The Airless Tires Market was valued at USD 181.85 Mn in 2024, and the total revenue of the Global Airless Tires Market is expected to grow at a CAGR of 6.29% from 2025 to 2032, reaching nearly USD 296.25 Mn by 2032.Airless Tires Market Overview:

Airless tires are non-pneumatic tires that use flexible materials or polyurethane spokes for support and shock absorption. They offer puncture resistance, low maintenance, and durability, making them ideal for commercial, industrial, and off-road applications while supporting sustainable mobility.To know about the Research Methodology :- Request Free Sample Report The Global Airless Tires Market is witnessing consistent growth, driven by the rising demand for durable, puncture-resistant, and low-maintenance mobility solutions. Growing environmental concerns, coupled with the use of recyclable materials, eco-friendly tire technologies, and reduced rolling resistance, are encouraging adoption across both commercial and industrial sectors. The extended lifespan of non-pneumatic tires combined with their ability to improve fuel efficiency, enhance safety, and lower operating costs positions them as a viable alternative to traditional pneumatic tires in next-generation mobility solutions. North America dominated the global airless tire industry in 2024, supported by advanced R&D initiatives, early adoption in construction, defense, and fleet management, and strong investments by leading tire manufacturers such as Michelin, Bridgestone, Goodyear, Hankook, and Amerityre. The region’s regulatory push toward sustainable mobility, green transportation, and fleet efficiency further strengthens its leadership. A key driver shaping the airless tires market is the growing uptake of radial airless tires in commercial vehicles, military-grade applications, and off-road equipment, where reliability and operational continuity are critical. Opportunities also lie in technological advancements such as 3D-printed airless tires, smart sensor-enabled tire systems, and advanced composite materials, which enhance cost efficiency and sustainability. Emerging trends such as the integration of airless tires with autonomous vehicles, electric mobility platforms, and last-mile delivery robots underscore the market’s transition toward future-ready, sustainable mobility solutions. Material Properties of Airless Tyres

Part Hub Spokes Outer Ring Thread Material AL 7075-T6 Polyurethane AISI 4340 Rubber Density 2800 1200 7800 1043 Youngs Modules 72000 32 210000 11.9 Poison Ratio 0.33 0.49 0.29 0.49 Yield Strength 500+ 140 470 6 Airless Tires Market Dynamics

Green Mobility Shift to Accelerate Airless Tires Market Growth The airless tires market is gaining momentum as sustainability becomes a central theme in global transportation. Airless tires reduce rolling resistance, improve fuel efficiency, and are increasingly manufactured with recyclable and eco-friendly materials. Their extended durability minimizes replacement cycles, significantly lowering tire waste in landfills. These advantages align with the automotive industry’s green mobility initiatives and smart city transportation goals, driving adoption. In 2023, Michelin and DHL partnered to deploy the Uptis airless tire on over 50 delivery vehicles in Singapore. The collaboration highlights the Airless Tires Market’s role in reducing tire waste and carbon emissions, supporting logistics companies in achieving sustainability targets. Reliability and Safety to Redefine Transportation Standards in the Airless Tires Market The airless tires market is propelled by rising demand for puncture-proof tires and low-maintenance solutions in passenger vehicles, commercial fleets, and heavy machinery. Airless tires provide superior resistance to punctures and blowouts, ensuring operational reliability in construction equipment, agricultural machinery, defense vehicles, and EV platforms. Their consistent performance across tough terrains reduces downtime while improving safety and efficiency. Premium Pricing and Noise to Impact Consumer Uptake of Airless Tires Market Despite strong potential, the airless tires market faces constraints from premium pricing and performance drawbacks. Premium models, such as Michelin’s Tweel, remain significantly more expensive than conventional tires, creating a barrier for widespread adoption. Additionally, higher vibration and noise levels compared to pneumatic alternatives impact passenger comfort. These challenges underscore the need for continuous R&D investments, OEM collaborations, and scalable production to ensure broader commercialization in the coming years.Airless Tires Market Segment Analysis

Based on Material, the airless tires market is segmented into rubber and plastic. The rubber segment held the dominant position in the airless tire market. The rubber industry has a long history of developing and refining tire technology. Manufacturers understand the behavior of rubber under various conditions and can optimize its performance for different applications. The established knowledge base gives rubber a significant advantage in the early stages of airless tire development. Rubber offers exceptional characteristics for tires, including high tensile strength, elasticity, and vibration absorption for a smoother ride.Based on Product, the airless tires market is segmented into rubber and plastic. The rubber segment held the dominant position in the airless tire market in 2024. The rubber industry has a long history of developing and refining tire technology. Manufacturers understand the behavior of rubber under various conditions and can optimize its performance for different applications. The established knowledge base gives rubber a significant advantage in the early stages of airless tire development. Rubber offers exceptional characteristics for tires, including high tensile strength, elasticity, and vibration absorption for a smoother ride. Based on tire size, the global airless tires market is segmented into <20 inches, 21–25 inches, 26–30 inches, 31–35 inches, and >35 inches. Based on current applications and airless tire technology, the 21–25 inches segment is expected to hold the dominant position in the market. The early adopters of airless tire technology are often seen in specialty applications like construction equipment, industrial vehicles, and low-speed electric vehicles. The 21–25-inch segment held the dominant position with a share of more than 38% because of its suitability for early adopter applications. It is expected to hold the dominant position during the forecast period. Based on Sales Channel, the airless tires market is segmented into OEM and Aftermarket. OEM’s segment dominated the global Airless Tires Market and accounted for over xx% of the market share. The factor attributed to the segment's growth is the increasing consumer inclination towards airless tires for their excellent performance in the market. The provision of safe driving conditions, enhanced strength, and excellent service with reduced maintenance are the critical factors for the OEMs segment growth. The manufacturers are increasing the production of airless tires to normalize product costs and attract more consumers. OEMs have the opportunity to design and integrate airless tires into next-generation vehicles, which allows for optimized performance and potential weight savings when the entire vehicle is engineered with non-pneumatic tires. OEMs can ensure airless tires on new vehicles meet their specific quality and performance standards during the manufacturing process. As airless tires gain popularity and public awareness increases, demand for aftermarket airless tires is expected to grow during the forecast period.

Airless Tires Market Regional Insight

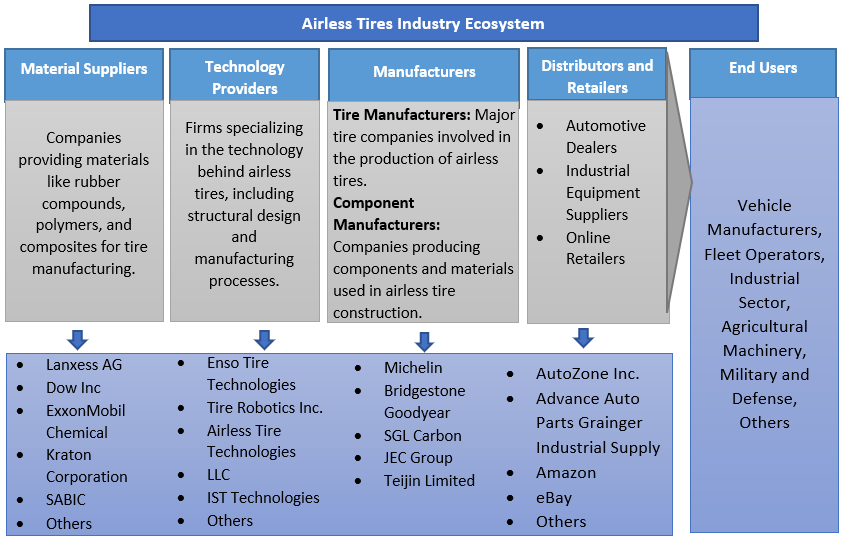

Airless Tires Market in North America: Innovation and Sustainability Driving Growth The demand for innovative and sustainable tire solutions is a primary driver of growth in the North America Airless Tires Market. With consumers increasingly prioritizing eco-conscious products, airless tires are gaining traction due to their durability, reduced maintenance, and environmental benefits. This shift creates a strong opportunity for sustainable mobility solutions in the region. As the technology matures and overcomes cost and performance challenges, airless tires are expected to emerge as a game-changing innovation in the North American automotive industry. Leading players are actively collaborating with vehicle manufacturers to integrate airless tires, particularly in off-road and utility vehicles. Moreover, the United States military’s interest in puncture-resistant and lightweight designs further underscores the market potential. Government-backed research and development, strategic partnerships, and green transportation policies are accelerating advancements, reinforcing North America’s position as a key hub for airless tire innovation. Airless Tires Industry Ecosystem

Airless Tires Market Competitive Landscape

The airless tire market is characterized by a diverse array of players, ranging from established tire manufacturers to specialized startups. Companies like Michelin and Bridgestone are at the forefront, leveraging their extensive research and development capabilities to innovate in airless tire technology. Michelin's "Tweel" and Bridgestone's airless tire prototypes exemplify the industry's shift towards sustainable and maintenance-free solutions. In parallel, startups such as The SMART Tire Company and SciTech Industries are introducing novel designs and materials, contributing to the market's dynamism. Michelin has been a pioneer in airless tire technology with its Tweel line, designed for various applications, including agriculture and construction. The company continues to invest in R&D to enhance the performance and scalability of airless tires, aiming to meet the growing demand for durable and low-maintenance solutions in industrial sectors. Bridgestone is actively developing airless tire prototypes, focusing on integrating them into electric and autonomous vehicles. The company's strategy includes partnerships with automotive manufacturers to test and refine airless tire technologies, positioning itself as a leader in sustainable mobility solutions.Airless Tires Market Recent Developments

• On April 12, 2025, Michelin (France) used 3D printing to create lunar rover tire prototypes, advancing airless tire technology for space exploration. • On July 29, 2025, Bridgestone (Japan) introduced airless tires designed to reduce rolling resistance and eliminate flats, targeting commercial applications across various vehicles. • On March 6, 2025, Sumitomo Rubber Industries (Japan) announced the closure of its Tonawanda, New York, tire plant, affecting 1,550 jobs as part of a strategic shift in manufacturing operations. • On April 22, 2024, Michelin (France) continued testing and development of its Uptis airless tires, emphasizing their potential role in future mobility solutions.Airless Tires Market Key Trends

Trend Description Commercialization & OEM Partnerships Major manufacturers like Michelin and Bridgestone are moving from prototypes to real-world pilots and limited launches (2023–2025), partnering with automakers and fleets to validate performance. Puncture-Proof and Low-Maintenance Appeal Airless tires eliminate flats and reduce maintenance needs, offering cost savings and improved uptime for commercial fleets, construction, and shared mobility services. Sustainability & Recycling Initiatives Focus on recyclable materials, reduced raw material use, and extended tire life to support environmental goals and circular economy models. Ongoing Technical & Cost Challenges High-speed performance, load capacity, and production costs remain barriers, prompting ongoing R&D in materials and design before mass-market adoption. Airless Tires Market Scope: Inquire before buying

Global Airless Tires Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 181.85 Mn. Forecast Period 2025 to 2032 CAGR: 7.6% Market Size in 2032: USD 296.25 Mn. Segments Covered: by Material Rubber Plastic by Product Radial Bias by Tire Size <20 inches 21-25 inches 26-30 inches 31- 35 inches >35 inches by Vehicle Type Military Vehicles PS/LT (Passenger& Light truck) All-Terrain Vehicles Utility Vehicles Others by Sales Channel OEM Aftermarkets Airless Tires Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South America)Airless Tires Market: Key Players are

North America 1. Amerityre Corporation (United States) 2. The SMART Tire Company (United States) 3. SciTech Industries (United States) 4. Camso Inc. (Canada) Europe 5. Michelin Group (France) 6. Continental AG (Germany) 7. Trelleborg AB (Sweden) 8. Nokian Tyres plc (Finland) 9. Pirelli Tyre S.p.A (Italy) Asia Pacific 10. Bridgestone Corporation (Japan) 11. Sumitomo Rubber Industries, Ltd. (Japan) 12. Yokohama Rubber Co., Ltd. (Japan) 13. Hankook Tire & Technology Co., Ltd. (South Korea) 14. Cheng Shin Rubber Co., Ltd. (Taiwan) 15. Kenda Rubber Industrial Co., Ltd. (Taiwan) 16. MRF Limited (India) 17. Apollo Tyres Ltd (India)Frequently Asked Questions:

1. What is driving the growth of the airless tires market? Ans: Rising demand for durable, puncture-resistant tires, sustainability initiatives, and cost-saving benefits like reduced maintenance are key growth drivers. 2. What is the expected CAGR of the global airless tires market (2025–2032)? Ans: The market is forecast to grow at a CAGR of around 6.29% during 2025–2032. 3. Which regions dominate the airless tires market? Ans: North America leads due to advanced R&D, fleet adoption, and strong OEM collaborations, followed by Europe and Asia-Pacific. 4. Who are the major players in the airless tire industry? Ans: Key companies include Michelin, Bridgestone, Goodyear, Hankook, and Amerityre. 5. What applications use airless tires the most? Ans: Commercial vehicles, construction equipment, military vehicles, and electric mobility platforms are major end-users.

1. Airless Tires Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Airless Tires Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Airless Tires Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Airless Tires Market: Dynamics 3.1. Airless Tires Market Trends by Region 3.1.1. North America Airless Tires Market Trends 3.1.2. Europe Airless Tires Market Trends 3.1.3. Asia Pacific Airless Tires Market Trends 3.1.4. Middle East and Africa Airless Tires Market Trends 3.1.5. South America Airless Tires Market Trends 3.2. Airless Tires Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Airless Tires Market Drivers 3.2.1.2. North America Airless Tires Market Restraints 3.2.1.3. North America Airless Tires Market Opportunities 3.2.1.4. North America Airless Tires Market Challenges 3.2.2. Europe 3.2.2.1. Europe Airless Tires Market Drivers 3.2.2.2. Europe Airless Tires Market Restraints 3.2.2.3. Europe Airless Tires Market Opportunities 3.2.2.4. Europe Airless Tires Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Airless Tires Market Drivers 3.2.3.2. Asia Pacific Airless Tires Market Restraints 3.2.3.3. Asia Pacific Airless Tires Market Opportunities 3.2.3.4. Asia Pacific Airless Tires Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Airless Tires Market Drivers 3.2.4.2. Middle East and Africa Airless Tires Market Restraints 3.2.4.3. Middle East and Africa Airless Tires Market Opportunities 3.2.4.4. Middle East and Africa Airless Tires Market Challenges 3.2.5. South America 3.2.5.1. South America Airless Tires Market Drivers 3.2.5.2. South America Airless Tires Market Restraints 3.2.5.3. South America Airless Tires Market Opportunities 3.2.5.4. South America Airless Tires Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Airless Tires Industry 3.8. Analysis of Government Schemes and Initiatives For Airless Tires Industry 3.9. Airless Tires Market Trade Analysis 3.10. The Global Pandemic Impact on Airless Tires Market 4. Airless Tires Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Airless Tires Market Size and Forecast, by Material (2024-2032) 4.1.1. Rubber 4.1.2. Plastic 4.2. Airless Tires Market Size and Forecast, by Product (2024-2032) 4.2.1. Radial 4.2.2. Bias 4.3. Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 4.3.1. <20 inches 4.3.2. 21-25 inches 4.3.3. 26-30 inches 4.3.4. 31- 35 inches 4.3.5. >35 inches 4.4. Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 4.4.1. Military Vehicles 4.4.2. PS/LT (Passenger& Light truck) 4.4.3. All-Terrain Vehicles 4.4.4. Utility Vehicles 4.4.5. Others 4.5. Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 4.5.1. OEM 4.5.2. Aftermarkets 4.6. Airless Tires Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Airless Tires Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Airless Tires Market Size and Forecast, by Material (2024-2032) 5.1.1. Rubber 5.1.2. Plastic 5.2. North America Airless Tires Market Size and Forecast, by Product (2024-2032) 5.2.1. Radial 5.2.2. Bias 5.3. North America Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 5.3.1. <20 inches 5.3.2. 21-25 inches 5.3.3. 26-30 inches 5.3.4. 31- 35 inches 5.3.5. >35 inches 5.4. North America Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 5.4.1. Military Vehicles 5.4.2. PS/LT (Passenger& Light truck) 5.4.3. All-Terrain Vehicles 5.4.4. Utility Vehicles 5.4.5. Others 5.5. North America Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 5.5.1. OEM 5.5.2. Aftermarkets 5.6. North America Airless Tires Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Airless Tires Market Size and Forecast, by Material (2024-2032) 5.6.1.1.1. Rubber 5.6.1.1.2. Plastic 5.6.1.2. United States Airless Tires Market Size and Forecast, by Product (2024-2032) 5.6.1.2.1. Radial 5.6.1.2.2. Bias 5.6.1.3. United States Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 5.6.1.3.1. <20 inches 5.6.1.3.2. 21-25 inches 5.6.1.3.3. 26-30 inches 5.6.1.3.4. 31- 35 inches 5.6.1.3.5. >35 inches 5.6.1.4. United States Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.1.4.1. Military Vehicles 5.6.1.4.2. PS/LT (Passenger& Light truck) 5.6.1.4.3. All-Terrain Vehicles 5.6.1.4.4. Utility Vehicles 5.6.1.4.5. Others 5.6.1.5. United States Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 5.6.1.5.1. OEM 5.6.1.5.2. Aftermarkets 5.6.2. Canada 5.6.2.1. Canada Airless Tires Market Size and Forecast, by Material (2024-2032) 5.6.2.1.1. Rubber 5.6.2.1.2. Plastic 5.6.2.2. Canada Airless Tires Market Size and Forecast, by Product (2024-2032) 5.6.2.2.1. Radial 5.6.2.2.2. Bias 5.6.2.3. Canada Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 5.6.2.3.1. <20 inches 5.6.2.3.2. 21-25 inches 5.6.2.3.3. 26-30 inches 5.6.2.3.4. 31- 35 inches 5.6.2.3.5. >35 inches 5.6.2.4. Canada Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.2.4.1. Military Vehicles 5.6.2.4.2. PS/LT (Passenger& Light truck) 5.6.2.4.3. All-Terrain Vehicles 5.6.2.4.4. Utility Vehicles 5.6.2.4.5. Others 5.6.2.5. Canada Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 5.6.2.5.1. OEM 5.6.2.5.2. Aftermarkets 5.6.3. Mexico 5.6.3.1. Mexico Airless Tires Market Size and Forecast, by Material (2024-2032) 5.6.3.1.1. Rubber 5.6.3.1.2. Plastic 5.6.3.2. Mexico Airless Tires Market Size and Forecast, by Product (2024-2032) 5.6.3.2.1. Radial 5.6.3.2.2. Bias 5.6.3.3. Mexico Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 5.6.3.3.1. <20 inches 5.6.3.3.2. 21-25 inches 5.6.3.3.3. 26-30 inches 5.6.3.3.4. 31- 35 inches 5.6.3.3.5. >35 inches 5.6.3.4. Mexico Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.3.4.1. Military Vehicles 5.6.3.4.2. PS/LT (Passenger& Light truck) 5.6.3.4.3. All-Terrain Vehicles 5.6.3.4.4. Utility Vehicles 5.6.3.4.5. Others 5.6.3.5. Mexico Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 5.6.3.5.1. OEM 5.6.3.5.2. Aftermarkets 6. Europe Airless Tires Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Airless Tires Market Size and Forecast, by Material (2024-2032) 6.2. Europe Airless Tires Market Size and Forecast, by Product (2024-2032) 6.3. Europe Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.4. Europe Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.5. Europe Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6. Europe Airless Tires Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.1.2. United Kingdom Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.1.3. United Kingdom Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.1.4. United Kingdom Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.1.5. United Kingdom Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6.2. France 6.6.2.1. France Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.2.2. France Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.2.3. France Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.2.4. France Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.2.5. France Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.3.2. Germany Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.3.3. Germany Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.3.4. Germany Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.3.5. Germany Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.4.2. Italy Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.4.3. Italy Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.4.4. Italy Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.4.5. Italy Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.5.2. Spain Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.5.3. Spain Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.5.4. Spain Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.5.5. Spain Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.6.2. Sweden Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.6.3. Sweden Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.6.4. Sweden Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.6.5. Sweden Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.7.2. Austria Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.7.3. Austria Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.7.4. Austria Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.7.5. Austria Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Airless Tires Market Size and Forecast, by Material (2024-2032) 6.6.8.2. Rest of Europe Airless Tires Market Size and Forecast, by Product (2024-2032) 6.6.8.3. Rest of Europe Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 6.6.8.4. Rest of Europe Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.8.5. Rest of Europe Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7. Asia Pacific Airless Tires Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Airless Tires Market Size and Forecast, by Material (2024-2032) 7.2. Asia Pacific Airless Tires Market Size and Forecast, by Product (2024-2032) 7.3. Asia Pacific Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.4. Asia Pacific Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.5. Asia Pacific Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6. Asia Pacific Airless Tires Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.1.2. China Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.1.3. China Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.1.4. China Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.1.5. China Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.2.2. S Korea Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.2.3. S Korea Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.2.4. S Korea Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.2.5. S Korea Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.3.2. Japan Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.3.3. Japan Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.3.4. Japan Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.3.5. Japan Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.4. India 7.6.4.1. India Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.4.2. India Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.4.3. India Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.4.4. India Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.4.5. India Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.5.2. Australia Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.5.3. Australia Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.5.4. Australia Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.5.5. Australia Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.6.2. Indonesia Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.6.3. Indonesia Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.6.4. Indonesia Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.6.5. Indonesia Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.7.2. Malaysia Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.7.3. Malaysia Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.7.4. Malaysia Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.7.5. Malaysia Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.8.2. Vietnam Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.8.3. Vietnam Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.8.4. Vietnam Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.8.5. Vietnam Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.9.2. Taiwan Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.9.3. Taiwan Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.9.4. Taiwan Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.9.5. Taiwan Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Airless Tires Market Size and Forecast, by Material (2024-2032) 7.6.10.2. Rest of Asia Pacific Airless Tires Market Size and Forecast, by Product (2024-2032) 7.6.10.3. Rest of Asia Pacific Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 7.6.10.4. Rest of Asia Pacific Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.10.5. Rest of Asia Pacific Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 8. Middle East and Africa Airless Tires Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Airless Tires Market Size and Forecast, by Material (2024-2032) 8.2. Middle East and Africa Airless Tires Market Size and Forecast, by Product (2024-2032) 8.3. Middle East and Africa Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 8.4. Middle East and Africa Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 8.5. Middle East and Africa Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 8.6. Middle East and Africa Airless Tires Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Airless Tires Market Size and Forecast, by Material (2024-2032) 8.6.1.2. South Africa Airless Tires Market Size and Forecast, by Product (2024-2032) 8.6.1.3. South Africa Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 8.6.1.4. South Africa Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.1.5. South Africa Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Airless Tires Market Size and Forecast, by Material (2024-2032) 8.6.2.2. GCC Airless Tires Market Size and Forecast, by Product (2024-2032) 8.6.2.3. GCC Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 8.6.2.4. GCC Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.2.5. GCC Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Airless Tires Market Size and Forecast, by Material (2024-2032) 8.6.3.2. Nigeria Airless Tires Market Size and Forecast, by Product (2024-2032) 8.6.3.3. Nigeria Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 8.6.3.4. Nigeria Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.3.5. Nigeria Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Airless Tires Market Size and Forecast, by Material (2024-2032) 8.6.4.2. Rest of ME&A Airless Tires Market Size and Forecast, by Product (2024-2032) 8.6.4.3. Rest of ME&A Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 8.6.4.4. Rest of ME&A Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.4.5. Rest of ME&A Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 9. South America Airless Tires Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Airless Tires Market Size and Forecast, by Material (2024-2032) 9.2. South America Airless Tires Market Size and Forecast, by Product (2024-2032) 9.3. South America Airless Tires Market Size and Forecast, by Tire Size(2024-2032) 9.4. South America Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 9.5. South America Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 9.6. South America Airless Tires Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Airless Tires Market Size and Forecast, by Material (2024-2032) 9.6.1.2. Brazil Airless Tires Market Size and Forecast, by Product (2024-2032) 9.6.1.3. Brazil Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 9.6.1.4. Brazil Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.1.5. Brazil Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Airless Tires Market Size and Forecast, by Material (2024-2032) 9.6.2.2. Argentina Airless Tires Market Size and Forecast, by Product (2024-2032) 9.6.2.3. Argentina Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 9.6.2.4. Argentina Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.2.5. Argentina Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Airless Tires Market Size and Forecast, by Material (2024-2032) 9.6.3.2. Rest Of South America Airless Tires Market Size and Forecast, by Product (2024-2032) 9.6.3.3. Rest Of South America Airless Tires Market Size and Forecast, by Tire Size (2024-2032) 9.6.3.4. Rest Of South America Airless Tires Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.3.5. Rest Of South America Airless Tires Market Size and Forecast, by Sales Channel (2024-2032) 10. Company Profile: Key Players 10.1. Amerityre Corporation (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. The SMART Tire Company (United States) 10.3. SciTech Industries (United States) 10.4. Camso Inc. (Canada) 10.5. Michelin Group (France) 10.6. Continental AG (Germany) 10.7. Trelleborg AB (Sweden) 10.8. Nokian Tyres plc (Finland) 10.9. Pirelli Tyre S.p.A (Italy) 10.10. Bridgestone Corporation (Japan) 10.11. Sumitomo Rubber Industries, Ltd. (Japan) 10.12. Yokohama Rubber Co., Ltd. (Japan) 10.13. Hankook Tire & Technology Co., Ltd. (South Korea) 10.14. Cheng Shin Rubber Co., Ltd. (Taiwan) 10.15. Kenda Rubber Industrial Co., Ltd. (Taiwan) 10.16. MRF Limited (India) 10.17. Apollo Tyres Ltd (India) 11. Key Findings 12. Industry Recommendations 13. Airless Tires Market: Research Methodology 14. Terms and Glossary