The AI in Oncology Market size was valued at USD 1.39 billion in 2024, and the total Revenue is expected to grow at a CAGR of 35.4 % from 2025 to 2032, reaching nearly USD 15.7 billion.AI in Oncology Market Overview:

The MMR report provides in-depth analysis of the AI in Oncology market by systematically examining economic viability, technological advancement, and real-world adoption. It evaluates pricing models, cost benefits, and return on investment for healthcare providers, while also analyzing innovation pipelines, patent activity, and R&D intensity. The report further assesses adoption levels across regions, clinical workflows, data integration readiness, and hospital infrastructure. it covers patient outcomes, accessibility, investment trends, sustainability considerations, and regulatory and ethical frameworks, offering a well-rounded view of market dynamics and future growth potential. AI in Oncology as a market is huge, if we consider the current scenario, AI is imprinting its footsteps across every field. Initially, AI was used to detect the cancer cells in tissue samples. But, recent advancements in AI in oncology market have made screening, diagnosis, testing, treatment and monitoring very feasible and effective. Technologies like Deep learning, Natural language processing, AI powered Algorithm, Robotics, etc, has changed the entire dimension of oncology and thus, AI in oncology has huge opportunity to completely revolutionize the market. Nearly 55% of the industry is controlled by North America, while Asia is emerging as a global market leader in oncology market. The recent investments, huge awareness and modern technologies indicate a CAGR OF 35.4%, which is hugely indicating the growth potential and future scope of AI in Oncology market.To know about the Research Methodology :- Request Free Sample Report

AI in Oncology Market Dynamics

Growth Drivers of AI in Oncology Market The key drivers for growth are advances in technology which has directly simplified and streamlined many complex processes in the Oncology market. With the advent of digital information, AI has showed promise across all cancer research areas. With the increasing expansion of data sets, molecular-level tumour information from cancer patients can be easily obtained. AI also has made analysing medical images, such as X-rays, CT scans, and MRIs simpler and more accurate. Risk mitigation, Drug testing, Analysis of current and future status of a patient, all has been possible as AI in oncology market has fared well. Also, treatments regarding each patient can be well directed and specialized increasing the chances of cure through such modified treatments. Another driving factor in AI in Oncology market is the use of Machine Learning. These technologies have enhanced robotics in oncology market. Robots can identify data from enormous dataset and recognize specific patterns. This has allowed the creation of advanced robots that can do complicated jobs, which mitigates the risk quotient to a significant limit. Robots can also learn, forecast, and optimise using the data allowing predictive maintenance and quality control. Example – Illumina released Connected Insights to enable tertiary analysis for oncology and uncommon disorders. Challenges of AI in Oncology market The major challenge in front of the AI in oncology market is regarding the use of such technologies. The intention behind the use can make the technology regressive or progressive. One such example is of IBM's Watson Oncology, where the AI module was showing non-specific results. Also, cases of failure in deep learning algorithms which misjudged the cancer cells and showed less accurate results has occurred in the past. The data required for these models to function is huge, especially if we talk about more common types of cancers, the dataset becomes huge to analyse. Also, the cost to collect, manage, analyse and derive the data is huge. Another challenge arises when the cancer is of rare type, where on the basis of insufficient data, the model fails to develop a proper treatment. The use of robotics is also questionable especially during direct interference between treatments. The issue of safety, accountability and approval are major challenges of AI in oncology market. Hacking AI systems could provide unauthorised access to patient data or diagnostic outcomes. Thus, tampering with such technologies can be easily possible which can endanger the patient’s life Trends in AI in Oncology market The field itself is relatively new and has huge scope in future. AI in oncology market can help with early detection by analysing a patient's medical history and test results to identify patterns that may indicate the presence of cancer. As new drugs are being discovered to cure cancer patients, AI can have a huge role in it. Right from formulation to testing, AI, Robotics, algorithms can play a crucial role in future. Also, AI in oncology market has offered specialists, a more detailed overview, which would eventually make the process even simpler in future. Also, with the advent of AI in oncology market, the implementation of radiation therapy on cancerous cells have changed. Use of AI in radiation therapy has been a huge future implementation of the technology. It can also enhance the quality of radiation therapy by identifying and correcting errors in treatment plans, streamlining the process and making it more efficientAI in Oncology Market Segment Analysis

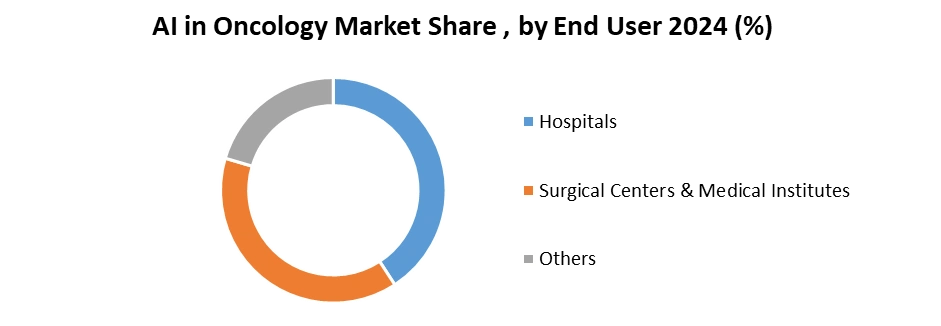

Based on the Application, the Diagnostics segment is dominated the AI in Oncology Market in 2024, driven by the widespread adoption of AI-powered imaging, pathology, and early cancer detection tools that improve diagnostic accuracy and reduce turnaround time. Radiation Therapy follows, supported by the use of AI for treatment planning, dose optimization, and precision targeting to enhance clinical outcomes. The Research & Development segment continues to grow steadily as AI accelerates drug discovery, biomarker identification, and clinical trial optimization. Chemotherapy applications are gaining traction through AI-driven treatment planning and response prediction, while Immunotherapy adoption is emerging, driven by AI-based patient stratification and therapy personalization. Based on the End-user, Hospitals segment is dominated the AI in Oncology Market in 2024, driven by high patient volumes, advanced diagnostic infrastructure, and increasing adoption of AI-enabled imaging, pathology, and clinical decision support systems. Surgical Centers & Medical Institutes follow, supported by growing use of AI for precision surgery planning, treatment optimization, and specialized cancer care. The Others segment, including diagnostic laboratories, research organizations, and specialty clinics, plays a complementary role, primarily focused on niche applications, clinical research, and pilot AI deployments.

AI in Oncology Market Regional Insights

Global The AI in Oncology market is huge, especially in today’s current scenario where technology has showed its power. The AI in Oncology market is on the verge of becoming the next crucial thing in oncology market. The reason has been technological advancements, huge investments and progressive research into this field. US has been leading the market and has 55% of market share. Asia Pacific is one of the fastest growing markets along with Israel which has established many companies like Ibex Medical Analytics, Nanox, etc helping its share increase in AI in Oncology market. North America enjoys the highest share of the market, which mainly consist of USA. The strong market presence of key players like Intel Corporation, GE Healthcare has made it sure that the market leader remains constant. The region has advanced laboratory facilities, cutting-edge technologies, and a strong ecosystem of clinicians, researchers, and industry players. Its application use has been one of the best which has helped them sustain the market force. The pre requisite of AI in Oncology market is huge, which makes it possible only for developed and developing countries to proceed in this industry. Canada and Mexico have smaller market share as compared to US but are emerging markets in AI in Oncology industry. Asia Pacific has been a growing market, especially after huge investments into the AI in Oncology market. China, Japan, India have emerged as leaders in the market. According to the World Health Organization, China had an estimated 3.9 million new cancer cases and 2.3 million cancer deaths in 2020. Thus, China has huge market share of the AI in Oncology industry. The technological prowess which China has, offers more opportunities for China to develop into this market. With India, companies like IBM, Microsoft, Google, NVIDIA, and Amazon Web Services are working on improving research and increase the efficiency. Increase in population and increase in patients both have made sure that the AI in Oncology market increase in Asia Pacific. Europe is the 2nd largest market of AI in Oncology market. Europe's top research institutions, universities, and hospitals are creating AI-based cancer diagnostic, treatment, and patient care solutions. National healthcare systems in countries like the United Kingdom, Germany, France, and the European countries have allocated funds and resources to promote AI adoption in oncology. The availability of electronic health records and large healthcare databases allows for the utilization of AI algorithms in analysing patient data and developing predictive models for cancer diagnosis and treatment. Companies like Siemens Healthcare GmbH, Sophia Genetics have helped Europe hold on its present and future market share. MEA has not seen much of a development into the AI in oncology market, but has huge potential in future. Investments into research and adoption of AI has been facilitated by many countries in Middle East and Africa. Saudi Arabia has started many projects and initiatives like KACST - a government-funded research organization that is working to develop AI-based solutions for cancer diagnosis and treatment. Also, collaborations and partnerships have helped Saudi Arabia to gain some market share. The Saudi government has partnered with the United States National Cancer Institute (NCI) to develop an AI-based system for early detection of cancer. Thus, the AI in Oncology market has huge potential but needs to be backed up by right development in research and infrastructure. The South American market is an emerging industry in AI and Oncology. Several research institutions and universities in South America are actively engaged in AI research for cancer treatment. Brazil has well developed infrastructure but the disparity between south American countries is a major reason for hinderance in its progress. Governments has been spending on research and adoption of AI LIKE FINEP is managed by Brazilian government, MinTIC is funded by Columbian government, FONDEF is funded by Chile government. Thus, such investments have made a difference but a lot of it is required to gain a larger share of AI in Oncology market.AI in Oncology Market Competitive Landscape

The AI in Oncology market has drawn huge attention from many companies who are willing to invest into these technologies and reap its benefits through its applications. The market has low entry barriers but a lot of financial backing is required to actually scale the product. Many big companies like IBM, Siemens, GE Healthcare have raised huge funds to cater to this dynamic market. AI in Oncology market is dominated by US. Nearly 55% of the market is held by North American companies. Apart from US, Europe has been the 2nd largest market. Germany is the leading country in AI in Oncology market in Europe. Along with Germany, UK and France have also showcased a significant growth in the market. Acquisitions has been common in the industry and one such example is of Merck which acquired Pandion Data to use AI-based solutions and improve the accuracy and efficiency of cancer diagnosis and treatment. Asia Pacific is shown the highest growth in the forecasted period.

AI in Oncology Market Scope: Inquire before buying

Global AI in Oncology Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.39 Bn. Forecast Period 2025 to 2032 CAGR: 35.4% Market Size in 2032: USD 15.7 Bn. Segments Covered: by Component Software Solutions Hardware Services by Cancer Type Breast Cancer Lung Cancer Prostate Cancer Colorectal Cancer Brain Tumor Others by Deployment Mode Cloud-Based On-Premises by Application Diagnostics Radiation Therapy Research & Development Chemotherapy Immunotherapy by End User Hospitals Surgical Centers & Medical Institutes Others AI in Oncology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)AI in Oncology Market, Key Players

The players mentioned are top companies working on AI in Oncology. All these companies have shown tremendous strategy and have huge potential to maximize the potential of AI in Oncology Market. 1. GE HealthCare 2. Siemens Healthineers AG 3. SOPHiA GENETICS 4. IBM Watson Health 5. NVIDIA Corporation 6. Intel Corporation 7. Oracle 8. Philips Healthcare 9. Medtronic plc 10. F. Hoffmann-La Roche Ltd. 11. Varian Medical Systems 12. Elekta AB 13. Tempus Labs Inc. 14. Flatiron Health 15. PathAI Inc. 16. Paige AI 17. ConcertAI 18. Azra AI 19. Digital Diagnostics Inc. 20. Median Technologies 21. Microsoft Corporation 22. Canon Medical Systems 23. Oncora Medical 24. Aidoc 25. iCAD Inc. 26. Lunit Inc. 27. Ibex Medical Analytics 28. Freenome Holdings Inc. 29. Owkin Inc. 30. Proscia Inc. 31. Others FAQ 1] What segments are covered in the AI in Oncology Market report? Ans. The segments covered in the AI in Oncology Market report are based on Component, Cancer Type, Deployment Mode, Application, End-User, and region 2] Which region is expected to hold the highest share of the AI in Oncology Market? Ans. The North America region is expected to hold the highest share of the AI in Oncology Market. 3] What is the market size of the AI in Oncology Market by 2032? Ans. The market size of the AI in Oncology Market by 2032 is USD 15.7 Bn. 4] What is the growth rate of the AI in Oncology Market? Ans. The Global AI in Oncology Market is growing at a CAGR of 35.4 % during the forecasting period 2025-2032. 5] What was the market size of the AI in Oncology Market in 2024? Ans. The market size of the AI in Oncology Market in 2024 was USD 1.39 Bn.

1. AI in Oncology Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. AI in Oncology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. Revenue (2024) 2.3.5. Market Share (%)2024 2.3.6. Growth Rate (%) 2.3.7. Profit Margin (%) 2.3.8. Y-O-Y (%) 2.3.9. R&D Investment 2.3.10. Patents 2.3.11. Technology Adoption 2.3.12. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. AI in Oncology Market: Dynamics 3.1. AI in Oncology Market Trends 3.2. AI in Oncology Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the AI in Oncology Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Pricing, Cost-Benefit & ROI Assessment 4.1. Pricing structures for AI oncology software, services, and hardware 4.2. Cost advantages of AI-based diagnostics vs. conventional oncology workflows 4.3. ROI for hospitals adopting AI-assisted radiology/pathology 4.4. Economic evaluation of AI in reducing repeat scans and misdiagnosis 4.5. Impact of subscription and pay-per-use models in oncology AI adoption 4.6. Affordability barriers in emerging markets 4.7. Value-based pricing opportunities tied to outcome improvements 5. Research, Innovation, and Patent Analysis 5.1. Global AI-oncology patent filing trends (2019–2024) 5.2. Key R&D programs in AI-driven cancer imaging, pathology, and genomics 5.3. Academic–industry collaborations for AI oncology algorithms 5.4. Innovation focus: precision imaging, predictive modeling, and workflow automation 5.5. Government & private funding initiatives for AI-enabled cancer care 5.6. 6. Statistical Overview and Adoption Metrics 6.1. Global and regional adoption of AI-integrated oncology platforms 6.2. Number of cancer patients by cancer type by region and country 6.3. Adoption rate by application (imaging, pathology, genomics, treatment planning) 6.4. AI-supported cancer diagnosis volume by region & cancer type 6.5. Hospital & cancer center AI utilization metrics 6.6. Forecast of patient access to AI-enabled cancer detection & treatment 7. Data Ecosystem, Interoperability & Integration Assessment 7.1. Oncology data collection challenges: imaging, genomic, and clinical datasets 7.2. EMR/EHR interoperability and data pipeline integration for AI models 7.3. Data labeling, annotation, and validation requirements in cancer diagnostics 7.4. Cloud-based oncology data management and security frameworks 7.5. Federated learning applications for multicenter cancer research 7.6. AI model accuracy vs. data diversity and population variance 7.7. Role of partnerships in data sharing across hospitals and cancer centers 8. Clinical Workflow & Use-Case Adoption Mapping 8.1. AI adoption in early cancer screening and risk prediction 8.2. Workflow integration in radiology, pathology, and tumor board processes 8.3. AI support for treatment planning in chemotherapy, radiotherapy, and immunotherapy 8.4. Clinical decision support impact on patient outcomes and diagnosis speed 8.5. Real-world evidence platforms enabling oncology analytics 8.6. AI-driven patient monitoring and recurrence prediction tools 8.7. Barriers to clinical adoption: trust, skill gaps, and operational compatibility 9. Hospital & Oncology Center Readiness Assessment 9.1. Digital infrastructure maturity across major cancer institutes 9.2. Availability of trained radiologists, oncologists, and AI technicians 9.3. Integration capability of existing systems (PACS, RIS, LIS, EMR) 9.4. Hardware readiness for AI imaging and real-time analysis 9.5. Staff training programs and AI skill development initiatives 9.6. Institutional procurement behavior for AI-based oncology solutions 9.7. Multi-center collaboration readiness for AI clinical trials 10. Patient Experience, Outcomes & Accessibility Insights 10.1. Improvement in diagnostic accuracy and treatment timelines through AI 10.2. AI’s role in personalized patient engagement and remote monitoring 10.3. Impact on patient affordability and reduced overall treatment cost 10.4. Accessibility improvements in rural/remote oncology care 10.5. Patient trust levels in AI-driven care recommendations 10.6. Reduction in diagnostic errors and cancer stage progression rates 10.7. Gaps in patient awareness and adoption of AI-based services 11. Technology & Innovation Analysis 11.1. Evolution of AI algorithms for oncology: deep learning, multimodal ML, explainable AI 11.2. Integration of AI with medical imaging platforms (MRI, CT, PET) 11.3. Advancements in genomic data interpretation and precision oncology models 11.4. AI-enabled radiotherapy planning and dose optimization tools 11.5. Innovation in AI-driven clinical decision support systems 11.6. Adoption of robotics, automation, and AI-enabled surgical oncology 11.7. R&D investments in digital pathology and AI pathology scanners 12. Investment, Funding & Partnership Landscape 12.1. VC and PE investment trends in oncology AI startups 12.2. Tech–pharma collaborations for AI-enabled drug discovery 12.3. Hospital–AI vendor partnerships for digital transformation 12.4. Funding patterns for AI-based clinical trial tools 12.5. M&A trends shaping the oncology AI market 12.6. Government funding programs supporting cancer AI research 12.7. Investment hotspots: imaging AI, genomics AI, therapy optimization AI 13. Environmental and Sustainability Analysis 13.1. Energy efficiency in AI model training and cloud infrastructure 13.2. Healthcare sustainability metrics for AI deployment in oncology 13.3. Data center waste and digital resource management 13.4. Adoption of green AI, low-power algorithms, and edge computing 13.5. Sustainable IT infrastructure models for cancer centers 14. Regulatory, Compliance & Ethical Impact Analysis 14.1. Country-wise regulatory approaches for AI-based medical devices 14.2. Approval challenges for AI diagnostic tools (adaptive algorithms, black-box models) 14.3. Compliance with patient data privacy laws (HIPAA, GDPR, regional laws) 14.4. Ethical considerations in AI-led oncology decision-making 14.5. Liability and risk frameworks for algorithmic misdiagnosis 14.6. Regulatory pathways for cloud-based oncology solutions 14.7. Impact of international harmonization efforts on AI adoption 15. AI in Oncology Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 15.1. AI in Oncology Market Size and Forecast, By Component (2024-2032) 15.1.1. Software Solutions 15.1.2. Hardware 15.1.3. Services 15.2. AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 15.2.1. Breast Cancer 15.2.2. Lung Cancer 15.2.3. Prostate Cancer 15.2.4. Colorectal Cancer 15.2.5. Brain Tumor 15.2.6. Others 15.3. AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 15.3.1. Cloud-Based 15.3.2. On-Premises 15.4. AI in Oncology Market Size and Forecast, By Application (2024-2032) 15.4.1. Diagnostics 15.4.2. Radiation Therapy 15.4.3. Research & Development 15.4.4. Chemotherapy 15.4.5. Immunotherapy 15.5. AI in Oncology Market Size and Forecast, By End-User (2024-2032) 15.5.1. Hospitals 15.5.2. Surgical Centers & Medical Institutes 15.5.3. Others 15.6. AI in Oncology Market Size and Forecast, By Region (2024-2032) 15.6.1. North America 15.6.2. Europe 15.6.3. Asia Pacific 15.6.4. Middle East and Africa 15.6.5. South America 16. North America AI in Oncology Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 16.1. North America AI in Oncology Market Size and Forecast, By Component (2024-2032) 16.1.1. Software Solutions 16.1.2. Hardware 16.1.3. Services 16.2. North America AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 16.2.1. Breast Cancer 16.2.2. Lung Cancer 16.2.3. Prostate Cancer 16.2.4. Colorectal Cancer 16.2.5. Brain Tumor 16.2.6. Others 16.3. North America AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 16.3.1. Cloud-Based 16.3.2. On-Premises 16.4. North America AI in Oncology Market Size and Forecast, By Application (2024-2032) 16.4.1. Diagnostics 16.4.2. Radiation Therapy 16.4.3. Research & Development 16.4.4. Chemotherapy 16.4.5. Immunotherapy 16.5. North America AI in Oncology Market Size and Forecast, By End-User (2024-2032) 16.5.1. Hospitals 16.5.2. Surgical Centers & Medical Institutes 16.5.3. Others 16.6. North America AI in Oncology Market Size and Forecast, by Country (2024-2032) 16.6.1. United States 16.6.1.1. United States AI in Oncology Market Size and Forecast, By Component (2024-2032) 16.6.1.2. United States AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 16.6.1.3. United States AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 16.6.1.4. United States AI in Oncology Market Size and Forecast, By Application (2024-2032) 16.6.1.5. United States AI in Oncology Market Size and Forecast, By End-User (2024-2032) 16.6.2. Canada 16.6.2.1. Canada AI in Oncology Market Size and Forecast, By Component (2024-2032) 16.6.2.2. Canada AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 16.6.2.3. Canada AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 16.6.2.4. Canada AI in Oncology Market Size and Forecast, By Application (2024-2032) 16.6.2.5. Canada AI in Oncology Market Size and Forecast, By End-User (2024-2032) 16.6.3. Mexico 16.6.3.1. Mexico AI in Oncology Market Size and Forecast, By Component (2024-2032) 16.6.3.2. Mexico AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 16.6.3.3. Mexico AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 16.6.3.4. Mexico AI in Oncology Market Size and Forecast, By Application (2024-2032) 16.6.3.5. Mexico AI in Oncology Market Size and Forecast, By End-User (2024-2032) 17. Europe AI in Oncology Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 17.1. Europe AI in Oncology Market Size and Forecast, By Component (2024-2032) 17.2. Europe AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 17.3. Europe AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 17.4. Europe AI in Oncology Market Size and Forecast, By Application (2024-2032) 17.5. Europe AI in Oncology Market Size and Forecast, By End-User (2024-2032) 17.6. Europe AI in Oncology Market Size and Forecast, By Country (2024-2032) 17.6.1. United Kingdom 17.6.2. France 17.6.3. Germany 17.6.4. Italy 17.6.5. Spain 17.6.6. Sweden 17.6.7. Russia 17.6.8. Rest of Europe 18. Asia Pacific AI in Oncology Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 18.1. Asia Pacific AI in Oncology Market Size and Forecast, By Component (2024-2032) 18.2. Asia Pacific AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 18.3. Asia Pacific AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 18.4. Asia Pacific AI in Oncology Market Size and Forecast, By Application (2024-2032) 18.5. Asia Pacific AI in Oncology Market Size and Forecast, By End-User (2024-2032) 18.6. Asia Pacific AI in Oncology Market Size and Forecast, by Country (2024-2032) 18.6.1. China 18.6.2. S Korea 18.6.3. Japan 18.6.4. India 18.6.5. Australia 18.6.6. Indonesia 18.6.7. Malaysia 18.6.8. Philippines 18.6.9. Thailand 18.6.10. Vietnam 18.6.11. Rest of Asia Pacific 19. Middle East and Africa AI in Oncology Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 19.1. Middle East and Africa AI in Oncology Market Size and Forecast, By Component (2024-2032) 19.2. Middle East and Africa AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 19.3. Middle East and Africa AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 19.4. Middle East and Africa AI in Oncology Market Size and Forecast, By Application (2024-2032) 19.5. Middle East and Africa AI in Oncology Market Size and Forecast, By End-User (2024-2032) 19.6. Middle East and Africa AI in Oncology Market Size and Forecast, By Country (2024-2032) 19.6.1. South Africa 19.6.2. GCC 19.6.3. Nigeria 19.6.4. Rest of ME&A 20. South America AI in Oncology Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 20.1. South America AI in Oncology Market Size and Forecast, By Component (2024-2032) 20.2. South America AI in Oncology Market Size and Forecast, By Cancer Type (2024-2032) 20.3. South America AI in Oncology Market Size and Forecast, By Deployment Mode (2024-2032) 20.4. 20.5. South America AI in Oncology Market Size and Forecast, By Application (2024-2032) 20.6. South America AI in Oncology Market Size and Forecast, By End-User (2024-2032) 20.7. South America AI in Oncology Market Size and Forecast, By Country (2024-2032) 20.7.1. Brazil 20.7.2. Argentina 20.7.3. Colombia 20.7.4. Chile 20.7.5. Rest of South America 21. Company Profile: Key Players 21.1. GE HealthCare 21.1.1. Company Overview 21.1.2. Business Portfolio 21.1.3. Financial Overview 21.1.4. SWOT Analysis 21.1.5. Strategic Analysis 21.2. Siemens Healthineers AG 21.3. SOPHiA GENETICS 21.4. IBM Watson Health 21.5. NVIDIA Corporation 21.6. Intel Corporation 21.7. Oracle 21.8. Philips Healthcare 21.9. Medtronic plc 21.10. F. Hoffmann-La Roche Ltd. 21.11. Varian Medical Systems 21.12. Elekta AB 21.13. Tempus Labs Inc. 21.14. Flatiron Health 21.15. PathAI Inc. 21.16. Paige AI 21.17. ConcertAI 21.18. Azra AI 21.19. Digital Diagnostics Inc. 21.20. Median Technologies 21.21. Microsoft Corporation 21.22. Canon Medical Systems 21.23. Oncora Medical 21.24. Aidoc 21.25. iCAD Inc. 21.26. Lunit Inc. 21.27. Ibex Medical Analytics 21.28. Freenome Holdings Inc. 21.29. Owkin Inc. 21.30. Proscia Inc. 21.31. Others 22. Key Findings 23. Analyst Recommendations 24. AI in Oncology Market – Research Methodology