The Additive Manufacturing Market size was valued at USD 27.45 Billion in 2024 and the total Additive Manufacturing revenue is expected to grow at a CAGR of 21.86% from 2025 to 2032, reaching nearly USD 133.51 Billion.Additive Manufacturing Market Overview

Additive Manufacturing (AM), commonly referred to as 3D printing, is revolutionizing the global manufacturing landscape by enabling the production of highly complex and customized components with exceptional precision and minimal material waste. Unlike traditional subtractive manufacturing processes that remove material from a solid block, additive manufacturing builds objects layer by layer using digital 3D models. This approach offers significant advantages such as design flexibility, cost efficiency in small-batch production, and reduced time-to-market, making it a vital technology driving the Fourth Industrial Revolution (Industry 4.0). The increasing demand for rapid prototyping across key industries such as automotive, aerospace & defense, healthcare, and consumer electronics drives the Additive Manufacturing Market growth. Manufacturers increasingly rely on 3D printing to create functional prototypes, production tools, and end-use parts that enhance performance and reduce development cycles. The technology’s ability to produce lightweight, durable components has also made it indispensable in the aerospace and automotive sectors, where weight reduction directly translates into energy efficiency and cost savings. The development of metal 3D printing materials such as titanium, aluminum, and nickel alloys has expanded AM’s application in high-performance industries. The advancements in polymer and ceramic materials are broadening their scope in medical implants, dental prosthetics, and consumer goods. Continuous innovations in industrial 3D printers, which offer higher speed, better accuracy, and improved scalability for mass customization.To know about the Research Methodology:- Request Free Sample Report

Trends: Growth in Automotive Additive Manufacturing

The automotive additive manufacturing market is undergoing rapid transformation as leading automakers adopt 3D printing technologies to enhance design flexibility, reduce production time, and lower costs. Projects such as BMW’s IDAM initiative and Volkswagen’s collaboration with HP exemplify large-scale industrial adoption, with production targets exceeding 50,000 3D-printed components annually. This expansion reflects the automotive sector’s growing reliance on metal AM, FDM, and binder jetting for lightweighting and topology optimization, improving vehicle performance and fuel efficiency. Automotive OEMs are also integrating AM software and AI-driven design simulation tools to optimize part geometry and accelerate product development. The combination of hardware, software, and services in the additive manufacturing industry is enabling mass customization of interior components, molds, and structural parts. As material costs decline and production scalability increases, the automotive sector continues to drive global Additive Manufacturing Market growth, making it one of the most lucrative applications in the 3D printing industry size outlook.Digital AM Workflows Driving Medical Growth

The Healthcare 3D Printing Market represents a breakthrough in personalized medicine, where additive manufacturing enables the creation of patient-specific implants, surgical tools, and anatomical models with unmatched precision. The use of polymer AM and metal AM, particularly DMLS and SLA technologies, is revolutionizing medical device production, reducing surgery time, and improving implant compatibility. Hospitals and medical device firms increasingly adopt industrial 3D printers for custom prosthetics, orthopedic implants, and dental applications, contributing to substantial market expansion. This trend aligns with the rise in biocompatible materials, regulatory advancements in AM certification (ASTM/ISO), and the digitalization of healthcare design workflows. The integration of AM software, scanning, and inspection systems ensures quality control and compliance, enhancing patient outcomes. With a rising global focus on healthcare innovation, the Additive Manufacturing Market size in the medical sector is projected to experience exponential growth through 2030.Market Dynamics

Increasing Prototyping Demand Across Healthcare, Automotive, and Aerospace Industries The rising global demand for rapid prototyping across major industries such as healthcare, automotive, and aerospace, driving the Additive Manufacturing Market growth. Additive manufacturing, commonly referred to as 3D printing, enables the creation of complex designs and functional prototypes directly from digital models, dramatically reducing the time and cost associated with traditional manufacturing methods. In the automotive sector, manufacturers leverage fused deposition modeling (FDM) and selective laser sintering (SLS) technologies to produce lightweight components, engine parts, and customized tooling. Companies such as BMW, Ford, and Volkswagen integrate stereolithography (SLA) and binder jetting technologies in their production lines to accelerate design validation and improve vehicle performance. The capability to test multiple design iterations quickly enhances innovation and reduces product development cycles—key competitive advantages in the Additive Manufacturing Industry. In the aerospace and defense industries, direct metal laser sintering (DMLS) and metal additive manufacturing are transforming the way high-strength, lightweight parts are produced. Components like turbine blades, fuel nozzles, and airframe brackets are being 3D-printed to achieve improved efficiency and reduced fuel consumption. Major players such as GE Additive, Stratasys, and EOS GmbH are leading innovation in this space, focusing on metal and polymer additive manufacturing to meet stringent performance standards. In the healthcare sector, the use of 3D printing for patient-specific implants, surgical tools, and prosthetics continues to rise, driven by increasing customization needs and advancements in polymer materials. This growing prototyping demand across sectors underscores the transformative role of additive manufacturing technologies in enabling faster product development, higher precision, and cost-effective production, boosting the global Additive Manufacturing Market. High Initial Investment Costs for Industrial-Grade Equipment to Restraint Additive Manufacturing Market Advanced metal AM systems such as DMLS, SLS, and EBM require significant capital expenditure, often exceeding hundreds of thousands of dollars. This high upfront cost limits accessibility for small and medium-sized enterprises (SMEs), slowing the overall additive manufacturing growth despite its long-term benefits. The expenditures for AM software, post-processing tools, and certification (ASTM/ISO) compliance elevate entry barriers. The industrial 3D printer market demands not only equipment investment but also skilled labor and infrastructure capable of maintaining consistent production standards. Additive Manufacturing Companies must allocate budgets for AM quality control, materials procurement, and supply chain management, which increase operational costs. While large corporations in the aerospace AM and automotive AM sectors can absorb these expenses, smaller firms struggle to justify such investments without guaranteed short-term returns. However, as AM technology outlook improves and AM pricing analysis shows gradual cost reductions in polymer AM and metal 3D printing market systems, the affordability gap is expected to narrow. Continuous innovation, leasing models, and government-backed incentives could help democratize access, supporting future expansion of the 3D printing industry size and additive manufacturing forecast.Additive Manufacturing Market Segment Analysis

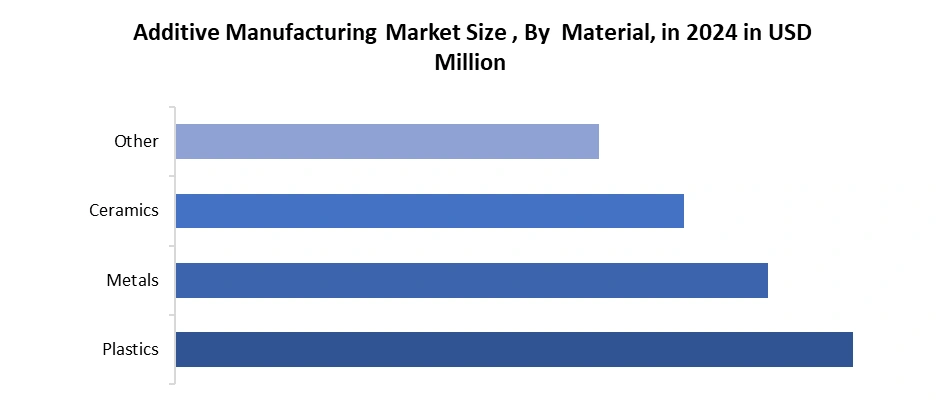

Based on Component, the Additive Manufacturing Market is segmented into Hardware, Software and Services. Hardware is expected to dominate the Additive Manufacturing industry over the forecast period. The sustained capital spends on industrial 3D printer market platforms (metal and polymer) and upgrades that boost throughput, accuracy, and uptime. Advances across DMLS, SLS, SLA, FDM, binder jetting, DED, EBM, and polyjet systems expand addressable use-cases from prototyping and tooling to certified functional parts in aerospace AM, automotive AM, and AM adoption in healthcare. Hardware leadership is reinforced by integrated build monitoring, AM quality control, in-situ sensors, and improved thermal management, key to repeatability and compliance with additive manufacturing standards and AM certification (ASTM/ISO). The hardware captures the largest share of the 3D Printing Market revenue stack, while software and services scale around installed base growth. Falling cost-per-part, larger build volumes, and automated powder/part handling improve ROI and support the positive 3D printing CAGR in the additive manufacturing industry. Vendors differentiate via multi-laser architectures, automated AM post-processing, and open/qualified material ecosystems that enhance AM materials market flexibility. For buyers, TCO is shaped by duty cycles, uptime, and AM supply chain resilience, not just sticker price, hence the importance of AM pricing analysis and AM vendor benchmarking in procurement.Based on Material, the market is categorized into Plastics, Metals, Ceramics and Others. Metals held the largest Additive Manufacturing Market share in 2024. high-value applications in the Metal 3D Printing Market segments such as aerospace & defense, automotive, energy, and medical implants. Titanium, aluminum, nickel superalloys, stainless steels, cobalt-chrome, and copper enable lightweight lattices, high-temperature components, heat exchangers, and implants key to performance and regulatory acceptance. On DMLS/LPBF, EBM, DED, and binder jetting routes, metals deliver superior strength-to-weight ratios and fatigue behavior, supporting certified end-use parts and expanding the 3D printing industry size. Driven by Additive Manufacturing Market drivers, prototyping demand and R&D activity, metal AM addresses production, not just prototypes, accelerating additive manufacturing growth across aerospace AM and automotive AM, lightweighting and topology optimization. Material innovation (finer powders, tighter PSDs, higher flowability), process maps, and parameter sets aligned to additive manufacturing standards improve repeatability and facilitate AM quality assurance porosity and residual stress testing.

Additive Manufacturing Market Regional Insights

North America dominated the Additive Manufacturing Market in 2024 and is expected to continue its dominance over the forecast period. The early technology adoption, a strong industrial base, and a well-established R&D infrastructure. The region’s leadership in the 3D printing market stems from the presence of key players such as 3D Systems, Stratasys, GE Additive, and HP, which continue to invest heavily in metal AM, polymer AM, and industrial 3D printer market advancements. The United States remains of innovation, supported by extensive government funding and private sector initiatives that promote digital manufacturing and Industry 4.0 integration. The Additive Manufacturing Industry in North America is characterized by significant investments in DMLS, SLA, SLS, and binder jetting technologies, particularly for aerospace AM, automotive AM, and healthcare applications. Aerospace companies such as Boeing and GE Aviation utilize metal 3D printing for fuel nozzles, brackets, and turbine parts, while the medical sector leverages 3D printing for patient-specific implants and prosthetics. These advancements reflect a strong AM technology outlook and highlight the region’s commitment to additive manufacturing growth. The AM market analysis for North America indicates increasing demand for AM software, AM services, and AM materials as enterprises seek to enhance production efficiency and reduce costs. The region’s regulatory alignment with AM certification (ASTM/ISO) standards and focus on AM quality control reinforce its competitive advantage. With continuous innovation and favorable government policies, North America is expected to maintain its dominance in the Global Additive Manufacturing Market and lead future 3D printing trends worldwide.Additive Manufacturing Market Competitive Landscape

The Additive Manufacturing Market is highly competitive and characterized by rapid technological innovation, strategic partnerships, and increasing consolidation among global and regional players. Leading companies such as 3D Systems, Stratasys, GE Additive, EOS GmbH, HP, and Materialise dominate the Additive Manufacturing Industry through extensive product portfolios and continuous R&D investments aimed at improving metal AM, polymer AM, and industrial 3D printer capabilities. Emerging players like Desktop Metal, Markforged, and Carbon are gaining traction with innovative technologies such as binder jetting, composite 3D printing, and AI-driven AM software. The competitive landscape is shaped by vertical integration, where companies expand from hardware to AM software, services, and materials, ensuring complete end-to-end solutions. Mergers, acquisitions, and collaborations are common, as firms seek to strengthen their global presence and technological expertise. Additive Manufacturing industry growth is fueled by partnerships across sectors such as aerospace, automotive, and healthcare, leveraging additive manufacturing opportunities for mass customization and lightweight production.Additive Manufacturing: Recent Developments

• November 7, 2024 – 3D Systems, Inc. announced multiple innovations at Formnext 2024, showcasing its commitment to advancing the Additive Manufacturing Market. The company introduced the PSLA 270 mid-frame projector-based polymer 3D printing platform, along with Wash 400/Wash 400F and Cure 400 post-processing systems, designed to accelerate production of end-use parts. It also launched Figure 4 Rigid Composite White and Accura AMX Rigid Composite White materials for high-stiffness, high-resolution applications. The new SLS and MultiJet Printing (MJP) materials, such as DuraForm PA12 Black and VisiJet Armor Max, and the INVAC 3D powder management system. • April 25, 2024 – GE Additive (Colibrium Additive) announced its rebranding as Colibrium Additive, a GE Aerospace company, marking a major strategic shift within its Propulsion & Additive Technologies (PAT) division. The new name, derived from “collaborative” and “equilibrium,” reflects the company’s mission to advance the additive manufacturing industry through partnership, reliability, and scalability. As part of the transition, Concept Laser and Arcam EBM legacy brands were retired, and AP&C, its metal powder business, underwent a brand refresh. The company also launched a global marketing campaign titled “A New Future”, emphasizing innovation, industry leadership, and alignment with GE Aerospace’s evolving identity. This rebrand reinforces Colibrium Additive’s role as a trusted leader in metal 3D printing and industrial AM solutions.Additive Manufacturing Market Scope: Inquire before buying

Global Additive Manufacturing Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 27.45 Bn. Forecast Period 2025 to 2032 CAGR: 21.86% Market Size in 2032: USD 133.51 Bn. Segments Covered: by Component Hardware Software Services by Material Plastics Metals Ceramics Others by Printer Type Desktop 3D Printer Industrial 3D Printer by Material Stereolithography Fuse Deposition Modeling Selective Laser Sintering Direct Metal Laser Sintering Polyjet Printing Inkjet Printing Electron Beam Melting Laser Metal Deposition Digital Light Processing Laminated Object Manufacturing Others by Application Prototyping Tooling Others by Vertical Aerospace Automotive Consumer Electronics & Education Healthcare Government Defense Others Additive Manufacturing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Additive Manufacturing Key Players

1. 3D Systems, Inc. 2. Stratasys Ltd. 3. GE Additive 4. EOS GmbH 5. HP Inc. 6. Materialise NV 7. SLM Solutions Group AG 8. ExOne Company 9. Desktop Metal, Inc. 10. Renishaw plc 11. Markforged, Inc. 12. Voxeljet AG 13. EnvisionTEC GmbH 14. Proto Labs, Inc. 15. Arcam AB 16. Carbon, Inc. 17. Xometry, Inc. 18. Ultimaker B.V. 19. Formlabs, Inc. 20. Nano Dimension Ltd. 21. Optomec, Inc. 22. Additive Industries B.V. 23. TRUMPF GmbH + Co. KG 24. HP Metal Jet 25. Siemens AG 26. BASF 3D Printing Solutions GmbH 27. Autodesk, Inc. 28. XYZprinting, Inc. 29. BigRep GmbH 30. GKN AdditiveFrequently Asked Questions:

1] What is the growth rate of the Global Additive Manufacturing Market? Ans. The Global Additive Manufacturing Market is growing at a significant rate of 21.86 % during the forecast period. 2] Which region is expected to dominate the Global Additive Manufacturing Market? Ans. North America is expected to dominate the Additive Manufacturing Market during the forecast period. 3] What was the Global Additive Manufacturing Market size in 2024? Ans. The Additive Manufacturing Market size is expected to reach USD 27.45 billion in 2024. 4] What is the expected Global Additive Manufacturing Market size by 2032? Ans. The Additive Manufacturing Market size is expected to reach USD 133.51 billion by 2032. 5] Which are the top players in the Global Additive Manufacturing Market? Ans. The major players in the Global Additive Manufacturing Market are 3D Systems, Inc., Stratasys Ltd., GE Additive, EOS GmbH, HP Inc. and others. 6] What are the factors driving the Global Additive Manufacturing Market growth? Ans. The increasing demand for rapid prototyping, advancements in metal and polymer 3D printing technologies, increasing industrial adoption in aerospace, automotive, and healthcare, supportive government initiatives, and continuous R&D investments enhancing material efficiency and production scalability.

1. Additive Manufacturing Market: Research Methodology 2. Additive Manufacturing Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Additive Manufacturing Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Total Company Revenue (2024) 3.3.6. Profit Margin (%) 3.3.7. Growth Rate (%) 3.3.8. Geographical Presence 3.4. Mergers and Acquisitions Details 4. Additive Manufacturing Market: Dynamics 4.1. Additive Manufacturing Market Trends 4.2. Additive Manufacturing Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Additive Manufacturing Market 5. Additive Manufacturing Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. Additive Manufacturing Market Size and Forecast, by Component (2024-2032) 5.1.1. Hardware 5.1.2. Software 5.1.3. Services 5.2. Additive Manufacturing Market Size and Forecast, by Material (2024-2032) 5.2.1. Plastics 5.2.2. Metals 5.2.3. Ceramics 5.2.4. Other 5.3. Additive Manufacturing Market Size and Forecast, by Printer Type (2024-2032) 5.3.1. Desktop 3D Printer 5.3.2. Industrial 3D Printer 5.4. Additive Manufacturing Market Size and Forecast, by Technology (2024-2032) 5.4.1. Stereolithography 5.4.2. Fuse Deposition Modeling 5.4.3. Selective Laser Sintering 5.4.4. Direct Metal Laser Sintering 5.4.5. Polyjet Printing 5.4.6. Inkjet Printing 5.4.7. Electron Beam Melting 5.4.8. Laser Metal Deposition 5.4.9. Digital Light Processing 5.4.10. Laminated Object Manufacturing 5.4.11. Others 5.5. Additive Manufacturing Market Size and Forecast, by Application (2024-2032) 5.5.1. Prototyping 5.5.2. Tooling 5.5.3. Others 5.6. Additive Manufacturing Market Size and Forecast, by Vertical (2024-2032) 5.6.1. Aerospace and Defense 5.6.2. Automotive 5.6.3. Consumer Electronics & Education 5.6.4. Healthcare 5.6.5. Government 5.6.6. Others 5.7. Additive Manufacturing Market Size and Forecast, by Region (2024-2032) 5.7.1. North America 5.7.2. Europe 5.7.3. Asia Pacific 5.7.4. Middle East and Africa 5.7.5. South America 6. North America Additive Manufacturing Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. North America Additive Manufacturing Market Size and Forecast, by Component (2024-2032) 6.1.1. Hardware 6.1.2. Software 6.1.3. Services 6.2. North America Additive Manufacturing Market Size and Forecast, by Material (2024-2032) 6.2.1. Plastics 6.2.2. Metals 6.2.3. Ceramics 6.2.4. Other 6.3. North America Additive Manufacturing Market Size and Forecast, by Printer Type (2024-2032) 6.3.1. Desktop 3D Printer 6.3.2. Industrial 3D Printer 6.4. North America Additive Manufacturing Market Size and Forecast, by Technology (2024-2032) 6.4.1. Stereolithography 6.4.2. Fuse Deposition Modeling 6.4.3. Selective Laser Sintering 6.4.4. Direct Metal Laser Sintering 6.4.5. Polyjet Printing 6.4.6. Inkjet Printing 6.4.7. Electron Beam Melting 6.4.8. Laser Metal Deposition 6.4.9. Digital Light Processing 6.4.10. Laminated Object Manufacturing 6.4.11. Others 6.5. North America Additive Manufacturing Market Size and Forecast, by Application (2024-2032) 6.5.1. Prototyping 6.5.2. Tooling 6.5.3. Others 6.6. North America Additive Manufacturing Market Size and Forecast, by Vertical (2024-2032) 6.6.1. Aerospace and Defense 6.6.2. Automotive 6.6.3. Consumer Electronics & Education 6.6.4. Healthcare 6.6.5. Government 6.6.6. Others 6.7. North America Additive Manufacturing Market Size and Forecast, by Country (2024-2032) 6.7.1. United States 6.7.2. Canada 6.7.3. Mexico 7. Europe Additive Manufacturing Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Europe Additive Manufacturing Market Size and Forecast, by Component (2024-2032) 7.2. Europe Additive Manufacturing Market Size and Forecast, by Material (2024-2032) 7.3. Europe Additive Manufacturing Market Size and Forecast, by Printer Type (2024-2032) 7.4. Europe Additive Manufacturing Market Size and Forecast, by Technology (2024-2032) 7.5. Europe Additive Manufacturing Market Size and Forecast, by Application (2024-2032) 7.6. Europe Additive Manufacturing Market Size and Forecast, by Vertical (2024-2032) 7.7. Europe Additive Manufacturing Market Size and Forecast, by Country (2024-2032) 7.7.1. United Kingdom 7.7.2. France 7.7.3. Germany 7.7.4. Italy 7.7.5. Spain 7.7.6. Russia 7.7.7. Rest of Europe 8. Asia Pacific Additive Manufacturing Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Asia Pacific Additive Manufacturing Market Size and Forecast, by Component (2024-2032) 8.2. Asia Pacific Additive Manufacturing Market Size and Forecast, by Material (2024-2032) 8.3. Asia Pacific Additive Manufacturing Market Size and Forecast, by Printer Type (2024-2032) 8.4. Asia Pacific Additive Manufacturing Market Size and Forecast, by Technology (2024-2032) 8.5. Asia Pacific Additive Manufacturing Market Size and Forecast, by Application (2024-2032) 8.6. Asia Pacific Additive Manufacturing Market Size and Forecast, by Vertical (2024-2032) 8.7. Asia Pacific Additive Manufacturing Market Size and Forecast, by Country (2024-2032) 8.7.1. China 8.7.2. South Korea 8.7.3. Japan 8.7.4. India 8.7.5. Australia 8.7.6. Indonesia 8.7.7. Malaysia 8.7.8. Philippines 8.7.9. Thailand 8.7.10. Vietnam 8.7.11. Rest of the Asia Pacific 9. Middle East and Africa Additive Manufacturing Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. Middle East and Africa Additive Manufacturing Market Size and Forecast, by Component (2024-2032) 9.2. Middle East and Africa Additive Manufacturing Market Size and Forecast, by Material (2024-2032) 9.3. Middle East and Africa Additive Manufacturing Market Size and Forecast, by Printer Type (2024-2032) 9.4. Middle East and Africa Additive Manufacturing Market Size and Forecast, by Technology (2024-2032) 9.5. Middle East and Africa Additive Manufacturing Market Size and Forecast, by Application (2024-2032) 9.6. Middle East and Africa Additive Manufacturing Market Size and Forecast, by Vertical (2024-2032) 9.7. Middle East and Africa Additive Manufacturing Market Size and Forecast, by Country (2024-2032) 9.7.1. South Africa 9.7.2. GCC 9.7.3. Nigeria 9.7.4. Rest of ME&A 10. South America Additive Manufacturing Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 10.1. South America Additive Manufacturing Market Size and Forecast, by Component (2024-2032) 10.2. South America Additive Manufacturing Market Size and Forecast, by Material (2024-2032) 10.3. South America Additive Manufacturing Market Size and Forecast, by Printer Type (2024-2032) 10.4. South America Additive Manufacturing Market Size and Forecast, by Technology (2024-2032) 10.5. South America Additive Manufacturing Market Size and Forecast, by Application (2024-2032) 10.6. South America Additive Manufacturing Market Size and Forecast, by Vertical (2024-2032) 10.7. South America Additive Manufacturing Market Size and Forecast, by Country (2024-2032) 10.7.1. Brazil 10.7.2. Argentina 10.7.3. Colombia 10.7.4. Chile 10.7.5. Rest Of South America 11. Company Profile: Key Players 11.1. 3D Systems, Inc. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Stratasys Ltd. 11.3. GE Additive 11.4. EOS GmbH 11.5. HP Inc. 11.6. Materialise NV 11.7. SLM Solutions Group AG 11.8. ExOne Company 11.9. Desktop Metal, Inc. 11.10. Renishaw plc 11.11. Markforged, Inc. 11.12. Voxeljet AG 11.13. EnvisionTEC GmbH 11.14. Proto Labs, Inc. 11.15. Arcam AB 11.16. Carbon, Inc. 11.17. Xometry, Inc. 11.18. Ultimaker B.V. 11.19. Formlabs, Inc. 11.20. Nano Dimension Ltd. 11.21. Optomec, Inc. 11.22. Additive Industries B.V. 11.23. TRUMPF GmbH + Co. KG 11.24. HP Metal Jet 11.25. Siemens AG 11.26. BASF 3D Printing Solutions GmbH 11.27. Autodesk, Inc. 11.28. XYZprinting, Inc. 11.29. BigRep GmbH 11.30. GKN Additive 12. Key Findings 13. Analyst Recommendations