 4.2.1. Brain Imaging 4.2.2. CFS Test for Alzheimer's Disease 4.3. Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 4.3.1. Hospital Pharmacy 4.3.2. Retail Pharmacy 4.3.3. E-commerce 4.4. Alzheimer’s Therapeutics Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Alzheimer’s Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 5.1.1. Cholinesterase Inhibitors 5.1.2. NMDA Receptor Antagonist 5.1.3. Combination Drug 5.1.4. Pipeline Drugs 5.2. North America Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 5.2.1. Brain Imaging 5.2.2. CFS Test for Alzheimer's Disease 5.3. North America Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 5.3.1. Hospital Pharmacy 5.3.2. Retail Pharmacy 5.3.3. E-commerce 5.4. North America Alzheimer’s Therapeutics Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 5.4.1.1.1. Cholinesterase Inhibitors 5.4.1.1.2. NMDA Receptor Antagonist 5.4.1.1.3. Combination Drug 5.4.1.1.4. Pipeline Drugs 5.4.1.2. United States Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 5.4.1.2.1. Brain Imaging 5.4.1.2.2. CFS Test for Alzheimer's Disease 5.4.1.3. United States Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 5.4.1.3.1. Hospital Pharmacy 5.4.1.3.2. Retail Pharmacy 5.4.1.3.3. E-commerce 5.4.2. Canada 5.4.2.1. Canada Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 5.4.2.1.1. Cholinesterase Inhibitors 5.4.2.1.2. NMDA Receptor Antagonist 5.4.2.1.3. Combination Drug 5.4.2.1.4. Pipeline Drugs 5.4.2.2. Canada Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 5.4.2.2.1. Brain Imaging 5.4.2.2.2. CFS Test for Alzheimer's Disease 5.4.2.3. Canada Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 5.4.2.3.1. Hospital Pharmacy 5.4.2.3.2. Retail Pharmacy 5.4.2.3.3. E-commerce 5.4.3. Mexico 5.4.3.1. Mexico Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 5.4.3.1.1. Cholinesterase Inhibitors 5.4.3.1.2. NMDA Receptor Antagonist 5.4.3.1.3. Combination Drug 5.4.3.1.4. Pipeline Drugs 5.4.3.2. Mexico Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 5.4.3.2.1. Brain Imaging 5.4.3.2.2. CFS Test for Alzheimer's Disease 5.4.3.3. Mexico Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 5.4.3.3.1. Hospital Pharmacy 5.4.3.3.2. Retail Pharmacy 5.4.3.3.3. E-commerce 6. Europe Alzheimer’s Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.2. Europe Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.3. Europe Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4. Europe Alzheimer’s Therapeutics Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.1.2. United Kingdom Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.1.3. United Kingdom Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4.2. France 6.4.2.1. France Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.2.2. France Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.2.3. France Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.3.2. Germany Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.3.3. Germany Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.4.2. Italy Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.4.3. Italy Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.5.2. Spain Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.5.3. Spain Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.6.2. Sweden Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.6.3. Sweden Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.7.2. Russia Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.7.3. Russia Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 6.4.8.2. Rest of Europe Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 6.4.8.3. Rest of Europe Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7. Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.2. Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.3. Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4. Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.1.2. China Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.1.3. China Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.2.2. S Korea Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.2.3. S Korea Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.3.2. Japan Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.3.3. Japan Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.4. India 7.4.4.1. India Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.4.2. India Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.4.3. India Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.5.2. Australia Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.5.3. Australia Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.6.2. Indonesia Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.6.3. Indonesia Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.7.2. Malaysia Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.7.3. Malaysia Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.8.2. Philippines Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.8.3. Philippines Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.9.2. Thailand Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.9.3. Thailand Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.10.2. Vietnam Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.10.3. Vietnam Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 7.4.11.2. Rest of Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 7.4.11.3. Rest of Asia Pacific Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 8. Middle East and Africa Alzheimer’s Therapeutics Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 8.2. Middle East and Africa Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 8.3. Middle East and Africa Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 8.4. Middle East and Africa Alzheimer’s Therapeutics Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 8.4.1.2. South Africa Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 8.4.1.3. South Africa Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 8.4.2.2. GCC Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 8.4.2.3. GCC Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 8.4.3.2. Egypt Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 8.4.3.3. Egypt Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 8.4.4.2. Nigeria Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 8.4.4.3. Nigeria Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 8.4.5.2. Rest of ME&A Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 8.4.5.3. Rest of ME&A Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 9. South America Alzheimer’s Therapeutics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 9.2. South America Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 9.3. South America Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 9.4. South America Alzheimer’s Therapeutics Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 9.4.1.2. Brazil Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 9.4.1.3. Brazil Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 9.4.2.2. Argentina Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 9.4.2.3. Argentina Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 9.4.3.2. Colombia Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 9.4.3.3. Colombia Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 9.4.4.2. Chile Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 9.4.4.3. Chile Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Alzheimer’s Therapeutics Market Size and Forecast, By Therapeutics (2024-2032) 9.4.5.2. Rest Of South America Alzheimer’s Therapeutics Market Size and Forecast, By Diagnostics (2024-2032) 9.4.5.3. Rest of South America Alzheimer’s Therapeutics Market Size and Forecast, By End-user (2024-2032) 10. Company Profile: Key Players 10.1. Biogen (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Eli Lilly and Company (United States) 10.3. Pfizer Inc. (United States) 10.4. Johnson & Johnson (United States) 10.5. AbbVie Inc. (United States) 10.6. Alzheon (United States) 10.7. Amgen Inc. (United States) 10.8. Bristol Myers Squibb (United States) 10.9. Merck & Co. (United States) 10.10. Amneal Pharmaceuticals Inc. (United States) 10.11. Roche Holding AG (Switzerland) 10.12. Novartis AG (Switzerland) 10.13. TauRx Therapeutics (United Kingdom) 10.14. AstraZeneca plc (United Kingdom) 10.15. Bayer AG (Germany) 10.16. H. Lundbeck A/S (Denmark) 10.17. Eisai Co. Ltd. (Japan) 10.18. Dr. Reddy’s Laboratories Ltd (India) 10.19. Aurobindo Pharma Ltd (India) 10.20. Macleods Pharmaceuticals Ltd (India) 10.21. Sun Pharmaceutical Industries Ltd (India) 10.22. Takeda Pharmaceutical Company Ltd (Japan) 10.23. Aspen Pharmacare (South Africa) 10.24. Eurofarma Laboratórios (Brazil) 10.25. Grupo Bagó (Argentina) 11. Key Findings 12. Industry Recommendations 13. Alzheimer’s Therapeutics Market: Research Methodology