Air Conditioning Compressor market size reached USD 24.61 billion in 2022 and is expected to reach USD 35.10 billion by 2029, growing at a CAGR of 5.2 % during the forecast period. The air conditioning compressor is an important component of the AC unit, and it is responsible for circulating the refrigerant throughout the system. These compressors are also used to increase the temperature of a low-pressure gas and to remove vapor from the evaporator. The future trend of the Air Conditioning Compressor market is expected to grow rapidly because of the increasing market share of equipment such as air conditioners, refrigerators, large industrial applications like metallurgy and mining, papermaking and printing, electronics and electricity, and power generation. The Air Conditioning Compressor market for an electric cars is also growing rapidly with the spread of electric vehicles. The production of car air-conditioning compressors is a core business of the Automobile Segment. By making full use of cutting-edge technologies, manufacturers develop and manufacture products that meet the needs of each local market throughout the world. This report investigated the global market for compressors used in various applications. The majority of these Air Conditioning compressors are made in Asia, specifically in China. Manufacturers provide compressors in a variety of refrigerants and cooling capacity sizes. Some compressor manufacturers offer low-GWP refrigerant models utilizing R-32 or R-290. China is the world’s largest manufacturer of Air Conditioning compressors, with an estimated annual capacity of approx. 200 million units per year. According to the MMR study, the ChinaIOL sold approximately 53% of the Room AC compressors domestically in 2022. Leading AC manufacturers found the tremendous business opportunity and are aggressively working to increase market share in Air Conditioning Compressor sector. Rising application in residential, industrial, transportation, and commercial sectors is a key driver for the growth of the global air conditioning compressor market during the forecast period. This report provides the significant Air Conditioning Compressor market’s competitor information, analysis, insight, and forecasts on the competitive pattern of key leading companies in the industry. Both primary and secondary research methodologies were used in preparing the report. Initially, comprehensive research on the Air Conditioning Compressor industry was conducted. The sources used to prepare the report include articles, blogs, product literature, annual reports, and other publications. In addition, telephonic interviews or email correspondence was carried out with Air Conditioning Compressor business marketing executives.To know about the Research Methodology :- Request Free Sample Report

Air Conditioning Compressor Market Dynamics:

Rise in automobile production and sales to drive the market growth The air-conditioning industry is rapidly growing as a result of increased automobile production and sales, rising car ownership, and rising customer expectations for vehicle comfort. Air Conditioning Compressors are essential to the smooth and effective operation of vehicle systems. Advanced heating, ventilation, and air conditioning (HVAC) systems provide thermal comfort for vehicle occupants in a wide variety of temperatures, from hot and humid to cooler. Various new technologies are finding their way into the global market, making Automotive AC Compressors more efficient in terms of manufacturing and operation costs. Installation of lightweight and compact-size compressors is becoming more common in all vehicle segments. These features also assist in reducing vehicle noise and vibration levels and achieving fuel economy targets. Over the years, air conditioning systems have become an integral part of all types of vehicles including passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCV). In developing economies significant opportunity exists for aftermarket installation of air conditioning systems in vehicles and such a trend is likely to prevail for the next five to six years. Increasing vehicle production, fleet on road and increasing installation of comfort features in economic segment cars is driving growth in the global air compressors market. Toyota Industries' automotive air-conditioning compressors are preferred not only by Toyota Motor Corporation but also by many other major car manufacturers throughout the world. They lead the global automobile air-conditioning compressor market, producing more than 13 million units per year at their global facilities. Furthermore, Electric cars are expected to become more popular in the near future and therefore it increasing demand for electric compressors. Toyota is undertaking extensive research into new compressors that use environmentally friendly refrigerants instead of chlorofluorocarbons (CFCs). Rapid Infrastructure Development to Boost Sales of Air Conditioning Compressor Over the Next Decade According to MMR Study, the healthy growth of the infrastructure sector around the world are continue to increase the sales of air conditioning compressors. Infrastructure is a significant contributor to global GDP and the growing residential and commercial sectors in emerging economies are expected to drive up demand for air conditioning compressors. The desire of consumers to live a healthy and luxurious lifestyle by increasing the air quality index in their homes has raised the demand for air conditioning systems. People are rapidly installing cooling appliances such as air conditioners in their homes, workplaces, hospitals, entertainment venues, transportation, and other sectors. Many people in developing countries consider air conditioning as a luxury home appliance. The market for Air Conditioning compressors is expected to grow as a result of the rising population, reduced AC prices, increased disposable income, changing consumer lifestyles, and easy availability of products through online shopping platforms. India is a newcomer to the rotary compressor manufacturing sector because of its increasing domestic demand for residential air conditioning. The Indian Air Conditioning Compressor market is considered to be an important region for developing improved efficiency inverter technology.Market Restraint :

High Energy Consumption and the Popularity of Alternative Cooling systems are expected to restrain the growth of the Air Conditioning Compressor Market during the forecast period. Despite a strong growth trajectory, several factors are hampering the growth of the air conditioning compressors market. High energy use and the adoption of alternative air conditioning systems are two of these reasons. Many technologies and improvements have been made in many industries, including innovative ice-powered air conditioning systems that reduce the need for compressors in air conditioners. High electricity consumption might also be a market restraint. Household air conditioning units consumed the most electricity from the total electric supply to the house, resulting in a rise in average electricity costs of 35% to 45%. More people are struggling to pay their energy bills with their earnings, resulting in regular power failures. As a result, maximum power consumption may act as a barrier to the air conditioning compressors market growth.Air Conditioning Compressor Market Segment Analysis:

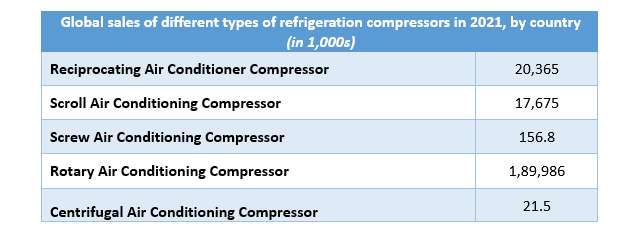

Based on the Type, the Rotary Air Conditioning Compressor segment is expected to hold the largest market share in 2022. Sales of rotary-type Air conditioning compressors are expected to account for more than 64.8% of the total air conditioning compressor market by the end of 2029. This might be attributed to the growing popularity of rotary air conditioning compressors in the residential and industrial sectors because of their numerous attractive features. Rotary-type air conditioning compressors are simpler, more dependable, and more efficient than other types of compressors. Furthermore, these compressors are silent and are less sensitive to vibration than other compressors. As a result, they are the preferred solution when operational noise is an issue. Rotary air conditioning compressors are increasingly being used in large chillers and small air conditioners. Thus, increased manufacturing and sales of these devices would finally result in strong demand for rotary compressors throughout the forecast period.

Based on Refrigerant type, the R290 refrigerant segment is expected to account for more than 36.1% of the global air conditioning compressor market in 2029. This can be attributed to R290 refrigerant's several advantages, including increased cooling capacity, improved efficiency, and eco-friendliness. R-290 offers great thermodynamic performance, in addition to being regular and energy efficient. Its low ozone-depleting qualities and low global warming potential (GWP) make it one of the most environmentally friendly refrigerants in the world. The coefficient of performance for R290 refrigerant is 10 to 15% greater than for other refrigerant types when used in air conditioners. R290 is ideally suited for a wide range of refrigeration and air conditioning applications in commercial, industrial, and household systems. It is at least 99.5 % pure and has extremely few impurities (moisture, unsaturated carbohydrates). These factors affect the sales of R290 type refrigerant in air conditioning appliances. Based on the Application, the Industrial segment dominated the global Air Conditioning Compressor market in 2022. Chemicals and petrochemicals, oil and gas, pharmaceuticals, construction, automotive and transportation, packaging sector, power generation, healthcare, metals and mining, and other industries all use industrial Air Conditioning compressors. The industrial Air Conditioning Compressor industry has enormous potential for growth because of rising investments and capacity expansions. Several growing economies, including Asia Pacific and Africa, have increased their industrial and economic development. Government measures to encourage industrial automation and an emphasis on industrial automation for best resource use are boosting demand for Air Conditioning compressors, which may be used to power pneumatic tools, packing, automation equipment, and conveyors.

Air Conditioning Compressor Market Regional Insights

The Asia Pacific Air Conditioning Compressor market revenue is expected to grow at a CAGR of 7.8% during the forecast period. Demand for air conditioning compressors in the Asia Pacific region is being driven by the strong growth of the residential and industrial sectors, as well as the rising usage of air conditioning equipment in these sectors. China has the world's largest population and Residential constructions are in more demand as the population grows. Furthermore, the country's industrial and technological industries are significant contributors to its GDP. As a result, growth in the industrial and residential sectors is pushing the country's sales of air conditioning compressors. Shanghai Highly Group Co., Ltd. produces air-conditioning compressors through its subsidiary, Shanghai Hitachi Electrical Appliances Co., Ltd., which has a total annual capacity of 20 million rotary compressors distributed between three Chinese sites and one in India. The largest facility, in Shanghai, can produce 10.3 million rotary compressor units each year.North America is expected to have significant growth in the global Air Conditioning Compressor market. The increasing use of air conditioning compressors in the residential, commercial, medical, and transportation sectors is a significant factor driving demand in the United States market. Demand for air conditioning compressors has increased significantly in recent years as a result of changes in climatic conditions, changing lifestyles, and fast expansion in the residential sector. According to the U.S. Energy Information Administration (EIA), energy usage for cooling the inside of buildings (space cooling) by the residential and commercial sectors in the United States in 2021 was around 389 billion kilowatt hours (kWh). The Air Conditioning Compressor market report determines the market share, size, current, and future trends, challenges, and forecast. It also assesses the Air Conditioning Compressor industry drivers, restraints, growth indicators, market dynamics, and risk. This report discusses business strategies as well as potential growth opportunities. It also offers a plethora of data on gross margin, SWOT analysis, CAGR, and prospects for the future of major key companies. This report segmented the market by Product Type, Application, Refrigerant type, and geographical location as well as the new techniques and manufacturing cost structures of the Air Conditioning Compressor market. The Report focuses on data on global market developments and the competitive landscape.

Air Conditioning Compressor Market Report Scope: Inquiry Before Buying

Air Conditioning Compressor Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 24.61 Bn. Forecast Period 2023 to 2029 CAGR: 5.2 % Market Size in 2029: US $ 35.10 Bn. Segments Covered: by Product Type 1. Reciprocating Air Conditioner Compressor 2. Scroll Air Conditioning Compressor 3. Screw Air Conditioning Compressor 4. Rotary Air Conditioning Compressor 5. Centrifugal Air Conditioning Compressor by Application 1. Residential 2. Commercial 3. Medical & Healthcare 4. Industrial 5. Transportation by Refrigerant type 1. R410A 2. R22 3. R404A 4. R134A 5. R290 6. R32 7. Others Air Conditioning Compressor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Air Conditioning Compressor Market, Key Players are

1. Emerson Electric Co. 2. Daikin Industries Ltd. 3. LG Electronics 4. The Danfoss Group 5. Tecumseh Products Company LLC 6. Panasonic Corporation 7. GEA Group AG 8. Johnson Controls–Hitachi Air Conditioning 9. BITZER SE 10. Officine Mario Dorin S.p.A. 11. Atlas Copco 12. Airman 13. Bitzer 14. BOGE 15. Carlyle Compressors 16. DOOSAN 17. Elgi 18. Embraco 19. Hanbell 20. Hongwuhuan 21. Ingersoll Rand 22. KAESER 23. KAISHAN 24. Kobelco 25. RECHI Group 26. Samsung FAQs: 1. Who are the key players in the Air Conditioning Compressor market? Ans. Emerson Electric Co., Daikin Industries Ltd., LG Electronics, and Samsung are some of the key manufacturers of air conditioning compressors. are some of the market players in the Air Conditioning Compressor market. 2. Which Refrigerant type segment dominates the Air Conditioning Compressor market? Ans. The R290 segment accounted for the largest share of the global Air Conditioning Compressor market in 2022. 3. How big is the Air Conditioning Compressor market? Ans. The Global Air Conditioning Compressor market size reached USD 24.61 billion in 2022 and is expected to reach USD 35.10 billion by 2029, growing at a CAGR of 5.2 % during the forecast period. 4. What are the key regions in the global market? Ans. Based On the region, the Air Conditioning Compressor Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and Latin America. The Asia Pacific dominates the global Air Conditioning Compressor market.

1. Global Air Conditioning Compressor Market: Research Methodology 2. Global Air Conditioning Compressor Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Air Conditioning Compressor Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Air Conditioning Compressor Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Air Conditioning Compressor Market Segmentation 4.1 Global Air Conditioning Compressor Market, By Application (2022-2029) • Residential • Commercial • Medical & Healthcare • Industrial • Transportation 4.2 Global Air Conditioning Compressor Market, By Product Type (2022-2029) • Reciprocating Air Conditioner Compressor • Scroll Air Conditioning Compressor • Screw Air Conditioning Compressor • Rotary Air Conditioning Compressor • Centrifugal Air Conditioning Compressor 4.3 Global Air Conditioning Compressor Market, by Refrigerant type (2022-2029) • R410A • R22 • R404A • R134A • R290 • R32 • Others 5. North America Air Conditioning Compressor Market(2022-2029) 5.1 North America Air Conditioning Compressor Market, By Application (2022-2029) • Residential • Commercial • Medical & Healthcare • Industrial • Transportation 5.2 North America Air Conditioning Compressor Market, By Product Type (2022-2029) • Reciprocating Air Conditioner Compressor • Scroll Air Conditioning Compressor • Screw Air Conditioning Compressor • Rotary Air Conditioning Compressor • Centrifugal Air Conditioning Compressor 5.3 North America Air Conditioning Compressor Market, by Refrigerant type (2022-2029) • R410A • R22 • R404A • R134A • R290 • R32 • Others 5.4 North America Air Conditioning Compressor Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Air Conditioning Compressor Market (2022-2029) 6.1. European Air Conditioning Compressor Market, By Application (2022-2029) 6.2. European Air Conditioning Compressor Market, By Product Type (2022-2029) 6.3. European Air Conditioning Compressor Market, by Refrigerant type (2022-2029) 6.4. European Air Conditioning Compressor Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Air Conditioning Compressor Market (2022-2029) 7.1. Asia Pacific Air Conditioning Compressor Market, By Application (2022-2029) 7.2. Asia Pacific Air Conditioning Compressor Market, By Product Type (2022-2029) 7.3. Asia Pacific Air Conditioning Compressor Market, by Refrigerant type (2022-2029) 7.4. Asia Pacific Air Conditioning Compressor Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Air Conditioning Compressor Market (2022-2029) 8.1 Middle East and Africa Air Conditioning Compressor Market, By Application (2022-2029) 8.2. Middle East and Africa Air Conditioning Compressor Market, By Product Type (2022-2029) 8.3. Middle East and Africa Air Conditioning Compressor Market, by Refrigerant type (2022-2029) 8.4. Middle East and Africa Air Conditioning Compressor Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Air Conditioning Compressor Market (2022-2029) 9.1. South America Air Conditioning Compressor Market, By Application (2022-2029) 9.2. South America Air Conditioning Compressor Market, By Product Type (2022-2029) 9.3. South America Air Conditioning Compressor Market, by Refrigerant type (2022-2029) 9.4 South America Air Conditioning Compressor Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Emerson Electric Co. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Daikin Industries Ltd. 10.3 LG Electronics 10.4 The Danfoss Group 10.5 Tecumseh Products Company LLC 10.6 Panasonic Corporation 10.7 GEA Group AG 10.8 Johnson Controls–Hitachi Air Conditioning 10.9 BITZER SE 10.10 Officine Mario Dorin S.p.A. 10.11 Atlas Copco 10.12 Airman 10.13 Bitzer 10.14 BOGE 10.15 Carlyle Compressors 10.16 DOOSAN 10.17 Elgi 10.18 Embraco 10.19 Hanbell 10.20 Hongwuhuan 10.21 Ingersoll Rand 10.22 KAESER 10.23 KAISHAN 10.24 Kobelco 10.25 RECHI Group 10.26 Samsung